Filed by Comtech Telecommunications Corp.

Commission File No.: 000-07928

Pursuant to Rule 425 under the Securities

Act of 1933

Subject Company: Gilat Satellite Networks

Ltd.

Commission File No.: 000-21218

Date: February 18, 2020

The following investor presentation was

presented by Comtech Telecommunications Corp. (“Comtech”) at an investor conference on February 18, 2020:

Investor Presentation Q1 Fiscal Year 20 20 This presentation reflects information as of December 4, 2019 Fix Building Graphic Noblecon16 Investor Presentation This presentation reflects quarterly financial information announced December 4, 2019, and other Company events through January 29, 2020.

Cautionary Statement Regarding Forward - Looking Statements Text 3 Certain information in this presentation contains forward - looking statements, including, but not limited to, information relating to Comtech’s and Gilat’s future performance and financial condition, plans and objectives of Comtech's management and Gilat’s management and Comtech's and Gilat’s assumptions regarding such future performance, financial condition and plans and objectives that involve certain significant known and unknown risks and uncertainties and other factors not under Comtech's or Gilat’s control which may cause their actual results, future performance and financial condition, and achievement of plans and objectives of Comtech's management and Gilat’s management to be materially different from the results, performance or other expectations implied by these forward - looking statements . Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” variations of such words and similar expressions are intended to identify such forward - looking statements, which generally are not historical in nature . Forward - looking statements could be affected by factors including, without limitation : risks associated with the ability to consummate the proposed transaction and the timing of the closing of the proposed transaction or the occurrence of any event, change or circumstance that could give rise to the termination of the merger agreement ; the risk that requisite regulatory approvals will not be obtained ; the possibility that the expected synergies from the proposed transaction or other recent acquisitions will not be fully realized, or will not be realized within the anticipated time periods ; the risk that Comtech’s and Gilat’s businesses will not be integrated successfully ; the possibility of disruption from the proposed transaction or other recent acquisitions making it more difficult to maintain business and operational relationships or retain key personnel ; the risk that Comtech will be unsuccessful in implementing a tactical shift in its Government Solutions segment away from bidding on large commodity service contracts and toward pursuing contracts for its niche products with higher margins ; the risks associated with Comtech’s ongoing evaluation and repositioning of its location technologies solutions offering in its Commercial Solutions segment ; the nature and timing of receipt of, and Comtech’s performance on, new or existing orders that can cause significant fluctuations in net sales and operating results ; the timing and funding of government contracts ; adjustments to gross profits on long - term contracts ; risks associated with international sales ; rapid technological change ; evolving industry standards ; new product announcements and enhancements, including the risks associated with Comtech's launch of its Heights TM Networking Platform (“Heights”) ; changing customer demands and or procurement strategies ; changes in prevailing economic and political conditions ; changes in the price of oil in global markets ; changes in foreign currency exchange rates ; risks associated with legal proceedings, customer claims for indemnification and other similar matters ; risks associated with Comtech's obligations under its Credit Facility ; risks associated with large contracts ; the impact of H . R . 1 , also known as the Tax Cuts and Jobs Act, which was enacted in December 2017 in the U . S .; and other factors described in this and Comtech's and Gilat’s other filings with the SEC . Neither Comtech nor Gilat undertakes any duty to update any forward - looking statements contained herein . 2

Use of Non - GAAP Financial Measures Text 3 In order to provide investors with additional information regarding the Company’s and Gilat’s financial results, this presentation contains "Non - GAAP financial measures" under the rules of the SEC . The Company’s and Gilat’s Adjusted EBITDA is a Non - GAAP measure that represents earnings (loss) before income taxes, interest (income) and other, write - off of deferred financing costs, interest expense, amortization of stock - based compensation, amortization of intangibles, depreciation expense, estimated contract settlement costs, settlement of intellectual property litigation, acquisition plan expenses, facility exit costs and strategic alternatives analysis expenses and other . The Company’s and Gilat’s definition of Adjusted EBITDA may differ from the definition of EBITDA or Adjusted EBITDA used by other companies and therefore may not be comparable to similarly titled measures used by other companies . Adjusted EBITDA is also a measure frequently requested by the Company’s and Gilat’s investors and analysts . The Company and Gilat believe that investors and analysts may use Adjusted EBITDA, along with other information contained in their SEC filings, in assessing the Company’s or Gilat’s performance and comparability of its results with other companies . The Company’s and Gilat’s Non - GAAP measures reflect the GAAP measures as reported, adjusted for certain items as described in Appendix III . These Non - GAAP financial measures have limitations as an analytical tool as they exclude the financial impact of transactions necessary to conduct the Company’s and Gilat’s business, such as the granting of equity compensation awards, and are not intended to be an alternative to financial measures prepared in accordance with GAAP . These measures are adjusted as described in the reconciliation of GAAP to Non - GAAP in Appendix III, but these adjustments should not be construed as an inference that all of these adjustments or costs are unusual, infrequent or non - recurring . Non - GAAP financial measures should be considered in addition to, and not as a substitute for or superior to, financial measures determined in accordance with GAAP . Investors are advised to carefully review the GAAP financial results that are disclosed in the Company’s and Gilat’s SEC filings . The Company has not quantitatively reconciled its fiscal 2020 Adjusted EBITDA target to the most directly comparable GAAP measure because items such as stock - based compensation, adjustments to the provision for income taxes, amortization of intangibles and interest expense, which are specific items that impact these measures, have not yet occurred, are out of the Company's control, or cannot be predicted . For example, quantification of stock - based compensation expense requires inputs such as the number of shares granted and market price that are not currently ascertainable . Accordingly, reconciliations to the Non - GAAP forward - looking metrics are not available without unreasonable effort and such unavailable reconciling items could significantly impact the Company's financial results . 3

