FRP Holdings, Inc. (NASDAQ-FRPH) –

Second Quarter Consolidated Results of

Operations

Net income for the second quarter of 2019 was

$9,825,000 or $.99 per share versus $119,982,000 or $11.87 per

share in the same period last year. Income from discontinued

operations for the second quarter of 2019 was $6,776,000 or $.68

per share versus $120,465,000 or $11.92 per share in the same

period last year. Second quarter of 2019 includes $536,000 in

pretax profit related to the sale of our office building at 7030

Dorsey Road. Second quarter of 2018 loss from continuing

operations of $879,000 included $1,085,000 in stock compensation

expense ($682,800 for the 2018 director stock grant and $402,000

for vesting of option grants from 2016 and 2017 due to the asset

disposition). The income from discontinued operations in the

current year and the prior year is related to the sale of the

Company’s industrial warehouse properties in May 2018. The

current year income from discontinued operations includes the sale

to the same buyer of our property at 1502 Quarry Drive for $11.7

million. This asset was excluded from the original sale due

to the tenant potentially exercising its right of first refusal to

purchase the property.

Second Quarter Segment Operating

Results

Asset Management Segment:

Most of the Asset Management Segment was

reclassified to discontinued operations leaving two commercial

properties as well as Cranberry Run, which we purchased first

quarter, and 1801 62nd Street which joined Asset Management on

April 1. Cranberry Run is a five-building industrial park in

Harford County, MD totaling 268,010 square feet of industrial/ flex

space and at quarter end was 32.8% leased and occupied. 1801

62nd Street is our most recent spec building in Hollander Business

Park and is our first warehouse with a 32-foot clear. We

completed construction on this building earlier this year and are

in the process of leasing it up. This quarter we completed

the sale of 7030 Dorsey Road in Anne Arundel County for

$8,850,000. It was one of the three commercial properties

remaining from the asset sale last May. Total revenues in

this segment were $662,000, up $94,000 or 16.5%, over the same

period last year. Operating loss was ($11,000), down $160,000

compared to the same quarter last year due to higher allocation of

corporate expenses as well as increased operating expenses

associated with the Cranberry Run acquisition and the addition of

1801 62nd Street to Asset Management this quarter.

Mining Royalty Lands Segment:

Total revenues in this segment were $2,633,000

versus $2,055,000 in the same period last year. Total

operating profit in this segment was $2,422,000, an increase of

$556,000 versus $1,866,000 in the same period last year.

Among the reasons for this increase in revenue and operating profit

is the contribution from our Ft. Myers quarry, the revenue from

which, now that mining has begun in earnest, was nearly double the

minimum royalty we have been receiving until recently.

Development Segment:

The Development segment is responsible for (i)

seeking out and identifying opportunistic purchases of income

producing warehouse/office buildings, and (ii) developing our

non-income producing properties into income production.

With respect to ongoing projects:

- We are fully engaged in the formal process of seeking PUD

entitlements for our 118-acre tract in Hampstead, Maryland, now

known as “Hampstead Overlook.” Hampstead Overlook received

non-appealable rezoning from industrial to residential during the

first quarter this year.

- We finished shell construction in December 2018 on the two

office buildings in the first phase of our joint venture with St.

John Properties. Shell construction of the two retail

buildings was completed in January. We are now in the process of

leasing these four single-story buildings totaling 100,030 square

feet of office and retail space. At quarter end, Phase I was

44% leased and 8% occupied.

- We are the principal capital source of a residential

development venture in Essexshire known as “Hyde Park.” We

have committed up to $9.2 million in exchange for an interest rate

of 10% and a preferred return of 20% after which a “waterfall”

determines the split of proceeds from sale. Hyde Park will

hold 122 town homes and four single-family lots and received a

non-appealable Plan Approval during the first quarter. We are

currently pursuing entitlements and have a home builder under

contract to purchase the land upon government approval to begin

development.

- In April 2018, we began construction on Phase II of our

RiverFront on the Anacostia project, now known as “The

Maren.” We expect to deliver the building in the first half

of 2020.

- In December 2018, the Company entered into a joint venture

agreement with MidAtlantic Realty Partners (MRP) for the

development of the first phase of a multifamily, mixed-use

development in northeast Washington, DC known as “Bryant

Street.” FRP contributed $32 million for common equity and

another $23 million for preferred equity to the joint

venture. Construction began in February 2019 and should be

finished in 2021. This project is located in an opportunity

zone and could defer a significant tax liability associated with

last year’s asset sale.

Stabilized Joint Venture Segment:

Average occupancy for the quarter was 96.37%,

and at the end of the quarter Dock 79 was 94.44% leased and 97.38%

occupied. Net Operating Income this quarter for this segment

was $1,866,000, up $200,000 or 12.00% compared to the same quarter

last year. Dock 79 is a joint venture between the Company and

MRP, in which FRP Holdings, Inc. is the majority partner with 66%

ownership.

Six Months Consolidated Results of

Operations.

Net income for first half of 2019 was

$11,723,000 or $1.17 per share versus $121,542,000 or $12.04 per

share in the same period last year. Income from discontinued

operations for the first half of 2019 was $6,862,000 or $.69 per

share versus $122,187,000 or $12.10 per share in the same period

last year. The first half of 2018 loss from continuing operations

of $1,572,000 included $1,085,000 in stock compensation expense

($682,800 for the 2018 director stock grant and $402,000 for

vesting of option grants from 2016 and 2017 due to the asset

disposition).

