Pursuant

to this prospectus supplement, the accompanying prospectus supplement and the accompanying base prospectus, we are offering

3,967,939 shares of our common stock to YA II PN, Ltd., a Cayman Islands exempt limited partnership (“Yorkville”) at a

price of approximately $1.26 per share, pursuant to our previously announced Standby

Equity Purchase Agreement with Yorkville dated April 28, 2022 (the “SEPA”). The total purchase price and proceeds

we will receive from the sale of the shares is $5,000,000. These shares are being issued as part of the commitment by Yorkville to

purchase from time to time, at our option, up to $200,000,000 of shares of our common stock pursuant to the SEPA, as described in

Prospectus Supplement dated April 28, 2022. We expect to issue the shares to Yorkville on or about May 23, 2022.

In addition to our issuance of our

shares to Yorkville pursuant to the SEPA, this prospectus supplement, the accompanying prospectus supplement and the accompanying prospectus

also cover the resale of these shares by Yorkville to the public. Though we have been advised by Yorkville, and Yorkville represents in

the SEPA, that Yorkville is purchasing the shares for its own account, for investment purposes in which it takes investment risk (including,

without limitation, the risk of loss), and without any view or intention to distribute such shares in violation of the Securities

Act of 1933, as amended (the “Securities Act”) or any other applicable securities laws, the Securities and Exchange Commission

(the “SEC”) may take the position that Yorkville may be deemed an “underwriter” within the meaning of Section

2(a)(11) of the Securities Act and any profits on the sales of shares of our common stock by Yorkville and any discounts, commissions

or concessions received by Yorkville are deemed to be underwriting discounts and commissions under the Securities Act. For additional

information on the methods of sale that may be used by Yorkville, see the section entitled “Plan of Distribution” on page

S- 5 of the accompanying prospectus supplement.

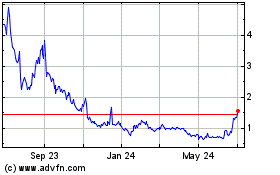

Our common stock trades on the Nasdaq Capital

Market (“Nasdaq”) under the symbols “EOSE.” On May 20, 2022, the last sale price of our common stock as reported

on Nasdaq was $1.12 per share.

The date of this prospectus supplement is May 23,

2022.

Offered by the Selling Securityholders Named

Herein

Eos Energy Enterprises, Inc. may from time to

time offer and sell common stock, preferred stock or senior debt securities. Specific terms of the preferred stock or senior debt

securities will be provided in supplements to this prospectus. In addition, this prospectus relates to the issuance by us of up to

7,001,751 shares of common stock that are issuable by us upon the exercise of public warrants (the “public warrants”)

assumed by us, which were previously registered in connection with the Business Combination (as defined below).

This prospectus also relates to the offer and

resale from time to time by the selling securityholders named in this prospectus of up to 39,145,143 shares of common stock, up to 325,000

warrants and up to $130,350,642 principal amount of 5%/6% Convertible Senior PIK Toggle Notes due 2026 (the “notes”), including

up to (i) 4,950,000 shares of common stock and 325,000 warrants to purchase shares of common stock originally issued in connection with

the initial public offering of B. Riley Principal Merger Corp. II, (ii) 325,000 shares of common stock issuable upon exercise of warrants

originally issued in connection with the initial public offering of B. Riley Principal Merger Corp. II, (iii) 27,175,613 shares of common

stock issued in connection with the consummation of our business combination with Eos Energy Storage LLC and the related private placement,

(iv) 80,294 shares of common stock issuable upon satisfaction of certain vesting terms set forth in previously issued restricted stock

units, (v) 97,877 shares of common stock that have been or may be issued to certain of the selling securityholders upon exercise of options

granted under the Eos Energy Enterprises, Inc. Amended and Restated 2012 Equity Incentive Plan, (vi) $102,900,000 principal amount of

notes originally issued to Spring Creek Capital, LLC (“Spring Creek”), a wholly-owned, indirect subsidiary of Koch Industries, Inc. pursuant

to the Indenture, dated April 7, 2022, between Eos Energy Enterprises, Inc. and Wilmington Trust, National Association, as trustee,

and the Investment Agreement dated July 6, 2021 with Spring Creek, (vii) a maximum of $27,450,642 principal amount of notes issuable

as future PIK interest payments on the notes and (viii) a maximum of 6,516,359 shares of common stock underlying the notes and issuable

upon conversion of the notes, which may be sold by Spring Creek from time to time.

We and the selling securityholders may sell the

securities covered by this prospectus in a number of different ways and at varying prices. The securities may be sold directly to you,

through agents, or through underwriters and dealers. If agents, underwriters or dealers are used to sell the securities, we will name

them and describe their compensation in a prospectus supplement.

