Filed Pursuant to Rule 424(b)(3)

Registration No. 333-230841

PROSPECTUS

5,500,000

Common Shares offered by the Selling Shareholders

This prospectus relates to the registration for resale by the

Selling Shareholder listed herein (the “Selling Shareholder”) or any of its pledgees, donees, transferees or successors

in interest, of up to 5,500,000 shares of our common stock, $0.004 par value per share, issuable to the Selling Shareholder upon

conversion of principal and interest under the Senior Convertible Note, in the aggregate principal amount of $5,000,000 accruing

interest at the rate of 10% per annum, issued to the Selling Shareholder on March 13, 2019 (the “Notes”).

We are not selling any securities under this prospectus and

will not receive any of the proceeds from the sale of shares by the Selling Shareholder.

The Selling Shareholder may sell the shares of common stock

described in this prospectus in a number of different ways and at varying prices. See “Plan of Distribution” for more

information about how the Selling Shareholder may sell the shares of common stock being registered.

We will pay the expenses incurred in registering these common

shares, including legal and accounting fees.

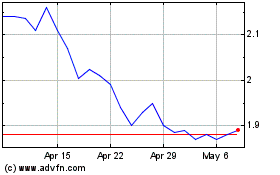

Our common shares are listed on the Nasdaq Capital Market under

the symbol “GLBS.” The closing sales price of our common stock on the Nasdaq Capital Market on April 17, 2019 was $2.97

per share. There were 3,211,107 of our common shares outstanding as of April 17, 2019.

An investment in these securities is speculative and involves

a high degree of risk. See the section entitled “Risk Factors” which begins on page 3 of this prospectus, and

other risk factors contained in any applicable prospectus supplement and in the documents incorporated by reference herein and

therein.

Neither the Securities and Exchange Commission nor any state

securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete.

Any representation to the contrary is a criminal offense.

The date of this prospectus is April

19, 2019

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

As permitted under the rules of the Securities

and Exchange Commission, or the Commission, this prospectus incorporates important business information about us that is contained

in documents that we have previously filed with the Commission but that are not included in or delivered with this prospectus.

You may obtain copies of these documents, without charge, from the website maintained by the Commission at www.sec.gov, as well

as other sources. You may also obtain copies of the incorporated documents, without charge, upon written or oral request to Globus

Maritime Limited, 128 Vouliagmenis Avenue, 3rd Floor, 166 74 Glyfada, Attica, Greece, or by telephone at +30 210 960 8300. See

“Where You Can Find Additional Information.”

You should rely only on the information

contained or incorporated by reference in this prospectus. Neither we nor the Selling Shareholders authorize any person to provide

information other than that provided in this prospectus and the documents incorporated by reference. Neither we nor the Selling

Shareholders are making an offer to sell common shares in any state or other jurisdiction where the offer or sale is not permitted.

You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front

of this prospectus regardless of its time of delivery, and you should not consider any information in this prospectus or in the

documents incorporated by reference herein to be investment, legal or tax advice. We encourage you to consult your own counsel,

accountant and other advisors for legal, tax, business, financial and related advice regarding an investment in our securities.

Unless otherwise indicated or unless the

context requires otherwise, all references in this prospectus to “Globus,” the “Company,” “we,”

“us,” “our,” or similar references, mean Globus Maritime Limited and, where applicable, its consolidated

subsidiaries. In addition, we use the term deadweight, or dwt, in describing the size of vessels. Dwt expressed in metric tons,

each of which is equivalent to 1,000 kilograms, refers to the maximum weight of cargo and supplies that a vessel can carry. To

the extent the Selling Shareholders transfer our common shares or our Note and the shares are not unrestricted, we may add the

recipients of those common shares and Note as Selling Shareholders via a prospectus supplement or post-effective amendment. Any

references to the “Selling Shareholders” shall be deemed to be references to each such additional Selling Shareholders.

ENFORCEABILITY OF CIVIL LIABILITIES

We are a Marshall Islands company, and

our principal executive office is located outside of the United States, in Greece. Most of our directors, officers and the experts

named in this registration statement and prospectus reside outside the United States. In addition, a substantial portion of our

assets and the assets of certain of our directors, officers and experts are located outside of the United States. As a result,

you may have difficulty serving legal process within the United States upon us or any of these persons. You may also have difficulty

enforcing, both in and outside the United States, judgments you may obtain in United States courts against us or these persons.

CAUTIONARY STATEMENT REGARDING FORWARD

LOOKING STATEMENTS

This prospectus includes “forward-looking

statements,” as defined by U.S. federal securities laws, with respect to our financial condition, results of operations and

business and our expectations or beliefs concerning future events. Forward-looking statements provide our current expectations

or forecasts of future events. Forward-looking statements include statements about our expectations, beliefs, plans, objectives,

intentions, assumptions and other statements that are not historical facts or that are not present facts or conditions. Forward-looking

statements and information can generally be identified by the use of forward-looking terminology or words, such as “anticipate,”

“approximately,” “believe,” “continue,” “estimate,” “expect,” “forecast,”

“intend,” “may,” “ongoing,” “pending,” “perceive,” “plan,”

“potential,” “predict,” “project,” “seeks,” “should,” “views”

or similar words or phrases or variations thereon, or the negatives of those words or phrases, or statements that events, conditions

or results “can,” “will,” “may,” “must,” “would,” “could”

or “should” occur or be achieved and similar expressions in connection with any discussion, expectation or projection

of future operating or financial performance, costs, regulations, events or trends. The absence of these words does not necessarily

mean that a statement is not forward-looking. Forward-looking statements and information are based on management’s current

expectations and assumptions, which are inherently subject to uncertainties, risks and changes in circumstances that are difficult

to predict.

All forward-looking statements involve

risks and uncertainties. The occurrence of the events described, and the achievement of the expected results, depend on many events,

some or all of which are not predictable or within our control. Actual results may differ materially from expected results.

In addition, important factors that, in

our view, could cause actual results to differ materially from those discussed in the forward-looking statements include:

|

|

·

|

general dry bulk shipping market conditions, including fluctuations in charterhire rates and vessel values;

|

|

|

·

|

the strength of world economies;

|

|

|

·

|

the stability of Europe and the Euro;

|

|

|

·

|

fluctuations in LIBOR or the discontinuance of LIBOR;

|

|

|

·

|

fluctuations in interest rates and foreign exchange rates;

|

|

|

·

|

changes in demand in the dry bulk shipping industry, including the market for our vessels;

|

|

|

·

|

changes in our operating expenses, including bunker prices, dry docking and insurance costs;

|

|

|

·

|

changes in governmental rules and regulations or actions taken by regulatory authorities;

|

|

|

·

|

potential liability from pending or future litigation;

|

|

|

·

|

general domestic and international political conditions;

|

|

|

·

|

potential disruption of shipping routes due to accidents or political events;

|

|

|

·

|

the availability of financing and refinancing;

|

|

|

·

|

our ability to meet requirements for additional capital and financing to grow our business;

|

|

|

·

|

vessel breakdowns and instances of off-hire;

|

|

|

·

|

potential exposure or loss from investment in derivative instruments;

|

|

|

·

|

potential conflicts of interest involving our Chief Executive Officer, the Chairman of our Board, their family and other members

of our senior management;

|

|

|

·

|

our ability to complete acquisition transactions as planned; and

|

|

|

·

|

other important factors described in “Risk Factors” and in other places incorporated by reference.

|

We have based these statements on assumptions

and analyses formed by applying our experience and perception of historical trends, current conditions, expected future developments

and other factors we believe are appropriate in the circumstances. All future written and verbal forward-looking statements attributable

to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred

to in this section. We undertake no obligation, and specifically decline any obligation, except as required by law, to publicly

update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. In light of

these risks, uncertainties and assumptions, the forward-looking events discussed in this prospectus might not occur.

