Table of Contents

Filed Pursuant to Rule 424(b)(5)

Registration File No. 333-226686

PROSPECTUS SUPPLEMENT

(To Prospectus dated August 28, 2018)

Gevo, Inc.

21,929,313 Shares of Common Stock

Pre-Funded Series 2020-C Warrants to Purchase 16,532,232 Shares of Common Stock

Pursuant to this prospectus supplement, we are offering, in a registered direct offering to certain purchasers, 21,929,313 shares of our common stock at a fixed price of $1.30 per share until the completion of this offering.

We are also offering to those purchasers, whose purchase of shares of our common stock in this offering would result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock following the consummation of this offering, the opportunity to purchase, if such purchaser so chooses, in lieu of shares of our common stock that would otherwise result in beneficial ownership in excess of 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock, pre-funded Series 2020-C warrants to purchase 16,532,232 shares of our common stock. Each pre-funded Series 2020-C warrant entitles the holder thereof to purchase one share of our common stock. Each pre-funded Series 2020-C warrant will be sold at a fixed price of $1.29 per pre-funded Series 2020-C warrant until the completion of this offering, which is the offering price per share of common stock, minus $0.01. The shares of common stock and the pre-funded Series 2020-C warrants are immediately separable and will be issued separately. The shares of our common stock issuable from time to time upon exercise of the pre-funded Series 2020-C warrants are also being offered pursuant to this prospectus supplement.

The pre-funded Series 2020-C warrants will be exercisable on the date of issuance and will expire when exercised in full, with an exercise price of $0.01 per share of common stock. The purchase price of $1.30 per share will be pre-paid, except for a nominal exercise price of $0.01 per share, upon issuance of the pre-funded Series 2020-C warrants and, consequently, no additional payment or other consideration (other than the nominal exercise price of $0.01 per share) will be required to be delivered to us by the holder upon exercise of the pre-funded Series 2020-C warrants. See “Description of Warrants” for more information on the securities offered hereby.

Our common stock is listed on the Nasdaq Capital Market under the symbol “GEVO.” On August 20, 2020, the last reported sale price of our common stock on the Nasdaq Capital Market was $1.82 per share. The pre-funded Series 2020-C warrants are not, and will not be, listed for trading on any national securities exchange or other trading system.

Investing in our securities involves a high degree of risk. Before buying any securities, you should review carefully the risks and uncertainties described under the heading “Risk Factors” beginning on page S-13 of this prospectus supplement, on page 3 of the accompanying prospectus and in the documents incorporated by reference into this prospectus supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved the securities described herein or determined if this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

We have retained H.C. Wainwright & Co., LLC, or the placement agent, as our exclusive placement agent to use its reasonable best efforts to solicit offers to purchase the securities in this offering. The placement agent has no obligation to buy any of the securities from us or to arrange for the purchase or sale of any specific number or dollar amount of the securities. We have agreed to pay the placement agent fees set forth in the table below, which assumes that we sell all of the securities we are offering.

|

|

|

Per Share of

Common

Stock

|

|

|

Per Pre-

Funded Series

2020-C

Warrant

|

|

|

Total

|

|

|

Public offering price

|

|

$

|

1.30

|

|

|

$

|

1.29

|

|

|

$

|

49,834,686.18

|

|

|

Placement agents fees(1)

|

|

$

|

0.091

|

|

|

$

|

0.091

|

|

|

$

|

3,500,000.60

|

|

|

Proceeds, before expenses, to us

|

|

$

|

1.209

|

|

|

$

|

1.199

|

|

|

$

|

46,334,685.58

|

|

|

|

(1)

|

See “Plan of Distribution” for further information regarding compensation arrangements with the placement agent.

|

Delivery of the shares of common stock and pre-funded Series 2020-C warrants is expected to be made on or about August 25, 2020.

H.C. Wainwright & Co.

The date of this prospectus supplement is August 20, 2020.

TABLE OF CONTENTS

PROSPECTUS

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement and the accompanying prospectus are part of a registration statement on Form S-3 that we filed with the U.S. Securities and Exchange Commission (the “SEC”) under the Securities Act of 1933, as amended (the “Securities Act”), utilizing a “shelf” registration process. This document is in two parts. The first part is this prospectus supplement, including the documents incorporated by reference herein, which describes the specific terms of this offering. The second part, the accompanying prospectus, including the documents incorporated by reference therein, provides more general information. We urge you to carefully read this prospectus supplement and the accompanying prospectus, and the documents incorporated by reference herein and therein, before buying any of the securities being offered under this prospectus supplement. This prospectus supplement may add to or update information contained in the accompanying prospectus and the documents incorporated by reference therein. To the extent that any statement we make in this prospectus supplement is inconsistent with statements made in the accompanying prospectus or any documents incorporated by reference therein that were filed before the date of this prospectus supplement, the statements made in this prospectus supplement will be deemed to modify or supersede those made in the accompanying prospectus and such documents incorporated by reference therein.

You should rely only on the information contained in this prospectus supplement and the accompanying prospectus or incorporated by reference herein or therein.

We have not, and the placement agent has not, authorized anyone to provide any information or to make any representations other than those contained in this prospectus supplement, the accompanying prospectus or in any free writing prospectuses prepared by or on behalf of us or to which we have referred you. We and the placement agent take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus supplement is an offer to sell only the securities offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus supplement, the accompanying prospectus or in any applicable free writing prospectus is current only as of its date, regardless of its time of delivery or any sale of our securities. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside of the United States: we have not, and the placement agent has not, done anything that would permit this offering or possession or distribution of this prospectus supplement, the accompanying prospectus or any free writing prospectuses in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside of the United States who come into possession of this prospectus supplement, the accompanying prospectus or any free writing prospectuses must inform themselves about, and observe any restrictions relating to, the offering of our securities and the distribution of this prospectus supplement, the accompanying prospectus or any free writing prospectuses outside of the United States.

You should assume that the information in this prospectus supplement and the accompanying prospectus is accurate only as of the date on the front of the applicable document and that any information we have incorporated by reference is accurate only as of the date of the document incorporated by reference, regardless of the date of delivery of this prospectus supplement or the accompanying prospectus, or the date of any sale of a security.

Unless otherwise mentioned or unless the context requires otherwise, all references in this prospectus supplement to the “Company,” “we,” “us,” “our,” and “Gevo” refer to Gevo, Inc., a Delaware corporation, and its consolidated subsidiaries.

TRADEMARKS

We use various of our trademarks, including, without limitation, Gevo® and GIFT™, in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein. This prospectus supplement includes, the accompanying prospectus includes, and the documents incorporated by reference herein include, trademarks, trade names and service marks that are the property of other organizations.

Solely for convenience, trademarks and trade names referred to in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein appear without the ® and ™ symbols, but those references are not intended to indicate, in any way, that we or the applicable owner will not assert, to the fullest extent under applicable law, our or its rights to these trademarks and trade names.

