Gilat Satellite Networks Ltd. (NASDAQ: GILT, TASE: GILT), a

worldwide leader in satellite networking technology, solutions and

services, today reported its unaudited results for the fourth

quarter and full year ended December 31, 2024.

Fourth Quarter

2024 Financial

Highlights

- Revenue of $78.1 million, up 3% compared with

$75.6 million in Q4 2023;

- GAAP operating income of $12.8 million,

compared with $2.9 million in Q4 2023;

- Non-GAAP operating income of $9.7 million,

compared with $6.1 million in Q4 2023;

- GAAP net income of $11.8 million, or $0.21 per

diluted share, compared with $3.4 million, or $0.06 per diluted

share, in Q4 2023;

- Non-GAAP net income of $8.5

million, or $0.15 per diluted share, compared with $6.5 million, or

$0.11 per diluted share, in Q4 2023;

- Adjusted EBITDA of $12.1 million, up 30%

compared with $9.4 million in Q4 2023.

Full year 2024

Financial Highlights

- Revenue of $305.4 million, up 15% compared

with $266.1 million in 2023;

- GAAP operating income of $27.7 million,

compared with $28.1 million in 2023;

- Non-GAAP operating income of $31.9 million, up

35% compared with $23.5 million in 2023;

- GAAP net income of $24.8 million, or $0.44 per

diluted share, compared with $23.5 million, or $0.41 per diluted

share in 2023;

- Non-GAAP net income of $28.2 million, or $0.49

per diluted share, compared with $19.9 million, or $0.35 per

diluted share 2023;

- Adjusted EBITDA was $42.2 million, up 16%

compared with adjusted EBITDA of $36.4 million in 2023.

2025 Guidance

Management’s financial guidance for 2025 is for revenues of

between $415 to $455 million, and Adjusted EBITDA is expected to be

between $47 to $53 million1.

Adi Sfadia, Gilat’s CEO, commented, "Gilat delivered strong

results with profitability of Adjusted EBITDA of $12.1 million for

the fourth quarter and $42.2 million for the entire year. These

results alongside our strong generation of cash flow underscore the

strength and resilience of our core business model, demonstrating

both operating leverage and the positive impact of our current

product revenue mix.”

“During the fourth quarter our Defense and In-Flight

Connectivity business continued to experience strong momentum with

increased orders and awards. The Defense segment, with a focus on

the US DoD, represents a significant growth opportunity for Gilat.

We are pleased with our progress in expanding opportunities to

serve the specialized needs of government and military customers

with our innovative satellite solutions,” Mr. Sfadia continued.

“With the closing of the Stellar Blu acquisition, our Commercial

business is poised for significant growth as we establish our

leadership in the expanding Electronically Steerable Antenna (ESA)

market. Our portfolio of IFC GEO, LEO and multi-orbit solutions

will be instrumental in capitalizing on increasing demand for

inflight connectivity by airlines and passengers.”

Mr. Sfadia concluded, “Looking ahead into 2025,

given the significant potential we see in the defense market and

our view of this as a strategic growth engine, we plan to increase

our investment in R&D, Sales and Marketing of the Defense

Segment. We believe that this targeted increase will allow us to

take advantage of the opportunities we see quicker and more

decisively to ensure a long term growth in this market. Coupled

with our recent acquisitions and positioning in the Satcom market,

Gilat has the resource base to scale the IFC and Defense businesses

and our track record of profitable, cash generating growth,

provides a strong foundation for Gilat’s continued success."

Commencing January 1, 2025, the company has

implemented a new organizational structure and reportable segments.

The new organizational structure and segment reporting are designed

to better target the diverse and attractive end markets the company

serves and to provide investors with greater insight into Gilat’s

business lines and strategic growth opportunities. The company will

report financial results based on the following three divisions:

Gilat Defense, Gilat Commercial and Gilat Peru.

-

Gilat Defense Division: provides secure,

rapid-deployment solutions for military organizations, government

agencies, and defense integrators, with a strong focus on the U.S.

Department of Defense resulting from our strategic acquisition of

DataPath Inc. By integrating technologies from Gilat, Gilat

DataPath, and Gilat Wavestream, the division delivers resilient

battlefield connectivity with multiple layers of communication

redundancy for high availability.

-

Gilat Commercial Division: provides advanced

broadband satellite communication networks for IFC, Enterprise and

Cellular Backhaul, supporting HTS, VHTS, and NGSO constellations

with turnkey solutions for service providers, satellite operators,

and enterprises. Our acquisition of Stellar Blu serves as the

cornerstone of this division, strengthening our position in the IFC

market and enabling us to provide cutting-edge connectivity

solutions that meet the demands of passengers, airlines, and

service providers worldwide.

-

Gilat Peru Division: specializes in end-to-end

telco solutions, including the operation and implementation of

large-scale network projects. With expertise in terrestrial fiber

optic, wireless, and satellite networks, Gilat Peru provides

technology integration, managed networks and services, connectivity

solutions, and reliable internet and voice access across the

region.

