INCORPORATION

OF CERTAIN DOCUMENTS BY REFERENCE

The

SEC allows us to “incorporate by reference” information into this prospectus supplement, which means that we can disclose

important information to you by referring you to other documents which we have filed or will file with the SEC. The information

incorporated by reference is considered a part of this prospectus supplement and should be read carefully. Certain information

in this prospectus supplement supersedes information incorporated by reference that we filed with the SEC prior to the date of

this prospectus supplement. Certain information that we file later with the SEC will automatically update and supersede the information

in this prospectus supplement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded,

to constitute a part of this prospectus.

We

incorporate by reference into this prospectus supplement and the registration statement of which it is a part the following documents,

including any amendments to such filings:

|

|

●

|

our

annual report on Form 20-F for the fiscal year ended June 30, 2019;

|

|

|

●

|

our

Report on Form 6-K furnished to the SEC on February 27, 2020 (excluding the information set forth in “Auditor’s

Independence Declaration” on page 4 and the “Independent auditor’s review report to the members of Genetic

Technologies Limited” on page 23 of such Exhibit thereto), as amended by our Report on Form 6-K/A furnished to the SEC

on July 16, 2020;

|

|

|

|

|

|

|

●

|

our

Reports on Form 6-K furnished to the SEC on March 16, 2020, April 8, 2020, April 17, 2020, April 21, 2020, April 24, 2020,

May 29, 2020, and June 19, 2020; and

|

|

|

|

|

|

|

●

|

the

description of ADSs representing our ordinary shares contained in our Registration Statement on Form 20-F filed with the SEC

on August 31, 2005, including any amendments or reports filed for the purpose of updating such description.

|

We

are also incorporating by reference all subsequent Annual Reports on Form 20-F that we file with the SEC and certain reports on

Form 6-K that we furnish to the SEC after the date of this prospectus (if they state that they are incorporated by reference into

this prospectus) prior to the termination of this offering. In all cases, you should rely on the later information over different

information included in this prospectus or any accompanying prospectus supplement.

Unless

expressly incorporated by reference, nothing in this prospectus shall be deemed to incorporate by reference information furnished

to, but not filed with, the SEC. Copies of all documents incorporated by reference in this prospectus, other than exhibits to

those documents unless such exhibits are specifically incorporated by reference in this prospectus, will be provided at no cost

to each person, including any beneficial owner, who receives a copy of this prospectus on the written or oral request of that

person made to:

Jerzy

Muchnicki

60-66

Hanover Street

Fitzroy,

Victoria, 3065, Australia

Tel:

011613-9415-1135

You

may also access these documents on our website, www.gtlabs.com.The information contained on, or that can be accessed through,

our website is not a part of this prospectus. We have included our website address in this prospectus solely as an inactive textual

reference.

PROSPECTUS

$75,000,000

American Depositary Shares Representing Ordinary Shares

Preference Shares

Warrants

Units

Genetic Technologies Limited

We may offer, issue and sell from time to time up to $75,000,000 of our ordinary shares, in the form of American Depositary Shares, or ADSs, preference shares, warrants to purchase ordinary shares, in the form of ADSs and a combination of such securities, separately or as units, in one or more offerings. Each ADS represents 600 ordinary shares. This prospectus provides a general description of offerings of these securities that we may undertake.

We refer to our ADSs, ordinary shares, preference shares, warrants, and units collectively as “securities” in this prospectus.

Each time we sell our securities pursuant to this prospectus, we will provide the specific terms of such offering in a supplement to this prospectus. The prospectus supplement may also add, update, or change information contained in this prospectus. You should read this prospectus, the accompanying prospectus supplement, together with the additional information described under the heading “Where You Can More Find Information,” before you make your investment decision.

We may, from time to time, offer to sell the securities, through public or private transactions, directly or through underwriters, agents or dealers, on or off the Nasdaq Capital Market, at prevailing market prices or at privately negotiated prices. If any underwriters, agents or dealers are involved in the sale of any of these securities, the applicable prospectus supplement will set forth the names of the underwriter, agent or dealer and any applicable fees, commissions or discounts.

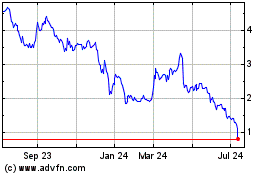

Our ADSs are listed on the Nasdaq Capital Market, or Nasdaq, under the symbol “GENE” and our ordinary shares are listed on the Australian Securities Exchange, or ASX, under the symbol “GTG.”

The aggregate market value of our outstanding ordinary shares held by non-affiliates as of the date of this prospectus was approximately $8,515,885 based on 4,063,134,143 ordinary shares outstanding as of such date, of which 1,836,997,964 were held by non-affiliates, and a price per ordinary share of A$0.007 based on the closing sale price of our ordinary shares on the ASX on 6 March, 2020. We have securities in the aggregate amount of $1,950,757 pursuant to General Instruction I.B.5 of Form F-3 during the prior 12 calendar month period that ends on, and includes, the date of this prospectus.

On March 12, 2020, the last sale price of the ADSs on the Nasdaq Capital Market was $2.36 per ADS and the last sale price of our ordinary shares on the ASX was A$0.006 per share.

Investing in these securities involves a high degree of risk. Please carefully consider the risks discussed in this prospectus under “Risk Factors” in this prospectus, in any accompanying prospectus supplement and in the documents incorporated by reference in this prospectus for a discussion of the factors you should carefully consider before deciding to purchase these securities.

Neither the U.S. Securities and Exchange Commission, any U.S. state securities commission, nor any other foreign securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is March 23, 2020.

Table of Contents

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission, or SEC, using a “shelf” registration process. Under this shelf registration process, we may sell our securities described in this prospectus in one or more offerings up to a total dollar amount of $75,000,000. Each time we offer our securities, we will provide you with a supplement to this prospectus that will describe the specific amounts, prices and terms of the securities we offer. The prospectus supplement may also add, update or change information contained in this prospectus. This prospectus, together with applicable prospectus supplements and the documents incorporated by reference in this prospectus and any prospectus supplements, includes all material information relating to this offering. Please read carefully both this prospectus and any prospectus supplement together with additional information described below under “Where You Can Find More Information” and “Incorporation of Certain Information by Reference.”

You should rely only on the information contained in or incorporated by reference in this prospectus and any applicable prospectus supplement. We have not authorized anyone to provide you with different or additional information. If anyone provides you with different or inconsistent information, you should not rely on it. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of securities described in this prospectus. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus or any prospectus supplement, as well as information we have previously filed with the SEC and incorporated by reference, is accurate as of the date on the front of those documents only. Our business, financial condition, results of operations and prospects may have changed since those dates. This prospectus may not be used to consummate a sale of our securities unless it is accompanied by a prospectus supplement.

Unless otherwise indicated or the context otherwise requires, all references in this prospectus to the “Company,” “Genetic Technologies,” “we,” “us” and “our” refer to Genetic Technologies Limited and its consolidated subsidiaries. References to “ordinary shares,” “ADSs,” “preference shares,” “warrants” and “share capital” refer to the ordinary shares, ADSs, preference shares, warrants and share capital, respectively, of the Company.

