Our goal is to make Freshpet the most sustainable pet food company in the world. Our commitment to nourishing Pets, People and Planet continues to expand with the following

efforts undertaken over the last year:

COMMITMENT TO GOOD CORPORATE GOVERNANCE | 20

|

OUR GOAL

|

OUR RESPONSE

|

|

Continue to innovate to enhance the sustainability of our products

|

We know that Nature’s Fresh consumers are concerned about climate change. As of July 2020, Nature’s Fresh became Freshpet’s first carbon neutral brand by purchasing offsets to cover all Scope 1, 2, and 3

emissions.

Based on strong consumer interest and feedback from existing Freshpet consumers, we are launching Freshpet Spring and Sprout, our first meatless dog food. This product is expected to bring in new consumers

and offer a more sustainable carbon footprint than traditional meat based dog food.

|

|

Commit to achieving company-wide carbon neutrality

|

We partnered with 3Degrees to calculate Freshpet’s Scope 1, 2, and 3 carbon emissions for 2019 and 2020. This extensive analysis used the latest science based approach to estimate emissions of our Scope 3

value chain including protein sources and distribution, among other points. These insights will help guide us toward emission reduction at the source in the future.

We acknowledge the importance of mitigating the effects of climate change sooner rather than later. Our engineering and operations team is working to reduce our emissions, but we realize these efforts will

take time. As an interim step, we aim to neutralize all Scope 1 and 2 emissions for calendar year 2021 using offsets. Additionally, we plan to be carbon neutral across scopes 1, 2, and 3 by 2025 using a combination of source reduction and

offsets.

|

|

Expand our water conservation commitment

|

In 2020, we backed our belief in water conservation with major infrastructure investments via on-site wastewater treatment and rainwater capture facilities. For 2021, we have completed a water footprint

analysis and our first engagement with CDP, a recognized non-profit that works with companies to disclose their environmental and water impacts.

In 2022, our new Kitchens 3.0 manufacturing facility in Ennis, Texas, will include a state-of-the-art steam recapture system that is expected to save up to 200,000 gallons of water a day.

|

In addition to the initiatives outlined above, we have added a strong corporate governance plan, centered with a diverse and independent board. Please see “—Freshpet’s

Commitment to Good Corporate Governance: Roadmap to 2025” for more information. We began sharing our current structure and long-term governance plan last year, and we plan to continue to highlight our progress and future plans.

Our 2021 sustainability report, which we plan to release in August, will provide more details on all our sustainability efforts.

COMMITMENT TO GOOD CORPORATE GOVERNANCE | 21

COMMITMENT TO HUMAN CAPITAL MANAGEMENT

At Freshpet, our vision is to create a happier, healthier world where Pets, People and the Planet thrive. We know that our people are our enduring advantage and we are

obsessed in our mission to ensure that all people who touch Freshpet are better in some way. We strive to be the place where people love to work and we encourage everyone to be grow, have fun and deliver on our vision. Our overall human resource

strategy is designed to attract, develop and retain the best qualified employees to meet our business goals on an ongoing basis and to execute our growth strategy.

As of December 31, 2020, Freshpet had employed 591 team members, an increase of approximately 28% from one year earlier, based across our 3 locations of Bethlehem,

Pennsylvania, Secaucus, New Jersey, and Ennis, Texas. In Europe, Freshpet has employed 7 employees as of December 31, 2021. None of our employees are represented by a labor union or covered by a collective bargaining agreement.

As of December 31, 2021, our workforce consisted of approximately 374 hourly production employees, 118 salaried and managerial employees in manufacturing and 99 salaried

and managerial employees in other functions, such as Marketing, Finance, Sales, Consumer Care, and other support and distribution roles.

Employee Engagement

In 2020, Freshpet achieved an engagement score of 82% with a total participation rate of 70%. Our Net Promoter score was 8.3, a 7% increase from our prior Net Promoter

Score, which we believe demonstrates our employees’ positive perception about the future of Freshpet and strong belief in our vision.

At Freshpet, our programs are designed to reward and support employees through competitive pay, creative incentive programs and generous benefits. We strive to ensure that

our benefit offerings meet the evolving needs of our diverse workforce across all of our locations. The surge in growth coupled with the COVID-19 pandemic put significant strain on our human resources in 2020. Labor shortages driven by factors relating

to the pandemic forced us to rethink our approach to attracting and retaining the right talent in the business. Freshpet implemented a number of creative employee incentive programs and invested heavily in marketing of employment opportunities to

recruit a high number of production and sanitation employees into our kitchens. Labor shortages compounded by high absenteeism due to testing, quarantine and childcare issues led to a series of systemic changes to our recruitment, training and

retention strategies. These revised practices will continue to form part of our ongoing efforts to ensure a strong, skilled employee base.

Health and Safety

The COVID-19 pandemic provided us with a defining moment to support and further develop and entrench our employee-centric culture. This showed up in our prioritization of

the health, safety and welfare of our employees. Our comprehensive response to the COVID-19 pandemic has included:

|

|

·

|

Adopting a COVID-19 screening and contact tracing process;

|

|

|

·

|

Establishing physical distancing procedures in our kitchens;

|

|

|

·

|

Modifying office workstations with physical dividers;

|

|

|

·

|

Implementing additional cleaning and disinfecting procedures;

|

|

|

·

|

Mandating work from home for our corporate office employees in Secaucus, New Jersey; and

|

|

|

·

|

Suspending our absenteeism policy to encourage those who did not feel well to stay home.

|

As a result of the COVID pandemic, we have added a full-time, bi-lingual on-site industrial nurse who

COMMITMENT TO GOOD CORPORATE GOVERNANCE | 22

works with our team on health-related issues. This has become a popular and heavily utilized resource for our team.

At our Freshpet Kitchens, the Company provides employees with extensive safety gear and protective clothing as well as a wide array of hot beverages and warm soups to help

our team members stay warm in our refrigerated facilities.

The Freshpet team regularly monitors and evaluates injury rates, safety observances and near-misses, and takes proactive steps to ensure employee safety is paramount in all

our planning.

Diversity and Inclusion

We believe that a diverse workforce is critical to our success, and our goal is to create a culture where we provide equal and fair opportunities for all of our employees.

Our values are reflected in our diverse workforce, and we believe that our competitive advantage lies in our diversity of thought, creativity in solving systemic problems and strengthening our partnerships with pet-caring organizations and the

communities in which we live.

Our workforce reflects the communities in which we operate. For example, our staff in the Freshpet Kitchens in Bethlehem, Pennsylvania is approximately 53% white, 30%

Hispanic, 10% African American and 7% other ethnicities as of December 31, 2020.

The Company and the Board have made deliberate efforts to expand the diversity of our leadership and Board, and create an inclusive environment. Currently, of the nine

non-executive members of the Board, three are women. One of the members of the Board is African American.

The Company’s senior leadership team consists of eight people, two of whom are women and one is African American. The Company made three significant new senior management

hires late in 2019 and during 2020. Two were female, one of whom is African American. The third is a Hispanic male. Each leads a significant part of our organization as they lead our Finance function (female), HR (female, African American) and

Manufacturing (male, Hispanic).

Employee Benefits

Freshpet offers a comprehensive collection of benefits designed to make Freshpet competitive within the talent pools from which it recruits. All Freshpet employees are

eligible for the same benefits regardless of title. In order to incentivize and engage our workforce, Freshpet provides:

|

|

·

Industry-leading compensation, including stock compensation for every employee (granted after 12-months of continuous employment for hourly employees)

|

|

|

·

Industry-leading healthcare offered equitably for every employee (including pet insurance)

|

|

|

|

|

|

|

|

|

·

Multi-year equity grants to “One-of -a-Kind Talent” employees identified by the Board

·

401(k) matching for every employee

|

|

|

·

Competitive perquisites, including pet insurance, free healthy snack room and catered lunches (including ice cream Fridays)

|

We also allow each employee to take home one package of Freshpet each day to feed their pet or the pet of someone close to them.