Six Months Segment Operating

Results

Asset Management Segment:

Most of the Asset Management Segment was

reclassified to discontinued operations leaving one recent

industrial acquisition, Cranberry Run, which we purchased first

quarter, 1801 62nd Street which joined Asset Management on April 1,

and two commercial properties after the sale this past quarter of

our office property at 7030 Dorsey Road. Cranberry Run is a

five-building industrial park in Harford County, MD totaling

268,010 square feet of industrial/ flex space. It is our plan

to make $1,455,000 in improvements in order to re-lease the

property for a total investment of $29.35 per square foot.

1801 62nd Street is our most recent spec building in Hollander

Business Park and is our first warehouse with a 32-foot

clear. We completed construction on this building earlier

this year and are in the process of leasing it up. Total

revenues in this segment were $1,303,000, up $154,000 or 13.4%,

over the same period last year. Operating loss was ($77,000),

down $472,000 compared to the same period last year due to higher

allocation of corporate expenses and operating expenses associated

with the Cranberry Run acquisition and the addition of 1801 62nd

Street to Asset Management this quarter.

Mining Royalty Lands Segment:

Total revenues in this segment were $4,862,000

versus $3,827,000 in the same period last year. Total

operating profit in this segment was $4,423,000, an increase of

$1,016,000 versus $3,407,000 in the same period last year.

Among the reasons for this increase in revenue and operating profit

is the contribution from our Ft. Myers quarry, the revenue from

which, now that mining has begun in earnest, was more than double

the minimum royalty we have been receiving until recently.

Development Segment:

The Development segment is responsible for (i)

seeking out and identifying opportunistic purchases of income

producing warehouse/office buildings, and (ii) developing our

non-income producing properties into income production.

With respect to ongoing projects:

- We are fully engaged in the formal

process of seeking PUD entitlements for our 118-acre tract in

Hampstead, Maryland, now known as “Hampstead Overlook.”

Hampstead Overlook received non-appealable rezoning from industrial

to residential during the first quarter this year.

- We finished shell construction in

December 2018 on the two office buildings in the first phase of our

joint venture with St. John Properties. Shell construction of

the two retail buildings was completed in January. We are now in

the process of leasing these four single-story buildings totaling

100,030 square feet of office and retail space. At quarter

end, Phase I was 44% leased and 8% occupied.

- We are the principal capital source

of a residential development venture in Essexshire known as “Hyde

Park.” We have committed up to $9.2 million in exchange for

an interest rate of 10% and a preferred return of 20% after which a

“waterfall” determines the split of proceeds from sale. Hyde

Park will hold 122 town homes and four single-family lots and

received a non-appealable Plan Approval during the first

quarter. We are currently pursuing entitlements and have a

home builder under contract to purchase the land upon government

approval to begin development.

- In April 2018, we began

construction on Phase II of our RiverFront on the Anacostia

project, now known as “The Maren.” We expect to deliver the

building in the first half of 2020.

- In December 2018, the Company

entered into a joint venture agreement with MidAtlantic Realty

Partners (MRP) for the development of the first phase of a

multifamily, mixed-use development in northeast Washington, DC

known as “Bryant Street.” FRP contributed $32 million for

common equity and another $23 million for preferred equity to the

joint venture. Construction began in February 2019 and should

be finished in 2021. This project is located in an

opportunity zone and could defer a significant tax liability

associated with last year’s asset sale.

Stabilized Joint Venture Segment:

Average occupancy for the first six months was

94.88%, and at the end of the second quarter Dock 79 was 94.44%

leased and 97.38% occupied. Net Operating Income for this

segment was $3,497,000, up $346,000 or 10.98% compared to the same

quarter last year, primarily due to substantial increases in NOI

from our retail tenants compared to this period last year.

Dock 79 is a joint venture between the Company and MRP, in

which FRP Holdings, Inc. is the majority partner with 66%

ownership.

Summary and Outlook

With this past quarter’s dispositions of our

assets at 1502 Quarry Drive and 7020 Dorsey Road for $11.7 million

and $8.85 million respectively, the Company continued and has

nearly completed the liquidation of its “heritage”

properties. Of the 43 buildings owned and operated by the

Company at the start of 2018, all that remains is the Company’s

home office building in Sparks, MD and the vacant lot in

Jacksonville still under lease to Vulcan that used to house Florida

Rock Industries’ home office. We are trying to find a home

for the proceeds from these recent sales in both opportunity zone

and like-kind exchange opportunities.

This quarter marked the fifth consecutive

quarter of increases in mining royalty revenue compared to the same

period the year before and represents the segment’s best ever

six-month start to a fiscal year. To add some further

perspective, the royalties collected through the first six months

are more than what we collected in any year from 2009 through

2014.

Construction remains on schedule for The Maren

and Bryant Street, with delivery expected at The Maren in the first

half of 2020. While construction should be complete at Bryant

St in 2021, the first residential unit should be delivered by the

end of 2020. These assets represent an investment of over $80

million and will more than triple the number of residential units

and square feet of mixed use we have in our existing portfolio.

This quarter Dock 79 reached its highest

occupancy rate since this same quarter last year. Given the

growing supply of multi-family in that submarket, the ability to

continue to renew more than half our tenants during the

construction of The Maren next door, while also growing rents

speaks to the premium the market places on this asset’s quality and

waterfront location.

Finally, in regards to the proceeds from last

year’s asset sale, we are actively pursuing different projects in

which to put the money to use while remaining cautious and perhaps

conservative in terms of the standard of quality of any project we

consider. We do not expect that our investors will have

unlimited patience as to when this money is put to work, and no one

is more anxious than our management team to return the money to our

shareholders in the form of new investments. However, it must

be an investment worth making. To that end, we have been

repurchasing shares of the Company when we believe it is

underpriced. As of June 30, we have repurchased 110,527

shares in 2019 at an average cost of $48.06 per share, and we have

received additional authorization from the board effective today to

make a further $10,000,000 in share

repurchases.