Certain figures included in this prospectus have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables may not be an arithmetic aggregation of the figures that precede them.

For investors outside of the United States: We have not taken any action to permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains statements that constitute forward-looking statements. Many of the forward-looking statements contained in this prospectus can be identified by the use of forward-looking words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “plan,” “potential” and “should,” among others.

Forward-looking statements appear in a number of places in this prospectus and include, but are not limited to, statements regarding our intent, belief, or current expectations. Forward-looking statements are based on our management’s beliefs and assumptions and on information currently available to our management. Such statements are subject to substantial risks and uncertainties, and actual results may differ materially from those expressed or implied in the forward-looking statements due to various important factors, including, but not limited to, those identified under “Risk Factors.” In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a guarantee by us or any other person that we will achieve our objectives and plans in any specified time frame, or at all.

1

Table of Contents

Forward-looking statements include, but are not limited to, statements about:

· the successful launch of our two new cancer risk assessment tests and our new tests under development;

· our competitive position in the molecular risk assessment and predictive testing area;

· our plans to research, develop, and launch our product candidates;

· the size and growth potential of the markets for our products;

· our ability to raise additional capital;

· our expectations regarding our ability to obtain and maintain intellectual property protection;

· our ability to attract and retain qualified employees and key personnel;

· our ability to retain and maintain relationship with third party consultants and advisors and their ability to perform adequately;

· our estimates regarding future revenue, expenses and needs for additional financing; and

· regulatory developments in the United States, China and other jurisdictions and our compliance with such regulations.

Forward-looking statements speak only as of the date they are made, and we do not undertake any obligation to update them in light of new information or future developments or to release publicly any revisions to these statements in order to reflect later events or circumstances or to reflect the occurrence of unanticipated events, except as may be required under applicable.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this prospectus, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements.

You should read this prospectus and the documents that we reference in this prospectus and have filed as exhibits to the registration statement, of which this prospectus is a part, completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

PROSPECTUS SUMMARY

You should read the following summary together with the more detailed information about us, the securities that may be sold from time to time, and our financial statements and the notes thereto, all of which appear elsewhere in this prospectus or in the documents incorporated by reference in this prospectus.

Overview

Founded in 1989, Genetic Technologies listed its ordinary shares on the ASX (GTG) in 2000 and its ADSs on the Nasdaq Capital Market (GENE) in 2005. Genetic Technologies is a molecular diagnostics company that offers predictive testing and assessment tools to help physicians proactively manage women’s health. The Company’s legacy product, BREVAGenplus, was a clinically validated risk assessment test for non-hereditary breast cancer and was first in its class. BREVAGenplus improved upon the predictive power of the first generation BREVAGen test and was designed to facilitate better informed decisions about breast cancer screening and preventive treatment plans. BREVAGenplus expanded the application of BREVAGen from Caucasian women to include African-Americans and Hispanics, and was directed towards women aged 35 years or above who have not had breast cancer and have one or more risk factors for developing breast cancer.

The Company successfully launched the first generation BREVAGen test across the U.S. via its U.S. subsidiary Phenogen Sciences Inc., and believes the addition of BREVAGenplus, launched in October 2014, significantly expanded the applicable market. The Company marketed BREVAGenplus to healthcare professionals

2

Table of Contents

in comprehensive breast health care and imaging centers, as well as to obstetricians/gynecologists (OBGYNs) and breast cancer risk assessment specialists (such as breast surgeons).

In May 2019, the Company announced that it had developed two new cancer risk assessment tests branded as GeneType for Breast Cancer and GeneType for Colorectal Cancer. The new breast cancer test provides substantial improvement over the Company’s legacy breast cancer test BREVAGenplus, by incorporating multiple additional clinical risk factors. This test will provide healthcare providers and their patients with a 5-year and lifetime risk assessment of the patient developing breast cancer. The colorectal cancer test will provide healthcare providers and their patients a 5-year, 10-year, and lifetime risk assessment of the patient developing colorectal cancer.

Both tests require the patient to submit a DNA sample to our testing laboratory for analysis. Currently, we have a fully-licensed laboratory in Australia at which we previously analyzed samples provided by users of our BREVAGen and BREVAGenplus testing products. We intend to open additional laboratories in the United States and other locations across the globe as demand increases for our testing products and services.

With the release of these two predictive genetic tests, and a pipeline of new tests under development, we believe that we are poised to increase collaboration with world-leading genetics institutes and research facilities and to commence product distribution in multiple jurisdictions, including the U.S. and China, in addition to Australia.

GeneType for Breast Cancer

Breast cancer is the most common form of cancer affecting women. It is estimated that in the United States approximately one in eight women will develop the disease in their lifetime; in 2018 over 250,000 women were diagnosed with invasive breast cancer and approximately 40,000 died as a result. Thus, there is a need to predict which women will develop the disease, and to apply measures to prevent it.

The identification in 2007 of a number of genetic biomarkers, consisting of single nucleotide polymorphisms (SNPs), each with an associated small relative risk of breast cancer, led to the development of the first commercially available genetic risk test for sporadic breast cancer, BREVAGen. The Company launched the product in the U.S. in June 2011. In October 2014, we released our next generation breast cancer risk assessment test, BREVAGenplus. This new version of the test incorporated a 10-fold expanded panel of SNPs known to be associated with the development of sporadic breast cancer, providing an increase in predictive power relative to its first-generation predecessor test. In addition, the new test was clinically validated in a broader population of women including, African American and Hispanic women. This increased the applicable market applicable to the first generation test beyond Caucasian women, and simplified the marketing process in medical clinics and breast health centers in the U.S.

The expanded panel of SNPs incorporated into our breast cancer tests were identified from multiple large-scale genome-wide association studies and subsequently tested in case-control studies utilizing specific Caucasian, African American and Hispanic patient samples.

BREVAGenplus was a clinically validated, predictive risk test for sporadic breast cancer which examined a woman’s clinical risk factors, combined with seventy seven scientifically validated SNPs to allow for more personalized breast cancer risk assessment and risk management.

In May 2019, we announced the development of our next generation breast cancer risk assessment test, ‘GeneType for Breast Cancer’. The new breast cancer test provided substantial improvement over our legacy breast cancer test BREVAGenplus by incorporating key clinical risk factors: family history, mammographic breast density and polygenic risk. This test will provide healthcare providers and their patients with a 5-year and lifetime risk assessment of the patient developing breast cancer.

Germline genetic testing for mutations in BRCA1 and BRCA2 allows for the identification of individuals at significantly increased risk for breast and other cancers. However, such mutations are relatively rare in the general population and account for less than 10% of all breast cancer cases. The remaining 90% of non-familial or sporadic breast cancer have to be defined by other genetic/clinical markers common to the population at large and this is where we have focused our attention.

We believe that there are over 90 million women in the United States over the age of 35 who will benefit from using a breast cancer risk assessment using the GeneType technology. The newly developed GeneType for

3

Table of Contents

Breast Cancer test is aimed at providing the most accurate risk assessment for breast cancer, whether or not the patient has a family history of breast cancer or has been identified as having high breast density.

