Current Report Filing (8-k)

October 18 2021 - 5:03PM

Edgar (US Regulatory)

false

0001101239

true

true

0001101239

2021-10-15

2021-10-15

0001101239

us-gaap:CommonClassAMember

2021-10-15

2021-10-15

0001101239

eqix:ZeroPointTwoFiveZeroPercentSeniorNotesDueTwoThousandTwentySevenMember

2021-10-15

2021-10-15

0001101239

eqix:OnePointZeroZeroZeroPercentSeniorNotesDueTwoThousandThirtyThreeMember

2021-10-15

2021-10-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): October 15, 2021

EQUINIX, INC.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

Delaware

|

|

000-31293

|

|

77-0487526

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

One Lagoon Drive

Redwood City, CA 94065

(Address of Principal Executive Offices, and Zip Code)

(650) 598-6000

Registrant’s Telephone Number, Including Area Code

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

|

|

|

☐

|

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

☐

|

Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

☐

|

Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common stock,

par value $0.001 per share

|

|

EQIX

|

|

The Nasdaq Stock Market LLC

|

|

0.250% Senior Notes due 2027

|

|

|

|

The Nasdaq Stock Market LLC

|

|

1.000% Senior Notes due 2033

|

|

|

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure

On October 18, 2021, Equinix, Inc. ("Equinix") issued a press release that includes, among other matters, information related to the Joint Venture, as defined and described in Item 8.01 below and incorporated into this Item 7.01 by reference. A copy of the press release is furnished as Exhibit 99.1 and is incorporated into this Item 7.01 by reference.

The information in this Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section and shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act, except as otherwise stated in such filings.

Item 8.01. Other Events.

On October 15, 2021, Equinix entered into an agreement to form a joint venture with PGIM Real Estate, the real estate investment and financing arm of Prudential Financial’s global asset management business (the "Joint Venture") whereby, upon closing, the Joint Venture will develop and operate two xScale data centers in Sydney, Australia. Pursuant to the terms of the Joint Venture, upon closing, PGIM Real Estate will control an 80% equity interest in the joint venture, and Equinix will own the remaining 20% equity interest.

The Joint Venture plans to secure financing prior to closing to fund a portion of the consideration paid to Equinix for the establishment of the Joint Venture and the planned development of the sites, working capital needs and other general corporate purposes of the Joint Venture.

The closing of the Joint Venture is subject to conditions including (i) certain financing conditions, including the fulfilment by each of Equinix and PGIM Real Estate of their funding obligations and obtaining certain external financing arrangements; (ii) completion of pre-closing reorganization; and (iii) obtaining required regulatory approvals.

Cautionary Statement Regarding Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other securities laws, including statements regarding the proposed Joint Venture and the development of certain data centers. The forward-looking statements involve risks and uncertainties. Actual results may differ materially from expectations discussed in such forward-looking statements. Although Equinix believes that its forward-looking statements are based reasonable assumptions, expected results may not be achieved, and actual results may differ materially from its expectations. Factors that might cause such differences include, but are not limited to, risks related to Equinix's ability to complete the closing of the joint ventures on the proposed terms and schedule; risks related to Equinix or PGIM Real Estate being able to satisfy their respective closing conditions related to the joint ventures, including obtaining regulatory approval; any inability of Equinix, PGIM Real Estate or the joint ventures to obtain financing as needed; risks related to whether the data centers which will be developed and contributed to the joint ventures will be integrated successfully, and whether such development and integration may be more difficult, time-consuming or costly than expected; risks that the expected benefits of the joint ventures will not occur; the challenges of operating and managing data centers and developing, deploying and delivering Equinix services; the ability to generate sufficient cash flow or otherwise obtain funds to repay new or outstanding indebtedness; competition from existing and new competitors; the loss or decline in business from key hyperscale companies; disruption from the joint ventures making it more difficult to conduct business as usual or maintain relationships with customers, employees or suppliers; and other risks described from time to time in Equinix's filings with the Securities and Exchange Commission. In particular, see recent Equinix quarterly and annual reports filed with the Securities and Exchange Commission, copies of which are available upon request from Equinix. Equinix does not assume any obligation to update the forward-looking information contained in this press release.

Equinix’s forward-looking statements should not be relied upon except as statements of Equinix’s present intentions and of Equinix’s present expectations, which may or may not occur. Cautionary statements should be read as being applicable to all forward-looking statements wherever they appear. Except as required by law, Equinix undertakes no obligation to release publicly the result of any revision to these forward-looking statements that may be made to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. Readers are also urged to carefully review and consider the various disclosures Equinix has made in this Current Report on Form 8-K, as well as Equinix’s other filings with the Securities and Exchange Commission. Equinix does not assume any obligation to update the forward-looking information contained in this Current Report on Form 8-K.

Item 9.01. Financial Statements and Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

EQUINIX, INC.

|

|

|

|

|

|

|

|

|

|

DATE: October 18, 2021

|

By:

|

/s/ KEITH D. TAYLOR

|

|

|

|

Keith D. Taylor

|

|

|

|

Chief Financial Officer

|

|

|

|

|

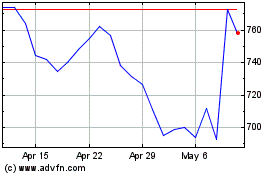

Equinix (NASDAQ:EQIX)

Historical Stock Chart

From Mar 2024 to Apr 2024

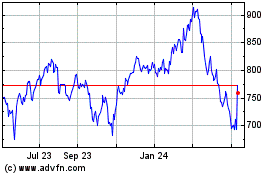

Equinix (NASDAQ:EQIX)

Historical Stock Chart

From Apr 2023 to Apr 2024