Filed

Pursuant to Rule 424(b)(5)

Registration

No. 333-252370

PROSPECTUS

SUPPLEMENT

(To

Prospectus dated February 5, 2021)

ESPORTS

ENTERTAINMENT GROUP, INC.

Up

to $20,000,000 of Common Stock

We

have entered into a sales agreement with Maxim Group LLC (“Maxim”) relating to the sale of shares of our common stock offered

by this prospectus supplement and the accompanying prospectus. In accordance with the terms of the sales agreement, we may offer and

sell up to a maximum aggregate amount of $20,000,000 of our common stock, $0.001 par value per share, from time to time through Maxim,

acting as agent.

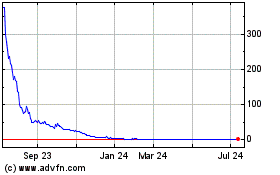

Our

common stock is traded on The NASDAQ Capital Market under the symbol “GMBL.” The closing price of our common stock on September

2, 2021 was $9.07 per share.

Sales

of our common stock, if any, under this prospectus supplement and the accompanying prospectus will be made by any method permitted that

is deemed an “at the market” offering as defined in Rule 415 under the Securities Act of 1933, as amended, or the Securities

Act, including by means of ordinary brokers’ transactions at market prices, in block transactions or as otherwise agreed by Maxim

and us. Maxim will act as our sales agent using commercially reasonable efforts consistent with its normal trading and sales practices.

There is no arrangement for funds to be received in any escrow, trust or similar arrangement.

Maxim

will be entitled to compensation at a commission rate of 3% of the gross sales price per share sold. The net proceeds to us that we receive

from sales of our common stock will depend on the number of shares actually sold and the offering price for such shares. We are limited

to the sale of not more than $20,000,000 of our common stock pursuant to the sales agreement. Based on the trading price of our common

stock and because there is no minimum offering amount provided for under the engagement agreement the actual proceeds to us will vary.

In

connection with the sale of the common stock on our behalf, Maxim may be deemed to be an “underwriter” within the meaning

of the Securities Act and the compensation of Maxim may be deemed to be underwriting commissions or discounts. We have also agreed to

provide indemnification and contribution to Maxim with respect to certain liabilities, including liabilities under the Securities Act.

Investing

in these securities involves a high degree of risk. Before buying shares of our common stock, you should carefully consider the risk

factors described in “Risk Factors” beginning on page S-15 of this prospectus supplement and in the documents incorporated

by reference into this prospectus supplement and any free writing prospectus that we have authorized for use in connection with this

offering.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or determined

if this prospectus supplement and the accompanying prospectus is accurate or complete. Any representation to the contrary is a criminal

offense.

MAXIM

GROUP LLC

The

date of this prospectus supplement is September 3, 2021

TABLE

OF CONTENTS

PROSPECTUS

SUPPLEMENT

PROSPECTUS

ABOUT

THIS PROSPECTUS SUPPLEMENT

This

prospectus supplement and the accompanying base prospectus form part of a registration statement on Form S-3 that we filed with the Securities

and Exchange Commission, which we refer to as the SEC, using a “shelf” registration process. This document contains two parts.

The first part consists of this prospectus supplement, which provides you with specific information about this offering. The second part,

the accompanying base prospectus dated February 5, 2021, provides more general information, some of which may not apply to this offering.

Generally, when we refer only to the “prospectus,” we are referring to both parts combined. This prospectus supplement may

add, update or change information contained in the accompanying base prospectus. To the extent that any statement we make in this prospectus

supplement is inconsistent with statements made in the accompanying base prospectus or any documents incorporated by reference herein

or therein, the statements made in this prospectus supplement will be deemed to modify or supersede those made in the accompanying base

prospectus and such documents incorporated by reference herein and therein.

In

this prospectus supplement, “EEG,” the “Company,” “we,” “us,” “our” and similar

terms refer to Esports Entertainment Group, Inc., a Nevada corporation, and its consolidated subsidiaries. References to our “common

stock” refer to the common stock of Esports Entertainment Group, Inc.

All

references in this prospectus supplement to our consolidated financial statements include, unless the context indicates otherwise, the

related notes.

The

industry and market data and other statistical information contained in the documents we incorporate by reference in the prospectus are

based on management’s own estimates, independent publications, government publications, reports by market research firms or other

published independent sources, and, in each case, are believed by management to be reasonable estimates. Although we believe these sources

are reliable, we have not independently verified the information.

You

should rely only on the information contained in or incorporated by reference in this prospectus supplement, the accompanying base prospectus

and in any free writing prospectus that we have authorized for use in connection with this offering. We have not, and Maxim has not,

authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should

not rely on it. You should assume that the information in this prospectus supplement, the accompanying base prospectus, the documents

incorporated by reference in the accompanying base prospectus, and in any free writing prospectus that we have authorized for use in

connection with this offering, is accurate only as of the date of those respective documents. Our business, financial condition, results

of operations and prospects may have changed since those dates. You should read this prospectus supplement, the accompanying base prospectus,

the documents incorporated by reference in the accompanying base prospectus, and any free writing prospectus that we have authorized

for use in connection with this offering, in their entirety before making an investment decision. You should also read and consider the

information in the documents to which we have referred you in the sections of the accompanying base prospectus entitled “Where

You Can Find More Information” and “Incorporation by Reference of Certain Documents.” We are not, and Maxim is not,

making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus supplement and our SEC filings that are incorporated by reference into this prospectus supplement contain or incorporate by

reference forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of

the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements, other than statements of historical

fact, included or incorporated by reference in this prospectus supplement regarding our development of our strategy, future operations,

future financial position, projected costs, prospects, plans and objectives of management are forward-looking statements. Forward-looking

statements may include, but are not limited to, statements about:

|

|

●

|

any

statements of the plans, strategies and objectives of management for future operations;

|

|

|

●

|

any

statements concerning proposed new products, services or developments;

|

|

|

●

|

any

statements regarding future economic conditions or performance;

|

|

|

●

|

our

ability to protect our intellectual property and operate our business without infringing upon the intellectual property rights of

others;

|

|

|

●

|

our

estimates regarding the sufficiency of our cash resources and our need for additional funding; and

|

|

|

●

|

our

intended use of the net proceeds from the offerings of shares of common stock under this prospectus supplement.

|

The

words “believe,” “anticipate,” “design,” “estimate,” “plan,” “predict,”

“seek,” “expect,” “intend,” “may,” “could,” “should,” “potential,”

“likely,” “projects,” “continue,” “will,” and “would” and similar expressions

are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Forward-looking

statements reflect our current views with respect to future events, are based on assumptions and are subject to risks and uncertainties.

We cannot guarantee that we actually will achieve the plans, intentions or expectations expressed in our forward-looking statements and

you should not place undue reliance on these statements. There are a number of important factors that could cause our actual results

to differ materially from those indicated or implied by forward-looking statements. These important factors include those discussed under

the heading “Risk Factors” contained or incorporated in this prospectus supplement and the accompanying prospectus and any

free writing prospectus we may authorize for use in connection with a specific offering. These factors and the other cautionary statements

made in this prospectus supplement and the accompanying prospectus should be read as being applicable to all related forward-looking

statements whenever they appear in this prospectus supplement and the accompanying prospectus. Except as required by law, we do not assume

any obligation to update any forward-looking statement. We disclaim any intention or obligation to update or revise any forward-looking

statement, whether as a result of new information, future events or otherwise.