GeneType for Colorectal Cancer

Globally in 2018, an estimated 1.8 million people were diagnosed with colorectal cancer (CRC), almost 10% of all cancers. In the United States, 1 in 22 men and 1 in 24 women will receive a colorectal cancer diagnosis during their lifetime. Detection relies on screening programs that unaffected individuals typically avoid, despite how crucial early detection is to survival.

Accurate risk assessment to determine those individuals at a higher risk is important for providing personalized screening and intervention plans. Questionnaire-based risk assessment models perform well on a population level, but are less able to predict “individual” risk. GeneType for Colorectal Cancer is designed to address this and enable “personalized” risk assessment. Most national screening programs only use age as a risk factor, where all patients within an age range are invited to screening. Tests that more accurately identify those patients at increased risk of colorectal cancer, such as GeneType for Colorectal Cancer, have the potential to impact healthcare at the system level down to the patient level. One reason being, patients can be flagged as “high risk” and therefore offered more intensive surveillance and/or risk reducing options.

GeneType for Colorectal Cancer targets men and women 30 years of age or older and individuals of Caucasian descent. We intend to broaden the applicable market for this test as we introduce future versions of GeneType for Colorectal Cancer. GeneType for Colorectal Cancer is the only genomic-based colorectal risk assessment that combines genetic risk markers with clinical risk markers to provide an integrated colorectal cancer risk score for the patient. This test minimizes the uncertainty associated with self-reported risk factors and incorporates an unambiguous combination of SNPs to calculate the CRC polygenic risk score.

Patients are stratified into risk categories of either average or increased risk compared to that of the population average. Tailored prevention and surveillance options for those at increased risk include personalized screening regimens, risk reducing medications and lifestyle changes.

We believe that there are over 200 million men and women in the United States over the age of 30 who will benefit from using a colorectal cancer risk assessment using the GeneType technology.

Recent Information

On October 29, 2019, we completed a rights offering to the holders of our ordinary shares (the “Rights Offering”), in which we issued 1,125,000,000 ordinary shares at an issue price of A$0.004, resulting in gross proceeds to the Company before transaction costs of A$4,500,000, or approximately US$3,043,000 at current exchange rates. The Company intends to use the net proceeds of the Rights Offering to commence sales of its latest breast cancer and colorectal cancer risk assessment products in the United States and Australia and to fund the development of additional polygenic risk tests. The Rights Offering also enabled the Company to regain compliance with Nasdaq Listing Rule 5550(b), which requires a minimum of $2,500,000 of stockholders’ equity.

On November 28, 2019, the Company’s shareholders approved a change of the Company’s name to “Genetype Limited” to better reflect its current business strategy and product branding. The name change will not be effective until the Company makes requisite filings with the Australian Securities and Investments Commission (“ASIC”), which we anticipate will occur in the first quarter of 2020.

Corporate Information

Our corporate headquarters and laboratory is located at 60-66 Hanover Street, Fitzroy, Victoria, 3065, Australia and our telephone number is 61 3 8412 7000. The offices of our U.S. subsidiary, Phenogen Sciences Inc., are located at 1300 Baxter Street, Suite 157, Charlotte, North Carolina 28269. The telephone number for the Phenogen Sciences office is (877) 992-7382. Our website address is www.gtglabs.com. The information in our website is not incorporated by reference into this prospectus and should not be considered as part of this prospectus.

4

Table of Contents

RISK FACTORS

Investing in our securities involves significant risk. The prospectus supplement applicable to each offering of our securities will contain a discussion of the risks applicable to an investment in the Company. Prior to making a decision about investing in our securities, you should carefully consider the specific factors discussed below and under the heading “Risk Factors” in the applicable prospectus supplement, together with all of the other information contained or incorporated by reference in the prospectus supplement or appearing or incorporated by reference in this prospectus. You should also consider the risks, uncertainties and assumptions discussed under the heading “Risk Factors” included in our most recent Annual Report on Form 20-F and any subsequent Annual Reports on Form 20-F we file after the date of this prospectus, and all other information contained in or incorporated by reference into this prospectus or the registration statement of which this prospectus forms a part, as updated by our subsequent filings under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and the risk factors and other information contained in any applicable prospectus supplement before acquiring any of our securities. These risks might cause you to lose all or part of your investment in the offered securities.

Risks Related to our Business

Declining general economic or business conditions, including as a result of the recent COVID-19 outbreak, may have a negative impact on our business.

Continuing concerns over economic and business prospects in the United States and other countries have contributed to increased volatility and diminished expectations for the global economy. These factors, coupled with the prospect of decreased business and consumer confidence and increased unemployment resulting from the recent COVID-19 outbreak, may precipitate an economic slowdown and recession. If the economic climate deteriorates, our business, including our access to patient samples and the addressable market for diagnostic tests that we may successfully develop, as well as the financial condition of our suppliers and our third-party payors, could be adversely affected, resulting in a negative impact on our business, financial condition, results of operations and cash flows.

CAPITALIZATION

A prospectus supplement or report on Form 6-K incorporated by reference into the registration statement of which this prospectus forms a part will include information on our consolidated capitalization.

USE OF PROCEEDS

Except as otherwise provided in the applicable prospectus supplement, we intend to use the net proceeds from the sale of the securities offered by this prospectus to support the introduction and distribution of our new products in the United States; for general product research and development, including the development of polygenic risk tests with TGen in the United States; expansion into China; and working capital and other general corporate purposes.

The intended application of proceeds from the sale of any particular offering of securities using this prospectus will be described in the accompanying prospectus supplement relating to such offering. The precise amount and timing of the application of these proceeds will depend on our funding requirements and the availability and costs of other funds.

DESCRIPTION OF SHARE CAPITAL AND CONSTITUTION

The following description of our share capital is only a summary.

Our constituent document or governing rules is a Constitution. Our Constitution is subject to the terms of the Listing Rules of the ASX and the Australian Corporations Act 2001. The rights and restrictions attaching to ordinary shares are derived through a combination of our Constitution, the common law applicable to Australia, the Listing Rules of the Australian Securities Exchange, the Corporations Act 2001 and other applicable law. A general summary of some of the rights and restrictions attaching to ordinary shares are summarized below. Each ordinary shareholder is entitled to receive notice of and to be present, to vote and to speak at general meetings.

We encourage you to read our Constitution which is included as an exhibit to this registration statement of which this prospectus forms a part. We do not have a limit on our authorized share capital and do not recognize the concept of par value under Australian law. Subject to restrictions on the issue of securities in our Constitution, the Corporations Act 2001 and the Listing Rules of the Australian Securities Exchange and any other applicable law, we may at any time issue shares and grant options or warrants on any terms, with the rights and restrictions and for the consideration that the board of directors determine.

Dividends

Holders of ordinary shares are entitled to receive such dividends as may be declared by the board of directors. All dividends are declared and paid according to the amounts paid up on the shares in respect of which the dividend is paid. As of the date of this prospectus, there have been no dividends paid to holders of ordinary shares.

5

Table of Contents

Any dividend unclaimed after a period of twelve years from the date of declaration of such dividend shall be paid to, and held by, the Public Trustee of Victoria. The payment by the board of directors of any unclaimed dividend, interest or other sum payable on or in respect of an ordinary share into a separate account shall not constitute us as a trustee in respect thereof.