See the sections entitled “Risk Factors”

of this prospectus and in our Annual Report on Form 20-F for the year ended December 31, 2018, which is incorporated herein

by reference, for a more complete discussion of these risks and uncertainties and for other risks and uncertainties. These factors

and the other risk factors described in this prospectus are not necessarily all of the important factors that could cause actual

results or developments to differ materially from those expressed in any of our forward-looking statements. Other unknown or unpredictable

factors also could harm our results. Consequently, there can be no assurance that actual results or developments anticipated by

us will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, us. Given

these uncertainties, prospective investors are cautioned not to place undue reliance on such forward-looking statements.

WHERE YOU CAN FIND ADDITIONAL INFORMATION

As required by the Securities Act, we filed

a registration statement relating to the securities offered by this prospectus with the Commission. This prospectus is a part of

that registration statement, which includes additional information.

Government Filings

We file annual and special reports with

the Commission. You may read and copy any document that we file and obtain copies at prescribed rates from the Commission’s

Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. You may obtain information on the operation of the Public

Reference Room by calling 1 (800) SEC-0330. The Commission maintains a website (http://www.sec.gov) that contains reports,

proxy and information statements and other information regarding issuers that file electronically with the Commission. Our filings

are also available on our website at http://www.globusmaritime.gr. The information on our website, however, is not, and should

not be deemed to be, a part of this prospectus.

This prospectus and any applicable prospectus

supplement are part of a registration statement that we filed with the Commission and do not contain all of the information in

the registration statement. The full registration statement may be obtained from the Commission or us, as indicated below. Documents

establishing the terms of the offered securities are filed as exhibits to the registration statement. Statements in this prospectus

or any applicable prospectus supplement about these documents are summaries and each statement is qualified in all respects by

reference to the document to which it refers. You should refer to the actual documents for a more complete description of the relevant

matters. You may inspect a copy of the registration statement at the Commission’s Public Reference Room in Washington, D.C.,

as well as through the Commission’s website.

Information Incorporated by Reference

The Commission allows us to “incorporate

by reference” information that we file with it. This means that we can disclose important information to you by referring

you to those filed documents. The information incorporated by reference is considered to be a part of this prospectus, and certain

information that we file later with the Commission prior to the termination of this offering will also be considered to be part

of this prospectus and will automatically update and supersede previously filed information, including information contained in

this document.

The following documents, filed with or

furnished to the SEC, are specifically incorporated by reference and form an integral part of this prospectus:

We are also incorporating by reference

all subsequent Annual Reports on Form 20-F that we file with the Commission and certain reports on Form 6-K that we furnish to

the Commission after the date of this prospectus (if they state that they are incorporated by reference into this prospectus) until

we file a post-effective amendment indicating that the offering of the securities made by this prospectus has been terminated.

In all cases, you should rely on the later information over different information included in this prospectus or the applicable

prospectus supplement.

You should rely only on the information

contained or incorporated by reference in this prospectus and any applicable prospectus supplement. We have not, and any underwriters

have not, authorized any other person to provide you with different information. If anyone provides you with different or inconsistent

information, you should not rely on it. We are not, and any underwriters are not, making an offer to sell these securities in any

jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus and

any applicable prospectus supplement as well as the information we previously filed or furnished with the Commission and incorporated

by reference, is accurate as of the dates on the front cover of those documents only. Our business, financial condition and results

of operations and prospects may have changed since those dates.

You may request a free copy of the above

mentioned filing or any subsequent filing we incorporate by reference to this prospectus by writing or telephoning us at the following

address:

Globus Maritime Limited

c/o Globus Shipmanagement Corp.

128 Vouliagmenis Avenue

3rd Floor

166 74 Glyfada

Attica, Greece

+30 210 960 8300

Information provided by the Company

We will furnish holders of our common shares

with Annual Reports containing audited financial statements and a report by our independent registered public accounting firm.

The audited financial statements will be prepared in accordance with International Financial Reporting Standards. As a “foreign

private issuer,” we are exempt from the rules under the Exchange Act prescribing the furnishing and content of proxy statements

to shareholders. While we furnish proxy statements to shareholders in accordance with the rules of the Nasdaq Capital Market, those

proxy statements do not conform to Schedule 14A of the proxy rules promulgated under the Exchange Act. In addition, as a “foreign

private issuer,” our officers and directors are exempt from the rules under the Exchange Act relating to short swing profit

reporting and liability.

PROSPECTUS SUMMARY

This summary highlights information

that appears later in this prospectus and is qualified in its entirety by the more detailed information and financial statements

included or incorporated by reference elsewhere in this prospectus. This summary may not contain all of the information that may

be important to you. As an investor or prospective investor, you should carefully review the entire prospectus, including the section

of this prospectus entitled “Risk Factors” and the more detailed information that appears later in this prospectus

and in the documents we incorporate by reference before making an investment in our common shares.

Our Business

Our Company

We are an integrated dry bulk shipping

company, providing marine transportation services on a worldwide basis. We own, operate and manage a fleet of dry bulk vessels

that transport iron ore, coal, grain, steel products, cement, alumina and other dry bulk cargoes internationally. We intend to

grow our fleet through timely and selective acquisitions of modern vessels in a manner that we believe will provide an attractive

return on equity and will be accretive to our earnings and cash flow based on anticipated market rates at the time of purchase.

There is no guarantee however, that we will be able to find suitable vessels to purchase or that such vessels will provide an attractive

return on equity or be accretive to our earnings and cash flow.

Our operations are managed by our Glyfada,

Greece-based wholly owned subsidiary, Globus Shipmanagement Corp., which we refer to as our Manager, which provides in-house commercial

and technical management for our vessels. Our Manager has entered into a ship management agreement with each of our wholly owned

vessel-owning subsidiaries to provide services that include managing day-to-day vessel operations, such as supervising the crewing,

supplying, maintaining of vessels and other services.

We originally incorporated as Globus Maritime

Limited on July 26, 2006 pursuant to the Companies (Jersey) Law 1991 (as amended), and began operations in September 2006. On November

24, 2010, we redomiciled into the Marshall Islands. Our common shares trade on the NASDAQ Global Market under the ticker “GLBS.”

