FRP Holdings, Inc. (NASDAQ-FRPH)

Fourth Quarter Consolidated Results of

Operations

Net income for the fourth quarter of 2018 was

$706,000 or $.07 per share versus $13,203,000 or $1.31 per share in

the same period last year. Income from discontinued

operations for the fourth quarter of 2018 was $20,000 or $.00 per

share versus $6,034,000 or $.60 per share in the same period last

year. The fourth quarter of 2017 included a reduction of

$12,043,000, or $1.20 per share, in the provision for income taxes

resulting from revaluing the Company’s net deferred tax liabilities

per the Tax Cuts and Jobs Act of 2017. This positively

impacted net income by the same amount.

The fourth quarter of 2018 was impacted by the

following items:

- Interest income is reduced by a $905,000 realized loss on the

sale of bonds during the quarter.

- Corporate expense includes $372,000 for the annual director

stock grant and $100,000 for stock options granted to

employees.

- Operating expenses includes $218,000 professional fees related

to organization of the Bryant St. joint venture.

- Operating expenses include $276,000 in due diligence costs on

the CSX Fort Smallwood potential purchase.

- Interest income includes the $81,000 preferred return on The

Maren.

- Loss on joint ventures includes $64,000 for our share of the

loss.

The fourth quarter of 2017 included consulting

fees of $200,000 charged to discontinued operations.

Fourth Quarter Segment Operating

Results

Asset Management Segment:

Most of the Asset Management Segment was

reclassified to discontinued operations leaving only three office

buildings. Total revenues in this segment were $592,000, up

$18,000 or 3.1%, over the same period last year. Operating

profit was $261,000, up $33,000 compared to the same quarter last

year due to lower allocation of corporate expenses.

Mining Royalty Lands Segment:

Total revenues in this segment were $2,187,000

versus $1,860,000 in the same period last year. Total

operating profit in this segment was $1,950,000, an increase of

$254,000 versus $1,696,000 in the same period last year.

Development Segment:

The Development segment is responsible for (i)

seeking out and identifying opportunistic purchases of income

producing warehouse/office buildings, and (ii) developing our

non-income producing properties into income production.

With respect to ongoing projects:

- We are fully engaged in the formal process of seeking PUD

entitlements for our 118-acre tract in Hampstead, Maryland, now

known as “Hampstead Overlook.”

- We finished shell construction this past quarter on the two

office buildings in the first phase of our joint venture with St.

John Properties. Shell construction of the two retail

buildings was completed subsequent to the end of the year in

January. We are now in the process of leasing these four

single-story buildings totaling 100,000 square feet of office and

retail space.

- We are the principal capital source of a residential

development venture in Essexshire now known as “Hyde Park.”

We have committed up to $9.2 million in exchange for an interest

rate of 10% and a preferred return of 20% after which a “waterfall”

determines the split of proceeds from sale. This project will

hold 125 town homes and 4 single family lots and is currently in

the entitlement process.

- During the second quarter of 2018, we began construction on a

94,350-square foot spec building at Hollander Business Park.

This Class “A” facility will be our first building with a 32-foot

clear and should come on line in the second quarter of 2019.

- In April, we began construction on Phase II of our RiverFront

on the Anacostia project, now known as “The Maren.” We expect

to deliver the building in the first half of 2020.

- In December 2018, the Company entered into a joint venture

agreement with MidAtlantic Realty Partners (MRP) for the

development of the first phase of a multifamily, mixed-use

development in northeast Washington, DC known as “Bryant

Street.” FRP contributed $32 million for common equity and

another $23 million for preferred equity to the joint

venture.

Stabilized Joint Venture Segment:

Average occupancy for the quarter was 94.63%,

and at the end of the fourth quarter Dock 79 was 96.39% leased and

95.08% occupied. During the fourth quarter, 65.57% of

expiring leases renewed with an average increase in rent of

3.36%. Dock 79 is a joint venture between the Company and

MRP, in which FRP Holdings, Inc. is the majority partner with 66%

ownership.

