Foresight Autonomous Holdings Ltd., an innovator in automotive

vision systems (Nasdaq and TASE: FRSX), today reported financial

results for the third quarter ended September 30, 2020. Foresight

ended the third quarter of 2020 with $14.5 million in cash and

short-term deposits, GAAP net loss of $11.4 million and non-GAAP

net loss for the same period of $10.5 million.

“Foresight continued to demonstrate steady progress in the third

quarter, as we established new partnerships with influential

players in Europe, Japan and China,” commented Haim Siboni, CEO of

Foresight. “We are confident that our new relationships with

leading companies such as Elbit Systems and FLIR Systems will lead

to stable sales growth, as we continue to refine our products and

technology based on feedback from our prototype system sales. I am

proud of how Foresight has responded to the market situation posed

by the COVID-19 pandemic, as we have worked not only to maintain

stable business performance, but also to develop a COVID-19 symptom

screening solution which leverages our leading thermal and

visible-light camera technology.”

“The third quarter also saw notable progress for our subsidiary

Eye-Net Mobile and our affiliated company Rail Vision,” continued

Mr. Siboni. “Both companies made impressive strides in new markets,

demonstrating the long-term potential of their innovative

technologies. Rail Vision has accomplished the first commercial

agreement for its shunting yard solution which is currently being

evaluated by a major European train operator, while Eye-Net

Mobile’s Eye-Net™ Protect solution is undergoing pilot projects

with two multi-billion-dollar Japanese companies. We are optimistic

that successful evaluation could lead to further collaboration with

these impressive partners.”

Third Quarter 2020 Financial

Results

- Research and development (R&D) expenses for the three

months ended September 30, 2020 were $2,157,000 compared to

$2,547,000 in the three months ended September 30, 2019. The

decrease is attributed mainly to a decrease in subcontracted

services.

- General and administrative (G&A) expenses for the three

months ended September 30, 2020 were $918,000 compared to $893,000

in the three months ended September 30, 2019. The increase is

attributed mainly to an increase in payroll expenses partially

offset by a decrease in professional services.

- GAAP net loss for the three months ended September 30, 2020 was

$3,980,000, or $0.02 loss per ordinary share, compared to GAAP net

loss of $3,931,000, or $0.03 loss per ordinary share, in the three

months ended September 30, 2019. The increase is attributed mainly

to an increase in equity in net loss of an affiliated company.

- Non-GAAP net loss for the three months ended September 30, 2020

was $3,420,000, or $0.02 loss per ordinary share, compared to a

non-GAAP net loss of $3,439,000, or $0.01 loss per ordinary share,

in the three months ended September 30, 2019. A reconciliation

between GAAP net loss and non-GAAP net loss is provided following

the financial statements that are part of this release. Non-GAAP

results exclude the effect of stock-based compensation expenses,

revaluation of other investments and revaluation of derivative

warrant liability.

Balance Sheet Highlights

- Cash and cash equivalents and short-term deposits totaled $14.5

million as of September 30, 2020, compared to $13.1 million on

September 30, 2019.

- Investments in Rail Vision Ltd. totaled $4.7 million as of

September 30, 2020, compared to $7.4 million on September 30, 2019.

The decrease is attributed mainly to equity in net loss of Rail

Vision’s results.

- GAAP shareholders’ equity totaled $18.8 million as of September

30, 2020, compared to $16.3 million as of December 31, 2019.

- Non-GAAP shareholders’ equity totaled $18.8 million as of

September 30, 2020, compared to $16.6 million as of December 31,

2019.

As of September 30,

As of

December 31,

(thousands of U.S. dollars)

2020

2019

2019

GAAP Results

Shareholders’ equity

$ 18,767

$ 20,307

$ 16,288

Non-GAAP Results

Shareholders' equity

$ 18,767

$ 20,631

$ 16,612

A reconciliation between GAAP shareholders’ equity results and

non-GAAP shareholders’ equity results is provided following the

financial statements that are part of this release. Non-GAAP

results exclude revaluation of other investments.

Recent Corporate

Highlights:

- Foresight Received Two Product Orders from Elbit Systems

Ltd.: In July, Foresight received two orders for product

development and customization from Elbit Systems Land Ltd., a

subsidiary of the leading Israeli defense company Elbit Systems.

According to the agreement, Foresight will supply a QuadSight®

prototype system with wide-angle field-of-view detection

capabilities to meet Elbit Systems’ specific requirements. The

modified prototype enhances the QuadSight system’s ability to

detect objects in a wider area of the road ahead.

- Foresight Initiated Pilot Project for COVID-19 Screening

Solution: Foresight announced in July that its COVID-19 symptom

screening solution, which is designed to detect several notable

symptoms of the coronavirus, will be tested in a pilot project with

Meuhedet, one of Israel’s largest health maintenance organizations.