Recruitment

Freshpet aggressively recruits for talent to fill our rapidly growing manufacturing operations. We have three full-time recruiters on staff who screen potential new hires

and conduct on-boarding training for them. We advertise on social media, billboards and radio and uses a variety of job referral services to attract the skilled labor we require.

COMMITMENT TO GOOD CORPORATE GOVERNANCE | 23

To fill the increasing managerial roles because of Freshpet’s growth, we use third-party recruiters who are experts on what makes Freshpet unique and have a deep

understanding of our culture and requirements. These recruiters have successfully filled a wide range of roles with a focus on increasing the diversity of our managerial ranks.

Governance of Corporate Responsibility

We believe good governance at all levels is necessary to drive corporate responsibility, and that our corporate governance is more effective when we consider environmental

and social issues as a part of corporate strategy, key risks, and our operations. As a part of this endeavor, our Board oversees the management team fulfilling responsibilities relating to sustainability and corporate social responsibility,

particularly those that may affect the stakeholders and stockholders of our Company, and the communities in which we operate. Our Board and its committees play a critical role in oversight of our corporate culture and holds management accountable for

its maintenance of high ethical standards, governance practices and compliance programs to protect our business, employees and reputation.

To promote honesty, integrity and compliance with applicable laws, we established our Code of Ethics that applies to every director, officer and employee. All Freshpet

employees are required to certify that they comply with the Code of Ethics and its related policies and programs.

Freshpet has a zero-tolerance policy for bribery and corruption. The Board established a robust Whistleblower Policy with regard to reports of concerns made by employees

and other parties, and to protect whistleblowers against harassment or retaliation. The Whistleblower line is monitored directly by our CEO and is reported to the Audit Committee quarterly. Freshpet did not receive any hotline inquiries in 2020.

COMMITMENT TO GOOD CORPORATE GOVERNANCE | 24

DIRECTORS, EXECUTIVE OFFICERS, & CORPORATE GOVERNANCE | 26

DIRECTORS, EXECUTIVE OFFICERS, AND CORPORATE GOVERNANCE

BOARD OF DIRECTORS

Set forth below is the name, age (as of August , 2021), position and a description of the business experience of each of our directors and director nominees:

|

NAME

|

AGE

|

POSITION(S)

|

CLASS

|

APPOINTED

|

CURRENT TERM EXPIRATION

|

|

DIRECTOR NOMINEES

|

|

Daryl G. Brewster

|

64

|

Director

|

I

|

Jan 2011

|

2021

|

|

Jacki S. Kelley

|

55

|

Director

|

I

|

Feb 2019

|

2021

|

|

CONTINUING DIRECTORS

|

|

J. David Basto

|

49

|

Director

|

II

|

Dec 2010

|

2022

|

|

Lawrence S. Coben, Ph.D.

|

63

|

Director

|

II

|

Nov 2014

|

2022

|

|

Walter N. George, III

|

64

|

Director

|

II

|

Nov 2014

|

2022

|

|

Craig D. Steeneck

|

63

|

Director

|

II

|

Nov 2014

|

2022

|

|

Charles A. Norris

|

75

|

Chairman of the Board and Director

|

III

|

Oct 2006

|

2023

|

|

William B. Cyr

|

58

|

Director and Chief Executive Officer

|

III

|

Sept 2016

|

2023

|

|

Olu Beck

|

55

|

Director

|

III

|

Oct 2019

|

2023

|

|

Leta D. Priest

|

62

|

Director

|

III

|

Sept 2018

|

2023

|

DIRECTORS, EXECUTIVE OFFICERS, & CORPORATE GOVERNANCE | 27

BACKGROUND OF DIRECTORS

DIRECTOR NOMINEES

|

Director

Daryl G. Brewster has been a member of our Board of Directors since January 2011. Since 2021, Mr. Brewster has served as the Chief Executive Officer of Transformational CPG Acquisition Corp., a

newly organized blank check company focused on effecting a potential transaction in the consumer packaged goods industry. Since 2013, Mr. Brewster has served as the Chief Executive Officer of CECP, a coalition of chief executive officers from

over 200 large cap companies focused on driving sustainable business and improving communication with strategic investors. Since 2008, Mr. Brewster has also been the founder and chief executive officer of Brookside Management, LLC, a boutique

consulting firm that provides C-level consulting and support to consumer companies and service providers to the industry. Mr. Brewster serves as an Operating Advisor to The Carlyle Group and previously served as a Management Advisor to MidOcean

Partners. Mr. Brewster served as the Chief Executive Officer of Krispy Kreme Doughnuts, Inc. from March 2006 through January 2008. From 1996 to 2006, Mr. Brewster was a senior executive at Nabisco, Inc. and Kraft, Inc. (which acquired Nabisco

in 2000), where he served in numerous senior executive roles, most recently as Group Vice President and President, Snacks, Biscuits and Cereal. Before joining Nabisco, Mr. Brewster served as Managing Director, Campbell’s Grocery Products

Ltd.—UK, Vice-President, Campbell’s Global Strategy, and Business Director, Campbell’s U.S. Soup. Mr. Brewster serves on the boards of several middle-market growth companies, and previously served on the board of E*Trade Financial Services,

Inc. Mr. Brewster provides the Board of Directors with experience in corporate leadership, public company operations, and an understanding of the pet and consumer packaged goods industries.

|

|

|

|

|

Director

Jacki S. Kelley has been a member of our Board of Directors since February 2019. Ms. Kelley has over 25 years of executive and senior leadership experience in the media and digital industries. Ms.

Kelley currently serves as CEO/Americas at Dentsu, Inc., a role she has held since January 2020. Prior to her current role, Ms. Kelley spent five years at Bloomberg, first joining as Chief Operating Officer of Bloomberg Media in 2014 and then

moving to Bloomberg LP in 2017 after being appointed Deputy Chief Operating Officer. Before joining Bloomberg, Ms. Kelley was the CEO, North America, and President of Global Clients for IPG Mediabrands as well as Global CEO, Universal McCann.

Ms. Kelley was also a Vice President, Worldwide Strategy & Solutions, at Yahoo! and worked with USA Today for 18 years, leaving the company as a Senior Vice President. Ms. Kelley also serves on the board of directors of Comic Relief USA and

is an Executive Board member of the Ad Council. Ms. Kelley was originally identified to the Board as a director candidate by Spencer Stuart, an executive and leadership search firm. Ms. Kelley provides the Board of Directors with corporate

leadership and extensive senior management experience in media and marketing.

|

|

|

|

|

CONTINUING DIRECTORS

|

|

|

|

|

Chairman of the Board and Director

Charles A. Norris has been a member of our Board of Directors and Chairman of the Board since October 2006. Mr. Norris served as a member of the board of directors of Primo Water Corporation from

2016 to April 2020 and previously served as the Chairman of Glacier Water Services Inc. from 2001 to 2016. Mr. Norris was previously a member of the board of directors of Advanced Engineering Management and MP Holdco LLC, and was Chairman of

the Board of Day Runner from September 2001 to November 2003, when it was sold. Mr. Norris is the retired President of McKesson

|

DIRECTORS, EXECUTIVE OFFICERS, & CORPORATE GOVERNANCE | 28

|

|

Water Products Company, a bottled water company and division of McKesson Corporation, where he served as President from 1990 until he retired in October

2000. From 1981 through 1989, Mr. Norris served as President of Deer Park Spring Water Company, which was a division of Nestlé USA, and then led an investor group that acquired the business in 1985 until it was sold to Clorox in 1987. Mr.