The following table presents information

concerning our vessels, each of which is owned by a wholly owned subsidiary of Globus Maritime Limited. We use the term deadweight

ton, or “dwt,” in describing the size of vessels. Deadweight ton or “dwt” is a unit of a vessel’s

capacity for cargo, fuel oil, stores and crew, measured in metric tons. A vessel’s dwt or total deadweight is the total weight

the vessel can carry when loaded to a particular line.

|

Vessel

|

|

Year

Built

|

|

|

Flag

|

|

Direct

Owner

|

|

Shipyard

|

|

Vessel Type

|

|

Delivery

Date

|

|

Carrying

Capacity

(dwt)

|

|

|

m/v Sun Globe

|

|

2007

|

|

|

Malta

|

|

Longevity Maritime Limited

|

|

Tsuneishi Cebu

|

|

Supramax

|

|

September 2011

|

|

|

58,790

|

|

|

m/v River Globe

|

|

2007

|

|

|

Marshall Islands

|

|

Devocean Maritime Ltd.

|

|

Yangzhou Dayang

|

|

Supramax

|

|

December 2007

|

|

|

53,627

|

|

|

m/v Sky Globe

|

|

2009

|

|

|

Marshall Islands

|

|

Domina Maritime Ltd.

|

|

Taizhou Kouan

|

|

Supramax

|

|

May 2010

|

|

|

56,855

|

|

|

m/v Star Globe

|

|

2010

|

|

|

Marshall Islands

|

|

Dulac Maritime S.A.

|

|

Taizhou Kouan

|

|

Supramax

|

|

May 2010

|

|

|

56,867

|

|

|

m/v Moon Globe

|

|

2005

|

|

|

Marshall Islands

|

|

Artful Shipholding S.A.

|

|

Hudong-Zhonghua

|

|

Panamax

|

|

June 2011

|

|

|

74,432

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total:

|

|

|

300,571

|

|

Corporate Information

Our executive office is located at the

office of our Manager at 128 Vouliagmenis Avenue, 3rd Floor, 166 74 Glyfada, Attica, Greece. Our telephone number is +30 210 960

8300. Our registered agent in the Marshall Islands is The Trust Company of the Marshall Islands, Inc. and our registered address

in the Marshall Islands is Trust Company Complex, Ajeltake Road, Ajeltake Island, Majuro, Marshall Islands MH96960. We maintain

our website at www.globusmaritime.gr. Information that is available on or accessed through our website does not constitute part

of, and is not incorporated by reference into, this prospectus.

Recent and Other Developments

On April 5, 2019, Firment Shipping Inc.

filed a Schedule 13D/A indicating that Mr. George Feidakis (and Firment Shipping Inc.) currently may be deemed to beneficially

own 415,930 of our common shares, representing approximately 13% of our outstanding common shares (rather than the 1,420,163 common

shares referenced in our annual report on Form 20-F, which represented 44.2% of our outstanding common shares).

On March 13, 2019, the Company signed a

securities purchase agreement with a private investor and on March 13, 2019 issued, for gross proceeds of $5 million, a senior

convertible note (the “Note”) that is convertible into shares of the Company’s common stock, par value $0.004

per share. If not converted or redeemed beforehand pursuant to the terms of the Note, the Note matures upon the first anniversary

of its issue. The Note was issued in a transaction exempt from registration under the Securities Act of 1933, as amended (the “Securities

Act”). In this registration statement and prospectus, we are registering for resale 5,500,000 common shares issuable upon

conversion of the Note.

In December 2018,

we entered into a Loan Agreement with Macquarie International Bank Limited for an amount up to US$13.5 million in order to refinance

two of our vessels, m/v Moon Globe and m/v Sun Globe.

In November 2018, we entered into a credit

facility for up to $15 million with Firment Shipping Inc., a related party to us, for the purpose of financing our general working

capital needs.

On October 15, 2018, we effected a ten-for-one

reverse stock split which reduced the number of outstanding common shares from 32,065,077 to 3,206,495 shares (adjustments were

made based on fractional shares). All figures expressed in this prospectus reflect the stock split unless expressly provided otherwise.

On October 19, 2017, we entered into a

Share and Warrant Purchase Agreement pursuant to which we sold for $2.5 million an aggregate of 250,000 of our common shares, par

value $0.004 per share and a warrant (the “October 2017 Warrant”) to purchase 1.25 million of our common shares at

a price of $16.00 per share to an investor in a private placement (the “October 2017 Private Placement”). These securities

were issued in transactions exempt from registration under the Securities Act. On that day, we also entered into a registration

rights agreement with the purchaser providing it with certain rights relating to registration under the Securities Act of the 250,000

common shares issued in connection with the October 2017 Private Placement and the common shares underlying the October 2017 Warrant.

As of the date hereof, the October 2017 Warrant has not been exercised.

In February 2017, we entered into a Share

and Warrant Purchase Agreement pursuant to which we sold for $5 million an aggregate of 500,000 of our common shares, par value

$0.004 per share and warrants to purchase 2.5 million of our common shares at a price of $16.00 per share (which were subject to

adjustment) to a number of investors in a private placement. In February 2017 we also agreed with two affiliated lenders to convert

a total of $20 million owed to such lenders in exchange for (a) 2 million common shares and (b) warrants to purchase 738,002 of

our common shares at a price of $16.00 per share (which were subject to adjustment). The warrants issued in February 2017 have

expired. We refer to these transactions together as the “February 2017 Transactions”. These securities were issued

in transactions exempt from registration under the Securities Act.

The Offering

The selling shareholder named in the table

located on page 5 of this prospectus (the “Selling Shareholder”) is offering an aggregate of 5,500,000 common shares,

none of which are currently issued and outstanding and all of which are issuable upon the conversion of a currently outstanding

Note, subject to the terms and limitations contained within the Note. See “Description of Capital Stock - Description of

the Note” on page 4 of this prospectus. We will not receive any proceeds upon the conversion of the Note. See

“Use of Proceeds” on page 4 of this prospectus.

RISK FACTORS

Investing in our common shares involves

a high degree of risk. You should carefully consider the risks set forth below and the discussion of risks under the heading “Item

3. Key Information—D. Risk Factors” in our Annual Report on Form 20-F for the year ended December 31, 2018, filed

with the Commission on March 28, 2019, and the other documents that are incorporated by reference in this prospectus. Please see

the section of this prospectus entitled “Incorporation by Reference of Certain Documents.” Any of the following risks

could materially and adversely affect our business, financial condition, results of operations or cash flows. In such a case, you

may lose all or part of your original investment.

RISKS RELATED TO THIS OFFERING

Our convertible note may be redeemed under circumstances

out of our control.

Under

the terms of the Note, the Note may be redeemed or immediately due upon an Event of Default (as defined within the Note), a Change

of Control (as defined within the Note), or a ten trading day period in which our stock trades below 120% of the Floor Price then

in effect, in some cases at a premium to the principal and interest outstanding under the Note. The Floor Price is, initially,

$2.25, and may be lowered by mutual agreements of us and the Investor, to an amount not less than $1.00. Some of the events giving

rise to these rights are out of the Company’s immediate control (such as our stock price being below the floor price), and

could trigger cross-default provisions under our other loan agreements. If we are unable to come up with the cash when due, we

may be unable to pay the redemption price, which could negatively affect our stock price.