PROSPECTUS

SUPPLEMENT SUMMARY

The

following summary highlights selected information contained in or incorporated by reference into this prospectus and does not contain

all the information that may be important to purchasers of our securities. Before making an investment decision, you should carefully

read the entire prospectus supplement, including the “Risk Factors” section, the accompanying base prospectus and the documents

and other information incorporated by reference into the prospectus.

About

Esports Entertainment Group, Inc.

Overview

Corporate

History

Esports

Entertainment Group, Inc. (“EEG”) was formed in the State of Nevada on July 22, 2008 under its prior name Virtual Closet,

Inc. Virtual Closet, Inc. changed its name to DK Sinopharma, Inc. on June 6, 2010. DK Sinopharma, Inc. changed its name to VGambling,

Inc. on August 12, 2014. On or about April 24, 2017, VGambling, Inc. changed its name to Esports Entertainment Group, Inc. The company

was engaged in a number of different enterprises up until May 20, 2013, when, pursuant to the terms of the Share Exchange Agreement,

they acquired all of the outstanding capital stock of H&H Arizona Corporation in exchange for 3,333,334 shares of its common stock.

From May 2013 until August 2018, its operations were limited to designing, developing and testing its wagering systems. They launched

their online esports wagering website (www.vie.gg) in August 2018.

Business

Overview

EEG

is the competitive playing of video games by amateur and professional teams as a spectator sport. Esports typically takes the form of

organized, multiplayer video games that include genre’s such as real-time strategy, fighting, first-person shooter and multiplayer

online battle arena games. As of June 30, 2021, the three most popular esports games were Dota 2, League of Legends (each multiplayer

online battle arena games) and Counter Strike: Global Offensive (a first-person shooter game). Other popular games include Fortnite,

StarCraft II, Call of Duty¸ Overwatch, Hearthstone and Apex Legends. Most major professional esports events and a wide range of

amateur esports events are broadcast live via streaming services including twitch.tv and youtube.com.

EEG

is an esports focused iGaming and entertainment company with a global footprint. EEG’s strategy is to build and acquire betting

and related platforms, and lever them into the rapidly growing esports vertical. We operate the business in two verticals, EEG iGaming

and EEG Games.

EEG

iGaming:

In

the EEG iGaming vertical, we have a best-in-class esports betting platform with full casino and sportsbook functionality. Our in-house

gambling software platform, Phoenix, is a modern reimagined sportsbook that caters to both millennial esports bettors as well as traditional

sports bettors. Phoenix is being developed through the assets and resources of FLIP Sports Limited, a software development company, that

we acquired in September 2020.

EEG’s

goal is to be a leader in the large and rapidly growing sector of esports real-money wagering, offering fans the ability to wager on

professional esports events in a licensed and secure environment. From February 2021, under the terms of their Maltese Gaming Authority

(MGA) license, we are now able to accept wagers from residents of over 180 jurisdictions including countries within the European Union,

Canada, New Zealand and South Africa, on our ‘‘Vie.bet’’ platform.

Alongside

the Vie.bet esports focused platform, EEG owns and operates:

|

●

|

Argyll

Entertainment’s flagship Sportnation.bet online sportsbook and casino brand, licensed in the UK and Ireland;

|

|

●

|

Lucky

Dino’s 5 online casino brands licensed by the MGA on its in-house built iDefix casino-platform; and

|

|

●

|

The

recently acquired Bethard online sportsbook and casino brands, operating under MGA, Spanish, Irish and Swedish licenses.

|

On

August 20, 2020, EEG announced entry into a multi-year partnership with Twin River Worldwide Holdings, Inc (NYSE: TRWH), now Bally’s

Corporation (NYSE: BALY), to launch their proprietary mobile sports betting product, ‘‘Vie.gg’, in the state of New

Jersey. EEG intends to have this platform, which was previously licensed in Curacao, live in the state during August 2021 or soon thereafter.

In

total EEG currently holds five Tier-1 gambling licenses (Malta, UK, Ireland, Spain and Sweden) and are in the process of acquiring one

additional gambling license in the United States for the state of New Jersey. Our acquisitions of Argyll Entertainment, Lucky Dino and

Bethard provide a foothold in mature markets in Europe into which we believe we can cross-sell our esports offerings.

EEG

Games:

In

the EEG Games vertical, focus is on providing esports entertainment experiences for every gamer. We do this through a combination of

1) in-person experiences (at Helix Centers), 2) online tournaments (through their recently acquired EGL tournament platform), and 3)

player-vs-player wagering (through their soon-to-be-released LANDuel product). In order to provide exposure for our platforms, we have

signed numerous exclusive marketing relationships with professional sports organizations across the NFL, NBA, NHL and MLS.

Underpinning

our EEG Games vertical is our proprietary infrastructure software, ggCircuit (“GGC”). ggCircuit is the leading provider of

local area network (“LAN”) Center management software, enabling us to seamlessly manage mission critical functions such as

game licensing and payments.

Recent

Developments

Entry

into a Securities Purchase Agreement with Investor

On

May 28, 2021, we entered into a Securities Purchase Agreement (“Purchase Agreement”) with an institutional investor (the

“Investor”) pursuant to which we sold a Senior Convertible Note dated June 2, 2021, with an initial principal amount of $35

million (the “Convertible Note”) in a transaction exempt from registration under Section 4(a)(2) of the Securities Act of

1933, as amended, and Rule 506 of Regulation D promulgated thereunder. The Convertible Note bears interest at a rate of 8% per annum

and matures two years following the date of issuance (the “Maturity Date”, subject to extension in certain circumstances,

including bankruptcy and outstanding events of default). In addition to the principal amount the Company is required to pay an additional

amount equal to 6% of the outstanding principal amount. After the occurrence and during the continuance of an Event of Default (as defined

in the Convertible Note), the Convertible Note will accrue interest at the rate of 12.0% per annum.

The

Convertible Note is convertible, at the option of the holder, into shares of the Company’s common stock at a conversion price of

$17.50 per share. The Convertible Note is subject to a most favored nations provision and standard adjustments in the event of any stock

split, stock dividend, stock combination, recapitalization or other similar transaction. If we enter into any agreement to issue (or

issue) any variable rate securities, the noteholder has the additional right to substitute such variable price (or formula) for the conversion

price.

In

connection with the sale of the Convertible Note, the Company issued two warrants to the Investor, the Series A Warrant and Series B

Warrant. Pursuant to the Series A Warrant, issued by the Company in favor of the Investor, the investor shall have the right to purchase

2,000,000 shares of the Company’s common stock at an exercise price of $17.50 per share. The Series A Warrant expires in 4 years.

The Series A Warrant has a cashless exercise provision provides that no effective registration statement exists and a beneficial ownership

limitation of 4.99% which may be increased or decreased up to 9.99%, provided that any such increase will not be effective until the

61st day after delivery of a notice to us of such increase.

Pursuant

to a Series B Warrant, issued by the Company in favor of the Investor, the investor shall have the right to purchase 2,000,000 shares

of the Company’s common stock at an exercise price of $17.50 per share. The Series B Warrant expires in 2 years. The Series B Warrant

has a cashless exercise provision provides that no effective registration statement exists and a beneficial ownership limitation of 4.99%

which may be increased or decreased up to 9.99%, provided that any such increase will not be effective until the 61st day after delivery

of a notice to us of such increase. The Series B Warrant is only exercisable to the extent that the indebtedness owing under the Convertible

Note is redeemed. For every share of common stock issuable upon conversion of the redemption amount on the Convertible Note, one warrant

share will vest and be eligible for exercise.

