Report of Foreign Issuer (6-k)

March 13 2019 - 4:07PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT

TO RULE 13a-16 OR

15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of March, 2019

Commission File Number: 001-34985

Globus

Maritime Limited

(Translation of registrant’s

name into English)

128 Vouliagmenis Avenue, 3rd Floor, Glyfada,

Attica, Greece, 166 74

(Address of principal executive office)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F

x

Form

40-F

¨

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1): _______

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(7): _______

Information Contained in this Report on Form 6-K

Globus Maritime Limited ("Globus",

or the “Company"), a dry bulk shipping company, announced today that on March 13, 2019 it signed a securities purchase

agreement with a private investor and agreed to issue, for gross proceeds of $5 million, a senior convertible note (the “Note”)

that is convertible into shares of the Company’s common stock, par value $0.004 per share. If not converted or redeemed beforehand

pursuant to the terms of the Note, the Note matures upon the anniversary of its issue. The

Note was issued, and the private placement closed, today.

The Note provides for interest to accrue

at 10% annually, which interest shall be paid on the first anniversary of the Note’s issuance unless the Note is converted

or redeemed pursuant to its terms beforehand. The interest may be paid in common shares of the Company, if certain conditions described

within the Note are met. The following summaries of the conversion and redemption provisions of the Note are qualified in their

entirety to the terms of the Note itself, which is attached as Exhibit 10.3 to a Report on Form 6-K published by the Company today:

|

|

·

|

The

Note may be converted, in whole or in part, into the Company’s common stock at any time by its holder, in which case all

principal, interest, and other amounts owed pursuant to the Note shall convert at a price per share which differs based upon the

performance of the Company’s stock price. The price per share for conversion purposes shall be $4.50 (the “Conversion

Price”); but if after June 7, 2019, the Company’s common stock trades below the Conversion Price, the price per share

for conversion purposes shall be the lowest of (a) the Conversion Price and (b) the highest of (i) $2.25 (the “Floor Price”)

and (ii) 87.5% of the average of the high and low bid price from any day chosen by the holder during the ten (10) consecutive

trading day period ending on and including the trading day immediately prior to the applicable conversion date (the “Alternate

Conversion Price”) regardless of the subsequent stock price.

|

|

|

·

|

The Note may be redeemed, in whole or in part, by request of its holder upon:

|

|

|

o

|

(a) an Event of Default (as defined within the Note), in exchange for the higher of (a) 120% of

all amounts owed under the Note, and (b) the value of the stock to which the Note could be converted (as calculated within Section

4(b) of the Note);

|

|

|

o

|

(b) a Change in Control (as defined within the Note) of the Company, in exchange for the higher

of (a) 120% of all amounts owed under the Note and (b) the value of the stock to which the Note could be converted (as calculated

within Section 5(c) of the Note); or

|

|

|

o

|

(c) a ten Trading Day period in which the common shares trade below 120% of the Floor Price,

in exchange for 100% of all amounts owed under the Note.

|

|

|

·

|

The Note may be redeemed, in whole or in part, at any time by the Company. If the Company elects

to redeem the Note, the Company shall immediately be obligated to pay the holder the greater of (a) 120% of all amounts owed under

the Note and (b) the value of the stock to which the Note could be converted (as calculated within Section 8(a) of the Note). If

the Company elects to redeem the Note, the Company (as a procedural matter) must first provide the holder notice, which could allow

the holder to convert prior to payment by the Company of the redemption amount.

|

|

|

·

|

If any portion of the Note is not redeemed or converted prior to its maturity date, on the maturity

date, the Company shall pay all outstanding principal in cash and may elect whether to pay the interest (and any other amounts

owed) in cash or shares of the Company’s common stock. If interest is paid in common stock, the Alternate Conversion Price

per share shall apply.

|

The Note includes anti-dilution protections

to its holder, which could cause the Conversion Price and Floor Price to be adjusted (upwards or downwards) proportionately upon

a stock split. The Note further allows the Company, with the holder’s consent, to reduce the Floor Price or the then current

conversion price, as to any amount and for any period of time deemed appropriate by the Company’s board of directors, but

to a price no less than $1.00 per share. The Company further entered into a registration rights agreement (the “Registration

Rights Agreement”) in which it agreed to register the resale of the common shares issuable upon conversion of the Note. The

Registration Rights Agreement includes liquidated damages provisions applicable if the Company fails to meet its obligations.

