Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

July 14 2022 - 8:01AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of July 2022

Commission File Number 001-40397

| FLORA GROWTH CORP. |

| (Exact name of registrant as specified in its charter) |

365 Bay Street, Suite 800

Toronto, Ontario M5H 2V1

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

☒ Form 20-F ☐ Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

INFORMATION CONTAINED IN THIS FORM 6-K REPORT

Explanatory Note

On July 8, 2022, Flora Growth Corp. (the “Company”) received a deficiency letter (the “Notice Letter”) from The Nasdaq Capital Market Listing Qualifications Department (“Nasdaq”) advising that, based on the Company’s closing bid price for the last 30 consecutive business days, the Company does not comply with the minimum bid price requirement of $1.00 per share, as set forth in Nasdaq Listing Rule 5550(a)(2).

In accordance with Nasdaq Listing Rule 5810(c)(3)(A), the Company has a grace period of 180 calendar days, until January 4, 2023, to regain compliance with the minimum closing price requirement for continued listing. If at any time during the 180-day notice period, the minimum closing bid price per share of the Company’s common shares closes at or above $1.00 for a period of ten consecutive business days, the Company will regain compliance and the matter will be closed. In the event the Company does not regain compliance within the 180-day grace period, the Company may be eligible to receive an additional 180-day grace period, provided that it meets the continued listing requirement for market value of publicly held shares and all other applicable standards for initial listing on The Nasdaq Capital Market, except for the bid price requirement, and provides written notice of its intention to cure the minimum bid price deficiency during the second 180-day grace period. If the Company meets these requirements, The Nasdaq Capital Market will inform the Company that it has been granted an additional 180 calendar days. However, if it appears to the Nasdaq Staff that the Company will not be able to cure the deficiency, or if the Company is otherwise not eligible, the Staff will provide notice that the Company’s securities will be subject to delisting.

An indicator will be displayed with quotation information related to the Company’s common shares on NASDAQ.com and NASDAQTrader.com and may be displayed by other third-party providers of market data information. Also, a list of all non-compliant Nasdaq companies and the basis for such non-compliance is posted on the Nasdaq website at listingcenter.nasdaq.com. The Company will be included in this list commencing five business days from the date of the Notice Letter.

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| FLORA GROWTH CORP. | |

| | | |

| Date: July 14, 2022 | By: | /s/ Luis Merchan | |

| | Name: Luis Merchan | |

| | Title: Chief Executive Officer | |

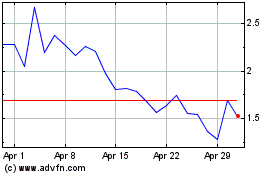

Flora Growth (NASDAQ:FLGC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Flora Growth (NASDAQ:FLGC)

Historical Stock Chart

From Apr 2023 to Apr 2024