Our stock price has been volatile and no assurance can

be made that it will not substantially depreciate.

Our stock

price has been volatile recently. The closing price of our common shares since January 1, 2018 has ranged from a peak of $13.70

on January 10, 2018 to a low of $2.53 on December 24, 2018, representing a decrease of 82%, adjusting for the 4:1 and 10:1 stock

split we effected on October 20, 2016 and October 15, 2018, respectively. We can offer no comfort or assurance that our stock price

will stop being volatile or not substantially depreciate.

Our existing shareholders will be diluted each time the

Note is converted.

The number of shares issuable upon the

conversion of the Note differs based upon the Company’s stock price (with a ceiling of $4.50, and a current Floor Price of

$2.25), among other factors as more fully described herein (See “Description of Capital Stock – Description of the

Note”). Notwithstanding, at the Floor Price, more than two million of our common shares could be issued pursuant to the Note.

The conversion of the Note and issuance of such common shares will dilute existing holders, potentially substantially, and could

hurt our stock price.

The sale of a substantial amount of our common shares,

including resale of the common shares issuable upon the conversion of the Note held by the Selling Shareholder, in the public market

could adversely affect the prevailing market price of our common shares.

Both the number of common shares issuable

upon conversion of the Note and the conversion price are subject to adjustment as more fully described in “Description of

Capital Stock - Description of the Note”. Sales of substantial amounts of our common shares in the public market, or the

perception that such sales might occur, could adversely affect the market price of our common shares, and the market value of our

other securities.

A substantial number of common shares are

being offered by this prospectus, and we cannot predict if and when the Selling Shareholder may sell such shares in the public

markets. Furthermore, in the future, we may issue additional common shares or other equity or debt securities convertible into

common shares in connection with a financing, acquisition, litigation settlement, employee arrangements, or otherwise. Any such

issuance would result in substantial dilution to our existing shareholders and could cause our stock price to decline.

If we are unable to deliver common shares free of restrictive

legends where required by the Securities Purchase Agreement, the Registration Rights Agreement, and the Note, we must make whole

any Selling Shareholder who loses money by purchasing common shares on the market to complete a trade.

The Securities Purchase Agreement, the

Registration Rights Agreement, and the Note require us to issue common shares upon a partial conversion of the Note, which, where

called for therein, must be free of restrictive legends. If we are unable to deliver proof that the above has occurred when required

and if a Selling Shareholder has traded the common shares that we have failed to deliver unlegended, penalty provisions of these

agreements require us to make whole any Selling Shareholder who loses money by purchasing shares on the common market to complete

its trade. Depending on our share price during this time and the number of shares to which the payments relate, we could be required

to pay a substantial sum.

USE OF PROCEEDS

This prospectus registers for resale 5,500,000

common shares, none of which have already issued pursuant to the conversion of the Note, and all of which are issuable upon conversion

of the Note (upon the conditions further described in “Description of Capital Stock - Description of the Note”). The

number of shares issuable upon conversion of the Note will differ based upon the performance of the Company’s stock price.

We will not receive any proceeds upon the conversion of the Note.

Of the $5 million we received in exchange

for issuance of the note, approximately $1,500,000 will be used to repay unaffiliated debt, and the balance will be used for general

corporate purposes, which may include the repayment of debt to affiliated persons and the settling of invoices from affiliated

service providers.

We will incur all costs associated with

this registration statement and prospectus (other than underwriting discounts and commissions and any transfer taxes), which we

anticipate to be approximately $25,000.

CAPITALIZATION

The following table sets forth our capitalization

table as of December 31, 2018:

|

|

·

|

An as Adjusted basis, as of December 31, 2018, to give effect to:

|

|

|

o

|

the March 2019 Convertible Debt Private Placement, in which the Company signed a securities purchase

agreement with a private investor, for gross proceeds of $5 million, a senior convertible note that is convertible into shares

of the Company’s common stock, par value $0.004 per share.

|

|

|

o

|

The issuance of 1,780 common shares in March 2019, being the share based payment to the Non- Executive

Directors of the Company for the 1

st

quarter of 2019.

|

|

|

o

|

The payment of installments under the loan agreements in March 2019, with the Hamburg Commercial

Bank AG and with the Macquarie Bank International Limited, of total amount $1.1 million.

|

|

|

|

Actual

|

|

|

As Adjusted

(unaudited)

|

|

|

|

|

(dollars in thousands except

per share and share data)

|

|

|

Capitalization:

|

|

|

|

|

|

|

|

Total debt (including current portion)

|

|

$

|

36,868

|

|

|

$

|

40,732

|

|

|

Preferred shares, $0.001 par value; 100,000,000 shares authorized, none issued, actual and adjusted

|

|

|

—

|

|

|

|

—

|

|

|

Common shares, $0.004 par value; 500,000,000 shares authorized, 3,209,327 shares issued and outstanding actual, 3,211,107 shares issued and outstanding as adjusted

|

|

$

|

13

|

|

|

$

|

13

|

|

|

Class B Shares, $0.001 par value; 100,000 shares authorized, none issued, actual and adjusted

|

|

|

|

|

|

|

|

|

|

Additional paid-in capital

|

|

$

|

140,334

|

|

|

$

|

140,344

|

|

|

Accumulated deficit

|

|

$

|

(99,297

|

)

|

|

$

|

(99,307

|

)

|

|

Total shareholders’ equity

|

|

$

|

41,050

|

|

|

$

|

41,050

|

|

|

Total capitalization

|

|

$

|

77,918

|

|

|

$

|

81,782

|

|

There have been no significant adjustments

to our capitalization since December 31, 2018. This table should be read in conjunction with the consolidated financial statements

and related notes included in our annual report for the year ended December 31, 2018, on Form 20-F filed with the Commission

on March 28, 2019 and incorporated by reference herein, as well as a Schedule 13D/A filed by Firment Shipping Inc. on April 5,

2019, which indicates that Mr. George Feidakis (and Firment Shipping Inc.) currently may be deemed to beneficially own 415,930

of our common shares, representing approximately 13% of our outstanding common shares (rather than the 1,420,163 common shares

referenced in our annual report on Form 20-F, which represented 44.2% of our outstanding common shares).

SELLING SHAREHOLDERS

The common shares being offered by the

selling shareholders are those issuable to the selling shareholders upon conversion of the Note. For additional information regarding

the issuance of the notes, see “Private Placement of Notes” above. We are registering the common shares in order to

permit the selling shareholders to offer the shares for resale from time to time. Except for the ownership of the Note issued pursuant

to the Securities Purchase Agreement, the selling shareholders have not had any material relationship with us within the past three

years except affiliates of the selling shareholders have been holders of less than 5% of our common shares within the last three

years, and were parties to that certain securities purchase agreement dated February 8, 2017 and a registration rights agreement

and warrant issued by the Company each dated February 9, 2017 (which warrants have expired).

The table below lists the selling shareholders

and other information regarding the beneficial ownership (as determined under Section 13(d) of the Securities Exchange Act of 1934,

as amended, and the rules and regulations thereunder) of the common shares held by each of the selling shareholders. The second

column lists the number of common shares beneficially owned by the selling shareholders, based on their respective ownership of

common shares and notes, as of April 19, 2019, assuming conversion of the notes held by each such selling shareholder on that date

but taking account of any limitations on conversion set forth therein.