On

July 13, 2021, the Purchaser consented to the Pledge entered into with Gameday Group Plc as described under the header below titled “Entry

into a Securities Purchase Agreement with Gameday Group Plc”, waived the provisions of Section 14(c) of the Note prohibiting the

Pledge, and agreed that the lien represented by the Pledge shall constitute a “Permitted Lien” for purposes of Section 31(uu)

of the Note.

Entry

into a Securities Purchase Agreement with Gameday Group Plc

On

May 25, 2021 (the “Signing Date”), we entered into a Share Sale and Purchase Agreement with Gameday Group Plc, a limited

liability company incorporated in Malta (the “Seller”, and together with the Company, the “Parties”). Subject

to the terms and conditions of the Purchase Agreement, the Parties agreed that the Shares (as defined below) will be sold by the Seller

to the Company five Business Days after the issuance of the Seller’s Pre-Closing Restructuring Confirmation (as defined below),

or such other date as the Parties may agree on writing (the “Closing Date”). All defined terms used herein and not otherwise

defined have the meanings set forth in the Purchase Agreement.

According

to the Purchase Agreement, the Seller owns certain business assets (the “Assets”) regarding the Bethard, Fastbet and Betive

brands (the “Business”), including (i) the brand name Bethard (and, together with the Fastbet and Betive brands the “Brands”);

(ii) domains relating to the Brands (the “Domains”); (iii) the customer databases relating to the Brands (the “Customer

Databases”); (iv) website content, materials and code pertaining to the Domains (or any part/s thereof) currently owned by the

Seller and any of its Affiliates (the “Front-End Code”); (v) certain licensee rights under an ambassador agreement originally

entered into by Bethard Group Limited (“BG”) and Unknown AB (“Unknown”), dated February 14, 2018 (and amended

on February 26, 2018 and on March 16, 2018), and thereafter assigned and novated by BG to Together Gaming Solutions p.l.c (“TGS”)

on April 30, 2019 and subsequently amended on March 27, 2020 (the “Zlatan Agreement”); and (vi) B2C online gambling licenses

in Sweden, Spain, Malta, and Ireland (each a “License” and together the “Licenses”).

As

described in the Purchase Agreement, Prozone Limited, a limited liability company incorporated in Malta (“Prozone”) prior

to the completion of all actions and the transactions (including the Transaction defined below) required to take place at the Closing

on the Closing Date (the “Closing”) intends to enter into (i) an asset transfer agreement with the Seller’s subsidiaries,

BG and TGS (the “Asset Transfer Agreements”), pursuant to which Prozone will acquire, prior to the Closing, full legal title

and ownership of the Assets (with the exception of the Licenses and the Zlatan Agreement) owned by each of BG and TGS, free and clear

from any Encumbrances;(ii) a white label platform licensing agreement with TGS for the Together Gaming Platform (the “Platform”)

(the “White Label Agreement”) regarding the Business; (iii) a turnkey platform licensing agreement with the TGS for the Platform

(the “Turnkey Agreement”); and (iv) a services agreement with BG for operational support services (the “Services Agreement”)

(the “Pre-Closing Restructuring”).

Following

the Pre-Closing Restructuring and prior to the Closing, the Seller assumed Prozone’s payment obligations to BG and TGS under

the Asset Transfer Agreements in consideration for receivables (of an aggregate amount that is equal to those payment obligations) due

by Prozone to the Seller in accordance with an assignment and novation agreement entered into between Prozone, the Seller, and BG and

an assignment and novation agreement entered into between Prozone, the Seller, and TGS (the “Assignment and Novation Agreements”).

These receivables were then capitalized (i.e., converted into shares in Prozone) and at which point Prozone had issued share capital

of the EUR 25,101,200 divided into 25,101,200 shares of EUR 1 each (the “Shares”), all of which was owned by the Seller.

The Seller subsequently sold all of the Shares of Prozone together with all rights attached to them and free from any Encumbrance to

the Company (the “Transaction”) on the Closing Date subject to the terms and conditions of the Purchase Agreement.

Following

the Closing, the Seller agreed to procure that each of the Licenses are transferred to Prozone as soon as practicable, subject to such

transfers being permitted under the relevant local regulations. Prozone agreed to operate for a minimum period of 24 months from the

Closing the Domains utilizing the Platform, pursuant to the terms of the White Label Agreement and/or the Turnkey Agreement. After 24

months from the Closing have passed, Prozone shall be free to terminate the White Label Agreement and/or Turnkey Agreement (as applicable)

and migrate the Domains and the Customer Databases to another platform of Prozone’s choice. The Seller agreed to procure that the

Zlatan Agreement (which is currently the subject of negotiation between TGS and Unknown) will be assigned and novated in favor of Prozone

pursuant to an assignment and novation agreement to be entered into between TGS, Unknown, and Prozone (the “Zlatan Agreement Assignment”).

The

Purchase Price for the Shares shall be an amount corresponding to the aggregate of (i) EUR 16,000,000 (the “Closing Payment”);

(ii) the additional consideration payable to the Seller by the Company as set out in Section 5 of the Purchase agreement (the “Additional

Payment”); and (iii) the shares of the Company’s common stock, par value $0.001 to be allotted and issued to the Seller by

the second year anniversary of the Closing Date, representing an aggregate value of the USD Currency Equivalent of EUR7,600,000 as set

out in Section 6 of the Purchase Agreement or such lower amount as may be applicable in accordance with Section 9.3 of the Purchase Agreement

(the “Share Consideration”, and together with the Closing Payment and the Additional Payment, the “Purchase Price”).

On

July 13, 2021, the Company and the Seller entered into an Amendment Agreement (the “Amendment”) with respect to the Purchase

Agreement, pursuant to which the Seller and the Company agreed to amend the Purchase Agreement, specifically the Purchase Price, as follows:

(i) the Company agreed to make a payment of EUR 12,000,000 (the “First Payment”) to the Seller by no later than July 13,

2021 (the “First Payment Date”) and a payment of EUR 4,000,000 (the “Second Payment”) to the Seller by no later

than October 1, 2021 (the “Second Payment Date”); (ii) the Company agreed to pay Seller an additional EUR 1,000,000 on the

First Payment Date, representing a refund to the Seller of an equivalent amount that the Seller has deposited with the Spanish Gaming

Authority (DGOJ) as a guarantee for regulatory purposes (the “Spanish Deposit Amount”). Further, the Additional Payment,

shall be increased from 12% of the Net Gaming Revenue during Relevant Period, effective July 1, 2021, to 15% of Net Gaming Revenue until

receipt of the Second Payment, following which it shall be reduced to 12% of Net Gaming Revenue for the remainder of the Relevant Period.

The

Additional Payment shall be reduced to 10% of Net Gaming Revenue in respect of any relevant jurisdiction where the Company has not yet

acquired the relevant B2C online gambling license for a three month period beginning July 31, 2021 but shall increase to 12% for the

remainder of the Relevant Period once the relevant license has been acquired by the Company.

On

July 13, 2021, the Company and the Seller entered into that certain Pledge of Shares Agreement (the “Pledge Agreement”),

whereby the Company agreed to pledge the Shares in favor of the Seller (the “Pledge”) as security for the Company’s

obligation to make the Second Payment by no later than the Second Payment Date, including any and all fees and/or expenses which the

Seller may incur in the protection or enforcement of its respective rights under the Purchase Agreement (the “Secured Obligations”).

The Pledge will be released by the Seller upon receipt by the Seller of the Second Payment. The Pledge Agreement constitutes a continuing

security for the due and punctual performance of all the Secured Obligations. The Pledge Agreement contains customary representations,

warranties and covenants, and other terms and conditions.

