Filed Pursuant to Rule 424(b)(4)

Registration No. 333-255387

140,000,000 Ordinary Shares

We are offering 140,000,000 ordinary shares pursuant

to this prospectus. The ordinary shares will be sold for a purchase price equal to $0.30 per share.

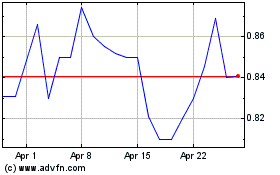

Our ordinary shares are listed

on The Nasdaq Capital Market under the symbol “FAMI.” The closing price of our ordinary shares on April 28, 2021, as

reported by The Nasdaq Capital Market, was $0.791 per share.

We are an “emerging

growth company” as defined in the Jumpstart Our Business Act of 2012, as amended, and, as such, will be subject to reduced public

company reporting requirements.

Investing in our securities involves a high

degree of risk. Before making any investment in these securities, you should consider carefully the risks and uncertainties in the section

entitled “Risk Factors” beginning on page 6 of this prospectus, any applicable prospectus supplement and in any

applicable free writing prospectuses, and under similar headings in the documents that are incorporated by reference into this prospectus.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete.

Any representation to the contrary is a criminal offense. The securities are not being offered in any jurisdiction where the offer is

not permitted.

|

|

|

Per Share

|

|

|

Total

|

|

|

Public offering price

|

|

$

|

0.30

|

|

|

$

|

42,000,000

|

|

|

Underwriting discount(1)

|

|

$

|

0.02025

|

|

|

$

|

2,835,000

|

|

|

Proceeds, before expenses, to Farmmi, Inc.

|

|

$

|

0.27975

|

|

|

$

|

39,165,000

|

|

|

(1)

|

We have agreed to pay a non-accountable expense allowance to Aegis Capital Corp. (the “Underwriter”) of 1% of the gross proceeds received in this offering and to reimburse the underwriters for other out-of-pocket expenses related to the offering. See “Underwriting” for additional disclosure regarding underwriter compensation.

|

This offering is being underwritten on a firm commitment

basis. We have granted the Underwriter an option for a period of 45 days from the date of the closing of this offering to purchase up

to an additional of our ordinary shares (equal to 15% of the number of shares offered hereby) on the same terms and conditions as set

forth above to cover over-allotments, if any. If the Underwriter exercises the option in full, the total underwriting discount will be

$3,260,250, and the total proceeds to us, before expenses, will be $45,039,750. See “Underwriting”

for more information.

The Underwriter expects to deliver the securities

to purchasers in the offering on or about May 3, 2021.

Sole Book-Running Manager

Aegis Capital Corp.

The date of this prospectus is April 28, 2021

Table

of Contents

You should rely only on

the information contained or incorporated by reference in this prospectus and in any free writing prospectus that we have authorized for

use in connection with this offering. Neither we nor the underwriter has authorized anyone to provide you with different information.

If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus is not an offer to sell

securities in any state where the offer or solicitation is not permitted. The information contained in this prospectus is complete and

accurate as of the date on the front cover of this prospectus, but information may have changed since that date. We are responsible for

updating this prospectus to ensure that all material information is included and will update this prospectus to the extent required by

law.

This prospectus includes statistical

and other industry and market data that we obtained from industry publications and research, surveys and studies conducted by third parties.

Industry publications and third-party research, surveys and studies generally indicate that their information has been obtained from sources

believed to be reliable, although they do not guarantee the accuracy or completeness of such information. While we believe that these

industry publications and third-party research, surveys and studies are reliable, we have not independently verified such data and we

do not make any representation as to the accuracy of the information.

We are not making an offer

of these securities in any state or jurisdiction where the offer is not permitted. No action is being taken in any jurisdiction outside

the United States to permit a public offering of the securities or possession or distribution of this prospectus supplement or the accompanying

base prospectus in that jurisdiction. Persons who come into possession of this prospectus supplement or the accompanying base prospectus

in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to this offering

and the distribution of this prospectus supplement or the accompanying base prospectus applicable to that jurisdiction.

PROSPECTUS SUMMARY

This summary highlights

selected information about us, this offering and information contained in greater detail elsewhere in this prospectus. This summary is

not complete and does not contain all of the information that you should consider before investing in our securities. You should carefully

consider, among other things, our financial statements and the related notes and the sections entitled “Risk Factors” and

“Operating and Financial Review and Prospects” included elsewhere in, or incorporated by reference into, this prospectus.

Unless the context otherwise requires, in this prospectus, the terms “Farmmi,” “the Company,” “us,”

“we” and “our” refer to Farmmi, Inc. and our subsidiaries.

Business Overview

In the fiscal year ended September 30, 2020,

we mainly processed and/or sold four categories of agricultural products: Shiitake mushrooms, Mu Er mushrooms, other edible fungi, and

other agricultural products. We do not grow fungi, but purchase dried edible fungi from third party suppliers, mainly from family farms,

and two co-operatives representing family farms, Jingning Liannong Trading Co. Ltd. (“JLT”) and Qingyuan Nongbang Mushroom

Industry Co., Ltd. (“QNMI”), with whom we have worked with for many years. JLT and QNMI are two companies in the Lishui

area where our facilities are located. They are co-operatives representing family farms which plant and provide edible fungi. JLT and

QNMI themselves do not have any facilities and do not process any fungi. They are established to share resources, such as procurement

information, and to enjoy the advantage of economy of scale. After we select and filter the dried edible fungi for specific sizes and

quality from our suppliers, we may further dehydrate them again, as deemed necessary, to ensure uniform moisture level of our products.

We then package the fungi products for sale. The only products we process and package are edible fungi, which are processed and packaged

at our own processing facilities. For other agricultural products, such as rice and edible oil, we purchase them from third-party suppliers,

and sell these products at our online store Farmmi Liangpin Market. Mainly through distributors, we offer gourmet dried mushrooms to domestic

and overseas retail supermarkets, produce distributors and foodservice distributors and operators. We have become an enterprise with advanced

processing equipment and business management experience, and we pride ourselves on consistently producing quality mushrooms and serving

our customers with a high level of commitment.

Currently, we estimate that approximately 94% of

our products are sold in China to domestic distributors and the remaining 6% are sold internationally, including USA, Japan, Canada and

other countries, through distributors. In addition, in order to enhance our e-commerce marketing presence, we developed our own e-commerce

website Farmmi Jicai (www.farmmi88.com) and online shopping mall Farmmi Liangpin Market (initially www.farmmi88.com; later switched

to mobile application and mini program on WeChat; closed in December 2020).

We conduct our business through the following structures:

|

Structure

|

|

Company

|

|

Business

|

|

Related PRC Legal

Restrictions on

Foreign-owned

Entity

|

|

Parent-subsidiary Structure

|

|

All of our foreign-owned entity subsidiaries

|

|

Process and/or sell agricultural products

|

|

None

|

|

|

|

|

|

|

|

|

|

Variable interest entity (“VIE”)

|

|

Hangzhou Nongyuan Network Technology Co., Ltd., a domestic company

|

|

Operate online business

|

|

Restrictions on operation of independent online stores (deemed as value-added telecommunication service business) by foreign-owned entities

|

We conduct the vast majority of our business through

a traditional equity ownership structure, which is a parent-subsidiary structure. The vast majority of our business is processing and/or

selling agricultural products. Based on the advice of our PRC legal counsel, PRC laws and regulations allow foreign-owned entities to

conduct such business directly, rather than through contractual VIE agreements. Our VIE had revenue of $4,558,854, $6,184,460 and

$3,369,258 in the years ended September 30, 2020, 2019 and 2018, respectively. As the chart above shows, our VIE operates only where

we are not permitted to own the operating company by PRC laws and regulations.

