First Solar, Inc. Announces Second Quarter 2019 Financial Results

August 01 2019 - 4:05PM

First Solar, Inc. (Nasdaq: FSLR) today announced financial results

for the second quarter ended June 30, 2019. Net sales for the

second quarter were $585 million, an increase of $53 million from

the prior quarter, primarily due to increased module and system

sales in the U.S. and Australia.

The Company reported a second quarter loss per

share of $(0.18), compared to a loss per share of $(0.64) in the

first quarter of 2019.

Cash, restricted cash and marketable securities

at the end of the second quarter decreased to $2.1 billion from

$2.3 billion at the end of the prior quarter, primarily as a result

of continued capital investments in Series 6 manufacturing

capacity.

“We continued to make significant progress in

our Series 6 transition during Q2, with improvements across all

manufacturing metrics,” said Mark Widmar, CEO of First Solar. “We

had record module production and shipments during the second

quarter, and with our recent bookings success we are now

essentially sold out through 2020, with significant bookings

visibility into 2021.”

2019 guidance has been updated as follows:

|

|

|

|

|

|

|

| |

|

2019 Guidance |

Prior |

Current |

|

| |

|

Net Sales |

$3.5B to $3.7B |

Unchanged |

|

| |

|

Gross Margin % (1) |

18% to 19% |

18.5% to 19.5% |

|

| |

|

Operating Expenses (2) |

$370M to $390M |

$360M to $380M |

|

| |

|

Operating Income |

$260M to $310M |

$290M to $340M |

|

| |

|

Earnings per Share |

$2.25 to $2.75 |

Unchanged |

|

| |

|

Net Cash Balance (3) |

$1.7B to $1.9B |

Unchanged |

|

| |

|

Capital Expenditures |

$650M to $750M |

Unchanged |

|

| |

|

Shipments |

5.4GW to 5.6GW |

Unchanged |

|

| |

|

|

|

|

|

|

(1) |

|

Includes $60 to

$70 million of ramp costs ($45 to $55 million previously) |

|

|

(2) |

|

Includes $55 to

$65 million of production start-up expense ($70 to $80 million

previously) |

|

|

(3) |

|

Defined as cash,

restricted cash and marketable securities less expected debt at the

end of 2019 |

|

| |

|

|

|

|

|

First Solar has scheduled a conference call for

today, August 1, 2019 at 4:30 p.m. ET to discuss this

announcement. A live webcast of this conference call and

accompanying materials are available at

investor.firstsolar.com.

The guidance figures presented above are subject

to a variety of assumptions and estimates. Investors are encouraged

to listen to the conference call and to review the accompanying

materials which contain more information about First Solar’s 2019

guidance.

An audio replay of the conference call will be

available approximately two hours after the conclusion of the call.

The audio replay will remain available through Thursday, August 8,

2019 and can be accessed by dialing +1 (800) 585-8367 if you are

calling from within the United States or +1 (416) 621-4642 if you

are calling from outside the United States and entering the replay

pass code 2308858. A replay of the webcast will also be available

on the Investors section of the Company’s website approximately

five hours after the conclusion of the call and remain available

for approximately 90 days.

About First Solar, Inc.

First Solar is a leading global provider of

comprehensive photovoltaic (“PV”) solar systems which use its

advanced module and system technology. The Company's integrated

power plant solutions deliver an economically attractive

alternative to fossil-fuel electricity generation today. From raw

material sourcing through end-of-life module recycling, First

Solar’s renewable energy systems protect and enhance the

environment. For more information about First Solar, please visit

www.firstsolar.com.

For First Solar Investors

This release contains forward-looking statements

which are made pursuant to safe harbor provisions of the Private

Securities Litigation Reform Act of 1995. All statements in this

release, other than statements of historical fact, are

forward-looking statements. These forward-looking statements

include, but are not limited to, statements concerning: our

financial guidance for 2019; the transition to Series 6 module

manufacturing in 2019; net sales, gross margin, operating expenses,

operating income, earnings per share, net cash balance, capital

expenditures, shipments, bookings, products and our business and

financial objectives for 2019. These forward-looking statements are

often characterized by the use of words such as “estimate,”

“expect,” “anticipate,” “project,” “plan,” “intend,” “seek,”

“believe,” “forecast,” “foresee,” “likely,” “may,” “should,”

