Gaming and Leisure Properties, Inc. Announces Shareholder Election Results for Fourth Quarter Dividend

December 23 2020 - 8:59AM

Gaming and Leisure Properties, Inc. (“GLPI” or the “Company”)

(NASDAQ: GLPI) announced today the results of shareholder elections

relating to its quarterly dividend declared by its Board of

Directors on November 5, 2020. The dividend of $0.60 per share of

the Company’s common stock, par value $0.01 per share, consists of

a combination of cash and shares and will be paid on December 24,

2020 to shareholders of record on November 16, 2020.

Based on shareholder elections, the dividend

will be paid in the form of approximately $27.6 million in cash and

approximately 2.5 million shares of the Company’s common stock. The

number of shares included for the common stock dividend election

was calculated based on the volume weighted average of the trading

prices of the Company's common stock on the Nasdaq Stock Market for

the three-day period of December 15, December 16 and December 17,

2020, or $43.3758 per share. Summarized results of the dividend

elections are as follows:

- To shareholders electing to receive the dividend in all stock,

the Company will pay the dividend in shares of common stock.

- To shareholders electing to receive

the dividend in all cash, the Company will pay the dividend in the

form of approximately $0.14 per share in cash and $0.46 per share

in common stock.

- To shareholders not making an election, the Company will pay

the dividend in the form of $0.12 per share in cash and $0.48 per

share in common stock.

- The Company will pay fractional shares of the common stock

dividend in cash.

If your shares are held through a bank, broker

or nominee, and you have questions regarding the dividend, please

contact such bank, broker or nominee. If you are a registered

shareholder and you have questions regarding the dividend, you may

call the election agent for the dividend, Broadridge Corporate

Issuer Solutions, Inc., at (888) 789-8409.

About Gaming and Leisure

Properties

GLPI is engaged in the business of acquiring,

financing, and owning real estate property to be leased to gaming

operators in triple-net lease arrangements, pursuant to which the

tenant is responsible for all facility maintenance, insurance

required in connection with the leased properties and the business

conducted on the leased properties, taxes levied on or with respect

to the leased properties and all utilities and other services

necessary or appropriate for the leased properties and the business

conducted on the leased properties. GLPI elected to be taxed as a

real estate investment trust (“REIT”) for U.S. federal income tax

purposes commencing with the 2014 taxable year and was the first

gaming-focused REIT in North America.

|

Contact |

|

|

Gaming and Leisure Properties, Inc. |

Investor Relations |

|

Matthew Demchyk, SVP Investments |

Joseph Jaffoni, Richard Land, James Leahy at JCIR |

|

610/378-8232 |

212/835-8500 |

|

investorinquiries@glpropinc.com |

glpi@jcir.com |

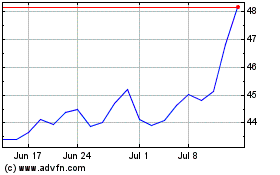

Gaming and Leisure Prope... (NASDAQ:GLPI)

Historical Stock Chart

From Mar 2024 to Apr 2024

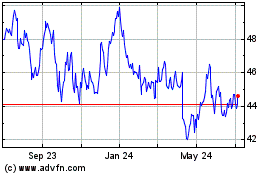

Gaming and Leisure Prope... (NASDAQ:GLPI)

Historical Stock Chart

From Apr 2023 to Apr 2024