Subsequent Events

Subsequent to the end of the quarter, on July 9,

we were informed by Cemex that Lake County issued Cemex a Mine

Operating Permit (MOP) for its “4 Corners Mine” on the property it

leases from the Company in Lake Louisa. This is the last of

the permits required to begin mining this property. In

addition to completing all the work necessary to prepare the site

to become an active sand mine, as a condition to begin operations,

Cemex will need to complete construction on a road adjacent to the

property within the next 30 months but can begin selling when the

road is halfway completed. Cemex expects to begin mining in

earnest and selling by first quarter of 2021. This permit is

the final regulatory hurdle to a process that began with the

purchase of this land in 2012. Once mining begins, Cemex’s

ability to realize these reserves should positively impact revenue

and income over the term of the lease as it creates an opportunity

to collect more than the minimums from this location.

Conference Call

The Company will host a conference call on

Monday, August 5, 2019 at 1:00 p.m. (EDT). Analysts,

stockholders and other interested parties may access the

teleconference live by calling 1-800-311-9406 (passcode 939063)

within the United States. International callers may dial

1-334-323-7224 (passcode 939063). Computer audio live

streaming is available via the Internet through the Company’s

website at www.frpholdings.com. You may also click on this

link for the live streaming

http://stream.conferenceamerica.com/frp080519. For the

archived audio via the internet, click on the following link

http://archive.conferenceamerica.com/archivestream/frp080519.mp3.

If using the Company’s website, click on the Investor Relations

tab, then select the earnings conference stream. An audio

replay will be available for sixty days following the conference

call. To listen to the audio replay, dial toll free 1-877-919-4059,

international callers dial 1-334-323-0140. The passcode of

the audio replay is 44184782. Replay options: “1” begins

playback, “4” rewind 30 seconds, “5” pause, “6” fast forward 30

seconds, “0” instructions, and “9” exits recording. There may

be a 30-40 minute delay until the archive is available following

the conclusion of the conference call.

Investors are cautioned that any statements in

this press release which relate to the future are, by their nature,

subject to risks and uncertainties that could cause actual results

and events to differ materially from those indicated in such

forward-looking statements. These include, but are not limited to:

the possibility that we may be unable to find appropriate

reinvestment opportunities for the proceeds from the Sale

Transaction; levels of construction activity in the markets

served by our mining properties; demand for flexible

warehouse/office facilities in the Baltimore-Washington-Northern

Virginia area demand for apartments in Washington D.C.; our ability

to obtain zoning and entitlements necessary for property

development; the impact of lending and capital market conditions on

our liquidity; our ability to finance projects or repay our debt;

general real estate investment and development risks; vacancies in

our properties; risks associated with developing and managing

properties in partnership with others; competition; our ability to

renew leases or re-lease spaces as leases expire; illiquidity of

real estate investments; bankruptcy or defaults of tenants; the

impact of restrictions imposed by our credit facility; the level

and volatility of interest rates; environmental liabilities;

inflation risks; cybersecurity risks; as well as other risks listed

from time to time in our SEC filings; including but not limited to;

our annual and quarterly reports. We have no obligation to revise

or update any forward-looking statements, other than as imposed by

law, as a result of future events or new information. Readers are

cautioned not to place undue reliance on such forward-looking

statements.

FRP Holdings, Inc. is a holding company engaged

in the real estate business, namely (i) leasing and management of

commercial properties owned by the Company, (ii) leasing and

management of mining royalty land owned by the Company, (iii) real

property acquisition, entitlement, development and construction

primarily for apartment, retail, warehouse, and office, (iv)

leasing and management of a residential apartment building.

FRP HOLDINGS, INC. AND

SUBSIDIARIES CONSOLIDATED STATEMENTS OF

INCOME (In thousands except per share amounts)

(Unaudited)

|

|

|

THREE MONTHS ENDED |

|

SIX

MONTHS ENDED |

|

|

|

JUNE 30, |

|

JUNE 30, |

|

|

|

2019 |

|

2018 |

|

2019 |

|

2018 |

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lease revenue |

|

$ |

3,730 |

|

|

3,498 |

|

|

7,215 |

|

|

6,801 |

|

|

Mining lands lease revenue |

|

|

2,633 |

|

|

2,055 |

|

|

4,862 |

|

|

3,827 |

|

| Total Revenues |

|

|

6,363 |

|

|

5,553 |

|

|

12,077 |

|

|

10,628 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of

operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation, depletion and amortization |

|

|

1,472 |

|

|

2,131 |

|

|

2,959 |

|

|

4,529 |

|

|

Operating expenses |

|

|

910 |

|

|

1,103 |

|

|

1,792 |

|

|

1,968 |

|

|

Property taxes |

|

|

713 |

|

|

611 |

|

|

1,466 |

|

|

1,286 |

|

|

Management company indirect |

|

|

610 |

|

|

455 |

|

|

1,202 |

|

|

816 |

|

|

Corporate expenses |

|

|

551 |

|

|

1,709 |

|

|

1,196 |

|

|

2,388 |

|

| Total cost of operations |

|

|

4,256 |

|

|

6,009 |

|

|

8,615 |

|

|

10,987 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating profit

(loss) |

|

|

2,107 |

|

|

(456 |

) |

|

3,462 |

|

|

(359 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net investment income,

including realized gains of $328, $0, $447 and $0,

respectively |

|

|

1,984 |

|

|

216 |

|

|

3,794 |

|

|

221 |

|

| Interest expense |

|

|

(272 |

) |

|

(807 |

) |

|

(860 |

) |

|

(1,650 |

) |

| Equity in loss of joint

ventures |

|

|

(272 |

) |

|

(11 |

) |

|

(536 |

) |

|

(23 |

) |

| Gain on real estate

investments |

|

|

536 |

|

|

— |

|

|

536 |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income (loss) from continuing