Text Legacy of Complex Problem Solving Innovative Solutions for Commercial and Government Customers Thought Leader in Secure Wireless Communications Comtech - Connections that Matter® Notes See Appendix III of this presentation for the reconciliation from US GAAP to Adjusted EBITDA, which is a Non - GAAP financial measure. ; We are a market leader in the growing secure wireless communications market — Satellite Ground Station Technologies — Public Safety and Location Technologies — Mission - Critical Technologies — High - Performance Transmission Technologies ; We are known for solving complex problems ; We generate profits and cash flows and have paid dividends 38 quarters in a row ; FY 2019 was our fourth consecutive year of revenue growth and our third consecutive year of Adjusted EBITDA growth ; We have strong visibility into future revenue ; Q1 FY 2020 financial results were strong 4

5 Fiscal 2019 $671.8M revenue $93.5M Adjusted EBITDA ~$1B of visibility with backlog and contracts 400+ engineering professionals Global market leader for satellite ground station equipment 50% market share of wireless 911 calls Leader in mission - critical and high - performance transmission technologies Corporate Large Contract Awards 2014 2016 2018 2017 2019 2015 Comtech Has Transformed Itself into a Wireless Leader Approximately $404.4M or 60.2% of our FY 2019 revenues did not exist in FY 2015 2018: Comtech awarded $134.0M contract to provide 911 public safety and location technologies to a U.S. Wireless Carrier and $59.0M strategic IDIQ contract from U.S. Navy for next generation satellite ground station equipment. 2016: Comtech awarded $45.0M contract to provide statewide Next Generation 911 IP Network and announces the availability of Heights Networking Platform Release 2.4. 2018: Comtech receives 3 - year $123.6M contract award to provide sustainment services for U.S. Army’s SNAP terminals (VSAT). 2014 - 2015: Comtech explored strategic alternatives to enhance shareholder value, but decided to remain independent. Shortly after, Fred Kornberg (current CEO) was named Executive Chairman with Mike Porcelain remaining as CFO. 2015: Revenue $307.3M Adjusted EBITDA $51.8M 2019: Comtech announces the acquisition of Solacom Technologies, Inc. (911 solutions). 2019: Comtech announces the acquisition of Next Generation 911 Business from General Dynamics. 2016: Comtech announces the acquisition of TeleCommunication Systems, Inc. for $423.6M. 2015: Comtech awarded multi - million dollar award for solid - state power amplifiers for in - flight entertainment and communications (IFEC) applications. 2018: Michael Porcelain promoted to COO and Michael Bondi promoted to CFO. 2019: Comtech wins a 5 - year $100.0M contract to develop a NG 911 system.

6 $ 48.1M $ 70.7M $ 78.4M $ 93.5M ~ $101.0M 2016A 2017A 2018A 2019A 2020E $ 411.0M $ 550.4M $ 570.6M $ 671.8M > $700.0M 2016A 2017A 2018A 2019A 2020E Fiscal 2020 is Expected to be Another Year of Growth ; Heights TM products, Next Generation 911 systems and important contract awards create strong revenue streams into the future ; Recent completed acquisitions have positive impact ; Long - term contract wins create stable and recurring revenue streams ; Well - positioned for growth Revenue (2) Adjusted EBITDA (2) (3) ; Targeting 14% in Fiscal 2020 ; Room for improved margins as we focus on efficiencies and greater scale ; Adjusted EBITDA supported by strong cash flow generation (2019 GAAP operating cash flows of $68.0M) ; Continued investments in R&D and marketing to support long - term growth Target Target ~12% ~13% ~14% ~14% ~14% Adjusted EBITDA as a % of Revenue Notes (1) Comtech’s fiscal year end is July 31. (2) Does not include impact of recently announced acquisitions of UHP, Gilat and CGC. (3) See Appendix III of this presentation for the reconciliation from US GAAP to Adjusted EBITDA. (USD in Millions) Comtech Acquires TCS

7 Comtech Participates in Growing Markets High speed in - flight connectivity is fast becoming a necessity for travelers and an imperative for airlines Increased threats of electronic warfare and demand for high - bandwidth battlefield communications Ultimate transition to 5G will increase data usage, requiring greater satellite backhaul In - Flight Satellite Connectivity Satellite Cellular Backhaul for 3G/4G and 5G Military Communications Modernization Strategy to obtain a leading position in IFC, with end - to - end solutions We offer a complete set of cellular backhaul capabilities and can provide customers with end - to - end solutions Comtech has strong relationships with military customers (including the U.S. Government) Comtech is Well Positioned to Take Advantage of Key Marketplace Trends Expected Growth in LEO / MEO / HTS & VHTS Satellite Constellations Will Require Significant Investment In Ground Infrastructure and Comtech Will Be Poised to Benefit Next - Generation 911 Upgrades Comtech offers state of the art 911 call handling and NG - 911 solutions, including precise location State and local governments must upgrade existing 911 call handling and next - generation systems

8 Comtech’s Two Segments Have Common Capabilities Text We leverage several key competencies, including R&D and engineering, across both segments to deliver superior capabilities to customers Secure Wireless Technology Communications Commercial Solutions Revenue $357.3M 53.2% of Total Adjusted EBITDA $66.6M 18.6% Adjusted EBITDA Margin Geography / Customer Type U.S. Government: 19.2% Domestic: 53.9% International: 26.9% Government Solutions Revenue $314.5M 46.8% of Total Adjusted EBITDA $35.6M 11.3% Adjusted EBITDA Margin Geography / Customer Type U.S. Government: 63.8% Domestic: 12.5% International: 23.7% Customer Examples Customer Examples Fiscal 2019 Customer Type as a % of Consolidated Revenue Market Leadership Positions Shared Relationships with Blue - Chip Customers 40.1% 34.5% 25.4% Domestic International U.S. Government Fiscal 2019 Results: Fiscal 2019 Results:

9 x Entry into the 911 public safety and location markets and significantly strengthened our U.S. Government business, created scale and diversified earnings x Further expanded presence in growing 911 public safety market and increased recurring revenues x Helped secure a five - year $100.0M contract to develop and maintain a cloud - based NG - 911 platform for a northeastern state in the U.S. Recent Successful Transactions Rationale and Highlights Feb 2016 $423.6M TCS is a leader provider of 911 public safety services, trusted location and satellite - based mission critical solutions Feb 2019 $31.5M Solacom is a leading provider of Next Generation 911 solutions for public safety agencies Apr 2019 $10.0M GD NG - 911 offers a 9 - 1 - 1 emergency communications system to state and local government clients Extensive Acquisition Experience with Successful Integrations Comtech Has A Proven Track Record Of Successful Acquisitions Jan 2020 $23.7M CGC is a leading provider of high precision full motion fixed and mobile X/Y satellite tracking antennas x Addresses customer requirements for expected growth in LEO and MEO satellite constellations Nov 2019 Pending $40.0M UHP is a leading provider of innovative and disruptive satellite ground station technology solutions Jan 2020 Pending $532.5M Gilat is a worldwide leader in satellite networking technology, solutions and services x Expands our product line in the satellite ground station market, with its growing need for reliable, high capacity satellite equipment, particularly in the VSAT market x Provides market leading positions in the satellite ground station and in - flight connectivity solutions markets and deep expertise in operating large network infrastructures Acquisition Close Date Purch Price

10 Gilat’s Segments Fixed Networks Mobility Solutions Terrestrial Infrastructure TTM Revenue of $137.2 million A True Market Leader With Highly Complementary Products - Key supplier of VSAT satellite modems & solid - state amplifiers - Deep experience with TDMA & in - flight connectivity technologies - Leading network infrastructure provider in Latin America Strong Global Footprint - Public company, listed on the TASE & Nasdaq stock exchange - ~900 talented employees worldwide with wireless R&D expertise - Sales teams and customer service centers located close to customers Highly Attractive Financial Profile - $254.3 million of TTM sales through June 30, 2019 (1) - $36.7 million of TTM Adjusted EBITDA through June 30, 2019 (2) - Profitable with strong cash flow generation Gilat Satellite Networks – Acquisition Announced in January 2020 The Gilat Business 3G/4G/5G cellular satellite backhaul and high - speed connectivity solutions for enterprises On - the - move satellite communications systems including in - flight communications Install and maintain large communication networks (including fiber) to thousands of rural communities Key Applications TTM Revenue of $94.9 million TTM Revenue of $22.2 million Customer Examples Notes (1) TTM r epresents Gilat’s f i nanc i a l s for the trailing four f i scal quarters ended June 30, 2019. (2) S ee further d i sc l osures and reconc ili at i ons to G AA P re l ated to the def i n i t i on and use of A d j usted EB I T D A .

11 Government 15% Commercial 85% Government 47% Commercial 53% Government 38% Commercial 62% United States 75% International 25% United States 38% International 62% Gilat Acquisition Offers Diversification While Enhancing Margins R e v enu e by Geography and Comtech Segment ( 3 ) (4) P ro F o r m a C ombine d Rev enu e Notes : (1) Represents Gilat’s f i nanc i a l s for the four f i scal quarters ended June 30, 2019. (2) S ee further d i sc l osures and reconc ili at i ons to G AA P re l ated to the def i n i t i on and use of A d j usted EB I T D A . (3) B ased on Co m tech’s f i scal year ended Ju l y 31, 201 9 and Gilat’s four f i scal quarters ended June 30, 2019. (4) Estimated based on Gilat’s fiscal year 2018 revenue by geography with the same percentage applied to TTM June 2019 revenue an d t hen added to Comtech’s actual business results. Trailing Twelve Months (1) June 30, 2019 F i s ca l Y e ar J u l y 31 , 201 9 F Y 201 9 + TTM June 30, 2019 P ro F o r m a ($ i n m illi on s ) R e v e nu e A d j u s t e d E B I T D A (2) % M a r g i n $ 671.8 $ 93.5 13.9 % $ 254.3 $36.7 14.4 % $ 926.1 $ 130.2 14.1 % United States 64% International 36% Excludes Synergies

12 The Combination Allows Comtech To Maximize Long - Term Market Growth Opportunities Exploiting an Inflection Point in Secure Wireless Markets Mobility / In - Flight (IFC) Complete Solutions Portfolio Deep, Global Market Access R&D and Distribution Scale Wireless Backhaul / 5G Government & Defense Accelerating Growth of Low - Cost Bandwidth Supply Incumbent GEO & MEO Satellite Operators New HTS & VHTS Satellites Emerging LEO & MEO Satellite Systems Rapidly Growing Connectivity Demand Gilat Acquisition Drives Global Market Access By Creating a World Leader with Combined Pro - Forma Sales Approaching Nearly $1.0 Billion Annually Excellent backdrop for extending Comtech’s technology leadership, given market dynamics Expanding 911 & Location Technologies into Developing Countries Upgrade Existing 911 and Location Systems