MARKET AND INDUSTRY DATA

Unless otherwise indicated, information contained in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein concerning our industry and the markets in which we operate, including our general expectations and market position, market opportunity, market size and market share, is based on information from our own management estimates and research, as well as from industry and general publications and research, surveys and studies conducted by third parties. Management estimates are derived from publicly available information, our knowledge of our industry and assumptions based on such information and knowledge, which we believe to be reasonable. This data involves a number of assumptions and limitations. In addition, assumptions and estimates of our and our industry’s future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors” and elsewhere in this prospectus supplement, the accompanying prospectus and in the sections entitled “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2019, filed with the SEC on March 17, 2020 (the “2019 Annual Report”), our Quarterly Report on Form 10-Q for the quarter ended March 31, 2020, filed with the SEC on May 13, 2020 (the “2020 Q1 Quarterly Report”), and our Quarterly Report on Form 10-Q for the quarter ended June 30, 2020, filed with the SEC on August 10, 2020 (the “2020 Q2 Quarterly Report”), each of which is incorporated by reference herein. These and other factors could cause our future performance to differ materially from our assumptions and estimates and those made by third parties.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein each contain forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). When used in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein, the words “expect,” “believe,” “anticipate,” “estimate,” “intend,” “plan” and similar expressions are intended to identify forward-looking statements. These statements relate to future events or our future financial or operational performance and involve known and unknown risks, uncertainties and other factors that could cause our actual results, levels of activity, performance or achievement to differ materially from those expressed or implied by these forward-looking statements. These statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. These forward-looking statements include, among other things, statements about: risks and uncertainties related to our ability to sell our products, our ability to expand or continue production of isobutanol, renewable hydrocarbon products and ethanol at our Luverne Facility (as defined herein), our ability to meet our production, financial and operational guidance, our strategy to pursue low-carbon renewable fuels for sale into California and elsewhere, our ability to replace our fossil-based energy sources with renewable energy sources at our production facilities, our ability and plans to construct a commercial hydrocarbon facility to produce renewable premium gasoline and jet fuel, our ability to raise additional funds to continue operations and/or expand our production facilities, our ability to perform under our existing renewable hydrocarbon offtake agreements and other supply agreements we may enter into in the future, our ability to enter into additional hydrocarbon supply agreements, our ability to obtain project finance debt and third-party equity for our renewable natural gas project, our ability to produce isobutanol, renewable hydrocarbon products and ethanol on a commercial level and at a profit, achievement of advances in our technology platform, the success of our upgraded production facility, the availability of suitable and cost-competitive feedstocks, our ability to gain market acceptance for our products, the expected cost-competitiveness and relative performance attributes of our isobutanol, renewable hydrocarbon products and ethanol, additional competition and changes in economic conditions, the future price and volatility of petroleum and products derived from petroleum, the impact of the novel coronavirus (“COVID-19”) on our business, financial condition and results of operations and our ability to effectively use the net proceeds from this offering. Important factors could cause actual results to differ materially from those indicated or implied by forward-looking statements such as those contained in documents we have filed with the SEC, including, but not limited to, those in the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the documents incorporated by reference herein, and the section entitled “Risk Factors” of this prospectus supplement and the accompanying prospectus. All forward-looking statements in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein are qualified entirely by the cautionary statements included in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein. These risks and uncertainties or other important factors could cause actual results to differ materially from results expressed or implied by forward-looking statements contained in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein. These forward-looking statements speak only as of the date made. We undertake no intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, and you should not rely on the forward-looking statements as representing our views as of any date subsequent to the date such statement is made.

PROSPECTUS SUPPLEMENT SUMMARY

The following summary highlights information contained elsewhere in this prospectus supplement and the accompanying prospectus and does not contain all of the information that you should consider in making your investment decision. Before investing in our securities, you should read this entire prospectus supplement and the accompanying prospectus carefully, including the documents incorporated by reference herein and therein, including the section entitled “Risk Factors” included elsewhere in this prospectus supplement and the accompanying prospectus, the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes thereto, which are incorporated by reference herein and therein. Some of the statements in this prospectus supplement, the accompanying prospectus and in the documents incorporated by reference herein, constitute forward-looking statements. See “Cautionary Note Regarding Forward-Looking Statements.”

Overview

We are a growth-oriented renewable fuels company that is commercializing the next generation of renewable low-carbon liquid transportation fuels with the potential to achieve a “net zero” greenhouse gas (“GHG”) footprint and address global needs of reducing GHG emissions with sustainable alternatives to petroleum fuels. As next generation renewable fuels, our hydrocarbon transportation fuels have the advantage of being “drop-in” substitutes for conventional fuels that are derived from crude oil, working seamlessly and without modification in existing fossil-fuel based engines, supply chains and storage infrastructure. In addition to the potential of net zero carbon emissions across the whole fuel life-cycle, our renewable fuels eliminate other pollutants associated with the burning of traditional fossil fuels such as particulates and sulfur, while delivering superior performance. We believe that the world is substantially under-supplied with low-carbon, drop-in renewable fuels that can be immediately used in existing transportation engines and infrastructure, and we are uniquely positioned to grow in serving that demand.

Our production processes and fuel products have been proven to work. We use low-carbon, renewable resource-based carbohydrates as raw materials. In the near-term, our feedstocks will primarily consist of non-food corn. As our technology is applied globally, feedstocks can consist of sugar cane, molasses or other cellulosic sugars derived from wood, agricultural residues and waste. Our patented fermentation yeast biocatalyst produces isobutanol, a four-carbon alcohol, via the fermentation of renewable plant biomass carbohydrates. The resulting renewable isobutanol has a variety of direct applications but, more importantly to our fundamental strategy, serves as a building block to make renewable isooctane (which we refer to as renewable premium gasoline) and renewable jet fuel using simple and common chemical conversion processes. We also reduce or eliminate fossil-based process energy inputs by replacing them with renewable energy such as wind-powered electricity and renewable natural gas (“RNG”).

Our technology represents a new generation of renewable fuel technology that overcomes the limitations of first-generation biofuels, highlighted by the following:

|

|

●

|

Potential to replace the whole gallon of liquid transportation fuels, including for airplanes, automobiles, boats, trucks and ships of all types, while delivering massively reduced or negative GHG emissions and reducing or eliminating pollutants such as particulates and sulfur, which have been linked to cancer and other human health issues;

|

|

|

●

|

Drop-in compatibility and performance, without modification to existing vehicles, airplanes and other infrastructure;

|

|

|

●

|

Scalability as a global and sustainable transportation fuel solution;

|

|

|

●

|

Potential for a “net zero” or even negative carbon footprint for our fuel products across the lifecycles and value chains of our products through sustainable or regenerative agriculture practices to reduce the carbon footprint of the carbohydrates used to make our products and the use of renewable energy (such as wind power and biogas) to run our hydrocarbon plants;

|

|

|

●

|

The production of value-added feed and food products, including protein, bran, and vegetable oil, to help feed the world using sustainably grown corn to make our products;

|

|

|

●

|

Through our platform fermentation technology, we possess the ability to use carbohydrates from various types of feedstock (including starch, dextrose, sugar, molasses, agricultural residues, and wood), thereby allowing our technology to be used in various economic conditions and taking advantage of raw materials abundant in different parts of the world;

|

|

|

●

|

Through our platform alcohols-to-hydrocarbons technology, which converts fermentation alcohols into chemical products, we have developed the ability to produce renewable chemicals such as aroma chemicals, flavorings, para-xylene for use polyester textile fibers and polyethylene terephthalate plastic used in drinking bottles; renewable synthetic rubber; renewable propylene and hydrogen. We expect to license these technologies in the future; and

|

|

|

●

|

The opportunity to further optimize the performance of our biocatalyst to improve the economics associated with the production of our products.

|

Our Assets

Facilities

We operate two production facilities. First, we operate a demonstration plant in Silsbee, Texas that was developed and is operated in partnership with South Hampton Resources (the “South Hampton Facility”). The South Hampton Facility has a capacity of approximately 100,000 gallons per year of renewable hydrocarbon products, including renewable premium gasoline and renewable jet fuel, that is converted from our renewable isobutanol.