Implications of Being an Emerging Growth Company

As a company with less than $1.07 billion in revenue

during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups

Act, or the JOBS Act, enacted in April 2012. An “emerging growth company” may take advantage of exemptions from some

of the reporting requirements that are otherwise applicable to public companies. These exceptions include:

|

¨

|

being permitted to present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations in this prospectus;

|

|

¨

|

not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended;

|

|

¨

|

reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements; and

|

|

¨

|

exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved.

|

We may take advantage of these provisions until

the last day of our fiscal year following the fifth anniversary of the closing of our initial public offering in February 2018. However,

if certain events occur prior to the end of such five-year period, including if we become a “large accelerated filer,” our

annual gross revenue exceeds $1.07 billion or we issue more than $1.0 billion of non-convertible debt in any three-year period, we will

cease to be an emerging growth company prior to the end of such five-year period.

We have elected to take advantage of certain of

the reduced disclosure obligations in this prospectus and may elect to take advantage of other reduced reporting requirements in future

filings. As a result, the information that we provide to our stockholders may be different than you might receive from other public reporting

companies in which you hold equity interests.

In addition, the JOBS Act provides that an emerging

growth company can take advantage of an extended transition period for complying with new or revised accounting standards. We have irrevocably

elected not to avail ourselves of this exemption and, therefore, we will be subject to the same new or revised accounting standards as

other public companies that are not emerging growth companies.

Foreign Private

Issuer Status

We are a foreign private issuer

within the meaning of the rules under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). As such,

we are exempt from certain provisions applicable to United States domestic public companies. For example:

|

|

●

|

we are not required to provide as many Exchange Act reports, or as frequently, as a domestic public company;

|

|

|

●

|

for interim reporting, we are permitted to comply solely with our home country requirements, which are less rigorous than the rules that apply to domestic public companies;

|

|

|

●

|

we are not required to provide the same level of disclosure on certain issues, such as executive compensation;

|

|

|

●

|

we are exempt from provisions of Regulation FD aimed at preventing issuers from making selective disclosures of material information;

|

|

|

●

|

we are not required to comply with the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act; and

|

|

|

●

|

we are not required to comply with Section 16 of the Exchange Act requiring insiders to file public reports of their share ownership and trading activities and establishing insider liability for profits realized from any “short-swing” trading transaction.

|

Recent Developments

Appointment of New Chief Operating Officer

On March 1, 2021, Ms. Liang

Han submitted her letter of resignation from her position as our Chief Operating Officer (“COO”), effective immediately. Ms. Han

confirmed that her resignation is purely personal and is not involved any disagreement with us. On March 4, 2021, our board of directors

approved and ratified the appointment of Mr. Dehong Zhang as our COO, effective March 1, 2021.

Underwritten Public

Offering

On

March 24, 2021, we closed an underwritten public offering of 6,469,467 ordinary

shares at a public offering price of $1.15 per share. On April 13, 2021, the underwriter exercised,

in full, its option to purchase an additional 970,419 ordinary shares at a price of $1.15 per share. Total gross proceeds to us from the

offering, including the funds received from the prior closing and exercise of this option, are approximately $8.6 million, before deducting

underwriting discounts, commissions and other offering expenses payable by us.

New Subsidiary

On

April 7, 2021, we incorporated Zhejiang Farmmi Biotechnology Co., Ltd. (“Farmmi Biotechnology”), through its wholly-owned

subsidiary Hangzhou Suyuan Agriculture Technology Co., Ltd. With the incorporation of Farmmi Biotechnology, the Company plans to

develop products related to mushroom powder and mushroom extract.

Corporate Information

We were incorporated in the

Cayman Islands on July 28, 2015. In February 2018, we completed our initial public offering and our ordinary shares commenced

trading on Nasdaq under the symbol “FAMI.”

We maintain a corporate website

at http://ir.farmmi.com.cn/. Information on our website, and any downloadable files found there, are not part of this prospectus and should

not be relied upon with respect to this offering.

Our registered office is located

at Tricor Services (Cayman Islands) Limited, Second Floor, Century Yard, Cricket Square, P.O. Box 902, Grand Cayman, KY1-1103, Cayman

Islands. Our registered office’s telephone number is +1 (345) 743 1700. Our agent in the U.S. is Shangzhi Zhang, with the address

of 33202 Havers Drive, Cary, NC 27518.

THE OFFERING

Ordinary shares offered

by us

|

|

140,000,000 ordinary shares (161,000,000 ordinary shares if the

underwriter exercise its option to purchase additional ordinary shares from us in full).

|

|

|

|

|

Ordinary shares

outstanding prior to this

offering

|

|

28,554,189 ordinary shares

|

|

|

|

|

|

Public offering price

|

|

$0.30 per share

|

|

|

|

|

Ordinary shares to be

outstanding after this

offering

|

|

168,554,189 ordinary shares

(189,554,189 ordinary shares

if the underwriter exercise its option to purchase additional ordinary shares from us in

full).

|

|

|

|

|

|

Over-allotment option

|

|

We have granted the underwriter an option, exercisable until 45 days after the closing of this

offering, to acquire purchase up to 21,000,000 additional ordinary shares (equal to 15% of the number of shares offered hereby)

solely to cover over-allotments, if any.

|

|

|

|

|

|

Use of proceeds

|

|

We estimate the net proceeds from this offering will be approximately

$38.3 million (approximately

$44.1 million if the underwriter exercises its over-allotment option in full),

after deducting underwriting discounts and commissions and estimated offering expenses payable by us. We currently intend to use the

net proceeds from this offering for working capital and general corporate purposes. See “Use of Proceeds” on page 11 of

this prospectus.

|

|

|

|

|

|

Risk factors

|

|

Investing in our shares involves a high degree of risk. See “Risk Factors” beginning on page 6 of this

prospectus and the other information included or incorporated by reference in this prospectus.

|

|

|

|

|

|

Listing

|

|

The ordinary shares are traded on Nasdaq under the symbol “FAMI”.

|

Unless otherwise indicated,

the number of ordinary shares outstanding prior to and after this offering is based on 28,554,189 ordinary shares issued and outstanding

as of April 20, 2021, and excludes:

|

|

●

|

800,000 ordinary shares underlying warrants we issued to an investor in a private placement, at an

exercise price of $1.15 per share (reset to $0.30 upon a dilutive issuance), with an expiration date of November 1,

2022;

|

|

|

●

|

812,694 ordinary shares underlying warrants we issued to the placement agent in the same private

placement, at an exercise price of $1.15 per share (reset to $0.30 upon a dilutive issuance), with an expiration date of

November 1, 2022; and

|

|

|

●

|

571,400 ordinary shares reserved under our 2018 share incentive plan (the “2018 Incentive Plan”).

|

Unless otherwise indicated,

all information in this prospectus assumes no exercise of the outstanding warrants described above, and assumes no exercise of the underwriter’s

over-allotment option.

