Ericsson Swings to Forecast-Beating Profit Amid 5G Momentum

April 17 2019 - 6:43AM

Dow Jones News

By Dominic Chopping

STOCKHOLM -- Ericsson AB swung to a forecast-beating

first-quarter net profit as operators in North America continued to

splash out on new fifth-generation networks, but cautioned that

margins could be squeezed as it builds market share.

The telecommunications equipment company reported a quarterly

net profit of 2.32 billion Swedish kronor ($250.3 million),

compared with a loss of 837 million kronor the year earlier, as

sales rose 13% to 48.91 billion kronor.

Analysts polled by FactSet expected a net profit of 1.51 billion

kronor on sales of 47.83 billion kronor.

Ericsson has emerged from a lengthy restructuring process and

bet big on the success of 5G, investing heavily in research while

slashing costs elsewhere. As part of this strategy it has been busy

building market share by offering operators what it calls

"strategic contracts": lower margin deals that give it a foothold

in the market.

This has been paying off, having announced commercial 5G deals

with 18 named operators at the close of the quarter and raising its

share of the network equipment market to 29.2% in 2018 compared

with 28.7% for 2017, according to a February report from telecom

market researcher Dell'Oro.

But these strategic contracts, with initially low margins, along

with 5G field trials and large-scale deployments of 5G in parts of

Asia this year, will gradually hit short-term margins. Gross

margins will start to be impacted in the second quarter, Ericsson

said.

The gross margin grew to 38.4% in the first quarter from

34.2%.

"Our strategy, to work with lead customers in lead markets, is

generating both 5G business and hands-on experience in 5G rollout

and commercialization," Chief Executive Borje Ekholm said.

North American operators are eager to lead the transition to 5G

and have been ahead of the pack with their investments in the new

technology, driving Ericsson's networks sales for several quarters.

That trend continued in the first quarter of 2019, with gross

margins in the key networks business rising to 43.2% from

38.9%.

Most parts of Europe are lagging in the transition to the new

technology though, primarily due to lack of spectrum, poor

investment climate and additional uncertainties related to future

vendor market access.

Nevertheless, Ericsson said Wednesday that it now expects the

Radio Access Network (RAN) equipment market to increase by 3% this

year, up from a previous forecast for 2% growth.

Ericsson has been involved in probes by the U.S. Securities and

Exchange Commission since 2013 and since 2015 with an investigation

by the U.S. Justice Department into the company's compliance with

the U.S. Foreign Corrupt Practices Act.

The company said Wednesday that it has recently begun settlement

discussions, and although talks are at a very early stage, it

believes the resolution of these matters will result in material

financial and other measures, the magnitude and impact of which

cannot be reliably estimated or ascertained at this time.

Write to Dominic Chopping at dominic.chopping@wsj.com

(END) Dow Jones Newswires

April 17, 2019 06:28 ET (10:28 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

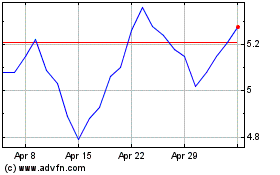

Ericsson (NASDAQ:ERIC)

Historical Stock Chart

From Mar 2024 to Apr 2024

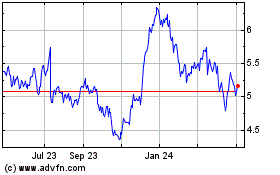

Ericsson (NASDAQ:ERIC)

Historical Stock Chart

From Apr 2023 to Apr 2024