First National Corporation (the “Company” or “First National”)

(NASDAQ: FXNC), the bank holding company of First Bank (the

“Bank”), reported unaudited consolidated net income of $2.4

million, or $0.38 per diluted share for the third quarter of 2021,

which resulted in return on average assets of 0.71% and return on

average equity of 8.64%. This compares to net income of $1.8

million, or $0.36 per diluted share, and return on average assets

of 0.74% and return on average equity of 8.52% for the third

quarter of 2020.

Net income for the third quarter of 2021 included $1.3 million

of merger related expenses from the Company’s acquisition of The

Bank of Fincastle (the “Merger”), which was consummated on July 1,

2021. In addition, there was no provision for loan losses in the

third quarter of 2021, compared to provision for loan losses of

$1.5 million for the third quarter of 2020.

During the third quarter of 2021, First Bank also negotiated and

completed the acquisition of an $82.6 million loan portfolio

originated from SmartBank’s branch located in the Richmond,

Virginia market. In connection with the purchase of the loan

portfolio, the Bank hired a team of employees based out of the

branch. SmartBank decided to close their branch operation on

December 31, 2021. First Bank will continue to operate a loan

production office from this location.

President and Chief Executive Officer Scott C. Harvard

commented, “The third quarter may have been the most productive in

our company’s 114 year history as we completed the acquisition of

The Bank of Fincastle and also seized the opportunity for a team

lift and loan portfolio acquisition in the Richmond market. The

transactions boosted assets to $1.4 billion and increased loan

balances by $205.1 million, while extending the Bank’s reach into

the Roanoke market and bolstering the banking team in Richmond.

These transactions reflect our strategy of hiring talented bankers

to support organic growth, which in turn positions the company well

for strategic acquisitions. I am incredibly proud of our people,

not just for the level of work and effort it took to successfully

complete two transformative transactions concurrently, but for

their can-do attitude when asked to step up to the challenge. We

believe our banking company is well positioned to be a leader in

Virginia banking for years to come.”

Key highlights of the third quarter of 2021 are as follows.

Comparisons are to the corresponding period in the prior year

unless otherwise stated:

|

|

• |

Successful team lift and $83 million loan portfolio acquisition in

the Richmond market |

|

|

• |

Completed the acquisition of The Bank of Fincastle |

|

|

• |

Total assets increased 44% to $1.4 billion |

|

|

• |

Total loans, excluding PPP loans, increased 39% to $799.6

million |

|

|

• |

Noninterest-bearing deposits increased 60% to $411.5 million |

|

|

• |

Net interest income increased 29%, or $2.2 million |

|

|

• |

Noninterest income increased 20%, or $447 thousand |

|

|

• |

Merger related expenses totaled $1.3 million |

|

|

• |

Nonperforming assets totaled $4.0 million, or 0.30% of total

assets |

|

|

|

|

ACQUISITION OF THE BANK OF FINCASTLE

On July 1, 2021, the Company completed the acquisition of The

Bank of Fincastle (“Fincastle”) for an aggregate purchase price of

$33.8 million of cash and stock. Fincastle was merged with

and into First Bank. The former Fincastle branches continued

to operate as The Bank of Fincastle, a division of First Bank,

until the systems were converted on October 16, 2021. For the

three-month and nine-month periods ended September 30, 2021, the

Company recorded merger related expenses of $1.3 million and $2.0

million, respectively. The Company estimates it will incur an

additional $1.4 million of merger related costs throughout the

fourth quarter of 2021 and first quarter of 2022, which would

result in aggregate costs related to the Merger of $3.4

million.

ACQUISITION OF THE SMARTBANK LOAN PORTFOLIO

On September 30, 2021, the Bank acquired $82.6 million of loans

and certain fixed assets from SmartBank related to their Richmond

area branch. First Bank agreed to assume the facility lease of

SmartBank’s branch office located in Glen Allen, Virginia. First

Bank paid a premium based on a specific percentage of the loans

sold and certain fixed assets were acquired at SmartBank’s book

value. Additionally, an experienced team of bankers based out of

the SmartBank location have transitioned to become employees of

First Bank. First Bank did not assume any deposit liabilities from

SmartBank in connection with the transaction and SmartBank intends

to close their branch operation on December 31, 2021. First Bank

will continue to operate a loan production office from the location

after the SmartBank branch is closed. First Bank’s assumption of

the lease and acquisition of the remaining branch assets is

expected to be completed in the fourth quarter of 2021, subject to

customary closing conditions.

SMALL BUSINESS ADMINISTRATION'S PPP

The Bank participated as a lender in the U.S. Small Business

Administration’s (“SBA”) Paycheck Protection Program (“PPP”) to

support local small businesses and non-profit organizations by

providing forgivable loans. Loan fees received from the SBA are

accreted into income evenly over the life of the loans, net of loan

origination costs, through interest and fees on loans. PPP

loans totaled $22.8 million at September 30, 2021, with $1.3

million scheduled to mature in the second and third quarters of

2022, and $21.5 million scheduled to mature in the first and second

quarters of 2026.

NET INTEREST INCOME

Net interest income increased $2.2 million, or 29%, to $9.7

million for the third quarter of 2021, compared to the same period

of 2020. The increase resulted from a $2.0 million, or 24% increase

in total interest and dividend income and a $176 thousand, or 23%,

decrease in total interest expense. Net interest income was

favorably impacted by a $383.8 million, or 43%, increase in average

earning assets and was partially offset by the impact of a 35-basis

point decrease in the net interest margin to 3.06% when comparing

the periods.