On

July 13, 2021, the Company and Seller, having met all conditions precedent in the Amendment consummated the closing for the Shares. Pursuant

to the Amendment, as consideration for the Shares, the Company paid the Seller EUR 12,000,000 at the Closing with the Second Payment

and Additional Consideration to follow in accordance with the Amendment.

Helix

Holdings, LLC Purchase Agreement

On

January 22, 2021, the Company entered into an equity purchase agreement (the “Helix Purchase Agreement”), by and among the

Company, Helix Holdings, LLC, a limited liability company incorporated under the laws of Delaware (“Helix”), and the equity

holders of Helix (the “Helix Equity Holders”), whereby the Company will acquire from the Helix Equity Holders all of the

issued and outstanding membership units of Helix (the “Helix Units”), making Helix a wholly owned subsidiary of the Company.

In

connection with the negotiation of the Helix Purchase Agreement, the Company advanced an aggregate of $400,000 to Helix during 2020 and

2021 in the form of loans (the “Helix Loans”). Upon execution of the Helix Purchase Agreement, the Company paid Helix an

additional $400,000 to be used for operating expenses pending the Closing (the “Operating Expense Payments”).

On

May 21, 2021, the Company and Helix amended the Helix Purchase Agreement pursuant to Amendment No. 1 to Equity Purchase Agreement (the

“Helix Amendment”) to, among other things, (A) update Exhibit A thereto, (B) provide for an additional indemnifiable event

by the Helix Equity Holders under Section 10.02 of the Helix Purchase Agreement with respect to post-closing pre-mature departures of

certain key employees of Helix, (C) extend the End Date (as defined in the Helix Purchase Agreement) to June 3, 2021, (D) provide for

a non-refundable operating expense payment to Helix in the amount of $100,000; provided, however, that if the transaction does not close

on or before June 1, 2021, the Company is required to make an additional non-refundable payment in the amount of $100,000 to Helix, (E)

increase the amount of the Purchase Price (as defined in the Helix Purchase Agreement) to be paid in cash from $8,500,000 to $10,000,000

and reduce the amount of the Purchase Price to be paid in stock from $8,500,000 to $7,000,000, and (F) change the Stock Payment (as defined

in the Helix Purchase Agreement) calculation from a variable formula to a fixed price formula, resulting in $7,000,000 of the Purchase

Price being payable to the Helix Equity Holders in shares of the Company’s common stock valued at $13.25 per share (528,302 shares).

On

June 1, 2021, the Company, Helix and the Helix Equity Holders, having met all conditions precedent in the Helix Purchase Agreement, consummated

the closing for the Helix Interests (the “Helix Closing”). Pursuant to the Helix Purchase Agreement, as consideration for

the Helix Interests, the Company paid the Helix Equity Holders at the Helix Closing: (i) $10,000,000 in cash (the “Helix Cash Consideration”)

and $7,000,000 in stock (the “Helix Stock Consideration”) through the issuance of 528,302 shares of the Company’s common

stock, par value $0.001 per share, determined using a price of $13.25 per share (the actual closing price of the Company’s common

stock on June 1, 2021 was $11.17 per share). In connection with the Helix Cash Consideration, the Company received credit for certain

loans and operating expense payments made by the Company to Helix during 2020 and 2021.

ggCIRCUIT

LLC Purchase Agreement

On

January 22, 2021, the Company entered into the GGC Purchase Agreement whereby the Company will acquire from the GGC Equity Holders all

of the issued and outstanding membership units of GGC (the “GGC Units”), making GGC a wholly owned subsidiary of the Company.

In

connection with the negotiation of the GGC Purchase Agreement, the Company advanced an aggregate of $600,000 to GGC during 2020 and 2021

in the form of loans (the “GGC Loans”). Upon execution of the GGC Purchase Agreement, the Company paid GGC an additional

$600,000 to be used for operating expenses pending the Closing (the “Operating Expense Payments”).

On

May 21, 2021, the Company and GGC amended the GGC Purchase Agreement pursuant to the Amendment No. 1 to Equity Purchase Agreement

(the “GGC Amendment”) to, among other things, (A) update Exhibit A thereto, (B) provide for an additional indemnifiable

event by the GGC Equity Holders under Section 10.02 of the GGC Purchase Agreement with respect to post-closing pre-mature departures

of certain key employees of GGC, (C) extend the End Date (as defined in the GGC Purchase Agreement) to June 3, 2021, (D) provide for

a non-refundable operating expense payment to GGC in the amount of $100,000; provided, however, that if the transaction does not

close on or before June 1, 2021, the Company is required to make an additional non-refundable payment in the amount of $100,000 to

GGC, (E) increase the amount of the Purchase Price (as defined in the GGC Purchase Agreement) to be paid in cash from $13,000,000 to

$15,000,000 and reduce the amount of the Purchase Price to be paid in stock from $13,000,000 to $11,000,000, and (F) change the

Stock Payment (as defined in the GGC Purchase Agreement) calculation from a variable formula to a fixed price formula, resulting in

$11,000,000 of the Purchase Price being payable to the GGC Equity Holders in shares of the Company’s common stock valued at

$13.25 per share (830,189 shares).

On

June 1, 2021, the Company, GGC and the GGC Equity Holders, having met all conditions precedent in the GGC Purchase Agreement, consummated

the closing for the GGC Interests (the “GGC Closing”). Pursuant to the GGC Purchase Agreement, as consideration for the GGC

Interests, the Company paid the GGC Equity Holders at the GGC Closing: (i) $15,000,000 in cash (the “GGC Cash Consideration”)

and $11,000,000 in stock (the “GGC Stock Consideration”) through the issuance of 830,189 shares of the Company’s common

stock, par value $0.001 per share, determined using a price of $13.25 per share (the actual closing price of the Company’s common

stock on June 1, 2021 was $11.17 per share). In connection with the GGC Cash Consideration, the Company received credit for certain loans

and operating expense payments made by the Company to GGC during 2020 and 2021.

Competitive

Advantages/Operational Strengths

The

online gambling and wagering industry is increasingly competitive. With relatively low barriers to entry, new competitors are entering

the esports wagering and video game tournament segments. In both of these segments, there currently exist several major competitors.

Most of EEG’s current competitors, including Unikrn, bet365, William Hill, Betway, and Pinnacle Sports, have far greater resources

than us.

However,

we believe the following strengths position us for sustainable growth:

Management

Team and Key Personnel Experience: EEG’s Board includes senior managers with extensive experience in online gambling, esports,

information technology, compliance, regulation, accounting and finance. EEG’s Officers and management include individuals with

extensive experience in online gambling, esports, information technology, marketing, business development, payment processing, compliance,

regulation, accounting, finance and customer service.

Unique

Positioning within Digital Gaming: EEG is the only digital gaming company with an esports-first focus and only digital gaming

company with full esports businesses; leading the effort to broaden legislation for betting on esports competitions. We are uniquely

focused on connecting to customers across a broad set of retail and digital businesses to achieve greater revenue, scale, and profitability,

as well as shaping esports infrastructure to facilitate omni-channel betting.