Norris remained with Clorox through 1989 following their acquisition of Deer Park. From 1973 to 1985, Mr. Norris served in various operational executive positions with Nestlé in both Switzerland and the United States. Mr. Norris has been

nominated to serve as Chairman of the Board of Directors of Transformational CPG Acquisition Corp., a newly organized blank check company focused on effecting a potential transaction in the consumer packaged goods industry. Mr. Norris provides

the Board of Directors with extensive corporate leadership experience as well as a deep understanding of our business.

|

|

|

|

|

Director and CEO

William B. Cyr has been a member of our Board of Directors and our Chief Executive Officer since September 2016. Before assuming his role at Freshpet, Mr. Cyr served as President and Chief Executive

Officer of Sunny Delight Beverages Co. (“SDBC”) from August 2004 to February 2016. Prior to joining SDBC, Mr. Cyr spent 19 years at Procter & Gamble, where he ultimately served as the Vice President and General Manager of the North American

Juice Business and Global Nutritional Beverages. Mr. Cyr serves as a Board and Executive Committee Member of the Consumer Brands Association, a position he has held since 2002. Additionally, during his time as President and Chief Executive

Officer of SDBC, Mr. Cyr was a member of the Board of Directors of American Beverage Association from 2007 until 2016 and on the Executive Committee from 2012 to 2016. Mr. Cyr holds an A.B. from Princeton University. Mr. Cyr provides the Board

of Directors with knowledge of the daily affairs of the Company, expertise in the consumer products industry and extensive experience in corporate leadership.

|

|

Director

J. David Basto has been a member of our Board of Directors since December 2010. Mr. Basto is a Managing Director of The Carlyle Group, which he joined in 2015. Prior to joining The Carlyle Group,

Mr. Basto was Founding Partner and Managing Director of Broad Sky Partners, from its formation in 2013 to 2015. Prior to co-founding Broad Sky Partners, Mr. Basto worked for MidOcean Partners from its inception in 2003 through 2013, most

recently as Managing Director and co-head of MidOcean Partner’s consumer sector investing team. Prior to MidOcean Partners, Mr. Basto worked for DB Capital Partners and its predecessor BT Capital Partners from 1998 through 2003. Previously, Mr.

Basto held positions with Juno Partners and Tucker Anthony Inc. Mr. Basto currently serves as chairman of the board of directors of PurposeBuilt Brands, Inc. Mr. Basto also serves on the board of directors of the parent entities of Manna Pro

Products, Arctic Glacier, Inc., Every Man Jack and Hive Brands. Mr. Basto provides the Board of Directors with extensive core business and leadership skills as well as expertise in analyzing financial issues and insights into the consumer

sector.

|

|

|

|

|

Director

Olu Beck has been a member of our Board of Directors since October 2019. Since January 2013, Ms. Beck has been the Founder and Chief Executive Officer of The Beck Group NJ, a boutique strategic and

management consulting firm. Ms. Beck also served as Chief Executive Officer and a member of the board of directors of Wholesome Sweeteners, Inc., a maker of consumer-packaged natural and organic sweeteners and snacks, from January 2016 to June

2018. Prior to that, Ms. Beck served as Head of Global & U.S. Marketing & Health and Wellness for Johnson and Johnson, Inc. from 2010 to 2012. Prior to Johnson and Johnson, Inc., Ms. Beck served in various executive leadership roles in

Finance and Sales at Mars Incorporated from 1989 to 2009, including serving as Chief Financial Officer of Uncle Ben’s Rice. Ms.

|

DIRECTORS, EXECUTIVE OFFICERS, & CORPORATE GOVERNANCE | 29

|

|

Beck also serves on the board of directors and audit committees of Hostess Brands, Inc. and Denny’s Inc. Ms. Beck has more than 25 years of experience in

portfolio business management and general management, including direct experience in transformational and strategic growth—both organically and through mergers and acquisition. Ms. Beck provides the Board of Directors with diversified,

cross-functional and global experience, extensive board and management experience in the consumer packaged goods industry and insights into leading practices in executive compensation, corporate governance and audit.

|

|

|

|

|

Director

Lawrence S. Coben, Ph.D. has been a member of our Board of Directors since November 2014. Dr. Coben has served as Chairman of the Board of NRG Energy since February 2017 and has been a director of

NRG since December 2003. Dr. Coben was Chairman and Chief Executive Officer of Tremisis Energy Corporation LLC from 2003 to December 2017. Dr. Coben was Chairman and Chief Executive Officer of Tremisis Energy Acquisition Corporation II, a

publicly held company, from July 2007 through March 2009 and of Tremisis Energy Acquisition Corporation from February 2004 to May 2006. From January 2001 to January 2004, Dr. Coben was a Senior Principal of Sunrise Capital Partners L.P., a

private equity firm. From 1997 to January 2001, Dr. Coben was an independent consultant. From 1994 to 1996, Dr. Coben was Chief Executive Officer of Bolivian Power Company. Dr. Coben served on the advisory board of Morgan Stanley Infrastructure

II, L.P. from September 2014 through December 2016. Dr. Coben is also Executive Director of the Escala Initiative (formerly the Sustainable Preservation Initiative) and a Consulting Scholar at the University of Pennsylvania Museum of

Archaeology and Anthropology. Dr. Coben provides the Board of Directors with significant managerial, strategic, and financial expertise, particularly as it relates to company financings, transactions and development initiatives.

|

|

|

|

|

Director

Walter N. George, III has been a member of our Board of Directors since November 2014. Mr. George is the President of G3 Consulting, LLC, a boutique advisory firm specializing in value creation in

small and mid-market consumer products companies, a company he founded in 2013. Mr. George served as President of the American Italian Pasta Company and Corporate Vice President of Ralcorp Holdings from 2010 until its sale to Conagra Foods in

2013. Mr. George served as Chief Operating Officer at American Italian Pasta Company from 2008 to 2010. From 2001 to 2008, Mr. George served in other executive roles with American Italian Pasta Company, including Senior Vice President—Supply

Chain and Logistics and Executive Vice President—Operations and Supply Chain. From 1988 through 2001, Mr. George held a number of senior operating positions with Hill’s Pet Nutrition, a subsidiary of Colgate Palmolive Company, most recently as

Vice President of Supply Chain. Mr. George currently serves on the boards of Old World Spice and Seasonings and Vision Bank. Mr. George is non-executive chairman of the board of Indigo Wild, LLC. Mr. George provides the Board of Directors with

operations expertise, consumer products and pet food industry expertise and public company experience.

|

|

|

|

|

Director

Leta D. Priest has been a member of our Board of Directors since September 2018. Ms. Priest has over 30 years of executive and senior leadership experience in the retail and consumer packaged goods

industries. Ms. Priest was a key leader in food for Walmart from May 2003 to November 2015 during Walmart’s expansion of grocery, including having served as Senior Vice President and General Merchandising Manager, Fresh Food from 2009 to 2015.

Ms. Priest also served as Senior Vice

|

DIRECTORS, EXECUTIVE OFFICERS, & CORPORATE GOVERNANCE | 30

|

|

President, General Merchandising Manager in other key areas of food for Walmart from January 2007 through 2015. Ms. Priest began her career with Walmart as Vice President of Food Development. Ms.

Priest joined Walmart from Safeway, where she served as Vice President Corporate Brands, North America from January 1998 to April 2003. Prior to her time at Safeway, Ms. Priest had 11 years of consumer products experience in senior leadership

roles across brand management and product development with The Torbitt & Castleman Company and Dole Food Company. Ms. Priest serves as a director on the following boards: Gehl Foods since November 2019 and Milo’s Tea Company since April

2018. In 2017, Ms. Priest completed seven years as a director on the Board of Feeding America. Ms. Priest provides the Board of Directors with corporate leadership, public company experience and extensive senior management experience in the

retail and consumer packaged goods industries.

|

|

|

|

|

Director

Craig D. Steeneck has been a member of our Board of Directors since November 2014. Mr. Steeneck served as the Executive Vice President and Chief Financial Officer of Pinnacle Foods Inc. from July

2007 to January 2019, where he oversaw the company’s financial operations, treasury, tax, investor relations, corporate development and information technology and was an integral part of the integration team for several of its acquisitions.

