Expedia Group, Inc. (“Expedia Group” or the “Company”) today

announced the commencement of a cash tender offer (the “Offer”) for

an aggregate purchase price of up to $950,000,000 (as it may be

increased by the Company, the “Maximum Amount”) of its 6.250%

Senior Notes due 2025 (the “Notes”) at the purchase price indicated

below. Holders whose Notes are purchased pursuant to the Offer will

be paid accrued and unpaid interest on the Notes from, and

including, the most recent interest payment date for such series of

Notes prior to the applicable settlement date to, but not

including, the applicable settlement date (“Accrued Interest”).

Dollars per $1,000 Principal

Amount of Notes(1)

Title of Security

CUSIP/ISIN

Aggregate Principal Amount

Outstanding

Aggregate Maximum Purchase

Price (Maximum Amount) (1)

Tender Offer

Consideration

Early Participation

Amount

Total Consideration(2)

6.250% Senior Notes due

2025

CUSIP: 30212PAS4 (144A) ISIN:

US30212PAS48 (144A) CUSIP: U3010DAH3 (Reg S) ISIN: USU3010DAH36

(Reg S)

$2,000,000,000

$950,000,000

$1,132.50

$50

$1,182.50

(1) Excludes Accrued Interest. Holders whose Notes are accepted

will also receive Accrued Interest on such Notes.

(2) The Total Consideration payable for the Notes includes the

Early Participation Amount and will be a price per $1,000 principal

amount of the Notes validly tendered in the Offer at or prior to

the Early Participation Date for the Offer and accepted for

purchase by us.

The Offer is being made pursuant to an Offer to Purchase, dated

today, which contains detailed information concerning the terms of

the Offer. Capitalized terms used in this announcement but not

defined have the meanings given to them in the Offer to Purchase.

Holders are advised to check with any bank, securities broker or

other intermediary through which they hold the Notes to determine

when such intermediary would require receipt of instructions from a

holder in order for that holder to be able to participate in the

Offer before the deadlines described herein. The deadlines set by

any such intermediary and The Depository Trust Company for the

tender of Notes may be earlier than the deadlines specified

herein.

The Offer will expire at 11:59 p.m., New York City time, on

March 15, 2021 unless extended or earlier terminated by the Company

(the “Expiration Date”). Holders of Notes that are validly tendered

at or prior to 5:00 p.m., New York City time, on March 1, 2021

(unless extended by the Company in its sole and absolute

discretion) (such date and time, as the same may be extended, the

“Early Participation Date”), and not validly withdrawn, and

accepted for purchase by the Company will receive the applicable

Total Consideration for their Notes set forth in the table above,

which includes the Early Participation Amount. Holders validly

tendering their Notes after the Early Participation Date, but at or

prior to the Expiration Date, will be eligible to receive the

applicable “Tender Offer Consideration,” which is an amount equal

to the applicable Total Consideration less the Early Participation

Amount. In addition, payments for Notes purchased will include

Accrued Interest on such Notes.

Tendered Notes may be withdrawn at any time at or prior to 5:00

p.m., New York City time, on March 1, 2021 (unless extended by the

Company in its sole and absolute discretion) (such date and time,

as the same may be extended, the “Withdrawal Date”), but not

thereafter unless otherwise required by applicable law. The Company

will accept for payment, and thereby purchase, all Notes validly

tendered and not validly withdrawn pursuant to the Offer at or

prior to the Expiration Date, subject to the Maximum Amount and

proration (if applicable), provided that Notes tendered at or prior

to the Early Participation Date will be accepted for purchase in

priority to Notes tendered after the Early Participation Date, but

at or prior to the Expiration Date. If, on the Early Payment Date,

Notes are purchased in the Offer representing an aggregate purchase

price that is equal to the Maximum Amount for the Offer, no

additional Notes will be purchased in the Offer, and there will be

no final settlement date for the Offer.