Second, we operate a wholly-owned, commercial-scale renewable isobutanol plant in Luverne, Minnesota (the “Luverne Facility”), which has a current capacity of approximately 1.5 million gallons per year of isobutanol. Using the proven technologies and experience gained at both the Luverne Facility and the South Hampton Facility, we intend to expand the Luverne Facility to produce substantially increased quantities of isobutanol and to add the production capacity to convert isobutanol into significant quantities of renewable premium gasoline and renewable jet fuel. We are planning to develop two production sites in addition to the Luverne Facility. Renewable fuel capacity under our initial planned expansions is expected to total 60-70 millions of gallons per year. As previously disclosed, production for ethanol and isobutanol operations is currently shut down until further notice.

The Luverne Facility expansion is in development and we are evaluating additional production sites. There are many ethanol productions facilities that are available or we expect will become available in the near future. We plan to acquire a site either through outright acquisition, or with a joint venture or partnership. Depending on the facility and design of the ethanol plant that we expect to acquire, we would expect to retrofit or build side by side production.

On April 2, 2020, we announced the engagement of Citigroup Global Markets, Inc. to assist us in exploring, among other things, project funding needed for the Luverne Facility expansion, as well as for other production expansion projects, in order to meet the growing, contracted demand for our renewable fuels. Concurrent with this offering, Citigroup is seeking to identify project equity investors consistent with our strategy to use project financing to finance the construction of production facilities to produce our products.

Take-or-Pay Contracts

We have a growing portfolio of long-term, take-or-pay contracts for our products. As of the date of this prospectus supplement, we have entered into the following contracts, among others:

|

|

●

|

Trafigura. In August 2020, we entered into a long-term take-or-pay purchase agreement with Trafigura Trading LLC (“Trafigura”) pursuant to which we agreed to supply renewable hydrocarbons to Trafigura, subject to certain conditions and exceptions. Performance under the agreement is subject to certain conditions, including acquiring a production facility to produce the renewable hydrocarbon products contemplated by the agreement and closing a financing transaction for sufficient funds to acquire and retrofit the production facility contemplated by the agreement.

|

|

|

●

|

Delta Air Lines. In December 2019, and as subsequently amended in April 2020, we entered into a long-term, take-or-pay purchase agreement with Delta Air Lines, Inc. (“Delta”) pursuant to which we agreed to sell and deliver 10 million gallons per year of renewable jet fuel to Delta, subject to certain conditions and exceptions, including Delta’s right to eliminate the take-or-pay requirements in certain circumstances. We expect to supply the renewable jet fuel to Delta upon completion of the proposed expansion of the Luverne Facility (the “Expanded Facility”), which we expect to occur by 2023.

|

|

|

●

|

Scandinavian Airlines System. In October 2019, we entered into a long-term, take-or-pay purchase agreement with Scandinavian Airlines System (“SAS”) pursuant to which we agreed to sell and deliver renewable jet fuel to SAS, subject to certain conditions and exceptions. We expect to supply the renewable jet fuel to SAS upon completion of the Expanded Facility, which we expect to occur by 2023.

|

|

|

●

|

Air Total. In August 2019, we entered into a take-or-pay purchase agreement with Air Total International, S.A. (“Air Total”) pursuant to which we agreed to supply renewable jet fuel to Air Total under a three-year offtake agreement. Air Total will initially purchase certain quantities of renewable jet fuel produced at the South Hampton Facility, and we expect to sell Air Total increasing amounts of renewable jet fuel upon the completion of two expansion projects to increase renewable jet fuel production capabilities at the Luverne Facility. We expect the expansion projects to be completed in 2023.

|

|

|

●

|

HCS Group GmbH. In February 2019, we entered into a take-or-pay purchase agreement with HCS Holding GmbH (“HCS”), pursuant to which we agreed to supply renewable premium gasoline to HCS under a 10-year offtake agreement. HCS will initially purchase certain quantities of renewable premium gasoline produced at the South Hampton Facility. We expect the expansion project to be completed in 2023. Assuming the expansion project is completed, and subject to the terms and conditions of the agreement, HCS would purchase a minimum of 2,000,000 gallons per year and a maximum of 4,000,000 gallons per year.

|

Technology Licensing Agreements

We have other contracts focused on licensing our technology:

|

|

●

|

Praj Industries. In August 2020, we entered into a binding, definitive Master Framework Agreement (“MFA”) with Praj Industries Ltd. (“Praj”) to collaborate on providing renewable, low carbon, low particulate, Sustainable Aviation Fuel (“SAF”) and renewable premium gasoline in India and neighboring countries. This follows an earlier announcement in April 2019 between us and Praj regarding the commercialization of renewable isobutanol, SAF and renewable premium gasoline. We will license our technology and Praj will provide technology, plant equipment and EPC services to sugar mills and ethanol plants to produce renewable isobutanol from 1G feedstock (such as cane juice, cane molasses and sugar syrup) and 2G feedstock (such as cellulosic biomass like straws and bagasse). The renewable isobutanol will be aggregated and transferred to various refineries. We will also license our technology and Praj will provide technology, plant equipment and EPC services to refineries for converting renewable isobutanol into SAF and premium gasoline through the ASTM-approved pathway of ATJ.

|

Intellectual Property

We have patents, trade secrets and know-how covering our technology, processes, catalysts, biocatalysts and plant operations:

|

|

●

|

We have 118 patents and patent applications directed to our technologies and specific methods and products that support our business in the renewable fuels and bio industrial chemicals markets. We continue to file new patent applications, for which terms extend up to 20 years from the filing date in the U.S. We have also been issued multiple patents in the U.S. and in foreign jurisdictions.

|

|

|

●

|

In addition to patents and patent applications, we have trade secrets that involve the biocatalyst, know-how and procedures to operate plants, and blockchain technology to track our products.

|

|

|

●

|

Pursuant to the terms of a Patent Cross-License Agreement (the “License Agreement”), dated August 15, 2015, with Butamax Advanced Biofuels LLC (“Butamax”), we have certain rights to approximately 250 patents and patent applications owned by Butamax relating to renewable isobutanol.

|

Our Business System and Sustainability

Our business system (from the raw materials to use of our advanced renewable fuels in all types of transportation) represents the entire circular economy in action. The graphic below is a summary representation of our business system at work in the Midwest region of the United States, and how each of the processes work together to produce advanced renewable fuels with a low-carbon footprint. We believe this system can work just as effectively in most other parts of the world.