13 Satellite Ground Station Technologies Public Safety and Location Technologies Notes (1) Northern Sky Research, Wireless Backhaul & 5G via Satellite, 13 th Ed., April 2019. Market size for 2018. (2) Frost & Sullivan, Next Generation 911 (NG911) Market Insight, 2017. Market size forecast by year 2022. (3) ABI Research, Location Technologies, 2015. World market size forecast by year 2018. Commercial Solutions Segment – Growth Drivers High - Performance Satellite Modems Solid - State and Traveling Wave Tube Amplifiers Software for Cellular 911 Call Routing and Next Generation 911 Software that Generates the Triangle & Dot for Advanced Location Mapping Market Size and Growth Rates $2.4 billion 1 Wireless backhaul equipment ~16.5% per year 1 2018 - 2028, Wireless backhaul equipment $350 million 2 Next Generation 911 market ~17% per year 2 2016 - 2022, Next Generation 911 market $402 million 3 Location - based services revenue ~4% per year 3 2016 - 2018, location - based services revenue Satellite Ground Station Technologies Public Safety and Location Technologies Cellular Backhaul Upgrades to HDTV / 4K In - Flight Entertainment and Connectivity (IFEC) High - Throughput Satellites Advanced Location and Mapping Services SMS Text Messaging used for 911 & Critical Applications Cellular Call Routing and Next Generation 911

14 Mission - Critical Technologies High - Performance Transmission Technologies Amplifiers for Identification, Friend or Foe and Electronic Warfare Applications Satellite Ground Station Products and Space Components Notes (1) Research and Markets, The Global C4ISR Market 2018 - 2026 - Market Size and Drivers: Market Profile, 2018. Market size forecast by 2026. (2) IHS Technology “Microwave Network Equipment Quarterly Market Tracker: Regional, Q2 2016”. Market size estimated for 2015. Government Solutions Segment – Growth Drivers U.S. Army SNAP 850+ Systems Deployed Tactical Satellite - based VSATs Over - the - Horizon Microwave Systems Tactical Satellite - based VSATs Market Size and Growth Rates ~$132 billion 1 Global C4ISR market ~4% per year 1 2018 - 2026, global C4ISR market $277 million 2 Non - line - of - sight Microwave Network Equipment market will reach $834 million by 2020 ~25% per year 2 2015 - 2020, Non - line - of - sight Microwave Network Equipment market High - Performance Transmission Technologies Mission - Critical Technologies Over - the - Horizon Troposcatter Technologies which Transmit Data over Unfriendly or Inaccessible Terrain Solid State High - Power Amplifiers Used for Electronic Warfare, Jamming, Medical & Aviation Applications Field Support Operations for Satellite and Wireless Communications Supply Chain Management of Satellite Ground Station and Space Components

15 Financials

16 We Have at Least $1 Billion of Visibility into Future Revenue Commercial Solutions Government Solutions $474.6M $624.6M $173.7M $343.7M $150.0M $170.0M Backlog Contracts in Place, Not in Backlog Revenue Visibility $648.3M $968.3M $320.0M As of October 31, 2019 As of October 31, 2019 Notes (1) In November 2019, the U.S. government announced that our teaming partner, Cubic, on a U.S. Marine Corps troposcatter oppo rtu nity was awarded a 10 - year $325.0 million “IDIQ” contract to provide 172 next - generation troposcatter systems and related services. In Ja nuary 2020, Cubic awarded Comtech a 10 - year $211.0 million subcontract, with an initial order of $13.4 million. (2) See previous pages for discussion of recently announced acquisitions. Does not include the impact of the U.S. Marine Corps Troposcatter Contract or the recently announced acquisitions of UHP, Gilat and CGC. As of October 31, 2019

Target Goals For Fiscal 2020 – As of December 4, 2019 Text Revenue $712.0M - $732.0M Adjusted EBITDA (1) $99.0M - $103.0M GAAP EPS $1.28 - $1.42 Non GAAP EPS $1.42 - $1.56 FY 2020 Targets Notes (1) Adjusted EBITDA represents earnings (loss) before income taxes, interest (income) and other, write - off of deferred financing cos ts, interest expense, amortization of stock - based compensation, amortization of intangibles, depreciation expense, estimated contract settlement costs , settlement of intellectual property litigation, acquisition plan expenses, facility exit costs and strategic alternatives analysis expenses an d other. • Net sales are now expected to range from approximately $712.0M to $732.0M with year - over - year growth in both our Commercial Solu tions and Government Solutions segments and we are targeting a fiscal 2020 book - to - bill ratio in excess of 1.0 • Total depreciation expense is expected to approximate $12.0M to $13.0M • Total amortization of intangible assets is expected to approximate $21.0M • Total amortization of stock - based compensation expense is expected to range from approximately $12.0M to $14.0M • GAAP operating income, as a percentage of net sales, is expected to approximate 7.0% as compared to the 6.2% achieved in fisc al 2019 • Our interest expense rate (including amortization of deferred financing costs) is expected to approximate 4.6% with total int ere st expense of approximately $7.5 million in fiscal 2020. Our current cash borrowing rate is approximately 4.0% • Our effective income tax rate (excluding discrete tax items) is expected to approximate 23.0% • Adjusted EBITDA is now expected to be in a range of approximately $99.0M to $103.0M or approximately 14.0% of the net sales t arg et range • Including our estimate of second quarter fiscal 2020 acquisition plan expenses of $2.4 million, GAAP EPS is now expected to r ang e from $1.28 to $1.42. Excluding actual and expected second quarter fiscal 2020 acquisition plan expenses, estimated contract settle men t costs, and net discrete tax benefits, Non - GAAP EPS is now expected to approximate $1.42 to $1.56. EPS assumes a diluted share count of 25. 1 million shares. Comments on FY 2020 Targets 17 $ millions, except per share data - Does not reflect recently announced acquisitions of UHP, Gilat and CGC - Next update in March 2020