PROVISION FOR LOAN LOSSES

There was no provision for loan losses for the third quarter of

2021. The allowance for loan losses totaled $5.4 million, or 0.66%

of total loans and there were no significant changes in the general

or specific reserve components of the allowance. The loans acquired

from Fincastle and SmartBank during the quarter did not require an

allowance for loan loss at September 30, 2021. Net

charge-offs totaled $31 thousand during the three-month period

ending September 30, 2021. The allowance for loan losses

totaled $5.4 million, or 0.89% of total loans at June 30, 2021, and

$7.8 million, or 1.20% of total loans at September 30, 2020.

Provision for loan losses totaled $1.5 million for the three-month

period ending September 30, 2020.

Loans 30 to 89 days past due and accruing totaled $3.3 million,

or 0.40% of total loans at September 30, 2021, compared to $885

thousand, or 0.14% of total loans one year ago. Accruing

substandard loans totaled $319 thousand at September 30, 2021 and

$3.8 million at September 30, 2020. Nonperforming assets totaled

$4.0 million, or 0.30% of total assets at September 30, 2021,

compared to $7.0 million, or 0.74% of total assets at September 30,

2020. Nonperforming assets were comprised of $2.2 million of

nonaccrual loans and $1.8 million of other real estate

owned. There were $1.5 million of commercial rental properties

included in other real estate owned that were acquired in the

Merger.

During the fourth quarter of 2020, and during the first half of

2021, the Bank modified terms of certain loans for customers that

continued to be negatively impacted by the pandemic by lowering

borrower’s loan payments with interest only payments for periods

ranging between 6 and 24 months. Modified loans totaled $13.3

million at September 30, 2021, with $13.2 million in the Bank’s

commercial real estate loan portfolio and $83 thousand in the

commercial and industrial loans portfolio. The loans were comprised

of $11.6 million in the lodging sector and $1.7 million in the

leisure sector. All modified loans were performing under their

modified terms as of September 30, 2021.

NONINTEREST INCOME

Noninterest income increased $447 thousand, or 20%, to $2.6

million compared to the same period of 2020. Service charges on

deposits increased $101 thousand, or 23%, ATM and check card fees

increased $84 thousand, or 13%, wealth management fees increased

$123 thousand, or 21%, and fees for other customer services

increased $111 thousand, or 34%. Service charges on deposits

benefited from an increase in overdraft fee income, the increase in

ATM and check card fees resulted from an increase in card use by

customers, wealth management revenue increased from a higher amount

of assets under management, and the increase in fees for other

customer services was impacted by an increase in mortgage fee

income.

NONINTEREST EXPENSE

Noninterest expense increased $3.3 million, or 54%, to $9.4

million, compared to the same period one year ago. The increase was

primarily attributable to a $1.9 million increase in salaries and

employee benefits, a $180 thousand increase in marketing expense, a

$324 thousand increase in legal and professional fees, a $274

thousand increase in data processing fees, and a $272 thousand

increase in other operating expenses. The increase in salaries and

employee benefits resulted primarily from merger related expenses

and the increase in the number of employees from the acquisition of

Fincastle. Marketing expenses increased from both merger related

expenses and timing of advertising campaigns. The increase in legal

and professional fees was attributable to merger related expenses.

Data processing expenses increased from merger related expenses and

from the impact of additional customer accounts from the merger

with Fincastle.

BALANCE SHEET

Total assets of First National increased $413.1 million, or 44%,

to $1.4 billion at September 30, 2021, compared to $942.7 million

at September 30, 2020. Loans, net of the allowance for loan losses

increased $176.4 million, or 28%, securities increased $144.4

million, or 109%, and interest-bearing deposits in banks and Fed

funds sold combined increased $67.2 million, or 62%. The increase

in loans was attributable to the acquisitions of Fincastle and the

SmartBank loan portfolio during the quarter, while the increases in

securities, interest-bearing deposits in banks and Fed funds sold

were attributable to the acquisition of Fincastle and growth in the

Bank’s deposit portfolio during the recent twelve-month period.

Total liabilities increased $378.4 million, or 44%, to $1.2

billion at September 30, 2021, compared to $860.5 million one year

ago. The increase in total liabilities was attributable to growth

in deposits. Total deposits increased $374.2 million, or 45%, to

$1.2 billion. Noninterest-bearing demand deposits increased $154.8

million, or 60%, savings and interest-bearing demand deposits

increased $172.6 million, or 36%, and time deposits increased $46.8

million, or 46%. Although the majority of the deposit portfolio

growth resulted from the acquisition of Fincastle, growth of the

Bank’s deposits over the prior twelve-month period also made a

meaningful contribution.

Shareholders’ equity increased $34.7 million, or 42%, to $116.9

million at September 30, 2021, compared to one year ago, from a

$27.5 million increase in common stock and surplus, primarily from

the issuance of common stock related to the Fincastle acquisition

and an $8.9 million increase in retained earnings. The Bank was

considered well-capitalized at September 30, 2021.

ABOUT FIRST NATIONAL

First National Corporation (NASDAQ: FXNC) is the parent company

and bank holding company of First Bank, a community bank that first

opened for business in 1907 in Strasburg, Virginia. The Bank offers

loan and deposit products and services through its website,

www.fbvirginia.com, its mobile banking platform, a network of ATMs

located throughout its market area, one loan production office, a

customer service center in a retirement community, and 20 bank

branch office locations located throughout the Shenandoah Valley,

the central regions of Virginia, and the Richmond and Roanoke

market areas. In addition to providing traditional banking

services, the Bank operates a wealth management division under the

name First Bank Wealth Management. First Bank also owns First Bank

Financial Services, Inc., which invests in entities that provide

investment services and title insurance, and Bank of Fincastle

Services, Inc., which has an investment in a mortgage company.