We will receive proceeds from the issuance and

sale of our common stock, preferred stock or senior debt securities and from the exercise of public warrants. We will not receive any

of the proceeds from the sale of securities by the selling securityholders. We will pay certain expenses associated with the registration

of the securities covered by this prospectus, as described in the section titled “Plan of Distribution.”

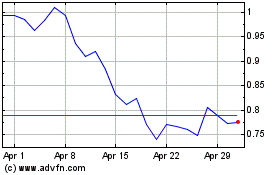

Our common stock and warrants to purchase common

stock are listed on the Nasdaq Capital Market (“Nasdaq”) under the symbols “EOSE” and “EOSEW,” respectively.

The closing price of our common stock on April 6, 2022 was $3.91 per share. The closing price of our

warrants on April 6, 2022 was $1.16 per warrant.

Investing in these securities involves

certain risks. You should review carefully the risks and uncertainties described under the heading “Risk Factors”

beginning on page 18 of our annual report on Form 10-K for the year ended December 31, 2021, which is incorporated herein by

reference, as amended or supplemented from time to time by any risk factors we include in subsequent annual or quarterly reports on

Form 10-K or 10-Q, respectively, and incorporated herein by reference.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved these securities, or determined if this prospectus is truthful or complete.

Any representation to the contrary is a criminal offense.

The date of this prospectus is April 25,

2022

Neither we nor the selling securityholders

have authorized anyone to provide you with information that differs from the information provided in this prospectus, as well as the information

incorporated by reference into this prospectus and any applicable prospectus supplement. Neither we nor the selling securityholders are

making an offer of these securities in any jurisdiction where the offer is not permitted. You should not assume that the information in

this prospectus, any applicable prospectus supplement or any documents incorporated by reference is accurate as of any date other than

the date of the applicable document. Since the respective dates of this prospectus and the documents incorporated by reference into this

prospectus, our business, financial condition, results of operations and prospects may have changed.

table

of contents

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement

that we filed with the SEC utilizing a “shelf” registration process. Under this shelf process, we may sell any combination

of the securities described in this prospectus in one or more offerings. This prospectus provides you with a general description of the

securities we may offer. Each time we sell securities, we will provide a prospectus supplement that will contain specific information

about the terms of that offering. The prospectus supplement may also add, update or change information contained in this prospectus. You

should read both this prospectus and any prospectus supplement together with additional information described under the heading “Where

You Can Find More Information.”

In this prospectus, unless the context otherwise

requires, the terms “Company,” “we,” “us,” “our,” and “Eos” refer to Eos Energy

Enterprises, Inc., a Delaware corporation. Prior to the consummation of the Business Combination (as defined below), the Company was known

as B. Riley Principal Merger Corp. II, or “BMRG”.

Where You Can Find

More Information

The SEC allows us to incorporate by reference

information in this document. This means that we can disclose important information to you by referring you to another document filed

separately with the SEC. The information incorporated by reference is considered to be part of this document, except for any information

that is superseded by information that is included directly in this document.

We are incorporating by reference the filings

listed below and any additional documents that we may file with the SEC pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange

Act on or after the date hereof and prior to the termination of any offering (other than documents or information deemed to have been

furnished and not filed in accordance with SEC rules):

| ● | our Annual Report on Form 10-K for the fiscal year ended

December 31, 2021, filed with the SEC on February 25, 2022 |

| ● | information specifically incorporated by reference in our

Annual Report on Form 10-K for the fiscal year ended December 31, 2021 from our Definitive

Proxy Statement on Schedule 14A filed with the SEC on March 31, 2022; |

| ● | our Current Report on Form 8-K filed with the SEC on February 14, 2022; and |

| ● | the description of our securities contained in our Registration Statement on Form 8-A (File No. 001-39291), filed with the SEC on

November 16, 2020, including any amendments or reports filed for the purpose of updating such description. |

Any statement contained in this prospectus, or

in a document incorporated or deemed to be incorporated by reference herein, shall be deemed to be modified or superseded to the extent

that a statement contained herein, or in any subsequently filed document that also is incorporated or deemed to be incorporated by reference

herein, modifies or supersedes such statement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded,

to constitute a part of this prospectus.

The SEC maintains a website at www.sec.gov, from

which you can inspect these documents and other information we have filed electronically with the SEC. You may also request copies of

these documents, at no cost to you, from our website (https://eosenergystorage.com),

or by writing or telephoning us at the following address:

Eos Energy Enterprises, Inc.