From June 2005 to July 2007, Mr. Steeneck served as Executive Vice President, Supply Chain Finance and IT of Pinnacle Foods, helping to redesign the supply chain to generate savings and improve financial performance. Pinnacle Foods was acquired

by Conagra Brands in October 2018. From April 2003 to June 2005, Mr. Steeneck served as Executive Vice President, Chief Financial Officer and Chief Administrative Officer of Cendant Timeshare Resort Group (now Wyndham Destinations, Inc.),

playing key roles in wide-scale organization of internal processes and staff management. From March 2001 to April 2003, Mr. Steeneck served as Executive Vice President and Chief Financial Officer of Resorts Condominiums International (now

Wyndham Destinations, Inc.). From October 1999 to February 2001, Mr. Steeneck was the Chief Financial Officer of International Home Foods Inc. Mr. Steeneck has served as a board member and Chairman of the Audit Committee of Hostess Brands, Inc.

since November 2016 and as lead independent director from January 2019 to December 2019. Mr. Steeneck has served as a board member of Collier Creek Holdings (now Utz Brands, Inc.) since November 2018, where he is Chairman of the Audit Committee

and member of the Compensation Committee. Mr. Steeneck served on the Board of Directors of Kind, Inc. from May 2019 to July 2020. Mr. Steeneck provides the Board of Directors with extensive management experience in the consumer-packaged goods

industry as well as accounting and financial expertise.

|

Stock Ownership Guidelines for Non-Employee Directors

Stock ownership guidelines are in place for our non-employee directors to encourage significant ownership of our common stock by our non-employee directors and to further

align the personal interests of our non-employee directors with the interests of the Company’s stockholders. Non-employee directors are expected to own common stock valued at an amount at least three times the cash retainer, as calculated for each

calendar year on the first trading day of each calendar year.

Family Relationships

There are no family relationships among any of our directors and executive officers.

Corporate Governance, Board Structure and Director Independence

Our Board of Directors consists of 10 members and is currently divided into three classes with staggered three-year terms. At each annual general meeting of stockholders,

the successors to directors whose terms then expire will be elected to serve from the time of election and qualification until the third annual meeting following election. The authorized number of directors may be changed by resolution of the Board of

Directors. Vacancies on the Board of Directors can be filled by resolution of the Board of

DIRECTORS, EXECUTIVE OFFICERS, & CORPORATE GOVERNANCE | 31

Directors. Mr. Norris serves as the Chairman of our Board of Directors. We believe that each of the members of our Board of Directors, except Mr. Cyr, is independent

consistent with the Nasdaq rules. Mr. Brewster and Ms. Kelley are the Class I directors, and their terms will expire at the Annual Meeting, unless reelected by stockholders. Mr. Basto, Mr. George, Mr. Steeneck and Dr. Coben are the Class II directors,

and their terms will expire in 2022. Mr. Norris, Ms. Priest, Ms. Beck and Mr. Cyr are the Class III directors, and their terms will expire in 2023. The division of our Board of Directors into three classes with staggered three-year terms may delay or

prevent a change of our management or a change in control. If the Declassification Proposal is approved by our stockholders at our Annual Meeting, our Board will be fully declassified by 2025. See “—Commitment to Good Corporate Governance” and

“Proposals—Proposal IV” for additional information.

Our Board of Directors met seven times during 2020. Under the Company’s corporate governance guidelines, Board members are expected to attend all meetings of the Board and

committees on which they serve. Each director serving on the Board in 2020 attended at least 75% of the total meetings of the Board and of Committees on which he or she served during the time he or she was on the Board in 2020. All of the members of

our Board of Directors serving at the time attended our 2020 annual stockholders’ meeting. Our corporate governance guidelines are available on our corporate website at www.freshpet.com. Our website is not part of

this Proxy Statement.

Board Committees

Our Board of Directors has three standing committees: an Audit Committee; a Nominating and Corporate Governance Committee; and a Compensation Committee. Each committee

reports to the Board of Directors as they deem appropriate, and as the Board of Directors may request. The composition, duties and responsibilities of these committees are set forth below. In the future, our Board of Directors may establish other

committees, as it deems appropriate, to assist it with its responsibilities.

AUDIT COMMITTEE

The Audit Committee is responsible for, among other matters: (1) appointing, compensating, retaining, evaluating, terminating and overseeing our independent registered

public accounting firm; (2) discussing with our independent registered public accounting firm their independence from management; (3) reviewing with our independent registered public accounting firm the scope and results of their audit and the audit

fee; (4) approving all audit and permissible non-audit services to be performed by our independent registered public accounting firm, including taking into consideration whether the independent auditor’s provision of any non-audit services to us is

compatible with maintaining the independent auditor’s independence; (5) overseeing the financial reporting process and discussing with management and our independent registered public accounting firm the interim and annual consolidated financial

statements that we file with the SEC; (6) reviewing and monitoring our accounting principles, accounting policies, financial and accounting controls and compliance with legal and regulatory requirements; (7) establishing procedures for the confidential

anonymous submission of concerns regarding questionable accounting, internal controls or auditing matters; (8) reviewing and approving related person transactions; (9) annually reviewing the Audit Committee charter and the committee’s performance; and

(10) handling such other matters that are specifically delegated to the Audit Committee by our Board of Directors from time to time.

Our Audit Committee consists of Mr. Steeneck (chair), Mr. Basto and Ms. Beck. Our Board of Directors has affirmatively determined that Mr. Steeneck, Mr. Basto and Ms. Beck

meet the definition of “independent directors” for purposes of serving on an Audit Committee under applicable SEC and Nasdaq rules. In addition, Mr. Steeneck qualifies as our “audit committee financial expert,” as such term is defined in Item 407 of

Regulation S-K. The Audit Committee met four times during 2020.

Our Board of Directors adopted a written charter for the Audit Committee, which is available on our corporate website at www.freshpet.com.

Our website is not part of this Proxy Statement.

DIRECTORS, EXECUTIVE OFFICERS, & CORPORATE GOVERNANCE | 32

NOMINATING AND CORPORATE GOVERNANCE COMMITTEE

The Nominating and Corporate Governance Committee is responsible for developing and recommending to the Board of Directors criteria for identifying and evaluating

candidates for directorships and making recommendations to the Board of Directors regarding candidates for election or re-election to the Board of Directors at each annual stockholders’ meeting. In addition, the Nominating and Corporate Governance

Committee is responsible for overseeing our corporate governance guidelines and reporting and making recommendations to the Board of Directors concerning corporate governance matters. The Nominating and Corporate Governance Committee is also

responsible for making recommendations to the Board of Directors concerning the structure, composition and function of the Board of Directors and its committees.

In considering director nominees, the Nominating and Corporate Governance Committee considers a number of factors, including:

|

|

1

|

the independence, judgment, strength of character, reputation in the business community, ethics and integrity of the individual;

|

|

|

2

|

the business or other relevant experience, skills and knowledge that the individual may have that will enable him or her to provide effective oversight of the Company’s business;

|

|

|

3

|

the fit of the individual’s skill set and personality with those of the other Board members so as to build a Board that works together effectively and constructively; and

|

|

|

4

|

the individual’s ability to devote sufficient time to carry out his or her responsibilities as a director in light of his or her occupation and the number of boards of directors of other public companies on which he or she serves.

|

When formulating its Board membership recommendations, the Nominating and Corporate Governance Committee will consider advice and recommendations from stockholders,

management and others as it deems appropriate. Although we do not have a formal policy regarding Board diversity, when evaluating candidates for nomination as a director, the Nominating and Corporate Governance Committee does consider diversity in its

many forms, including among others, experience, skills, ethnicity, race and gender. We believe a diverse Board, as so defined, provides for different points of view and robust debate and enhances the effectiveness of the Board. Upon identifying a

potential nominee, members of the Nominating and Corporate Governance Committee will interview the candidate, and based upon that interview, reference checks and committee discussions, make a recommendation to the Board.

The Nominating and Corporate Governance Committee evaluates director candidates recommended by a stockholder according to the same criteria as a candidate identified by the

Nominating and Corporate Governance Committee. To date, the Company has not received a recommendation for a director candidate from our stockholders.

