Fossil Group, Inc. (NASDAQ: FOSL) today announced financial results

for the second quarter ended July 2, 2022.

Second Quarter Summary

- Second quarter worldwide net sales

decreased to $371 million, down 10% on a reported basis and 5% in

constant currency, reflecting declines across all three

regions.

- FOSSIL brand sales increased 7% in

constant currency with double digit growth in traditional watches,

jewelry and leathers partially offset by declines in

smartwatches.

- Direct to consumer net sales

increased 5% in constant currency, led by 26% growth in store sales

largely offset by decreased e-commerce sales.

- Operating loss of $11 million

compared to operating income of $14 million a year ago. Adjusted

operating loss of $8 million compared to adjusted operating income

of $21 million last year.

- As of July 2, 2022, cash and cash

equivalents of $167 million.

“During the second quarter, global operating

conditions remained challenging,” said Kosta Kartsotis, Chairman

and CEO. “We saw softening consumer demand during the quarter,

reflecting ongoing inflationary pressure and continued

pandemic-related restrictions in China. Additionally, the slowdown

in consumer purchasing led to fewer inventory replenishment orders

from our wholesale partners. While this macro backdrop impacted our

core traditional watch category, our jewelry and leathers

businesses grew at double digit rates in the quarter.”

“We believe consumer sentiment will continue to

be pressured in the second half of the year and have adjusted our

full year outlook to reflect moderating demand globally. Our teams

are remaining agile while focusing on our core initiatives in

digital and brand heat, and we are confident that our strategies

will maximize shareholder value over the long term.”

Second Quarter 2022 Operating

Results

Amounts referred to as “adjusted” as well as

“constant currency” are non-GAAP financial measures.

Reconciliations of these non-GAAP financial measures to their

closest reported GAAP measures are included at the end of this

press release.

- Net sales totaled

$371.2 million, a decrease of 10% on a reported basis and 5% in

constant currency compared to $410.9 million in the second quarter

of fiscal 2021. Net sales, in constant currency,

decreased 6% in Asia, 4% in the Americas and 3% in Europe versus

the same quarter last year. Traditional watch sales declined 7% in

constant currency in the second quarter while smartwatch sales

decreased 18%, largely driven by the Americas as compared to the

prior year period. The leathers and jewelry categories each grew

12% in constant currency during the second quarter. FOSSIL branded

sales increased 7% in constant currency with growth in Asia and the

Americas partially offset by a decrease in Europe. Direct to

consumer net sales increased 5% in constant currency, led by 26%

growth in store sales largely offset by decreased e-commerce sales.

Total digital sales were down 21% in constant currency versus the

prior year period and reflected 35% of our sales mix compared to

41% in the prior year period. Lower digital sales were primarily

due to traffic shifts from owned e-commerce to brick and mortar

distribution in Europe and the Americas and COVID driven lockdowns

in mainland China.

- Gross profit

totaled $191.3 million compared to $221.8 million in the second

quarter of 2021. Gross margin decreased 240 basis points to 51.6%

versus 54.0% a year ago. The year-over-year decrease primarily

reflects a non-recurrence of the prior year's tariff reductions,

increased freight costs and an unfavorable currency impact. These

costs were partially offset by favorable product mix and pricing

increases and net foreign currency hedging contract gains in the

current year as compared to net foreign currency hedging contract

losses last year.

- Operating expenses

totaled $202.3 million compared to $207.5 million a year

ago. As a percentage of net sales, operating expenses

were 54.5% in the second quarter of 2022 compared to 50.5% in the

prior year second quarter. Selling, general and administrative

(“SG&A”) expenses were $199.2 million compared to $200.5

million in the second quarter of 2021. As a percentage of net

sales, SG&A expenses were 53.7% in the second quarter of 2022

compared to 48.8% in the prior year second quarter, largely driven

by increased compensation costs and investments in our digital

initiatives, which were partially offset by a decline in marketing

expenses and reduced store costs resulting from lower store

count.