In the above representation of our system, the most basic raw material for making our renewable fuel products is the carbon dioxide in the atmosphere (i.e. the GHG). Atmospheric carbon dioxide and water are captured by growing plants through photosynthesis (via sunlight) to produce carbohydrates. Carbohydrates sources already shown to work in our system include starch, dextrose, sucrose, molasses and from cellulosics such as wood waste, wood and agricultural residues such as straw. In our first plants, we plan on using sustainably grown field corn as the carbohydrate source. Kernels of corn are comprised of approximately 70% carbohydrate and 30% protein. The kernels are ground up, and then the protein is separated from the carbohydrates either before or after the fermentation process. The carbohydrates are used for fermentation producing isobutanol. The protein is a valuable component of animal feed product delivering nutrition to animals in meat and dairy production. The feed products are value added, having the starch removed. With the starch removed, cattle and other livestock emit less enteric emissions than if they ate whole corn, yet 100% of the nutritional value of corn is delivered to the food chain. In our process, approximately 10 pounds of protein rich feed product is produced for each gallon of renewable fuel produced.

Reducing the fossil carbon footprint of the energy sources in our business system is important to reducing the carbon footprint of our renewable fuel products. In September 2019, we secured 5 megawatts of wind power from our partnership with Juhl Clean Energy Assets, Inc. to replace the grid electricity needed at the Luverne Facility. We are also establishing a supply of RNG to operate our process boilers at the Luverne Facility. We have contracted with three dairies in the Midwest that are expected to produce about 350,000 MMBtus of RNG per year using anaerobic digestion. About half of the RNG production is expected to be used at our Luverne Facility and the remaining production is expected to be sold in the RNG markets, which are highly developed in places like California. An additional benefit of RNG production is that nitrogen, phosphorus and potassium nutrients are captured from the manure and can be used as field fertilizer. We believe that practices around the full accounting for both negative and positive externalities are evolving and will increasingly benefit us.

The impact of using renewable energy at our plants has potential to significantly reduce the carbon footprint associated with our products. When sustainable farming techniques used to grow our corn feedstocks (such as regenerative agriculture techniques) are accounted for, our renewable premium gasoline and renewable jet fuel products realize a GHG reduction of approximately 75% using EURED II calculation methods using the averages based upon the corn supplied to us (based upon the study by Sheehan, 2016). Furthermore, if we source feedstock from the farms that use conservation tillage such as strip tillage or drills, the corn GHG footprints are so low that we believe that we can run our total business system at a negative carbon footprint. We believe that we can achieve similar results by using waste wood, straw or municipal solid waste as feedstocks, depending upon the GHG footprint of the feedstock and the energy source used for production.

Our technology and business system embrace a new generation of systemic sustainability. We are focused on, and committed to, addressing the problem of supplying transportation fuels with a meaningful alternative that reduces GHGs and pollution, including the land utilization practices to generate our raw materials. We are working to establish accountability for the sustainability attributes of our entire business system, from the establishment of audited certification of our feedstocks (i.e. International Sustainability and Carbon Certification System and the Roundtable on Sustainable Biomaterials), to the development of distributed ledger technology in partnership with Blocksize Capital to enable the tracking of sustainability attributes proving assurance of sustainability to our customers.

Market Opportunities

Low-Carbon Footprint Renewable Fuels. Liquid transportation fuels are historically dominated by fossil, carbon-based raw materials. A barrel of oil is fractioned in the refining process into jet fuel, gasoline and diesel fuel. The amount of fossil-based fuels used worldwide for transportation totaled 965 billion gallons per year in 2017, according to the U.S. Energy Information Administration (the “EIA”), with U.S. demand of 229 billion gallons per year, not counting bunker fuel. The graphic below shows a breakdown of the products making up the liquid transportation fuel demand in 2017:

The size of the liquid transportation fuel markets is expected to remain steady through 2050 according to the EIA, even with the increased deployment of electric vehicles and hybrid vehicles. In addition, based on recent fundamental trends (including increasing petroleum demand, especially from emerging markets), regulatory initiatives worldwide and in the U.S. (such as California’s Low Carbon Fuel Standard) and the changing political discourse throughout the world with an increased focus on climate change, we believe there will be an increased need for economical, renewable and environmentally sensitive alternatives to existing liquid transportation fuels.

We believe that mandates for low-carbon fuels will continue to spread around the world as countries grapple with GHG reductions. We also believe that our renewable premium gasoline, jet fuel and diesel fuel products can rapidly gain market share as industry, political and regulatory trends accelerate over time. Our technology has the ability to be deployed globally. The rate of deployment will be driven by economics and financial returns on production facilities utilizing our technology.

Animal Feed and Proteins. A valuable byproduct of our fermentation process for the production of isobutanol is a nutritious protein stream that can be sold as animal feed. Our business model does not impose a ‘food versus fuel choice’; the carbohydrates we convert do not possess healthy nutritional content and cannot be utilized in the food chain in any meaningful or beneficial way.

Future Potential Products and Licensable Technologies

Para-Xylene for Polyester Materials. We have a technology to convert an intermediate from our hydrocarbon process into a key ingredient for polyester plastics and fiber. This key ingredient, para-xylene, enables 100% renewable polyester materials and has already been produced at demonstration plant scale, and proven to work. The market size for para-xylene is estimated to be about 50 million metric tons per year. Our technology is differentiated by how we make para-xylene in that it is made in simple steps without complicated side products. The potential market, ignoring price, would be on the order of 35 to 40 million metric tons per year. This technology would be an add on incremental expansion to a plant that makes jet fuel and isooctane, and therefore could be sized for specialty products, which could command a premium price.

Ethanol and/or isobutanol into diesel fuel. We possess the technology to convert ethanol into diesel and jet fuel. This technology has been demonstrated at lab scale. We see that this technology could be deployed after an isooctane plant is operational because there is a side stream that could be blended to into gasoline. This technology could work synergistically with renewable premium gasoline.

Alcohols into olefins. We have developed the technology to convert ethanol into propylene while generating hydrogen gas. The propylene is fully renewable and suitable for conversion into polypropylene into fibers and plastics. The hydrogen produced is suitable for fuel cell or other uses. We expect that we would license this technology in the future.

Alcohols to specialty chemicals. We have developed a catalytic technology to convert fermentation alcohols into specialty chemicals for fragrances, flavors and aromas.

Our Strategy

Our products address global needs for drop-in low-carbon, clean-burning, high-performance fuels. Our strategy is to exploit our patented technology, process know-how, proven operations, proven product performance, business systems and product offtake agreements to develop and install renewable fuel production capacity that provides project investors with attractive, risk-adjusted financial returns while also providing our company substantial streams of fee income around technology licensing, project construction management and operations and maintenance roles, as well as substantial residual project equity cash flow distributions. Our strategy minimizes the use of our capital in constructing projects.