Top

Tier Technology Assets:

|

|

●

|

EEG

has acquired businesses with state-of-the-art B2B/B2C technologies across esports competition infrastructure, for in-person and internet-based

competitions, for tournaments, esports wagering and skill-based betting (P2P).

|

|

|

|

|

|

|

●

|

Acquiring

Genji Analytics, an established esports analytics provider for game publishers and esports leagues, will allow for reorientation

towards betting, through provision of customized marketing, better betting lines and greater customer retention.

|

|

|

●

|

ggCircuit

Proprietary Platform: ggCircuit’s ggLeap cloud-based management software solution enables Gaming Centers to run games through

the stat integrated client, reward gamers for playing the games they love, as well as run their own local tournaments. ggCircuit

is currently used by over 600 LAN centers and connects with over 2 million gamers monthly. In the future EEG plan to offer products

such as player-vs-player betting to the gamers on the network.

|

|

|

|

|

|

|

●

|

Lucky

Dino’s online casino platform - included in the acquisition of Lucky Dino was iDefix, a modern online casino platform licensed

in Malta, upon which the Lucky Dino’s online casino brands operate on . iDefix provides a full technical solution for casino

operations, with various management tools as well as in-depth business intelligence reporting and analysis. The technology is built

on a scalable event-driven micro-services-based architecture offering advanced automation features including AML compliance and KYC

handling, Responsible Gambling management and monitoring, fraud and bonus abuse detection, as well as Gamification, CRM and bonus

management.

|

|

|

|

|

|

|

●

|

Argyll’s

proprietary sports betting rewards and bonus efficiency technology, provides and industry-leading customer loyalty program, driving

above industry customer retention rates and player lifetime values. The Program helped earn Argyll the Innovative Start-up of the

Year award and the 2018 EGR Marketing & Innovation Awards, and will be able to be leveraged across all of EEG’s verticals.

|

|

|

|

|

|

|

●

|

Argyll’s

technology and Lucky Dino’s full igaming tech stack will accelerate the development of EEG’s new Vie esports-centric

platform, and generate synergies from further digital gaming acquisitions.

|

Strong

Brand Partnerships: EEG has already partnered, via “affiliate Marketing Agreements’’, with ten leading brands

in pro sports, including Football, Hockey, Basketball and Soccer, with an aggregate fanbase of over 50 million, as well as with several

individual social media influencers.

|

|

●

|

Pro

sports team partnerships lever huge customer databases for esports tournament participation and betting, lowering EEGs customer acquisition

costs.

|

|

|

●

|

As

a “Marketing Affiliate’’, the esports team will provide their fans with a link to EEG’s online tournament

platform (EGL), where the fan can enter tournaments to win team merchandise, and subscribe to subsequent tournaments.

|

Helix

LAN Center Expertise: Our Helix team prides themselves on building LAN Centers in an efficient manner and programming the centers

to engage local communities. This programming (community tournaments, after-school camps, pro-team watch parties) is what drives traffic

to these centers on a day-in day-out basis. Because of the team’s expertise in this area, we have been approached by numerous entities

such as universities, theme parks and pro sports teams to build and manage centers on their properties.

Growth

Strategy

In

the future, we intend to:

|

|

●

|

expand

its Esports services into more of the 41 states where skill-based gambling is legal, enhance the Product offering, as well as create

relationships with players that will migrate into their Vie.gg real-money wagering platform.

|

|

|

|

|

|

|

●

|

expand

its Esports Wagering services into more jurisdictions, utilizing the recently acquired MGA gaming license, which provides opportunity

for access into over 180 countries, as well as the recent multi-year partnership with Twin River Worldwide Holdings, Inc (NYSE: TRWH),

now Bally’s Corporation (NYSE: BALY), to launch our proprietary mobile sports betting product in the state of New Jersey.

|

|

|

|

|

|

|

●

|

continue

with our M&A strategy in the iGaming and Traditional Sports Betting space, to acquire profitable Operators in different jurisdictions,

that will also allow for cross-pollination of services (Sportsbook, Casino and Esports).

|

Future

Products and Services:

Online

Esports Tournament Play

EEG

intends to offer players from around the world, including the United States, the ability to enter and participate in online video game

tournaments and win cash prizes, via our enhanced EGL Tournament platform. Online esports tournament play consists of two or more people

playing against each other in a game from their personal phones or computers, where such players do not necessarily have to be playing

in real time. These events could be held over the course of a day, a week or even a month and the winner will be the one with the top

score or the fastest time at the conclusion of the event. Cash-based tournaments involving games of skill are not considered gambling

in most U.S. states because the generally accepted definition of gambling involves three specific things: (1) the award of a prize, (2)

paid-in consideration (meaning entrants pay to compete) and (3) an outcome determined on the basis of chance. As a result, games of skill

are not generally subject to the same laws and regulations as our esports event wagering service. We expect participants in our tournaments

being able to enter and play against each other with prize money distributed to the last remaining competitors. We anticipate collecting

a tournament entry fee for our tournaments, as well as a percentage of total winnings that are paid to users (typically 10% of the entry

fees) and thus none of their money will be at risk or otherwise dependent on the outcome. We intend to offer users a wide selection of

video games of skill to be played online for real money in small groups to major tournaments. The tournament platform will also serve

as a tool to help them determine which markets they are finding the most esports players. we believe using the tournament platform to

penetrate the US market will allow us to grow our brand within the esports community and lead to lower customer-acquisition-costs for

their wagering platform.

International

Market Expansion

EEG

received a Gaming Service License for online betting from the Malta Gaming Authority in April 2020, established a brick and mortar office

in such jurisdiction and commenced online gaming operations in that jurisdiction in February 2021, both on the Vie.gg and Argyll Brands.

The Lucky Dino and Bethard brand acquisitions added additional Spanish and Swedish licenses, together with UK and Irish licenses that

Argyll already operates under. In the future, EEG may consider obtaining additional country specific gaming licenses should we determine

there is sufficient local demand for their services in these markets. In order to effectively penetrate international markets, we intend

to translate our website into several additional languages and offer customer service and technical support in the local language of

key markets.

EEG’s

Online Wagering Platforms

According

to Zion Market Research’s, Online Gambling & Betting Market by Game Form (Poker, Casino, Sports Betting, Bingo, Lottery, Horse

Racing Betting, and Others) and by Component (Hardware, Software, and Service): Global Industry Perspective, Comprehensive Analysis and

Forecast, 2017 – 2024, the online gambling market represents one of the fastest growing segments of the gambling industry. Zion

Market estimated the size of the global online gambling market in 2018 was in excess of $45.8 billion and is projected to reach $94.4

billion by 2024.

Although

the Vie.gg brand is focused solely on offering online wagering on the widest range of esports events broadcast from around the world,

the acquisition of Lucky Dino included the acquisition of iDefix, a modern online casino platform licensed in Malta, that the Lucky Dino

online casino brands operate on iDefix provides a full technical solution for casino operations, with various management tools as well

as in-depth business intelligence reporting and analysis. The Argyll and Bethard Brands offer online users traditional casino style games

such as roulette, blackjack , or slots, as well as offering online wagering on traditional sporting events such as soccer, horse racing

and football.

On

the Vie.gg esports-focused wagering platform, a player can place a bet on a team participating in any number of tournaments which are

scheduled to be held in the upcoming weeks. They also maintain a “how to play” section on the website which provides players

with instructional videos on placing bets as well as other pieces of information that may be beneficial to an inexperienced player or

a new user of our website. Additionally, we maintain a “frequently asked questions” section which provides customers with

the ability to easily navigate general questions relating to the website, personal account information, payment processing, betting rules

and procedures as well as tips.

Marketing

and Sales Initiatives

The

Company has several sponsorship marketing agreements in place for its website as well as an extended marketing agreement with Dignitas,

an esports brand owned by Harris Blitzer sports and entertainment with multiple professional teams playing several titles with over a

million fans worldwide. The Company also has an agreement with Allied Esports to run esports tournaments to promote the brand globally

to esports fans.