18 Strong Visibility with Growing Markets History of Long - Term Capital Return to Stockholders Commitment to Innovation and Engineering Experienced Management Team Market Leadership Positions We Believe the Future is Bright for Many Years to Come

19 Appendix I Historical Data and Trends

40.8% 36.1% 23.1% Domestic International U.S. Government Sales by Customer Type Overview of Q1 FY20 Performance (Reported in December 2019) ; Q1 FY 2020 Revenue was $170.3 million ; GAAP Operating Income of $9.3 million includes amortization of $5.2 million, depreciation of $2.7 million, stock - based compensation of $0.9 million, acquisition plan expenses of $2.4 million and estimated contract settlement costs of $0.2 million ; Adjusted EBITDA (1) ( non - GAAP) of $20.6 million or 12.1% of net sales ; GAAP diluted EPS of $0.26 ; Non - GAAP diluted EPS ( 2 ) of $ 0 . 32 55.4% 44.6% Commercial Government % of Revenue 20 Commercial Solutions Revenue $94.3M Adjusted EBITDA $16.6M Adjusted EBITDA 17.6% Government Solutions Revenue $76.0M Adjusted EBITDA $8.2M Adjusted EBITDA 10.8% Notes (1) Adjusted EBITDA represents earnings (loss) before income taxes, interest (income) and other, write - off of deferred financing cos ts, interest expense, amortization of stock - based compensation, amortization of intangibles, depreciation expense, estimated contract settlement costs, settlement of intellect ual property litigation, acquisition plan expenses, facility exit costs and strategic alternatives analysis expenses and other. (2) See Appendix III of this presentation for the reconciliation of GAAP earnings per diluted share to Non - GAAP earnings per diluted share.

Recent Quarterly Operating Results Text Q1 Q2 Q3 Q4 Q1 2019 2019 2019 2019 2020 Revenue Commercial Solutions 77,973$ 86,735$ 89,600$ 102,985$ 94,314$ Government Solutions 82,871 77,398 80,848 73,387 75,953 Total Revenue 160,844$ 164,133$ 170,448$ 176,372$ 170,267$ Net Income 3,468$ 7,826$ 7,612$ 6,135$ 6,388$ Adjusted EBITDA 17,982$ 23,201$ 24,038$ 28,251$ 20,615$ % of Revenue GAAP Gross Profit 35.9% 37.3% 37.8% 36.3% 37.3% GAAP R&D Expenses 8.2% 8.5% 7.9% 8.9% 8.7% GAAP SG&A Expenses 19.8% 19.5% 19.6% 17.8% 18.7% GAAP Operating Income 4.5% 7.6% 6.6% 5.9% 5.5% Net Income 2.2% 4.8% 4.5% 3.5% 3.8% Adjusted EBITDA (1) 11.2% 14.1% 14.1% 16.0% 12.1% Notes (1) See Appendix III of this presentation for the reconciliation of reported Net Income to Adjusted EBITDA. (2) C omtech’s fiscal year end is July 31. $ in 000s 21

Recent Annual Operating Results Text 2016 2017 2018 2019 Revenue Commercial Solutions 248,955$ 330,867$ 345,076$ 357,293$ Government Solutions 162,049 219,501 225,513 314,504 Total Revenue 411,004$ 550,368$ 570,589$ 671,797$ Net Income (Loss) (7,738)$ 15,827$ 29,769$ 25,041$ Adjusted EBITDA 48,062$ 70,705$ 78,374$ 93,472$ % of Revenue GAAP Gross Profit 41.7% 39.6% 39.2% 36.8% GAAP R&D Expenses 10.3% 9.9% 9.4% 8.4% GAAP SG&A Expenses (1) 23.1% 21.1% 20.0% 19.1% GAAP Operating Income (Loss) (0.1)% 6.7% 6.2% 6.2% Net Income (Loss) (1.9)% 2.9% 5.2% 3.7% Adjusted EBITDA (2) 11.7% 12.8% 13.7% 13.9% GAAP EPS (0.46)$ 0.67$ 1.24$ 1.03$ $ in 000s Notes (1) In FY 2016 and FY 2019, acquisition plan expenses were presented as a separate line item , and therefore they are not included in the SG&A percentage . (2) See Appendix III of this presentation for the reconciliation of reported Net Income (Loss) to Adjusted EBITDA. (3 ) Comtech’s fiscal year end is July 31. 2016: Fiscal 2016 impacted by TCS acquisition 2017: Excluding $18.8 million of favorable adjustments (described in our Form 10 - K), GAAP operating income would have been 3.3% of net sales 22 2018: Includes $11.8 million, or $0.49 per diluted share, discrete tax benefit (“Tax Gain”) primarily due to Tax Reform

2016 2017 2018 2019 YTD 2020 $162,049 $219,501 $225,513 $314,504 $75,953 Government Solutions Historical Revenue Results Text Notes (1) Comtech’s fiscal year end is July 31 . 2016 2017 2018 2019 YTD 2020 $248,955 $330,867 $345,076 $357,293 $94,314 Commercial Solutions $ in 000s $ in 000s 23 2016 2017 2018 2019 YTD 2020 $411,004 $550,368 $570,589 $671,797 $170,267 Consolidated Revenue $ in 000s

Our Customer Base Text Notes (1) Comtech’s fiscal year end is July 31. (2) Totals may not foot due to rounding . 2016 2017 2018 2019 YTD 2020 41% 33% 36% 40% 41% 29% 39% 39% 35% 36% 30% 28% 26% 25% 23% U.S. Government Domestic International 24