Calendar Year 2018 Consolidated Results

of Operations

Net income for 2018 was $124,472,000 or $12.32

per share versus $41,750,000 or $4.16 per share in the same period

last year. Income from discontinued operations for 2018 was

$122,129,000 or $12.09 per share versus $11,003,000 or $1.10 per

share in the same period last year. Interest

income was reduced by realized losses on bond and bond fund sales

of $1,195,000 in 2018. Calendar year 2017 included a gain on

remeasurement of investment of $60.2 million in the Company’s Dock

79 real estate partnership as a result of the asset’s stabilization

and the ensuing change in control of the partnership for accounting

purposes. This change in control brought with it this

substantial and non-taxable gain. The gain is based on the

difference between the carrying value and the fair value of all

assets and liabilities in the partnership and is included in income

from continuing operations before income taxes. Calendar year

2017 also included a gain of $12,043,000, or $1.20 per share, due

to a reduction in the provision for income taxes resulting from

revaluing the Company’s net deferred tax liabilities per the Tax

Cuts and Jobs Act of 2017.

Total revenues were $22,022,000, up 41.1%,

versus the same period last year, primarily because of the addition

of rental revenues from Dock 79 when its results were consolidated

starting in July 2017.

Calendar Year 2018 Segment Operating

Results

Asset Management Segment:

Total revenues in this segment were $2,309,000,

up $25,000 or 1.1%, over the same period last year. Operating

profit of $898,000 was up $17,000 compared to the same period last

year.

Mining Royalty Lands Segment:

Total revenues in this segment were $8,139,000

versus $7,241,000 in the same period last year. Total

operating profit in this segment was $7,290,000, an increase of

$725,000 versus $6,565,000 in the same period last year.

Stabilized Joint Venture Segment:

Average occupancy for 2018 was 94.77%, and at

the end of 2018 Dock 79 was 96.39% leased and 95.08% occupied.

Through calendar year 2018, 58.40% of expiring leases renewed with

an average increase in rent of 3.29%. Dock 79 is a joint

venture between the Company and MRP, in which FRP Holdings, Inc. is

the majority partner with 66% ownership.

Summary and Outlook

2018 was among the more important years in the

history of this company. Our mining royalty segment had its

biggest year ever in terms of both revenue and operating profit; we

broke ground on The Maren, Phase II of RiverFront on the Anacostia;

and we entered an incredibly important joint venture with MRP in

our Bryant Street Project. But without a doubt, the most

important event was the sale of our industrial real estate

portfolio. This asset sale provides us with substantial

liquidity heading into a period of economic uncertainty when

liquidity may be at a premium. At the very least, it gives us

the very enviable problem of what to do with a substantial amount

of money. We have said before that because we believe that we

sold at the top, we are not anxious to turn around and reinvest at

the top. Though we believe there are still some investment

opportunities out there right now that make financial sense—Bryant

Street is an excellent example—we would like to hold on to most of

the cash until asset prices cool off and the economic future

becomes a little clearer.

We end the year a very different company than we

started, and yet a number of things remain the same—we still have

some of the best assets in the businesses we are involved in and

our management team remains committed to maximizing the value of

your investment. Central to both those issues is how we

decide to redeploy the proceeds of the warehouse sale, so please,

at the risk of repeating ourselves, rest assured that we will not

squander this opportunity.

Conference Call

The Company will also host a conference call on

Thursday, March 7, 2019 at 1:00 p.m. (EST). Analysts,

stockholders and other interested parties may access the

teleconference live by calling 1-800-311-9406 (passcode 939063)

within the United States. International callers may dial

1-334-323-7224 (passcode 939063). Computer audio live

streaming is available via the Internet through the Company’s

website at www.frpholdings.com. You may also click on this

link for the live streaming

http://stream.conferenceamerica.com/frp030719. For the

archived audio via the internet, click on the following

linkhttp://archive.conferenceamerica.com/archivestream/frp030719.mp3.

If using the Company’s website, click on the Investor Relations

tab, then select the earnings conference stream. An audio

replay will be available for sixty days following the conference

call. To listen to the audio replay, dial toll free 1-877-919-4059,

international callers dial 1-334-323-0140. The passcode of

the audio replay is 15511787. Replay options: “1” begins

playback, “4” rewind 30 seconds, “5” pause, “6” fast forward 30

seconds, “0” instructions, and “9” exits recording. There may

be a 30-40 minute delay until the archive is available following

the conclusion of the conference call. Investors are

cautioned that any statements in this press release which relate to

the future are, by their nature, subject to risks and uncertainties

that could cause actual results and events to differ materially

from those indicated in such forward-looking statements. These

include, but are not limited to: the possibility that we may be

unable to find appropriate reinvestment opportunities for the

proceeds from the Sale Transaction; levels of construction activity

in the markets served by our mining properties; demand for flexible

warehouse/office facilities in the Baltimore-Washington-Northern

Virginia area demand for apartments in Washington D.C.; our ability

to obtain zoning and entitlements necessary for property

development; the impact of lending and capital market conditions on

our liquidity; our ability to finance projects or repay our debt;