Gilat has prepared unaudited illustrations of

the company’s financial reports for Fiscal Years 2023 and 2024 to

reflect the company’s results based on the new segment reporting,

which can be found in the IR section on Gilat’s website. For

additional information about Gilat’s new divisional structure,

please click here: Link

Key Recent Announcements

-

Gilat Secures Over $18 Million Orders Addressing Demand for

In-Flight Connectivity Solutions

-

Gilat Receives $9 Million in Orders for Multi-Orbit SkyEdge

Platforms

-

Gilat Completes Acquisition of Stellar Blu Solutions LLC

-

Gilat and Hispasat Provided Immediate Satellite Communication to

Support Disaster Recovery Efforts After Hurricane Helene

-

Gilat Receives Over $3 Million in Orders to Support LEO

Constellations

-

Gilat Awarded Over $5 Million in orders to Support Critical

Connectivity for Defense Forces

-

Gilat Receives $4M in Orders for Advanced Portable Terminals from

Global Defense Customers

Conference Call Details

Gilat’s Management will discuss its fourth

quarter and full year 2024 results and business achievements and

participate in a question-and-answer session:

| Date: |

Wednesday,

February 12, 2025 |

| Start: |

09:30 AM EST / 16:30 IST |

| Dial-in: |

US: 1-888-407-2553 |

| |

International: +972-3-918-0609 |

| |

|

A simultaneous webcast of the conference call

will be available on the Gilat website at gilat.com and through

this link: https://veidan.activetrail.biz/gilatq4-2024

The webcast will also be archived for a period

of 30 days on the Company’s website and through the link above.

Non-GAAP Measures

The attached summary unaudited financial

statements were prepared in accordance with U.S. Generally Accepted

Accounting Principles (GAAP). To supplement the consolidated

financial statements presented in accordance with GAAP, the Company

presents non-GAAP presentations of gross profit, operating

expenses, operating income, income before taxes on income, net

income, Adjusted EBITDA, and earnings per share. The adjustments to

the Company’s GAAP results are made with the intent of providing

both management and investors with a more complete understanding of

the Company’s underlying operational results, trends, and

performance. Non-GAAP financial measures mainly exclude, if and

when applicable, the effect of stock-based compensation expenses,

amortization of purchased intangibles, lease incentive

amortization, other non-recurring expenses, other integration

expenses, other operating expenses (income), net, and income tax

effect on the relevant adjustments.

Adjusted EBITDA is presented to compare the

Company’s performance to that of prior periods and evaluate the

Company’s financial and operating results on a consistent basis

from period to period. The Company also believes this measure, when

viewed in combination with the Company’s financial results prepared

in accordance with GAAP, provides useful information to investors

to evaluate ongoing operating results and trends. Adjusted EBITDA,

however, should not be considered as an alternative to operating

income or net income for the period and may not be indicative of

the historic operating results of the Company; nor is it meant to

be predictive of potential future results. Adjusted EBITDA is not a

measure of financial performance under GAAP and may not be

comparable to other similarly titled measures for other companies.

Reconciliation between the Company's net income and adjusted EBITDA

is presented in the attached summary financial statements.

Non-GAAP presentations of gross profit,

operating expenses, operating income, income before taxes on

income, net income, adjusted EBITDA and earnings per share should

not be considered in isolation or as a substitute for any of the

consolidated statements of operations prepared in accordance with

GAAP, or as an indication of Gilat’s operating performance or

liquidity.

About Gilat

Gilat Satellite Networks Ltd. (NASDAQ: GILT,

TASE: GILT) is a leading global provider of satellite-based

broadband communications. With over 35 years of experience, we

develop and deliver deep technology solutions for satellite,

ground, and new space connectivity, offering next-generation

solutions and services for critical connectivity across commercial

and defense applications. We believe in the right of all people to

be connected and are united in our resolution to provide

communication solutions to all reaches of the world.

Together with our wholly-owned

subsidiaries—Gilat Wavestream, Gilat DataPath, and Gilat Stellar

Blu—we offer integrated, high-value solutions supporting

multi-orbit constellations, Very High Throughput Satellites (VHTS),

and Software-Defined Satellites (SDS) via our Commercial and

Defense Divisions. Our comprehensive portfolio is comprised of a

cloud-based platform and modems; high-performance satellite

terminals; advanced Satellite On-the-Move (SOTM) antennas and ESAs;

highly efficient, high-power Solid State Power Amplifiers (SSPA)

and Block Upconverters (BUC) and includes integrated ground systems

for commercial and defense markets, field services, network

management software, and cybersecurity services.

