Amended Current Report Filing (8-k/a)

May 20 2019 - 4:58PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K/A

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): March 4, 2019

FAMOUS DAVE’S OF AMERICA, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

Minnesota

|

0-21625

|

41-1782300

|

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

(Address of principal executive offices) (Zip Code)

12701 Whitewater Drive, Suite 290, Minnetonka, MN 55343

(952) 294-1300

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

DAVE

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 par value

|

DAVE

|

The Nasdaq Global Market

|

Indicated by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Explanatory Note

Famous Dave’s of America, Inc. (the “Company”)

filed a Current Report on Form 8-K on March 4, 2019 (the “Original Form 8-K”) reporting its acquisition of four Famous Dave’s restaurants in Colorado (the “Colorado Purchased Restaurants”).

On March 4, 2019,

Famous Dave’s Ribs, Inc., a wholly-owned subsidiary of the Company completed the acquisition of the Colorado Purchased Restaurants. The sellers of the Colorado Purchased Restaurants were

Legendary BBQ, Inc., Cornerstar BBQ, Inc., Razorback BBQ, Inc., Larkridge BBQ, Inc., and Quebec Square BBQ, Inc. The sellers were franchisees of the Company. The contract purchase price for the Colorado Purchased Restaurants was approximately $4,100,000, exclusive of closing costs, plus an amount equal to the book value of the restaurant inventory, plus the assumption the gift card liability associated with the Colorado Purchased Restaurants. The Company funded the purchase price with cash on hand.

The financial information reflected in this Amended Current Report on Form 8-K/A pertains to all of the properties comprising the Colorado Purchased Restaurants.

Businesses are considered related if they are under common control or management, or the acquisitions are dependent on each other or a single common event or condition. Therefore, based on the common management and control, the

Purchased Restaurants are considered

a single business acquisition for purposes of calculating significance under Rule 8-04 of Regulation S-X promulgated by the U.S. Securities and Exchange Commission ("Regulation S-X").

This Amended Current Report on Form 8-K/A is being filed for the purpose of complying with the provisions of Rule 8-04 of Regulation S-X. As such, this Amended Current Report on Form 8-K/A provides (i) the financial information related to our acquisition of the Colorado Purchased Restaurants as required by Item 9.01 of Form 8-K and (ii) certain additional information with respect to such acquisitions.

Item 2.01.

Completion of Acquisition or Disposition of Assets.

The description of the acquisition of the Purchased Restaurants set forth in the Explanatory Note of this Amended Current Report on Form 8-K/A is incorporated by reference into this Item 2.01 in its entirety.

In evaluating the Colorado Purchased Restaurants as a potential acquisition and determining the appropriate amount of consideration to be paid, the Company considered a variety of factors including: location; revenue; primary demographic trends within the target markets; cash flow; expenses; and the lack of required capital improvements.

The Company believes that the properties associated with the Colorado Purchased Restaurants are well located, have acceptable roadway access and are well maintained. Each of the properties associated with the Colorado Purchased Restaurants is subject to competition from similar restaurants within its respective market area, and the economic performance of restaurants associated with the Colorado Purchased Restaurants could be affected by changes in local economic conditions. The Company did not consider any other factors material or relevant to the decision to acquire the Colorado Purchased Restaurants, and after reasonable inquiry, the Company is not aware of any material factors other than those discussed above that would cause the reported financial information not to be necessarily indicative of future operating results.

Item 9.01.

Financial Statements and Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

FAMOUS DAVE’S OF AMERICA, INC.

|

|

|

|

|

Date: May 20, 2019

|

By:

|

/s/ Paul M. Malazita

|

|

|

|

Name: Paul M. Malazita

|

|

|

|

Title: Chief Financial Officer and Secretary

|

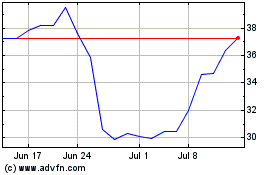

Dave (NASDAQ:DAVE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Dave (NASDAQ:DAVE)

Historical Stock Chart

From Apr 2023 to Apr 2024