operations before income taxes |

|

|

4,083 |

|

|

(1,058 |

) |

|

6,396 |

|

|

(1,811 |

) |

| Provision for (benefit from)

income taxes |

|

|

1,131 |

|

|

(179 |

) |

|

1,803 |

|

|

(239 |

) |

| Income (loss) from continuing

operations |

|

|

2,952 |

|

|

(879 |

) |

|

4,593 |

|

|

(1,572 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income from discontinued

operations, net |

|

|

6,776 |

|

|

120,465 |

|

|

6,862 |

|

|

122,187 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

|

9,728 |

|

|

119,586 |

|

|

11,455 |

|

|

120,615 |

|

| Loss attributable to

noncontrolling interest |

|

|

(97 |

) |

|

(396 |

) |

|

(268 |

) |

|

(927 |

) |

| Net income

attributable to the Company |

|

$ |

9,825 |

|

|

119,982 |

|

|

11,723 |

|

|

121,542 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per common

share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income (loss) from continuing

operations- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.30 |

|

|

(0.09 |

) |

|

0.46 |

|

|

(0.16 |

) |

|

Diluted |

|

$ |

0.30 |

|

|

(0.09 |

) |

|

0.46 |

|

|

(0.16 |

) |

| Discontinued operations- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.68 |

|

|

12.01 |

|

|

0.69 |

|

|

12.19 |

|

|

Diluted |

|

$ |

0.68 |

|

|

11.92 |

|

|

0.69 |

|

|

12.10 |

|

| Net income attributable to the

Company- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.99 |

|

|

11.96 |

|

|

1.18 |

|

|

12.13 |

|

|

Diluted |

|

$ |

0.99 |

|

|

11.87 |

|

|

1.17 |

|

|

12.04 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Number of shares (in

thousands) used in computing: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-basic earnings per common share |

|

|

9,915 |

|

|

10,033 |

|

|

9,933 |

|

|

10,024 |

|

|

-diluted earnings per common share |

|

|

9,960 |

|

|

10,109 |

|

|

9,978 |

|

|

10,099 |

|

FRP HOLDINGS, INC. AND

SUBSIDIARIESCONSOLIDATED BALANCE

SHEETS(In thousands, except share data)(Unaudited)