Gilat’s products and tailored solutions support

multiple applications including government and defense, IFC and

mobility, broadband access, cellular backhaul, enterprise,

aerospace, broadcast, and critical infrastructure clients all while

meeting the most stringent service level requirements. For more

information, please visit: http://www.gilat.com

Certain statements made herein that are not

historical are forward-looking within the meaning of the Private

Securities Litigation Reform Act of 1995. The words “estimate”,

“project”, “intend”, “expect”, “believe” and similar expressions

are intended to identify forward-looking statements. These

forward-looking statements involve known and unknown risks and

uncertainties. Many factors could cause the actual results,

performance or achievements of Gilat to be materially different

from any future results, performance or achievements that may be

expressed or implied by such forward-looking statements, including,

among others, changes in general economic and business conditions,

inability to maintain market acceptance to Gilat’s products,

inability to timely develop and introduce new technologies,

products and applications, rapid changes in the market for Gilat’s

products, loss of market share and pressure on prices resulting

from competition, introduction of competing products by other

companies, inability to manage growth and expansion, loss of key

OEM partners, inability to attract and retain qualified personnel,

inability to protect the Company’s proprietary technology and risks

associated with Gilat’s international operations and its location

in Israel, including those related to the terrorist attacks by

Hamas, and the hostilities between Israel and Hamas and Israel and

Hezbollah. For additional information regarding these and other

risks and uncertainties associated with Gilat’s business, reference

is made to Gilat’s reports filed from time to time with the

Securities and Exchange Commission. We undertake no obligation to

update or revise any forward-looking statements for any reason.

Contact:

Gilat Satellite Networks

Hagay Katz, Chief Product and

Marketing Officerhagayk@gilat.com

Alliance Advisors:

GilatIR@allianceadvisors.com Phone: +1 212 838 3777

_________________1 We do not provide

forward-looking guidance on a GAAP basis because we are unable to

reasonably provide forward-looking guidance for certain financial

data, such as amortization of purchased intangibles and

earnout-based expenses related to recent acquisitions. As a result,

we are not able to provide a reconciliation of GAAP to non-GAAP

financial measures for forward-looking data without unreasonable

effort.

| |

| GILAT

SATELLITE NETWORKS LTD. |

|

CONSOLIDATED STATEMENTS OF INCOME |

| U.S.

dollars in thousands (except share and per share

data) |

| |

|

|

|

|

|

|

|

|

|

| |

|

|

Twelve months ended |

|

Three months

ended |

| |

|

|

December

31, |

|

December 31, |

|

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| |

|

|

Unaudited |

|

Audited |

|

Unaudited |

| |

|

|

|

|

|

|

|

|

|

| Revenues |

|

$ |

305,448 |

|

|

$ |

266,090 |

|

|

$ |

78,128 |

|

|

$ |

75,612 |

|

| Cost of

revenues |

|

|

192,117 |

|

|

|

161,145 |

|

|

|

47,107 |

|

|

|

46,692 |

|

|

|

|

|

|

|

|

|

|

|

|

| Gross

profit |

|

|

113,331 |

|

|

|

104,945 |

|

|

|

31,021 |

|

|

|

28,920 |

|

|

|

|

|

|

|

|

|

|

|

|

| Research and

development expenses, net |

|

38,136 |

|

|

|

41,173 |

|

|

|

10,108 |

|

|

|

11,624 |

|

| Selling and

marketing expenses |

|

27,381 |

|

|

|

25,243 |

|

|

|

6,657 |

|

|

|

7,119 |

|

| General and

administrative expenses |

|

26,868 |

|

|

|

19,215 |

|

|

|

6,192 |

|

|

|

6,312 |

|

| Other operating

expenses (income), net |

|

|

(6,751 |

) |

|

|

(8,771 |

) |

|

|

(4,706 |

) |

|

|

986 |

|

|

|

|

|

|

|

|

|

|

|

|

| Total

operating expenses |

|

|

85,634 |

|

|

|

76,860 |

|

|

|

18,251 |

|

|

|

26,041 |

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

income |

|

|

27,697 |

|

|

|

28,085 |

|

|

|

12,770 |

|

|

|

2,879 |

|

|

|

|

|

|

|

|

|

|

|

|

| Financial income,

net |

|

|

1,504 |

|

|

|

109 |

|

|

|

63 |

|

|

|

1,196 |

|

|

|

|

|

|

|

|

|

|

|

|

| Income

before taxes on income |

|

29,201 |

|

|

|

28,194 |

|

|

|

12,833 |

|

|

|

4,075 |

|

|

|

|

|

|

|

|

|

|

|

|

| Taxes on

income |

|

|

(4,352 |

) |

|

|

(4,690 |

) |

|

|

(1,069 |

) |

|

|

(628 |

) |

|

|

|

|

|

|

|

|

|

|

|

| Net

income |

|

$ |

24,849 |

|

|

$ |

23,504 |

|

|

$ |

11,764 |

|

|

$ |

3,447 |

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings

per share (basic and diluted) |

$ |

0.44 |

|

|

$ |

0.41 |

|

|

$ |

0.21 |

|

|

$ |

0.06 |

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted

average number of shares used in |

|

|

|

|

|

|

|

|

|

computing earnings per

share |

|

|

|

|

|

|

|

|

| |

Basic |

|

|

57,016,920 |

|

|

|

56,668,999 |

|

|

|

57,017,032 |

|

|

|

56,820,774 |

|

| |

Diluted |

|

|

57,016,920 |

|

|

|

56,672,537 |

|

|

|

57,017,032 |

|

|

|

56,820,774 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GILAT

SATELLITE NETWORKS LTD. |

|

RECONCILIATION BETWEEN GAAP AND NON-GAAP CONSOLIDATED

STATEMENTS OF INCOME |

| FOR

COMPARATIVE PURPOSES |

| U.S.