Constitution

Our constituent document is a Constitution which is similar in nature to the by-laws of a company incorporated under the laws of the U.S. Our Constitution does not provide for or prescribe any specific objects or purposes of the Company. Our Constitution is subject to the terms of the Listing Rules of the Australian Securities Exchange and the Corporations Act 2001. Our Constitution may be amended or repealed and replaced by special resolution of shareholders, which is a resolution passed by at least 75% of the votes cast by shareholders who vote by person or proxy at a duly convened shareholders meeting.

Shareholders Meetings

We must hold an annual general meeting within five months of the end of each fiscal year. Our end of fiscal year is currently June 30 each year. At the annual general meeting, shareholders typically consider the annual financial report, directors’ report and auditor’s report and vote on matters, including the election of directors, the appointment of the auditor (if necessary) and fixing the aggregate limit of non-executive directors’ remuneration. We may also hold other meetings of shareholders from time to time. The annual general meeting must be held in addition to any other meetings which we may hold.

The board of directors may call and arrange a meeting of shareholders, when and where they decide. The directors must call a meeting of shareholders when requested by shareholders who hold at least 5% of the votes that may be cast at the meeting or at least 100 members who are entitled to vote at the meeting or as otherwise required by the Corporations Act 2001. Shareholders with at least 5% of the votes that may be cast at a meeting may also call and hold a general meeting, subject to the notification requirements of the Corporations Act 2001.

Unless applicable law or our Constitution requires a special resolution, a resolution of shareholders is passed if more than 50% of the votes at the meeting are cast in favor of the resolution by shareholders in person or proxy entitled to vote upon the relevant resolution. A special resolution is passed if the notice of meeting sets out the intention to propose the special resolution and it is passed if at least 75% of the votes at the meeting are cast by shareholders in person or proxy entitled to vote upon the relevant resolution.

A special resolution usually involves more important questions affecting the Company as a whole or the rights of some or all of our shareholders. Special resolutions are required in a variety of circumstances under our Constitution and the Corporations Act 2001, including without limitation:

· to change our name;

· to amend or repeal and replace our Constitution;

· to approve the terms of issue of preference shares;

· to approve the variation of class rights of any class of shareholders;

· to convert one class of shares into another class of shares;

· to approve certain buy backs of shares;

· to approve a selective capital reduction of our shares;

· to approve financially assisting a person to acquire shares in the Company;

· to remove and replace our auditor;

· to change our company type;

· with the leave of an authorized Australian court, to approve our voluntary winding up;

· to confer on a liquidator of the Company either a general authority or a particular authority in respect of compensation arrangements of the liquidator; and

· to approve an arrangement entered into between a company about to be, or in the course of being, wound up.

6

Table of Contents

Shareholder Voting Rights

At a general meeting, every shareholder present (in person or by proxy, attorney or representative) and entitled to vote has one vote on a show of hands. Every shareholder present (in person or by proxy, attorney or representative) and entitled to vote has one vote per fully paid ordinary share and that portion of a vote for any partly paid share that the amount paid on the partly paid share bears to the total amounts paid and payable, on a poll. This is subject to any other rights or restrictions which may be attached to any shares. In the case of an equality of votes on a resolution at a meeting (whether on a show of hands or on a poll), the chairman of the meeting has a deciding vote in addition to any vote that the chairman of the meeting has in respect of that resolution.

Issue of Shares and Changes in Capital

Subject to our Constitution, the Corporations Act 2001, the Listing Rules of the Australian Securities Exchange and any other applicable law, we may at any time issue shares and grant options or warrants on any terms, with preferred, deferred or other special rights and restrictions and for the consideration and other terms that the directors determine. Our power to issue shares includes the power to issue bonus shares (for which no consideration is payable to the Company), preference shares (including redeemable preference shares) and partly paid shares.

Pursuant to the Listing Rules of the Australian Securities Exchange, our Board may in their discretion issue securities to persons who are not related parties of our Company, without the approval of shareholders, if such issue, when aggregated with securities issued by us during the previous 12-month period would be an amount that would not exceed 15% of our issued share capital at the commencement of the 12-month period (or a combined limit of up to 25% of our issued share capital, subject to certain conditions, if prior approval for the additional 10% is obtained from shareholders at our annual meeting of shareholders). Other allotments of securities require approval by an ordinary resolution of shareholders unless these other allotments of securities fall under a specified exception under the Listing Rules.

The Company may issue preference shares, by approval of a special majority, which is a resolution of which notice has been given and that has been passed by at least 75% of the voting rights represented at the meeting, in person, by proxy, or by written ballot and entitled to vote on the resolution. There are no preference shares issued or allotted as at the date of this prospectus.

Subject to the requirements of our Constitution, the Corporations Act 2001, the Listing Rules of the Australian Securities Exchange and any other applicable law, we may:

· consolidate or divide our share capital into a larger or smaller number by resolution passed by shareholders at a general meeting;

· reduce our share capital by special resolution passed by at least 75% of the votes cast by shareholders who vote by person or proxy at a duly convened shareholders meeting (and are not otherwise excluded by law) provided that the reduction is fair and reasonable to our shareholders as a whole, and does not materially prejudice our ability to pay creditors;

· undertake an equal access buyback of our ordinary shares by ordinary resolution of shareholders (although if we have bought back less than 10% of our shares over the period of the previous 12 months, shareholder approval may not be required); and

· undertake a selective buyback of certain shareholders’ shares by special resolution passed by at least 75% of the votes cast by shareholders who vote by person or proxy at a duly convened shareholders meeting (and are not otherwise excluded by law), with no votes being cast in favor of the resolution by any person whose shares are proposed to be bought back or by their associates.

In certain circumstances, including the division of a class of shares into further classes of shares, the issue of additional shares or the issue of a new class of shares, we may require the approval of any class of shareholders whose rights are varied or are taken to be varied by special resolution of shareholders generally and by special resolution of the holder of shares in that class whose rights are varied or taken to be varied.

7

Table of Contents

Dividends may be paid on shares of one class but not another and at different rates for different classes.

Exchange Controls

Australia has largely abolished exchange controls on investment transactions. The Australian dollar is freely convertible into U.S. dollars. In addition, there are currently no specific rules or limitations regarding the export from Australia of profits, dividends, capital or similar funds belonging to foreign investors, except that certain payments to non-residents must be reported to the Australian Cash Transaction Reports Agency, which monitors such transaction, and amounts on account of potential Australian tax liabilities may be required to be withheld unless a relevant taxation treaty can be shown to apply.

Takeover Approval Provisions

Any proportional takeover scheme must be approved by those shareholders holding shares included in the class of shares in respect of which the offer to acquire those shares was first made. The registration of the transfer of any shares following the acceptance of an offer made under a scheme is prohibited until that scheme is approved by the relevant shareholders.

The Foreign Acquisitions and Takeovers Act 1975

Under Australian law, in certain circumstances foreign persons are prohibited from acquiring more than a limited percentage of the shares in an Australian company without approval from the Australian Treasurer. These limitations are set forth in the Australian Foreign Acquisitions and Takeovers Act, or the Takeovers Act.