Key elements of our strategy include:

|

|

●

|

Continue to enter into supply agreements for low-carbon hydrocarbon fuels made from alcohols like isobutanol with customers to support capacity growth using project financing or other less expensive and less dilutive forms of capital. We intend to continue to build on our existing customer contracts, such as our supply agreements with Trafigura, Delta, SAS, Air Total and HCS, by entering into additional binding off-take agreements that would economically support the expansion of the Luverne Facility to increase the production capability of isobutanol and its derivative hydrocarbon products. If we are able to obtain sufficient new supply agreements, we expect to be able to raise capital to fund such conversion of the Luverne Facility using project financing or other less expensive and less dilutive forms of capital as compared to corporate equity and warrant offerings that we are conducting herewith and have used in the past.

|

|

|

●

|

Upon receipt of project financing, we plan to expand the Luverne Facility to produce renewable premium gasoline and jet fuel. Upon, and subject to, securing adequate financing, we plan to expand the Luverne Facility to enable the production of isobutanol and its derivative products at levels sufficient to supply our initial larger scale off-take agreements.

|

|

|

●

|

Expand the global production capacity of renewable premium gasoline, jet fuel and diesel fuel, and intermediates for chemical and plastics production via licensing core and adjacent technologies around the world. We have proven that our isobutanol production process works in full-scale fermenter systems at the Luverne Facility, and we have also proven that our renewable isobutanol can be readily converted to hydrocarbon products at the Silsbee Facility. Our technology can be used to produce isobutanol from feedstocks other than corn, such as sugar, molasses, agricultural residues (e.g., straw, bagasse, stover), wood and wood residues and biogenic municipal solid waste. Feedstocks differ in their abundancy around the world. We intend to expand the global production of isobutanol and its derivative hydrocarbon products beyond the Luverne Facility through a low-cost, high-margin licensing model, in collaboration with partners such as Praj Industries, with whom we have previously announced a joint development agreement. We have several technologies that we expect to eventually license. We have already proven that fully renewable polyester can be produced using intermediates from our renewable premium gasoline production. We have developed a technology to convert ethanol to hydrogen and propylene. We have developed a technology to convert short chain fermentation alcohols into fine chemicals such as flavors and fragrances.

|

|

|

●

|

Grow our business to achieve economies of scale to reduce selling prices of renewable fuels. We believe that the long-term price of oil is relevant to the demand for our products, and the value in the market for reducing carbon should make our selling prices more attractive in the future. In addition, as we scale up our business and achieve economies of scale, we can drive down our selling price of our renewable fuels to make our products more economical and attractive to our customers. We believe we can drive economies of scale by securing additional offtake supply agreements, with continued expansion of our production facilities and/or licensing our technology to others. Already, the net selling price to the customer approaches parity with fossil-based fuels. We also believe that with additional plants using our technology and with contracts for products that we expect to establish, we should be able to achieve attractive reinvestment economics making further plant buildouts attractive to project investors.

|

|

|

●

|

Establish a business system that has potential to deliver “net zero” carbon emission fuel products. The concept of “net zero” carbon emissions is based on using sustainably produced, renewable resource-based raw materials as the product carbon source combined with reducing or eliminating fossil-based process energy inputs by using renewable electricity and RNG. The full life-cycle carbon footprint of our products, from generation of feedstocks to actual burning of the fuels, can be zero or even negative if regenerative or sustainable agricultural practices are used for the feedstock production. Our potential use of blockchain techniques could allow a complete and accurate accounting for positive and negative contributions to environmental metric which, in turn, would enable value transfers that incentivize systemic renewable and regenerative business practices across the value chain.

|

|

|

●

|

Undertake incremental process improvements to lower energy consumption at the Luverne Facility. By investing additional capital at the Luverne Facility, we believe that we can lower the carbon intensity (i.e. lower the carbon dioxide emissions from the Luverne Facility) for our isobutanol and its derivative hydrocarbon products. The infrastructure could also be used for low carbon ethanol markets if the economics were warranted.

|

Competitive Strengths

|

|

●

|

Platform technologies and products to address large markets. Because isobutanol can be readily converted into hydrocarbon products, including isooctane, isooctene, renewable jet fuel, lubricants, polyester, rubber, plastics, fibers and other polymers, we believe that the addressable markets are very large; potentially ultimately reaching 40% of the global petrochemicals markets depending on the price of oil and the market value of carbon footprint reduction.

|

|

|

●

|

Growing, take-or-pay contracted demand for our renewable products. We currently have take-or-pay contracts in place for a maximum of 17 million gallons per year of our renewable premium gasoline and jet fuel. We believe these take-or-pay contracts are suitable for sponsoring debt and equity project financing for expansion of our production capabilities.

|

|

|

●

|

Proven commercial production processes. Our renewable isobutanol production technology has been proven to work at a commercial scale in a 1 million liter fermenter at our Luverne Facility. Additional trains of proven fermentation equipment and systems will be needed to increase capacity at the site. Our technology to convert renewable isobutanol into renewable jet fuel, isooctane, isooctene and para-xylene (building block for polyester) has been proven at our Silsbee Facility.

|

|

|

●

|

Proven commercial products, renewable premium gasoline and jet fuel.

|

|

|

o

|

Renewable premium gasoline. We produce a product called isooctane that we refer to as renewable premium gasoline. We have demonstrated that isooctane makes up 50% to 60% of fossil-based gasoline, and we believe isooctane is a direct substitute for alkylate and reformate. Given that our isooctane is renewable, we have the ability to produce a renewable premium gasoline. We believe that our renewable premium gasoline is substantially similar to fossil-based premium gasoline. Subject to receipt of certain regulatory approvals, our renewable premium gasoline could be a direct substitute for fossil-based premium gasoline for use in commerce in the U.S. Additionally, our renewable isooctane, like alkylate or reformate, when added to lower-octane fossil-based gasoline, produces a higher octane premium gasoline simultaneously lowering the GHG footprint and other pollution emissions. Because of the high octane of our isooctane product, our customer HCS has been supplying the F1 Racing Circuit in the E.U. In the U.S., the combination of “drop-in” to existing fleets and infrastructure while lowering the GHG footprint and pollution was a major driver for the City of Seattle to begin adoption of our renewable fuels in their fuel supply. We believe other municipal fleets looking to lower their carbon footprint are likely to follow because of the very low switching cost compared to alternatives such as electric vehicles, compressed natural gas vehicles or other clean technologies, which would require new fleets of vehicles and supporting infrastructure. In the consumer gasoline markets, we expect that the demand will grow for premium gasoline with high octane ratings as more cars come onto the road with engines designed for high miles per gallon.

|

|

|

o

|

Renewable Jet Fuel. In 2016, ASTM International included our renewable jet fuel in ASTM D7566 (Standard Specification for Aviation Turbine Fuel Containing Synthesized Hydrocarbons), which means that our renewable jet fuel can be used in commercial aviation on a blended basis up to 50% with petroleum-based jet fuel. In fact, our renewable jet fuel has been used to fuel commercial flights in the U.S. by Alaska Airlines, Lufthansa, United Airlines, Etihad, Cathay Pacific Airways, Emirates, Japan Airlines, Korean Air and Atlas Air. In addition, our renewable isobutanol has been sold commercially in the Houston market as a fuel blendstock.

|

|

|

●

|

Existing commercial-scale production facility. Our Luverne Facility is located in the middle of the U.S. with access to attractively priced renewable wind power electricity (for our electricity demand), renewable natural gas (for thermal energy), certified sustainable corn as a feedstock, rail services, and a trained production leadership team who knows how to produce Gevo products and train employees.

|

|

|

●

|

Retrofit and side-by-side ethanol and isobutanol production. We have demonstrated that we can retrofit an existing ethanol plant for isobutanol production and manage both ethanol and isobutanol production using different yeasts without causing cross contamination, while still operating an integrated and efficient plant. This means that as Gevo production technologies expand, greenfield production sites are not required and existing low-cost ethanol infrastructure that is underutilized in today’s ethanol markets can be converted to produce isobutanol, which can be further converted to renewable fuels such as renewable premium gasoline and renewable jet fuel. We believe the current ethanol market presents significant acquisition opportunities for Gevo suitable for retrofit at attractive prices.

|

|

|

●

|

Abundant, readily sourced feedstocks available globally. Through our platform fermentation technology, we have the ability to use carbohydrates from various types of feedstock (including starch, dextrose, sugar, molasses, agricultural residues and wood), allowing our technology to be used in various economic conditions. The feedstocks are abundantly available across the globe, typically at reasonable prices and easily aggregated.

|

|

|

●

|

Experienced management team. Our management team brings over 100 years of combined experienced in the development and commercialization of low-carbon products, projects and businesses

|

Recent Developments

Cash

As of August 20, 2020, we have cash and cash equivalents of approximately $21.1 million, which does not include the gross proceeds from the exercises of the Series 2020-A Warrants. See "--Series 2020-A Warrants Exercises."

