SCHEDULE

14A

(Rule

14a-101)

INFORMATION

REQUIRED IN PROXY STATEMENT

SCHEDULE

14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of the Securities

Exchange

Act of 1934 (Amendment No. 1)

|

Filed by the Registrant x

|

Filed by a Party other than the Registrant ¨

|

|

|

|

|

|

Check the appropriate box:

|

|

|

|

¨ Preliminary Proxy Statement

|

¨

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

¨ Definitive Proxy Statement

|

|

|

|

x Definitive Additional Materials

|

|

|

|

¨ Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12

|

Glen

Burnie Bancorp

(Name of Registrant as Specified in Its

Charter)

N/A

(Name of Person(s)

Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate

box):

|

|

¨

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4)

and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction

applies:

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction

computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

¨ Fee paid previously with preliminary materials.

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

April 12, 2021

Dear Fellow Stockholder:

The Notice of Annual Meeting

of Stockholders of Glen Burnie Bancorp (the “Company”) mailed to you late last week included a Proxy Statement with information

concerning the matters to be voted on at the 2021 Annual Meeting of Stockholders to be held virtually via the Internet at www.meetingcenter.io/22000663,

password - GLBZ2021, on Thursday, May 13, 2021 at 2:00 p.m., Eastern Time.

Subsequent to the printing

and mailing of the Proxy Statement, the Company became aware that the information set forth in the section of the Proxy Statement titled

“Voting Securities and Principal Holders Thereof” was not complete. Accompanying this letter is the corrected information

to be set forth in that Section.

All other information, including

the manner of voting, is as set forth in the Proxy Statement previously sent to you.

Our board of directors and

management appreciate your continuing support of the Company, and we urge you to vote your shares as soon as possible.

This Proxy Supplement is being

mailed on or about April 12, 2021.

|

|

Sincerely,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Chairman

|

|

President and Chief

|

|

|

|

|

Executive Officer

|

PROXY STATEMENT SUPPLEMENT

OF

GLEN BURNIE BANCORP

101 Crain Highway, S.E.

Glen Burnie, Maryland 21061

ANNUAL MEETING OF STOCKHOLDERS

May 13, 2021

VOTING

SECURITIES AND PRINCIPAL HOLDERS THEREOF

The securities entitled to

vote at the Annual Meeting consist of the Company’s common stock, par value $1.00 per share (the “Common Stock”). Stockholders

of record as of the close of business on March 31, 2021 (the “Record Date”) are entitled to one vote for each share then held.

At the Record Date, the Company had 2,845,103 shares of Common Stock issued and outstanding. The presence, in person or by proxy, of at

least a majority of the total number of shares of Common Stock outstanding and entitled to vote will be necessary to constitute a quorum

at the Annual Meeting. Persons and groups beneficially owning in excess of 5% of the Common Stock are required to file certain reports

with respect to such ownership pursuant to the Securities Exchange Act of 1934 (the “Exchange Act”). The following table sets

forth, as of the Record Date, certain information as to the Common Stock beneficially owned by all persons who were known to the Company

to beneficially own more than 5% of the Common Stock outstanding at the Record Date.

|

|

|

Amount and Nature

|

|

|

Percent of Shares

|

|

|

Name and Address

|

|

of Beneficial

|

|

|

of Common Stock

|

|

|

of Beneficial Owner

|

|

Ownership1

|

|

|

Outstanding

|

|

|

John E. Demyan

|

|

|

285,217

|

2

|

|

|

10.04

|

%

|

|

101 Crain Highway, S.E.

|

|

|

|

|

|

|

|

|

|

Glen Burnie, Maryland 21061

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Marrian K. McCormick

|

|

|

149,469

|

3

|

|

|

5.26

|

%

|

|

8 Oak Lane

|

|

|

|

|

|

|

|

|

|

Glen Burnie, Maryland 21061

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Edward E. Haddock, Jr. Family Trusts II4

|

|

|

143,944

|

4

|

|

|

5.1

|

%

|

|

3300 University Boulevard, Suite 218

|

|

|

|

|

|

|

|

|

|

Winter Park, Florida 32792

|

|

|

|

|

|

|

|

|

1Rounded

to nearest whole share. For purposes of this table, a person is deemed to be the beneficial owner of any shares of Common Stock if he

or she has or shares voting or investment power with respect to such Common Stock or has a right to acquire beneficial ownership at any

time within 60 days from the Record Date. As used herein, “voting power” is the power to vote or direct the voting of shares

and “investment power” is the power to dispose or direct the disposition of shares. Except as otherwise noted, ownership is

direct, and the named individuals or group exercise sole voting and investment power over the shares of the Common Stock.

2Includes

284,217 shares held by Mr. Demyan individually and 1,000 shares held by Mrs. Demyan.

3Includes

1,461 shares held by Mrs. McCormick individually, 12,854 shares held by Mrs. McCormick for the benefit of minor children, 20,242 shares

held by Mrs. McCormick as trustee of the McCormick Family Trust, and 114,912 shares held by Mrs. McCormick as one of the trustees for

The Kuethe Family Educational Trust.

4Based

on information filed by the holders with the Securities and Exchange Commission (“SEC”). These shares of Common Stock are

reported as beneficially owned by The Edward E. Haddock, Jr. Family Trusts II, Edward E. Haddock,

Jr. Family Foundation, The Edward E. Haddock, Jr. Sons Trusts II – Rob Haddock 678 Share Trust II, and The Edward E. Haddock,

Jr. Sons Trusts II – Scott Haddock 678 Share Trust II, all of which share voting and dispositive power. Due to relationships among

these reporting persons, each of the reporting persons may be deemed to be: (i) the beneficial owner of the shares directly held

by the other reporting persons; and (ii) each of the reporting persons may be deemed a member of a “group” within the

meaning of Section 13(d)(3) of the Exchange Act or Rule 13d-5 thereunder with one or more of the other reporting persons

hereunder. Although the reporting persons reported their ownership of such securities as if they were members of a “group,”

each reporting person disclaims that such reporting person is the beneficial owner of any securities other than those directly held by

such reporting person.

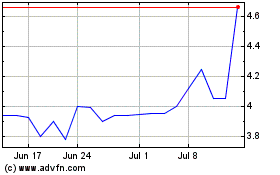

Glen Burnie Bancorp (NASDAQ:GLBZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

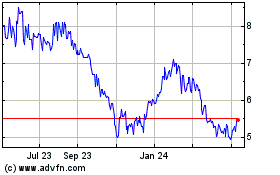

Glen Burnie Bancorp (NASDAQ:GLBZ)

Historical Stock Chart

From Apr 2023 to Apr 2024