Under the Takeovers Act, as currently in effect, any foreign person, together with associates, or parties acting in concert, is prohibited from acquiring 20% or more of the shares in any company having total assets of A$266 million or more (or A$1,154 million or more in case of U.S. investors). “Associates” is a broadly defined term under the Takeovers Act and includes:

· spouses, lineal ancestors and descendants, and siblings;

· partners, officers of companies, the company, employers and employees, and corporations;

· their shareholders related through substantial shareholdings or voting power;

· corporations whose directors are controlled by the person, or who control a person; and

· associations between trustees and substantial beneficiaries of trust estates.

In addition, a foreign person may not acquire shares in a company having total assets of A$266 million or more (or A$1,154 million or more in case of U.S. investors) if, as a result of that acquisition, the total holdings of all foreign persons and their associates will exceed 40% in aggregate without the approval of the Australian Treasurer. If the necessary approvals are not obtained, the Treasurer may make an order requiring the acquirer to dispose of the shares it has acquired within a specified period of time. The same rule applies if the total holdings of all foreign persons and their associates already exceeds 40% and a foreign person (or its associate) acquires any further shares, including in the course of trading in the secondary market of the ADSs. At present, we do not have total assets of A$266 million or more and therefore no approval would be required from the Australian Treasurer.

Each foreign person seeking to acquire holdings in excess of the above caps (including their associates, as the case may be) would need to complete an application form setting out the proposal and relevant particulars of the acquisition/shareholding. The Australian Treasurer then has 30 days to consider the application and make a decision. However, the Australian Treasurer may extend the period by up to a further 90 days by publishing an interim order. The Australian Treasurer has issued a guideline titled Australia’s Foreign Investment Policy which provides an outline of the policy. The policy provides that the Treasurer will reject an application if it is contrary to the national interest.

8

Table of Contents

If the level of foreign ownership exceeds 40% at any time, we would be considered a foreign person under the Takeovers Act. In such event, we would be required to obtain the approval of the Australian Treasurer for us, together with our associates, to acquire (i) more than 20% of an Australian company or business with assets totaling over A$266 million; or (ii) any direct or indirect ownership in Australian residential real estate and certain non-residential real estate.

The percentage of foreign ownership in us would also be included determining the foreign ownership of any Australian company or business in which it may choose to invest. Since we have no current plans for any such acquisition and do not own any property, any such approvals required to be obtained by us as a foreign person under the Takeovers Act will not affect our current or future ownership or lease of property in Australia.

Our Constitution does not contain any additional limitations on a non-resident’s right to hold or vote our securities.

Australian law requires any off market transfer of our shares to be made in writing. Otherwise, while our ordinary shares remain listed on the ASX, transfers take place electronically through the ASX’s exchange process and requirements. No stamp duty will be payable in Australia on the transfer of ADSs.

Liquidation Rights

After satisfaction of the claims of creditors, preferential payments to holders of outstanding preference shares and subject to any special rights or restrictions attached to shares, on a winding up, any available assets must be used to repay the capital contributed by the shareholders and any surplus must be distributed among the shareholders in proportion to the number of fully paid shares held by them. For this purpose a partly paid share is treated as a fraction of a share equal to the proportion which the amount paid bears to the total issue price of the share before the winding up began.

If we experience financial problems, the directors may appoint an administrator to take over our operations to see if we can come to an arrangement with our creditors. If we cannot agree with our creditors, Genetic Technologies Limited may be wound up.

A receiver, or receiver and manager, may be appointed by order of a court or under an agreement with a secured creditor to take over some or all of the assets of a company. A receiver may be appointed, for example, because an amount owed to a secured creditor is overdue.

We may be wound up by order of a court, or voluntarily if our shareholders pass a special resolution to do so. A liquidator is appointed when a court orders a company to be wound up or the shareholders of a company pass a resolution to wind up the company. A liquidator is appointed to administer the winding up of a company.

DESCRIPTION OF AMERICAN DEPOSITARY SHARES

The Bank of New York Mellon, as depositary, will register and deliver ADSs. Each ADS represents six hundred ordinary shares (or a right to receive six hundred ordinary shares) deposited with HSBC Bank Australia Limited, as custodian for the depositary. Each ADS also represents any other securities, cash or other property which may be held by the depositary. The depositary’s corporate trust office at which the ADSs are administered, and its executive offices, are located at 240 Greenwich Street, New York, New York 10286.

You may hold ADSs either (A) directly (i) by having an American depositary receipt, which is a certificate evidencing a specific number of ADSs, registered in your name, or (ii) by holding ADSs in the Direct Registration System, or (B) indirectly through your broker or other financial institution. If you hold ADSs directly, you are an ADS holder. This description assumes you hold the ADSs directly. If you hold the ADSs indirectly, you must rely on the procedures of your broker or other financial institution to assert the rights of ADR holders described in this section. You should consult with your broker or financial institution to find out what those procedures are.

9

Table of Contents

The Direct Registration System is a system administered by DTC pursuant to which the depositary may register the ownership of uncertificated ADSs, which ownership shall be confirmed by periodic statements issued by the depositary to the ADS holders entitled thereto.

As an ADS holder, we will not treat you as one of our shareholders and you will not have shareholder rights. Australian law governs shareholder rights. The depositary will be the holder of the shares underlying the ADSs. As a holder of ADSs, you will have ADS holder rights. A deposit agreement among us, the depositary and you, as an ADS holder, and the beneficial owners of ADSs set out ADS holder rights as well as the rights and obligations of the depositary. New York law governs the deposit agreement and the ADSs.

The following is a summary of the material provisions of the deposit agreement. For more complete information, you should read the entire deposit agreement and the form of American depositary receipt. Directions on how to obtain copies of those documents are provided under “Where You Can Find Additional Information.”

Dividends and Other Distributions

If we Pay a Dividend or Other Distribution, How Will You Receive Dividends and Other Distributions on the Shares?

In the event that we pay a cash dividend or make another distribution, the depositary has agreed to pay to you the cash dividends or other distributions it or the custodian receives on shares or other deposited securities, after deducting its fees and expenses. You will receive these distributions in proportion to the number of shares the ADSs represent.

· Cash. The depositary will convert any cash dividend or other cash distribution we pay on the shares into U.S. dollars, if it can do so on a reasonable basis and can transfer the U.S. dollars to the United States. If that is not possible or if any government approval is needed and cannot be obtained, the deposit agreement allows the depositary to distribute the foreign currency only to those ADR holders to whom it is possible to do so. It will hold the foreign currency it cannot convert for the account of the ADS holders who have not been paid. It will not invest the foreign currency and it will not be liable for any interest.

Before making a distribution, any withholding taxes, or other governmental charges that must be paid will be deducted. The depositary will distribute only whole U.S. dollars and cents and will round fractional cents to the nearest whole cent. If exchange rates fluctuate during a time when the depositary cannot convert the foreign currency, you may lose some or all of the value of the distribution.

· Shares. The depositary may distribute additional ADSs representing any shares we distribute as a dividend or free distribution. The depositary will only distribute whole ADSs. It will sell shares which would require it to deliver a fractional ADS and distribute the net proceeds in the same way as it does with cash. If the depositary does not distribute additional ADSs, the outstanding ADSs will also represent the new shares.