Summary

Financial Data

In the table below, we provide you with historical

selected financial data for the Company. The selected consolidated statements of operations data for the fiscal years ended September 30,

2020, 2019 and 2018 and the selected consolidated balance sheets data as of September 30, 2020 and 2019 have been derived from our

audited consolidated financial statements, which are included in this annual report beginning on page F-1. The selected consolidated

balance sheet data for the year ended September 30, 2018 have been derived from our audited consolidated balance sheet as of September 30,

2018, which is not included in this annual report. The selected consolidated statements of operations data for the years ended September 30,

2017 and 2016 and the selected consolidated balance sheet data as of ended September 30, 2017 and 2016 have been derived from our

audited consolidated financial statements for the years ended September 30, 2017 and 2016, which are not included in this annual

report. Our historical results do not necessarily indicate results expected for any future periods. The selected consolidated financial

data should be read in conjunction with, and are qualified in their entirety by reference to, our audited consolidated financial statements

and related notes and “Item 5. Operating and Financial Review and Prospects” below. Our audited consolidated financial statements

are prepared and presented in accordance with US GAAP.

(All amounts in U.S. dollars)

Statements of operations data:

|

|

|

For the years ended September 30,

|

|

|

|

|

2020

|

|

|

2019

|

|

|

2018

|

|

|

2017

|

|

|

2016

|

|

|

Revenues

|

|

$

|

30,167,779

|

|

|

$

|

30,841,875

|

|

|

$

|

29,819,088

|

|

|

$

|

26,665,601

|

|

|

$

|

20,715,230

|

|

|

Gross profit

|

|

$

|

4,964,536

|

|

|

$

|

5,422,124

|

|

|

$

|

5,067,615

|

|

|

$

|

4,524,722

|

|

|

$

|

3,343,814

|

|

|

Operating expenses

|

|

$

|

2,863,521

|

|

|

$

|

2,386,511

|

|

|

$

|

1,989,687

|

|

|

$

|

1,055,493

|

|

|

$

|

474,361

|

|

|

Income from operations

|

|

$

|

2,101,015

|

|

|

$

|

3,035,613

|

|

|

$

|

3,077,928

|

|

|

$

|

3,469,229

|

|

|

$

|

2,869,453

|

|

|

Provision for Income taxes

|

|

$

|

35,331

|

|

|

$

|

34,564

|

|

|

$

|

9,063

|

|

|

$

|

5,793

|

|

|

$

|

269,367

|

|

|

Net income (loss)

|

|

$

|

813,455

|

|

|

$

|

(311,004

|

)

|

|

$

|

3,229,266

|

|

|

$

|

3,270,346

|

|

|

$

|

2,310,090

|

|

|

Earnings (loss) per share, basic

|

|

$

|

0.05

|

|

|

$

|

(0.03

|

)

|

|

$

|

0.29

|

|

|

$

|

0.33

|

|

|

$

|

0.23

|

|

|

Earnings (loss) per share, diluted

|

|

$

|

0.05

|

|

|

$

|

(0.03

|

)

|

|

$

|

0.27

|

|

|

$

|

0.33

|

|

|

$

|

0.23

|

|

|

Weighted average Ordinary Shares outstanding, basic

|

|

|

16,244,856

|

|

|

|

12,183,847

|

|

|

|

11,173,699

|

|

|

|

10,000,000

|

|

|

|

10,000,000

|

|

|

Weighted average Ordinary Shares outstanding, diluted

|

|

|

16,244,856

|

|

|

|

12,183,847

|

|

|

|

12,093,507

|

|

|

|

10,000,000

|

|

|

|

10,000,000

|

|

Balance sheets data:

|

|

|

As of September 30,

|

|

|

|

|

2020

|

|

|

2019

|

|

|

2018

|

|

|

2017

|

|

|

2016

|

|

|

Current assets

|

|

$

|

37,022,171

|

|

|

$

|

29,705,028

|

|

|

$

|

21,339,634

|

|

|

$

|

13,741,413

|

|

|

$

|

13,053,584

|

|

|

Total assets

|

|

$

|

38,191,746

|

|

|

$

|

30,482,631

|

|

|

$

|

22,075,997

|

|

|

$

|

13,843,929

|

|

|

$

|

13,135,055

|

|

|

Current liabilities

|

|

$

|

8,367,387

|

|

|

$

|

8,145,080

|

|

|

$

|

2,221,900

|

|

|

$

|

2,529,848

|

|

|

$

|

5,847,672

|

|

|

Total liabilities

|

|

$

|

9,036,589

|

|

|

$

|

8,145,080

|

|

|

$

|

2,862,355

|

|

|

$

|

3,191,015

|

|

|

$

|

5,847,672

|

|

|

Total stockholders’ equity (net assets)

|

|

$

|

28,285,176

|

|

|

$

|

21,498,503

|

|

|

$

|

18,338,270

|

|

|

$

|

9,756,338

|

|

|

$

|

6,391,882

|

|

RISK FACTORS

An investment in our shares

involves significant risks. Before making an investment in our shares, you should carefully read all of the information contained in this

prospectus and in the documents incorporated by reference herein, including the risk factors contained in our Annual Report on Form 20-F

for the year ended September 30, 2020 filed with the Securities and Exchange Commission (the “SEC”) on January 29,

2021. For a discussion of risk factors that you should carefully consider before deciding to purchase any of our shares, please review

the additional risk factors disclosed below and the information under the heading “Risk Factors” in the accompanying prospectus.

In addition, please read “Prospectus Summary” and “Cautionary Note Regarding Forward-Looking Statements” in this

prospectus, where we describe additional uncertainties associated with our business and the forward-looking statements included or incorporated

by reference in this prospectus. The risks and uncertainties described below are not the only risks facing us. Please note that additional

risks not currently known to us or that we currently deem immaterial also may adversely affect our business, results of operations, financial

condition and prospects. Our business, financial condition, results of operations and prospects could be materially and adversely affected

by these risks, and you may lose all or part of your original investment.

Risks Related to an Investment in Our Shares

and this Offering

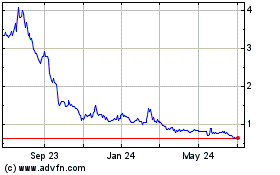

The market price

of our ordinary shares has been, and may continue to be, highly volatile, and such volatility could cause the market price of our ordinary

shares to decrease and could cause you to lose some or all of your investment in our ordinary shares.