“goal,” “target,” “might,” “will,” “could,” “predict,” “continue”

and the negative or plural of these words and other comparable

terminology. Forward-looking statements are only predictions based

on our current expectations and our projections about future events

and therefore speak only as of the date of this release. You should

not place undue reliance on these forward-looking statements. We

undertake no obligation to update any of these forward-looking

statements for any reason, whether as a result of new information,

future developments or otherwise. These forward-looking statements

involve known and unknown risks, uncertainties and other factors

that may cause our actual results, levels of activity, performance

or achievements to differ materially from those expressed or

implied by these statements. These factors include, but are not

limited to: structural imbalances in global supply and demand for

PV solar modules; the market for renewable energy, including solar

energy; our competitive position and other key competitive factors;

reduction, elimination, or expiration of government subsidies,

policies, and support programs for solar energy projects; the

impact of public policies, such as tariffs or other trade remedies

imposed on solar cells and modules; our ability to execute on our

long-term strategic plans; our ability to execute on our solar

module technology and cost reduction roadmaps; our ability to

improve the wattage of our solar modules; interest rate

fluctuations and both our and our customers’ ability to secure

financing; the creditworthiness of our offtake counterparties and

the ability of our offtake counterparties to fulfill their

contractual obligations to us; the ability of our customers to

perform under their contracts with us; our ability to attract new

customers and to develop and maintain existing customer and

supplier relationships; our ability to successfully develop and

complete our systems business projects; our ability to convert

existing production facilities to support new product lines, such

as Series 6 module manufacturing; general economic and business

conditions, including those influenced by U.S., international, and

geopolitical events; environmental responsibility, including with

respect to cadmium telluride (“CdTe”) and other semiconductor

materials; claims under our limited warranty obligations; changes

in, or the failure to comply with, government regulations and

environmental, health, and safety requirements; effects resulting

from pending litigation, including the class action lawsuit against

us; future collection and recycling costs for solar modules covered

by our module collection and recycling program; our ability to

protect our intellectual property; our ability to prevent and/or

minimize the impact of cyber-attacks or other breaches of our

information systems; our continued investment in research and

development; the supply and price of components and raw materials,

including CdTe; our ability to attract and retain key executive

officers and associates; and the matters discussed under the

captions “Risk Factors” and “Management’s Discussion and Analysis

of Financial Conditions and Results of Operations” of our most

recent Annual Report on Form 10-K and our subsequently filed

Quarterly Reports on Form 10-Q, as supplemented by our other

filings with the Securities and Exchange Commission.