The pilot will take place in Israel in the city of Ashdod, where

Meuhedet’s largest clinic serves approx. 50,000 patients. The

screening solution, based on Foresight’s extensive experience with

thermal and visible light cameras, is designed to detect high body

temperature and signs of fatigue.

- Foresight Received Order for Two Prototype Systems from

Multi-Billion-Dollar Chinese Technology Company: Two QuadSight

vision system prototypes were ordered in July by the automotive

solutions business unit of a multi-billion-dollar global Chinese

technology company. The technology company may use Foresight’s

technology to improve its autonomous vehicle and safety solutions,

and the prototype sales could result in future collaboration.

- Rail Vision Signed Commercial Agreement to Supply Shunting

Yard Systems to Leading European Train Operator: Rail Vision,

an affiliate of Foresight, announced in September that it signed a

commercial agreement with an affiliate of Knorr-Bremse AG, a $17

billion Europe-based group. According to the agreement,

Knorr-Bremse will supply Rail Vision’s Assisted Remote Shunting

(ARS) systems to a leading European train operator. As first

announced in April, Rail Vision received an initial order from a

leading European train operator for an ARS prototype system and to

execute an Operational Functional Test. According to the terms of

the agreement, the train operator may choose to purchase 30 ARS

systems, and may then exercise the option to purchase an additional

45 ARS systems.

- Eye-Net Mobile Received Patent Approval for Accident

Prevention Solution: In late July, Eye-Net Mobile, a

wholly-owned subsidiary of Foresight, received a notice of

allowance from the U.S. Patent and Trademark Office for its patent

application for a “system and method for preventing car accidents

and collisions between vehicles and pedestrians.” The patented

technology refers to Eye-Net Mobile’s accident prevention system,

which predicts collisions between vehicles and pedestrians through

a dedicated software application on the mobile devices of

pedestrians and vehicle users.

- Eye-Net Mobile Announced Two Pilot Projects with Global

Japanese Technology Companies: In August, Eye-Net Mobile

announced two pilot projects for its Eye-Net Protect cellular based

V2X (vehicle-to-everything) accident prevention solution. The

Eye-Net Protect system will be evaluated by a multi-billion-dollar

global Japanese technology company, as well as by a

multi-billion-dollar multinational Japanese electronics company.

The projects will evaluate the Software Development Kit (SDK)

configuration of the Eye-Net Protect solution.

- Foresight Completed Development of Commercial Version of

Automatic Calibration Software: In September, Foresight

announced the completion of a commercial version of its

groundbreaking automatic calibration software. Foresight’s software

solution ensures stereoscopic sensors remain calibrated regardless

of their position on the car. These calibration capabilities are

essential to create the accurate stereoscopic 3D perception needed

for reliable automotive vision systems. Additionally, Foresight

submitted two new patent applications related to multiple-sensor

camera systems.

Use of Non-GAAP Financial Results

In addition to disclosing financial results calculated in

accordance with United States generally accepted accounting

principles (GAAP), the company’s earnings release contains non-GAAP

financial measures of net loss for the period that excludes the

effect of stock-based compensation expenses, the revaluation of

other investments and revaluation of derivative warrant liability,

and non-GAAP financial measures of shareholders’ equity that

excludes the effect of derivative warrant liability and the

revaluation of other investments. The company’s management believes

the non-GAAP financial information provided in this release is

useful to investors’ understanding and assessment of the company’s

ongoing operations. Management also uses both GAAP and non-GAAP

information in evaluating and operating business internally and as

such deemed it important to provide all this information to

investors. The non-GAAP financial measures disclosed by the company

should not be considered in isolation or as a substitute for, or

superior to, financial measures calculated in accordance with GAAP,

and the financial results calculated in accordance with GAAP and

reconciliations to those financial statements should be carefully

evaluated. Reconciliations between GAAP measures and non-GAAP

measures are provided later in this press release.

About Foresight

Foresight Autonomous Holdings Ltd. (Nasdaq and TASE: FRSX),

founded in 2015, is a technology company engaged in the design,

development and commercialization of stereo/quad-camera vision

systems for the automotive industry. Through the company’s wholly

owned subsidiaries, Foresight Automotive Ltd. and Eye-Net Mobile

Ltd., Foresight develops both “in-line-of-sight” vision systems and

“beyond-line-of-sight” cellular-based applications. Foresight’s

vision sensor is a four-camera system based on 3D video analysis,

advanced algorithms for image processing, and sensor fusion. .

Eye-Net Mobile’s cellular-based application is a V2X

(vehicle-to-everything) accident prevention solution based on

real-time spatial analysis of clients’ movement.