Stockholders may recommend candidates at any time, but to be considered by the Nominating and Corporate Governance Committee for inclusion in the Company’s proxy statement

for the 2022 annual meeting of stockholders, recommendations must be submitted to the attention of the Chairman of the Nominating and Corporate Governance Committee not earlier than the close of business on May 26, 2022 nor later than the close of

business on June 25, 2022 (assuming the Company does not change the date of the 2022 annual meeting of stockholders by more than 30 days before or 70 days after the anniversary of the 2021 Annual Meeting). A stockholder recommendation must contain:

|

|

1

|

the candidate’s name, a detailed biography outlining the candidate’s relevant background, professional and business experience and other significant accomplishments;

|

|

|

2

|

an acknowledgment from the candidate that he or she would be willing to serve on the Board, if elected;

|

|

|

3

|

a statement by the stockholder outlining the reasons why this candidate’s skills, experience and

|

DIRECTORS, EXECUTIVE OFFICERS, & CORPORATE GOVERNANCE | 33

|

|

|

background would make a valuable contribution to the Board; and

|

|

|

|

|

|

|

4

|

a minimum of two references from individuals that have either worked with the candidate, served on a board of directors or board of trustees with the candidate, or can otherwise provide relevant perspective on the candidate’s capabilities as a

potential Board member.

|

Stockholder submissions recommending director candidates for consideration must be sent to the Company’s corporate offices, located at 400 Plaza Drive, 1st Floor, Secaucus,

NJ 07094, Attention: Corporate Secretary.

Our Nominating and Corporate Governance Committee consists of Mr. George (Chair), Dr. Coben and Ms. Kelley. Our Board of Directors has affirmatively determined that Mr.

George, Dr. Coben and Ms. Kelley meet the definition of “independent directors” for purposes of serving on a Nominating and Corporate Governance Committee under applicable SEC and Nasdaq rules. Our Nominating and Corporate Governance Committee met four

times during 2020.

Our Board of Directors adopted a written charter for the Nominating and Corporate Governance Committee, which is available on our corporate website at www.freshpet.com. Our website is not part of this Proxy Statement.

COMPENSATION COMMITTEE

The Compensation Committee is responsible for, among other matters: (1) reviewing key employee compensation goals, policies, plans and programs; (2) reviewing and approving

the compensation of our directors, Chief Executive Officer and other executive officers; (3) reviewing and approving employment agreements and other similar arrangements between us and our executive officers; and (4) administering our stock plans and

other incentive compensation plans. The Compensation Committee may delegate its responsibilities to a subcommittee formed by the Compensation Committee. The Compensation Committee, in its sole discretion, may also engage legal, accounting, or other

consultants or experts, including compensation consultants, to assist in carrying out its responsibilities.

Our Compensation Committee consists of Mr. Brewster (Chair), Ms. Beck and Ms. Priest. Our Board of Directors has affirmatively determined that Mr. Brewster, Ms. Beck and

Ms. Priest meet the definition of “independent directors” for purposes of serving on a Compensation Committee under applicable SEC and Nasdaq rules. Our Compensation Committee met seven times during 2020. Mr. King served on the Compensation Committee

until his resignation from the Board in September 2020, and Ms. Kelley served on the Compensation Committee until June 2021.

Our Board of Directors adopted a written charter for the Compensation Committee, which is available on our corporate website at www.freshpet.com.

Our website is not part of this Proxy Statement.

Risk Oversight

Our Board of Directors is responsible for overseeing our risk management process. The Board of Directors focuses on our general risk management strategy and the most

significant risks facing us and ensures that appropriate risk mitigation strategies are implemented by management. The Board of Directors is also apprised of risk management matters in connection with its general oversight and approval of corporate

matters and significant transactions.

Our Board of Directors does not have a standing risk management committee, but rather administers this oversight function directly through our Board of Directors as a

whole, as well as through various standing committees of our Board of Directors that address risks inherent in their respective areas of oversight. In particular, our Board of Directors is responsible for monitoring and assessing strategic risk

exposure, our Audit Committee is responsible for overseeing our major financial risk exposures and the steps our management has taken to monitor and control these exposures and our Compensation Committee assesses and monitors whether any of our

compensation policies and programs has the potential to encourage unnecessary risk-taking. In addition, our Audit Committee oversees the performance of our

DIRECTORS, EXECUTIVE OFFICERS, & CORPORATE GOVERNANCE | 34

internal audit function and considers and approves or disapproves any related-party transactions.

Our management is responsible for day-to-day risk management. This oversight includes identifying, evaluating and addressing potential risks that may exist at the

enterprise, strategic, financial, operational, compliance and reporting levels.

Leadership Structure of the Board of Directors

The positions of Chairman of the Board and Chief Executive Officer are presently separated. We believe that separating these positions allows our Chief Executive Officer to

focus on our day-to-day business, while allowing the Chairman of the Board to lead the Board of Directors in its fundamental role of providing advice to and independent oversight of management. Our Board of Directors recognizes the time, effort and

energy that the Chief Executive Officer is required to devote to his position in the current business environment, as well as the commitment required to serve as our Chairman. While our Bylaws and corporate governance guidelines do not require that our

Chairman and Chief Executive Officer positions be separate, our Board of Directors believes that having separate positions is the appropriate leadership structure for us at this time and demonstrates our commitment to good corporate governance.

Compensation Committee Interlocks and Insider Participation

None of the members of the Compensation Committee is or has been an executive officer or employee of the Company, nor did they have any relationships requiring disclosure

by the Company under Item 404 of Regulation S-K. During 2020, none of our executive officers served as a director or a member of a compensation committee (or other committee serving an equivalent function) of any other entity, an executive officer of

which served as one of our directors or a member of the Compensation Committee.

Code of Ethics

We adopted a written General Code of Ethics (“General Code”) which applies to all of our directors, officers and other employees, including our principal executive officer,

principal financial officer and controller. In addition, we adopted a written Code of Ethics for Executive Officers and Principal Accounting Personnel (“Code of Ethics”), which applies to our principal executive officer, principal financial officer,

controller and other designated members of our management. Copies of each code are available on our corporate website at www.freshpet.com. The information contained on our website does not constitute a part of this

Proxy Statement. We will provide any person, without charge, upon request, a copy of our General Code or Code of Ethics. Such requests should be made in writing to the attention of our Corporate Secretary at the following address: Freshpet, Inc., 400

Plaza Drive, 1st Floor, Secaucus, New Jersey 07094.

Communications to the Board of Directors

Stockholders and other interested parties may contact any member (or all members) of the Board by U.S. mail. Such correspondence should be sent c/o Corporate Secretary,

Freshpet, Inc., 400 Plaza Drive, 1st Floor, Secaucus, New Jersey 07094.

All communications received as set forth in the preceding paragraph will be opened by the Corporate Secretary for the sole purpose of determining whether the contents

represent a message to the Company’s directors. The Corporate Secretary will forward copies of all correspondence that, in the opinion of the Corporate Secretary, deals with the functions of the Board or its committees or that he or she otherwise

determines requires the attention of any member, group or committee of the Board.

Executive Officers

Set forth below is the name, age (as of August , 2021), position and a description of the business experience of each of our executive officers (business experience

for Mr. Cyr, who is both a director and executive officer, can be found in the section entitled “—Board of Directors”).