FORWARD-LOOKING STATEMENTS

Certain information contained in this discussion may include

“forward-looking statements” within the meaning of Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. These forward-looking

statements relate to the Company’s future operations and are

generally identified by phrases such as “the Company expects,” “the

Company believes” or words of similar import. Although the Company

believes that its expectations with respect to the forward-looking

statements are based upon reliable assumptions within the bounds of

its knowledge of its business and operations, there can be no

assurance that actual results, performance or achievements of the

Company will not differ materially from any future results,

performance or achievements expressed or implied by such

forward-looking statements. Forward-looking statements involve a

number of risks and uncertainties, including the rapidly changing

uncertainties related to the COVID-19 pandemic and its potential

adverse effect on the economy, our employees and customers, and our

financial performance. For details on other factors that could

affect expectations, see the risk factors and other cautionary

language included in the Company’s Annual Report on Form 10-K for

the year ended December 31, 2020, and other filings with the

Securities and Exchange Commission.

CONTACTS

|

Scott C. Harvard |

|

M. Shane Bell |

|

President and CEO |

|

Executive Vice President and CFO |

|

(540) 465-9121 |

|

(540) 465-9121 |

|

sharvard@fbvirginia.com |

|

sbell@fbvirginia.com |

|

|

|

|

FIRST NATIONAL CORPORATIONQuarterly

Performance Summary(in thousands, except share and per

share data)

| |

|

(unaudited) |

|

| |

|

For the Quarter Ended |

|

| |

|

September 30, |

|

|

June 30, |

|

|

March 31, |

|

|

December 31, |

|

|

September 30, |

|

| |

|

2021 |

|

|

2021 |

|

|

2021 |

|

|

2020 |

|

|

2020 |

|

|

Income Statement |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest and fees on loans |

|

$ |

9,215 |

|

|

$ |

7,074 |

|

|

$ |

7,143 |

|

|

$ |

7,310 |

|

|

$ |

7,568 |

|

|

Interest on deposits in banks |

|

|

79 |

|

|

|

37 |

|

|

|

33 |

|

|

|

31 |

|

|

|

25 |

|

|

Interest on federal funds sold |

|

|

8 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Interest on securities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxable interest |

|

|

766 |

|

|

|

697 |

|

|

|

717 |

|

|

|

567 |

|

|

|

575 |

|

|

Tax-exempt interest |

|

|

242 |

|

|

|

215 |

|

|

|

180 |

|

|

|

163 |

|

|

|

152 |

|

|

Dividends |

|

|

21 |

|

|

|

22 |

|

|

|

22 |

|

|

|

24 |

|

|

|

23 |

|

| Total interest income |

|

$ |

10,331 |

|

|

$ |

8,045 |

|

|

$ |

8,095 |

|

|

$ |

8,095 |

|

|

$ |

8,343 |

|

| Interest expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest on deposits |

|

$ |

369 |

|

|

$ |

328 |

|

|

$ |

363 |

|

|

$ |

410 |

|

|

$ |

541 |

|

|

Interest on subordinated debt |

|

|

156 |

|

|

|

154 |

|

|

|

154 |

|

|

|

160 |

|

|

|

160 |

|

|

Interest on junior subordinated debt |

|

|

68 |

|

|

|

68 |

|

|

|

66 |

|

|

|

68 |

|

|

|

68 |

|

| Total interest expense |

|

$ |

593 |

|

|

$ |

550 |

|

|

$ |

583 |

|

|

$ |

638 |

|

|

$ |

769 |

|

| Net interest income |

|

$ |

9,738 |

|

|

$ |

7,495 |

|

|

$ |

7,512 |

|

|

$ |

7,457 |

|

|

$ |

7,574 |

|

| Provision for (recovery of)

loan losses |

|

|

— |

|

|

|

(1,000 |

) |

|

|

— |

|

|

|

(200 |

) |

|

|

1,500 |

|

| Net interest income after

provision for (recovery of) loan losses |

|

$ |

9,738 |

|

|

$ |

8,495 |

|

|

$ |

7,512 |

|

|

$ |

7,657 |

|

|

$ |

6,074 |

|

| Noninterest income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Service charges on deposit accounts |

|

$ |

547 |

|

|

$ |

447 |

|

|

$ |

442 |

|

|

$ |

553 |

|

|

$ |

446 |

|

|

ATM and check card fees |

|

|

753 |

|

|

|

682 |

|

|

|

601 |

|

|

|

576 |

|

|

|

669 |

|

|

Wealth management fees |

|

|

696 |

|

|

|

657 |

|

|

|

643 |

|

|

|

598 |

|

|

|

573 |

|

|

Fees for other customer services |

|

|

434 |

|

|

|

307 |

|

|

|

286 |

|

|

|

216 |

|

|

|

323 |

|

|

Income from bank owned life insurance |

|

|

161 |

|

|

|

100 |

|

|

|

113 |

|

|

|

124 |

|

|

|

131 |

|

|

Net gains on securities |

|

|

— |

|

|

|

— |

|

|

|

37 |

|

|

|

2 |

|

|

|

38 |

|

|

Net gains on sale of loans |

|

|

— |

|

|

|

18 |

|

|

|

7 |

|

|

|

10 |

|

|

|

3 |

|

|

Other operating income |

|

|

57 |

|

|

|

224 |

|

|

|

14 |

|

|

|

73 |

|

|

|

18 |

|

| Total noninterest income |

|

$ |

2,648 |

|

|

$ |

2,435 |

|

|

$ |

2,143 |

|

|

$ |

2,152 |

|

|

$ |

2,201 |

|

| Noninterest expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Salaries and employee benefits |