3920 Park Avenue

Edison, New Jersey 08820

Attn: General Counsel

(732) 225-8400

Exhibits to these documents will not be sent,

however, unless those exhibits have been specifically incorporated by reference into this prospectus.

Special Note Regarding

Forward-Looking Statements

This prospectus and the documents incorporated

by reference into this prospectus contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act

of 1995. The words “anticipate,” “believe,” “estimate,” “project,” “expect,” “intend,”

“plan,” “should,” and similar expressions, as they relate to us, are intended to identify forward-looking statements.

These statements appear in a number of places in this prospectus and the documents incorporated by reference herein, and include statements

regarding the intent, belief or current expectations of Eos Energy Enterprises, Inc. Forward-looking statements are based on our management’s

beliefs, as well as assumptions made by, and information currently available to, them. Because such statements are based on expectations

as to future financial and operating results and are not statements of fact, actual results may differ materially from those projected.

Factors which may cause actual results to differ materially from current expectations include, but are not limited to:

| ● | changes adversely affecting the business in which we are engaged; |

| ● | our ability to forecast trends accurately; our ability to generate cash, service indebtedness and incur additional indebtedness; |

| ● | our ability to raise financing in the future; |

| ● | our ability to develop efficient manufacturing processes to scale and to forecast related costs and efficiencies accurately; |

| ● | fluctuations in our revenue and operating results; |

| ● | competition from existing or new competitors; |

| ● | the failure to convert firm order backlog to revenue; |

| ● | risks associated with security breaches in our information technology systems; |

| ● | risks related to legal proceedings or claims; |

| ● | risks associated with evolving energy policies in the United States and other countries and the potential costs of regulatory compliance; |

| ● | risks associated with changes to U.S. trade environment; |

| ● | risks resulting from the impact of global pandemics, including the novel coronavirus, Covid-19; |

| ● | risks related to adverse changes in general economic conditions; |

| ● | other factors detailed under the section entitled “Risk Factors” herein; and |

| ● | other risks and uncertainties described in our Annual Report on Form 10-K for the year ended December 31, 2021 and our subsequent

filings with the SEC, that we incorporate by reference herein. |

Should one or more of these risks or uncertainties

materialize, they could cause our actual results to differ materially from the forward-looking statements. Forward-looking statements

speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and, except as

required by law, the Company assumes no obligation and does not intend to update or revise these forward-looking statements, whether as

a result of new information, future events, or otherwise.

Summary

This summary highlights selected information

and does not contain all of the information that is important to you. This summary is qualified in its entirety by the more detailed information

included in or incorporated by reference into this prospectus. Before making your investment decision with respect to our securities,

you should carefully read this entire prospectus, any applicable prospectus supplement and the documents referred to in “Where You

Can Find More Information.”

Overview

We design, manufacture, and deploy safe, scalable,

and sustainable, low total cost of ownership battery storage solutions for the electricity industry. Our flagship technology is the proprietary

Eos Znyth aqueous zinc battery, the core of the Eos DC energy storage system (the “Eos ZnythTM system”), with both

front-of-the-meter and behind-the-meter applications, particularly applications with three to twelve- hour use cases. The flexibility

of the ZnythTM battery allows the battery to support use cases such as frequency regulation’s one second response time. The

Eos ZnythTM system is the first non lithium-ion (“Li-ion”) stationary battery energy storage system (“BESS”)

that is competitive in price and performance with Li-ion and is more flexible, safe and sustainable. The ZnythTM battery is

fully recyclable, does not require any rare earth or conflict materials, is manufactured in the United States with a primarily domestic

supply chain, and is scalable to multi-GWh sites or can be sized for small commercial sites. Stationary BESS are used to store energy

for many purposes, including stabilizing and reducing congestion of the power grid, reducing peak energy usage, and time-shifting of renewable

energy sources. When coupled with renewable energy sources such as solar photovoltaic (“PV”) and wind generation, the Eos

ZnythTM system can store energy that the renewable source produces and discharge energy when the source is not producing energy,

thus reducing the intermittency and increasing the value and reliability of the renewable energy source. Additionally, storage is used

by commercial and industrial (“C&I”) customers to save energy costs by reducing their peak usage, thus reducing demand

charges and avoiding peak energy pricing from utilities. We believe that scalable energy storage serves as a central catalyst for modernizing

and creating a more reliable and resilient, efficient, sustainable, and affordable grid. The significant market demand for battery storage

is driven by independent power producers (“IPP”), renewable developers, utilities and C&I customers who are especially

eager for a reliable, sustainable, safe, low-cost and scalable battery storage solution to complement their other energy resources.