dollars in thousands (except share and per share

data) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended |

|

Three months ended |

| |

|

December 31, 2024 |

|

December 31, 2023 |

| |

|

GAAP |

|

Adjustments (*) |

|

Non-GAAP |

|

GAAP |

|

Adjustments (*) |

|

Non-GAAP |

|

|

|

Unaudited |

|

Unaudited |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross

profit |

$ |

31,021 |

|

$ |

575 |

|

|

$ |

31,596 |

|

$ |

28,920 |

|

$ |

617 |

|

|

$ |

29,537 |

| Operating

expenses |

|

18,251 |

|

|

3,680 |

|

|

|

21,931 |

|

|

26,041 |

|

|

(2,615 |

) |

|

|

23,426 |

| Operating

income |

|

12,770 |

|

|

(3,105 |

) |

|

|

9,665 |

|

|

2,879 |

|

|

3,232 |

|

|

|

6,111 |

| Income before

taxes on income |

|

12,833 |

|

|

(3,105 |

) |

|

|

9,728 |

|

|

4,075 |

|

|

3,232 |

|

|

|

7,307 |

| Net income |

$ |

11,764 |

|

$ |

(3,252 |

) |

|

$ |

8,512 |

|

$ |

3,447 |

|

$ |

3,097 |

|

|

$ |

6,544 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic earnings per

share |

$ |

0.21 |

|

$ |

(0.06 |

) |

|

$ |

0.15 |

|

$ |

0.06 |

|

$ |

0.06 |

|

|

$ |

0.12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted earnings

per share |

$ |

0.21 |

|

$ |

(0.06 |

) |

|

$ |

0.15 |

|

$ |

0.06 |

|

$ |

0.05 |

|

|

$ |

0.11 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average

number of shares used in |

|

|

|

|

|

|

|

|

|

|

|

|

computing earnings per share |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

57,017,032 |

|

|

|

|

57,017,032 |

|

|

56,820,774 |

|

|

|

|

56,820,774 |

|

Diluted |

|

57,017,032 |

|

|

|

|

57,024,316 |

|

|

56,820,774 |

|

|

|

|

56,987,939 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

(*) |

Adjustments reflect

the effect of stock-based compensation expenses as per ASC 718,

amortization of purchased intangibles, other operating income

(expenses), net, other integration expenses

and income tax effect on such adjustments which is calculated using

the relevant effective tax rate. |

| |

|

| |

|

Three months ended |

|

Three months ended |

| |

|

December 31, 2024 |

|

December 31, 2023 |

| |

|

|

|

Unaudited |

|

|

|

|

|

Unaudited |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP net

income |

|

|

$ |

11,764 |

|

|

|

|

|

|

$ |

3,447 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

|

|

|

|

|

|

|

|

|

|

| Stock-based

compensation expenses |

|

|

|

133 |

|

|

|

|

|

|

|

129 |

|

|

|

| Amortization of

purchased intangibles |

|

|

|

389 |

|

|

|

|

|

|

|

448 |

|

|

|

| Other integration

expenses |

|

|

|

53 |

|

|

|

|

|

|

|

40 |

|

|

|

| |

|

|

|

|

575 |

|

|

|

|

|

|

|

617 |

|

|

|

| Operating

expenses |

|

|

|

|

|

|

|

|

|

|

|

| Stock-based

compensation expenses |

|

|

|

653 |

|

|

|

|

|

|

|

796 |

|

|

|

| Stock-based

compensation expenses related to business combination |

|

140 |

|

|

|

|

|

|

|

662 |

|

|

|

| Amortization of

purchased intangibles |

|

|

|

216 |

|

|

|

|

|

|

|

162 |

|

|

|

| Other operating

income (expenses), net and other integration expenses |

|

(4,689 |

) |

|

|

|

|

|

|

995 |

|

|

|

|

|

|

|

|

|

(3,680 |

) |

|

|

|

|

|

|

2,615 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Taxes on

income |

|

|

|

(147 |

) |

|

|

|

|

|

|

(135 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP net

income |

|

|

$ |

8,512 |

|

|

|

|

|

|

$ |

6,544 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GILAT

SATELLITE NETWORKS LTD. |

|

RECONCILIATION BETWEEN GAAP AND NON-GAAP CONSOLIDATED

STATEMENTS OF INCOME |

| FOR

COMPARATIVE PURPOSES |

| U.S.