Historical Bookings & Backlog Text Notes (1) Comtech’s fiscal year end is July 31 . $ in 000s $ in 000s Bookings Total Backlog 25 2016 2017 2018 2019 YTD 2020 $451,278 $512,593 $755,054 $724,056 $135,656 2016 2017 2018 2019 YTD 2020 $484,005 $446,230 $630,695 $682,954 $648,343

Total Research and Development Expense Text $ in 000s Notes (1) Research and development expense includes company - funded and customer - funded. (2) Comtech’s fiscal year end is July 31. 2016 2017 2018 2019 YTD 2020 $59,622 $81,310 $70,793 $71,086 $17,586 $ in 000s Research and Development Expense 26

Recent Balance Sheet Trends Text Balance Sheet Notes ( 1 ) As defined in our Credit Facility, as amended. (2) Comtech’s fiscal year end is July 31. $ in 000s Oct. 31, Jan. 31, Apr. 30, Jul. 31, Oct. 31, 2018 2019 2019 2019 2019 Cash and Cash Equivalents 42,943$ 45,997$ 45,152$ 45,576$ 46,873$ Working Capital 162,305 156,072 127,541 134,967 143,856 Total Assets 866,940 843,327 903,487 887,711 931,022 Current and Long-Term Debt (1) 195,565$ 176,274$ 174,965$ 165,757$ 169,567$ Stockholders' Equity 506,096 512,877 524,949 535,082 537,644 Total Capitalization 701,661$ 689,151$ 699,914$ 700,839$ 707,211$ 27

Market Data Text General Market Information Nasdaq Symbol: CMTL Institutional Holders (2) : 240 52 - Week Range (1) : $21.15 - $34.97 Analyst Coverage: 5 Source: Nasdaq Analysts Notes (1) 52 - week range indicates the high and low closing prices during the period of November 1, 2018 through October 31, 2019. (2) As of November 27, 2019. 28 Institution Analyst Name Citibank N.A. Asiya Merchant Jefferies Group LLC George Notter Noble Capital Markets Joe Gomes Northland Capital Markets Michael Latimore Quilty Analytics Chris Quilty

Appendix II Supplemental Acquisition Information

30 Gilat Transaction Summary Overview ; Comtech to acquire Gilat for $10.25 per share (70% in cash and 30% in stock) ; The Gilat acquisition is highly strategic and significantly expands Comtech’s existing capabilities and provides new channels for growth against a very favorable satellite communications industry backdrop ; Gilat is a leading global provider of satellite - based broadband communications with strong positions in mobile inflight connectivity, cellular backhaul, and broadband access ; During the period most comparable to Comtech’s fiscal year ended July 31, 2019, Gilat reported trailing twelve months sales of $254.3 million and $36.7 million of Adjusted EBITDA through June 30, 2019 (1) Transaction Terms & Shareholder Information ; Gilat shareholders will receive $7.18 per share in cash and 0.08425 of a share of Comtech stock — Total consideration of $10.25 represents a premium of approximately 14.52% as compared to the 90 - day volume weighted average trading price ; Total enterprise value of $532.5 million ; Gilat shareholders will own approximately 16.1% of the combined company. Comtech plans to pursue a dual listing on the Nasdaq and Tel Aviv Stock Exchange to become effective upon closing of the transaction Financial Impact ; Comtech balance sheet and financial profile will remain strong and Comtech has obtained committed bank financing with low - cost cash interest rate of approximately 4.0% to 5.0% ; Net leverage of 3.85x at close with $45.0 million of unrestricted cash at close and given expected strong cash flows, net leverage of 3.00 within 12 months following close ; Comtech’s current annual dividend target of $0.40 expected to be maintained ; Acquisition expected to be cash accretive within 12 months following close with only $2.0 million of synergies Timing and Closing ; Transaction unanimously approved by the Boards of Directors of both companies ; Closing expected late in Comtech’s fiscal 2020 or early fiscal 2021, subject to the satisfaction of customary closing conditions, including regulatory approvals and Gilat shareholder approval ; Gilat’s directors, executive officers and certain significant shareholders holding approximately 45% of Gilat’s shares in the aggregate have entered into voting agreements to vote in favor of the transaction Note (1) TTM r epresents Gilat’s f i nanc i a l s for the trailing four f i scal quarters ended June 30, 2019. Also, see further d i sc l osures and reconc ili at i ons to G AA P re l ated to the def i n i t i on and use of A d j usted EB I T D A .

31 + Drives Global Market Access By Creating a World Leader • Complemen ts Comtech’s global market footprint , establishing a presence within key international markets with sales approaching nearly $1.0 billion annually • Substantially enhances Gilat’s access to key markets including the U.S. Government / DoD given Comtech’s strong established position with these customers • Enables Comtech to offer customers a more complete end - to - end technology solution , and strengthens Comtech’s existing R&D excellence , adding a team of hundreds of engineers across the world who are experts in the field Expands Product Portfolio With Highly Complementary Technology • Large installed base of complementary technologies and longstanding favorable customer reputation (~1.5 mil. TDMA VSAT satellite modems, >500 networks globally) • Respected portfolio of next - generation Ka - band solid - state amplifiers for commercial and military customers • Deep expertise in installing and operating large sophisticated networks that can provide rural communities with vital communication capabilities Enhances Platform To Accelerate Shareholder Value Creation • Creates additional business scale to improve margins • Deal is partial stock, providing a strong post - merger balance sheet with expected net leverage of only ~3.00x within 12 months of close • Anticipated to be cash accretive during the 1 st full year post - close with conservative synergies of $2.0 million derived from the elimination of public company costs with additional opportunities for both sales growth and further efficiencies in Year 2 • CMTL expected to be dual - listed on TASE (Tel Aviv Stock Exchange) & Nasdaq driving increased liquidity for shareholders & new investors Broadens Leadership in High - Growth IFC & Backhaul Markets • Gilat is a leader in the growing in - flight connectivity (“IFC”) market with complementary IFC amplifiers, modems, and antennas and strong relationships with IFC customers such as Gogo, Honeywell and Global Eagle, enabling large IFC networks globally • Significant investments in R&D will pave the way for satellite integration into the 5G cellular backhaul ecosystem • Allows Comtech and Gilat to integrate complementary technologies and strengthens relationships with top - tier MNOs such as Softbank, T - Mobile, and NTT DoCoMo Key Strategic Benefits of Gilat Acquisition