This amount is unaudited and preliminary, and does not present all information necessary for an understanding of our financial condition as of August 20, 2020. Our estimate is based solely on information available to us as of the date of this prospectus supplement. Our estimate contained in this prospectus supplement, therefore, is a forward-looking statement. Actual results for the quarter ending September 30, 2020 remain subject to the completion of management’s and our audit committee’s final reviews and our other financial closing procedures and the completion of the preparation of our unaudited consolidated financial statements. Our actual unaudited consolidated financial statements and related notes as of and for the three months ending September 30, 2020 may not be filed with the SEC until after this offering is completed, and consequently may not be available to your prior to you investing in this offering.

The preliminary financial data included in this prospectus supplement has been prepared by and is the responsibility of our management. Our independent accountant, Grant Thornton LLP, has not audited, reviewed, compiled or performed any procedures with respect to the preliminary financial data. Accordingly, Grant Thornton LLP does not express an opinion or any other form of assurance with respect thereto.

July 2020 Offering

In July 2020, we completed a public offering (the “July 2020 Offering”) of (i) 20,896,666 Series 1 units (the “Series 1 Units”) at a price of $0.60 per Series 1 Unit, and (ii) 9,103,334 Series 2 units (the “Series 2 Units”) at a price of $0.59 per Series 2 Unit. The Offering was made under a registration statement on Form S-1 filed with the Securities and Exchange Commission, declared effective on June 30, 2020.

Each Series 1 Unit consists of one share of the Company’s common stock and one Series 2020-A warrant to purchase one share of the Company’s common stock (each, a “Series 2020-A Warrant”). Each Series 2 Unit consists of a pre-funded Series 2020-B warrant to purchase one share of the Company’s common stock (each, a “Series 2020-B Warrant” and, together with the Series 2020-A Warrants, the “Warrants”) and one Series 2020-A Warrant. The Series 2020-A Warrants are exercisable beginning on the date of original issuance and will expire five years from the date of issuance, at an exercise price of $0.60 per share. The pre-funded Series 2020-B Warrants are exercisable beginning on the date of issuance at a nominal exercise price of $0.01 per share of common stock any time until the Series 2020-B Warrants are exercised in full. In connection with the Offering, the Company issued Series 2020-A Warrants to purchase an aggregate of 30,000,000 shares of common stock.

The net proceeds to us from the July 2020 Offering were approximately $16.2 million, after deducting placement agent fees and other estimated offering expenses payable by the Company, and not including any future proceeds from the exercise of the Warrants.

Debt Conversions

In July 2020, certain holders of our 12% convertible senior secured notes due 2020/2021 (the “2020/21 Notes”) converted $2 million in aggregate principal amount of 2020/21 Notes (including the conversion of an additional $0.3 million for make-whole payment) into an aggregate of 4,169,428 shares of common stock pursuant to the terms of the indenture governing the 2020/21 Notes. There was $12.5 million principal outstanding for the 2020/21 Notes upon completion of the conversion of the 2020/21 Notes.

Series 2020-A Warrants Exercises

On August 20, 2020, we received notices of exercise from holders of our Series 2020-A Warrants to issue an aggregate of 22,968,432 shares of common stock for total gross proceeds of approximately $13.8 million. Following these exercises, Series 2020-A Warrants to purchase 7,031,568 shares of our common stock remain outstanding at an exercise price of $0.60 per share.

Corporate Information

We were incorporated in Delaware in June 2005 under the name Methanotech, Inc. and filed an amendment to our certificate of incorporation changing our name to Gevo, Inc. on March 29, 2006. Our principal executive offices are located at 345 Inverness Drive South, Building C, Suite 310, Englewood, Colorado 80112, and our telephone number is (303) 858-8358. We maintain an internet website at www.gevo.com. Information contained in or accessible through our website does not constitute part of this prospectus supplement or the accompanying prospectus.

The Offering

|

Common stock offered by us in this offering

|

21,929,313 shares.

|

|

|

|

|

Pre-funded Series 2020-C warrants offered

by us in this offering

|

Pre-funded Series 2020-C warrants to purchase up to 16,532,232 shares of common stock. We are offering to those purchasers whose purchase of shares of common stock in this offering would result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% or 9.99%, at the election of the purchaser, of our outstanding common stock following the consummation of this offering, the opportunity to purchase, if such purchaser so chooses, pre-funded Series 2020-C warrants, in lieu of shares of common stock that would otherwise result in beneficial ownership in excess of 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock.

Each pre-funded Series 2020-C warrant will entitle the holder to purchase one share of common stock. The pre-funded Series 2020-C warrants will be exercisable on the date of issuance and will expire when exercised in full, at an exercise price of $0.01 per share of common stock. The purchase price of $1.30 per share will be pre-paid, except for a nominal exercise price of $0.01 per share, upon issuance of the pre-funded Series 2020-C warrants and, consequently, no additional payment or other consideration (other than the nominal exercise price of $0.01 per share) will be required to be delivered to us by the holder upon exercise.

This prospectus supplement also relates to the offering of the shares of common stock issuable upon exercise of the pre-funded Series 2020-C warrants. The exercise price of the pre-funded Series 2020-C warrants and the number of shares into which the pre-funded Series 2020-C warrants may be exercised are subject to adjustment in certain circumstances.

|

|

|

|

|

Beneficial ownership limitation in the

pre-funded Series 2020-C warrants

|

A holder (together with its affiliates) may not exercise any portion of the pre-funded Series 2020-C warrants to the extent that the holder, together with its affiliates and certain related parties, would beneficially own more than 4.99% (or, at the election of the holder prior to the date of issuance, 9.99%) of our outstanding common stock after exercise. The holder may increase or decrease this beneficial ownership limitation to any other percentage not in excess of 9.99% upon notice to us, provided that, in the case of an increase of such beneficial ownership limitation, such notice shall not be effective until 61 days following notice to us.

|

|

|

|

|

Shares of common stock outstanding after

this offering

|

92,260,369 shares of common stock (assuming the exercise of all of the pre-funded Series 2020-C warrants).

|

|

|

|

|

Use of proceeds

|

We estimate that our net proceeds from this offering will be approximately $46.1 million, after deducting the placement agent’s fees and estimated offering expenses payable by us.