- Operating income

(loss) was a loss of $10.9 million compared to income of

$14.3 million in the second quarter of 2021. Operating

margin was (2.9)% in the second quarter of 2022 compared to 3.5% in

the prior year second quarter. Adjusted operating loss totaled $7.8

million compared to adjusted operating income of $21.3 million in

the second quarter of 2021. Adjusted operating margin was (2.1)% in

the second quarter of 2022 compared to 5.2% in the prior year

second quarter.

- Interest expense

decreased to $4.3 million compared to $6.5 million in the second

quarter of 2021, primarily driven by reduced debt issuance costs

amortization and a lower borrowing rate.

- Other income

(expense) was expense of $1.7 million compared to expense

of $0.5 million in the second quarter of 2021.

- Income (loss) before income

taxes was $(16.9) million compared to $7.3 million in the

second quarter of 2021.

- Adjusted EBITDA

was $(0.03) million, or (0.1)% of net sales in the second quarter

of 2022 and $30.3 million, or 7.4% in the prior year quarter.

- Net income (loss)

totaled $(19.1) million with net loss per diluted share of $0.37,

which compares to $(1.2) million and net loss per diluted share of

$0.02 in the prior year quarter. Adjusted net loss for the second

quarter was $(16.6) million with adjusted loss per diluted share of

$0.33 compared to adjusted net income of $4.3 million with adjusted

income per diluted share of $0.08 in the prior year

quarter. During the second quarter of 2022, currencies

unfavorably affected loss per diluted share by approximately

$0.04.

Balance Sheet Summary

As of July 2, 2022, the Company had cash and

cash equivalents of $167 million. Inventories at the end of the

second quarter of 2022 totaled $438 million, an increase of 24%

versus a year ago. Total debt was $249 million.

Outlook

The Company is updating its guidance for full

year 2022 to reflect a more cautious outlook on global markets,

including a slowdown in consumer spending in our categories, the

likelihood of ongoing COVID-19 related restrictions in mainland

China, and the estimated impact of prevailing foreign currency

translation.

For fiscal year 2022, the Company now expects

worldwide net sales declines of approximately 8% to 4% versus prior

guidance of net sales growth of flat to 3%. This

updated guidance includes an estimated foreign currency negative

impact of 450 basis points, which compares to our prior estimate of

350 basis points for the full year.

The Company is reducing adjusted operating

margin(1) guidance for the full year and now expects adjusted

operating margin of 2% to 4% compared to prior guidance of 5.5% to

6.5%.

(1) A reconciliation of adjusted operating

margin, a non-GAAP financial measure, to a corresponding GAAP

measure is not available on a forward-looking basis without

unreasonable efforts due to the high variability and low visibility

of certain income and expense items that are excluded in

calculating adjusted operating margin.

Safe Harbor

Certain statements contained herein that are not

historical facts, constitute “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of 1995

and involve a number of risks and uncertainties. The

actual results of the future events described in such

forward-looking statements could differ materially from those

stated in such forward-looking statements. Among the

factors that could cause actual results to differ materially are:

increased political uncertainty and the Ukraine crisis; the effect

of worldwide economic conditions; the effect of the COVID-19

pandemic; the impact of inflation; results of tax examinations;

significant changes in consumer spending patterns or preferences;

interruptions or delays in the supply of key components or

products; acts of war or acts of terrorism; loss of key facilities;

data breach or information systems disruptions; changes in foreign

currency valuations in relation to the U.S. dollar; lower levels of

consumer spending resulting from a general economic downturn or

generally reduced shopping activity caused by public safety or

consumer confidence concerns; the performance of our products

within the prevailing retail environment; customer acceptance of

both new designs and newly-introduced product lines; changes in the

mix of product sales; the effects of vigorous competition in the

markets in which we operate; compliance with debt covenants and

other contractual provisions and meeting debt service obligations;

risks related to the success of our business strategy; the

termination or non-renewal of material licenses; risks related to

foreign operations and manufacturing; changes in the costs of

materials and labor; government regulation and tariffs; our ability

to secure and protect trademarks and other intellectual property

rights; levels of traffic to and management of our retail stores;

loss of key personnel and the outcome of current and possible

future litigation, as well as the risks and uncertainties set forth

in the Company’s most recent Annual Report on Form 10-K and

subsequent Quarterly Reports on Form 10-Q filed with the Securities

and Exchange Commission (the “SEC”). These forward-looking

statements are based on our current expectations and beliefs

concerning future developments and their potential effect on us.