Expedia Group reserves the right, but is under no obligation, to

increase the Maximum Amount at any time, subject to compliance with

applicable law, which could result in Expedia Group purchasing a

greater aggregate principal amount of Notes in the Offer. There can

be no assurance that Expedia Group will exercise its right to

increase the Maximum Amount. If Expedia Group increases the Maximum

Amount, it does not expect to extend the Withdrawal Date, subject

to applicable law. Accordingly, holders should not tender any Notes

that they do not wish to have purchased in the Offer.

Expedia Group is making the Offer in order to retire Notes prior

to their maturity. Substantially concurrently with the commencement

of the Offer, Expedia Group has commenced an offering of Senior

Notes (the “Senior Notes”) and Convertible Senior Notes (the

“Convertible Notes,” and the issuance of Senior Notes and/or

Convertible Notes, the “Financing Transaction”), subject to market

and other conditions. This press release is not an offer to sell,

or a solicitation of an offer to purchase, the Senior Notes or the

Convertible Notes.

Also substantially concurrently with the commencement of the

Offer, Expedia Group issued a conditional notice of redemption (the

“Redemption”) for all of its outstanding 7.000% Senior Notes due

2025 (the “7.000% Notes”), which were issued on May 5, 2020 in the

aggregate principal amount of $750 million, with an expected

redemption date of March 3, 2021 (the “Redemption Date”), at a

redemption price equal to 100% of the principal amount of the

7.000% Notes to be redeemed, plus the Applicable Premium (as

defined in the indenture governing the 7.000% Notes) as of, and

accrued and unpaid interest thereon to but excluding, the

Redemption Date (the “Redemption Price”). Notwithstanding the

foregoing, the Redemption is conditioned on the receipt of

aggregate net proceeds (after the payment of any fees and expenses

related to the Financing Transaction) of the Financing Transaction

in an amount equal to no less than the Redemption Price.

The Offer is conditioned upon, among other things, (i) Expedia

Group receiving aggregate net proceeds from the Financing

Transaction (after the payment of any fees and expenses related to

the Financing Transaction) in an amount equal to no less than the

sum of the Maximum Amount and the Redemption Price and (ii) the

satisfaction of certain customary conditions described in the Offer

to Purchase. The Offer is not conditioned upon the tender of any

minimum principal amount of Notes. Subject to applicable law,

Expedia Group may, at its sole discretion, waive any condition

applicable to the Offer and may extend the Offer. Under certain

conditions and as more fully described in the Offer to Purchase,

Expedia Group may terminate the Offer before the Expiration

Date.

Expedia Group has appointed BofA Securities, Goldman Sachs &

Co. LLC and J.P. Morgan Securities LLC to act as dealer managers

for the Offer, and has retained D.F. King & Co., Inc. to serve

as the tender agent and information agent. Requests for documents

may be directed to D.F. King & Co., Inc. by email at

expe@dfking.com or by telephone at +1 212-269-5550 (banks and

brokers) or +1 800-829-6551. Questions regarding the Offer may be

directed to BofA Securities at (980) 387-3907, Goldman Sachs &

Co. LLC at (212) 357-1452 and J.P. Morgan Securities LLC at (917)

808-9154.

This announcement is not (i) an offer to sell or purchase, or a

solicitation of an offer to purchase or sell, any securities or

(ii) a notice of redemption or an obligation to issue a notice of

redemption. The Offer is being made solely by Expedia Group

pursuant to the Offer to Purchase. The Offer is not being made to,

nor will Expedia Group accept tenders of Notes from, holders in any

jurisdiction in which the Offer or the acceptance thereof would not

be in compliance with the securities or blue sky laws of such

jurisdiction.

Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995. These forward-looking statements reflect the views of our

management regarding current expectations and projections about

future events and are based on currently available information.