32 Clear Path To Driving Future Shareholder Value Year 1 Rapid changes and growth in the satellite industry require business scale and strength Both Gilat’s and Comtech’s management and talented global workforce are expected to remain in place, with industry - leading R&D Drive industry leading innovation by integrating complementary technologies and functionalities to provide best - in - class satellite network solutions Year 1 & Beyond Focus on Growth Opportunities Minimal Integration Risks With a Focus on Driving Long - Term Growth & Expanding Margins Fully committed financing from our lending partners with cash interest costs expected to range from 4.0% to 5.0% and significant flexibility going forward Strong cash flow generation expected to result in quick pay - down of acquisition debt with Year 2 net leverage targets of approximately 3.00x Adds a sizable base to Comtech’s backlog with more visibility to future revenues and a path to improved combined Adjusted EBITDA margin as revenue and cost synergies are achieved Financial Considerations Expected to be cash accretive in the first year after acquisition closes Assumes conservative synergies of only $2.0 million from elimination of public company costs Sharp focus on collaboration between Comtech & Gilat, with a substantial focus on maximizing its positioning for long - term growth and success Excluding the impact of amortization of intangibles associated with purchase accounting and acquisition plan expenses, the acquisition is expected to:

33 Appendix III Reconciliation of GAAP to Non - GAAP Financial Measures

Reconciliation of CMTL GAAP to Non - GAAP Financial Measures Text Quarterly Adjusted EBITDA Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Reported net income 3,468$ 7,826$ 7,612$ 6,135$ 6,388$ Income tax expense (benefit) (2,127) 2,371 1,547 2,078 1,145 Net interest expense & other 2,735 2,216 2,137 2,192 1,727 Write-off of deferred financing costs 3,217 - - - - Stock-based compensation expense 1,046 1,191 1,119 8,071 879 Depreciation and amortization 7,140 7,137 7,454 8,516 7,857 Acquisition plan expenses 1,130 1,778 1,704 1,259 2,389 Estimated contract settlement costs - 3,886 2,465 - 230 Settlement of intellectual property litigation - (3,204) - - - Facility exit costs 1,373 - - - - Adjusted EBITDA 17,982$ 23,201$ 24,038$ 28,251$ 20,615$ Quarterly Operating Income Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Operating income 7,293$ 12,413$ 11,296$ 10,405$ 9,260$ Facility exit costs 1,373 - - - - Acquisition plan expenses 1,130 1,778 1,704 1,259 2,389 Estimated contract settlement costs - 3,886 2,465 - 230 Settlement of intellectual property litigation - (3,204) - - - Adjusted operating income 9,796$ 14,873$ 15,465$ 11,664$ 11,879$ Quarterly Net Income Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Net income 3,468$ 7,826$ 7,612$ 6,135$ 6,388$ Facility exit costs 1,061 - - - - Acquisition plan expenses 873 1,369 1,295 966 1,840 Write-off of deferred financing costs 2,485 - - - - Estimated contract settlement costs - 2,992 1,873 - 177 Settlement of intellectual property litigation - (2,467) - - - Net discrete tax (benefit) expense (including Tax Reform) (2,432) - (600) 116 (588) Adjusted net income 5,455$ 9,720$ 10,180$ 7,217$ 7,817$ Notes (1) See statement regarding the use of Non - GAAP financial measures in the front of this presentation. (2) Dollar amounts in thousands, except per share information. Comtech’s fiscal year end is July 31. 34

Reconciliation of CMTL GAAP to Non - GAAP Financial Measures (cont’d) Text Annual Adjusted EBITDA 2016 2017 2018 2019 Reported net (loss) income (7,738)$ 15,827$ 29,769$ 25,041$ Income tax expense (benefit) (454) 9,654 (5,143) 3,869 Write-off of deferred financing costs - - - 3,217 Net interest expense & other 7,616 11,561 10,449 9,280 Stock-based compensation expense 4,117 8,506 8,569 11,427 Depreciation and amortization 23,245 37,177 34,730 30,247 Estimated contract settlement costs - - - 6,351 Settlement of intellectual property litigation - (12,020) - (3,204) Acquisition plan expenses 21,276 - - 5,871 Facility exit costs - - - 1,373 Adjusted EBITDA 48,062$ 70,705$ 78,374$ 93,472$ Annual Earnings (Loss) per Diluted Share 2016 2017 2018 2019 GAAP diluted earnings (loss) per share (0.46)$ 0.67$ 1.24$ 1.03$ Acquisition plan expenses 1.03 - - 0.19 Estimated contract settlement costs - - - 0.20 Settlement of intellectual property litigation - (0.33) - (0.10) Net discrete tax benefit (including Tax Reform) - - (0.49) (0.12) Write-off of deferred financing costs - - - 0.10 Facility exit costs - - - 0.04 Non-GAAP earnings per diluted share 0.57$ 0.34$ 0.75$ 1.34$ Notes (1) See statement regarding the use of Non - GAAP financial measures in the front of this presentation. (2) Dollar amounts in thousands, except per share information. Comtech’s fiscal year end is July 31. (3) Totals may not foot due to rounding. 35