While management believes that these forward-looking statements are

reasonable as and when made, there can be no assurance that future

developments affecting us will be those that we

anticipate. Readers of this release should consider

these factors in evaluating, and are cautioned not to place undue

reliance on, the forward-looking statements contained

herein. The Company assumes no obligation to publicly

update or revise any forward-looking statements, whether as a

result of new information, future events, or otherwise, except as

required by law.

About Fossil

Group, Inc.

Fossil Group, Inc. is a global design,

marketing, distribution and innovation company specializing in

lifestyle accessories. Under a diverse portfolio of

owned and licensed brands, our offerings include traditional

watches, smartwatches, jewelry, handbags, small leather goods,

belts and sunglasses. We are committed to delivering

the best in design and innovation across our owned brands, Fossil,

Michele, Relic, Skagen and Zodiac, and licensed brands, Armani

Exchange, Diesel, DKNY, Emporio Armani, kate spade new york,

Michael Kors, PUMA and Tory Burch. We bring each brand

story to life through an extensive distribution network across

numerous geographies, categories and channels. Certain

press release and SEC filing information concerning the Company is

also available at www.fossilgroup.com.

|

Investor Relations: |

Christine Greany |

| |

The Blueshirt Group |

| |

(858) 722-7815 |

| |

christine@blueshirtgroup.com |

| |

|

| Consolidated Income

Statement Data |

For the 13

Weeks Ended |

|

For the 13

Weeks Ended |

|

For the 26

Weeks Ended |

|

For the 26

Weeks Ended |

| ($ in millions, except

per share data): |

July 2, 2022 |

|

July 3, 2021 |

|

July 2, 2022 |

|

July 3, 2021 |

|

Net sales |

$ |

371.2 |

|

|

$ |

410.9 |

|

|

$ |

747.0 |

|

|

$ |

774.0 |

|

| Cost of sales |

|

179.9 |

|

|

|

189.1 |

|

|

|

371.3 |

|

|

|

369.6 |

|

|

Gross profit |

|

191.3 |

|

|

|

221.8 |

|

|

|

375.7 |

|

|

|

404.4 |

|

| Gross margin |

|

51.6 |

% |

|

|

54.0 |

% |

|

|

50.3 |

% |

|

|

52.2 |

% |

| Operating expenses: |

|

|

|

|

|

|

|

|

Selling, general and administrative expenses |

|

199.1 |

|

|

|

200.5 |

|

|

|

395.0 |

|

|

|

387.8 |

|

|

Other long-lived asset impairments |

|

0.2 |

|

|

|

1.3 |

|

|

|

0.5 |

|

|

|

5.7 |

|

|

Restructuring charges |

|

2.9 |

|

|

|

5.7 |

|

|

|

5.4 |

|

|

|

13.3 |

|

| Total operating expenses |

$ |

202.2 |

|

|

$ |

207.5 |

|

|

$ |

400.9 |

|

|

$ |

406.8 |

|

| Total operating expenses (% of

net sales) |

|

54.5 |

% |

|

|

50.5 |

% |

|

|

53.7 |

% |

|

|

52.6 |

% |

| Operating income (loss) |

|

(10.9 |

) |

|

|

14.3 |

|

|

|

(25.2 |

) |

|

|

(2.4 |

) |

| Operating margin |

|

(2.9 |

)% |

|

|

3.5 |

% |

|

|

(3.4 |

)% |

|

|

(0.3 |

)% |

| Interest expense |

|

4.3 |

|

|

|

6.5 |

|

|

|

8.3 |

|

|

|

13.9 |

|

| Other income (expense) -

net |

|

(1.7 |

) |

|

|

(0.5 |

) |

|

|

(0.1 |

) |

|

|

1.4 |

|

| Income (loss) before income

taxes |

|

(16.9 |

) |

|

|

7.3 |

|

|

|

(33.6 |

) |

|

|

(14.9 |