dollars in thousands (except share and per share

data) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Twelve months ended |

|

Twelve months ended |

| |

|

|

|

December 31, 2024 |

|

December 31, 2023 |

| |

|

|

|

GAAP |

|

Adjustments (*) |

|

Non-GAAP |

|

GAAP |

|

Adjustments (*) |

|

Non-GAAP |

| |

|

|

|

Unaudited |

|

Audited |

|

Unaudited |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross

profit |

|

|

$ |

113,331 |

|

$ |

3,673 |

|

|

$ |

117,004 |

|

$ |

104,945 |

|

$ |

895 |

|

|

$ |

105,840 |

| Operating

expenses |

|

|

|

85,634 |

|

|

(500 |

) |

|

|

85,134 |

|

|

76,860 |

|

|

5,434 |

|

|

|

82,294 |

| Operating

income |

|

|

|

27,697 |

|

|

4,173 |

|

|

|

31,870 |

|

|

28,085 |

|

|

(4,539 |

) |

|

|

23,546 |

| Income before

taxes on income |

|

|

|

29,201 |

|

|

4,173 |

|

|

|

33,374 |

|

|

28,194 |

|

|

(4,539 |

) |

|

|

23,655 |

| Net

income |

|

|

$ |

24,849 |

|

$ |

3,376 |

|

|

$ |

28,225 |

|

$ |

23,504 |

|

$ |

(3,597 |

) |

|

$ |

19,907 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic earnings per

share |

|

|

$ |

0.44 |

|

$ |

0.06 |

|

|

$ |

0.50 |

|

$ |

0.41 |

|

$ |

(0.06 |

) |

|

$ |

0.35 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted earnings

per share |

|

|

$ |

0.44 |

|

$ |

0.05 |

|

|

$ |

0.49 |

|

$ |

0.41 |

|

$ |

(0.06 |

) |

|

$ |

0.35 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average

number of shares used in |

|

|

|

|

|

|

|

|

|

|

|

|

|

computing earnings per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

|

57,016,920 |

|

|

|

|

57,016,920 |

|

|

56,668,999 |

|

|

|

|

56,668,999 |

|

Diluted |

|

|

|

57,016,920 |

|

|

|

|

57,041,778 |

|

|

56,672,537 |

|

|

|

|

56,784,601 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(*) |

Adjustments reflect

the effect of stock-based compensation expenses as per ASC 718,

amortization of purchased intangibles, other operating income,

net, other non-recurring expenses, other integration expenses

and income tax effect on such adjustments which is calculated using

the relevant effective tax rate. |

|

|

|

|

| |

|

|

|

Twelve months ended |

|

Twelve months ended |

| |

|

|

|

December 31, 2024 |

|

December 31, 2023 |

| |

|

|

|

|

|

Unaudited |

|

|

|

|

|

Unaudited |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP net

income |

|

|

|

|

$ |

24,849 |

|

|

|

|

|

|

$ |

23,504 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock-based

compensation expenses |

|

|

|

|

|

518 |

|

|

|

|

|

|

|

407 |

|

|

|

| Amortization of

purchased intangibles |

|

|

|

|

|

2,412 |

|

|

|

|

|

|

|

448 |

|

|

|

| Other

non-recurring expenses |

|

|

|

|

|

466 |

|

|

|

|

|

|

|

- |

|

|

|

| Other integration

expenses |

|

|

|

|

|

277 |

|

|

|

|

|

|

|

40 |

|

|

|

| |

|

|

|

|

|

|

3,673 |

|

|

|

|

|

|

|

895 |

|

|

|

| Operating

expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock-based

compensation expenses |

|

|

|

|

|

2,771 |

|

|

|

|

|

|

|

2,354 |

|

|

|

| Stock-based

compensation expenses related to business combination |

|

3,437 |

|

|

|

|

|

|

|

662 |

|

|

|

| Amortization of

purchased intangibles |

|

|

988 |

|

|

|

|

|

|

|

312 |

|

|

|

| Other operating

income, net and other integration expenses |

|

|

(6,696 |

) |

|

|

|

|

|

|

(8,762 |

) |

|

|

|

|

|

|

|

|

|

|

500 |

|

|

|

|

|

|

|

(5,434 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Taxes on

income |

|

|

|

|

|

(797 |

) |

|

|

|

|

|

|

942 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP net

income |

|

|

|

|

$ |

28,225 |

|

|

|

|

|

|

$ |

19,907 |

|

|

|

| GILAT

SATELLITE NETWORKS LTD. |

|

SUPPLEMENTAL INFORMATION |

| U.S.