|

$ |

5,446 |

|

|

$ |

3,693 |

|

|

$ |

3,555 |

|

|

$ |

3,212 |

|

|

$ |

3,498 |

|

|

Occupancy |

|

|

500 |

|

|

|

399 |

|

|

|

447 |

|

|

|

422 |

|

|

|

433 |

|

|

Equipment |

|

|

519 |

|

|

|

433 |

|

|

|

431 |

|

|

|

440 |

|

|

|

439 |

|

|

Marketing |

|

|

243 |

|

|

|

138 |

|

|

|

106 |

|

|

|

112 |

|

|

|

63 |

|

|

Supplies |

|

|

176 |

|

|

|

77 |

|

|

|

88 |

|

|

|

90 |

|

|

|

112 |

|

|

Legal and professional fees |

|

|

586 |

|

|

|

483 |

|

|

|

737 |

|

|

|

310 |

|

|

|

262 |

|

|

ATM and check card expense |

|

|

329 |

|

|

|

268 |

|

|

|

231 |

|

|

|

253 |

|

|

|

259 |

|

|

FDIC assessment |

|

|

87 |

|

|

|

78 |

|

|

|

69 |

|

|

|

105 |

|

|

|

52 |

|

|

Bank franchise tax |

|

|

153 |

|

|

|

172 |

|

|

|

168 |

|

|

|

161 |

|

|

|

162 |

|

|

Data processing expense |

|

|

465 |

|

|

|

216 |

|

|

|

204 |

|

|

|

196 |

|

|

|

191 |

|

|

Amortization expense |

|

|

5 |

|

|

|

5 |

|

|

|

14 |

|

|

|

24 |

|

|

|

33 |

|

|

Other real estate owned expense (income), net |

|

|

14 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Other operating expense |

|

|

903 |

|

|

|

668 |

|

|

|

600 |

|

|

|

569 |

|

|

|

631 |

|

| Total noninterest expense |

|

$ |

9,426 |

|

|

$ |

6,630 |

|

|

$ |

6,650 |

|

|

$ |

5,894 |

|

|

$ |

6,135 |

|

| Income before income

taxes |

|

$ |

2,960 |

|

|

$ |

4,300 |

|

|

$ |

3,005 |

|

|

$ |

3,915 |

|

|

$ |

2,140 |

|

| Income tax expense |

|

|

562 |

|

|

|

958 |

|

|

|

569 |

|

|

|

759 |

|

|

|

386 |

|

| Net income |

|

$ |

2,398 |

|

|

$ |

3,342 |

|

|

$ |

2,436 |

|

|

$ |

3,156 |

|

|

$ |

1,754 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FIRST NATIONAL CORPORATIONQuarterly

Performance Summary(in thousands, except share and per

share data)

| |

|

(unaudited) |

|

| |

|

For the Quarter Ended |

|

| |

|

September 30, |

|

|

June 30, |

|

|

March 31, |

|

|

December 31, |

|

|

September 30, |

|

| |

|

2021 |

|

|

2021 |

|

|

2021 |

|

|

2020 |

|

|

2020 |

|

|

Common Share and Per Common Share Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income, basic |

|

$ |

0.39 |

|

|

$ |

0.69 |

|

|

$ |

0.50 |

|

|

$ |

0.65 |

|

|

$ |

0.36 |

|

| Weighted average shares,

basic |

|

|

6,220,456 |

|

|

|

4,868,901 |

|

|

|

4,863,823 |

|

|

|

4,858,288 |

|

|

|

4,854,144 |

|

| Net income, diluted |

|

$ |

0.38 |

|

|

$ |

0.69 |

|

|

$ |

0.50 |

|

|

$ |

0.65 |

|

|

$ |

0.36 |

|

| Weighted average shares,

diluted |

|

|

6,229,525 |

|

|

|

4,873,286 |

|

|

|

4,872,097 |

|

|

|

4,861,208 |

|

|

|

4,854,649 |

|

| Shares outstanding at period

end |

|

|

6,226,418 |

|

|

|

4,870,459 |

|

|

|

4,868,462 |

|

|

|

4,860,399 |

|

|

|

4,858,217 |

|

| Tangible book value at period

end |

|

$ |

18.11 |

|

|

$ |

18.21 |

|

|

$ |

17.65 |

|

|

$ |

17.47 |

|

|

$ |

16.92 |

|

| Cash dividends |

|

$ |

0.12 |

|

|

$ |

0.12 |

|

|

$ |

0.12 |

|

|

$ |

0.11 |

|

|

$ |

0.11 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Key Performance

Ratios |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Return on average assets |

|

|

0.71 |

% |

|

|

1.31 |

% |

|

|

1.00 |

% |

|

|

1.31 |

% |

|

|

0.74 |

% |

| Return on average equity |

|

|

8.64 |

% |

|

|

15.33 |

% |

|

|

11.53 |

% |

|

|

15.03 |

% |

|

|

8.52 |

% |

| Net interest margin |

|

|

3.06 |

% |

|

|

3.10 |

% |

|

|

3.27 |

% |

|

|

3.30 |

% |

|

|

3.41 |

% |

| Efficiency ratio (1) |

|

|

64.82 |

% |

|

|

63.65 |

% |

|

|

64.53 |

% |

|

|

61.00 |

% |

|

|

62.35 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average

Balances |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average assets |

|

$ |

1,337,247 |

|

|

$ |

1,026,583 |

|

|

$ |

988,324 |

|

|

$ |

954,810 |

|

|

$ |

944,390 |

|

| Average earning assets |

|

|

1,272,969 |

|

|

|

976,842 |

|

|

|

937,199 |

|

|

|

904,511 |

|

|

|

889,127 |

|

| Average shareholders’