Contacts

First Solar

Investorsinvestor@firstsolar.com

First Solar

Mediamedia@firstsolar.com

|

|

|

FIRST SOLAR, INC. AND SUBSIDIARIES |

|

CONSOLIDATED BALANCE SHEETS |

|

(In thousands, except share data) |

|

(Unaudited) |

|

|

|

|

|

June 30, |

|

December 31, |

|

|

|

2019 |

|

2018 |

|

ASSETS |

|

|

|

|

| Current assets: |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

1,221,568 |

|

|

$ |

1,403,562 |

|

|

Marketable securities |

|

807,561 |

|

|

1,143,704 |

|

|

Accounts receivable trade, net |

|

269,527 |

|

|

128,282 |

|

|

Accounts receivable, unbilled and retainage |

|

127,972 |

|

|

458,166 |

|

|

Inventories |

|

586,621 |

|

|

387,912 |

|

|

Balance of systems parts |

|

91,728 |

|

|

56,906 |

|

|

Project assets |

|

1,703 |

|

|

37,930 |

|

|

Prepaid expenses and other current assets |

|

305,566 |

|

|

243,061 |

|

|

Total current assets |

|

3,412,246 |

|

|

3,859,523 |

|

| Property, plant and equipment,

net |

|

2,006,334 |

|

|

1,756,211 |

|

| PV solar power systems,

net |

|

304,657 |

|

|

308,640 |

|

| Project assets |

|

528,246 |

|

|

460,499 |

|

| Deferred tax assets, net |

|

76,892 |

|

|

77,682 |

|

| Restricted cash and

investments |

|

328,591 |

|

|

318,390 |

|

| Goodwill |

|

14,462 |

|

|

14,462 |

|

| Intangible assets, net |

|

69,119 |

|

|

74,162 |

|

| Inventories |

|

149,157 |

|

|

130,083 |

|

| Notes receivable,

affiliate |

|

— |

|

|

22,832 |

|

| Other assets |

|

248,103 |

|

|

98,878 |

|

|

Total assets |

|

$ |

7,137,807 |

|

|

$ |

7,121,362 |

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

| Current liabilities: |

|

|

|

|

|

Accounts payable |

|

$ |

242,541 |

|

|

$ |

233,287 |

|

|

Income taxes payable |

|

15,293 |

|

|

20,885 |

|

|

Accrued expenses |

|

421,595 |

|

|

441,580 |

|

|

Current portion of long-term debt |

|

28,312 |

|

|

5,570 |

|

|

Deferred revenue |

|

112,237 |

|

|

129,755 |

|

|

Other current liabilities |

|

23,341 |

|

|

14,380 |

|

|

Total current liabilities |

|

843,319 |

|

|

845,457 |

|

| Accrued solar module

collection and recycling liability |

|

136,275 |

|

|

134,442 |

|

| Long-term debt |

|

452,976 |

|

|

461,221 |

|

| Other liabilities |

|

570,113 |

|

|

467,839 |

|

|

Total liabilities |

|

2,002,683 |

|

|

1,908,959 |

|

| Commitments and

contingencies |

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

Common stock, $0.001 par value per share; 500,000,000 shares

authorized; 105,390,383 and 104,885,261 shares issued and

outstanding at June 30, 2019 and December 31, 2018,

respectively |

|

105 |

|

|

105 |

|

|

Additional paid-in capital |

|

2,826,533 |

|

|

2,825,211 |

|

|

Accumulated earnings |

|

2,355,406 |

|

|

2,441,553 |

|

|

Accumulated other comprehensive loss |

|

(46,920 |

) |

|

(54,466 |

) |

|

Total stockholders’ equity |

|

5,135,124 |

|

|

5,212,403 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

7,137,807 |

|

|

$ |

7,121,362 |

|

|

|

|

FIRST SOLAR, INC. AND SUBSIDIARIES |

|

CONSOLIDATED STATEMENTS OF OPERATIONS |

|

(In thousands, except per share amounts) |

|

(Unaudited) |

| |

| |

Three Months Ended |

|

Six Months Ended |

| |

June 30, |

|

March 31, |

|

June 30, |

|

June 30, |

|

June 30, |

| |

2019 |

|

2019 |

|

2018 |

|

2019 |

|

2018 |

|

Net sales |

$ |

584,956 |

|

|

$ |

531,978 |

|

|

$ |

309,318 |

|

|

$ |

1,116,934 |

|

|

$ |

876,583 |

|

| Cost of sales |

507,774 |

|

|

531,866 |

|

|

317,376 |

|

|

1,039,640 |

|

|

711,843 |

|

| Gross profit (loss) |

77,182 |

|

|

112 |

|

|

(8,058 |

) |

|

77,294 |

|

|

164,740 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative |

50,934 |

|

|

45,352 |

|

|

50,854 |

|

|

96,286 |

|

|

91,980 |

|

|

Research and development |

24,395 |

|

|

21,877 |

|

|

20,370 |

|

|

46,272 |

|

|

40,694 |

|

|

Production start-up |

10,437 |

|

|

9,522 |

|

|

24,352 |

|

|

19,959 |

|

|

61,436 |

|

| Total operating expenses |

85,766 |

|

|

76,751 |

|

|

95,576 |

|

|

162,517 |

|

|

194,110 |

|

| Operating loss |

(8,584 |

) |

|

(76,639 |

) |

|

(103,634 |

) |

|

(85,223 |

) |

|

(29,370 |

) |

| Foreign currency gain (loss),

net |

1,726 |

|

|

172 |

|

|

2,422 |

|

|

1,898 |

|

|

(95 |

) |

| Interest income |

13,510 |

|

|

14,259 |

|

|

16,865 |

|

|

27,769 |

|

|

28,689 |

|

| Interest expense, net |

(8,921 |

) |

|

(10,121 |

) |

|

(6,065 |

) |

|

(19,042 |

) |

|

(11,247 |

) |

| Other (loss) income, net |

(4,438 |

) |

|

3,509 |

|

|

(4,328 |

) |

|

(929 |

) |

|

13,606 |

|

| (Loss) income before taxes and

equity in earnings |

(6,707 |

) |

|

(68,820 |

) |

|

(94,740 |

) |

|

(75,527 |

) |

|

1,583 |

|

| Income tax (expense)

benefit |

(11,744 |

) |

|

1,394 |

|

|

6,164 |

|

|

(10,350 |

) |

|

(5,461 |

) |

| Equity in earnings, net of

tax |

(97 |

) |

|

(173 |

) |

|

40,085 |

|

|

(270 |

) |

|

38,338 |

|

| Net (loss) income |

$ |

(18,548 |

) |

|

$ |

(67,599 |

) |

|

$ |

(48,491 |

) |

|

$ |

(86,147 |

) |

|

$ |

34,460 |

|

| |

|

|

|

|

|

|

|

|

|

| Net (loss) income per

share: |

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

(0.18 |

) |

|

$ |

(0.64 |

) |

|

$ |

(0.46 |

) |

|

$ |

(0.82 |

) |

|

$ |

0.33 |

|

|

Diluted |

$ |

(0.18 |

) |

|

$ |

(0.64 |

) |

|

$ |

(0.46 |

) |

|

$ |

(0.82 |

) |

|

$ |

0.32 |

|

| Weighted-average number of

shares used in per share calculations: |

|

|

|

|

|

|

|

|

|

|

Basic |

105,369 |

|

|

105,046 |

|

|

104,776 |

|

|

105,208 |

|

|

104,664 |

|

|

Diluted |

105,369 |

|

|

105,046 |

|

|

104,776 |

|

|

105,208 |

|

|

106,234 |

|

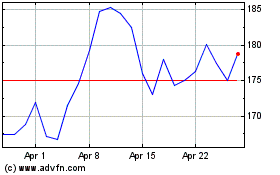

First Solar (NASDAQ:FSLR)

Historical Stock Chart

From Mar 2024 to Apr 2024

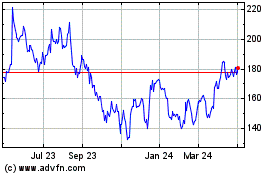

First Solar (NASDAQ:FSLR)

Historical Stock Chart

From Apr 2023 to Apr 2024