dollars in thousands |

| |

|

|

|

|

|

|

|

|

|

|

| ADJUSTED

EBITDA: |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Twelve months

ended |

|

Three months

ended |

| |

|

|

|

December

31, |

|

December 31, |

|

|

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| |

|

|

|

Unaudited |

|

Unaudited |

| |

|

|

|

|

|

|

|

|

|

|

| GAAP net income |

|

|

|

$ |

24,849 |

|

|

$ |

23,504 |

|

|

$ |

11,764 |

|

|

$ |

3,447 |

|

| Adjustments: |

|

|

|

|

|

|

|

|

|

| Financial income,

net |

|

|

|

|

(1,504 |

) |

|

|

(109 |

) |

|

|

(63 |

) |

|

|

(1,196 |

) |

| Taxes on

income |

|

|

|

4,352 |

|

|

|

4,690 |

|

|

|

1,069 |

|

|

|

628 |

|

| Stock-based

compensation expenses |

|

|

|

3,289 |

|

|

|

2,761 |

|

|

|

786 |

|

|

|

925 |

|

| Stock-based

compensation expenses related to business combination |

|

3,437 |

|

|

|

662 |

|

|

|

140 |

|

|

|

662 |

|

| Depreciation and

amortization (*) |

|

|

|

13,777 |

|

|

|

13,627 |

|

|

|

3,068 |

|

|

|

3,862 |

|

| Other operating

expenses (income), net |

|

|

(6,751 |

) |

|

|

(8,771 |

) |

|

|

(4,706 |

) |

|

|

986 |

|

| Other

non-recurring expenses |

|

|

|

466 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Other integration

expenses |

|

|

|

332 |

|

|

|

49 |

|

|

|

70 |

|

|

|

49 |

|

| |

|

|

|

|

|

|

|

|

|

|

| Adjusted

EBITDA |

|

|

$ |

42,247 |

|

|

$ |

36,413 |

|

|

$ |

12,128 |

|

|

$ |

9,363 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| (*) Including amortization of

lease incentive |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| SEGMENT

REVENUES: |

|

|

|

|

|

|

|

|

|

|

|

Twelve months ended |

|

Three months

ended |

|

|

|

|

|

December

31, |

|

December

31, |

|

|

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

|

|

Unaudited |

|

Audited |

|

Unaudited |

|

|

|

|

|

|

|

|

|

|

|

|

| Satellite

Networks |

|

|

$ |

198,174 |

|

|

$ |

168,527 |

|

|

$ |

49,064 |

|

|

$ |

53,517 |

|

| Integrated

Solutions |

|

|

|

54,925 |

|

|

|

46,133 |

|

|

|

17,257 |

|

|

|

9,503 |

|

| Network

Infrastructure and Services |

|

|

|

52,349 |

|

|

|

51,430 |

|

|

|

11,807 |

|

|

|

12,592 |

|

| |

|

|

|

|

|

|

|

|

|

|

| Total

revenues |

|

|

$ |

305,448 |

|

|

$ |

266,090 |

|

|

$ |

78,128 |

|

|

$ |

75,612 |

|

| GILAT

SATELLITE NETWORKS LTD. |

|

CONSOLIDATED BALANCE SHEETS |

| U.S.

dollars in thousands |

| |

|

|

|

|

| |

|

December 31, |

|

December 31, |

|

|

|

|

2024 |

|

|

|

2023 |

|

| |

|

Unaudited |

|

Audited |

| |

|

|

|

|

|

ASSETS |

|

|

|

|

| |

|

|

|

|

| CURRENT

ASSETS: |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

119,384 |

|

|

$ |

103,961 |

|

|

Restricted cash |

|

|

853 |

|

|

|

736 |

|

|

Trade receivables, net |

|

|

53,554 |

|

|

|

44,725 |

|

|

Contract assets |

|

|

20,987 |

|

|

|

28,327 |

|

|

Inventories |

|

|

38,890 |

|

|

|

38,525 |

|

|

Other current assets |

|

|

21,963 |

|

|

|

24,299 |

|

| |

|

|

|

|

|

Total current assets |

|

|

255,631 |

|

|

|

240,573 |

|

| |

|

|

|

|

| LONG-TERM

ASSETS: |

|

|

|

|

|

Restricted cash |

|

|

12 |

|

|

|

54 |

|

|

Long-term contract assets |

|

|

8,146 |

|

|

|

9,283 |

|

|

Severance pay funds |

|

|

5,966 |

|

|

|

5,737 |

|

|

Deferred taxes |

|

|

11,896 |

|

|

|

11,484 |

|

|

Operating lease right-of-use assets |

|

|

6,556 |

|

|

|

5,105 |

|

|

Other long-term assets |

|

|

5,288 |

|

|

|

9,544 |

|

| |

|

|

|

|

|

Total long-term assets |

|

|

37,864 |

|

|

|

41,207 |

|

| |

|

|

|

|

| PROPERTY AND

EQUIPMENT, NET |

|

|

70,834 |

|

|

|

74,315 |

|

|

|

|

|

|

|

| INTANGIBLE ASSETS,

NET |

|

|

12,925 |

|

|

|

16,051 |

|

|

|

|

|

|

|

| GOODWILL |

|

|

52,494 |

|

|

|

54,740 |

|

|

|

|

|

|

|

| TOTAL

ASSETS |

|

$ |

429,748 |

|

|

$ |

426,886 |

|

|

|

|

|

|

|

| GILAT

SATELLITE NETWORKS LTD. |

|

CONSOLIDATED BALANCE SHEETS (Cont.) |

| U.S.

