Expedia Group, Inc. (NASDAQ: EXPE) (the “Company”) today

announced the pricing for its previously announced tender offers to

purchase for cash up to $500,000,000 aggregate principal amount

(the “Aggregate Tender Cap”) of the Company’s 2.950% Senior Notes

due 2031 (the “2031 Notes”) and 3.25% Senior Notes due 2030 (the

“2030 Notes” and, together with the 2031 Notes, the

“Securities”).

Title of Security

CUSIP No./ ISIN No.

Principal Amount

Outstanding

Acceptance Priority

Level(1)

Aggregate Principal Amount

Tendered

Aggregate Principal Amount

Expected to Be Accepted

Early Tender

Payment(2)(3)

U.S. Treasury Reference

Security

Reference

Yield(4)

Bloomberg Reference

Page

Fixed Spread

Total

Consideration(5)

2.950% Senior Notes due

2031

30212P BH7 / US30212PBH73; 30212P

BF1 / US30212PBF18; U3010D AM2 / USU3010DAM21

$1,000,000,000

1

$685,101,000

$500,000,000

$50

2.75% UST due 8/15/2032

3.283%

FIT1

210 bps

$835.70

3.25% Senior Notes due

2030

30212P AR6 / US30212PAR64; 30212P

AQ8 / US30212PAQ81; U3010D AG5 / USU3010DAG52

$1,250,000,000

2

N/A(6)

$0

$50

2.75% UST due 8/15/2032

N/A(6)

FIT1

205 bps

N/A(6)

The tender offers are being made pursuant to an offer to

purchase, dated August 26, 2022 (as it may be amended or

supplemented from time to time, the “Offer to Purchase”), which

sets forth the terms and conditions of the tender offers. Although

the tender offers are scheduled to expire at 11:59 p.m., New York

City time, on September 23, 2022, because the aggregate principal

amount of Securities validly tendered and not validly withdrawn

prior to or at the Early Tender Date exceeded the Aggregate Tender

Cap, there will be no Final Settlement Date (as defined in the

Offer to Purchase), and no Securities tendered after the Early

Tender Date will be accepted for purchase. Further, because the

Company intends to accept for purchase an aggregate principal

amount of 2031 Notes in excess of the Aggregate Tender Cap, no 2030

Notes will be accepted for purchase. Securities tendered and not

purchased on the Early Settlement Date will be returned to holders

promptly after the Early Settlement Date.

The consideration (the “Total Consideration”) to be paid per

$1,000 principal amount of 2031 Notes validly tendered and accepted

for purchase has been determined in the manner described in the

Offer to Purchase by reference to the applicable “Fixed Spread”

specified in the table above, plus the Reference Yield for the 2031

Notes specified in the table above. Holders of 2031 Notes that were

validly tendered and not validly withdrawn at or prior to the Early

Tender Date and accepted for purchase will receive the Total

Consideration, which is inclusive of an amount in cash equal to the

amount set forth on the table above under the heading “Early Tender

Payment” (the “Early Tender Payment”), plus accrued and unpaid

interest on such 2031 Notes from the applicable last interest

payment date up to, but not including, the settlement date, payable

on such settlement date. It is anticipated that the settlement date

for the 2031 Notes that were validly tendered at or prior to the

Early Tender Date and accepted for purchase by the Company will be

September 13, 2022.

The tender offers are subject to the satisfaction or waiver by

the Company of certain conditions as set forth in the Offer to

Purchase. The tender offers are not conditioned upon the tender of

any minimum principal amount of the Securities, and neither of the

tender offers is conditioned on the consummation of the other

tender offer.

Information Relating to the Tender Offers

Goldman Sachs and J.P. Morgan are the dealer managers for the

tender offers. Investors with questions regarding the tender offers

may contact Goldman Sachs at (800) 828-3182 (toll-free) or (212)

357-1452 (U.S. callers) and J.P. Morgan at (866) 834-4666

(toll-free) or (212) 834-3554 (collect). D.F. King & Co., Inc.

is the tender and information agent for the tender offers and can

be contacted at (800) 370-1749 (toll-free) (bankers and brokers can

call collect at (212) 269-5550) or by email at expe@dfking.com.

None of the Company or its affiliates, their respective boards

of directors, the dealer managers, the tender and information agent

or the trustee with respect to any Securities is making any

recommendation as to whether holders should tender any Securities

in response to any of the tender offers, and neither the Company

nor any such other person has authorized any person to make any

such recommendation. Holders must make their own decision as to

whether to tender any of their Securities, and, if so, the

principal amount of Securities to tender.

Holders are urged to evaluate carefully all information in the

Offer to Purchase, including the documents incorporated by

reference therein, and to consult their own investment and tax

advisors. If a holder holds Securities through a custodian bank,

broker, dealer, commercial bank, trust company or other nominee, it

may contact such custodian or nominee.