general real estate investment and development risks; vacancies in

our properties; risks associated with developing and managing

properties in partnership with others; competition; our ability to

renew leases or re-lease spaces as leases expire; illiquidity of

real estate investments; bankruptcy or defaults of tenants; the

impact of restrictions imposed by our credit facility; the level

and volatility of interest rates; environmental liabilities;

inflation risks; cybersecurity risks; as well as other risks listed

from time to time in our SEC filings; including but not limited to;

our annual and quarterly reports. We have no obligation to revise

or update any forward-looking statements, other than as imposed by

law, as a result of future events or new information. Readers are

cautioned not to place undue reliance on such forward-looking

statements.

FRP Holdings, Inc. is a holding company engaged

in the real estate business, namely (i) leasing and management of

commercial properties owned by the Company, (ii) leasing and

management of mining royalty land owned by the Company, (ii) real

property acquisition, entitlement, development and construction

primarily for apartment, retail, warehouse, and office, (iv)

leasing and management of a residential apartment building.

| Contact: |

John D. Milton, Jr. |

|

| |

Chief Financial Officer |

904/858-9100 |

| |

|

|

| |

|

|

FRP HOLDINGS, INC. AND

SUBSIDIARIESCONSOLIDATED STATEMENTS OF

INCOME(In thousands except per share

amounts)(Unaudited)

|

|

|

THREE MONTHS ENDED |

|

TWELVE MONTHS ENDED |

|

|

|

DECEMBER 31, |

|

DECEMBER 31, |

|

|

|

2018 |

|

2017 |

|

2018 |

|

2017 |

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Rental

revenue |

|

$ |

3,282 |

|

|

|

3,206 |

|

|

|

13,219 |

|

|

|

7,815 |

|

| Mining

Royalty and rents |

|

|

2,165 |

|

|

|

1,842 |

|

|

|

8,050 |

|

|

|

7,153 |

|

| Revenue –

reimbursements |

|

|

205 |

|

|

|

165 |

|

|

|

753 |

|

|

|

634 |

|

| Total Revenues |

|

|

5,652 |

|

|

|

5,213 |

|

|

|

22,022 |

|

|

|

15,602 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of

operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation, depletion and amortization |

|

|

1,548 |

|

|

|

2,631 |

|

|

|

7,898 |

|

|

|

5,934 |

|

| Operating

expenses |

|

|

1,334 |

|

|

|

824 |

|

|

|

4,285 |

|

|

|

2,136 |

|

|

Environmental remediation recovery |

|

|

— |

|

|

|

— |

|

|

|

(465 |

) |

|

|

— |

|

| Property

taxes |

|

|

676 |

|

|

|

632 |

|

|

|

2,625 |

|

|

|

2,016 |

|

|

Management company indirect |

|

|

399 |

|

|

|

333 |

|

|

|

1,765 |

|

|

|

1,295 |

|

| Corporate

expenses (Note 4 Related Party) |

|

|

1,042 |

|

|

|

670 |

|

|

|

3,952 |

|

|

|

3,180 |

|

| Total cost of

operations |

|

|

4,999 |

|

|

|

5,090 |

|

|

|

20,060 |

|

|

|

14,561 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating

profit |

|

|

653 |

|

|

|

123 |

|

|

|

1,962 |

|

|

|

1,041 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net investment income,

including realized losses |

|

|

797 |

|

|

|

— |

|

|

|

2,672 |

|

|

|

— |

|

| Interest expense |

|

|

(685 |

) |

|

|

(1,958 |

) |

|

|

(3,103 |

) |

|

|

(2,741 |

) |

| Equity in loss of joint

ventures |

|

|

(52 |

) |

|

|

(9 |

) |

|

|

(88 |

) |

|

|

(1,598 |

) |

| Gain on remeasurement

of investment in real estate partnership |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