· Rights to Purchase Additional Shares. If we offer holders of our securities any rights to subscribe for additional shares or any other rights, the depositary may make these rights available to you. If the depositary decides it is not legal and practical to make the rights available but that it is practical to sell the rights, the depositary will use reasonable efforts to sell the rights and distribute the proceeds in the same way as it does with cash. The depositary will allow rights that are not distributed or sold to lapse. In that case, you will receive no value for them.

If the depositary makes rights available to you, it will exercise the rights and purchase the shares on your behalf. The depositary will then deposit the shares and deliver ADSs to you. It will only exercise rights if you pay it the exercise price and any other charges the rights require you to pay.

10

Table of Contents

U.S. securities laws may restrict transfers and cancellation of the ADSs represented by shares purchased upon exercise of rights. For example, you may not be able to trade these ADSs freely in the United States. In this case, the depositary may deliver restricted depositary shares that have the same terms as the ADSs described in this section except for changes needed to put the necessary restrictions in place.

· Other Distributions. The depositary will send to you anything else we distribute on deposited securities by any means it thinks is legal, fair and practical. If it cannot make the distribution in that way, the depositary has a choice. It may decide to sell what we distributed and distribute the net proceeds, in the same way as it does with cash. Or, it may decide to hold what we distributed, in which case ADSs will also represent the newly distributed property. However, the depositary is not required to distribute any securities (other than ADSs) to you unless it receives satisfactory evidence from us that it is legal to make that distribution.

The depositary is not responsible if it decides that it is unlawful or impractical to make a distribution available to any ADS holders. We have no obligation to register ADSs, shares, rights or other securities under the Securities Act. We also have no obligation to take any other action to permit the distribution of ADSs, shares, rights or anything else to ADS holders. This means that you may not receive the distributions we make on our shares or any value for them if it is illegal or impractical for us to make them available to you.

Deposit, Withdrawal and Cancellation

How Are ADSs Issued?

The depositary will deliver ADSs if you or your broker deposits shares or evidence of rights to receive shares with the custodian. Upon payment of its fees and expenses and of any taxes or charges, such as stamp taxes or stock transfer taxes or fees, the depositary will register the appropriate number of ADSs in the names you request and will deliver the ADSs to or upon the order of the person or persons entitled thereto.

How Do ADS Holders Cancel an ADS?

You may turn in the ADSs at the depositary’s corporate trust office. Upon payment of its fees and expenses and of any taxes or charges, such as stamp taxes or stock transfer taxes or fees, the depositary will deliver the shares and any other deposited securities underlying the ADSs to you or a person you designate at the office of the custodian. Or, at your request, risk and expense, the depositary will deliver the deposited securities at its corporate trust office, if feasible.

Voting Rights

How Do You Vote?

You may instruct the depositary to vote the deposited securities, but only if we ask the depositary to ask for your instructions. Otherwise, you won’t be able to exercise your right to vote unless you withdraw the shares. However, you may not know about the meeting enough in advance to withdraw the shares.

If we ask for your instructions, the depositary will notify you of the upcoming vote and arrange to deliver our voting materials to you. The materials will (1) describe the matters to be voted on and (2) explain how you may instruct the depositary to vote the shares or other deposited securities underlying the ADSs as you direct. For instructions to be valid, the depositary must receive them on or before the date specified. The depositary will try, as far as practical, subject to the laws of Australia and our Constitution, to vote or to have its agents vote the shares or other deposited securities as you instruct. The depositary will only vote or attempt to vote as you instruct or as described below. Notwithstanding anything to the contrary contained in the deposit agreement, the depositary will not exercise a discretionary proxy in respect of the deposited securities for which it has not timely received instructions.

11

Table of Contents

If we ask the depositary to solicit your instructions but the depositary does not receive voting instructions from you by the specified date, it will consider you to have authorized and directed it to give a discretionary proxy to a person designated by us to vote the number of ordinary shares represented by your ADSs. The depositary will give a discretionary proxy in those circumstances to vote on all questions as to be voted upon unless we notify the depositary that:

· we do not wish to receive a discretionary proxy;

· there is substantial shareholder opposition to the particular questions; or

· the particular question would have an adverse impact on our shareholders.

We are required to notify the depositary if one or more of the conditions specified above exists.

We cannot assure you that you will receive the voting materials in time to ensure that you can instruct the depositary to vote your shares. In addition, the depositary and its agents are not responsible for failing to carry out voting instructions or for the manner of carrying out voting instructions. This means that you may not be able to exercise your right to vote and there may be nothing you can do if your shares are not voted as you requested.

In order to give you a reasonable opportunity to instruct the depositary as to the exercise of voting rights relating to deposited securities, if we request the depositary to act, we will try to give the depositary notice of any such meeting and details concerning the matters to be voted upon sufficiently in advance of the meeting date.

Fees and Expenses

|

Persons Depositing or Withdrawing Shares Must

|

|

|

|

Pay:

|

|

For:

|

|

|

|

|

|

|

|

·

|

US$5.00 (or less) per 100 ADSs (or portion of 100 ADSs)

|

|

·

|

Issuance of ADSs, including issuances resulting from a distribution of shares or rights or other property

|

|

|

|

|

·

|

Cancellation of ADSs for the purpose of withdrawal, including if the deposit agreement terminates

|

|

·

|

US$0.02 (or less) per ADS

|

|

·

|

Any cash distribution to you

|

|

·

|

A fee equivalent to the fee that would be payable if securities distributed to you had been shares and the shares had been deposited for issuance of ADSs

|

|

·

|

Distribution of securities distributed to holders of deposited securities which are distributed by the depositary to ADS holders

|

|

·

|

Expenses of the depositary

|

|

·

|

Cable, telex and facsimile transmissions (when expressly provided in the deposit agreement)

|

|

|

|

|

·

|

Converting foreign currency to U.S. dollars

|

|

·

|

Taxes and other governmental charges the depositary or the custodian have to pay on any ADS or share underlying an ADS, for example, stock transfer taxes, stamp duty or withholding taxes

|

|

·

|

As necessary

|

|

·

|

Any charges incurred by the depositary or its agents for servicing the deposited securities

|

|

·

|

As necessary

|

|

·

|

US$0.02 (or less) per ADS per year

|

|

·

|

Depositary services

|

The depositary collects its fees for issuance and cancellation of ADSs directly from investors depositing shares or surrendering ADSs for the purpose of withdrawal or from intermediaries acting for them. The depositary collects fees for making distributions to investors by deducting those fees from the amounts distributed or by selling a portion of distributable property to pay the fees. The depositary may collect its annual fee for depositary services by deduction from cash distributions or by directly billing investors or by charging the book-entry system accounts of participants acting for them. The depositary may generally refuse to provide fee-attracting services until its fees for those services are paid.

