Global Partner Acquisition Corp II Announces Separate Trading of its Class A Ordinary Shares and Warrants, Commencing March 4...

March 03 2021 - 12:58PM

Global Partner Acquisition Corp II (“GPAC II” or the “Company”)

announced that, commencing March 4, 2021, holders of the units sold

in the Company’s initial public offering may elect to separately

trade the Company’s Class A ordinary shares and the Company’s

warrants included in the units. No fractional warrants will be

issued upon separation of the units and only whole warrants will

trade. The Class A ordinary shares and warrants that are

separated will trade on the Nasdaq Capital Market under the symbols

“GPAC” and “GPACW,” respectively. Those units not separated will

continue to trade on the Nasdaq Capital Market under the symbol

“GPACU.” Holders of units will need to have their brokers contact

Continental Stock Transfer & Trust Company, the Company’s

transfer agent, in order to separate their units into Class A

ordinary shares and warrants.

This communication shall not constitute an offer to sell or the

solicitation of an offer to buy the securities of the Company, nor

shall there be any sale of these securities in any state or

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such state or jurisdiction.

About Global Partner Acquisition Corp

II

Global Partner Acquisition Corp II is a blank check company

formed for the purpose of entering into a merger, share exchange,

asset acquisition, share purchase, reorganization or similar

business combination with one or more businesses. Although the

Company may pursue a business combination target in any business,

industry or sector, the Company intends to focus its efforts on

completing a business combination with a company in one of the

following sectors: consumer; food; branded products;

e-commerce and retail disruptors; and the consumerization of

healthcare, as well as certain service sectors and the technology

driving changes across these sectors and related industries. The

Company believes that its combined team’s capabilities were

demonstrated in the sourcing and completion of the GPAC I merger

with Purple Innovation Inc., as well as the team’s significant work

with Purple since the closing of that merger.

Cautionary Note Concerning Forward-Looking

Statements

This communication contains “forward-looking statements,”

including with respect to Company’s business and intention to

consummate an initial business combination. No assurance can be

given that any forward-looking statement will prove to be accurate.

Forward-looking statements are subject to numerous risks and

uncertainties, many of which are beyond the control of the Company,

including those set forth in the Risk Factors section of the

Company’s registration statement and prospectus relating to its

initial public offering, as filed with the U.S. Securities and

Exchange Commission (“SEC”). Copies are available on the SEC’s

website, www.sec.gov. The Company undertakes no obligation to

update these statements after the date of this communication,

except as required by law.

Contacts

Global Partner Acquisition Corp II Paul Zepf (917)

793-1965paul@gpac2.com

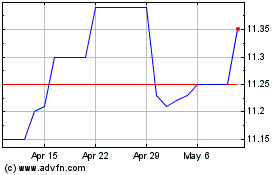

Global Partner Acqusitio... (NASDAQ:GPAC)

Historical Stock Chart

From Mar 2024 to Apr 2024

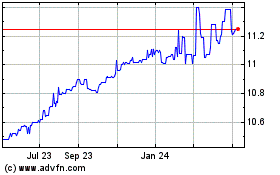

Global Partner Acqusitio... (NASDAQ:GPAC)

Historical Stock Chart

From Apr 2023 to Apr 2024