) |

| Provision for income

taxes |

|

2.0 |

|

|

|

8.1 |

|

|

|

6.7 |

|

|

|

10.2 |

|

|

Less: Net income attributable to noncontrolling interest |

|

0.2 |

|

|

|

0.4 |

|

|

|

0.3 |

|

|

|

0.5 |

|

| Net income (loss) attributable

to Fossil Group, Inc. |

$ |

(19.1 |

) |

|

$ |

(1.2 |

) |

|

$ |

(40.6 |

) |

|

$ |

(25.6 |

) |

| Earnings per share: |

|

|

|

|

|

|

|

|

Basic |

$ |

(0.37 |

) |

|

$ |

(0.02 |

) |

|

$ |

(0.78 |

) |

|

$ |

(0.50 |

) |

|

Diluted |

$ |

(0.37 |

) |

|

$ |

(0.02 |

) |

|

$ |

(0.78 |

) |

|

$ |

(0.50 |

) |

| Weighted average common shares

outstanding: |

|

|

|

|

|

|

|

|

Basic |

|

51.7 |

|

|

|

52.0 |

|

|

|

51.9 |

|

|

|

51.8 |

|

|

Diluted |

|

51.7 |

|

|

|

52.0 |

|

|

|

51.9 |

|

|

|

51.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated Balance Sheet Data ($ in

millions): |

July 2, 2022 |

|

July 3, 2021 |

|

Assets: |

|

|

|

|

Cash and cash equivalents |

$ |

167.1 |

|

|

$ |

252.3 |

|

|

Accounts receivable - net |

|

176.5 |

|

|

|

187.6 |

|

|

Inventories |

|

437.9 |

|

|

|

352.0 |

|

|

Other current assets |

|

183.3 |

|

|

|

157.3 |

|

|

Total current assets |

$ |

964.8 |

|

|

$ |

949.2 |

|

|

Property, plant and equipment - net |

$ |

80.6 |

|

|

$ |

97.6 |

|

|

Operating lease right-of-use assets |

|

168.6 |

|

|

|

199.5 |

|

|

Intangible and other assets - net |

|

69.4 |

|

|

|

91.1 |

|

|

Total long-term assets |

$ |

318.6 |

|

|

$ |

388.2 |

|

|

Total assets |

$ |

1,283.4 |

|

|

$ |

1,337.4 |

|

| |

|

|

|

|

Liabilities and stockholders’ equity: |

|

|

|

|

Accounts payable, accrued expenses and other current

liabilities |

$ |

420.7 |

|

|

$ |

483.4 |

|

|

Short-term debt |

|

0.6 |

|

|

|

38.4 |

|

|

Total current liabilities |

$ |

421.3 |

|

|

$ |

521.8 |

|

|

Long-term debt |

$ |

248.9 |

|

|

$ |

139.7 |

|

|

Long-term operating lease liabilities |

|

163.9 |

|

|

|

203.0 |

|

|

Other long-term liabilities |

|

55.3 |

|

|

|

63.6 |

|

|

Total long-term liabilities |

$ |

468.1 |

|

|

$ |

406.3 |

|

|

Stockholders’ equity |

|

394.0 |

|

|

$ |

409.3 |

|

|

Total liabilities and stockholders’ equity |

$ |

1,283.4 |

|

|

$ |

1,337.4 |

|

|

|

|

|

|

|

|

|

|

Constant Currency Financial

Information

The following table presents the Company’s

business segment and product net sales on a constant currency basis

which are non-GAAP financial measures. To calculate net sales on a

constant currency basis, net sales for the current fiscal year

period for entities reporting in currencies other than the U.S.

dollar are translated into U.S. dollars at the average rates during

the comparable period of the prior fiscal year. The Company

presents constant currency information to provide investors with a

basis to evaluate how its underlying business performed excluding

the effects of foreign currency exchange rate fluctuations. The

constant currency financial information presented herein should not

be considered a substitute for, or superior to, the measures of

financial performance prepared in accordance with GAAP.