12

Table of Contents

Payment of Taxes

You will be responsible for any taxes or other governmental charges payable on the ADSs or on the deposited securities represented by any of the ADSs. The depositary may refuse to register any transfer of the ADSs or allow you to withdraw the deposited securities represented by the ADSs until such taxes or other charges are paid. It may apply payments owed to you or sell deposited securities represented by the ADSs to pay any taxes owed and you will remain liable for any deficiency. If the depositary sells deposited securities, it will, if appropriate, reduce the number of ADSs to reflect the sale and pay to you any proceeds, or send to you any property, remaining after it has paid the taxes.

|

Reclassifications, Recapitalizations and Mergers

|

|

|

|

If we:

|

|

Then:

|

|

·

·

|

Change the nominal or par value of our shares

Reclassify, split up or consolidate any of the deposited securities

|

|

·

|

The securities received by the depositary will become deposited securities. Each ADS will automatically represent its equal share of the new deposited securities.

|

|

·

|

Recapitalize, reorganize, merge, liquidate, sell all or substantially all of our assets, or take any similar action

|

|

·

|

The depositary may, and will if we ask it to, deliver new ADRs or ask you to surrender your outstanding ADRs in exchange for new ADRs identifying the new deposited securities.

|

Amendment and Termination

How May the Deposit Agreement Be Amended?

We may agree with the depositary to amend the deposit agreement and the ADSs without your consent for any reason. If an amendment adds or increases fees or charges, except for taxes and other governmental charges or expenses of the depositary for registration fees, facsimile costs, delivery charges or similar items, or prejudices a substantial right of ADS holders, it will not become effective for outstanding ADSs until 30 days after the depositary notifies ADS holders of the amendment. At the time an amendment becomes effective, you are considered, by continuing to hold the ADS, to agree to the amendment and to be bound by the ADRs and the deposit agreement as amended.

How May the Deposit Agreement Be Terminated?

The depositary will terminate the deposit agreement at our direction by mailing a notice of termination to the ADS holders then outstanding at least 90 days prior to the date fixed in such notice for such termination. The depositary may also terminate the deposit agreement by mailing a notice of termination to us and the ADS holders then outstanding if at any time 90 days shall have expired after the depositary shall have delivered to our company a written notice of its election to resign and a successor depositary shall not have been appointed and accepted its appointment.

After termination, the depositary and its agents will do the following under the deposit agreement but nothing else: collect dividends and other distributions on the deposited securities, sell rights and other property, and deliver shares and other deposited securities upon cancellation of ADSs. One year after termination, the depositary may sell any remaining deposited securities by public or private sale. After that, the depositary will hold the money it received on the sale, as well as any other cash it is holding under the deposit agreement for the pro rata benefit of the ADS holders that have not surrendered their ADSs. It will not invest the money and has no liability for interest. The depositary’s only obligations will be to account for the money and other cash. After termination our only obligations will be to indemnify the depositary and to pay fees and expenses of the depositary that we agreed to pay.

13

Table of Contents

Limitations on Obligations and Liability

Limits on Our Obligations and the Obligations of the Depositary; Limits on Liability to Holders of ADSs

The deposit agreement expressly limits our obligations and the obligations of the depositary. It also limits our liability and the liability of the depositary. We and the depositary:

· are only obligated to take the actions specifically set forth in the deposit agreement without negligence or bad faith;

· are not liable if either of us is prevented or delayed by law or circumstances beyond our control from performing our obligations under the deposit agreement;

· are not liable if either of us exercises discretion permitted under the deposit agreement;

· have no obligation to become involved in a lawsuit or other proceeding related to the ADSs or the deposit agreement on your behalf or on behalf of any other party if it involves expenses or liability unless you furnish satisfactory indemnity; and

· may rely upon the advice of or information from legal counsel, accountants, any person presenting shares for deposit and any other holder of ADSs or any other person if we believe in good faith such person is competent to give such advice or information.

· In the deposit agreement, we and the depositary agree to indemnify each other under certain circumstances.

Requirements for Depositary Actions

Before the depositary will deliver or register a transfer of an ADS, make a distribution on an ADS, or permit withdrawal of shares, the depositary may require:

· payment of stock transfer or other taxes or other governmental charges and transfer or registration fees charged by third parties for the transfer of any shares or other deposited securities;

· satisfactory proof of the identity and genuineness of any signature or other information it deems necessary; and

· compliance with regulations it may establish, from time to time, consistent with the deposit agreement, including presentation of transfer documents.

The depositary may refuse to deliver ADSs or register transfers of ADSs generally when the transfer books of the depositary or our transfer books are closed or at any time if the depositary or we think it advisable to do so.

Your Right to Receive the Shares Underlying Your ADRs

You have the right to cancel the ADSs and withdraw the underlying shares at any time except:

· When temporary delays arise because: (i) the depositary has closed its transfer books or we have closed our transfer books; (ii) the transfer of shares is blocked to permit voting at a shareholders’ meeting; or (iii) we are paying a dividend on our shares.

· When you or other ADS holders seeking to withdraw shares owe money to pay fees, taxes and similar charges.

· When it is necessary to prohibit withdrawals in order to comply with any laws or governmental regulations that apply to ADSs or to the withdrawal of shares or other deposited securities.

· This right of withdrawal may not be limited by any other provision of the deposit agreement.

14

Table of Contents

DESCRIPTION OF PREFERENCE SHARES

Subject to any limitations under the Corporations Act, ASX Listing Rules or the Constitution, our board of directors may issue preference shares with any preferential rights, privileges or conditions. The rights and restrictions attaching to any preference shares are set out in our Constitution or in a special resolution of shareholders. Our Constitution does not limit the amount of preference shares that we may issue.

We do not have any preference shares outstanding as of the date of this prospectus. In the future we may issue preference shares that could be converted into ordinary shares. A prospectus supplement will contain and describe the material terms of any preference shares that we offer to the public in the United States, along with any material U.S. federal or Australian income tax considerations relating to the offer of such preference shares.

Consistent with the ASX Listing Rules and our Constitution, any preference shares issued by us must confer on the holders of those preference shares:

· the same rights as holders of ordinary shares to receive notices of general meetings, other notices, reports and accounts and to attend general meetings;

· the right to vote in each of the following circumstances and in no others: (i) in a period during which a dividend (or part of a dividend) in respect of the share is in arrears; (ii) on a proposal to reduce our share capital; (iii) on a resolution to approve the terms of a buy-back agreement; (iv) on a proposal that affects rights attached to the shares; (v) on a proposal to wind up our company; (vi) on a proposal for the disposal of the whole of our property, business and undertaking; (vii) during the winding up of our company; (viii) subject to the ASX Listing Rules and Nasdaq, in any additional circumstances specified in the terms of issue of such preference shares by us relating to the shares upon issuance;

· a dividend in preference to holders of ordinary shares; and

· a return of capital in preference to holders of ordinary shares if we were to be wound up.

The ASX Listing Rules impose certain limitations on the issuance of preference shares by companies such as our company that are listed on ASX, including:

· any dividends on preference shares must be at a commercial rate; and

· any anti-dilution rights must be limited to the right to adjust the number of ordinary shares into which preference shares convert in the event of a share split or consolidation (i.e., reverse stock split), a bonus or entitlement issue (e.g., stock dividend), or other capital reconstruction.

Further, the Corporations Act places certain limitations on payment of dividends, including preferred dividends. A right to receive dividends on a preference share may be expressed to be cumulative where it cannot be paid due to legal limitations.