Reconciliation of CMTL GAAP to Non - GAAP Financial Measures (cont’d) Text Earnings (Loss) per Diluted Share Q1 2019 Q2 2019 Q3 2019 Q4 2019 FY 19 Q1 2020 GAAP earnings (loss) per diluted share 0.14$ 0.32$ 0.31$ 0.25$ 1.03$ 0.26$ Acquisition plan expenses 0.04 0.06 0.05 0.04 0.19 0.07 Estimated contract settlement costs - 0.12 0.08 - 0.20 0.01 Settlement of intellectual property litigation - (0.10) - - (0.10) - Net discrete tax benefit (including Tax Reform) (0.10) - (0.02) - (0.12) (0.02) Write-off of deferred financing costs 0.10 - - - 0.10 - Facility exit costs 0.04 - - - 0.04 - Non-GAAP earnings (loss) per diluted share 0.22$ 0.40$ 0.42$ 0.29$ 1.34$ 0.32$ Notes (1) See statement regarding the use of Non - GAAP financial measures in the front of this presentation. (2) Dollar amounts in thousands, except per share information. Comtech’s fiscal year end is July 31. (3) Totals may not foot due to rounding. 36

37 Reconciliation of CMTL and GILT GAAP to Non - GAAP Financial Measures Notes (1) See statement regarding the use of Non - GAAP financial measures in the front of this presentation. (2) Totals may not foot due to rounding. (3) Pro forma combined results exclude all expenses resulting from the acquisition (including, for example, changes in interest e xpe nse associated with the credit facility commitment received by Comtech, as well as synergies and changes in amortization of acquired intangi ble s.) ($ in millions) Pro Forma July 31, 2019 June 30, 2019 Combined (3) Reconciliation of GAAP Net Income to Adjusted EBITDA (1) : Net income $ 25.0 $ 20.2 45.2$ Provision for (benefit from) income taxes 3.9 (0.9) 3.0 Interest income and other - - - Write-off of deferred financing costs 3.2 - 3.2 Interest expense 9.2 3.5 12.8 Amortization of stock-based compensation 11.4 1.8 13.2 Amortization of intangibles 18.3 1.1 19.5 Depreciation 11.9 10.5 22.4 Estimated contract settlement costs 6.4 - 6.4 Settlement of intellectual property litigation (3.2) - (3.2) Acquisition plan expenses 5.9 - 5.9 Facility exit costs 1.4 - 1.4 Trade secret litigation - (0.1) (0.1) Reorganization costs - 0.6 0.6 Adjusted EBITDA $ 93.5 $ 36.7 $ 130.2 Excludes Synergies Four Fiscal Quarters Ended:

Additional Information and Where to Find It Text This presentation contains information in respect of a proposed business combination involving Comtech and Gilat . This document does not constitute an offer to sell or the solicitation of an offer to buy or subscribe for any securities or a solicitation of any vote or approval nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction . The proposed transaction will be submitted to the shareholders of Gilat for their consideration . Comtech intends to file with the U . S . Securities and Exchange Commission (the “SEC”) a Registration Statement on Form S - 4 that will include a preliminary prospectus with respect to Comtech’s common stock to be issued in the proposed transaction and a proxy statement of Gilat in connection with the proposed merger of an indirect subsidiary of Comtech with and into Gilat, with Gilat surviving . The information in the preliminary proxy statement/prospectus is not complete and may be changed . Comtech may not sell the common stock referenced in the proxy statement/prospectus until the Registration Statement on Form S - 4 becomes effective . The proxy statement/prospectus will be provided to Gilat shareholders . Comtech and Gilat also plan to file other documents with the SEC regarding the proposed transaction . This document is not a substitute for any prospectus, proxy statement or any other document that Comtech or Gilat may file with the SEC in connection with the proposed transaction . Investors and security holders of Comtech and Gilat are urged to read the proxy statement/prospectus and any other relevant documents that will be filed with the SEC carefully and in their entirety when they become available because they will contain important information about the proposed transaction . You may obtain copies of all documents filed with the SEC regarding the proposed transaction, free of charge, at the SEC’s website ( www . sec . gov ) . In addition, investors and security holders will be able to obtain a free copy of the proxy statement/prospectus (when they become available) and other documents filed with the SEC by Comtech on Comtech’s Investor Relations page on Comtech’s web site at www . comtechtel . com or by writing to Comtech, Investor Relations, (for documents filed with the SEC by Comtech), or by Gilat on Gilat’s Investor Relations page on Gilat’s web site at www . Gilat . com or by writing to Gilat, Investor Relations, (for documents filed with the SEC by Gilat) . This document and the information contained herein shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction . No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U . S . Securities Act of 1933 , as amended . 2 38

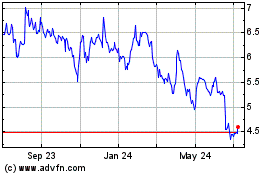

Gilat Satellite Networks (NASDAQ:GILT)

Historical Stock Chart

From Mar 2024 to Apr 2024

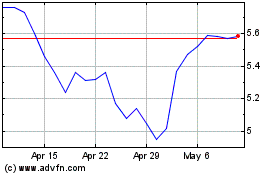

Gilat Satellite Networks (NASDAQ:GILT)

Historical Stock Chart

From Apr 2023 to Apr 2024