EEG

is looking to expand into new geographic territories by obtaining licenses to operate in those territories. The need for hands-on implementation

in these territories and support will require investment in additional marketing activities, offices, and other overhead.

We

will also accelerate our expansion if we find complementary businesses that they are able to acquire in other markets. Marketing efforts

to expand into new territories have included esports team and tournament sponsorship, affiliate marketing, social media advertising,

content creation, and attendance at esports and gaming events in addition to personal contact with other industry leaders.

Esports

games are played by professional teams, amateur teams, and individuals. Professional esports teams have their own social media presence,

with some of the top professional teams having millions of fans who follow and interact with the team on a regular basis. A website of

a professional esports team usually contains specific information about the team and lists upcoming tournaments or events in which the

team will be participating. As part of EEG’s efforts to market our online gaming services, we are entering into affiliate marketing

agreements with professional Esports teams.

As

a marketing affiliate, an esports team will promote our brand in the content they create and on their social media and through their

Website.

We

plan to increase marketing efforts and awareness of our websites, www.vie.gg, www.sportnation.bet, www.luckydino.com

and www.bethard.com, as well as future offerings by:

|

|

●

|

Educating

sports betting consumers to bet on esports in an effort to convert gamers to start betting on esports.

|

|

|

|

|

|

|

●

|

Sponsoring

professional esports teams and tournaments that have a global reach.

|

|

|

|

|

|

|

●

|

Working

with sports and gaming celebrities and social media influencers who have an interest in video games and esports to generate new customers.

EEG intends to increase its efforts in attracting esports players and other celebrities who have an interest in video games and esports.

|

|

|

|

|

|

|

●

|

Using

a multichannel approach focused on acquiring and retaining customers we intend to utilize multiple social media platforms to promote

our wagering business including, but not limited to, Facebook Twitter, Instagram, Snapchat, TikTok, Youtube, Twitch, Whatsapp, QQ,

WeChat, email and SMS messages and using online advertisements, paid search optimization, and various social media campaigns to increase

our online presence and drive traffic to our website. EEG intends to increase its investments in online advertisements, including

esports gambling-related websites. We also intend to continue to invest in optimizing the Company’s website so it will attain

a high ranking under key search words or phrases, such as “esports gambling.”

|

Regulations

Affecting our Business

The

offering and operation of online real-money gambling platforms and related software and solutions is subject to extensive regulation

and approval by various national, federal, state, provincial, tribal and foreign agencies (collectively, “gaming authorities”).

Gambling laws require EEG to obtain licenses or findings of suitability from gaming authorities for EEG, including each of our subsidiaries

engaged in these activities, and certain of our directors, officers, employees and in some instances, significant shareholders (typically

beneficial owners of more than 5% of a company’s outstanding equity). The criteria used by gambling authorities to make determinations

as to qualification and suitability of an applicant varies among jurisdictions, but generally require the submission of detailed personal

and financial information followed by a thorough and sometimes lengthy investigation. Gaming authorities have broad discretion in determining

whether an applicant qualifies for licensing or should be found suitable. Gambling authorities generally look to the following criteria

when determining to grant a license or finding of suitability, including (i) the financial stability, integrity and responsibility of

the applicant, (ii) the quality and security of the applicant’s online real-money platform and gaming equipment and related software,

as applicable, and (iii) the past history of the applicant. Gambling authorities may, subject to certain administrative proceeding requirements,

(i) deny an application, or limit, condition, restrict, revoke or suspend any license, registration, finding of suitability or approval,

and (ii) fine any person licensed, registered or found suitable or approved. Notwithstanding the foregoing, some jurisdictions explicitly

prohibit gaming in all or certain forms and we will not market our gambling services in these jurisdictions. If any director, officer

or employee of EEG fails to qualify for a license or is found unsuitable (including due to the failure to submit the required documentation)

by a gaming authority, EEG may deem it necessary, or be required to, sever its relationship with such person, which may include terminating

the employment of any such person. Gambling authorities have the right to investigate any individual or entity having a material relationship

with EEG, to determine whether such individual or entity is suitable or should be licensed to do business as a business associate of

ours. In addition, certain gambling authorities monitor the activities of the entities they regulate both in their respective jurisdiction

and in other jurisdictions to ensure that these entities are in compliance with local standards on a worldwide basis.

On

May 14, 2018, the Supreme Court of the United States struck down the Professional and Amateur Sports Protection Act, a 1992 law that

barred state-authorized sports gambling with some exceptions and made Nevada the only state where a person could wager on the results

of a single game. Since the Supreme Court’s decision, sports gambling has commenced in several states and several more states have

enabling legislation pending. We believe that the Supreme Court’s decision will allow our platform to be used in the United States

at some point in the future. We plan to explore expansion of our esports online wagering platform into the US market place at the appropriate

time.

The

Unlawful Internet Gambling Enforcement Act of 2006 (“UIEGA”) made it a federal offense, punishable by up to five years in

prison, for a business to accept payments “in connection with the participation of another person in unlawful internet gambling.”

In support of such new prohibitions, the UIGEA uses a variety of terms — some of which are ambiguous or undefined. Initially, the

UIGEA broadly defines a “bet or wager” as: the staking or risking by any person of something of value upon the outcome of

a contest of others, a sporting event, or a game subject to chance, upon an agreement or understanding that the person or another person

will receive something of value in the event of a certain outcome.

Further,

a “bet or wager” specifically includes a chance on a lottery or prize awarded predominantly by chance; a “scheme”

as defined in Title 28, U.S.C. § 3702 relating to government-sponsored amateur or professional sports betting and, “any instructions

or information pertaining to the establishment or movement of funds by the bettor or customer in, to, or from, an account with the business

of betting or wagering.” While this final prohibition incorporates the term “business of betting or wagering,” that

term is not specifically defined anywhere in the UIGEA. The only reference to that term comes in § 5362(2), which states: The term

“business of betting or wagering” does not include the activities of a financial transaction provider, or any interactive

computer service or telecommunications service.

Nonetheless,

the law does contain specific prohibitions. In order to establish a violation of the UIGEA, it must be shown that:

|

|

1.

|

A

“person” was engaged in the business of betting or wagering;

|

|

|

|

|

|

|

2.

|

That

person knowingly accepted a financial instrument or proceeds thereof; and

|

|

|

|

|

|

|

3.

|

That

instrument was accepted (by the person) in connection with the participation of another person in “unlawful Internet gambling.”

|

In

the context of this statute “unlawful Internet gambling” is defined as follows:

To

place, receive, or otherwise knowingly transmit a bet or wager by any means which involves the use, at least in part, of the Internet

where such bet or wager is unlawful under any applicable Federal or State law in the state or tribal lands in which the bet or wager

is initiated, received, or otherwise made.

Therefore,

the UIGEA only applies to online gambling transactions that are already prohibited by other state, federal, or tribal laws. Therefore,

in order for the financial transaction to be prohibited by § 5363 of the UIGEA, the bet or wager must be “initiated, received,

or otherwise made” in a place where such activity (the bet of wager) violates preexisting state, federal, or tribal law.

At

the current time, we are able to accept wagers on our vie.bet website from residents of over 180 jurisdictions including Canada, Japan,

and South Africa, under our MGA license. We do not accept wagers from United States residents at this time, and will not do so until

our vie.gg site is live in New Jersey in compliance with all applicable regulations, and therefore the bet or wager on our platform is

not “initiated, received, or otherwise made” in a place where such activity violates pre-existing state, federal, or tribal

law.