The stock market in general

and the market prices of our ordinary shares on Nasdaq, in particular, are or will be subject to fluctuation, and changes in these prices

may be unrelated to our operating performance. During the first quarter of calendar year 2021, the market price of our ordinary shares

fluctuated from a high of $2.47 per share to a low of $0.96 per share, and the price of our ordinary shares continues to fluctuate. We

anticipate that the market prices of our shares will continue to be subject to wide fluctuations. The market price of our shares

is, and will be, subject to a number of factors, including:

|

|

·

|

actual or anticipated fluctuations in our revenue and other operating results;

|

|

|

·

|

the financial projections we may provide to the public, any changes in these projections or our failure to meet these projections;

|

|

|

·

|

actions of securities analysts who initiate or maintain coverage of us, changes in financial estimates by any securities analysts who follow the Company, or our failure to meet these estimates or the expectations of investors;

|

|

|

·

|

announcements by us or our competitors of significant products or features, technical innovations, acquisitions, strategic partnerships, joint ventures, or capital commitments;

|

|

|

·

|

price and volume fluctuations in the overall stock market, including as a result of trends in the economy as a whole;

|

|

|

·

|

lawsuits threatened or filed against us; and

|

|

|

·

|

other events or factors, including those resulting from war or incidents of terrorism, or responses to these events.

|

These factors may materially and

adversely affect the market price of our shares and result in substantial losses by our investors.

We will have broad discretion in the use

of the net proceeds of this offering and may not use them effectively.

We intend to use the net proceeds

from this offering for general corporate purposes and working capital. As a result, our management will retain broad discretion in the

allocation and use of the net proceeds of this offering, and investors will be relying on the judgment of our management with regard to

the use of these net proceeds, and could spend the net proceeds in ways that do not improve our results of operations or enhance the value

of our ordinary shares. The failure by management to apply these funds effectively could result in financial losses that could have a

material adverse effect on our business, cause the price of our ordinary shares to decline and delay the development of our Company.

We will need additional

capital in the future. If additional capital is not available, we may not be able to continue to operate our business pursuant to our

business plan or we may have to discontinue our operations entirely.

Regardless of the success

of this offering, we will require additional capital in the future. We have incurred losses in each year since our inception. If we continue

to use cash at our historical rates of use we will need significant additional financing, which we may seek through a combination of private

and public equity offerings, debt financings and collaborations and strategic and licensing arrangements. To the extent that we raise

additional capital through the sale of equity or convertible debt securities, the ownership interest will be diluted, and the terms of

any such offerings may include liquidation or other preferences that may adversely affect the then existing shareholders rights. Debt

financing, if available, would result in increased fixed payment obligations and may involve agreements that include covenants limiting

or restricting our ability to take specific actions such as incurring debt or making capital expenditures. If we raise additional funds

through collaboration, strategic alliance or licensing arrangements with third parties, we may have to relinquish valuable rights to our

technologies, future revenue streams or product candidates, or grant licenses on terms that are not favorable to us.

Ordinary shares representing a substantial

percentage of our currently outstanding shares may be sold in this offering, which could cause the price of our ordinary shares to decline.

Pursuant to this offering,

we may sell up to 161,000,000 ordinary shares representing approximately 563.8%, of our outstanding ordinary shares as of April 28, 2021. This sale and any future

sales of a substantial number of ordinary shares in the public market, or the perception that such sales may occur, could materially adversely

affect the price of our ordinary shares. We cannot predict the effect, if any, that market sales of those ordinary shares or the availability

of those ordinary shares for sale will have on the market price of our ordinary shares.

Raising additional capital by issuing shares

may cause dilution to existing shareholders.

We are currently authorized

to issue 200,000,000 ordinary shares. As of April 20, 2021, we had 28,554,189 ordinary shares issued and outstanding, and 2,184,094 ordinary

shares reserved for future issuance under outstanding warrants and under the 2018 Incentive Plan.

We may seek additional capital

through a combination of private and public equity offerings, debt financings and collaborations and strategic and licensing arrangements.

To the extent that we raise additional capital through the sale of equity or convertible debt securities, the ownership interest will

be diluted, and the terms of any such offerings may include liquidation or other preferences that may adversely affect the then existing

shareholders rights.

Future sales of our ordinary shares could reduce the market price

of the ordinary shares.

Substantial

sales of our ordinary shares may cause the market price of our ordinary shares to decline. Sales by us or our security holders of substantial

amounts of our ordinary shares, or the perception that these sales may occur in the future, could cause a reduction in the market price

of our ordinary shares.

The

issuance of any additional ordinary shares or any securities that are exercisable for or convertible into our ordinary shares, may have

an adverse effect on the market price of the ordinary shares and will have a dilutive effect on our existing shareholders and holders

of ordinary shares.

We do not know whether a market for the

ordinary shares will be sustained or what the trading price of the ordinary shares will be and as a result it may be difficult for you

to sell your ordinary shares.

Although

our ordinary shares trade on Nasdaq Capital Market, an active trading market for the ordinary shares may not be sustained. It may be difficult

for you to sell your ordinary shares without depressing the market price for the ordinary shares. As a result of these and other factors,

you may not be able to sell your ordinary shares. Further, an inactive market may also impair our ability to raise capital by selling

ordinary shares, or may impair our ability to enter into strategic partnerships or acquire companies or products by using our ordinary

shares as consideration.

We have no plans to pay dividends on our

ordinary shares, and you may not receive funds without selling the ordinary shares.

We have not declared or paid

any cash dividends on our ordinary shares, nor do we expect to pay any cash dividends on our ordinary shares for the foreseeable future.

We currently intend to retain any additional future earnings to finance our operations and growth and, therefore, we have no plans to

pay cash dividends on our ordinary shares at this time. Any future determination to pay cash dividends on our ordinary shares will be

at the discretion of our board of directors and will be dependent on our earnings, financial condition, operating results, capital requirements,

any contractual restrictions, and other factors that our board of directors deems relevant. Accordingly, you may have to sell some or

all of the ordinary shares in order to generate cash from your investment. You may not receive a gain on your investment when you sell

the ordinary shares and may lose the entire amount of your investment.

As a foreign private issuer, we are permitted

to follow certain home country corporate governance practices instead of applicable SEC and Nasdaq requirements, which may result in less

protection than is accorded to investors under rules applicable to domestic issuers.

As a foreign private issuer,

we are permitted to follow certain home country corporate governance practices instead of those otherwise required under the rules of

the Nasdaq Stock Market for domestic issuers. Following our home country governance practices as opposed to the requirements that would

otherwise apply to a U.S. company listed on the Nasdaq Stock Market, may provide less protection than is accorded to investors under the

rules of the Nasdaq Stock Market applicable to domestic issuers. For more information, see “Item 16G. Corporate Governance”

in our Annual Report on Form 20-F for the year ended September 30, 2020.

In addition, as a foreign

private issuer, we are exempt from the rules and regulations under the Securities Exchange Act of 1934, as amended, or the Exchange

Act, related to the furnishing and content of proxy statements, and our officers, directors and principal shareholders are exempt

from the reporting and short-swing profit recovery provisions contained in Section 16 of the Exchange Act. In addition, we are not

required under the Exchange Act to file annual, quarterly and current reports and financial statements with the SEC as frequently or as

promptly as domestic companies whose shares are registered under the Exchange Act.

We may lose our foreign private issuer status in the future,

which could result in significant additional costs and expenses.