Actual results could differ materially from those contained in

these forward-looking statements for a variety of reasons,

including, but not limited to, those discussed in the section

entitled “Risk Factors” in our Annual Report on Form 10-K for the

year ended December 31, 2020, as well as those discussed elsewhere

in our public filings with the Securities and Exchange Commission

(“SEC”). COVID-19, and the volatile regional and global economic

conditions stemming from it, and additional or unforeseen effects

from the COVID-19 pandemic, could also give rise to or aggravate

these risk factors, which in turn could materially adversely affect

our business, financial condition, liquidity, results of operations

(including revenues and profitability) and/or stock price. Further,

COVID-19 may also affect our operating and financial results in a

manner that is not presently known to us or that we currently do

not consider to present significant risks to our operations. Other

unknown or unpredictable factors also could have a material adverse

effect on our business, financial condition and results of

operations. Accordingly, readers should not place undue reliance on

these forward-looking statements. The use of words such as

“anticipates,” “believes,” “could,” “estimates,” “expects,” “goal,”

“intends,” “likely,” “may,” “plans,” “potential,” “predicts,”

“projected,” “seeks,” “should” and “will,” or the negative of these

terms or other similar expressions, among others, generally

identify forward-looking statements; however, these words are not

the exclusive means of identifying such statements. In addition,

any statements that refer to expectations, projections or other

characterizations of future events or circumstances are

forward-looking statements. These forward-looking statements are

inherently subject to uncertainties, risks and changes in

circumstances that are difficult to predict. We are not under any

obligation to, and do not intend to, publicly update or review any

of these forward-looking statements, whether as a result of new

information, future events or otherwise, even if experience or

future events make it clear that any expected results expressed or

implied by those forward-looking statements will not be realized.

Please carefully review and consider the various disclosures made

in this press release and in our reports filed with the SEC that

attempt to advise interested parties of the risks and factors that

may affect our business, prospects and results of operations.

Disclaimer

This announcement must be read in conjunction with the Offer to

Purchase. This announcement and the Offer to Purchase (including

the documents incorporated by reference therein) contain important

information which must be read carefully before any decision is

made with respect to the Offer. If any holder of Notes is in any

doubt as to the action it should take, it is recommended to seek

its own legal, tax, accounting and financial advice, including as

to any tax consequences, immediately from its stockbroker, bank

manager, attorney, accountant or other independent financial or

legal adviser. Any individual or company whose Notes are held on

its behalf by a broker, dealer, bank, custodian, trust company or

other nominee or intermediary must contact such entity if it wishes

to participate in the Offer. None of Expedia Group, the dealer

managers, the tender and information agent, or any person who

controls or is a director, officer, employee or agent of such

persons, or any affiliate of such persons, makes any recommendation

as to whether holders of Notes should participate in the Offer.

About Expedia Group

Expedia Group is the world's travel platform, and our mission is

to power global travel for everyone, everywhere. We believe travel

is a force for good. Travel is an essential human experience that

strengthens connections, broadens horizons and bridges divides. We

leverage our platform and technology capabilities across an

extensive portfolio of businesses and brands to orchestrate the

movement of people and the delivery of travel experiences on both a

local and global basis. Our family of travel brands includes: Brand

Expedia®, Hotels.com®, Expedia® Partner Solutions, Vrbo®, Egencia®,

trivago®, HomeAway®, Orbitz®, Travelocity®, Hotwire®, Wotif®,

ebookers®, CheapTickets®, Expedia Group™ Media Solutions,

CarRentals.com™, Expedia® Cruises™, Classic Vacations®, Traveldoo®

and VacationRentals.com.

© 2021 Expedia, Inc., an Expedia Group company. All rights

reserved. Trademarks and logos are the property of their respective

owners. CST: 2029030-50

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210216005728/en/

Investor Relations ir@expediagroup.com Communications

press@expediagroup.com

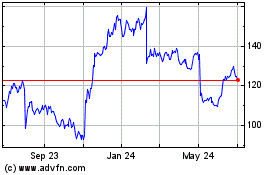

Expedia (NASDAQ:EXPE)

Historical Stock Chart

From Mar 2024 to Apr 2024

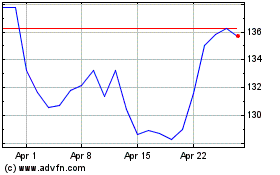

Expedia (NASDAQ:EXPE)

Historical Stock Chart

From Apr 2023 to Apr 2024