DIRECTORS, EXECUTIVE OFFICERS, & CORPORATE GOVERNANCE | 35

|

NAME

|

AGE

|

POSITION(S)

|

|

William B. Cyr

|

58

|

Director and Chief Executive Officer

|

|

Scott Morris

|

52

|

President and Chief Operating Officer

|

|

Heather Pomerantz

|

47

|

Chief Financial Officer

|

|

Stephen L. Weise

|

62

|

Executive Vice President, Manufacturing & Supply Chain

|

|

Stephen Macchiaverna

|

63

|

Executive Vice President, Secretary and Treasurer

|

|

Cathal Walsh

|

49

|

Senior Vice President, Managing Director of Europe

|

|

Thembeka “Thembi” Machaba

|

43

|

Senior Vice President, Human Resources

|

|

Ivan Garcia

|

36

|

Vice President, Controller

|

Background of Executive Officers

President, Chief Operating Officer & Co-Founder

Scott Morris is a co-founder of Freshpet and has served as our Chief Operating Officer since July 2015 and President since March 2016. Mr. Morris served as our Chief

Marketing Officer from January 2014 to July 2015 and Senior Vice President of Sales and Marketing from 2010 to 2013. Mr. Morris is involved in all aspects of Company development and focuses his time helping to build the team, cultural values and

innovative approach that has led the Company to success. Prior to joining Freshpet, Mr. Morris was Vice President of Marketing at The Meow Mix Company from 2002 to 2006. Previously, Mr. Morris worked at Nestlé Purina from 1990 to 2002, holding various

leadership positions in Sales and Marketing. Mr. Morris also works as an advisor and investor in several small consumer packaged goods companies with strong social missions and a focus to improve food and the world. Additionally, in 2020, Mr. Morris

co-founded Hive Brands, an e-commerce marketplace that curates sustainable food and household goods brands.

Chief Financial Officer

Heather Pomerantz has served as Chief Financial Officer since October 2020. Ms. Pomerantz previously served as our Executive Vice President of Finance from January

2020 to October 2020. Prior to joining Freshpet, from March 2019 to December 2019, Ms. Pomerantz served as the Vice President of Finance for North America for The Nature’s Bounty Co. Prior to joining The Nature’s Bounty Co., Ms. Pomerantz served in

various finance and accounting roles at Unilever from June 2001 to February 2019, concluding as Vice President of North America Transformation. Prior to joining Unilever, Ms. Pomerantz worked as a consultant at PricewaterhouseCoopers LLP, where she had

responsibilities for ERP implementations. Ms. Pomerantz has over twenty years of oversight and leadership experience in finance and systems roles in the consumer packaged goods industry.

EVP, Manufacturing & Supply Chain

Stephen L. Weise has served as EVP of Manufacturing & Supply Chain, previously titled Executive Vice President of Operations, since July 2015. Mr. Weise has over 25 years of experience in the manufacturing and distribution of consumer

products. Prior to joining Freshpet, from June 2013 to July 2015, Mr. Weise was an Account Manager at TBM Consulting, a consulting firm that specialized in operational excellence and lean manufacturing. From 2003 to February 2013, Mr. Weise held the

role of COO at the Arthur Wells Group, a 3PL specializing in consumer products and temperature-controlled distribution. Prior to that, from 2002 to 2003, Mr. Weise served as the SVP of Operations for the B. Manischewitz Company, a specialty food

manufacturer. From 2000 to 2002, Mr. Weise served as Chief Operating Officer at the Eight in One Pet Products Company, from 1995 to 2000 as VP of Manufacturing at Chock Full O’ Nuts, and from 1986 to 1995 in various positions at Kraft Foods.

EVP, Secretary & Treasurer

Stephen Macchiaverna has served as Executive Vice President, Secretary and Treasurer since September 2020. Prior to that time, Mr. Macchiaverna served as Senior Vice

President, Controller & Secretary, from October 2006. Prior to joining Freshpet, Mr. Macchiaverna was the Controller for The Meow Mix Company from its inception in 2002 through its sale and transition to Del Monte Foods in 2006. From 1999 to 2001,

Mr. Macchiaverna was the Vice President of Finance and Treasurer of Virgin Drinks USA, Inc. Mr. Macchiaverna began his consumer-packaged goods career with First Brands Corporation, where he worked from 1986 to 1999, most recently as Divisional

Controller for all domestic subsidiaries.

DIRECTORS, EXECUTIVE OFFICERS, & CORPORATE GOVERNANCE | 36

Mr. Macchiaverna has over 30 years’ experience in consumer-packaged goods financial management.

Co-Founder, SVP and Managing Director of Europe

Cathal Walsh is a co-founder of Freshpet and has served as Senior Vice President, Managing Director of Europe, previously titled Senior Vice President of Cooler

Operations, since January 2011 and previously served as our Chief Operating Officer from October 2006 to January 2011. Prior to joining Freshpet, Mr. Walsh was Zone Marketing Manager at Nestlé Worldwide from 2000 to 2005 and was Marketing Manager at

Nestlé Pet Care from 1996 to 2000. Mr. Walsh has over 25 years’ experience in packaged goods marketing, sales and management, including in international food markets.

SVP, Human Resources

Thembeka “Thembi” Machaba joined Freshpet in August 2020 as SVP of Human Resources. Ms. Machaba has over 20 years’ experience in the Manufacturing, Food & Beverage industries. Prior to joining Freshpet, Ms. Machaba was a Vice President of

Global Human Resources and Organization Development at Molson Coors from January 2019 to August 2020 and Senior Director of Global Human Resources from October 2016 to December 2018. Ms. Machaba held various roles within Human Resources at MillerCoors,

the North American Business unit of Molson Coors, from August 2012 to October 2016. Prior to moving to the United States, Ms. Machaba served in a number of senior Human Resource roles in SABMiller, a global brewing company in South Africa, from 2003 to

2011. Prior to joining SABMiller, Ms. Machaba worked in a training role at AFROX, a chemical manufacturing company in South Africa. Prior to that, Ms. Machaba worked at Unilever SA in various Human Resources roles.

VP of Finance, Controller

Ivan Garcia has served as Vice President of Finance since April 2017 and Controller since September 2020, having previously served as Director of Financial Reporting and Budgeting from June 2015 to March 2017 and Manager of Financial Reporting

from February 2014 to May 2015. Prior to joining Freshpet, Mr. Garcia held progressive roles at KPMG LLP, including Manager of Audit, from September 2007 to January 2014, where he served both public and private clients mainly in the consumer and

industrial market segments.

Stock Ownership Guidelines

Stock ownership guidelines (or Guidelines) are in place for our senior executive officers (or Covered Persons)—including our NEOs—to encourage significant ownership of our

common stock by our senior executives and to further align the personal interests of our senior executives with the interests of our stockholders. The Guidelines require (i) our CEO to own common stock valued at four times annual base pay, (ii) our

NEOs, other than our CEO, to own common stock valued at three times annual base pay, and (iii) our other senior executive officers to own common stock valued at up to two times annual base pay, based on seniority.

Covered Persons are required to achieve their respective levels of stock ownership within the later of five years of the date they enter the listed positions or the date

the Guidelines were adopted. If a Covered Person is not in compliance with the Guidelines, the Covered Person will be required to retain at least 50% of the Covered Person’s vested stock options and vested stock units granted pursuant to a stock

incentive plan of the Company. If the Covered Person falls below the Guidelines solely as a result of a decline in the value of our common stock, the Covered Person will have a period of 12 months within which to increase such Covered Person’s stock

ownership to meet the Guidelines. Notwithstanding the terms of the Guidelines, Covered Persons may sell or otherwise dispose of shares of our common stock to (a) pay the exercise price of Company stock options in a net-share stock option transaction;

and (b) satisfy any applicable tax withholding obligations due in connection with the exercise of options or the vesting or payment of any restricted stock units. If the Guidelines place a hardship on a Covered Person, the Compensation Committee is

empowered to develop an alternative stock ownership guideline for a Covered Person that reflects both the intention of the Guidelines and the personal circumstances of the Covered Person.

DIRECTORS, EXECUTIVE OFFICERS, & CORPORATE GOVERNANCE | 37

EXECUTIVE COMPENSATION | 39

INTRODUCTION

This CD&A describes the material elements of compensation awarded to, earned by, or paid to each of our named executive officers (or NEOs). This CD&A also describes

Freshpet’s philosophy behind and objectives for executive compensation, as well as the manner in which the Company awards, and our NEOs earn, such compensation. Finally, this CD&A is intended to supplement the data presented in the Summary

Compensation Table and other compensation tables that follow the CD&A.