dollars in thousands (except share data) |

| |

|

|

|

|

| |

|

December 31, |

|

December 31, |

| |

|

|

2024 |

|

|

|

2023 |

|

| |

|

Unaudited |

|

Audited |

| |

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

| |

|

|

|

|

| CURRENT

LIABILITIES: |

|

|

|

|

|

Short-term debt |

|

$ |

- |

|

|

$ |

7,453 |

|

|

Trade payables |

|

|

17,107 |

|

|

|

13,873 |

|

|

Accrued expenses |

|

|

45,368 |

|

|

|

51,906 |

|

|

Advances from customers and deferred revenues |

|

|

18,587 |

|

|

|

34,495 |

|

|

Operating lease liabilities |

|

|

2,557 |

|

|

|

2,426 |

|

|

Other current liabilities |

|

|

17,817 |

|

|

|

16,431 |

|

| |

|

|

|

|

|

Total current liabilities |

|

|

101,436 |

|

|

|

126,584 |

|

| |

|

|

|

|

| LONG-TERM

LIABILITIES: |

|

|

|

|

|

Long-term loan |

|

|

2,000 |

|

|

|

2,000 |

|

|

Accrued severance pay |

|

|

6,677 |

|

|

|

6,537 |

|

|

Long-term advances from customers and deferred revenues |

|

|

580 |

|

|

|

1,139 |

|

|

Operating lease liabilities |

|

|

4,014 |

|

|

|

3,022 |

|

|

Other long-term liabilities |

|

|

10,606 |

|

|

|

12,916 |

|

|

|

|

|

|

|

|

Total long-term liabilities |

|

|

23,877 |

|

|

|

25,614 |

|

| |

|

|

|

|

| SHAREHOLDERS'

EQUITY: |

|

|

|

|

|

Share capital - ordinary shares of NIS 0.2 par value |

|

|

2,733 |

|

|

|

2,733 |

|

|

Additional paid-in capital |

|

|

943,294 |

|

|

|

937,591 |

|

|

Accumulated other comprehensive loss |

|

|

(6,120 |

) |

|

|

(5,315 |

) |

|

Accumulated deficit |

|

|

(635,472 |

) |

|

|

(660,321 |

) |

| |

|

|

|

|

| Total shareholders'

equity |

|

|

304,435 |

|

|

|

274,688 |

|

| |

|

|

|

|

| TOTAL LIABILITIES AND

SHAREHOLDERS' EQUITY |

|

$ |

429,748 |

|

|

$ |

426,886 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GILAT

SATELLITE NETWORKS LTD. |

|

CONSOLIDATED STATEMENTS OF CASH FLOWS |

| U.S.