| |

Net SalesFor the 13 Weeks

Ended |

|

Net SalesFor the 26 Weeks

Ended |

|

July 2, 2022 |

|

July 3, 2021 |

|

July 2, 2022 |

|

July 3, 2021 |

|

($ in millions) |

As Reported |

|

Impact of Foreign Currency Exchange Rates |

|

Constant Currency |

|

As Reported |

|

As Reported |

|

Impact of Foreign Currency Exchange Rates |

|

Constant Currency |

|

As Reported |

| Segment: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Americas |

$ |

168.3 |

|

$ |

0.8 |

|

$ |

169.1 |

|

$ |

176.7 |

|

$ |

330.2 |

|

$ |

1.0 |

|

$ |

331.2 |

|

$ |

329.2 |

| Europe |

|

107.9 |

|

|

12.5 |

|

|

120.4 |

|

|

124.4 |

|

|

232.4 |

|

|

19.2 |

|

|

251.6 |

|

|

233.7 |

| Asia |

|

92.6 |

|

|

4.3 |

|

|

96.9 |

|

|

103.5 |

|

|

179.4 |

|

|

5.9 |

|

|

185.3 |

|

|

202.1 |

| Corporate |

|

2.4 |

|

|

0.1 |

|

|

2.5 |

|

|

6.3 |

|

|

5.0 |

|

|

0.1 |

|

|

5.1 |

|

|

9.0 |

| Total net sales |

$ |

371.2 |

|

$ |

17.7 |

|

$ |

388.9 |

|

$ |

410.9 |

|

$ |

747.0 |

|

$ |

26.2 |

|

$ |

773.2 |

|

$ |

774.0 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Product Categories: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Watches: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Traditional watches |

$ |

258.7 |

|

$ |

11.4 |

|

$ |

270.1 |

|

$ |

290.6 |

|

$ |

520.1 |

|

$ |

16.6 |

|

$ |

536.7 |

|

$ |

533.0 |

|

Smartwatches |

|

33.4 |

|

|

2.0 |

|

|

35.4 |

|

|

43.1 |

|

|

71.4 |

|

|

3.1 |

|

|

74.5 |

|

|

96.0 |

| Total watches |

$ |

292.1 |

|

$ |

13.4 |

|

$ |

305.5 |

|

$ |

333.7 |

|

$ |

591.5 |

|

$ |

19.7 |

|

$ |

611.2 |

|

$ |

629.0 |

| Leathers |

|

35.9 |

|

|

1.3 |

|

|

37.2 |

|

|

33.3 |

|

|

70.1 |

|

|

2.0 |

|

|

72.1 |

|

|

67.5 |

| Jewelry |

|

33.9 |

|

|

2.6 |

|

|

36.5 |

|

|

32.6 |

|

|

68.6 |

|

|

3.8 |

|

|

72.4 |

|

|

58.7 |

| Other |

|

9.3 |

|

|

0.4 |

|

|

9.7 |

|

|

11.3 |

|

|

16.8 |

|

|

0.7 |

|

|

17.5 |

|

|

18.8 |

| Total net sales |

$ |

371.2 |

|

$ |

17.7 |

|

$ |

388.9 |

|

$ |

410.9 |

|

$ |

747.0 |

|

$ |

26.2 |

|

$ |

773.2 |

|

$ |

774.0 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA, Adjusted operating

income (loss), Adjusted net income (loss) and Adjusted earnings

(loss) per share

Adjusted EBITDA, Adjusted operating income

(loss), Adjusted net income (loss) and Adjusted earnings (loss) per

share are non-GAAP financial measures. We define

Adjusted EBITDA as our net income (loss) before the impact of

income tax expense (benefit), plus interest expense, amortization

and depreciation, impairment expense, other non-cash charges,

stock-based compensation expense, restructuring expense and

unamortized debt issuance costs included in loss on extinguishment

of debt minus interest income. We define Adjusted operating income

(loss) as operating income (loss) before impairment expense and

restructuring expense. We define Adjusted net income (loss) and

Adjusted earnings (loss) per share as net income (loss)

attributable to Fossil Group, Inc. and diluted earnings (loss) per

share, respectively, before impairment expense, restructuring

expense and unamortized debt issuance costs included in loss on

extinguishment of debt. We have included Adjusted EBITDA, Adjusted

operating income (loss), Adjusted net income (loss) and Adjusted

earnings (loss) per share herein because they are widely used by

investors for valuation and for comparing our financial performance

with the performance of our competitors. We also use both non-GAAP

financial measures to monitor and compare the financial performance

of our operations. Our presentation of Adjusted EBITDA,

Adjusted operating income (loss), Adjusted net income (loss) and

Adjusted earnings (loss) per share may not be comparable to

similarly titled measures other companies report.