60,196 |

|

| Gain on investment land

sold |

|

|

43 |

|

|

|

— |

|

|

|

40 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income (loss) before

income taxes |

|

|

756 |

|

|

|

(1,844 |

) |

|

|

1,483 |

|

|

|

56,898 |

|

| Provision for (benefit

from) income taxes |

|

|

255 |

|

|

|

(8,021 |

) |

|

|

524 |

|

|

|

7,350 |

|

| Income from continuing

operations |

|

|

501 |

|

|

|

6,177 |

|

|

|

959 |

|

|

|

49,548 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income from

discontinued operations, net of tax |

|

|

20 |

|

|

|

6,034 |

|

|

|

122,129 |

|

|

|

11,003 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

|

521 |

|

|

|

12,211 |

|

|

|

123,088 |

|

|

|

60,551 |

|

| Gain (loss)

attributable to noncontrolling interest |

|

|

(185 |

) |

|

|

(992 |

) |

|

|

(1,384 |

) |

|

|

18,801 |

|

| Net income

attributable to the Company |

|

$ |

706 |

|

|

|

13,203 |

|

|

|

124,472 |

|

|

|

41,750 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per

common share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income from

continuing operations- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.05 |

|

|

|

0.62 |

|

|

|

0.10 |

|

|

|

4.97 |

|

|

Diluted |

|

$ |

0.05 |

|

|

|

0.61 |

|

|

|

0.09 |

|

|

|

4.94 |

|

| Discontinued

operations- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.00 |

|

|

|

0.60 |

|

|

|

12.16 |

|

|

|

1.10 |

|

|

Diluted |

|

$ |

0.00 |

|

|

|

0.60 |

|

|

|

12.09 |

|

|

|

1.10 |

|

| Net income

attributable to the Company- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.07 |

|

|

|

1.32 |

|

|

|

12.40 |

|

|

|

4.19 |

|

|

Diluted |

|

$ |

0.07 |

|

|

|

1.31 |

|

|

|

12.32 |

|

|

|

4.16 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number of shares (in thousands) used in

computing: |

|

|

|

|

|

|

|

|

|

|

|

| -basic

earnings per common share |

|

|

10,049 |

|

|

|

10,011 |

|

|

|

10,040 |

|

|

|

9,975 |

|

| -diluted

earnings per common share |

|

|

10,094 |

|

|

|

10,070 |

|

|

|

10,105 |

|

|

|

10,040 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FRP HOLDINGS, INC. AND

SUBSIDIARIESCONSOLIDATED BALANCE

SHEETS(In thousands, except share data)(Unaudited)