The following table lists our NEOs for 2020, which is the group consisting of each individual who served as our Chief Executive Officer or Chief Financial Officer during

2020, and our three other most highly compensated executive officers who were serving as executive officers on December 31, 2020.

|

NAME

|

PRINCIPAL POSITION

|

|

William B. Cyr

|

Chief Executive Officer

|

|

Scott Morris

|

President and Chief Operating Officer

|

|

Heather Pomerantz

|

Chief Financial Officer

|

|

Stephen L. Weise

|

Executive Vice President, Manufacturing & Supply Chain

|

|

Cathal Walsh

|

Senior Vice President, Managing Director of Europe

|

|

Richard Kassar

|

Vice Chairman, formerly Chief Financial Officer

|

|

*

|

Mr. Kassar stepped down from his role as Chief Financial Officer and began an advisory role as Vice Chairman on September 30, 2020. Heather Pomerantz was appointed as our Chief Financial Officer effective October 1, 2020.

|

LEADERSHIP CHANGES

Heather Pomerantz, previously Executive Vice President of Finance, became the Chief Financial Officer in October 2020 and Richard Kassar, previously Chief Financial

Officer, began an advisory role as Vice Chairman at that time. Additionally, the Company announced two significant new hires in 2020: Thembi Machaba joined Freshpet in August 2020 as Senior Vice President of Human Resources, and Ricardo Moreno joined

the Company as Vice President of Manufacturing in December 2020.

COMPENSATION PHILOSOPHY AND OBJECTIVES

Our philosophy is to align our executive compensation with the interests of our stockholders by basing our more fundamental compensation decisions on financial objectives

that our Board of Directors (or Board) believes have a significant impact on long-term stockholder value. An important goal of our executive compensation program is to help ensure that we hire and retain talented and experienced executives who are

motivated to achieve or exceed our short-term and long-term corporate goals. Our executive compensation program is designed to reinforce a strong pay-for-performance orientation and to serve the following purposes:

|

|

·

|

to reward our NEOs for sustained financial and operating performance and strong leadership;

|

|

|

·

|

to align our NEOs’ interests with the interests of our stockholders; and

|

|

|

·

|

to encourage our successful NEOs to remain with us for the long-term.

|

Underpinning our compensation philosophy is the belief that Freshpet is a growth company with the potential to have a significant impact on the pet food industry. Achieving

that potential should result in value creation for our stockholders. Thus, we believe that management’s incentives, our annual goals, and our longer-term goals set by the Company’s Compensation Committee (or Compensation Committee) and the Board should

reflect that growth orientation.

COMPENSATION STRATEGY

The Compensation Committee has numerous tools at its disposal to help Freshpet accomplish its short-

EXECUTIVE COMPENSATION | 40

and long-term performance goals. The Compensation Committee generally chooses to utilize those tools as follows in its administration and oversight of our executive

compensation program.

The Compensation Committee selects a peer group for compensation comparison purposes that includes a blend of comparably-sized companies in similar industries, including

pet-related companies—our most likely sources of talent to support our growth. But the Compensation Committee also deliberately adds companies experiencing significant growth to help ensure that our compensation practices are competitive with—and

relevant to—the circumstances found in growth-oriented companies so that they contribute to the growth potential of Freshpet. The Company considers peer group data for overall compensation and for specific elements of compensation.

Significant Portion of Compensation as Equity

We award a significant portion of executive compensation as equity as we believe this is an effective way to help management focus on our long-term goals while also

aligning stockholder and management interests. A meaningful portion of our executive compensation consists of stock options, which awards have no value to the recipient unless our stock price rises. Additionally, supplemental awards within the broader

organization are rarely paid in cash but instead consist of equity awards. Finally, in 2020, we again decided to include all employees Company-wide in our equity compensation program, including hourly employees, in order to better foster an ownership

mentality and drive long-term growth. For each grant, the vesting requirement is typically at least three years or tied to a specific, long-term achievement.

Long-Term Goal Setting

We set a four-year growth goal for management in 2016 and have issued significant equity awards to our most senior managers tied to that goal. For our CEO, Mr. Cyr, his

2016 award of stock options replaced subsequent annual awards in order to emphasize the importance of achieving our long-term growth goals. Messrs. Kassar, Morris and Weise also received stock options with the same objectives in 2016 to help ensure

alignment amongst our leadership team with the Company’s long-term goals. Additionally, our COO, Mr. Morris, was granted a significant number of stock options in 2017 (replacing subsequent annual grants) to drive similar behavior. Further, the Board

has continually reinforced to management its belief in driving long-term growth via annual goals that are set. The Board has encouraged management to make prudent, near-term investments—even at the expense of near-term earnings—to better drive

long-term growth and to enable Freshpet to satisfy our overarching goal of long-term growth.

In 2020, upon the conclusion of the performance period for the 2016 multi-year grants, the Company set new long-term goals and issued significant multi-year grants to the

current leadership and the leading candidates to be the next generation of leadership within the Company. In total, eight individuals (including two women and two leaders who identify as minorities) were included in the program. The program included

aggressive growth goals, and the Company believes that delivery of those goals would generate significant long-term value creation for the Company and its investors. For the NEOs, the equity grants are 75% performance-based and 25% time-based and

replace all annual grants for the next four years for those individuals. Our experience with the 2016 program and the results it delivered would indicate that this approach will focus and align management on the greatest long-term value creation.

Encouraging Teamwork

We strongly believe that teamwork among our workforce is essential to help us achieve our long-term growth potential. Thus, all bonus-eligible employees—including our

NEOs—are compensated using the same bonus formula. Each employee earns the same percentage of his or her target award each year, assuming there are no outstanding, individual performance issues. We believe that this creates an “all-for-one and

one-for-all” mentality within Freshpet that allows individual employees to make the right choices for the Company without regard to their impact on the achievement of less important functional or personal goals. Additionally, Mr. Cyr, at his own

recommendation, has chosen to forego salary increases and instead has reallocated those dollars within his leadership team to reinforce his commitment to our teams and to recognize the strong performance of his colleagues. For 2021, Mr. Cyr

specifically allocated his base salary increase to three leaders who were most responsible for protecting the safety of our team during the COVID pandemic.

EXECUTIVE COMPENSATION | 41

Incenting Sales Growth

We set what we believe to be aggressive net sales growth targets for management each year and our annual incentive plan formula places equal value—both weighting (50%) and

economic value ($ at risk)—on the achievement of those net sales growth targets versus profitability goals. This helps to ensure that our management seeks to drive sales growth in concert with profit growth.

Demanding Quality

We believe that no factor is more important to our long-term success than the quality of the products that we produce every day. As such, every manufacturing employee is

incentivized each quarter for the achievement of a set of goals, many of which are either directly or indirectly connected to the production of outstanding pet foods that meet our high-quality standards. The Board also regularly reviews the Company’s

performance against its quality targets.

HOW ELEMENTS OF OUR EXECUTIVE COMPENSATION PROGRAM ARE RELATED TO EACH OTHER

The various components of our compensation program are related but distinct and are designed to emphasize “pay for performance,” with a significant portion of total

compensation reflecting a risk aspect tied to our long-term and short-term financial and strategic goals. Our compensation philosophy is designed to foster entrepreneurship at all levels of the organization and is focused on employee value and

retention by making long-term, equity-based incentive opportunities a substantial component of our executive compensation. The appropriate level for each compensation component is based in part, but not exclusively, on internal equity and consistency,

experience, and responsibilities, and other relevant considerations such as rewarding extraordinary performance. The Compensation Committee has not adopted any formal or informal policies or guidelines for allocating compensation between long-term and

currently paid out compensation, between cash and non-cash compensation, or among different forms of non-cash compensation.

BUSINESS HIGHLIGHTS AND FISCAL 2020 OVERVIEW

While fiscal year 2020 has been uniquely challenging to businesses around the globe, including Freshpet, the Board and management team

focused on responding decisively to manage the business impacts of the pandemic while maintaining our philosophy of pay-for-performance in the midst of significant and unprecedented challenges. As a result, the Company delivered its strongest year of

net sales growth since 2015 despite the numerous challenges presented by the COVID pandemic.

|

EVENT/TOPIC

|

IMPACT/RESPONSE

|

|

COVID-19

|

We experienced increased demand and lower media costs.