Adjusted EBITDA, Adjusted operating income (loss), Adjusted net

income (loss) and Adjusted earnings (loss) per share are not

intended to be used as alternatives to any measure of our

performance in accordance with GAAP.

The following tables reconcile Adjusted EBITDA

to the most directly comparable GAAP financial measure, which is

income (loss) before income taxes. Certain line items

presented in the tables below, when aggregated, may not foot due to

rounding.

| |

Fiscal 2021(1) |

|

Fiscal 2022 |

|

|

| ($ in

millions): |

Q3 |

|

Q4 |

|

Q1 |

|

Q2 |

|

Total |

|

Income (loss) before income taxes |

$ |

40.9 |

|

|

$ |

27.1 |

|

|

$ |

(16.7 |

) |

|

$ |

(16.9 |

) |

|

$ |

34.4 |

|

|

Plus: |

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

6.4 |

|

|

|

4.8 |

|

|

|

4.0 |

|

|

|

4.3 |

|

|

|

19.5 |

|

|

Amortization and depreciation |

|

7.0 |

|

|

|

6.2 |

|

|

|

6.2 |

|

|

|

5.8 |

|

|

|

25.2 |

|

|

Impairment expense |

|

0.6 |

|

|

|

2.9 |

|

|

|

0.3 |

|

|

|

0.2 |

|

|

|

4.0 |

|

|

Other non-cash charges |

|

1.1 |

|

|

|

(0.6 |

) |

|

|

(0.2 |

) |

|

|

(0.2 |

) |

|

|

0.1 |

|

|

Stock-based compensation |

|

2.9 |

|

|

|

2.4 |

|

|

|

2.2 |

|

|

|

3.8 |

|

|

|

11.3 |

|

|

Restructuring expense |

|

5.4 |

|

|

|

3.2 |

|

|

|

2.6 |

|

|

|

2.9 |

|

|

|

14.1 |

|

|

Unamortized debt issuance costs included in loss on extinguishment

of debt |

|

— |

|

|

|

11.7 |

|

|

|

— |

|

|

|

— |

|

|

|

11.7 |

|

|

Less: |

|

|

|

|

|

|

|

|

|

|

Interest income |

|

0.1 |

|

|

|

0.1 |

|

|

|

0.1 |

|

|

|

0.2 |

|

|

|

0.5 |

|

| Adjusted EBITDA |

$ |

64.2 |

|

|

$ |

57.6 |

|

|

$ |

(1.7 |

) |

|

$ |

(0.3 |

) |

|

$ |

119.8 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Prior period amounts have been adjusted to conform to

the current period presentation.