equity |

|

|

110,153 |

|

|

|

87,442 |

|

|

|

85,708 |

|

|

|

83,545 |

|

|

|

81,894 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Asset

Quality |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loan charge-offs |

|

$ |

111 |

|

|

$ |

1,085 |

|

|

$ |

66 |

|

|

$ |

165 |

|

|

$ |

115 |

|

| Loan recoveries |

|

|

80 |

|

|

|

64 |

|

|

|

67 |

|

|

|

73 |

|

|

|

96 |

|

| Net charge-offs

(recoveries) |

|

|

31 |

|

|

|

1,021 |

|

|

|

(1 |

) |

|

|

92 |

|

|

|

19 |

|

| Non-accrual loans |

|

|

2,158 |

|

|

|

2,102 |

|

|

|

6,814 |

|

|

|

6,714 |

|

|

|

6,974 |

|

| Other real estate owned,

net |

|

|

1,848 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Nonperforming assets |

|

|

4,006 |

|

|

|

2,102 |

|

|

|

6,814 |

|

|

|

6,714 |

|

|

|

6,974 |

|

| Loans 30 to 89 days past due,

accruing |

|

|

3,276 |

|

|

|

550 |

|

|

|

906 |

|

|

|

996 |

|

|

|

885 |

|

| Loans over 90 days past due,

accruing |

|

|

7 |

|

|

|

5 |

|

|

|

— |

|

|

|

302 |

|

|

|

6 |

|

| Troubled debt restructurings,

accruing |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Special mention loans |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

510 |

|

| Substandard loans,

accruing |

|

|

319 |

|

|

|

322 |

|

|

|

1,343 |

|

|

|

1,394 |

|

|

|

3,804 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Capital Ratios

(2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total capital |

|

$ |

128,197 |

|

|

$ |

95,856 |

|

|

$ |

94,044 |

|

|

$ |

91,243 |

|

|

$ |

89,155 |

|

| Tier 1 capital |

|

|

122,763 |

|

|

|

90,391 |

|

|

|

86,717 |

|

|

|

84,032 |

|

|

|

81,883 |

|

| Common equity tier 1

capital |

|

|

122,763 |

|

|

|

90,391 |

|

|

|

86,717 |

|

|

|

84,032 |

|

|

|

81,883 |

|

| Total capital to risk-weighted

assets |

|

|

14.42 |

% |

|

|

16.25 |

% |

|

|

16.05 |

% |

|

|

15.82 |

% |

|

|

15.34 |

% |

| Tier 1 capital to

risk-weighted assets |

|

|

13.81 |

% |

|

|

15.32 |

% |

|

|

14.80 |

% |

|

|

14.57 |

% |

|

|

14.09 |

% |

| Common equity tier 1 capital

to risk-weighted assets |

|

|

13.81 |

% |

|

|

15.32 |

% |

|

|

14.80 |

% |

|

|

14.57 |

% |

|

|

14.09 |

% |

| Leverage ratio |

|

|

9.22 |

% |

|

|

8.78 |

% |

|

|

8.78 |

% |

|

|

8.80 |

% |

|

|

8.67 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FIRST NATIONAL CORPORATIONQuarterly

Performance Summary(in thousands, except share and per

share data)

| |

|

(unaudited) |

|

| |

|

For the Quarter Ended |

|

| |

|

September 30, |

|

|

June 30, |

|

|

March 31, |

|

|

December 31, |

|

|

September 30, |

|

| |

|

2021 |

|

|

2021 |

|

|

2021 |

|

|

2020 |

|

|

2020 |

|

|

Balance Sheet |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and due from banks |

|

$ |

19,182 |

|

|

$ |

13,913 |

|

|

$ |

11,940 |

|

|

$ |

13,115 |

|

|

$ |

13,349 |

|

| Interest-bearing deposits in

banks |

|

|

95,459 |

|

|

|

114,334 |

|

|

|

164,322 |

|

|

|

114,182 |

|

|

|

108,857 |

|

| Federal funds sold |

|

|

80,589 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Securities available for sale,

at fair value |

|

|

266,600 |

|

|

|

222,236 |

|

|

|

159,742 |

|

|

|

140,225 |

|

|

|

117,132 |

|

| Securities held to maturity,

at amortized cost |

|

|

10,046 |

|

|

|

10,898 |

|

|

|

13,424 |

|

|

|

14,234 |

|

|

|

15,101 |

|

| Restricted securities, at

cost |

|

|

1,813 |

|

|

|

1,631 |

|

|

|

1,631 |

|

|

|

1,875 |

|

|

|

1,848 |

|

| Loans held for sale |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

245 |

|

|

|

— |

|

| Loans, net of allowance for

loan losses |

|

|

816,977 |

|

|

|

611,883 |

|

|

|

630,716 |

|

|

|

622,429 |

|

|

|

640,591 |

|

| Other real estate owned |

|

|

1,848 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Premises and equipment,

net |

|

|

22,401 |

|

|

|

18,876 |

|

|

|

19,087 |

|

|

|

19,319 |

|

|

|

19,548 |

|

| Accrued interest

receivable |

|

|

3,823 |

|

|

|

2,662 |

|

|

|

2,609 |

|

|

|

2,717 |

|

|

|

3,156 |

|

| Bank owned life insurance |

|

|

24,141 |

|

|

|

18,128 |

|

|

|

18,029 |

|

|

|

17,916 |

|

|

|

17,792 |

|

| Goodwill |

|

|

4,011 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Core deposit intangibles,

net |

|

|

159 |

|

|

|

— |

|

|

|

5 |

|

|

|

19 |

|

|

|

43 |

|

| Other assets |

|

|

8,740 |

|

|

|

10,032 |

|

|

|

6,625 |

|

|

|

4,656 |

|

|

|

5,316 |

|

| Total assets |

|

$ |

1,355,789 |

|

|

$ |

1,024,593 |

|

|

$ |

1,028,130 |

|

|

$ |

950,932 |

|

|

$ |

942,733 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Noninterest-bearing demand