Eos Energy Storage LLC, our wholly-owned subsidiary,

was founded in 2008 under the name Grid Storage Technologies, initially focusing on developing the chemistry of its proprietary electrolyte-based

battery technology and improving mechanical design and system performance. Our products, which are developed and manufactured in the United

States, have the ability to play a pivotal role in the transition to a more sustainable, resilient and low carbon energy future. We have

transformed from an organization that focused primarily on research and development to one focused on commercialization of our energy

storage solution and, more recently, to scaling our manufacturing platform. We produced our first proof of concept with generation 1 of

the Eos ZnythTM system in 2015 (“Gen 1”) and began commercial shipments of our generation 2 Eos ZnythTM system

in 2018 (“Gen 2”). During 2020, we completed the development of our Generation 2.3 Eos ZnythTM systems (“Gen

2.3”) and shipped our first Gen 2.3 system in December 2020. As of December 31, 2021, we have delivered 22 Eos ZnythTM

systems comprised of over 9,300 ZnythTM batteries or approximately 28 megawatt hours (“MWh”). Each Gen 2.3 20 foot

battery container (“Eos Cube”) is comprised of 144 batteries, which are connected to, and monitored through, our proprietary

battery management system. Each system is individually designed with the appropriate number of Eos Cube to achieve the end user’s

desired energy needs. We also offer a larger battery systems in the form of our prefabricated building system (“Eos Hangar”)

which provides 40MWh of storage per Eos Hangar and an indoor racking solution (“Eos Stack”) that leverages the safe and modular

characteristics of the ZnythTM battery in providing indoor energy solutions for C&I buildings.

Corporate Information

BMRG was incorporated in Delaware in June 2019

as a blank check company under the name B. Riley Principal Merger Corp. II. On November 16, 2020 (the “Closing Date”), BMRG,

EES LLC, BMRG Merger Sub, LLC (“Merger Sub I”), BMRG Merger Sub II, LLC (“Merger Sub II”), New Eos Energy LLC

(“Newco”) and AltEnergy Storage VI, LLC consummated the transactions contemplated under the Merger Agreement entered into

on September 7, 2020 between the parties, following the approval at the special meeting of the stockholders of BMRG held on October 15,

2020. On the Closing Date, (1) Merger Sub I merged with and into Newco, with Newco continuing as the surviving company and a wholly-owned

subsidiary of the Company, and (2) Newco then merged with and into Merger Sub II, with Merger Sub II continuing as the surviving

company and a wholly-owned subsidiary of the Company (together, the “Business Combination”). In connection with the Business

Combination, the registrant changed its name from B. Riley Merger Corp. II to Eos Energy Enterprises, Inc., and Merger Sub II changed

its name from BMRG Merger Sub II, LLC to Eos Energy Enterprises Intermediate Holdings, LLC.

Additional Information

The mailing address of our principal executive office

is 3920 Park Avenue, Edison, NJ 08820, and our phone number is (732) 225-8400. Our corporate website address is www.eosenergystorage.com.

Information contained on or accessible through our website is not a part of this prospectus, and the inclusion of our website address

in this prospectus is an inactive textual reference only.

Risk Factors Summary

The following is a summary of the principal risks

that could adversely affect our business, operations and financial results.

Risk Related to Our Common Stock and Warrants

| ● | To the extent that any shares of common stock are issued upon exercise of any of the warrants, the number of shares eligible for resale

in the public market would increase. |

| ● | Provisions in our Charter may inhibit a takeover of us, which could limit the price investors might be willing to pay in the future

for our common stock and could entrench management. |

| ● | Future resales of common stock may cause the market price of our securities to drop significantly, even if our business is doing well. |

| ● | We may redeem the public warrants prior to their exercise at a time that is disadvantageous to such warrant holders, thereby making

your public warrants worthless. |

| ● | Our stock price may be volatile and may decline regardless of our operating performance. |

| ● | There can be no assurance that the warrants will be in the money at the time they become exercisable, and they may expire worthless. |

| ● | There can be no assurance that our common stock will be able to comply with the continued listing standards of Nasdaq. |