Despite lockdowns and labor challenges, the Company completed construction and commenced the operations of Freshpet Kitchens 2.0 at our Freshpet Kitchens in Bethlehem,

Pennsylvania, the Company’s largest completed capital project.

We strived to keep our employees safe to ensure their health and well-being and so that the Company could fulfill its responsibilities to customers and consumers who

depend on a steady supply of Freshpet.

|

|

2020 Company Performance

|

Net sales increased 30% for the year ended 2020, our highest annual growth for net sales in 5 years.

Household penetration of Freshpet increased 24%, and the buying rate of the brand increased 7%, in each case, compared to the prior fiscal year.

|

EXECUTIVE COMPENSATION | 42

|

Pay Governance & Philosophy

|

We have tied our executive compensation plans to strategic and financial objectives of Freshpet’s long-term strategy and shareholder value creation.

A significant portion of the pay for our NEOs is at-risk in both short- and long-term incentives, with a greater emphasis on payout conditions directly tied to achievement

of aggressive objectives of the Feed the Growth strategy. Please see “—Annual Incentive Awards” and —Long-Term Equity Compensation” for further details.

Our shareholders annually vote on Say-on-Pay, helping to show a proven track record of investor support of executive compensation plans. Please see “Proposals—Proposal

III” for more information.

We have a disciplined approach compared to historical CEO pay levels despite total shareholder outperformance compared to peer companies. Please see “Pay-For-Performance

Alignment” for further details.

We have implemented a pay governance framework that we believe promotes long-term shareholder interests. Please see “—Long-Term Equity Compensation” for further details.

|

|

Long-Term Incentivization to

Maximize Shareholder Value

|

Our stock options generally contain a time-based vesting feature

to promote executive retention and align the interests of our executive officers with our stockholders. Please see “—Long-Term Equity Compensation” for further details.

|

|

2020 NEO Pay

|

In 2020, we paid annual incentive awards to our NEOs totaling

approximately $1.3 million in the aggregate. In 2020, we also made multi-year grants of stock options under our 2014 Plan to our NEOs with a grant date fair value, assuming the highest

level of performance, of approximately $56 million in the aggregate, with 75% of those options being performance-based grants and 25% being time-based grants. Please see “—Executive

Compensation Tables—Summary Compensation Table” for further details.

|

|

Why you should support the Say-on-Pay

Proposal

|

In 2020, Freshpet adapted to the COVID-19 pandemic to achieve a record year of growth in net sales.

Our Compensation Committee’s long-term focused executive compensation plan directly incentivized management to deliver outstanding shareholder returns over both short- and

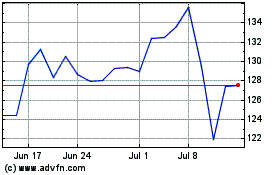

long-term time horizons. For example, our stock price improved from $10.15 on December 30, 2016 to $161.19 on July 2, 2021.

We are committed to incentive programs that motivate and retain a high-quality management team to focus on Freshpet’s strategy execution.

Our 2020 incentive plans are aligned with Company performance and achievement of strategic goals over the long-term.

|

EXECUTIVE COMPENSATION | 43

|

|

Freshpet’s strong pay-for-performance alignment as well as past Say-on-Pay support from shareholders demonstrate the discipline of the Company’s executive compensation

program that we believe is directly tied to shareholder value creation.

|

PAY-FOR-PERFORMANCE ALIGNMENT

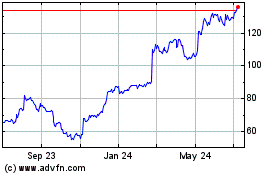

The following graph provides a three-year realizable pay-for-performance overview for our CEO, beginning with December 31, 2017 and ending

with December 31, 2020. As illustrated below, the Compensation Committee has maintained our CEO’s compensation below the median of the competitive market despite top total shareholder return (“TSR”) outperformance.

3-Year TSR Performance Percentile Rank(1)

(Annualized TSR with period ending 12/31/2020)

|

|

(1)

|

Please see “—Peer Group” for our list of peers and their corresponding exchange ticker symbols. Craft Brew Alliance, Inc. is excluded from the above chart as it was purchased by Anheuser-Busch InBev in late 2020.

|

The following graph compares our total common stock return with the total return for (i) the NASDAQ Composite Index (the “NASDAQ

Composite”) and (ii) the Russell 3000 Index (the “Russell 3000”) for the five year period ended December 31, 2020. The graph assumes that $100 was invested on December 31, 2015, in each of our common stock, the NASDAQ Composite and the Russell 3000.

EXECUTIVE COMPENSATION | 44

As shown above, Freshpet’s total common stock return for the 5-year period ended December 31, 2020 has significantly outpaced the total

return for the NASDAQ Composite and the Russell 3000 indices over the same period. The comparisons in the graph are not intended to forecast or be indicative of possible future performance of our common stock.

The Compensation Committee believes that its disciplined, long-term focused approach to compensation design incentivizes management to

achieve challenging objectives of Freshpet’s long-term strategy, which we believe directly correlates to the Company’s peer-leading shareholder value creation and rigorous pay-for-performance alignment. Please see “—Long-Term Equity Compensation” for

further details.

FISCAL 2019 SAY-ON-PAY VOTE RESULTS

In September 2020, at our last annual meeting of stockholders, our Say-on-Pay proposal was approved by approximately 99.5% of the votes

cast by our stockholders. The Compensation Committee and management are committed to continually strengthening our pay-for-performance correlation, as well as the overall design of our executive compensation program to support driving the right

behaviors for sustainable success, aligning with best practices in corporate governance and reflecting the interests of our stockholders and stakeholders. The Compensation Committee and management view the annual say-on-pay vote as an important

guidepost when considering stockholder perspective.

INDEPENDENT COMPENSATION CONSULTANT

In 2019 and 2020, the Compensation Committee retained Korn Ferry (“KF”) to advise it on compensation practices for our top nine officers, including each NEO. Specifically,

KF was engaged to review our compensation peer group and our compensation structure for our executive officers, develop and recommend targets for our executive compensation program by analyzing the compensation structures of our peer group companies

and market trends, and provide advice to the Compensation Committee on our executive compensation structure and program based on KF’s analysis. KF was also engaged to

EXECUTIVE COMPENSATION | 45

separately review the compensation arrangements applicable to employees at the director level and above, and the non-employee, independent directors of the Board. The

Compensation Committee, in consultation with KF, decided to continue in 2020 the executive compensation structure suggested by KF in 2018, as the Compensation Committee determined that the program remained effective in achieving our objectives of

retaining talented and experienced executives who are motivated to achieve or exceed our short-term and long-term corporate goals.

PEER GROUP

The Compensation Committee, in consultation with KF, considered several factors in selecting an industry-specific compensation peer group for our 2020 compensation program.

Considerations generally included the following:

|

|

·

|

revenue between 0.4 and 2.5 times Freshpet’s revenue;

|

|

|

·

|

companies in the food, beverage, and pet products industries;

|

|

|

·

|

companies with similar location and geographical reach;

|

|

|

·

|

companies with similar span, scope, and vertical integration;

|

|

|

·

|

companies experiencing similar rates of growth;

|

|

|

·

|

companies with similar operating complexity; and

|

|

|

·

|

other publicly traded companies.

|

Based on the foregoing considerations, the Compensation Committee determined that our compensation peer group for 2020 would consist of the following entities:

|

|

·

|

Beyond Meat, Inc. (BYND)

|

|

·

|

John B. Sanfilippo & Son, Inc. (JBSS)

|

|

·

|

PetIQ Inc. (PETQ)

|

|

|

|

|

|

|

|

|

|

|

|

|

·

|

Bridgford Foods Corporation (BRID)

|

|

·

|

Landec Corporation (LNDC)

|

|

·

|

PetMed Express, Inc. (PETS)

|

|

|

|

|

|

|

|

|

|

|

|

|

·

|

Craft Brew Alliance, Inc. (BREW)

|

|

·

|

Medifast, Inc. (MED)

|

|