deposits |

|

$ |

411,527 |

|

|

$ |

290,571 |

|

|

$ |

292,280 |

|

|

$ |

263,229 |

|

|

$ |

256,733 |

|

| Savings and interest-bearing

demand deposits |

|

|

652,624 |

|

|

|

528,002 |

|

|

|

526,012 |

|

|

|

479,035 |

|

|

|

480,017 |

|

| Time deposits |

|

|

148,419 |

|

|

|

95,732 |

|

|

|

97,765 |

|

|

|

100,197 |

|

|

|

101,645 |

|

| Total deposits |

|

$ |

1,212,570 |

|

|

$ |

914,305 |

|

|

$ |

916,057 |

|

|

$ |

842,461 |

|

|

$ |

838,395 |

|

| Subordinated debt |

|

|

9,993 |

|

|

|

9,992 |

|

|

|

9,992 |

|

|

|

9,991 |

|

|

|

9,987 |

|

| Junior subordinated debt |

|

|

9,279 |

|

|

|

9,279 |

|

|

|

9,279 |

|

|

|

9,279 |

|

|

|

9,279 |

|

| Accrued interest payable and

other liabilities |

|

|

7,041 |

|

|

|

2,335 |

|

|

|

6,876 |

|

|

|

4,285 |

|

|

|

2,816 |

|

| Total liabilities |

|

$ |

1,238,883 |

|

|

$ |

935,911 |

|

|

$ |

942,204 |

|

|

$ |

866,016 |

|

|

$ |

860,477 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Preferred stock |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

| Common stock |

|

|

7,783 |

|

|

|

6,088 |

|

|

|

6,086 |

|

|

|

6,075 |

|

|

|

6,073 |

|

| Surplus |

|

|

31,889 |

|

|

|

6,295 |

|

|

|

6,214 |

|

|

|

6,151 |

|

|

|

6,081 |

|

| Retained earnings |

|

|

75,554 |

|

|

|

73,901 |

|

|

|

71,144 |

|

|

|

69,292 |

|

|

|

66,670 |

|

| Accumulated other

comprehensive income, net |

|

|

1,680 |

|

|

|

2,398 |

|

|

|

2,482 |

|

|

|

3,398 |

|

|

|

3,432 |

|

| Total shareholders’

equity |

|

$ |

116,906 |

|

|

$ |

88,682 |

|

|

$ |

85,926 |

|

|

$ |

84,916 |

|

|

$ |

82,256 |

|

| Total liabilities and

shareholders’ equity |

|

$ |

1,355,789 |

|

|

$ |

1,024,593 |

|

|

$ |

1,028,130 |

|

|

$ |

950,932 |

|

|

$ |

942,733 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loan

Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mortgage loans on real

estate: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Construction and land development |

|

$ |

45,194 |

|

|

$ |

25,035 |

|

|

$ |

25,720 |

|

|

$ |

27,328 |

|

|

$ |

27,472 |

|

|

Secured by farmland |

|

|

3,748 |

|

|

|

495 |

|

|

|

507 |

|

|

|

521 |

|

|

|

533 |

|

|

Secured by 1-4 family residential |

|

|

294,216 |

|

|

|

235,158 |

|

|

|

236,870 |

|

|

|

235,814 |

|

|

|

234,198 |

|

|

Other real estate loans |

|

|

358,821 |

|

|

|

244,960 |

|

|

|

248,357 |

|

|

|

246,362 |

|

|

|

249,786 |

|

| Loans to farmers (except those

secured by real estate) |

|

|

857 |

|

|

|

232 |

|

|

|

436 |

|

|

|

637 |

|

|

|

1,120 |

|

| Commercial and industrial

loans (except those secured by real estate) |

|

|

104,807 |

|

|

|

102,734 |

|

|

|

117,109 |

|

|

|

109,201 |

|

|

|

124,157 |

|

| Consumer installment

loans |

|

|

6,577 |

|

|

|

5,179 |

|

|

|

5,684 |

|

|

|

6,458 |

|

|

|

7,378 |

|

| Deposit overdrafts |

|

|

172 |

|

|

|

174 |

|

|

|

112 |

|

|

|

143 |

|

|

|

194 |

|

| All other loans |

|

|

8,019 |

|

|

|

3,381 |

|

|

|

3,407 |

|

|

|

3,450 |

|

|

|

3,530 |

|

| Total loans |

|

$ |

822,411 |

|

|

$ |

617,348 |

|

|

$ |

638,202 |

|

|

$ |

629,914 |

|

|

$ |

648,368 |

|

| Allowance for loan losses |

|

|

(5,434 |

) |

|

|

(5,465 |

) |

|

|

(7,486 |

) |

|

|

(7,485 |

) |

|

|

(7,777 |

) |

| Loans, net |

|

$ |

816,977 |

|

|

$ |

611,883 |

|

|

$ |

630,716 |

|

|

$ |

622,429 |

|

|

$ |

640,591 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FIRST NATIONAL CORPORATIONQuarterly