We intend to use the net proceeds received from this offering to fund working capital and for other general corporate purposes, which may include the repayment of outstanding indebtedness. See “Use of Proceeds.”

|

|

Risk factors

|

This investment involves a high degree of risk. See “Risk Factors” for a discussion of factors you should carefully consider before deciding to invest in our securities.

Investing in our securities involves a high degree of risk. See the section entitled “Risk Factors” of this prospectus supplement, the accompanying prospectus and the section entitled “Risk Factors” in the documents incorporated by reference herein and therein for a discussion of factors you should carefully consider before investing in our securities.

|

|

|

|

|

Nasdaq Capital Market symbol

|

“GEVO.” The pre-funded Series 2020-C warrants are not, and will not be, listed for trading on any national securities exchange or other nationally recognized trading system, including the Nasdaq Capital Market.

|

Unless otherwise noted, the number of shares of common stock to be outstanding immediately after this offering as set forth above is based on 53,798,824 shares outstanding as of August 19, 2020, and excludes:

|

|

●

|

1,556 shares of our common stock issuable upon exercise of outstanding options at a weighted-average exercise price of $877.93 per share;

|

|

|

●

|

751,209 shares of our common stock issuable upon the vesting and settlement of outstanding restricted stock awards at a weighted-average grant date fair value of $1.81 per share;

|

|

|

●

|

30,050,812 shares of our common stock issuable upon exercise of outstanding warrants at a weighted-average exercise price of $0.88 per share;

|

|

|

●

|

288,126 shares of common stock available for future grant under our Amended and Restated 2010 Stock Incentive Plan (the “2010 Plan”); and

|

|

|

●

|

190 shares of common stock available for issuance pursuant to our Employee Stock Purchase Plan (the “ESPP”).

|

Unless otherwise indicated, this prospectus supplement assumes no exercise of the pre-funded Series 2020-C warrants.

RISK FACTORS

An investment in our securities involves a high degree of risk. Prior to making a decision about investing in our securities, you should carefully consider the following risks and uncertainties, as well as those discussed under the caption “Risk Factors” in the accompanying prospectus and in the documents incorporated by reference herein and therein. If any of the risks described in this prospectus supplement, the accompanying prospectus or the documents incorporated by reference herein, actually occur, our business, prospects, financial condition or operating results could be harmed. In that case, the trading price of our securities could decline, and you may lose all or part of your investment. Additional risks and uncertainties not presently known to us or that we currently believe are immaterial may also impair our business operations and our liquidity. You should also refer to the other information contained in this prospectus and the accompanying prospectus, or incorporated by reference herein and therein, including our financial statements and the related notes thereto and the information set forth under the heading “Cautionary Note Regarding Forward-Looking Statements.”

Risks Related to our Business and Strategy

Our take-or-pay contracts, including our take-or-pay purchase agreement with Trafigura, are subject to significant conditions precedent and, as a result, the revenues that we expect from such contracts may never be realized.

Our ability to realize revenue under our take-or-pay-contracts, including our take-or-pay purchase agreement with Trafigura, is not guaranteed and is subject to significant conditions precedent. In order to actually realize revenue under such contracts, we are required to, among other things, complete the Expanded Facility or acquire and retrofit a facility at another suitable location, which is, in turn, dependent on our ability to secure the requisite financing. If we are unable to raise sufficient capital on acceptable terms, or at all, the revenues under such contracts may never be achieved. Our ability to obtain adequate financing will depend on, among other things, the status of our product development, our financial condition and general conditions in the capital, financial and debt markets at the time such financing is sought. In addition, any further common stock, warrant or convertible debt financings could result in the dilution of ownership interests of our then-current stockholders. Furthermore, even if we are able to satisfy all conditions precedent to our take-or-pay contracts, including completion of the Expanded Facility or acquiring and retrofitting a facility at another suitable location, and securing adequate funding, we still may never realize the full amount of revenue that we expect or project to earn from such contracts. In any event, failure to realize the expected revenue thereunder would have a material adverse effect on our business, financial condition, results of operation and liquidity.

Risks Related to this Offering and Owning Our Securities

Management will have broad discretion as to the use of the net proceeds from this offering, and may not use the proceeds effectively.

Our management will have broad discretion in the application of the net proceeds from this offering and could spend the proceeds in ways that do not improve our results of operations or enhance the value of our common stock. For example, management could invest the proceeds in assets that do not produce attractive returns or to make acquisitions of properties or businesses that do not prove to be attractive or otherwise are unsuccessful. Conversely, management may not be able to identify and complete investments or acquisitions. Our failure to apply these funds effectively could have a material adverse effect on our business, financial condition and results of operations and cause the price of our common stock to decline.

A large number of shares issued in this offering may be sold in the market following this offering, which may depress the market price of our common stock.

As of August 19, 2020, there were 53,798,824 shares of our common stock outstanding. All of our issued and outstanding shares, including the shares issued in this offering and issuable upon exercise of the pre-funded Series 2020-C warrants, may be sold in the market following this offering and will be freely tradeable, except for any shares held by our “affiliates,” as that term is defined in Rule 144 under the Securities Act.

Sales of substantial amounts of our common stock in the public market after this offering, or the perception that such sales will occur, could depress the market price of our common stock. Sales of a substantial number of shares of our common stock in the public market following this offering could cause the market price of our common stock to decline. If there are more shares of common stock offered for sale than buyers are willing to purchase, then the market price of our common stock may decline to a market price at which buyers are willing to purchase the offered shares of common stock and sellers remain willing to sell the shares.

The pre-funded Series 2020-C warrants issued in this offering may not have any value.

The pre-funded Series 2020-C warrants will be exercisable on the date of issuance and will expire when exercised in full, at an exercise price of $0.01 per share of common stock. The purchase price of $1.29 per share of the pre-funded Series 2020-C warrants will be pre-paid, except for a nominal exercise price of $0.01 per share, upon issuance of the pre-funded Series 2020-C warrants and, consequently, no additional payment or other consideration (other than the nominal exercise price of $0.01 per share) will be required to be delivered to us by the holder upon exercise. In the event our common stock does not exceed the exercise price of the prefunded Series 2020-C warrants, which is $0.01 per share issued in this offering during the period when such warrants are exercisable, such pre-funded Series 2020-C warrants may not have any value.

Holders of our common stock may not be permitted to exercise warrants that they hold on account of a beneficial ownership limitation.

The pre-funded Series 2020-C warrants being offered hereby will prohibit a holder from exercising its warrants if doing so would result in such holder beneficially owning more than 4.99% (or, at the election of the holder prior to the date of issuance, 9.99%), of our common stock. Any holder may increase or decrease this beneficial ownership limitation to any other percentage not in excess of 9.99% upon notice to us, provided that, in the case of an increase of such beneficial ownership limitation, such notice shall not be effective until 61 days following notice to us. As a result, you may not be able to exercise your warrants for shares of our common stock at a time when it would be financially beneficial for you to do so.

There is no public market for the pre-funded Series 2020-C warrants being offered by us in this offering.

There is no established public trading market for the pre-funded Series 2020-C warrants to purchase shares of our common stock being offered by us in this offering, and we do not expect a market to develop. In addition, we do not intend to apply to list the pre-funded Series 2020-C warrants on any national securities exchange or other trading system. Without an established market, the liquidity of the pre-funded Series 2020-C warrants may be extremely limited or non-existent.