The third column lists the common shares

being offered by this prospectus by the selling shareholders and does not take in account any limitations on conversion of the

notes set forth therein.

In accordance with the terms of a registration

rights agreement with the holders of the notes, this prospectus generally covers the resale of 200% of the maximum number of common

shares issued or issuable pursuant to the Notes, including payment of interest on the notes through March 13, 2020, determined

as if the outstanding notes (including interest on the notes through March 13, 2020) were converted in full (without regard to

any limitations on conversion contained therein solely for the purpose of such calculation) at a conversion price of $1.00, which

is the lowest price at which the note may convert pursuant to its terms, and would only apply if the Company and the selling shareholder

agreed to lower the existing $2.25 price per share). Because the conversion price of the notes may be adjusted, the number of shares

that will actually be issued may be different than the number of shares being offered by this prospectus. The fourth column assumes

the sale of all of the shares offered by the selling shareholders pursuant to this prospectus.

Under the terms of the notes, a selling

shareholder may not convert the notes to the extent (but only to the extent) such selling shareholder or any of its affiliates

would beneficially own a number of shares of our common shares which would exceed 4.99% of the outstanding shares of the Company.

The number of shares in the second column reflects these limitations. The selling shareholders may sell all, some or none of their

shares in this offering. See “Plan of Distribution.”

|

Selling Shareholders

|

|

Number of

Common

Shares

Owned

Prior to

Offering

|

|

|

Maximum

Number of

Common

Shares to be

Sold

Pursuant to

this

Prospectus

|

|

|

Number of

Common

Shares of

Owned

After

Offering

|

|

|

Arnaki Ltd (1)

|

|

|

168,650

|

(4)

|

|

|

5,500,000

|

(2)

|

|

|

0

|

(3)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

Arnaki Ltd. is a British Virgin Islands corporation with mailing address: Rodus Building, 4th floor, Road Reef, P.O. Box 756 Road Town, Tortola, VG1110, British Virgin Islands.

|

|

(2)

|

Assumes full exercise at maturity, without partial exercise prior to maturity, as though the Blocker Provision did not exist, at a price of $1.00 per share (which price is the lowest price to which the Floor Price could be lowered pursuant to the Note).

|

|

(3)

|

Assumes sale of all of the common shares issuable pursuant to the Note.

|

|

(4)

|

This figure represents the greatest number of our common shares that Arnaki Ltd. could currently acquire upon conversion of the Note before the Blocker Provision applied; notwithstanding, this provision does not limit Arnaki Ltd. from acquiring up to 4.99% of our common shares, selling all of their common shares, and re-acquiring up to 4.99% of our common shares. Until June 7, 2019, all principal and other amounts owed pursuant to the Note can convert to equity at $4.50 per common share, and therefore the principal under the Note can convert into a maximum of 1,111,111 common shares on the date hereof. After June 7, 2019, the price applicable in a conversion of the Note differs based upon the Company’s stock price. Arnaki Ltd. does not own any of the Company’s shares on the date hereof.

|

PLAN OF DISTRIBUTION

We are registering the

common shares issuable upon conversion of the notes to permit the resale of these common shares by the holders of the notes from

time to time after the date of this prospectus. We will not receive any of the proceeds from the sale by the selling shareholders

of the common shares. We will bear all fees and expenses incident to our obligation to register the common shares.

The selling shareholders

may sell all or a portion of the common shares held by them and offered hereby from time to time directly or through one or more

underwriters, broker-dealers or agents. If the common shares are sold through underwriters or broker-dealers, the selling shareholders

will be responsible for underwriting discounts or commissions or agent’s commissions. The common shares may be sold in one

or more transactions at fixed prices, at prevailing market prices at the time of the sale, at varying prices determined at the

time of sale or at negotiated prices. These sales may be effected in transactions, which may involve crosses or block transactions,

pursuant to one or more of the following methods:

|

|

·

|

on any national securities exchange or quotation service on which the securities may be listed

or quoted at the time of sale;

|

|

|

·

|

in the over-the-counter market;

|

|

|

·

|

in transactions otherwise than on these exchanges or systems or in the over-the-counter market;

|

|

|

·

|

through the writing or settlement of options, whether such options are listed on an options exchange

or otherwise;

|

|

|

·

|

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

|

|

|

·

|

block trades in which the broker-dealer will attempt to sell the shares as agent but may position

and resell a portion of the block as principal to facilitate the transaction;

|

|

|

·

|

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

|

|

|

·

|

an exchange distribution in accordance with the rules of the applicable exchange;

|

|

|

·

|

privately negotiated transactions;

|

|

|

·

|

short sales made after the date the Registration Statement is declared effective by the SEC;

|

|

|

·

|

broker-dealers may agree with a selling security holder to sell a specified number of such shares

at a stipulated price per share;

|

|

|

·

|

a combination of any such methods of sale; and

|

|

|

·

|

any other method permitted pursuant to applicable law.

|

The selling shareholders

may also sell common shares under Rule 144 promulgated under the Securities Act of 1933, as amended, if available, rather

than under this prospectus. In addition, the selling shareholders may transfer the common shares by other means not described in

this prospectus. If the selling shareholders effect such transactions by selling common shares to or through underwriters, broker-dealers

or agents, such underwriters, broker-dealers or agents may receive commissions in the form of discounts, concessions or commissions

from the selling shareholders or commissions from purchasers of the common shares for whom they may act as agent or to whom they

may sell as principal, which will be borne by the selling shareholders (which discounts, concessions or commissions as to particular

underwriters, broker-dealers or agents may be in excess of those customary in the types of transactions involved). In connection

with sales of the common shares or otherwise, the selling shareholders may enter into hedging transactions with broker-dealers,

which may in turn engage in short sales of the common shares in the course of hedging in positions they assume. The selling shareholders

may also sell common shares short and deliver common shares covered by this prospectus to close out short positions and to return

borrowed shares in connection with such short sales. The selling shareholders may also loan or pledge common shares to broker-dealers

that in turn may sell such shares.

The selling shareholders

may pledge or grant a security interest in some or all of the notes or common shares owned by them and, if they default in the

performance of their secured obligations, the pledgees or secured parties may offer and sell the common shares from time to time

pursuant to this prospectus or any amendment to this prospectus under Rule 424(b)(3) or other applicable provision of the Securities

Act amending, if necessary, the list of selling shareholders to include the pledgee, transferee or other successors in interest

as selling shareholders under this prospectus. The selling shareholders also may transfer and donate the common shares in other

circumstances in which case the transferees, donees, pledgees or other successors in interest will be the selling beneficial owners

for purposes of this prospectus.