dollars in thousands |

| |

|

|

|

|

|

|

|

|

|

| |

|

|

Twelve months ended |

|

Three months ended |

| |

|

|

December 31, |

|

December

31, |

|

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| |

|

|

Unaudited |

|

Audited |

|

Unaudited |

| Cash flows

from operating activities: |

|

|

|

|

|

|

|

|

| Net

income |

|

$ |

24,849 |

|

|

$ |

23,504 |

|

|

$ |

11,764 |

|

|

$ |

3,447 |

|

|

Adjustments required to reconcile net income to net cash

provided by operating activities: |

|

|

|

|

|

|

|

|

| Depreciation and

amortization |

|

|

13,554 |

|

|

|

13,402 |

|

|

|

3,012 |

|

|

|

3,805 |

|

| Capital gain from

sale of property |

|

|

- |

|

|

|

(2,084 |

) |

|

|

- |

|

|

|

- |

|

| Stock-based

compensation *) |

|

|

6,726 |

|

|

|

3,423 |

|

|

|

926 |

|

|

|

1,587 |

|

| Accrued severance

pay, net |

|

|

(89 |

) |

|

|

167 |

|

|

|

(72 |

) |

|

|

12 |

|

| Deferred taxes,

net |

|

|

1,834 |

|

|

|

2,662 |

|

|

|

298 |

|

|

|

(1,203 |

) |

| Decrease

(increase) in trade receivables, net |

|

|

(9,347 |

) |

|

|

13,448 |

|

|

|

(2,328 |

) |

|

|

9,561 |

|

| Decrease

(increase) in contract assets |

|

|

8,519 |

|

|

|

(1,694 |

) |

|

|

11,506 |

|

|

|

(7,804 |

) |

| Decrease

(increase) in other assets and other adjustments

(including |

|

|

|

|

|

|

|

|

|

short-term, long-term and effect of exchange rate changes on

cash and cash equivalents) |

|

|

11,661 |

|

|

|

(351 |

) |

|

|

8,590 |

|

|

|

(3,949 |

) |

| Decrease

(increase) in inventories, net |

|

|

(1,928 |

) |

|

|

(2,387 |

) |

|

|

544 |

|

|

|

3,798 |

|

| Increase

(decrease) in trade payables |

|

|

3,196 |

|

|

|

(7,635 |

) |

|

|

(1,884 |

) |

|

|

(2,314 |

) |

| Increase

(decrease) in accrued expenses |

|

|

(5,906 |

) |

|

|

735 |

|

|

|

(8,581 |

) |

|

|

3,517 |

|

| Increase

(decrease) in advances from customers and deferred revenues |

|

|

(16,390 |

) |

|

|

803 |

|

|

|

(4,228 |

) |

|

|

(1,843 |

) |

| Increase

(decrease) in other liabilities |

|

|

(5,010 |

) |

|

|

(12,049 |

) |

|

|

(3,265 |

) |

|

|

1,343 |

|

| Net cash

provided by operating activities |

|

|

31,669 |

|

|

|

31,944 |

|

|

|

16,282 |

|

|

|

9,957 |

|

|

|

|

|

|

|

|

|

|

|

|

| Cash flows

from investing activities: |

|

|

|

|

|

|

|

|

| Purchase of

property and equipment |

|

|

(6,610 |

) |

|

|

(10,746 |

) |

|

|

(2,515 |

) |

|

|

(2,090 |

) |

| Acquisitions of

subsidiary, net of cash acquired |

|

|

- |

|

|

|

(4,107 |

) |

|

|

- |

|

|

|

(4,107 |

) |

| Receipts from sale

of property |

|

|

- |

|

|

|

2,168 |

|

|

|

- |

|

|

|

- |

|

| Net cash

used in investing activities |

|

|

(6,610 |

) |

|

|

(12,685 |

) |

|

|

(2,515 |

) |

|

|

(6,197 |

) |

|

|

|

|

|

|

|

|

|

|

|

| Cash flows

from financing activities: |

|

|

|

|

|

|

|

|

| Repayment of

credit facility, net |

|

|

(7,453 |

) |

|

|

(1,590 |

) |

|

|

- |

|

|

|

(1,590 |

) |

| Repayments of

short-term debts |

|

|

(7,836 |

) |

|

|

- |

|

|

|

(3,793 |

) |

|

|

- |

|

| Proceeds from

short-term debts |

|

|

7,836 |

|

|

|

- |

|

|

|

1,066 |

|

|

|

- |

|

| Costs associated

with entering into a long-term debt |

|

|

(654 |

) |

|

|

- |

|

|

|

(654 |

) |

|

|

- |

|

| Net cash

used in financing activities |

|

|

(8,107 |

) |

|

|

(1,590 |

) |

|

|

(3,381 |

) |

|

|

(1,590 |

) |

| |

|

|

|

|

|

|

|

|

|

| Effect of

exchange rate changes on cash, cash equivalents and restricted

cash |

|

|

(1,454 |

) |

|

|

(63 |

) |

|

|

(896 |

) |

|

|

2,288 |

|

| |

|

|

|

|

|

|

|

|

|

| Increase

in cash, cash equivalents and restricted cash |

|

|

15,498 |

|

|

|

17,606 |

|

|

|

9,490 |

|

|

|

4,458 |

|

| |

|

|

|

|

|

|

|

|

|

| Cash, cash

equivalents and restricted cash at the beginning of the

period |

|

|

104,751 |

|

|

|

87,145 |

|

|

|

110,759 |

|

|

|

100,293 |

|

| |

|

|

|

|

|

|

|

|

|

| Cash, cash

equivalents and restricted cash at the end of the

period |

|

$ |

120,249 |

|

|

$ |

104,751 |

|

|

$ |

120,249 |

|

|

$ |

104,751 |

|

|

|

|

|

|

|

|

|

|

|

|

| *) |

Stock-based

compensation including expenses related to business combination in

the amounts of $3,437 and $662 for the twelve months ended December

31, 2024 and 2023, respectively. |

| |

Stock-based

compensation including expenses related to business combination in

the amounts of $140 and $662 for the three months ended December

31, 2024 and 2023, respectively. |

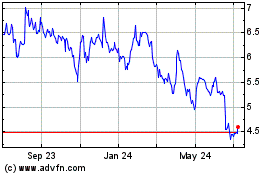

Gilat Satellite Networks (NASDAQ:GILT)

Historical Stock Chart

From Jan 2025 to Feb 2025

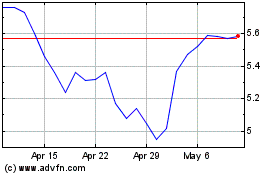

Gilat Satellite Networks (NASDAQ:GILT)

Historical Stock Chart

From Feb 2024 to Feb 2025