The determination of our status

as a foreign private issuer is made annually on the last business day of our most recently completed second fiscal quarter and, accordingly,

the next determination will be made with respect to us on or after December 31, 2021. We would lose our foreign private issuer status

if (1) a majority of our outstanding voting securities are directly or indirectly held of record by U.S. residents, and (2) a

majority of our shareholders or a majority of our directors or management are U.S. citizens or residents, a majority of our assets are

located in the United States, or our business is administered principally in the United States. If we were to lose our foreign private

issuer status, the regulatory and compliance costs to us under U.S. securities laws as a U.S. domestic issuer may be significantly higher.

We may also be required to modify certain of our policies to comply with corporate governance practices associated with U.S. domestic

issuers, which would involve additional costs.

Risks Related to the Current Pandemic

We face risks related to health epidemics that could impact our

sales and operating results.

Our business could be adversely affected by the

effects of a widespread outbreak of contagious disease, including the outbreak of respiratory illness caused by a novel coronavirus (“COVID-19”)

first identified in Wuhan, Hubei Province, China and declared as a pandemic by the World Health Organization in March 2020. Any outbreak

of contagious diseases, and other adverse public health developments, particularly in China, could have a material and adverse effect

on our business operations. These could include disruptions or restrictions on our ability to carry out our operations, as well as temporary

closures of our facilities and ports or the facilities of our customers and third-party service providers. Any disruption or delay of

our customers or third-party service providers would likely impact our operating results and the ability of the Company to continue as

a going concern. In addition, a significant outbreak of contagious diseases in the human population could result in a widespread health

crisis that could adversely affect the economies and financial markets of China and many other countries, resulting in an economic downturn

that could affect demand for our products and significantly impact our operating results.

COVID-19 has had a significant impact on our operations for the

year ended September 30, 2020 and could materially adversely affect our business and financial results for the remaining months of

the 2021 fiscal year.

Our ability to manufacture and/or sell our products

may be impaired by damages or disruption to our manufacturing, warehousing or distribution capabilities, or to the capabilities of our

suppliers, logistics service providers or distributors as a result of the impact from COVID-19. This damage or disruption could result

from events or factors that are impossible to predict or are beyond our control, such as raw material scarcity, pandemics, government

shutdowns, disruptions in logistics, supplier capacity constraints, adverse weather conditions, natural disasters, fire, terrorism or

other events. In December 2019, COVID-19 emerged in Wuhan, China. Because of the shelter-in-place orders and travel restrictions

mandated by the Chinese government, the production and sales activities of the Company stopped during the end of January and February 2020,

which adversely impacted the Company’s production and sales during that period. Although the production and sales resumed at the

end of March 2020, the COVID-19 outbreak has had a significant adverse impact on our business and operations during the fiscal year

ended September 30, 2020. The Company’s operations may be affected by the ongoing outbreak of COVID-19. The continued uncertainties

associated with COVID-19 may cause the Company’s revenue and cash flows to underperform in the next 12 months. A resurgence could

negatively affect the sales, the collection of the payments from account receivables and the utilization of advances to suppliers. The

extent of the future impact of COVID-19 is still highly uncertain and cannot be predicted as of the financial statement reporting date.

If COVID-19 further impacts its production and sales, the Company’s financial condition, results of operations, and cash flows could

continue to be adversely affected.

CAUTIONARY

Note Regarding Forward-Looking Statements

This prospectus includes and

incorporates forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities

Act”), and Section 21E of the Exchange Act. We intend such forward-looking statements to be covered by the safe harbor provisions

for forward-looking statements contained in the United States Private Securities Litigation Reform Act of 1995. All statements, other

than statements of historical facts, included or incorporated by reference in this prospectus regarding our strategy, future operations,

financial position, future revenues, projected costs, prospects, plans and objectives of management, including, without limitation, the

discussion of whether and when potential acquisition transactions will close, expectations concerning our ability to increase our revenue,

expectations with respect to operational efficiency, expectations regarding financing, and expectations concerning our business strategy,

under “Prospectus Summary - Recent Developments,” are forward-looking statements. The words “anticipates,” “believes,”

“estimates,” “expects,” “intends,” “may,” “plans,” “projects,”

“will,” “would” and similar expressions are intended to identify forward-looking statements, although not all

forward-looking statements contain these identifying words. We cannot guarantee that we actually will achieve the plans, intentions or

expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. There

are a number of important factors that could cause our actual results to differ materially from those indicated by these forward-looking

statements. These important factors include the factors that we identify in the documents we incorporate by reference in this prospectus,

as well as other information we include or incorporate by reference in this prospectus. See “Risk Factors.” You should read

these factors and other cautionary statements made in this prospectus, and in the documents we incorporate by reference as being applicable

to all related forward-looking statements wherever they appear in this prospectus, and in the documents incorporated by reference herein

and therein. We do not assume any obligation to update any forward-looking statements made by us except to the extent required by law.

Use

of Proceeds

We estimate the net

proceeds from this offering will be approximately $38.3 million, after deducting underwriter commissions and discounts, and

estimated offering expenses payable by us.

We currently intend to use

the net proceeds from this offering for working capital and general corporate purposes. As a result, our management will retain broad

discretion in the allocation and use of the net proceeds of this offering, and investors will be relying on the judgment of our management

with regard to the use of these net proceeds. Pending application of the net proceeds for the purposes as described above, we expect to

invest the net proceeds in short-term, interest-bearing securities, investment grade securities, certificates of deposit or direct or

guaranteed obligations of the U.S. government.

CAPITALIZATION

The following

table sets forth our capitalization:

|

|

●

|

on an actual basis as of September 30, 2020;

|

|

|

●

|

on a pro forma basis to give effect to (i) the issuance of 596,600 ordinary shares to our employees in March 2021 under the 2018 Incentive Plan, and (ii) the net proceeds of approximately $7.7 million received in connection with the sale of 6,469,467 ordinary shares in an underwritten public offering in March 2021 and 970,419 ordinary shares pursuant to the exercise of the underwriter’s over-allotment option in April 2021 (the “March 2021 Offering”); and

|

|

|

|

|

|

|

●

|

on a pro forma as adjusted basis to give further effect to this offering based on a public offering

price of $0.30 per share, after deducting the underwriting discounts and commissions and estimated offering expenses payable by us

and excluding the exercise of the over-allotment option held by the underwriter with respect to this offering.

|

The information set forth

in the following table should be read in conjunction with, and is qualified in its entirety by, reference to our audited and unaudited

financial statements and the notes thereto incorporated by reference into this prospectus.