| |

|

June 30 |

|

December 31 |

| Assets: |

|

2019 |

|

2018 |

|

Real estate investments at cost: |

|

|

|

|

|

|

|

|

| Land |

|

$ |

84,383 |

|

|

|

83,721 |

|

| Buildings and

improvements |

|

|

144,779 |

|

|

|

144,543 |

|

| Projects under

construction |

|

|

2,508 |

|

|

|

6,683 |

|

|

Total investments in properties |

|

|

231,670 |

|

|

|

234,947 |

|

| Less accumulated depreciation

and depletion |

|

|

27,472 |

|

|

|

28,394 |

|

|

Net investments in properties |

|

|

204,198 |

|

|

|

206,553 |

|

| |

|

|

|

|

|

|

|

|

| Real estate held for

investment, at cost |

|

|

7,167 |

|

|

|

7,167 |

|

| Investments in joint

ventures |

|

|

94,937 |

|

|

|

88,884 |

|

|

Net real estate investments |

|

|

306,302 |

|

|

|

302,604 |

|

| |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

|

56,169 |

|

|

|

22,547 |

|

| Cash held in escrow |

|

|

20,066 |

|

|

|

202 |

|

| Accounts receivable, net |

|

|

783 |

|

|

|

564 |

|

| Investments available for sale

at fair value |

|

|

122,183 |

|

|

|

165,212 |

|

| Federal and state income taxes

receivable |

|

|

27,206 |

|

|

|

9,854 |

|

| Unrealized rents |

|

|

459 |

|

|

|

53 |

|

| Deferred costs |

|

|

645 |

|

|

|

773 |

|

| Other assets |

|

|

463 |

|

|

|

455 |

|

| Assets of discontinued

operations |

|

|

871 |

|

|

|

3,224 |

|

| Total assets |

|

$ |

535,147 |

|

|

|

505,488 |

|

| |

|

|

|

|

|

|

|

|

|

Liabilities: |

|

|

|

|

|

|

|

|

| Secured notes payable |

|

$ |

88,857 |

|

|

|

88,789 |

|

| Accounts payable and accrued

liabilities |

|

|

2,044 |

|

|

|

3,545 |

|

| Environmental remediation

liability |

|

|

92 |

|

|

|

100 |

|

| Deferred revenue |

|

|

858 |

|

|

|

27 |

|

| Deferred income taxes |

|

|

50,439 |

|

|

|

27,981 |

|

| Deferred compensation |

|

|

1,446 |

|

|

|

1,450 |

|

| Tenant security deposits |

|

|

252 |

|

|

|

53 |

|

| Liabilities of discontinued

operations |

|

|

158 |

|

|

|

288 |

|

|

Total liabilities |

|

|

144,146 |

|

|

|

122,233 |

|

| |

|

|

|

|

|

|

|

|

| Commitments and

contingencies |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Equity: |

|

|

|

|

|

|

|

|

| Common stock, $.10 par

value25,000,000 shares authorized,9,863,451 and 9,969,174 shares

issuedand outstanding, respectively |

|

|

986 |

|

|

|

997 |

|

| Capital in excess of par

value |

|

|

57,562 |

|

|

|

58,004 |

|

| Retained earnings |

|

|

313,373 |

|

|

|

306,307 |

|

| Accumulated other

comprehensive income, net |

|

|

1,210 |

|

|

|

(701 |

) |

|

Total shareholders’ equity |

|

|

373,131 |

|

|

|

364,607 |

|

| Noncontrolling interest

MRP |

|

|

17,870 |

|

|

|

18,648 |

|

|

Total equity |

|

|

391,001 |

|

|

|

383,255 |

|

| Total liabilities and

shareholders’ equity |

|

$ |

535,147 |

|

|

|

505,488 |

|

Asset Management Segment:

| |

|

Three months ended June 30 |

|

|

|

|

| (dollars in thousands) |

|

2019 |

|

% |

|

2018 |

|

% |

|

Change |

|

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Lease revenue |

|

$ |

662 |

|

|

|

100.0 |

% |

|

|

568 |

|

|

|

100.0 |

% |

|

|

94 |

|

|

|

16.5 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation, depletion and

amortization |

|

|

196 |

|

|

|

29.6 |

% |

|

|

129 |

|

|

|

22.7 |

% |

|

|

67 |

|

|

|

51.9 |

% |

| Operating expenses |

|

|

175 |

|

|

|

26.5 |

% |

|

|

91 |

|

|

|

16.0 |

% |

|

|

84 |

|

|

|

92.3 |

% |

| Property taxes |

|

|

90 |

|

|

|

13.6 |

% |

|

|

40 |

|

|

|

7.1 |

% |

|

|

50 |

|

|

|

125.0 |

% |

| Management company

indirect |

|

|

73 |

|

|

|

11.0 |

% |

|

|

50 |

|

|

|

8.8 |

% |

|

|

23 |

|

|

|

46.0 |

% |

| Corporate expense |

|

|

139 |

|

|

|

21.0 |

% |

|

|

109 |

|

|

|

19.2 |

% |

|

|

30 |

|

|

|

27.5 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of operations |

|

|

673 |

|

|

|

101.7 |

% |

|

|

419 |

|

|

|

73.8 |

% |

|

|

254 |

|

|

|

60.6 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating profit |

|

$ |

(11 |

) |

|

|

-1.7 |

% |

|

|

149 |

|

|

|

26.2 |

% |

|

|

(160 |

) |

|

|

-107.4 |

% |

Mining Royalty Lands

Segment:

| |

|

Three months ended June 30 |

|

|

|

|

| (dollars in thousands) |

|

2019 |

|

% |

|

2018 |

|

% |

|

Change |

|

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Mining lands lease revenue |

|

$ |

2,633 |

|

|

|

100.0 |

% |

|

|

2,055 |

|

|

|

100.0 |

% |

|

|

578 |

|

|

|

28.1 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation, depletion and

amortization |

|

|

42 |

|

|

|

1.6 |

% |

|

|

36 |

|

|

|

1.8 |

% |

|

|

6 |

|

|

|

16.7 |

% |

| Operating expenses |

|

|

15 |

|

|

|

0.6 |

% |

|

|

40 |

|

|

|

1.9 |

% |

|

|

(25 |

) |

|

|

-62.5 |

% |

| Property taxes |

|

|

69 |

|

|

|

2.6 |

% |

|

|

61 |

|

|

|

3.0 |

% |

|

|

8 |

|

|

|

13.1 |

% |

| Management company

indirect |

|

|

49 |

|

|

|

1.8 |

% |

|

|

— |

|

|

|

0.0 |

% |

|

|

49 |

|

|

|

0.0 |

% |

| Corporate expense |

|

|

36 |

|

|

|

1.4 |

% |

|

|

52 |

|

|

|

2.5 |

% |

|

|

(16 |

) |

|

|

-30.8 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of operations |

|

|

211 |

|

|

|

8.0 |

% |

|

|

189 |

|

|

|

9.2 |

% |

|

|

22 |

|

|

|

11.6 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating profit |

|

$ |

2,422 |

|

|

|

92.0 |

% |

|

|

1,866 |

|

|

|

90.8 |

% |

|

|

556 |

|

|

|

29.8 |

% |

Development

Segment:

| |

|

Three months ended June 30 |

| (dollars in thousands) |

|

2019 |

|

2018 |

|

Change |

| |

|

|

|

|

|

|

|

Lease revenue |

|

$ |

316 |

|

|

|

317 |

|

|

|

(1 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation, depletion and

amortization |

|

|

49 |

|

|

|

57 |

|

|

|

(8 |

) |

| Operating expenses |

|

|

95 |

|

|

|

367 |

|

|

|

(272 |

) |

| Property taxes |

|

|

295 |

|

|

|

231 |

|

|

|

64 |

|

| Management company

indirect |

|

|

442 |

|

|

|

292 |

|

|

|

150 |

|

| Corporate expense |

|

|

341 |

|

|

|

283 |

|

|

|

58 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of operations |

|

|

1,222 |

|

|

|

1,230 |

|

|

|

(8 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Operating loss |

|

$ |

(906 |

) |

|

|

(913 |

) |

|

|

7 |

|

Stabilized Joint Venture

Segment:

| |

|

Three months ended June 30 |

|

|

|

|

| (dollars in thousands) |

|

2019 |

|

% |

|

2018 |

|

% |

|

Change |

|

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Lease revenue |

|

$ |

2,752 |

|

|

|

100.0 |

% |

|

|

2,613 |

|

|

|

100.0 |

% |

|

|

139 |

|

|

|

5.3 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation, depletion and

amortization |

|

|

1,185 |

|

|

|

43.0 |

% |

|

|

1,909 |

|

|

|

73.1 |

% |

|

|

(724 |

) |

|

|

-37.9 |

% |

| Operating expenses |

|

|

625 |

|

|

|

22.7 |

% |

|

|

605 |

|

|

|

23.1 |

% |

|

|

20 |

|

|

|

3.3 |

% |

| Property taxes |

|

|

259 |

|

|

|

9.4 |

% |

|

|

279 |

|

|

|

10.7 |

% |

|

|

(20 |

) |

|

|

-7.2 |

% |

| Management company

indirect |

|

|

46 |

|

|

|

1.7 |

% |

|

|

113 |

|

|

|

4.3 |

% |

|

|

(67 |

) |

|

|

-59.3 |

% |

| Corporate expense |

|

|

35 |

|

|

|

1.3 |

% |

|

|

95 |

|

|

|

3.6 |

% |

|

|

(60 |

) |

|

|

-63.2 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of operations |

|

|

2,150 |

|

|

|

78.1 |

% |

|

|

3,001 |

|

|

|

114.8 |

% |

|

|

(851 |

) |

|

|

-28.4 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating profit |

|

$ |

602 |

|

|

|

21.9 |

% |

|

|

(388 |

) |

|

|

-14.8 |

% |

|

|

990 |

|

|

|

-255.2 |

% |

Asset Management Segment:

| |

|

Six months ended June 30 |

|

|

|

|

| (dollars in thousands) |

|

2019 |

|

% |

|

2018 |

|

% |

|

Change |

|

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Lease revenue |

|

$ |

1,303 |

|

|

|

100.0 |

% |

|

|

1,149 |

|

|

|

100.0 |

% |

|

|

154 |

|

|

|

13.4 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation, depletion and

amortization |

|

|

373 |

|

|

|

28.6 |

% |

|

|

260 |

|

|

|

22.6 |

% |

|

|

113 |

|

|

|

43.5 |

% |

| Operating expenses |

|

|

384 |

|

|

|

29.5 |

% |

|

|

229 |

|

|

|

19.9 |

% |

|

|

155 |

|

|

|

67.7 |

% |

| Property taxes |

|

|

146 |

|

|

|

11.2 |

% |

|

|

79 |

|

|

|

6.9 |

% |

|

|

67 |

|

|

|

84.8 |

% |

| Management company

indirect |

|

|

175 |

|

|

|

13.4 |

% |

|

|

74 |

|

|

|

6.5 |

% |

|

|

101 |

|

|

|

136.5 |

% |

| Corporate expense |

|

|

302 |

|

|

|

23.2 |

% |

|

|

112 |

|

|

|

9.7 |

% |

|

|

190 |

|

|

|

169.6 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of operations |

|

|

1,380 |

|

|

|

105.9 |

% |

|

|

754 |

|

|

|

65.6 |

% |

|

|

626 |

|

|

|

83.0 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating profit |

|

$ |

(77 |

) |

|

|

-5.9 |

% |

|

|

395 |

|

|

|

34.4 |

% |

|

|

(472 |

) |

|

|

-119.5 |

% |

Mining Royalty Lands

Segment:

| |

|

Six months ended June 30 |

|

|

|

|

| (dollars in thousands) |

|

2019 |

|

% |

|

2018 |

|

% |

|

Change |

|

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Mining lands lease revenue |

|

$ |

4,862 |

|

|

|

100.0 |

% |

|

|

3,827 |

|

|

|

100.0 |

% |

|

|

1,035 |

|

|

|

27.0 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation, depletion and

amortization |

|

|

94 |

|

|

|

1.9 |

% |

|

|

90 |

|

|

|

2.4 |

% |

|

|

4 |

|

|

|

4.4 |

% |

| Operating expenses |

|

|

31 |

|

|

|

0.7 |

% |

|

|

80 |

|

|

|

2.1 |

% |

|

|

(49 |

) |

|

|

-61.3 |

% |

| Property taxes |

|

|

137 |

|

|

|

2.8 |

% |

|

|

121 |

|

|

|

3.2 |

% |

|

|

16 |

|

|

|

13.2 |

% |

| Management company

indirect |

|

|

98 |

|

|

|

2.0 |

% |

|

|

— |

|

|

|

0.0 |

% |

|

|

98 |

|

|

|

0.0 |

% |

| Corporate expense |

|

|

79 |

|

|

|

1.6 |

% |

|

|

129 |

|

|

|

3.3 |

% |

|

|

(50 |

) |

|

|

-38.8 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of operations |

|

|

439 |

|

|

|

9.0 |

% |

|

|

420 |

|

|

|

11.0 |

% |

|

|

19 |

|

|

|

4.5 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating profit |

|

$ |

4,423 |

|

|

|

91.0 |

% |

|

|

3,407 |

|

|

|

89.0 |

% |

|

|

1,016 |

|

|

|

29.8 |

% |

Development

Segment:

| |

|

Six months ended June 30 |

| (dollars in thousands) |

|

2019 |

|

2018 |

|

Change |

| |

|

|

|

|

|

|

|

Lease revenue |

|

$ |

585 |

|

|

|

614 |

|

|

|

(29 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation, depletion and

amortization |

|

|

107 |

|

|

|

114 |

|

|

|

(7 |

) |

| Operating expenses |

|

|

141 |

|

|

|

475 |

|

|

|

(334 |

) |

| Property taxes |

|

|

618 |

|

|

|

499 |

|

|

|

119 |

|

| Management company

indirect |

|

|

837 |

|

|

|

533 |

|

|

|

304 |

|

| Corporate expense |

|

|

740 |

|

|

|

702 |

|

|

|

38 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of operations |

|

|

2,443 |

|

|

|

2,323 |

|

|

|

120 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Operating loss |

|

$ |

(1,858 |

) |

|

|

(1,709 |

) |

|

|

(149 |

) |

Stabilized Joint Venture

Segment:

| |

|

Six months ended June 30 |

|

|

|

|

| (dollars in thousands) |

|

2019 |

|

% |

|

2018 |

|

% |

|

Change |

|

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Lease revenue |

|

$ |

5,327 |

|

|

|

100.0 |

% |

|

|

5,038 |

|

|

|

100.0 |

% |

|

|

289 |

|

|

|

5.7 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation, depletion and

amortization |

|

|

2,385 |

|

|

|

44.8 |

% |

|

|

4,065 |

|

|

|

80.7 |

% |

|

|

(1,680 |

) |

|

|

-41.3 |

% |

| Operating expenses |

|

|

1,236 |

|

|

|

23.2 |

% |

|

|

1,184 |

|

|

|

23.5 |

% |

|

|

52 |

|

|

|

4.4 |

% |

| Property taxes |

|

|

565 |

|

|

|

10.6 |

% |

|

|

587 |

|

|

|

11.7 |

% |

|

|

(22 |

) |

|

|

-3.7 |

% |

| Management company

indirect |

|

|

92 |

|

|

|

1.7 |

% |

|

|

209 |

|

|

|

4.1 |

% |

|

|

(117 |

) |

|

|

-56.0 |

% |

| Corporate expense |

|

|

75 |

|

|

|

1.4 |

% |

|

|

237 |

|

|

|

4.7 |

% |

|

|

(162 |

) |

|

|

-68.4 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of operations |

|

|

4,353 |

|

|

|

81.7 |

% |

|

|

6,282 |

|

|

|

124.7 |

% |

|

|

(1,929 |

) |

|

|

-30.7 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating profit |

|

$ |

974 |

|

|

|

18.3 |

% |

|

|

(1,244 |

) |

|

|

-24.7 |

% |

|

|

2,218 |

|

|

|

-178.3 |

% |

Discontinued

Operations:

|

|

|

Three months ended |

|

Six

months ended |

|

|

|

June 30, |

|

June 30, |

|

|

|

2019 |

|

2018 |

|

2019 |

|

2018 |

|

Lease Revenue |

|

|

222 |

|

|

4,110 |

|

|

|

460 |

|

|

11,657 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of

operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation, depletion and amortization |

|

|

12 |

|

|

1,217 |

|

|

|

41 |

|

|

3,102 |

|

|

Operating expenses |

|

|

139 |

|

|

464 |

|

|

|

234 |

|

|

1,642 |

|

|

Property taxes |

|

|

26 |

|

|

449 |

|

|

|

46 |

|

|

1,247 |

|

|

Management company indirect |

|

|

— |

|

|

812 |

|

|

|

— |

|

|

990 |

|

|

Corporate expenses |

|

|

— |

|

|

655 |

|

|

|

— |

|

|

1,402 |

|

| Total cost of operations |

|

|

177 |

|

|

3,597 |

|

|

|

321 |

|

|

8,383 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating

profit |

|

|

45 |

|

|

513 |

|

|

|

139 |

|

|

3,274 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense |

|

|

— |

|

|

(187 |

) |

|

|

— |

|

|

(587 |

) |

| Gain on sale of buildings |

|

|

9,245 |

|

|

164,807 |

|

|

|

9,268 |

|

|

164,807 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before income

taxes |

|

|

9,290 |

|

|

165,133 |

|

|

|

9,407 |

|

|

167,494 |

|

| Provision for income

taxes |

|

|

2,514 |

|

|

44,668 |

|

|

|

2,545 |

|

|

45,307 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income from

discontinued operations |

|

$ |

6,776 |

|

|

120,465 |

|

|

|

6,862 |

|

|

122,187 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per common

share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from discontinued operations- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

0.68 |

|

|

12.01 |

|

|

|

0.69 |

|

|

12.19 |

|

|

Diluted |

|

|

0.68 |

|

|

11.92 |

|

|

|

0.69 |

|

|

12.10 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Financial

Measures.

To supplement the financial results presented in

accordance with GAAP, FRP presents certain non-GAAP financial

measures within the meaning of Regulation G promulgated by the

Securities and Exchange Commission. The non-GAAP financial measure

included in this quarterly report is net operating income (NOI).