The company's systems are designed to improve driving safety by

enabling highly accurate and reliable threat detection while

ensuring the lowest rates of false alerts. Foresight is targeting

the Advanced Driver Assistance Systems (ADAS), the semi-autonomous

and autonomous vehicle markets and predicts that its systems will

revolutionize automotive safety by providing an automotive-grade,

cost-effective platform and advanced technology.

For more information about Foresight and its wholly owned

subsidiary, Foresight Automotive, visit www.foresightauto.com, follow @ForesightAuto1 on

Twitter, or join Foresight Automotive on LinkedIn.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995 and other Federal

securities laws. Words such as “expects,” “anticipates,” “intends,”

“plans,” “believes,” “seeks,” "estimates" and similar expressions

or variations of such words are intended to identify

forward-looking statements. For example, Foresight is using

forward-looking statements in this press release when it discusses

its expected stable sales growth and further collaborations with

partners. Because such statements deal with future events and are

based on Foresight’s current expectations, they are subject to

various risks and uncertainties and actual results, performance or

achievements of Foresight could differ materially from those

described in or implied by the statements in this press release.

The forward-looking statements contained or implied in this press

release are subject to other risks and uncertainties, including

those discussed under the heading “Risk Factors” in Foresight’s

annual report on Form 20-F filed with the Securities and Exchange

Commission (“SEC”) on March 31, 2020, and in any subsequent filings

with the SEC. The following factors, among others, could cause

actual results to differ materially from those described in the

forward-looking statements: Foresight’s burn rate, its ability to

generate revenue, and its ability to continue as a going concern.

Based on the projected cash flows and Foresight’s cash balances as

of September 30, 2020, Foresight’s management is of the opinion

that as of September 30, 2020, without further fund raising it will

not have enough resources to enable it to continue advancing its

activities for a period of at least 12 months. As a result, there

is substantial doubt about Foresight’s ability to continue as a

going concern. Except as otherwise required by law, Foresight

undertakes no obligation to publicly release any revisions to these

forward-looking statements to reflect events or circumstances after

the date hereof or to reflect the occurrence of unanticipated

events. References and links to websites have been provided as a

convenience, and the information contained on such websites is not

incorporated by reference into this press release.

FORESIGHT AUTONOMOUS

HOLDINGS LTD.

INTERIM CONDENSED

CONSOLIDATED BALANCE SHEETS

U.S. dollars in thousands

As of September 30, 2020

As of September 30, 2019

As of December 31, 2019

ASSETS

Current assets:

Cash and cash equivalents

$

9,395

$

5,070

$

4,827

Short Term Deposits

5,142

8,068

5,233

Marketable equity

securities

19

36

23

Other receivables

446

773

613

Total current assets

15,002

13,947

10,696

Non-current assets:

ROU Asset

1,127

1,340

1,278

Investment in affiliate

company

4,730

7,400

6,729

Fixed assets, net

487

668

631

6,344

9,408

8,638

Total assets

$

21,346

$

23,355

$

19,334

LIABILITIES AND SHAREHOLDERS’

EQUITY

Current liabilities:

Trade payables

$

188

$

675

$

498

Operating Lease Liability

401

413

411

Other accounts payables

1,158

892

1,130

Total current liabilities

1,747

1,980

2,039

Non-current liabilities:

Operating Lease Liability

832

1,068

1,007

-

Total liabilities

2,579

3,048

3,046

Shareholders’ equity:

Common stock of NIS 0 par

value;

-

-

-

Additional paid-in capital

79,478

65,330

65,681

Accumulated deficit

(60,753

)

(45,023

)

(49,393

)

Total Foresight autonomous

holdings LTD. Shareholders’ equity

18,725

20,307

19,334

Non-Controlling Interest

42

-

-

Total equity

18,767

20,307

16,288

Total liabilities and stockholders’

equity

$

21,346

$

23,355

$

19,334

FORESIGHT AUTONOMOUS

HOLDINGS LTD.

INTERIM CONDENSED

CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

U.S. dollars in thousands

Nine months ended September

30,

Three months ended September

30,

2020

2019

2020

2019

Research and development expenses, net

(6,374)

(7,007)

(2,157)

(2,547)

Marketing and sales

(973)

(1,616)

(307)

(519)

General and administrative expenses

(2,212)

(2,666)

(918)

(893)

Operating loss

(9,559)

(11,289)

(3,382)

(3,959)

Equity in net gain (loss) of an affiliated

company

(1,999)

(168)

(655)

(184)

Financing income (expenses), net

198

388

57

212

Net loss

(11,360)

(11,069)

(3,980)

(3,931)

FORESIGHT AUTONOMOUS

HOLDINGS LTD.

