Current Report Filing (8-k)

February 24 2021 - 4:30PM

Edgar (US Regulatory)

February 24, 20210000798941falseFirst Citizens BancShares Inc /DE/00007989412021-02-242021-02-240000798941us-gaap:CommonClassAMember2021-02-242021-02-240000798941us-gaap:SeriesAPreferredStockMember2021-02-242021-02-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 24, 2021

_________________________________________________________________

First Citizens BancShares, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

001-16715

|

56-1528994

|

|

(State or other jurisdiction

of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4300 Six Forks Road

|

Raleigh

|

North Carolina

|

27609

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: (919) 716-7000

________________________________________________________________________________

(Former name or former address, if changed since last report)

|

|

|

|

|

|

|

|

|

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities Registered Pursuant to Section 12(b) of the Securities Exchange Act of 1934:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol

|

Name of each exchange on which registered

|

|

Class A Common Stock, Par Value $1

|

FCNCA

|

Nasdaq Global Select Market

|

|

Depositary Shares, Each Representing a 1/40th Interest in a Share of 5.375% Non-Cumulative Perpetual Preferred Stock, Series A

|

FCNCP

|

Nasdaq Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensation Arrangement of Certain Officers

On February 24, 2021, upon the recommendation of the joint Compensation, Nominations and Governance Committee of the Board of Directors of First Citizens BancShares, Inc. (“BancShares”) and of the Board of Directors of First-Citizens Bank & Trust Company, a North Carolina corporation and wholly-owned subsidiary of BancShares (the “Company”), the Company’s Board of Directors adopted the First-Citizens Bank & Trust Company Nonqualified Deferred Compensation Plan (the “Plan”).

The Plan, which will become effective on March 1, 2021 (the “Effective Date”), is a nonqualified deferred compensation plan established for a select group of management and other highly compensated employees (within the meaning of the Employee Retirement Income Security Act of 1974, as amended) of the Company and its participating affiliates. The Plan is designed to permit eligible employees, including the Company’s named executive officers, to save for retirement and other long-term financial goals on a tax-deferred basis. Pursuant to the Plan, participants may elect annually to defer receipt of up to eighty percent (80%) of their base salary and eligible bonuses, including performance-based compensation paid pursuant to the Company’s Long-Term Incentive Plan. The Plan does not provide for the Company to make any additional or discretionary contributions to the Plan.

Amounts deferred under the Plan will be credited with investment returns based on deemed investment options selected by the participant from a menu of publicly-traded mutual funds or other deemed investment options determined by the Plan Administrator from time to time. The deemed investment options are to be used for measurement purposes only and amounts deferred will not represent any actual investments on the participants’ behalf. The amount required to be paid to a participant under the Plan shall be equal to a participant’s elective deferrals to the Plan, as adjusted for the hypothetical gains or losses on the participant’s deemed investment options.

Participant contributions to the Plan will be fully vested at all times. Distributions of participant accounts will be made following a participant’s separation of service, death, disability, or certain limited unforeseeable emergencies. In accordance with the terms of the Plan, distributions will generally be paid in a single lump sum unless the participant elects upon commencing participation in the Plan to receive distributions in annual installments over five (5), ten (10), or fifteen (15) years. Payments under the Plan will be made (or commence) within ninety (90) days of the January 31st of the calendar year immediately following the year in which a participant’s triggering event occurs.

The Plan is designed to comply with Section 409A of the Internal Revenue Code of 1986, as amended (“Section 409A”) and all distributions will be made in accordance with Section 409A. The Company may generally amend or terminate the Plan at any time, provided that any such action complies with the requirements of Section 409A and does not reduce a participant’s account balance in the Plan.

A Rabbi Trust may (but need not) be established by the Company in connection with the Plan for purposes of holding assets necessary to fund benefits payable under the Plan. Whether or not a Rabbi Trust is created, Plan participants (and their beneficiaries) shall at all times have the same status as general unsecured creditors of the Company.

The foregoing description of the Plan does not purport to be complete and is qualified in its entirety by reference to the full text of the Plan, a copy of which is attached hereto as Exhibit 10.1 and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits. The following exhibit accompanies this report.

|

|

|

|

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

10.1

|

|

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First Citizens BancShares, Inc.

|

|

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date:

|

February 24, 2021

|

|

By: /s/ Craig L. Nix

|

|

|

|

|

|

Craig L. Nix

|

|

|

|

|

|

Chief Financial Officer

|

|

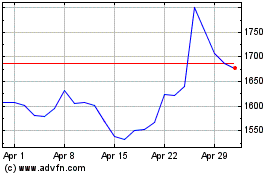

First Citizens BancShares (NASDAQ:FCNCA)

Historical Stock Chart

From Mar 2024 to Apr 2024

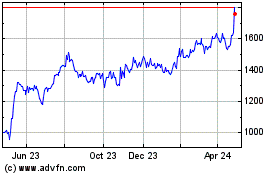

First Citizens BancShares (NASDAQ:FCNCA)

Historical Stock Chart

From Apr 2023 to Apr 2024