Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

July 27 2020 - 5:23PM

Edgar (US Regulatory)

Free Writing Prospectus

Filed Pursuant to Rule 433

Registration No. 333-230568

Dated July 27, 2020

350,000 Depositary Shares,

Each Representing a 1/25th Interest in a Share of

Series L Preferred Stock

(Non-Cumulative, Liquidation Amount $1000 per Depositary Share)

Pricing Term Sheet

|

|

|

|

|

Issuer:

|

|

Fifth Third Bancorp (the “Company”)

|

|

|

|

|

Securities Offered:

|

|

350,000 Depositary Shares (representing 14,000 shares of Series L Preferred Stock)

|

|

|

|

|

Security Type:

|

|

SEC Registered

|

|

|

|

|

Currency:

|

|

USD

|

|

|

|

|

Liquidation Amount:

|

|

$1,000 per Depositary Share ($25,000 per share of Series L Preferred Stock)

|

|

|

|

|

Price to Public:

|

|

$1,000 per Depositary Share

|

|

|

|

|

Expected Ratings*:

|

|

Baa3 (stable) (Moody’s) / BB+ (stable) (S&P) / BB+ (negative) (Fitch)

|

|

|

|

|

Trade Date:

|

|

July 27, 2020

|

|

|

|

|

Settlement Date:

|

|

July 30, 2020 (T+3)

|

|

|

|

|

Maturity Date:

|

|

Perpetual

|

|

|

|

|

Dividend Rate (Non-Cumulative):

|

|

From the original issue date to, but excluding, September 30, 2025 (the “first dividend reset date”), a fixed rate per annum equal to 4.500%, and from, and including, the first dividend reset date, for each dividend

reset period (as defined in the preliminary prospectus supplement), a rate per annum equal to the Five-Year U.S. Treasury Rate (as defined in the preliminary prospectus supplement) as of the most recent reset dividend determination date (as defined

in the preliminary prospectus supplement) plus 4.215%. The dividend rate will be reset on the first dividend reset date and on each date falling on the fifth anniversary of the preceding dividend reset

date

|

|

|

|

|

|

|

|

|

Dividend Payment Dates:

|

|

March 31, June 30, September 30 and December 31 of each year, commencing September 30, 2020, on a non-cumulative basis when, as and if a dividend is declared on the

Series L Preferred Stock by the board of directors of the Company

|

|

|

|

|

Day Count Convention:

|

|

30/360

|

|

|

|

|

Optional Redemption:

|

|

Subject to receiving required regulatory approvals, the Company may redeem the Series L Preferred Stock at its option, (i) in whole or in part, on any Dividend Payment Date on or after September 30, 2025, and

(ii) following a “regulatory capital event”, as described in the preliminary prospectus supplement, in whole, but not in part, at in each case at 100% of their liquidation preference, plus declared but unpaid dividends, if any,

without accumulation of undeclared dividends to the redemption date. Upon any redemption of the Series L Preferred Stock, the depositary will redeem a proportionate number of Depositary Shares.

|

|

|

|

|

|

|

Neither the holders of the Series L Preferred Stock nor the holders of Depositary Shares will have the right to require the redemption or repurchase of the Series L Preferred Stock.

|

|

|

|

|

Voting Rights:

|

|

None generally, except as required by Ohio law and described in the preliminary prospectus supplement.

|

|

|

|

|

Proceeds (Before Expenses) to Company:

|

|

$346,500,000

|

|

|

|

|

Ranking:

|

|

The Series L Preferred Stock will rank:

|

|

|

|

|

|

|

• senior to Fifth Third’s common shares;

• equally with our 5.10%

Fixed-to-Floating Rate Non-Cumulative Perpetual Preferred Stock, Series H, our 6.625% Fixed-to-Floating Rate Non-Cumulative Perpetual Preferred Stock, Series I, our 4.90% Fixed-to-Floating Rate Non-Cumulative Perpetual Preferred Stock, Series J, our

6.00% Non-Cumulative Perpetual Class B Preferred Stock, Series A, and our 4.95% Non-Cumulative Perpetual Preferred Stock, Series K;

|

|

|

|

|

|

|

|

|

|

|

• at least equally with all shares of preferred stock and all other equity

securities the terms of which provide that such preferred stock or other equity securities rank on a parity with the Series L Preferred Stock; and

• junior to Fifth Third’s secured and unsecured debt.

|

|

|

|

|

Use of Proceeds:

|

|

General corporate purposes

|

|

|

|

|

Form:

|

|

Book-entry only

|

|

|

|

|

CUSIP/ISIN:

|

|

316773 DB3 / US316773DB33

|

|

|

|

|

Joint Book-Running Managers:

|

|

Morgan Stanley & Co. LLC

|

|

|

|

Citigroup Global Markets Inc.

|

|

|

|

Fifth Third Securities, Inc.

|

|

|

|

RBC Capital Markets, LLC

|

|

|

|

|

Co-Managers:

|

|

CastleOak Securities, L.P.

|

|

|

|

Siebert Williams Shank & Co., LLC

|

* Note: A securities rating is not a recommendation to buy, sell or hold securities and may be subject to revision or

withdrawal at any time.

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this

communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these

documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling Morgan

Stanley & Co. LLC toll-free at 1-866-718-1649, Citigroup Global Markets Inc. toll-free at

1-800-831-9146, Fifth Third Securities, Inc. toll-free at 1-866-531-5353 and RBC Capital Markets, LLC toll-free at 1-866-375-6829.

Under Rule 15c6-1 of the Securities Exchange Act of 1934, as amended, trades in the secondary market generally are

required to settle in two business days, unless the parties to such trade expressly agree otherwise. Accordingly, purchasers who wish to trade the Depositary Shares on the pricing date will be required, by virtue of the fact that the Depositary

Shares initially will settle in three business days (T+3), to specify alternative settlement arrangements to prevent a failed settlement.

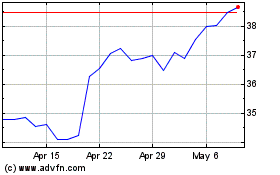

Fifth Third Bancorp (NASDAQ:FITB)

Historical Stock Chart

From Mar 2024 to Apr 2024

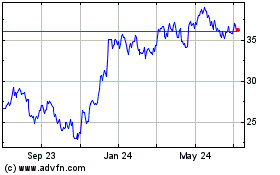

Fifth Third Bancorp (NASDAQ:FITB)

Historical Stock Chart

From Apr 2023 to Apr 2024