|

|

|

As of September 30, 2020

|

|

|

|

|

Actual

|

|

|

Pro Forma

|

|

|

Pro Forma

As

Adjusted

|

|

|

|

|

(in U.S. dollars)

|

|

|

Cash

|

|

$

|

548,151

|

|

|

$

|

8,285,053

|

|

|

$

|

46,546,128

|

|

|

Total Current Assets

|

|

|

37,022,171

|

|

|

|

44,759,073

|

|

|

|

83,020,148

|

|

|

Total Assets

|

|

|

38,191,746

|

|

|

|

45,928,648

|

|

|

|

84,189,723

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Liabilities

|

|

|

8,367,387

|

|

|

|

8,367,387

|

|

|

|

8,367,387

|

|

|

Total Liabilities

|

|

|

9,036,589

|

|

|

|

9,036,589

|

|

|

|

9,036,589

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shareholders’ Equity:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ordinary Shares, par value $0.001, 200,000,000 shares authorized and 20,517,703, 28,554,189 and 168,554,189 shares issued and outstanding - actual, pro forma and pro forma as adjusted

|

|

|

20,518

|

|

|

|

28,554

|

|

|

|

168,554

|

|

|

Additional paid-in capital

|

|

|

20,335,228

|

|

|

|

28,869,504

|

|

|

|

66,990,579

|

|

|

Statutory reserves

|

|

|

972,092

|

|

|

|

972,092

|

|

|

|

972,092

|

|

|

Retained earnings

|

|

|

6,770,426

|

|

|

|

5,965,016

|

|

|

|

5,965,016

|

|

|

Accumulated other comprehensive income

|

|

|

186,912

|

|

|

|

186,912

|

|

|

|

186,912

|

|

|

Total Shareholders’ Equity attributable to the Company

|

|

|

28,285,176

|

|

|

|

36,022,078

|

|

|

|

74,283,153

|

|

|

Noncontrolling Interest

|

|

|

869,981

|

|

|

|

869,981

|

|

|

|

869,981

|

|

|

Total Equity

|

|

|

29,155,157

|

|

|

|

36,892,059

|

|

|

|

75,153,134

|

|

|

Total Liabilities and Equity

|

|

$

|

38,191,746

|

|

|

$

|

45,928,648

|

|

|

$

|

84,189,723

|

|

The preceding table

excludes as of September 30, 2020: (a) 800,000 ordinary shares underlying warrants we issued to an investor in a private

placement, at an exercise price of $1.15 per share (reset to $0.30 upon a dilutive issuance), with an expiration date of November 1, 2022, (b) 812,694

ordinary shares underlying warrants we issued to the placement agent in the same private placement, at an exercise price of

$1.15 per share (reset to $0.30 upon a dilutive issuance), with an expiration date of November 1, 2022, and (c) 571,400 ordinary shares reserved under the 2018

Incentive Plan.

Dividend

Policy

We have never declared or paid any cash dividends

on our ordinary shares. We anticipate that we will retain any earnings to support operations and to finance the growth and development

of our business. Therefore, we do not expect to pay cash dividends in the foreseeable future. Any future determination relating to our

dividend policy will be made at the discretion of our Board of Directors and will depend on a number of factors, including future earnings,

capital requirements, financial conditions and future prospects and other factors the Board of Directors may deem relevant.

Under Cayman Islands law, a Cayman Islands company

may pay a dividend out of either its profit or share premium account, but a dividend may not be paid if this would result in the company

being unable to pay its debts as they fall due in the ordinary course of business. According to our First Amended and Restated Articles

of Association, dividends can be declared and paid out of funds lawfully available to us, which include the share premium account. Dividends,

if any, would be paid in proportion to the number of ordinary shares a shareholder holds.

If we determine to pay dividends on any of our

ordinary shares in the future, as a holding company, we will be dependent on receipt of funds from our foreign-owned Chinese subsidiaries.

Current PRC regulations permit our indirect PRC subsidiaries to pay dividends to their shareholders only out of their accumulated profits,

if any, determined in accordance with Chinese accounting standards and regulations. In addition, each of our subsidiaries in China is

required to set aside at least 10% of its after-tax profits each year, if any, to fund a statutory reserve until such reserve reaches

50% of its registered capital. Farmmi Enterprise and Farmmi Technology are also required to further set aside a portion of its after-tax

profits to fund the employee welfare fund, although the amount to be set aside, if any, is determined at the discretion of its Board of

Directors. Although the statutory reserves can be used, among other ways, to increase the registered capital and eliminate future losses

in excess of retained earnings of the respective companies, the reserve funds are not distributable as cash dividends except in the event

of liquidation.

In addition, pursuant to the EIT Law and its implementation

rules, dividends generated after January 1, 2008 and distributed to Farmmi by Farmmi Enterprise and Farmmi Technology are subject

to withholding tax at a rate of 10% unless otherwise exempted or reduced according to treaties or arrangements between the PRC central

government and governments of other countries or regions where the non-PRC-resident enterprises are incorporated.

Under existing PRC foreign exchange regulations,

payments of current account items, including profit distributions, interest payments and trade and service-related foreign exchange transactions,

can be made in foreign currencies without prior approval of the State Administration of Foreign Exchange, or SAFE, by complying with certain

procedural requirements. Specifically, under the existing exchange restrictions, without prior approval of SAFE, cash generated from operations

in China may be used to pay dividends to the Company. Farmmi Enterprise and Farmmi Technology may go to a licensed bank to remit its after-tax

profits out of China. Nevertheless, the bank will require Farmmi Enterprise and Farmmi Technology to produce the following documents for

verification before it may transfer the dividends to Farmmi’s overseas bank account of: (1) tax payment statement and tax return;

(2) auditor’s report issued by a Chinese certified public accounting firm confirming the availability of profits and dividends

for distribution in the current year; (3) the Board minutes authorizing the distribution of dividends to its shareholders; (4) the

foreign exchange registration certificate issued by SAFE; (5) the capital verification report issued by a Chinese certified public

accounting firm; (6) if the declared dividends will be distributed out of accumulated profits earned in prior years, Farmmi

Enterprise and Farmmi Technology must appoint a Chinese certified public accounting firm to issue an auditors’ report to the bank

to certify Farmmi Enterprise and Farmmi Technology’s financial position during the years from which the profits arose; and

(7) other information as required by SAFE.

MARKET AND INDUSTRY DATA

This prospectus and the documents incorporated

by reference in this prospectus contain market data and industry statistics that are based on independent industry publications and other

publicly available information. Although we believe that these sources are reliable, we do not guarantee the accuracy or completeness

of this information and we have not independently verified this information. Although we are not aware of any misstatements regarding

the market and industry data presented or incorporated by reference in this prospectus, these estimates involve risks and uncertainties

and are subject to change based on various factors, including those discussed in the section titled “Risk Factors” or incorporated

by reference herein, and any related free writing prospectus. Accordingly, investors should not place undue reliance on this information.

DESCRIPTION OF CAPITAL STOCK

We (Farmmi, Inc.) are a Cayman Islands exempted

company with limited liability duly registered with the Cayman Islands Registrar of Companies. Our affairs are governed by our First Amended

and Restated Memorandum and Articles of Association, as amended by a shareholders’ resolution dated September 12, 2020 (together,

the “Amended and Restated Memorandum and Articles of Association”), the Companies Act (as revised) of the Cayman Islands (the

“Companies Act”), and the common law of the Cayman Islands. Our corporate purposes are unrestricted and we have the authority

to carry out any object not prohibited by any law as provided by Section 7(4) of the Companies Act.