To the extent required

by the Securities Act and the rules and regulations thereunder, the selling shareholders and any broker-dealer participating in

the distribution of the common shares may be deemed to be “underwriters” within the meaning of the Securities Act,

and any commission paid, or any discounts or concessions allowed to, any such broker-dealer may be deemed to be underwriting commissions

or discounts under the Securities Act. At the time a particular offering of the common shares is made, a prospectus supplement,

if required, will be distributed, which will set forth the aggregate amount of common shares being offered and the terms of the

offering, including the name or names of any broker-dealers or agents, any discounts, commissions and other terms constituting

compensation from the selling shareholders and any discounts, commissions or concessions allowed or re-allowed or paid to broker-dealers.

Under the securities laws

of some states, the common shares may be sold in such states only through registered or licensed brokers or dealers. In addition,

in some states the common shares may not be sold unless such shares have been registered or qualified for sale in such state or

an exemption from registration or qualification is available and is complied with.

There can be no assurance

that any selling shareholder will sell any or all of the common shares registered pursuant to the registration statement, of which

this prospectus forms a part.

The selling shareholders

and any other person participating in such distribution will be subject to applicable provisions of the Securities Exchange Act

of 1934, as amended, and the rules and regulations thereunder, including, without limitation, to the extent applicable, Regulation M

of the Exchange Act, which may limit the timing of purchases and sales of any of the common shares by the selling shareholders

and any other participating person. To the extent applicable, Regulation M may also restrict the ability of any person engaged

in the distribution of the common shares to engage in market-making activities with respect to the common shares. All of the foregoing

may affect the marketability of the common shares and the ability of any person or entity to engage in market-making activities

with respect to the common shares.

We will pay all expenses

of the registration of the common shares pursuant to the registration rights agreement, estimated to be $25,000 in total, including,

without limitation, Securities and Exchange Commission filing fees and expenses of compliance with state securities or “blue

sky” laws; provided, however, a selling shareholder will pay all underwriting discounts and selling commissions, if any.

We will indemnify the selling shareholders against liabilities, including some liabilities under the Securities Act in accordance

with the registration rights agreements or the selling shareholders will be entitled to contribution. We may be indemnified by

the selling shareholders against civil liabilities, including liabilities under the Securities Act that may arise from any written

information furnished to us by the selling shareholder specifically for use in this prospectus, in accordance with the related

registration rights agreements or we may be entitled to contribution.

Once sold under the registration

statement, of which this prospectus forms a part, the common shares will be freely tradable in the hands of persons other than

our affiliates.

DESCRIPTION OF CAPITAL STOCK

We refer you to “Item 10. Additional

Information B. Memorandum and Articles of Association” contained within our Annual Report on Form 20-F for the year ended

December 31, 2018, which was filed on March 28, 2019 and is incorporated by reference into this prospectus, for the description

of our capital stock.

Transfer Agent

The registrar and transfer agent for our

common shares is Computershare Inc.

Share History

On March 13, 2019, the Company signed a

securities purchase agreement with a private investor and on March 13, 2019 issued, for gross proceeds of $5 million, a senior

convertible note (the “Note”) that is convertible into shares of the Company’s common stock, par value $0.004

per share. If not converted or redeemed beforehand pursuant to the terms of the Note, the Note matures upon the first anniversary

of its issue. The Note was issued in a transaction exempt from registration under the Securities Act of 1933, as amended (the “Securities

Act”). As of the date hereof, no conversion of the Note has occurred. In this registration statement and prospectus, we are

registering for resale 5,500,000 common shares issuable upon conversion of the Note.

On October 15, 2018, we effected a ten-for-one

reverse stock split which reduced the number of outstanding common shares from 32,065,077 to 3,206,495 shares (adjustments were

made based on fractional shares). All figures expressed herein reflect the stock split unless expressly provided otherwise.

On October 19, 2017, we entered into a

Share and Warrant Purchase Agreement pursuant to which we sold for $2.5 million an aggregate of 250,000 of our common shares,

par value $0.004 per share and a warrant (the “October 2017 Warrant”) to purchase 1.25 million of our common shares

at a price of $16.00 per share to an investor in a private placement (the “October 2017 Private Placement”). These

securities were issued in transactions exempt from registration under the Securities Act. On that day, we also entered into a

registration rights agreement with the purchaser providing it with certain rights relating to registration under the Securities

Act of the 250,000 common shares issued in connection with the October 2017 Private Placement and the common shares underlying

the October 2017 Warrant. As of the date hereof, the October 2017 Warrant has not been exercised.

In February 2017, we entered into a Share

and Warrant Purchase Agreement pursuant to which we sold for $5 million an aggregate of 500,000 of our common shares, par value

$0.004 per share and warrants (the “February 2017 Warrants”) to purchase 2.5 million of our common shares at a price

of $16.00 per share (which were subject to adjustment) to a number of investors in a private placement. The February 2017 Warrants

expired in February 2019. In February 2017 we also agreed with two affiliated lenders to convert a total of $20 million owed to

such lenders in exchange for (a) 2 million common shares and (b) warrants to purchase 738,002 of our common shares at a price of

$16.00 per share (which were subject to adjustment), which warrants have expired. We refer to these transactions together as the

“February 2017 Transactions”. These securities were issued in transactions exempt from registration under the Securities

Act.

Description of the Note

The Note provides for interest to accrue

at 10% annually, which interest shall be paid on the first anniversary of the Note’s issuance unless the Note is converted

or redeemed pursuant to its terms beforehand. The interest may be paid in common shares of the Company, if certain conditions described

within the Note are met. The following summaries of the conversion and redemption provisions of the Note are qualified in their

entirety to the terms of the Note itself, which is attached as Exhibit 4.8 hereto:

|

|

·

|

The Note may be converted, in whole or in part, into the Company’s common stock at any time by its holder, in which case

all principal, interest, and other amounts owed pursuant to the Note shall convert at a price per share which differs based upon

the performance of the Company’s stock price. The price per share for conversion purposes shall be $4.50 (the “Conversion

Price”); but if after June 7, 2019, the Company’s common stock trades below $4.50, the price per share for conversion

purposes shall be the lowest of (a) the Conversion Price and (b) the highest of (i) $2.25 (the “Floor Price”) and (ii)

87.5% of the average of the high and low bid price from any day chosen by the holder during the ten consecutive trading day period

ending on and including the trading day immediately prior to the applicable conversion date (the “Alternate Conversion Price”)

regardless of the subsequent stock price.

|

|

|

·

|

The Note may be redeemed, in whole or in part, by request of its holder upon:

|

|

|

o

|

(a) an Event of Default (as defined within the Note), in exchange for the higher of (a) 120% of all amounts owed under the

Note, and (b) the value of the stock to which the Note could be converted (as calculated within Section 4(b) of the Note);

|

|

|

o

|

(b) a Change in Control (as defined within the Note) of the Company, in exchange for the higher of (a) 120% of all amounts

owed under the Note and (b) the value of the stock to which the Note could be converted (as calculated within Section 5(c) of the

Note); or

|

|

|

o

|

(c) a ten Trading Day period in which the common shares trade below 120% of the Floor Price, in exchange for 100% of all amounts

owed under the Note.

|

|

|

·

|

The Note may be redeemed, in whole or in part, at any time by the Company. If the Company elects to redeem the Note, the Company

shall immediately be obligated to pay the holder the greater of (a) 120% of all amounts owed under the Note and (b) the value of

the stock to which the Note could be converted (as calculated within Section 8(a) of the Note). If the Company elects to redeem

the Note, the Company (as a procedural matter) must first provide the holder notice, which could allow the holder to convert prior

to payment by the Company of the redemption amount.

|

|

|

·

|

If any portion of the Note is not redeemed or converted prior to its maturity date, on the maturity date, the Company shall

pay all outstanding principal in cash and (so long as there has been no “Equity Conditions Failure”, as such term is

defined within the Note) may elect whether to pay the interest (and any other amounts owed) in cash or shares of the Company’s

common stock. If interest is paid in common stock, the Alternate Conversion Price per share shall apply.

|

The Note includes anti-dilution protections

to its holder, which could cause the Conversion Price and Floor Price to be adjusted (upwards or downwards) proportionately upon

a stock split. The Note further allows the Company, with the holder’s consent, to reduce the Floor Price or the then current

conversion price, as to any amount and for any period of time deemed appropriate by the Company’s board of directors, but

to a price no less than $1.00 per share.