| |

|

December 31 |

|

December 31 |

|

Assets: |

|

2018 |

|

2017 |

| Real estate investments

at cost: |

|

|

|

|

|

|

|

|

| Land |

|

$ |

83,721 |

|

|

|

87,235 |

|

| Buildings and

improvements |

|

|

144,543 |

|

|

|

147,670 |

|

| Projects under

construction |

|

|

6,683 |

|

|

|

1,764 |

|

| Total

investments in properties |

|

|

234,947 |

|

|

|

236,669 |

|

| Less accumulated

depreciation and depletion |

|

|

28,394 |

|

|

|

26,755 |

|

| Net

investments in properties |

|

|

206,553 |

|

|

|

209,914 |

|

| |

|

|

|

|

|

|

|

|

| Real estate held for

investment, at cost |

|

|

7,167 |

|

|

|

7,176 |

|

| Investments in joint

ventures |

|

|

88,884 |

|

|

|

13,406 |

|

| Net real

estate investments |

|

|

302,604 |

|

|

|

230,496 |

|

| |

|

|

|

|

|

|

|

|

| Cash and cash

equivalents |

|

|

22,547 |

|

|

|

4,524 |

|

| Cash held in

escrow |

|

|

202 |

|

|

|

333 |

|

| Accounts receivable,

net |

|

|

564 |

|

|

|

615 |

|

| Investments available

for sale at fair value |

|

|

165,212 |

|

|

|

— |

|

| Federal and state

income taxes receivable |

|

|

9,854 |

|

|

|

2,962 |

|

| Unrealized rents |

|

|

53 |

|

|

|

223 |

|

| Deferred costs |

|

|

773 |

|

|

|

2,708 |

|

| Other assets |

|

|

455 |

|

|

|

179 |

|

| Assets of discontinued

operations |

|

|

3,224 |

|

|

|

176,694 |

|

| Total assets |

|

$ |

505,488 |

|

|

|

418,734 |

|

| |

|

|

|

|

|

|

|

|

|

Liabilities: |

|

|

|

|

|

|

|

|

| Secured notes payable,

current portion |

|

$ |

— |

|

|

|

125 |

|

| Secured notes payable,

less current portion |

|

|

88,789 |

|

|

|

90,029 |

|

| Accounts payable and

accrued liabilities |

|

|

3,545 |

|

|

|

2,081 |

|

| Environmental

remediation liability |

|

|

100 |

|

|

|

2,037 |

|

| Deferred revenue |

|

|

27 |

|

|

|

107 |

|

| Deferred income

taxes |

|

|

27,981 |

|

|

|

25,982 |

|

| Deferred

compensation |

|

|

1,450 |

|

|

|

1,457 |

|

| Tenant security

deposits |

|

|

53 |

|

|

|

54 |

|

| Liabilities of

discontinued operations |

|

|

288 |

|

|

|

32,280 |

|

| Total

liabilities |

|

|

122,233 |

|

|

|

154,152 |

|

| |

|

|

|

|

|

|

|

|

| Commitments and

contingencies |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity: |

|

|

|

|

|

|

|

|

| Common stock, $.10 par

value 25,000,000 shares authorized, 9,969,174 and 10,014,667

shares issued and outstanding, respectively |

|

|

997 |

|

|

|

1,001 |

|

| Capital in excess of

par value |

|

|

58,004 |

|

|

|

55,636 |

|

| Retained earnings |

|

|

306,307 |

|

|

|

186,855 |

|

| Accumulated other

comprehensive income (loss), net |

|

|

(701 |

) |

|

|

38 |

|

| Total

shareholders’ equity |

|

|

364,607 |

|

|

|

243,530 |

|

| Noncontrolling interest

MRP |

|

|

18,648 |

|

|

|

21,052 |

|

| Total

equity |

|

|

383,255 |

|

|

|

264,582 |

|

| Total liabilities and

shareholders’ equity |

|

$ |

505,488 |

|

|

|

418,734 |

|

Asset Management Segment:

| |

|

Three months ended December 31 |

|

|

|

|

| (dollars in

thousands) |

|

2018 |

|

% |

|

2017 |

|

% |

|

Change |

|

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Rental revenue |

|

$ |

569 |

|

|

|

96.1 |

% |

|

|

553 |

|

|

|

96.3 |

% |

|

|

16 |

|

|

|

2.9 |

% |

|

Revenue-reimbursements |

|

|

23 |

|

|

|

3.9 |

% |

|

|

21 |

|

|

|

3.7 |

% |

|

|

2 |

|

|

|

9.5 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total revenue |

|

|

592 |

|

|

|

100.0 |

% |

|

|

574 |

|

|

|

100.0 |

% |

|

|

18 |

|

|

|

3.1 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation, depletion

and amortization |

|

|

135 |

|

|

|

22.8 |

% |

|

|

127 |

|

|

|

22.1 |

% |

|

|

8 |

|

|

|

6.3 |

% |

| Operating expenses |

|

|

117 |

|

|

|

19.8 |

% |

|

|

118 |

|

|

|

20.6 |

% |

|

|

(1 |

) |

|

|

-0.8 |

% |

| Property taxes |

|

|

42 |

|

|

|

7.1 |

% |

|

|

39 |

|

|

|

6.8 |

% |

|

|

3 |

|

|

|

7.7 |

% |

| Management company

indirect |

|

|

30 |

|

|

|

5.0 |

% |

|

|

26 |

|

|

|

4.5 |

% |

|

|

4 |

|

|

|

15.4 |

% |

| Corporate expense |

|

|

7 |

|

|

|

1.2 |

% |

|

|

36 |

|

|

|

6.3 |

% |

|

|

(29 |

) |

|

|

-80.6 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of operations |

|

|

331 |

|

|

|

55.9 |

% |

|

|

346 |

|

|

|

60.3 |

% |

|

|

(15 |

) |

|

|

-4.3 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating profit |

|

$ |

261 |

|

|

|

44.1 |

% |

|

|

228 |

|

|

|

39.7 |

% |

|

|

33 |

|

|

|

14.5 |

% |

Mining Royalty Lands

Segment:

| |

|

Three months ended December 31 |

| (dollars in

thousands) |

|

2018 |

|

% |

|

2017 |

|

% |

| |

|

|

|

|

|

|

|

|

| Mining Royalty and

rents |

|

$ |

2,165 |

|

|

|

99.0 |

% |

|

|

1,842 |

|

|

|

99.0 |

% |

|

Revenue-reimbursements |

|

|

22 |

|

|

|

1.0 |

% |

|

|

18 |

|

|

|

1.0 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total revenue |

|

|

2,187 |

|

|

|

100.0 |

% |

|

|

1,860 |

|

|

|

100.0 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation, depletion

and amortization |

|

|

53 |

|

|

|

2.4 |

% |

|

|

19 |

|

|

|

1.0 |

% |

| Operating expenses |

|

|

40 |

|

|

|

1.8 |

% |

|

|

38 |

|

|

|

2.0 |

% |

| Property taxes |

|

|

87 |

|

|

|

4.0 |

% |

|

|

64 |

|

|

|

3.5 |

% |

| Corporate expense |

|

|

57 |

|

|

|

2.6 |

% |

|

|

43 |

|

|

|

2.3 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of operations |

|

|

237 |

|

|

|

10.8 |

% |

|

|

164 |

|

|

|

8.8 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating profit |

|

$ |

1,950 |

|

|

|

89.2 |

% |

|

|

1,696 |

|

|

|

91.2 |

% |

Development

Segment:

| |

|

Three months ended December 31 |

|

| (dollars in

thousands) |

|

2018 |

|

2017 |

|

Change |

|

| |

|

|

|

|

|

|

|

| Rental revenue |

|

$ |

144 |

|

|

|

184 |

|

|

|

(40 |

) |

|

|

Revenue-reimbursements |

|

|

118 |

|

|

|

115 |

|

|

|

3 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total revenue |

|

|

262 |

|

|

|

299 |

|

|

|

(37 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation, depletion

and amortization |

|

|

57 |

|

|

|

74 |

|

|

|

(17 |

) |

|

| Operating expenses |

|

|

580 |

|

|

|

41 |

|

|

|

539 |

|

|

| Property taxes |

|

|

269 |

|

|

|

277 |

|

|

|

(8 |

) |

|

| Management company

indirect |

|

|

314 |

|

|

|

267 |

|

|

|

47 |

|

|

| Corporate expense |

|

|

874 |

|

|

|

296 |

|

|

|

578 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of operations |

|

|

2,094 |

|

|

|

955 |

|

|

|

1,139 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating loss |

|

$ |

(1,832 |

) |

|

|

(656 |

) |

|

|

(1,176 |

) |

|

Stabilized Joint Venture

Segment:

| |

|

Three Months Ended December 31 |

| (dollars in

thousands) |

|

2018 |

|

% |

|

2017 |

|

% |

| |

|

|

|

|

|

|

|

|

| Rental revenue |

|

$ |

2,569 |

|

|

|

98.4 |

% |

|

|

2,470 |

|

|

|

99.6 |

% |

|

Revenue-reimbursements |

|

|

42 |

|

|

|

1.6 |

% |

|

|

10 |

|

|

|

.4 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total revenue |

|

|

2,611 |

|

|

|

100.0 |

% |

|

|

2,480 |

|

|

|

100.0 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation and

amortization |

|

|

1,303 |

|

|

|

49.9 |

% |

|

|

2,411 |

|

|

|

97.2 |

% |

| Operating expenses |

|

|

597 |

|

|

|

22.9 |

% |

|

|

627 |

|

|

|

25.3 |

% |

| Property taxes |

|

|

278 |

|

|

|

10.6 |

% |

|

|

252 |

|

|

|

10.2 |

% |

| Management company

indirect |

|

|

55 |

|

|

|

2.1 |

% |

|

|

40 |

|

|

|

1.6 |

% |

| Corporate expense |

|

|

104 |

|

|

|

4.0 |

% |

|

|

38 |

|

|

|

1.5 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of operations |

|

|

2,337 |

|

|

|

89.5 |

% |

|

|

3,368 |

|

|

|

135.8 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating profit |

|

$ |

274 |

|

|

|

10.5 |

% |

|

$ |

(888 |

) |

|

|

-35.8 |

% |

Asset Management Segment:

| |

|

Twelve months ended December 31 |

|

|

|

|

| (dollars in

thousands) |

|

2018 |

|

% |

|

2017 |

|

% |

|

Change |

|

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Rental revenue |

|

$ |

2,212 |

|

|

|

95.8 |

% |

|

|

2,203 |

|

|

|

96.5 |

% |

|

|

9 |

|

|

|

0.4 |

% |

|

Revenue-reimbursements |

|

|

97 |

|

|

|

4.2 |

% |

|

|

81 |

|

|

|

3.5 |

% |

|

|

16 |

|

|

|

19.8 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total revenue |

|

|

2,309 |

|

|

|

100.0 |

% |

|

|

2,284 |

|

|

|

100.0 |

% |

|

|

25 |

|

|

|

1.1 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation, depletion

and amortization |

|

|

540 |

|

|

|

23.4 |

% |

|

|

512 |

|

|

|

22.4 |

% |

|

|

28 |

|

|

|

5.5 |

% |

| Operating expenses |

|

|

452 |

|

|

|

19.6 |

% |

|

|

489 |

|

|

|

21.4 |

% |

|

|

(37 |

) |

|

|

-7.6 |

% |

| Property taxes |

|

|

164 |

|

|

|

7.1 |

% |

|

|

148 |

|

|

|

6.5 |

% |

|

|

16 |

|

|

|

10.8 |

% |

| Management company

indirect |

|

|

102 |

|

|

|

4.4 |

% |

|

|

100 |

|

|

|

4.4 |

% |

|

|

2 |

|

|

|

2.0 |

% |

| Corporate expense |

|

|

153 |

|

|

|

6.6 |

% |

|

|

154 |

|

|

|

6.7 |

% |

|

|

(1 |

) |

|

|

-0.6 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of operations |

|

|

1,411 |

|

|

|

61.1 |

% |

|

|

1,403 |

|

|

|

61.4 |

% |

|

|

8 |

|

|

|

0.6 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating profit |

|

$ |

898 |

|

|

|

38.9 |

% |

|

|

881 |

|

|

|

38.6 |

% |

|

|

17 |

|

|

|

1.9 |

% |

Mining Royalty Lands

Segment:

| |

|

Twelve months ended December 31 |

| (dollars in

thousands) |

|

2018 |

|

% |

|

2017 |

|

% |

| |

|

|

|

|

|

|

|

|

| Mining Royalty and

rents |

|

$ |

8,050 |

|

|

|

98.9 |

% |

|

|

7,153 |

|

|

|

98.8 |

% |

|

Revenue-reimbursements |

|

|

89 |

|

|

|

1.1 |

% |

|

|

88 |

|

|

|

1.2 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total revenue |

|

|

8,139 |

|

|

|

100.0 |

% |

|

|

7,241 |

|

|

|

100.0 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation, depletion

and amortization |

|

|

198 |

|

|

|

2.4 |

% |

|

|

110 |

|

|

|

1.5 |

% |

| Operating expenses |

|

|

168 |

|

|

|

2.1 |

% |

|

|

159 |

|

|

|

2.2 |

% |

| Property taxes |

|

|

269 |

|

|

|

3.3 |

% |

|

|

240 |

|

|

|

3.3 |

% |

| Corporate expense |

|

|

214 |

|

|

|

2.6 |

% |

|

|

167 |

|

|

|

2.3 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of operations |

|

|

849 |

|

|

|

10.4 |

% |

|

|

676 |

|

|

|

9.3 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating profit |

|

$ |

7,290 |

|

|

|

89.6 |

% |

|

|

6,565 |

|

|

|

90.7 |

% |

Development

Segment:

| |

|

Twelve months ended December 31 |

|

| (dollars in

thousands) |

|

2018 |

|

2017 |

|

Change |

|

| |

|

|

|

|

|

|

|

| Rental revenue |

|

$ |

753 |

|

|

|

785 |

|

|

|

(32 |

) |

|

|

Revenue-reimbursements |

|

|

453 |

|

|

|

445 |

|

|

|

8 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total revenue |

|

|

1,206 |

|

|

|

1,230 |

|

|

|

(24 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation, depletion

and amortization |

|

|

228 |

|

|

|

337 |

|

|

|

(109 |

) |

|

| Operating expenses |

|

|

1,198 |

|

|

|

200 |

|

|

|

998 |

|

|

| Environmental

remediation recovery |

|

|

(465 |

) |

|

|

— |

|

|

|

(465 |

) |

|

| Property taxes |

|

|

1,037 |

|

|

|

1,108 |

|

|

|

(71 |

) |

|

| Management company

indirect |

|

|

1,312 |

|

|

|

1,113 |

|

|

|

199 |

|

|

| Corporate expense |

|

|

1,984 |

|

|

|

1,231 |

|

|

|

753 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of operations |

|

|

5,294 |

|

|

|

3,989 |

|

|

|

1,305 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating loss |

|

$ |

(4,088 |

) |

|

|

(2,759 |

) |

|

|

(1,329 |

) |

|

Stabilized Joint Venture

Segment:

| |

|

Twelve Months Ended December 31 |

| (dollars in

thousands) |

|

2018 |

|

% |

|

2017 |

|

% |

| |

|

|

|

|

|

|

|

|

| Rental revenue |

|

$ |

10,254 |

|

|

|

98.9 |

% |

|

|

4,827 |

|

|

|

99.6 |

% |

|

Revenue-reimbursements |

|

|

114 |

|

|

|

1.1 |

% |

|

|

20 |

|

|

|

.4 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total revenue |

|

|

10,368 |

|

|

|

100.0 |

% |

|

|

4,847 |

|

|

|

100.0 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation and

amortization |

|

|

6,932 |

|

|

|

66.9 |

% |

|

|

4,975 |

|

|

|

102.7 |

% |

| Operating expenses |

|

|

2,467 |

|

|

|

23.8 |

% |

|

|

1,288 |

|

|

|

26.6 |

% |

| Property taxes |

|

|

1,155 |

|

|

|

11.1 |

% |

|

|

520 |

|

|

|

10.7 |

% |

| Management company

indirect |

|

|

351 |

|

|

|

3.4 |

% |

|

|

82 |

|

|

|

1.7 |

% |

| Corporate expense |

|

|

393 |

|

|

|

3.8 |

% |

|

|

65 |

|

|

|

1.3 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of operations |

|

|

11,298 |

|

|

|

109.0 |

% |

|

|

6,930 |

|

|

|

143.0 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating profit |

|

$ |

(930 |

) |

|

|

-9.0 |

% |

|

$ |

(2,083 |

) |

|

|

-43.0 |

% |

|

|

FRP HOLDINGS, INC. AND

SUBSIDIARIES DISCONTINUED

OPERATIONS(In thousands except per share

amounts)(Unaudited)

|

|

|

THREE MONTHS ENDED |

|

TWELVE MONTHS ENDED |

|

|

|

DECEMBER 31, |

|

DECEMBER 31, |

|

|

|

2018 |

|

2017 |

|

2018 |

|

2017 |

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Rental

revenue |

|

$ |

189 |

|

|

|

5,936 |

|

|

|

9,791 |

|

|

|

22,570 |

|

| Revenue –

reimbursements |

|

|

33 |

|

|

|

1,306 |

|

|

|

2,307 |

|

|

|

5,019 |

|

| Total Revenues |

|

|

222 |

|

|

|

7,242 |

|

|

|

12,098 |

|

|

|

27,589 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of

operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation, depletion and amortization |

|

|

30 |

|

|

|

1,871 |

|

|

|

3,161 |

|

|

|

7,598 |

|

| Operating

expenses |

|

|

48 |

|

|

|

915 |

|

|

|

1,742 |

|

|

|

3,485 |

|

| Property

taxes |

|

|

20 |

|

|

|

800 |

|

|

|

1,286 |

|

|

|

3,008 |

|

|

Management company indirect |

|

|

— |

|

|

|

192 |

|

|

|

1,360 |

|

|

|

734 |

|

| Corporate

expenses |

|

|

4 |

|

|

|

200 |

|

|

|

1,462 |

|

|

|

200 |

|

| Total cost of

operations |

|

|

102 |

|

|

|

3,978 |

|

|

|

9,011 |

|

|

|

15,025 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating

profit |

|

|

120 |

|

|

|

3,264 |

|

|

|

3,087 |

|

|

|

12,564 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense |

|

|

— |

|

|

|

(495 |

) |

|

|

(587 |

) |

|

|

(1,582 |

) |

| Gain on sale of

buildings |

|

|

(92 |

) |

|

|

— |

|

|

|

164,915 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before income

taxes |

|

|

28 |

|

|

|

2,769 |

|

|

|

167,415 |

|

|

|

10,982 |

|

| Provision for (benefit

from) income taxes |

|

|

8 |

|

|

|

(3,265 |

) |

|

|

45,286 |

|

|

|

(21 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income from

discontinued operations |

|

$ |

20 |

|

|

|

6,034 |

|

|

|

122,129 |

|

|

|

11,003 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per

common share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income (loss) from

discontinued operations- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.00 |

|

|

|

0.60 |

|

|

|

12.16 |

|

|

|

1.10 |

|

|

Diluted |

|

$ |

0.00 |

|

|

|

0.60 |

|

|

|

12.09 |

|

|

|

1.10 |

|

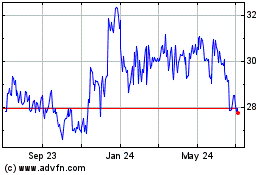

FRP (NASDAQ:FRPH)

Historical Stock Chart

From Mar 2024 to Apr 2024

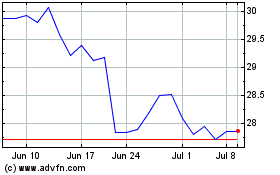

FRP (NASDAQ:FRPH)

Historical Stock Chart

From Apr 2023 to Apr 2024