| |

Fiscal 2020(1) |

|

Fiscal 2021 |

|

|

| ($ in

millions): |

Q3 |

|

Q4 |

|

Q1 |

|

Q2 |

|

Total |

|

Income (loss) before income taxes |

$ |

9.5 |

|

|

$ |

11.5 |

|

|

$ |

(22.2 |

) |

|

$ |

7.3 |

|

|

$ |

6.1 |

|

|

Plus: |

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

8.0 |

|

|

|

8.4 |

|

|

|

7.3 |

|

|

|

6.5 |

|

|

|

30.2 |

|

|

Amortization and depreciation |

|

10.3 |

|

|

|

10.0 |

|

|

|

8.9 |

|

|

|

7.5 |

|

|

|

36.7 |

|

|

Impairment expense |

|

4.6 |

|

|

|

6.5 |

|

|

|

4.5 |

|

|

|

1.3 |

|

|

|

16.9 |

|

|

Other non-cash charges |

|

2.0 |

|

|

|

1.0 |

|

|

|

(0.2 |

) |

|

|

(0.4 |

) |

|

|

2.5 |

|

|

Stock-based compensation |

|

3.2 |

|

|

|

1.9 |

|

|

|

1.8 |

|

|

|

2.5 |

|

|

|

9.4 |

|

|

Restructuring expense |

|

5.7 |

|

|

|

10.9 |

|

|

|

7.5 |

|

|

|

5.7 |

|

|

|

29.8 |

|

|

Less: |

|

|

|

|

|

|

|

|

|

|

Interest income |

|

0.1 |

|

|

|

0.2 |

|

|

|

0.1 |

|

|

|

0.1 |

|

|

|

0.5 |

|

| Adjusted EBITDA |

$ |

43.3 |

|

|

$ |

50.0 |

|

|

$ |

7.5 |

|

|

$ |

30.3 |

|

|

$ |

131.1 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Prior period amounts have been adjusted to conform to the

current period presentation.

The following tables reconcile Adjusted

operating income (loss), Adjusted net income (loss) and Adjusted

earnings (loss) per share to the most directly comparable GAAP

financial measures, which are operating income (loss), net income

(loss) attributable to Fossil Group, Inc. and diluted earnings

(loss) per share, respectively. Certain line items presented in the

table below, when aggregated, may not foot due to rounding.