The full conversion of the Note would dilute

the ownership percentage of the Company held by existing stockholders and could hurt the Company’s stock price.

Under the terms of the Note, the Company

may not issue shares to the extent such issuance would cause the Holder, together with its affiliates and attribution parties,

to beneficially own a number of common shares which would exceed 4.99% (which may be increased upon no less than 61 days’

notice, but not to exceed 9.99%) of our then outstanding common shares immediately following such issuance, excluding for purposes

of such determination common shares issuable upon subsequent conversion of principal or interest on the Note. This provision does

not limit a Holder from acquiring up to 4.99% of our common shares, selling all of their common shares, and re-acquiring up to

4.99% of our common shares.

The Note provides its holder the right

to receive distributions (including distributions in kind of property such as rights to acquire stock) as though the Note had converted

in full without the existence of the Blocker Provisions. The Securities Purchase Agreement furthermore offers the Buyer the right

to acquire up to 50% of securities sold by the Company, except for Common Stock and options provided to directors, officers, or

employees of the Company in their capacity as such.

The Company further entered into a registration

rights agreement (the “Registration Rights Agreement”) in which it agreed to register the resale of the common shares

issuable upon conversion of the Note. The Registration Rights Agreement includes liquidated damages provisions applicable if the

Company fails to meet its obligations.

Listing

Our

common stock is listed on The NASDAQ Capital Market under the symbol “GLBS”.

TAX CONSIDERATIONS

Marshall Islands Tax Considerations

The following discussion is based upon

the opinion of Watson Farley & Williams LLP and the current laws of the Republic of the Marshall Islands and is applicable

only to persons who are not citizens of and do not reside in, maintain offices in or engage in business, transactions, or operations

in the Republic of the Marshall Islands.

Because we and our subsidiaries do not,

and we do not expect that we or any of our subsidiaries will, conduct business, transactions, or operations in the Republic of

the Marshall Islands, and because we anticipate that all documentation related to any offerings pursuant to this prospectus will

be executed outside of the Republic of the Marshall Islands, under current Marshall Islands law holders of our common shares will

not be subject to Marshall Islands taxation or withholding on dividends. In addition, holders of our common shares will not be

subject to Marshall Islands stamp, capital gains or other taxes on the purchase, ownership or disposition of common shares, and

you will not be required by the Republic of the Marshall Islands to file a tax return relating to the shares of common shares.

It is the responsibility of each shareholder

to investigate the legal and tax consequences, under the laws of pertinent jurisdictions, including the Marshall Islands, of its

investment in us. Accordingly, each shareholder is urged to consult its tax counsel or other advisor with regard to those matters.

Further, it is the responsibility of each shareholder to file all state, local and non-U.S., as well as U.S. federal, tax returns

which may be required of such shareholder.

United States Tax Considerations

The following is a discussion of material United States federal

income tax consequences of the ownership and disposition of the Company’s common shares that, subject to the representations,

covenants, assumptions, conditions and qualifications described herein, may be relevant to prospective shareholders and, unless

otherwise noted in the following discussion, is the opinion of Watson Farley & Williams LLP, our United States counsel,

insofar as it relates to matters of United States federal income tax law and legal conclusions with respect to those matters. The

opinion of our counsel is dependent on the accuracy of representations made by us to them, including descriptions of our operations

contained herein. This discussion is based upon the provisions of the Internal Revenue Code of 1986, as amended, or the Code, existing

final, temporary and proposed regulations thereunder and current administrative rulings and court decisions, all as in effect on

the effective date of this prospectus and all of which are subject to change, possibly with retroactive effect. Changes in these

authorities may cause the tax consequences to vary substantially from the consequences described below. No rulings have been or

are expected to be sought from the United States Internal Revenue Service, or the IRS, with respect to any of the United States

federal income tax consequences discussed below, and no assurance can be given that the IRS will not take contrary positions.

The following summary does not deal with all United States federal

income tax consequences applicable to any given holder of our common shares, nor does it address the United States federal income

tax considerations applicable to categories of investors subject to special taxing rules, such as expatriates, banks, real estate

investment trusts, regulated investment companies, insurance companies, tax-exempt organizations, dealers or traders in securities

or currencies, partnerships, S corporations, estates and trusts, investors that hold their common shares as part of a hedge, straddle

or an integrated or conversion transaction, investors whose “functional currency” is not the United States dollar or

investors that own, directly or indirectly, 10% or more of our stock by vote or value. Furthermore, the discussion does not address

alternative minimum tax consequences or estate or gift tax consequences, or any state tax consequences, and is limited to shareholders

that will hold their common shares as “capital assets” within the meaning of Section 1221 of the Code. Each shareholder

is encouraged to consult, and discuss with his or her own tax advisor the United States federal, state, local and non-United States

tax consequences particular to him or her of the acquisition, ownership or disposition of common shares. Further, it is the responsibility

of each shareholder to file all state, local and non-United States, as well as United States federal, tax returns that may be required

of it.

United States Federal Income Taxation of United

States Holders

As used herein, “United States Holder” means a beneficial

owner of the Company’s common shares that is an individual citizen or resident of the United States for United States federal

income tax purposes, a corporation or other entity taxable as a corporation created or organized in or under the laws of the United

States or any state thereof (including the District of Columbia), an estate the income of which is subject to United States federal

income taxation regardless of its source or a trust where a court within the United States is able to exercise primary supervision

over the administration of the trust and one or more United States persons (as defined in the Code) have the authority to control

all substantial decisions of the trust (or a trust that has made a valid election under United States Department of the Treasury

regulations to be treated as a domestic trust). A “Non-United States Holder” generally means any owner (or beneficial

owner) of common shares that is not a United States Holder, other than a partnership. If a partnership holds common shares, the

tax treatment of a partner will generally depend upon the status of the partner and upon the activities of the partnership. Partners

of partnerships holding common shares should consult their own tax advisors regarding the tax consequences of an investment in

the common shares (including their status as United States Holders or Non-United States Holders).

