Current Report Filing (8-k)

November 17 2022 - 9:01AM

Edgar (US Regulatory)

0001437925false00014379252022-11-172022-11-17iso4217:USDxbrli:sharesiso4217:USDxbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of Earliest Event Reported): November 17, 2022

GOLDEN MATRIX GROUP, INC. |

(Exact name of registrant as specified in its charter) |

Nevada | | 001-41326 | | 46-1814729 |

(State or other jurisdiction of incorporation or organization) | | (Commission file number) | | (IRS Employer Identification No.) |

3651 Lindell Road, Suite D131

Las Vegas, NV 89103

(Address of principal executive offices)(zip code)

Registrant’s telephone number, including area code: (702) 318-7548

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Common Stock, $0.00001 Par Value Per Share | | GMGI | | The NASDAQ Stock Market LLC (The NASDAQ Capital Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On November 17, 2022, Golden Matrix Group, Inc. (the “Company”, “we” and “us”) issued a press release disclosing its preliminary estimated total revenues for the fiscal year ended October 31, 2022. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K, and is incorporated into this Item 2.02 by reference.

The information contained in this Current Report and Exhibit 99.1 hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

The press release furnished as Exhibit 99.1 to this Current Report on Form 8-K, may contain forward-looking information within the meaning of applicable securities laws (“forward-looking statements”). These forward-looking statements represent the Company’s current expectations or beliefs concerning future events and can generally be identified using statements that include words such as “estimate,” “expects,” “project,” “believe,” “anticipate,” “intend,” “plan,” “foresee,” “forecast,” “likely,” “will,” “target” or similar words or phrases. These forward-looking statements are subject to risks, uncertainties and other factors, many of which are outside of the Company’s control which could cause actual results to differ materially from the results expressed or implied in the forward-looking statements, including, but not limited to, the Company’s preliminary revenue results for the fiscal year ended October 31, 2022 and whether actual financial results for the fiscal year ended October 31, 2022 will differ materially from the preliminary results reported; the impact of the COVID-19 pandemic on the Company; the need for additional financing, the terms of such financing and the availability of such financing; the ability of the Company and/or its subsidiaries to obtain additional gaming licenses; the ability of the Company to manage growth; the ability of the Company to complete acquisitions, and the terms of and availability of funding for such acquisitions; disruptions caused by acquisitions; dilution caused by fund raising and/or acquisitions; the Company’s reliance on its management; the Company’s ability to complete acquisitions and the available funding for such acquisitions; disruptions caused by acquisitions; dilution caused by fund raising, the conversion of outstanding preferred stock, and/or acquisitions; the Company’s ability to maintain the listing of its common stock on the Nasdaq Capital Market; the Company’s expectations for future growth, revenues, profitability; the Company’s expectations regarding future plans and timing thereof; the fact that the Company’s chief executive officer has voting control over the Company; related party relationships; the potential effect of economic downturns, recessions, increases in interest rates and inflation, and market conditions, decreases in discretionary spending and therefore demand for our products, and increases in the cost of capital, related thereto, among other affects thereof, on the Company’s operations and prospects; the Company’s ability to protect proprietary information; the ability of the Company to compete in its market; the Company’s lack of effective internal controls; dilution caused by efforts to obtain additional financing; the effect of current and future regulation, the Company’s ability to comply with regulations and potential penalties in the event it fails to comply with such regulations; the risks associated with gaming fraud, user cheating and cyber-attacks; risks associated with systems failures and failures of technology and infrastructure on which the Company’s programs rely; foreign exchange and currency risks; the outcome of contingencies, including legal proceedings in the normal course of business; the ability to compete against existing and new competitors; the ability to manage expenses associated with sales and marketing and necessary general and administrative and technology investments; and general consumer sentiment and economic conditions that may affect levels of discretionary customer purchases of the Company’s products, including potential recessions and global economic slowdowns. The Company undertakes no obligation to publicly update or revise any of the forward-looking statements, whether because of new information, future events or otherwise, made in the release or in any of its Securities and Exchange Commission (SEC) filings or public disclosures, except as provided by law. Consequently, you should not consider any such list to be a complete set of all potential risks and uncertainties. More information on potential factors that could affect the Company’s financial results is included from time to time in the “Forward-Looking Statements,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of the Company’s periodic and current filings with the SEC, including the Form 10-Qs and Form 10-Ks, filed with the SEC and available at www.sec.gov. Forward-looking statements speak only as of the date they are made.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

* Furnished herewith.

The inclusion of any website address in this Form 8-K, and any exhibit thereto, is intended to be an inactive textual reference only and not an active hyperlink. The information contained in, or that can be accessed through, such website is not part of or incorporated into this Form 8-K.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf by the undersigned, hereunto duly authorized.

| GOLDEN MATRIX GROUP, INC. | |

| | |

Date: November 17, 2022 | By: | /s/ Anthony Brian Goodman | |

| | Anthony Brian Goodman | |

| | Chief Executive Officer | |

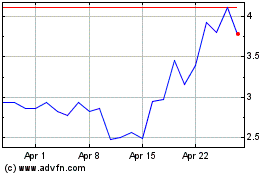

Golden Matrix (NASDAQ:GMGI)

Historical Stock Chart

From Mar 2024 to Apr 2024

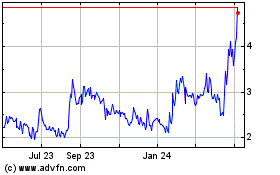

Golden Matrix (NASDAQ:GMGI)

Historical Stock Chart

From Apr 2023 to Apr 2024