As of April 20,

2021, we had authorized 200,000,000 ordinary shares, of $0.001 par value per share each, of which 28,554,189 were issued and

outstanding, excluding the shares underlying (a) warrants we issued to an investor in a private placement to purchase an

aggregate of 800,000 ordinary shares, at an exercise price of $1.15 per share (reset to $0.30 upon a dilutive issuance), with an expiration date of November 1,

2022, (b) warrants we issued to the placement agent in the same private placement to purchase an aggregate of 812,694 ordinary

shares, at an exercise price of $1.15 per share (reset to $0.30 upon a dilutive issuance), with an expiration date of November 1, 2022, and (c) 571,400

ordinary shares reserved under the 2018 Incentive Plan.

Ordinary Shares

General

All of our issued and outstanding ordinary shares

are fully paid and non-assessable. Our ordinary shares are issued when registered in our register of members in the registered form. Our

shareholders who are non-residents of the Cayman Islands may freely hold and vote their ordinary shares. Our First Amended and Restated

Memorandum and Articles of Association do not permit us to issue bearer shares.

Outstanding Warrants

On November 1, 2018, we issued to an institutional

investor (a) senior convertible notes with an aggregate principal amount of $7,500,000 (the “Notes”) which were

initially convertible into an aggregate of 1,198,084 of the Company’s ordinary shares at the conversion price of $6.26 per

share, and (b) the Investor Warrants to purchase an aggregate of 800,000 ordinary shares at an initial exercise price of

$6.53 per share. We also issued the Placement Agent Warrants to purchase an aggregate of 119,808 ordinary shares at an initial exercise

price of $7.183 per share to the placement agent (together with the Investor Warrants, the “Warrants”). The Warrants

may be exercised at any time after issuance and expire on November 1, 2022. We repaid the Notes as of June 22, 2020.

If the resale of the ordinary shares issuable upon

exercise of such Warrants is not covered by an effective registration statement or an exemption from registration, the holders of such

Warrants are afforded cashless exercise rights. In such event, the holders would pay the exercise price by surrendering the Warrants for

that number of ordinary shares equal to the quotient obtained by dividing (x) the product of the number of ordinary shares underlying

the Warrants, multiplied by the exercise price of the Warrants by (y) the daily volume weighted average price of the ordinary shares

on the primary U.S. trading market on which the ordinary shares are then listed or quoted as reported by Bloomberg L.P. on the trading

date immediately prior to the date of exercise.

The number of ordinary shares issuable on exercise

of the outstanding Warrants and the exercise price of such Warrants may be adjusted in certain circumstances, including in the event of

a share split or dividend. In addition, if we subsequently complete a dilutive issuance while the Warrants are outstanding, the exercise

price for the Warrants will be reduced to the price of the dilutive issuance (but the number of shares underlying the Warrants shall not

be adjusted). We may be required to repurchase the Warrants for their Black-Scholes value in the event we engage in a fundamental transaction

like a reorganization, merger or consolidation.

The Warrants may be exercised upon delivery of

an exercise notice, duly signed by the holders, accompanied by full payment of the exercise price, in U.S. dollars and in same day cleared

funds that will not be reversed, delivered into the Company’s bank account, free and clear of any restriction, condition, set-off,

deduction, or withholding.

The Warrants holders do not have the rights or

privileges of holders of ordinary shares nor do they have voting rights until they exercise their Warrants and receive ordinary shares.

After the issuance of ordinary shares upon exercise of the Warrants, each holder will be entitled to one vote for each share held of record

on all matters to be voted on by stockholders. Notwithstanding the foregoing, in the event we issue securities pro rata to the holders

of our ordinary shares, the holders of the Warrants will be entitled to acquire on the same terms such securities as they would have been

able to acquire if they had held ordinary shares rather than Warrants.

On March 10, 2020, we

adjusted the exercise price of the Warrants to $2 per share according to the terms of the Warrants. On July 10, 2020, according to

the terms of the Placement Agent Warrants, we adjusted the number of shares underlying the Placement Agent Warrants from 119,808 to 812,694,

ten percent (10%) of the number of ordinary shares actually issued by us in repayment of principal under the Notes. On March 24,

2021, in connection with the March 2021 Offering, we reset the exercise price of the Warrants to $1.15 per share. In connection with

this offering, we will reset the exercise price of the Warrants to $0.30 per share.

Registration Rights

On November 1, 2018, we entered into a registration

rights agreement (the “Registration Rights Agreement”) with an institutional investor in connection with a private placement

transaction related to the Notes and the Warrants, pursuant to which we shall, register under the Securities Act for resale 150% shares

of our ordinary shares issuable upon the conversion or repayment of such Notes or the exercise of such Warrants. The Registration Rights

Agreement contains customary terms such as piggyback registration rights.

We complied with our obligations under the Registration

Rights Agreement by filing a registration statement with the SEC (File No.: 333-228677) on December 4, 2018, which was declared effective

on February 12, 2019, amended by a post-effective amendment on Form F-3 which was filed with SEC on November 27, 2019 and

declared effective on December 3, 2019 (the “2019 Registration Statement”). The 2019 Registration Statement registered

3,459,719 ordinary shares, 150% of an aggregate of 2,306,479 ordinary shares underlying the principal of the Notes, interest repayment

of the Notes, the Investor Warrants, and the Placement Agent Warrants (before we adjusted the number of shares underlying the Placement

Agent Warrants).

Under the 2019 Registration Statement, we registered

179,712 ordinary shares by the 2019 Registration Statement, 150% of 119,808 ordinary shares underlying the Placement Agent Warrants. On

July 10, 2020, in accordance with the terms of the Placement Agent Warrants, we adjusted the number of shares underlying the Placement

Agent Warrants from 119,808 to 812,694, ten percent (10%) of the number of ordinary shares actually issued by us in repayment of principal

under the Notes. On March 17, 2021, we filed a registration statement on Form F-3 (File No.: 333-254397) to register 1,039,329

ordinary shares, 150% of the remaining 692,886 ordinary shares underlying the Placement Agent Warrants. This registration statement was

declared effective on April 16, 2021.

If we fail, under certain

circumstances to file and keep effective a registration statement with respect to the securities covered under the Registration Rights

Agreement, we have agreed to pay liquidated damages to each investor in an amount equal to one percent (1.0%) of the aggregate amount

invested by such investor pursuant to the Notes for each 30-day period or pro rata for any portion thereof during which the failure to

file or keep effective continues. The registration rights will terminate with respect to each investor upon the date such investor ceases

to hold registrable securities under the terms of the Registration Rights Agreement.

DESCRIPTION OF SECURITIES WE ARE OFFERING

We are offering 140,000,000 of our ordinary shares

in this offering.

Ordinary Shares

The material terms and provisions of our ordinary

shares and each other class of our securities which qualifies or limits our ordinary shares are described under the caption “Description

of Capital Stock” in this prospectus.

Listing

Our ordinary shares list on the Nasdaq Capital

Market under the symbol “FAMI.”

Transfer Agent and Registrar

The transfer agent and registrar for our ordinary

shares is TranShare Corporation.

Our board of directors has general and unconditional

authority to grant options over, offer or otherwise deal with or dispose of any unissued shares in our capital without further action

by our shareholders (whether forming part of the original or any increased share capital), either at a premium or at par, with or without

preferred, deferred or other special rights or restrictions, whether in regard to dividend, voting, return of capital or otherwise and

to such persons, on such terms and conditions, and at such times as the directors may decide, but so that no share shall be issued at

a discount, except in accordance with the provisions of the Companies Act. We will not issue bearer shares.