Performance Summary(in thousands, except share and per

share data)

| |

|

(unaudited) |

|

| |

|

For the Quarter Ended |

|

| |

|

September 30, |

|

|

June 30, |

|

|

March 31, |

|

|

December 31, |

|

|

September 30, |

|

| |

|

2021 |

|

|

2021 |

|

|

2021 |

|

|

2020 |

|

|

2020 |

|

|

Reconciliation of Tax-Equivalent Net Interest

Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP measures: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income – loans |

|

$ |

9,215 |

|

|

$ |

7,074 |

|

|

$ |

7,143 |

|

|

$ |

7,310 |

|

|

$ |

7,568 |

|

|

Interest income – investments and other |

|

|

1,116 |

|

|

|

971 |

|

|

|

952 |

|

|

|

785 |

|

|

|

775 |

|

|

Interest expense – deposits |

|

|

(369 |

) |

|

|

(328 |

) |

|

|

(363 |

) |

|

|

(410 |

) |

|

|

(541 |

) |

|

Interest expense – subordinated debt |

|

|

(156 |

) |

|

|

(154 |

) |

|

|

(154 |

) |

|

|

(160 |

) |

|

|

(160 |

) |

|

Interest expense – junior subordinated debt |

|

|

(68 |

) |

|

|

(68 |

) |

|

|

(66 |

) |

|

|

(68 |

) |

|

|

(68 |

) |

| Total net interest income |

|

$ |

9,738 |

|

|

$ |

7,495 |

|

|

$ |

7,512 |

|

|

$ |

7,457 |

|

|

$ |

7,574 |

|

| Non-GAAP measures: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax benefit realized on non-taxable interest income – loans |

|

$ |

8 |

|

|

$ |

8 |

|

|

$ |

8 |

|

|

$ |

8 |

|

|

$ |

8 |

|

|

Tax benefit realized on non-taxable interest income – municipal

securities |

|

|

64 |

|

|

|

57 |

|

|

|

48 |

|

|

|

43 |

|

|

|

41 |

|

| Total tax benefit realized on

non-taxable interest income |

|

$ |

72 |

|

|

$ |

65 |

|

|

$ |

56 |

|

|

$ |

51 |

|

|

$ |

49 |

|

| Total tax-equivalent net

interest income |

|

$ |

9,810 |

|

|

$ |

7,560 |

|

|

$ |

7,568 |

|

|

$ |

7,508 |

|

|

$ |

7,623 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FIRST NATIONAL CORPORATIONYear-to-Date

Performance Summary(in thousands, except share and per

share data)

| |

|

(unaudited) |

|

| |

|

For the Nine Months Ended |

|

| |

|

September 30, |

|

|

September 30, |

|

| |

|

2021 |

|

|

2020 |

|

|

Income Statement |

|

|

|

|

|

|

|

|

| Interest income |

|

|

|

|

|

|

|

|

|

Interest and fees on loans |

|

$ |

23,432 |

|

|

$ |

22,187 |

|

|

Interest on deposits in banks |

|

|

149 |

|

|

|

159 |

|

| Interest on federal funds

sold |

|

|

8 |

|

|

|

— |

|

|

Interest on securities |

|

|

|

|

|

|

|

|

|

Taxable interest |

|

|

2,180 |

|

|

|

1,881 |

|

|

Tax-exempt interest |

|

|

637 |

|

|

|

454 |

|

|

Dividends |

|

|

65 |

|

|

|

75 |

|

| Total interest income |

|

$ |

26,471 |

|

|

$ |

24,756 |

|

| Interest expense |

|

|

|

|

|

|

|

|

|

Interest on deposits |

|

$ |

1,060 |

|

|

$ |

2,179 |

|

|

Interest on federal funds purchased |

|

|

— |

|

|

|

— |

|

|

Interest on subordinated debt |

|

|

464 |

|

|

|

341 |

|

|

Interest on junior subordinated debt |

|

|

202 |

|

|

|

225 |

|

|

Interest on other borrowings |

|

|

— |

|

|

|

— |

|

| Total interest expense |

|

$ |

1,726 |

|

|

$ |

2,745 |

|

| Net interest income |

|

$ |

24,745 |

|

|

$ |

22,011 |

|

| Provision for (recovery of)

loan losses |

|

|

(1,000 |

) |

|

|

3,200 |

|

| Net interest income after

provision for loan losses |

|

$ |

25,745 |

|

|

$ |

18,811 |

|

| Noninterest income |

|

|

|

|

|

|

|

|

|

Service charges on deposit accounts |

|

$ |

1,436 |

|

|

$ |

1,475 |

|

|

ATM and check card fees |

|

|

2,036 |

|

|

|

1,738 |

|

|

Wealth management fees |

|

|

1,996 |

|

|

|

1,610 |

|

|

Fees for other customer services |

|

|

1,027 |

|

|

|

767 |

|

|

Income from bank owned life insurance |

|

|

374 |

|

|

|

345 |

|

|

Net gains (losses) on securities |

|

|

37 |

|

|

|

38 |

|

|

Net gains on sale of loans |

|

|

25 |

|

|

|

60 |

|

|

Other operating income |

|

|

295 |

|

|

|

40 |

|

| Total noninterest income |

|

$ |

7,226 |

|

|

$ |

6,073 |

|

| Noninterest expense |

|

|

|

|

|

|

|

|

|

Salaries and employee benefits |

|

$ |

12,694 |

|

|

$ |

10,109 |

|

|

Occupancy |

|

|

1,346 |

|

|

|

1,244 |

|

|

Equipment |

|

|

1,383 |

|

|

|

1,267 |

|

|

Marketing |

|

|

487 |

|

|

|

243 |

|

|

Supplies |

|

|

341 |

|

|

|

304 |

|

|

Legal and professional fees |

|

|

1,806 |

|

|

|

842 |

|

|

ATM and check card expense |

|

|

828 |

|

|

|

727 |

|

|

FDIC assessment |

|

|

234 |

|

|

|

142 |

|

|

Bank franchise tax |

|

|

493 |

|

|

|

476 |

|

|

Data processing expense |

|

|

885 |

|

|

|

563 |

|

|

Amortization expense |

|

|

24 |

|

|

|

127 |

|

|

Other real estate owned expense (income), net |

|

|

14 |

|

|

|

(9 |

) |

|

Other operating expense |

|

|

2,171 |

|

|

|

1,857 |

|

| Total noninterest expense |

|

$ |

22,706 |

|

|

$ |

17,892 |

|

| Income before income

taxes |

|

$ |

10,265 |

|

|

$ |

6,992 |

|

| Income tax expense |

|

|

2,089 |

|

|

|

1,290 |

|

| Net income |

|

$ |

8,176 |

|

|

$ |

5,702 |

|

| |

|

|

|

|

|

|

|

|

FIRST NATIONAL CORPORATIONYear-to-Date

Performance Summary(in thousands, except share and per

share data)