| |

For the 13 Weeks Ended July 2, 2022 |

| ($ in millions, except

per share data): |

As Reported |

Other Long-Lived Asset Impairment |

Restructuring Expenses |

As Adjusted |

|

Operating income (loss) |

$ |

(10.9 |

) |

$ |

0.2 |

|

$ |

2.9 |

|

$ |

(7.8 |

) |

|

Operating margin (% of net sales) |

|

(2.9 |

)% |

|

|

|

(2.1 |

)% |

|

Interest expense |

|

(4.3 |

) |

|

— |

|

|

— |

|

|

(4.3 |

) |

|

Other income (expense) - net |

|

(1.7 |

) |

|

— |

|

|

— |

|

|

(1.7 |

) |

|

Income (loss) before income taxes |

|

(16.9 |

) |

|

0.2 |

|

|

2.9 |

|

|

(13.8 |

) |

|

Provision for income taxes |

|

2.0 |

|

|

— |

|

|

0.6 |

|

|

2.6 |

|

|

Less: Net income attributable to noncontrolling interest |

|

(0.2 |

) |

|

— |

|

|

— |

|

|

(0.2 |

) |

|

Net income (loss) attributable to Fossil Group, Inc. |

$ |

(19.1 |

) |

$ |

0.2 |

|

$ |

2.3 |

|

$ |

(16.6 |

) |

| Diluted earnings (loss) per

share |

$ |

(0.37 |

) |

$ |

— |

|

$ |

0.04 |

|

$ |

(0.33 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

For the 13 Weeks Ended July 3, 2021 |

| ($ in millions, except

per share data): |

As Reported |

Other Long-Lived Asset Impairment |

Restructuring Expenses |

As Adjusted |

|

Operating income (loss) |

$ |

14.3 |

|

$ |

1.3 |

|

$ |

5.7 |

|

$ |

21.3 |

|

|

Operating margin (% of net sales) |

|

3.5 |

% |

|

|

|

5.2 |

% |

|

Interest expense |

|

(6.5 |

) |

|

— |

|

|

— |

|

|

(6.5 |

) |

|

Other income (expense) - net |

|

(0.5 |

) |

|

— |

|

|

— |

|

|

(0.5 |

) |

|

Income (loss) before income taxes |

|

7.3 |

|

|

1.3 |

|

|

5.7 |

|

|

14.3 |

|

|

Provision for income taxes |

|

8.1 |

|

|

0.3 |

|

|

1.2 |

|

|

9.6 |

|

|

Less: Net income attributable to noncontrolling interest |

|

(0.4 |

) |

|

— |

|

|

— |

|

|

(0.4 |

) |

|

Net income (loss) attributable to Fossil Group, Inc. |

$ |

(1.2 |

) |

$ |

1.0 |

|

$ |

4.5 |

|

$ |

4.3 |

|

| Diluted earnings (loss) per

share |

$ |

(0.02 |

) |

$ |

0.02 |

|

$ |

0.09 |

|

$ |

0.08 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

For the 26 Weeks Ended July 2, 2022 |

| ($ in millions, except

per share data): |

As Reported |

Other Long-Lived Asset Impairment |

Restructuring Expenses |

As Adjusted |

|

Operating income (loss) |

$ |

(25.2 |

) |

$ |

0.5 |

|

$ |

5.4 |

|

$ |

(19.3 |

) |

|

Operating margin (% of net sales) |

|

(3.4 |

)% |

|

|

|

(2.6 |

)% |

|

Interest expense |

|

(8.3 |

) |

|

— |

|

|

— |

|

|

(8.3 |

) |

|

Other income (expense) - net |

|

(0.1 |

) |

|

— |

|

|

— |

|

|

(0.1 |

) |

|

Income (loss) before income taxes |

|

(33.6 |

) |

|

0.5 |

|

|

5.4 |

|

|

(27.7 |

) |

|

Provision for income taxes |

|

6.7 |

|

|

0.1 |

|

|

1.1 |

|

|

7.9 |

|

|

Less: Net income attributable to noncontrolling interest |

|

(0.3 |

) |

|

— |

|

|

— |

|

|

(0.3 |

) |

|

Net income (loss) attributable to Fossil Group, Inc. |

$ |

(40.6 |

) |

$ |

0.4 |

|

$ |

4.3 |

|

$ |

(35.9 |

) |

| Diluted earnings (loss) per

share |

$ |

(0.78 |

) |

$ |

0.01 |

|

$ |

0.08 |

|

$ |

(0.69 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

For the 26 Weeks Ended July 3, 2021 |

| ($ in millions, except

per share data): |

As Reported |

Other Long-Lived Asset Impairment |

Restructuring Expenses |

As Adjusted |

|

Operating income (loss) |

$ |

(2.4 |

) |

$ |

5.7 |

|

$ |

13.3 |

|

$ |

16.6 |

|

|

Operating margin (% of net sales) |

|

(0.3 |

)% |

|

|

|

2.1 |

% |

|

Interest expense |

|

(13.9 |

) |

|

— |

|

|

— |

|

|

(13.9 |

) |

|

Other income (expense) - net |

|

1.4 |

|

|

— |

|

|

— |

|

|

1.4 |

|

|

Income (loss) before income taxes |

|

(14.9 |

) |

|

5.7 |

|

|

13.3 |

|

|

4.1 |

|

|

Provision for income taxes |

|

10.2 |

|

|

1.2 |

|

|

2.8 |

|

|

14.2 |

|

|

Less: Net income attributable to noncontrolling interest |

|

(0.5 |

) |

|

— |

|

|

— |

|

|

(0.5 |

) |

|

Net income (loss) attributable to Fossil Group, Inc. |

$ |

(25.6 |

) |

$ |

4.5 |

|

$ |

10.5 |

|

$ |

(10.6 |

) |

| Diluted earnings (loss) per

share |

$ |

(0.50 |

) |

$ |

0.09 |

|

$ |

0.20 |

|

$ |

(0.21 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Store Count Information

|

|

July 3, 2021 |

|

Opened |

|

Closed |

|

July 2, 2022 |

|

Americas |

166 |

|

|

0 |

|

|

9 |

|

|

157 |

|

| Europe |

133 |

|

|

1 |

|

|

21 |

|

|

113 |

|

| Asia |

87 |

|

|

4 |

|

|

12 |

|

|

79 |

|

| Total stores |

386 |

|

|

5 |

|

|

42 |

|

|

349 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

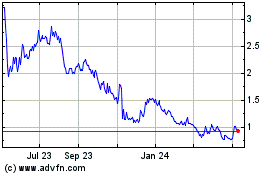

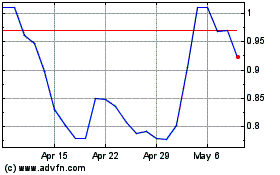

Fossil (NASDAQ:FOSL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Fossil (NASDAQ:FOSL)

Historical Stock Chart

From Apr 2023 to Apr 2024