Except as set forth in the applicable pre-funded Series 2020-C warrant, holders of our warrants will have no rights as common stockholders until such holders exercise their warrants and acquire our common stock.

Until you acquire shares of our common stock upon exercise of your pre-funded Series 2020-C warrants, you will have no rights with respect to the shares of our common stock underlying such warrants, except for those rights set forth in the pre-funded Series 2020-C warrants. Upon exercise of your warrants, you will be entitled to exercise the rights of a common stockholder only as to matters for which the record date occurs after the exercise date.

We may not be permitted by the agreements governing our indebtedness, including our secured indebtedness with affiliates of Whitebox Advisors LLC (collectively, “Whitebox”), to repurchase our warrants, and we may not have the ability to do so.

Under certain circumstances, if a “fundamental transaction” or “extraordinary transaction” (as such terms are defined in our various warrants) occurs, holders of our warrants may require us to repurchase, for cash, the remaining unexercised portion of such warrants for an amount of cash equal to the value of the warrant as determined in accordance with the Black-Scholes option pricing model and the terms of our warrants. Our ability to repurchase our warrants depends on our ability to generate cash flow in the future. To some extent, this is subject to general economic, financial, competitive, legislative and regulatory factors and other factors that are beyond our control. We cannot assure you that we will maintain sufficient cash reserves or that our business will generate cash flow from operations at levels sufficient to permit us to repurchase our warrants. In addition, any such repurchase of our warrants may result in a default under the agreements governing our indebtedness, including our secured indebtedness with Whitebox, unless we are able to obtain such lender’s consent prior to the taking of such action. If we were unable to obtain such consent, compliance with the terms of our warrants would trigger an event of default under such agreements governing our indebtedness.

Future issuances of our common stock or instruments convertible or exercisable into our common stock, including in connection with conversions of our 2020/21 Notes or exercises of warrants, including the pre-funded Series 2020-C warrants offered hereby, may materially and adversely affect the price of our common stock and cause dilution to our existing stockholders.

Historically, we have raised capital by issuing common stock and warrants in underwritten public offerings because no other reasonable sources of capital were available. These underwritten public offerings of common stock and warrants have materially and adversely affected the prevailing market prices of our common stock and caused significant dilution to our stockholders. We have also historically raised capital or refinanced outstanding debt through the issuance of convertible notes.

We may need to raise capital through these public offerings of common stock, warrants and convertible debt in the future.

We may obtain additional funds through public or private debt or equity financings, subject to certain limitations in the agreements governing our indebtedness, including the 2020/21 Notes. If we issue additional shares of common stock or instruments convertible into common stock, it may materially and adversely affect the price of our common stock. In addition, the conversion of some or all of the 2020/21 Notes and/or the exercise of some or all of our warrants, including the pre-funded Series 2020-C warrants offered hereby, may dilute the ownership interests of our stockholders, and any sales in the public market of any of our common stock issuable upon such conversion or exercise could adversely affect prevailing market prices of our common stock. Additionally, under the terms of certain of our outstanding warrants, in the event that a warrant is exercised at a time when we do not have an effective registration statement covering the underlying shares of common stock on file with the SEC, such warrant may be “net” or “cashless” exercised, which will dilute the ownership interests of existing stockholders without any corresponding benefit to the Company of a cash payment for the exercise price of such warrant.

As of August 19, 2020, we had approximately $12.5 million in outstanding 2020/21 Notes. Any conversion of the outstanding 2020/21 Notes (including any interest that is paid in kind) into shares of our common stock could depress the trading price of our common stock. In addition, under the terms of the 2020/21 Notes, subject to certain restrictions, we have the option to issue common stock to any converting holder in lieu of making any required make-whole payment in cash. If we elect to issue our common stock for such payment, it will be at the same conversion rate that is applicable to conversions of the principal amount of the 2020/21 Notes. If we elect to issue additional shares of our common stock for such payments, this may cause significant additional dilution to our existing stockholders.

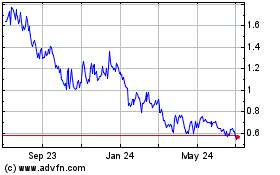

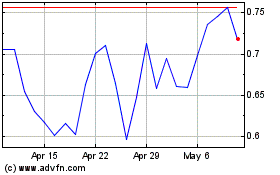

Our stock price may be volatile, and your investment in our securities could suffer a decline in value.

The market price of shares of our common stock has experienced significant price and volume fluctuations. We cannot predict whether the price of our common stock will rise or fall. A variety of factors may have a significant effect on our stock price, including:

|

|

●

|

actual or anticipated fluctuations in our liquidity, financial condition and operating results;

|

|

|

●

|

the position of our cash and cash equivalents;

|

|

|

●

|

the impact of the novel coronavirus (COVID-19) pandemic to our business, our financial condition, our results of operation and liquidity;

|

|

|

●

|

actual or anticipated changes in our growth rate relative to our competitors;

|

|

|

●

|

actual or anticipated fluctuations in our competitors’ operating results or changes in their growth rate;

|

|

|

●

|

announcements of technological innovations by us, our partners or our competitors;

|

|

|

●

|

announcements by us, our partners or our competitors of significant acquisitions, strategic partnerships, joint ventures or capital commitments;

|

|

|

●

|

the entry into, modification or termination of licensing arrangements, marketing arrangements, and/or research, development, commercialization, supply, off-take or distribution arrangements;

|

|

|

●

|

our ability to consistently produce commercial quantities of isobutanol, renewable hydrocarbon products and ethanol at the Luverne Facility, the planned Expanded Facility and the ramp up production to nameplate capacity;

|

|

|

●

|

our ability to repay our indebtedness when it becomes due;

|

|

|

●

|

our ability to refinance, restructure or convert our current and future indebtedness;

|

|

|

●

|

additions or losses of customers or partners;

|

|

|

●

|

our ability to obtain certain regulatory approvals for the use of our isobutanol and ethanol in various fuels and chemicals markets;

|

|

|

●

|

commodity prices, including oil, ethanol and corn prices;

|

|

|

●

|

additions or departures of key management or scientific personnel;

|

|

|

●

|

competition from existing products or new products that may emerge;

|

|

|

●

|

issuance of new or updated research reports by securities or industry analysts;

|

|

|

●

|

fluctuations in the valuation of companies perceived by investors to be comparable to us;

|

|

|

●

|

litigation involving us, our general industry or both;

|

|

|

●

|

disputes or other developments related to proprietary rights, including patents, litigation matters and our ability to obtain patent protection for our technologies;

|

|

|

●

|

announcements or expectations of additional financing efforts or the pursuit of strategic alternatives;

|

|

|

●

|

changes in existing laws, regulations and policies applicable to our business and products, and the adoption of or failure to adopt carbon emissions regulation;

|

|

|

●

|

sales of our common stock or equity-linked securities, such as warrants, by us or our stockholders;

|

|

|

●

|

share price and volume fluctuations attributable to inconsistent trading volume levels of our shares;

|

|

|

●

|

general market conditions in our industry; and

|

|

|

●

|

general economic and market conditions.

|