Great

Britain

Betting

and gaming with respect to customers in Great Britain (England, Scotland and Wales, but excluding Northern Ireland, the Channel Islands

and the Isle of Man) is regulated by the Gambling Act 2005 (the “2005 Act”). The 2005 Act established the Gambling Commission

as the regulator responsible for granting licenses to operate gambling services as well as overseeing compliance with applicable law

and regulation. In 2014, the UK Parliament passed the Gambling (Licensing and Advertising) Act 2014, which required all remote gambling

operators serving customers in Great Britain or advertising in Great Britain to obtain a license from the Gambling Commission. Our Argyll

Brands operate in the UK pursuant to remote operating licenses issued by the Gambling Commission along with the separate software and

“key personnel” individual licenses. Various additional operating subsidiaries of EEG are endorsed upon the licenses and

are hence authorized to carry out the licensed activities on a so-called “umbrella” basis in addition to the “primary”

licensee. The terms of these operating licenses require that the relevant subsidiaries of EEG must source all gambling software used

in connection with British players from the holder of a gambling software licenses issued by the Gambling Commission. So long as the

applicable license fees are paid and the British licenses are not suspended, revoked or otherwise surrendered, EEG expects that the licenses

will remain valid indefinitely.

British

regulations require licensed companies to file quarterly returns as well as a more extensive “annual assurance statement”

to provide the Gambling Commission with information regarding matters such as significant changes in control systems, risk management

and governance since the last assurance statement, how the licensee is addressing gambling by problem and at-risk customers and any improvements

that the licensee plans to implement to its control systems, risk management and governance and/or its approach to addressing problem

and at-risk gambling and promoting socially responsible gambling. The Gambling Commission also subjects its licensees to periodical regulatory

compliance visits subsequent to which recommendations may be issued to the licensee.

Intellectual

Property

EEG

has not filed to register any patents, trade names or trademarks in any jurisdictions in relation to our Vie.gg brand, but we do intend

to file applications to register patents, tradenames or trademarks in the near future.

Argyll

owns a European Union registered trade mark for its SportNation brand.

EEG’s

Risks and Challenges

An

investment in EEG’s securities involves a high degree of risk. You should carefully consider the risks summarized below. The risks

are discussed more fully in the “Risk Factors” section of this prospectus immediately following this prospectus summary.

These risks include, but are not limited to, the following:

|

|

●

|

We

are a development stage company with a limited operating history.

|

|

|

●

|

The

gaming and interactive entertainment industries are intensely competitive. Esports faces competition from a growing number of companies

and, if Esports is unable to compete effectively, its business could be negatively impacted.

|

|

|

|

|

|

|

●

|

They

have a history of accumulated deficits, recurring losses and negative cash flows from operating activities. We may be unable to achieve

or sustain profitability

|

|

|

|

|

|

|

●

|

The

failure to enforce and maintain our intellectual property rights could enable others to use trademarks used by their business which

could adversely affect the value of the Company.

|

|

|

|

|

|

|

●

|

The

Company may be subject to claims of intellectual property infringement or invalidity and adverse outcomes of litigation could unfavorably

affect its operating results.

|

|

|

|

|

|

|

●

|

Compromises

of the Company’s systems or unauthorized access to confidential information or EEG’s customers’ personal information

could materially harm EEG’s reputation and business.

|

|

|

|

|

|

|

●

|

There

is a risk that the Company’s network systems will be unable to meet the growing demand for its online products.

|

|

|

|

|

|

|

●

|

Systems,

network or telecommunications failures or cyber-attacks may disrupt the Company’s business and have an adverse effect on EEG’s

results of operations.

|

|

|

|

|

|

|

●

|

Malfunctions

of third-party communications infrastructure, hardware and software expose Esports to a variety of risks

|

THE

OFFERING

|

Common

stock offered by us

|

2,205,072

shares of our common stock (at an assumed offering price of $9.07

per share, which was the closing price of our common stock on The NASDAQ Capital Market on September 2, 2021). The actual number

of shares to be issued will vary depending on the sales price in this offering.

|

|

|

|

|

Total

Common stock outstanding before the offering

|

21,970,085

shares of common stock.(1)

|

|

|

|

|

Common

stock to be outstanding after the offerings

|

Up

to 24,175,157 assuming the sale of all of the shares of common stock being offered by us (at an assumed offering price of

$9.07 per share, which was the closing price of our common stock on The NASDAQ Capital Market on September 2,

2021). The actual number of shares to be issued will vary depending on the sales price in this offering.

|

|

|

|

|

Manner

of offering

|

“At

the market offering” that may be made from time to time on The NASDAQ Capital Market or other market for our common stock in

the U.S. through our agent, Maxim Group, LLC (“Maxim”). Maxim will make all sales using commercially reasonable efforts

consistent with its normal trading and sales practices, on mutually agreeable terms between the sales agent and us. See “Plan

of Distribution.”

|

|

|

|

|

Use

of proceeds

|

We

will use the net proceeds from this offering for general corporate purposes. See “Use of Proceeds” on page S-17.

|

|

|

|

|

Risk

factors

|

An

investment in our shares of common stock is highly speculative and involves a number of risks. You should carefully consider the

information contained in the “Risk Factors” section beginning on page S-15 of this prospectus supplement, and elsewhere

in this prospectus supplement and the base prospectus, and the information we incorporate by reference, before making your investment

decision.

|

|

|

|

|

NASDAQ

Capital Market symbol

|

Our

common stock is listed on The NASDAQ Capital Market under the symbol “GMBL” and warrants are listed under the symbol

“GMBLW.”

|

The

number of shares of common stock to be outstanding after this offering excludes the following as of September 2, 2021:

|

●

|

3,350,599

shares of common stock issuable upon exercise of warrants outstanding having a weighted average exercise price of $12.21 per share,

and inclusive of the 2,000,000 Series A Warrants outstanding with an exercise price of $17.50 that were issued in connection with

the sale of the Convertible Note;

|

|

●

|

2,000,000

shares issuable upon a conversion of the Convertible Note into shares of common stock at a conversion price of $17.50;

|

|

●

|

2,000,000

Series B Warrants that were issued in connection with the sale of the Convertible Note and can be exercised at a price of $17.50

should the Company redeem the Convertible Note prior to its maturity date of June 2, 2023;

|

|

●

|

shares

contingently issuable in connection with the Bethard acquisition, whereby the amount issuable in shares shall be determined prior

to the 24 month anniversary date of the acquisition, or July 13, 2023, and based on U.S. dollar equivalent of up to a maximum contingent

share consideration amount of €7,600,000 divided by the 30-day volume weighted average unit price per share of Common Stock

at the time of issuance.

|

|

●

|

473,926

shares of common stock issuable upon exercise of outstanding options

with a weighted average exercise price of $5.49 per share; and

|

|

●

|

609,654

shares reserved for future issuances under our equity compensation plans;

|

RISK

FACTORS

An

investment in our securities involves a high degree of risk. Before deciding whether to invest in our securities, you should consider

carefully the risks described below and discussed under the sections captioned “Risk Factors” contained in our Annual Report

on Form 10-K for the year ended June 30, 2020, which are incorporated by reference into this prospectus supplement and the accompanying

base prospectus in their entirety, together with other information in this prospectus supplement, the accompanying base prospectus, the

information and documents incorporated by reference herein and therein, and in any free writing prospectus that we have authorized for

use in connection with this offering. If any of these risks actually occurs, our business, financial condition, results of operations

or cash flow could be seriously harmed. This could cause the trading price of our common stock to decline, resulting in a loss of all

or part of your investment.