The full details of the tender offers are included in the Offer

to Purchase. Holders are strongly encouraged to read carefully the

Offer to Purchase, including materials incorporated by reference

therein, because they contain important information. The Offer to

Purchase may be obtained from D.F. King & Co., Inc., free of

charge, by calling toll-free at (800) 370-1749 (bankers and brokers

can call collect at (212) 269-5550) or by email at

expe@dfking.com.

About Expedia Group

Expedia Group, Inc. companies power travel for everyone,

everywhere through our global platform. Driven by the core belief

that travel is a force for good, we help people experience the

world in new ways and build lasting connections. We provide

industry-leading technology solutions to fuel partner growth and

success, while facilitating memorable experiences for travelers.

Our organization is made up of four pillars: Expedia Services,

focused on the group’s platform and technical strategy; Expedia

Marketplace, centered on product and technology offerings across

the organization; Expedia Brands, housing all our consumer brands;

and Expedia for Business, consisting of business-to-business

solutions and relationships throughout the travel ecosystem. The

Expedia Group family of brands includes: Expedia®, Hotels.com®,

Expedia® Partner Solutions, Vrbo®, trivago®, Orbitz®, Travelocity®,

Hotwire®, Wotif®, ebookers®, CheapTickets®, Expedia Group™ Media

Solutions, CarRentals.com™, and Expedia Cruises™.

Forward-Looking Statements

This communication contains “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995. These forward-looking statements reflect the views of the

Company’s management regarding current expectations and projections

about future events and are based on currently available

information. Actual results could differ materially from those

contained in these forward-looking statements for a variety of

reasons, including, but not limited to, those discussed in the

Company’s Annual Report on Form 10-K for the year ended December

31, 2021, Part I, ITEM 1A, “Risk Factors,” as well as those

discussed in the Offer to Purchase. COVID-19, and the volatile

regional and global economic conditions stemming from it, and

additional or unforeseen effects from the COVID-19 pandemic, could

also give rise to or aggravate these risk factors, which in turn

could materially adversely affect our business, financial

condition, liquidity, results of operations (including revenues and

profitability) and/or stock price. Further, COVID-19 may also

affect the Company’s operating and financial results in a manner

that is not presently known to it or that it currently does not

consider to present significant risks to its operations. Other

unknown or unpredictable factors also could have a material adverse

effect on the Company’s business, financial condition and results

of operations. Accordingly, readers should not place undue reliance

on these forward-looking statements. The use of words such as

“anticipates,” “believes,” “could,” “estimates,” “expects,” “goal,”

“intends,” “likely,” “may,” “plans,” “potential,” “predicts,”

“projected,” “seeks,” “should” and “will,” or the negative of these

terms or other similar expressions, among others, generally

identify forward-looking statements; however, these words are not

the exclusive means of identifying such statements. In addition,

any statements that refer to expectations, projections or other

characterizations of future events or circumstances are

forward-looking statements. These forward-looking statements are

inherently subject to uncertainties, risks and changes in

circumstances that are difficult to predict. Accordingly, you

should not place undue reliance on those statements. The Company is

not under any obligation to, and does not intend to, publicly

update or review any forward-looking statement or other statement

in this communication, the Offer to Purchase or in any related

supplement the Company prepares or authorizes or in any documents

incorporated by reference into the Offer to Purchase, whether as a

result of new information, future events or otherwise, even if

experience or future events make it clear that any expected results

expressed or implied by these forward-looking statements will not

be realized. Please carefully review and consider the various

disclosures made in this communication, the Offer to Purchase and

in the Company’s reports filed with the SEC that attempt to advise

interested parties of the risks and factors that may affect the

Company’s business, prospects and results of operations.

__________________________________________ 1 The offers with

respect to the Securities are subject to the Aggregate Tender Cap

of $500,000,000. 2 Per $1,000 principal amount. 3 The Total

Consideration for Securities validly tendered at or prior to 5:00

p.m., New York City time, on September 9, 2022 (the “Early Tender

Date”) and accepted for purchase is calculated using the applicable

Fixed Spread and is inclusive of the Early Tender Payment. 4 The

Reference Yield was determined at 10:00 a.m., New York City time,

on September 12, 2022. 5 Payable per each $1,000 principal amount

of each specified series of Securities validly tendered and not

validly withdrawn at or prior to the Early Tender Date and accepted

for purchase, inclusive of the applicable Early Tender Payment. 6

Given that no 2030 Notes will be accepted for purchase, the

“Reference Yield”, “Total Consideration” and “Principal Amount

Tendered” have been intentionally omitted.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220912005744/en/

Investor Relations Communications ir@expediagroup.com

press@expediagroup.com

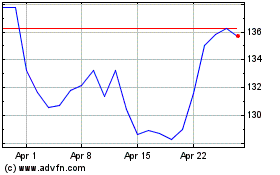

Expedia (NASDAQ:EXPE)

Historical Stock Chart

From Mar 2024 to Apr 2024

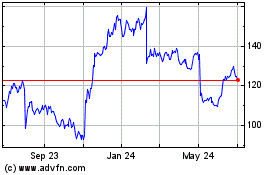

Expedia (NASDAQ:EXPE)

Historical Stock Chart

From Apr 2023 to Apr 2024