Distributions

Subject to the discussion of passive foreign investment companies,

or PFICs, below, any distributions made by the Company with respect to the common shares to a United States Holder will generally

constitute dividends, which may be taxable as ordinary income or qualified dividend income as described in more detail below, to

the extent of the Company’s current or accumulated earnings and profits as determined under United States federal income

tax principles. Distributions in excess of the Company’s earnings and profits will be treated as a nontaxable return of capital

to the extent of the United States Holder’s tax basis in its common shares and, thereafter, as capital gain.

Dividends paid in respect of the Company’s common shares

may qualify for the preferential rate attributable to qualified dividend income if: (1) the common shares are readily tradable

on an established securities market in the United States; (2) the Company is not a PFIC for the taxable year during which the dividend

is paid or in the immediately preceding taxable year; (3) the United States Holder has owned the common shares for more than 60

days in the 121-day period beginning 60 days before the date on which the common shares become ex-dividend and (4) the United States

Holder is not under an obligation to make related payments with respect to positions in substantially similar or related property.

The first requirement currently is and has been met, as our common shares are listed on the Nasdaq Capital Market tier of the Nasdaq

Stock Market, which is an established securities market. Further, there is no minimal trading requirement for shares to be “readily

tradable,” so as long as our common shares remain listed on the Nasdaq Capital Market or any other established securities

market in the United States, the first requirement will be satisfied. However, if our common shares are delisted and are not tradable

on an established securities market in the United States, the first requirement would not be satisfied, and dividends paid in respect

of our common shares would not qualify for the preferential rate attributable to qualified dividend income. The second requirement

is expected to be met as more fully described below under “—Consequences of Possible PFIC Classification.” Satisfaction

of the final two requirements will depend on the particular circumstances of each United States Holder. Consequently, if any of

these requirements are not met, the dividends paid to individual United States Holders in respect of the Company’s common

shares would not be treated as qualified dividend income and would be taxed as ordinary income at ordinary rates.

Amounts taxable as dividends generally will be treated as income

from sources outside the United States and will, depending on your circumstances, be “passive” or “general”

income which, in either case, is treated separately from other types of income for purposes of computing the foreign tax credit

allowable to you. However, if (1) the Company is 50% or more owned, by vote or value, by United States persons and (2) at least

10% of the Company’s earnings and profits are attributable to sources within the United States, then for foreign tax credit

purposes, a portion of our dividends would be treated as derived from sources within the United States. Under such circumstances,

with respect to any dividend paid for any taxable year, the United States source ratio of the Company’s dividends for foreign

tax credit purposes would be equal to the portion of the Company’s earnings and profits from sources within the United States

for such taxable year, divided by the total amount of the Company’s earnings and profits for such taxable year.

Consequences of Possible

PFIC Classification

A non-United States entity treated as a corporation for United

States federal income tax purposes will be a PFIC in any taxable year in which, after taking into account the income and assets

of the corporation and certain subsidiaries pursuant to a “look through” rule, either: (1) 75% or more of its gross

income is “passive” income or (2) 50% or more of the average value of its assets is attributable to assets that produce

passive income or are held for the production of passive income. If a corporation is a PFIC in any taxable year that a person holds

shares in the corporation (and was not a qualified electing fund with respect to such year, as discussed below), the shares held

by such person will be treated as shares in a PFIC for all future years (absent an election which, if made, may require the electing

person to pay taxes in the year of the election). A United States Holder of shares in a PFIC would be required to file an annual

information return on IRS Form 8621 containing information regarding the PFIC as required by United States Department of the Treasury

regulations.

While there are legal uncertainties involved in this determination,

including as a result of adverse case law described herein, based upon the Company’s and its subsidiaries’ expected

operations as described herein and based upon the current and expected future activities and operations of the Company and its

subsidiaries, the income of the Company and such subsidiaries from time charters should not constitute “passive income”

for purposes of applying the PFIC rules, and the assets that the Company owns for the production of this time charter income should

not constitute passive assets for purposes of applying the PFIC rules.

Although there is no legal authority directly on point, this

view is based principally on the position that the gross income that the Company and its subsidiaries derive from time charters

constitutes services income rather than passive rental income. The Fifth Circuit Court of Appeals decided in

Tidewater Inc.

v. United States

, 565 F.3d 299 (5th Cir., 2009) that a typical time charter is a lease, and not a contract for the provision

of transportation services. In that case, the court was considering a tax issue that turned on whether the taxpayer was a lessor

where a vessel was under a time charter, and the court did not address the definition of passive income or the PFIC rules; however,

the reasoning of the case could have implications as to how the income from a time charter would be classified under such rules.

If the reasoning of the

Tidewater

case is applied to the Company’s situation and the Company’s or its subsidiaries’

time charters are treated as leases, the Company’s or its subsidiaries’ time charter income could be classified as

rental income and the Company would be a PFIC unless more than 25% of the income of the Company (taking into account the subsidiary

look through rule) is from spot charters plus other active income or an active leasing exception applies. The IRS has announced

that it will not follow the reasoning of the Tidewater case and would have treated the income from the time charters at issue in

that case as services income, including for other purposes of the Code. The Company intends to take the position that all of its

time, voyage and spot chartering activities will generate active services income and not passive leasing income, but in the absence

of direct legal authority specifically relating to the Code provisions governing PFICs, the IRS or a court could disagree with

this position. Although the matter is not free from doubt as described herein, based on the current operations and activities of

the Company and its subsidiaries and on the relative values of the vessels in the Company’s fleet and the charter income

in respect of the vessels, Globus Maritime Limited should not be treated as a PFIC during the taxable year ended December 31, 2018.

Based on the Company’s intention and expectation that

the Company’s subsidiaries’ income from spot, time and voyage chartering activities plus other active operating income

will be greater than 25% of the Company’s total gross income at all relevant times and that the gross value of the vessels

subject to such time, voyage or spot charters will exceed the gross value of all the passive assets the Company owns at all relevant

times, Globus Maritime Limited does not expect that it will constitute a PFIC with respect to a taxable year in the near future.

The Company will try to manage its vessels and its business

so as to avoid being classified as a PFIC for a future taxable year; however there can be no assurance that the nature of the Company’s

assets, income and operations will remain the same in the future (notwithstanding the Company’s current expectations). Additionally,

no assurance can be given that the IRS or a court of law will accept the Company’s position that the time charters that the

Company’s subsidiaries have entered into or any other time charter that the Company or a subsidiary may enter into will give

rise to active income rather than passive income for purposes of the PFIC rules, or that future changes of law will not adversely

affect this position. The Company has not obtained a ruling from the IRS on its time charters or its PFIC status and does not intend

to seek one. Any contest with the IRS may materially and adversely impact the market for the common shares and the prices at which

they trade. In addition, the costs of any contest on the issue with the IRS will result in a reduction in cash available for distribution

and thus will be borne indirectly by the Company’s shareholders.

If Globus Maritime Limited were to be classified as a PFIC in

any year, each United States Holder of the Company’s shares will be subject (in that year and all subsequent years) to special

rules with respect to: (1) any “excess distribution” (generally defined as any distribution received by a shareholder

in a taxable year that is greater than 125% of the average annual distributions received by the shareholder in the three preceding