DESCRIPTION OF WARRANTS

We may issue and offer warrants under the material terms and conditions described in this prospectus and any accompanying prospectus supplement. The accompanying prospectus supplement may add, update or change the terms and conditions of the warrants as described in this prospectus.

We may issue warrants to purchase our ordinary shares represented by ADSs. Warrants may be issued independently or together with any securities and may be attached to or separate from those securities. The warrants may be issued under warrant or subscription agreements to be entered into between us and a bank or trust company, as warrant agent, all of which will be described in the prospectus supplement relating to the warrants we are offering. The warrant agent will act solely as our agent in connection with the warrants and will not have any obligation or relationship of agency or trust for or with any holders or beneficial owners of warrants.

15

Table of Contents

The particular terms of the warrants, the warrant or subscription agreements relating to the warrants and the warrant certificates representing the warrants will be described in the applicable prospectus supplement, including, as applicable:

· the title of such warrants;

· the aggregate number of such warrants;

· the price or prices at which such warrants will be issued and exercised;

· the currency or currencies in which the price of such warrants will be payable;

· the date on which the right to exercise such warrants shall commence and the date on which such right shall expire;

· if applicable, the minimum or maximum amount of such warrants which may be exercised at any one time;

· if applicable, the designation and terms of the securities with which such warrants are issued and the number of such warrants issued with each such security;

· if applicable, the date on and after which such warrants and the related securities will be separately transferable;

· if applicable, any provisions for cashless exercise of the warrants;

· if applicable; any exercise limitations with respect to the ownership limitations by the holder exercising the warrant;

· information with respect to book-entry procedures, if any;

· any material Australian and United States federal income tax consequences;

· the anti-dilution provisions of the warrants, if any; and

· any other terms of such warrants, including terms, procedures and limitations relating to the exchange and exercise of such warrants.

Holders of warrants will not be entitled, solely by virtue of being holders, to vote, to consent, to receive dividends, to receive notice as shareholders with respect to any meeting of shareholders for the election of directors or any other matters, or to exercise any rights whatsoever as a holder of the equity securities purchasable upon exercise of the warrants.

The description in the applicable prospectus supplement of any warrants we offer will not necessarily be complete and will be qualified in its entirety by reference to the applicable warrant agreement and warrant certificate, which will be filed with the SEC if we offer warrants. For more information on how you can obtain copies of the applicable warrant agreement if we offer warrants, see “Where You Can Find More Information” and “Incorporation of Certain Information by Reference.” We urge you to read any applicable prospectus supplement and the applicable warrant agreement and form of warrant certificate in their entirety.

DESCRIPTION OF UNITS

We may issue units comprised of one or more of the other securities described in this prospectus in any combination. Each unit will be issued so that the holder of the unit is also the holder of each security included in the unit. Thus, the holder of a unit will have the rights and obligations of a holder of each included security. The unit

16

Table of Contents

agreement under which a unit is issued may provide that the securities included in the unit may not be held or transferred separately, at any time or at any time before a specified date.

The applicable prospectus supplement will describe:

· the designation and terms of the units and of the securities comprising the units, including whether and under what circumstances those securities may be held or transferred separately;

· any unit agreement under which the units will be issued;

· any provisions for the issuance, payment, settlement, transfer or exchange of the units or of the securities comprising the units; and

· whether the units will be issued in fully registered or global form.

The applicable prospectus supplement will describe the terms of any units. The preceding description and any description of units in the applicable prospectus supplement does not purport to be complete and is subject to and is qualified in its entirety by reference to the unit agreement and, if applicable, collateral arrangements and depositary arrangements relating to such units. For more information on how you can obtain copies of the applicable unit agreement if we offer units, see “Where You Can Find More Information” and “Incorporation of Certain Information by Reference.” We urge you to read the applicable unit agreement and any applicable prospectus supplement in their entirety.

PLAN OF DISTRIBUTION

The securities being offered by this prospectus may be sold:

· through agents;

· to or through one or more underwriters on a firm commitment or agency basis;

· through put or call option transactions relating to the securities;

· to or through dealers, who may act as agents or principals, including a block trade (which may involve crosses) in which a broker or dealer so engaged will attempt to sell as agent but may position and resell a portion of the block as principal to facilitate the transaction;

· through privately negotiated transactions;

· purchases by a broker or dealer as principal and resale by such broker or dealer for its own account pursuant to this prospectus;

· directly to purchasers, including our affiliates, through a specific bidding or auction process, on a negotiated basis or otherwise; to or through one or more underwriters on a firm commitment or best efforts basis;

· exchange distributions and/or secondary distributions;

· ordinary brokerage transactions and transactions in which the broker solicits purchasers;

· in “at-the-market” offerings, within the meaning of Rule 415(a)(4) of the Securities Act to or through a market maker or into an existing trading market, on an exchange or otherwise;

· transactions not involving market makers or established trading markets, including direct sales or privately negotiated transactions;

17

Table of Contents

· transactions in options, swaps or other derivatives that may or may not be listed on an exchange;

· through any other method permitted pursuant to applicable law; or

· through a combination of any such methods of sale.

At any time a particular offer of the securities covered by this prospectus is made, a revised prospectus or prospectus supplement, if required, will be distributed which will set forth the aggregate amount of securities covered by this prospectus being offered and the terms of the offering, including the name or names of any underwriters, dealers, brokers or agents, any discounts, commissions, concessions and other items constituting compensation from us and any discounts, commissions or concessions allowed or re-allowed or paid to dealers. Such prospectus supplement, and, if necessary, a post-effective amendment to the registration statement of which this prospectus is a part, will be filed with the SEC to reflect the disclosure of additional information with respect to the distribution of the securities covered by this prospectus. In order to comply with the securities laws of certain states, if applicable, the securities sold under this prospectus may only be sold through registered or licensed broker-dealers. In addition, in some states the securities may not be sold unless they have been registered or qualified for sale in the applicable state or an exemption from registration or qualification requirements is available and is complied with.

The distribution of securities may be effected from time to time in one or more transactions, including block transactions and transactions on the Nasdaq Capital Market or any other organized market where the securities may be traded. The securities may be sold at a fixed price or prices, which may be changed, or at market prices prevailing at the time of sale, at prices relating to the prevailing market prices or at negotiated prices. The consideration may be cash or another form negotiated by the parties. Agents, underwriters or broker-dealers may be paid compensation for offering and selling the securities. That compensation may be in the form of discounts, concessions or commissions to be received from us or from the purchasers of the securities. Any dealers and agents participating in the distribution of the securities may be deemed to be underwriters, and compensation received by them on resale of the securities may be deemed to be underwriting discounts. If any such dealers or agents were deemed to be underwriters, they may be subject to statutory liabilities under the Securities Act.

Agents may from time to time solicit offers to purchase the securities. If required, we will name in the applicable prospectus supplement any agent involved in the offer or sale of the securities and set forth any compensation payable to the agent. Unless otherwise indicated in the prospectus supplement, any agent will be acting on a best efforts basis for the period of its appointment. Any agent selling the securities covered by this prospectus may be deemed to be an underwriter, as that term is defined in the Securities Act, of the securities.