The full conversion of the Note would dilute

the ownership percentage of the Company held by existing stockholders and could hurt the Company’s stock price.

Under the terms of the Note, the Company

may not issue shares to the extent such issuance would cause the Holder, together with its affiliates and attribution parties,

to beneficially own a number of common shares which would exceed 4.99% (which may be increased upon no less than 61 days’

notice, but not to exceed 9.99%) of our then outstanding common shares immediately following such issuance, excluding for purposes

of such determination common shares issuable upon subsequent conversion of principal or interest on the Note. This provision does

not limit a Holder from acquiring up to 4.99% of our common shares, selling all of their common shares, and re-acquiring up to

4.99% of our common shares.

The Company intends to use the proceeds

from the sale of the Note for general corporate purposes and working capital including repayment of $1.5 million of debt. The Company

does not presently intend to use any of the proceeds for affiliated persons, but it may do so in the future.

The Note and the shares of common stock issuable upon the conversion

of the Note have not been registered under the Securities Act of 1933, as amended (the “Securities Act”), and may not

be offered or sold in the United States or to a U.S. person absent a registration statement or exemption from registration.

The Purchase Agreement contain representations and warranties

that are typical for private placements by public companies.

The representations, warranties and covenants contained in the

Purchase Agreement, Registration Rights Agreement and Note were made solely for the benefit of the parties to those agreements

and may be subject to limitations agreed upon by the contracting parties. Accordingly, the Purchase Agreement, Registration Rights

Agreement and Note are incorporated herein by reference only to provide investors with information regarding the terms of the Purchase

Agreement, Registration Rights Agreement and Loan Amendment Agreements, and not to provide investors with any other factual information

regarding the Company or its business, and should be read in conjunction with the disclosures in the Company’s periodic reports

and other filings with the Securities and Exchange Commission.

The foregoing description of the Purchase Agreement, Registration

Rights Agreement, and Note do not purport to be complete and is qualified in its entirety by reference to the full text of those

agreements, which are filed as Exhibit 10.1, 10.2, and 10.3 to this Current Report on Form 6-K and incorporated herein by reference.

The issuance of the Note was made in accordance with the Purchase

Agreement, and pursuant to one or more exemptions from registration under the Securities Act provided by Section 4(a)(2) of the

Securities Act and certain rules and regulations promulgated under that section and/or Regulation D and Regulation S promulgated

under the Securities Act. The Purchaser represented in the Purchase Agreement that it acquired the Note, for its own account and

not with a view to or for distributing or reselling such Securities or any part thereof. In addition, the Purchaser agreed not

to sell or otherwise dispose of all or any part of its Securities except pursuant to an effective registration statement under

the Securities Act or under an exemption from such registration and in compliance with applicable federal and state securities

laws. The Purchaser represented that they were not solicited nor did they execute the Purchase Agreement in the United States.

Exhibits

The following exhibit is filed as part of this Report on Form

6-K:

*Filed herewith

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

Date: March 13, 2019

|

|

GLOBUS MARITIME LIMITED

|

|

|

|

|

|

|

By:

|

/s/ Athanasios Feidakis

|

|

|

Name:

|

Athanasios Feidakis

|

|

|

Title:

|

President, Chief Executive Officer and Chief Financial Officer

|

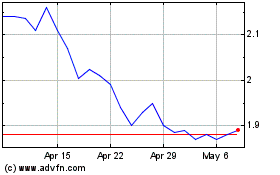

Globus Maritime (NASDAQ:GLBS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Globus Maritime (NASDAQ:GLBS)

Historical Stock Chart

From Apr 2023 to Apr 2024