| |

|

(unaudited) |

|

| |

|

For the Nine Months Ended |

|

| |

|

September 30, |

|

|

September 30, |

|

| |

|

2021 |

|

|

2020 |

|

|

Common Share and Per Common Share Data |

|

|

|

|

|

|

|

|

| Net income, basic |

|

$ |

1.54 |

|

|

$ |

1.17 |

|

| Weighted average shares,

basic |

|

|

5,322,696 |

|

|

|

4,884,805 |

|

| Net income, diluted |

|

$ |

1.53 |

|

|

$ |

1.17 |

|

| Weighted average shares,

diluted |

|

|

5,329,939 |

|

|

|

4,886,668 |

|

| Shares outstanding at period

end |

|

|

6,226,418 |

|

|

|

4,858,217 |

|

| Tangible book value at period

end |

|

$ |

18.11 |

|

|

$ |

16.92 |

|

| Cash dividends |

|

$ |

0.36 |

|

|

$ |

0.33 |

|

| |

|

|

|

|

|

|

|

|

| Key Performance

Ratios |

|

|

|

|

|

|

|

|

| Return on average assets |

|

|

0.97 |

% |

|

|

0.86 |

% |

| Return on average equity |

|

|

11.40 |

% |

|

|

9.49 |

% |

| Net interest margin |

|

|

3.13 |

% |

|

|

3.58 |

% |

| Efficiency ratio (1) |

|

|

64.34 |

% |

|

|

63.04 |

% |

| |

|

|

|

|

|

|

|

|

| Average

Balances |

|

|

|

|

|

|

|

|

| Average assets |

|

$ |

1,121,225 |

|

|

$ |

883,741 |

|

| Average earning assets |

|

|

1,063,597 |

|

|

|

827,240 |

|

| Average shareholders’

equity |

|

|

95,861 |

|

|

|

80,228 |

|

| |

|

|

|

|

|

|

|

|

| Asset

Quality |

|

|

|

|

|

|

|

|

| Loan charge-offs |

|

$ |

1,262 |

|

|

$ |

619 |

|

| Loan recoveries |

|

|

211 |

|

|

|

262 |

|

| Net charge-offs |

|

|

1,051 |

|

|

|

357 |

|

| |

|

|

|

|

|

|

|

|

| Reconciliation of

Tax-Equivalent Net Interest Income |

|

|

|

|

|

|

|

|

| GAAP measures: |

|

|

|

|

|

|

|

|

|

Interest income – loans |

|

$ |

23,432 |

|

|

$ |

22,187 |

|

|

Interest income – investments and other |

|

|

3,039 |

|

|

|

2,569 |

|

|

Interest expense – deposits |

|

|

(1,060 |

) |

|

|

(2,179 |

) |

|

Interest expense – federal funds purchased |

|

|

— |

|

|

|

— |

|

|

Interest expense – subordinated debt |

|

|

(464 |

) |

|

|

(341 |

) |

|

Interest expense – junior subordinated debt |

|

|

(202 |

) |

|

|

(225 |

) |

|

Interest expense – other borrowings |

|

|

— |

|

|

|

— |

|

| Total net interest income |

|

$ |

24,745 |

|

|

$ |

22,011 |

|

| Non-GAAP measures: |

|

|

|

|

|

|

|

|

|

Tax benefit realized on non-taxable interest income – loans |

|

$ |

24 |

|

|

$ |

26 |

|

|

Tax benefit realized on non-taxable interest income – municipal

securities |

|

|

169 |

|

|

|

121 |

|

| Total tax benefit realized on

non-taxable interest income |

|

$ |

193 |

|

|

$ |

147 |

|

| Total tax-equivalent net

interest income |

|

$ |

24,938 |

|

|

$ |

22,158 |

|

| |

|

|

|

|

|

|

|

|

(1) The efficiency ratio is computed by dividing

noninterest expense excluding other real estate owned

income/expense, amortization of intangibles, gains and losses on

disposal of premises and equipment, and merger related

expenses by the sum of net interest income on a tax-equivalent

basis and noninterest income, excluding gains and losses on sales

of securities. Tax-equivalent net interest income is

calculated by adding the tax benefit realized from interest income

that is nontaxable to total interest income then subtracting total

interest expense. The tax rate utilized in calculating the tax

benefit is 21%. See the tables above for tax-equivalent net

interest income and reconciliations of net interest income to

tax-equivalent net interest income. The efficiency ratio is a

non-GAAP financial measure that management believes provides

investors with important information regarding operational

efficiency. Such information is not prepared in accordance

with U.S. generally accepted accounting principles (GAAP) and

should not be construed as such. Management believes;

however, such financial information is meaningful to the reader in

understanding operational performance, but cautions that such

information not be viewed as a substitute for GAAP.

(2) All capital ratios reported are for First Bank.

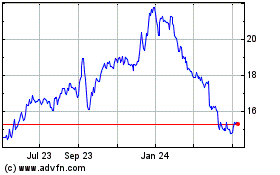

First National (NASDAQ:FXNC)

Historical Stock Chart

From Mar 2024 to Apr 2024

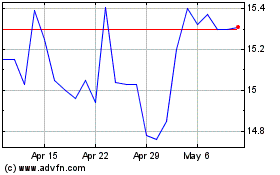

First National (NASDAQ:FXNC)

Historical Stock Chart

From Apr 2023 to Apr 2024