Risks

Related to this Offering

Our

management will have broad discretion over the use of the net proceeds from this offering, you may not agree with how we use the proceeds

and the proceeds may not be invested successfully.

We

have not designated any portion of the net proceeds from this offering to be used for any particular purpose. Accordingly, our management

will have broad discretion as to the use of the net proceeds from this offering and could use them for purposes other than those contemplated

at the time of commencement of this offering. Accordingly, you will be relying on the judgment of our management with regard to the use

of these net proceeds, and you will not have the opportunity, as part of your investment decision, to assess whether the proceeds are

being used appropriately. It is possible that, pending their use, we may invest the net proceeds in a way that does not yield a favorable,

or any, return for our company.

If

you purchase shares of common stock in this offering, you will suffer immediate and substantial dilution in the book value of your investment.

The

price per share of our common stock in this offering may exceed the net tangible book value per share of our common stock outstanding

prior to this offering. Therefore, if you purchase shares of our common stock in this offering, you may pay a price per share that substantially

exceeds our net tangible book value per share after this offering. See “Dilution” for a more detailed discussion of the dilution

you may incur in connection with this offering.

There

may be future sales or other dilution of our equity, which may adversely affect the market price of our common stock.

We

are generally not restricted from issuing additional common stock, including any securities that are convertible into or exchangeable

for, or that represent the right to receive, common stock. The market price of our common stock could decline as a result of sales of

common stock or securities that are convertible into or exchangeable for, or that represent the right to receive, common stock after

this offering or the perception that such sales could occur.

Sales

of a significant number of shares of our common stock in the public markets, or the perception that such sales could occur, could cause

the market price of our common stock to drop significantly, even if our business is doing well.

Sales

of a substantial number of shares of our common stock in the public market could occur at any time. These sales, or the perception in

the market that the holders of a large number of shares intend to sell shares, could reduce the market price of our common stock. After

this offering, assuming we sell $20,000,000 shares of common stock at an assumed offering price of $9.07 per share, which was

the closing price of our common stock on The NASDAQ Capital Market on September 2, 2021, we will have outstanding 24,175,157

shares of common stock based on 21,970,085 shares of common stock outstanding on September 2, 2021. The shares

outstanding also include the shares that we are selling in this offering, which may be resold in the public market immediately without

restriction, unless purchased by our affiliates.

Because

we do not intend to declare cash dividends on our shares of common stock in the foreseeable future, stockholders must rely on appreciation

of the value of our common stock for any return on their investment.

We

have never declared or paid cash dividends on our common stock. We currently anticipate that we will retain future earnings for the development,

operation and expansion of our business and do not anticipate declaring or paying any cash dividends in the foreseeable future. In addition,

the terms of any future debt agreements may preclude us from paying dividends. As a result, we expect that only appreciation of the price

of our common stock, if any, will provide a return to investors in this offering for the foreseeable future.

We

may not be able to maintain compliance with NASDAQ’s continued listing requirements.

Our

common stock is listed on The NASDAQ Capital Market. There are a number of continued listing requirements that we must satisfy in order

to maintain our listing on The NASDAQ Capital Market. If we fail to maintain compliance with all applicable continued listing requirements

for The NASDAQ Capital Market and NASDAQ determines to delist our common stock, the delisting could adversely affect the market liquidity

of our common stock, our ability to obtain financing to repay debt and fund our operations.

USE

OF PROCEEDS

After

giving effect to the sale of the maximum number of shares of our Common Stock under this prospectus supplement, we estimate that the

maximum potential net proceeds we will receive will be approximately $19,370,000 after deducting the agent’s fees and estimated

offering expenses. However, we cannot guarantee if or when these net proceeds will be received. The amount of proceeds from this offering

will depend upon the number of shares of our common stock sold and the market price at which they are sold. There can be no assurance

that we will be able to sell any shares under or fully utilize the engagement letter with Maxim as a source of financing.

We

intend to use the net proceeds for the Second Payment owed to Gameday Group Plc, working capital and other general corporate purposes.

We

have not determined the amount of net proceeds to be used specifically for such purposes and, as a result, management will retain broad

discretion over the allocation of net proceeds. The occurrence of unforeseen events or changed business conditions could result in the

application of the net proceeds from this offering in a manner other than as described in this prospectus supplement. Pending the use

of any net proceeds, we expect to invest the net proceeds in interest-bearing, marketable securities.

CAPITALIZATION

The

following table sets forth our capitalization as of March 31, 2021:

|

|

●

|

On

an actual basis;

|

|

|

●

|

On

a pro forma basis to give effect to following:

|

GGC

and Helix acquisitions (1):

|

|

(i)

|

the

payment of $12,900,000 in cash and $9,273,211 in common stock to the GGC Equity Holders on June 1, 2021;

|

|

|

(ii)

|

the

payment of $7,790,651 in cash and $5,901,133 in common stock to the Helix Equity Holders on June 1, 2021;

|

|

|

(iii)

|

payments

totaling $200,000 to the GGC Equity Holders and Helix Equity Holders prior to June 1, 2021 to fund operating expenses;

|

|

|

(iv)

|

payments

totaling $2,809,349 that were deposited into escrow at the closing of the GGC and Helix acquisitions that is contingent upon future

service by certain GGC Equity Holders and Helix Equity Holders

|

|

|

(v)

|

payment of transaction costs of $470,420 upon closing

of the GGC and Helix acquisitions.

|

Bethard

acquisition:

|

|

(i)

|

the

initial cash payment of €13,000,000 (approximately $15,346,019 using exchange rates in effect at the acquisition date) comprised

of €12,000,000 (approximately $14,165,556 using exchange rates in effect at the acquisition date) paid in cash at closing and

€1,000,000 (approximately $1,180,463 using exchange rates in effect at the acquisition date) paid in cash to acquire a regulatory

deposit for the Bethard operations in Spain.

|

Issuance

of Convertible Note:

|

|

(i)

|

the

issuance of the Convertible Note on June 2, 2021, with an original principal amount of $35,000,000 with proceeds received of $32,515,000,

net of debt issuance costs of $2,485,000.

|

|

|

●

|

on

a pro forma, as adjusted basis to give effect to (i) the receipt of estimated net

proceeds of $19,370,000 assuming the sale of 2,205,072 shares of our common

stock (at an assumed offering price of $9.07 per share, which was the closing price

of our common stock on The NASDAQ Capital Market on September 2, 2021), after

deducting the estimated commissions payable by us; and (ii) the Second Payment of €4,000,000

(approximately $4,721,852 using exchange rates in effect at the acquisition date) that is

payable in cash for Bethard no later than October 1, 2021 as described under “Use

of Proceeds”.

|

You

should read the data set forth in the table below in conjunction with (a) our financial statements, including the related notes, and

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” from our Annual Report on Form

10-K for the fiscal year ended June 30, 2020, and (b) our unaudited condensed consolidated financial statements, including the related

notes, and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” from our Quarterly

Report on Form 10-Q for the quarterly period ended March 31, 2021, which are incorporated by reference into this prospectus supplement

and the accompanying prospectus.

|

|

|

As

of March 31, 2021

|

|

|

|

|

Actual

(Unaudited)

|

|

|

Pro

Forma

|

|

|

Pro Forma,

As Adjusted

|

|

|

Cash

and restricted cash

|

|

$

|

20,309,049

|

|

|

$

|

13,307,610

|

|

|

$

|

27,955,758

|

|

|