INTERIM CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOW

U.S. dollars in thousands

Nine months ended September

30,

Three months ended September

30,

2020

2019

2020

2019

Net cash used in operating

activities

Loss for the Period

(11,360)

(11,069)

(3,980)

(3,931)

Adjustments to reconcile profit (loss) to

net cash used in operating activities:

2,852

2,259

1,249

827

Net cash used in operating

activities

(8,508)

(8,810)

(2,731)

(3,104)

Cash Flows from Investing

Activities

Changes in short term deposits

91

4,438

1,987

4,212

Proceed from other investments

-

21

-

-

Proceed from sales marketable

securities

68

-

-

-

Purchase of fixed assets

(48)

(73)

(39)

(34)

Net cash provided by investing

activities

111

4,386

1,948

4,178

Cash flows from Financing

Activities:

Issuance of ordinary shares and warrants,

net of issuance expenses

12,929

6,521

(153)

-

Net cash provided (used) by financing

activities

12,929

6,521

(153)

-

Effect of exchange rate changes on cash

and cash equivalents

36

(185)

19

(51)

Increase (decrease) in cash and cash

equivalents

4,568

1,912

(917)

1,023

Cash and cash equivalents at the

beginning of the period

4,827

3,158

10,312

4,047

Cash and cash equivalents at the end of

the period

9,395

5,070

9,395

5,070

FORESIGHT AUTONOMOUS

HOLDINGS LTD.

INTERIM CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOW

U.S. dollars in thousands

Adjustments to

reconcile profit (loss) to net cash used in operating

activities:

Nine months

ended September 30,

Three months

ended September 30,

2020

2019

2020

2019

Share-based payment

910

1,286

560

450

Depreciation

192

193

61

65

Revaluation of derivative warrant

liability

-

1

-

(42)

Equity in loss (gain) of an affiliated

company

1,999

168

655

184

Revaluation of securities

(64)

(13)

(5)

(5)

Revaluation of other investments

-

324

-

-

exchange rate changes on cash and cash

equivalents

(36)

185

(19)

51

Changes in assets and liabilities:

Decrease (increase) in other

receivables

167

(302)

(135)

(264)

Increase (decrease) in Trade payables

(310)

331

94

368

Change in operating lease liability

(15)

105

2

30

Increase (decrease) in other accounts

payable

9

(19)

36

(10)

Adjustments to reconcile loss to net

cash used in operating activities

2,852

2,259

1,249

827

FORESIGHT AUTONOMOUS

HOLDINGS LTD.

SUPPLEMENTAL

RECONCILIATION OF GAAP TO NON-GAAP SHAREHOLDERS'

EQUITY

U.S. dollars in thousands

As of September 30, 2020

As of September 30, 2019

As of December 31, 2019

GAAP Shareholders' equity

18,767

20,307

16,288

Revaluation of other investments

--

324

324

Non-GAAP Shareholders' equity

18,767

20,631

16,612

SUPPLEMENTAL

RECONCILIATION OF GAAP TO NON-GAAP RESULTS

U.S. dollars in thousands

Nine months ended September

30

Three months ended September

30,

2020

2019

2020

2019

GAAP operating loss

(9,559)

(11,289)

(3,382)

(3,959)

Stock-based compensation in research and

development

374

442

215

158

Stock-based compensation in sales and

marketing

46

152

14

54

Stock-based compensation in general and

administrative

490

692

331

238

Non-GAAP operating loss

(8,649)

(10,003)

(2,822)

(3,509)

GAAP Financing income (expenses),

net

198

388

57

212

Revaluation of other investments

--

324

--

-

Revaluation of derivative warrant

liability expenses

--

1

--

42

Non-GAAP Financing income, net

198

713

57

254

GAAP net loss

(11,360)

(11,069)

(3,980)

(3,931)

Stock-based compensation expenses

910

1,286

560

450

Revaluation of other investments

--

324

--

-

Revaluation of derivative warrant

liability

--

1

--

42

Non-GAAP net loss

(10,450)

(9,457)

(3,420)

(3,439)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20201112006055/en/

Investor Relations Contact: Miri Segal-Scharia CEO MS-IR

LLC msegal@ms-ir.com 917-607-8654

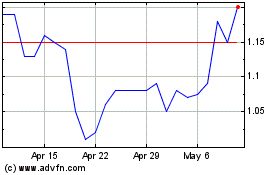

Foresight Autonomous (NASDAQ:FRSX)

Historical Stock Chart

From Mar 2024 to Apr 2024

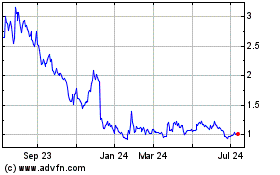

Foresight Autonomous (NASDAQ:FRSX)

Historical Stock Chart

From Apr 2023 to Apr 2024