FRP uses this non-GAAP financial measure to analyze its continuing

operations and to monitor, assess, and identify meaningful trends

in its operating and financial performance. This measure is not,

and should not be viewed as, a substitute for GAAP financial

measures.

| Net Operating Income

Reconciliation |

|

|

|

|

|

|

|

|

|

|

|

| Six months ended 06/30/19 (in

thousands) |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Stabilized |

|

|

|

|

|

|

| |

Asset |

|

|

|

Joint |

|

Mining |

|

Unallocated |

|

FRP |

| |

Management |

|

Development |

|

Venture |

|

Royalties |

|

Corporate |

|

Holdings |

| |

Segment |

|

Segment |

|

Segment |

|

Segment |

|

Expenses |

|

Totals |

|

Income (loss) from continuing operations |

|

335 |

|

|

|

(1,347 |

) |

|

|

25 |

|

|

|

3,211 |

|

|

|

2,369 |

|

|

|

4,593 |

|

| Income Tax Allocation |

|

124 |

|

|

|

(499 |

) |

|

|

109 |

|

|

|

1,190 |

|

|

|

879 |

|

|

|

1,803 |

|

| Income (loss) from

continuing operations before income taxes |

|

459 |

|

|

|

(1,846 |

) |

|

|

134 |

|

|

|

4,401 |

|

|

|

3,248 |

|

|

|

6,396 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Less: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gains on sale of

buildings |

|

536 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

536 |

|

|

Unrealized rents |

|

— |

|

|

|

— |

|

|

|

29 |

|

|

|

— |

|

|

|

— |

|

|

|

29 |

|

|

Interest income |

|

— |

|

|

|

526 |

|

|

|

— |

|

|

|

— |

|

|

|

3,268 |

|

|

|

3,794 |

|

| Plus: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Unrealized rents |

|

3 |

|

|

|

— |

|

|

|

— |

|

|

|

228 |

|

|

|

— |

|

|

|

231 |

|

| Equity in loss of Joint

Venture |

|

— |

|

|

|

514 |

|

|

|

— |

|

|

|

22 |

|

|

|

— |

|

|

|

536 |

|

|

Interest Expense |

|

— |

|

|

|

— |

|

|

|

840 |

|

|

|

— |

|

|

|

20 |

|

|

|

860 |

|

|

Depreciation/Amortization |

|

373 |

|

|

|

107 |

|

|

|

2,385 |

|

|

|

94 |

|

|

|

— |

|

|

|

2,959 |

|

|

Management Co. Indirect |

|

175 |

|

|

|

837 |

|

|

|

92 |

|

|

|

98 |

|

|

|

— |

|

|

|

1,202 |

|

|

Allocated Corporate Expenses |

|

302 |

|

|

|

740 |

|

|

|

75 |

|

|

|

79 |

|

|

|

— |

|

|

|

1,196 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Operating Income |

|

776 |

|

|

|

(174 |

) |

|

|

3,497 |

|

|

|

4,922 |

|

|

|

— |

|

|

|

9,021 |

|

| Net Operating Income

Reconciliation |

|

|

|

|

|

|

|

|

|

|

|

| Six months ended 06/30/18 (in

thousands) |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Stabilized |

|

|

|

|

|

|

| |

Asset |

|

|

|

Joint |

|

Mining |

|

Unallocated |

|

FRP |

| |

Management |

|

Development |

|

Venture |

|

Royalties |

|

Corporate |

|

Holdings |

| |

Segment |

|

Segment |

|

Segment |

|

Segment |

|

Expenses |

|

Totals |

|

Income from continuing operations |

|

288 |

|

|

|

(1,247 |

) |

|

|

(2,362 |

) |

|

|

2,469 |

|

|

|

(720 |

) |

|

|

(1,572 |

) |

| Income Tax Allocation |

|

107 |

|

|

|

(462 |

) |

|

|

(532 |

) |

|

|

915 |

|

|

|

(267 |

) |

|

|

(239 |

) |

| Income from continuing

operations before income taxes |

|

395 |

|

|

|

(1,709 |

) |

|

|

(2,894 |

) |

|

|

3,384 |

|

|

|

(987 |

) |

|

|

(1,811 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Less: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized rents |

|

— |

|

|

|

— |

|

|

|

116 |

|

|

|

— |

|

|

|

— |

|

|

|

116 |

|

|

Interest income |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

221 |

|

|

|

221 |

|

| Plus: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Unrealized rents |

|

29 |

|

|

|

— |

|

|

|

— |

|

|

|

241 |

|

|

|

— |

|

|

|

270 |

|

| Equity in loss of Joint

Venture |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

23 |

|

|

|

— |

|

|

|

23 |

|

|

Interest Expense |

|

— |

|

|

|

— |

|

|

|

1,650 |

|

|

|

— |

|

|

|

— |

|

|

|

1,650 |

|

|

Depreciation/Amortization |

|

260 |

|

|

|

114 |

|

|

|

4,065 |

|

|

|

90 |

|

|

|

— |

|

|

|

4,529 |

|

|

Management Co. Indirect |

|

74 |

|

|

|

533 |

|

|

|

209 |

|

|

|

— |

|

|

|

— |

|

|

|

816 |

|

|

Allocated Corporate Expenses |

|

112 |

|

|

|

702 |

|

|

|

237 |

|

|

|

129 |

|

|

|

1,208 |

|

|

|

2,388 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Operating Income

(loss) |

|

870 |

|

|

|

(360 |

) |

|

|

3,151 |

|

|

|

3,867 |

|

|

|

— |

|

|

|

7,528 |

|

Contact:

John D. Baker III

Chief Financial

Officer

904/858-9100

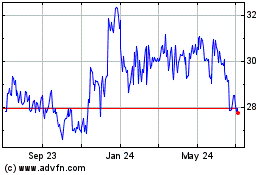

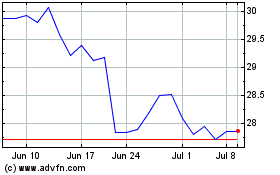

FRP (NASDAQ:FRPH)

Historical Stock Chart

From Mar 2024 to Apr 2024

FRP (NASDAQ:FRPH)

Historical Stock Chart

From Apr 2023 to Apr 2024