Our board of directors, without shareholder approval,

may issue preferred shares with voting, conversion or other rights that could adversely affect the voting power and other rights of holders

of our ordinary shares. Subject to the directors’ duty to act in the Company’s best interest, preferred shares can be issued

quickly with terms calculated to delay or prevent a change in control of us or make removal of management more difficult. Additionally,

the issuance of preferred shares may have the effect of decreasing the market price of the ordinary shares, and may adversely affect the

voting and other rights of the holders of ordinary shares. Issuance of these preferred shares may dilute the voting power of holders of

our ordinary shares.

Fiscal Year

Our fiscal year begins on October 1st of each

year and ends on September 30th of the next calendar year.

Record Dates

For the purpose of determining shareholders entitled

to notice of, or to vote at any general meeting of shareholders or any adjournment thereof, or shareholders entitled to receive dividend

or other distribution payments, or in order to make a determination of shareholders for any other purpose, our board of directors may

determine a record date which shall not exceed forty (40) clear days prior to the date where the determination will be made. As defined

by our Amended and Restated Memorandum and Articles of Association, “clear days” mean “in relation to a period of notice

means that period excluding both the day when the notice is given or deemed to be given and the day for which it is given or on which

it is to take effect.”

General Meetings of Shareholders

As a condition of admission to a shareholders’

meeting, a shareholder must be duly registered as our shareholder at the applicable record date for that meeting and all calls or installments

then payable by such shareholder to us in respect of our ordinary shares must have been paid.

Subject to any special rights or restrictions as

to voting then attached to any shares, at any general meetings every shareholder who is present in person or by proxy (or, in the case

of a shareholder being a corporation, by its duly authorized representative not being himself or herself a shareholder entitled to vote)

shall have one vote per share.

As a Cayman Islands exempted company, we are not

obliged by the Companies Act to call annual general meetings; however, our First Amended and Restated Articles of Association provide

that in each year we will hold an annual general meeting of shareholders at a time determined by our board of directors. For the annual

general meeting of shareholders the agenda will include, among other things, the adoption of our annual accounts and the appropriation

of our profits. In addition, the agenda for a general meeting of shareholders will only include such items as have been included therein

by the board of directors.

Additionally, we may, but are not required to (unless

required by the Act), in each year hold any other extraordinary general meeting.

The Companies Act of the Cayman Islands provides

shareholders with only limited rights to requisition a general meeting, and does not provide shareholders with any right to put any proposal

before a general meeting. However, these rights may be provided in a company’s articles of association. Our First Amended and Restated

Articles of Association provide that upon the requisition of shareholders representing not less than two-thirds of the voting rights entitled

to vote at a general meeting, our board will convene an extraordinary general meeting and put the resolutions so requisitioned to a vote

at such meeting. However, shareholders may propose only ordinary resolutions to be put to a vote at such meeting and shall have no right

to propose resolutions with respect to the election, appointment or removal of directors or with respect to the size of the board of directors

of the Company. Our First Amended and Restated Articles of Association provide no other right to put any proposals before annual general

meetings or extraordinary general meetings.

Subject to regulatory requirements, our annual

general meeting and any extraordinary general meetings must be called by not less than ten (10) clear days’ notice prior to

the relevant shareholders meeting and convened by a notice discussed below. Alternatively, upon the prior consent of all holders entitled

to receive notice, with regards to the annual general meeting, and the holders of 95% in par value of the shares entitled to receive notice

of some particular meeting, that meeting may be convened by a shorter notice and in a manner deemed appropriate by those holders.

We will give notice of each general meeting of

shareholders by publication on our website and in any other manner that we may be required to follow in order to comply with Cayman Islands

law, Nasdaq Capital Market and SEC requirements. The holders of registered shares may be convened for a shareholders’ meeting by

means of letters sent to the addresses of those shareholders as registered in our shareholders’ register, or, subject to certain

statutory requirements, by electronic means. We will observe the statutory minimum convening notice period for a general meeting of shareholders,

which is currently seven (7) clear days.

A quorum for a general meeting consists of any

one or more persons holding or representing by proxy not less than one-third of our issued and outstanding voting shares entitled to vote

upon the business to be transacted.

A resolution put to vote at the meeting shall be

decided on a poll. An ordinary resolution to be passed by the shareholders requires the affirmative vote of a simple majority of the votes

cast by, or on behalf of, the shareholders entitled to vote who are present in person or by proxy and voting at the meeting. A special

resolution requires the affirmative vote of no less than two-thirds of the votes cast by the shareholders entitled to vote who are present

in person or by proxy at a general meeting (except for certain matters described below which require an affirmative vote of two-thirds).

Both ordinary resolutions and special resolutions may also be passed by a unanimous written resolution signed by all the shareholders

of the Company, as permitted by the Companies Act and our First Amended and Restated Articles of Association.

Our First Amended and Restated Articles of Association

provide that the affirmative vote of no less than two-thirds of votes cast by the shareholders entitled to vote who are present in person

or by proxy at a general meeting shall be required to approve any amendments to any provisions of our First Amended and Restated Articles

of Association that relate to or have an impact upon the procedures regarding the election, appointment, removal of directors and size

of the board.

Pursuant to our First Amended and Restated Articles

of Association, the general meeting of shareholders is chaired by the chairman of our board of directors. If the chairman of our board

of directors is absent, the directors present at the meeting shall appoint one of them to be chairman of the general meeting. If neither

the chairman nor another director is present at the general meeting of shareholders within fifteen minutes after the time appointed for

holding the meeting, the shareholders present may elect any one of them to be chairman. The order of business at each meeting shall be

determined by the chairman of the meeting, and he or she shall have the right and authority to prescribe such rules, regulations and procedures

and to do all such acts and things as are necessary or desirable for the proper conduct of the meeting, including, without limitation,

the establishment of procedures for the maintenance of order and safety, limitations on the time allotted to questions or comments on

the affairs of the Company, restrictions on entry to such meeting after the time prescribed for the commencement thereof, and the opening

and closing of the polls.

Liquidation Rights

Subject to any special rights, privileges or restrictions

as to the distribution of available surplus assets on liquidation applicable to any class or classes of shares (1) if we are wound

up and the assets available for distribution among our shareholders are more than sufficient to repay the whole of the capital paid up

at the commencement of the winding up, the excess shall be distributed pari passu among our shareholders in proportion to

the amount paid up at the commencement of the winding up on the shares held by them, respectively, and (2) if we are wound up and

the assets available for distribution among our shareholders as such are insufficient to repay the whole of the paid-up capital, those

assets shall be distributed so that, as nearly as may be, the losses shall be borne by our shareholders in proportion to the capital paid

up at the commencement of the winding up on the shares held by them, respectively.

If we are wound up, the liquidator may with the

sanction of a special resolution and any other sanction required by the Companies Act, divide among our shareholders in specie the whole

or any part of our assets and may, for such purpose, value any assets and may determine how such division shall be carried out as between