Risks Related to the Notes

| ● | The notes are effectively subordinated to our secured debt and any liabilities of our subsidiaries. |

| ● | The notes are our obligations only and our operations are conducted through, and substantially all of our consolidated assets are

held by, our subsidiaries. |

| ● | Servicing our debt requires a significant amount of cash, and we may not have sufficient cash flow from our business to pay our substantial

debt. |

| ● | The notes do not include any make-whole conversion feature and therefore will not adequately compensate you for any lost value of

your notes as a result of a fundamental change transaction or redemption. |

| ● | The notes may not pay any cash interest. |

| ● | Regulatory actions and other events may adversely affect the trading price and liquidity of the notes. |

| ● | Volatility in the market price and trading volume of our common stock could adversely impact the trading price of the notes. |

| ● | Despite our current debt levels, we may still incur substantially more debt or take other actions which would intensify the risks

discussed above. |

| ● | Redemption may adversely affect your return on the notes. |

| ● | We may not have the ability to raise the funds necessary to settle conversions of the notes or to repurchase the notes upon a fundamental

change, and our future debt may contain limitations on our ability to pay cash upon conversion or repurchase of the notes. |

| ● | The conversion feature of the notes may adversely affect our financial condition and operating results. |

| ● | Future sales of our common stock or equity-linked securities in the public market could lower the market price for our common stock

and adversely impact the trading price of the notes. |

| ● | Holders of notes will not be entitled to any rights with respect to our common stock, but they will be subject to all changes made

with respect to them to the extent our conversion obligation includes shares of our common stock. |

| ● | The governmental approval requirement with respect to conversions of the notes could result in your receiving less than the value

of our common stock into which the notes would otherwise be convertible, and could delay your receipt of any shares of our common stock

upon conversion. |

| ● | Upon conversion of the notes, you may receive less valuable consideration than expected because the value of our common stock may

decline after you exercise your conversion right but before we settle our conversion obligation. |

| ● | The notes are not protected by restrictive covenants. |

| ● | The conversion rate of the notes may not be adjusted for all dilutive events. |

| ● | Some significant restructuring transactions may not constitute a fundamental change, in which case we would not be obligated to offer

to repurchase the notes. |

| ● | We cannot assure you that an active trading market will develop for the notes. |

| ● | Any adverse rating of the notes may cause their trading price to fall. |

| ● | You may be subject to tax if we make or fail to make certain adjustments to the conversion rate of the notes even though you do not

receive a corresponding cash distribution. |

| ● | The notes will be issued with original issue discount for U.S. federal income tax purposes. |

| ● | Certain provisions in the notes and the indenture could delay or prevent an otherwise beneficial takeover or takeover attempt of us

and, therefore, the ability of holders to exercise their rights associated with a potential fundamental change. |

| ● | If the notes are issued in book-entry form, holders must rely on DTC’s procedures to receive communications relating to the

notes and exercise their rights and remedies. |

THE OFFERING

The summary below describes the principal terms of the securities.

Certain of the terms and conditions described below are subject to important limitations and exceptions. The “Description of Capital

Stock” and “Description of Notes” sections of this prospectus contains a more detailed description of the terms and

conditions of the securities. As used in this section, “we,” “our,” and “us” refer to Eos Energy Enterprises,

Inc. and not to its consolidated subsidiaries.

|

Common Stock and

Warrants

|

| Issuer |

|

Eos Energy Enterprises, Inc., a Delaware corporation. |

| |

|

|

| Shares of Common Stock Outstanding |

|

53,958,013 shares of common stock as of March 2, 2022. |

| |

|

|

| Shares of Common Stock Offered by the Company |

|

Up to 7,001,751 shares of our common stock issuable upon exercise of outstanding public warrants. |

| |

|

|

| Shares of Common Stock Offered by the Selling Securityholders |

|

Up to 39,145,143 shares of our common stock, consisting of (i) 4,950,000 shares of common stock originally issued in connection

with the initial public offering of B. Riley Principal Merger Corp. II, (ii) 325,000 shares of common stock issuable upon exercise of

warrants originally issued in connection with the initial public offering of B. Riley Principal Merger Corp. II, (iii) 27,175,613 shares

of common stock issued in connection with the consummation of our business combination with Eos Energy Storage LLC and the related private

placement, (iv) 80,294 shares of common stock issuable upon satisfaction of certain vesting terms set forth in previously issued restricted

stock units, (v) 97,877 shares of common stock that have been or may be issued to certain of the selling securityholders upon exercise

of options granted under the Eos Energy Enterprises, Inc. Amended and Restated 2012 Equity Incentive Plan, and (vi) a maximum of 6,516,359

shares of common stock issuable upon conversion of the notes. |

| |

|

|

| Warrants Offered by the Selling Securityholders |

|

Up to 325,000 warrants to purchase shares of common stock originally issued in connection with the initial public offering of B. Riley Principal Merger Corp. II. |

| |

|

|

| Redemption at Our Option |

|

The public warrants are redeemable in certain circumstances. See the section entitled “Description of Capital Stock—Warrants” for further discussion. |

| |

|

|

| Use of Proceeds |

|

The applicable selling securityholder will receive all of the proceeds from the sale under this prospectus of the shares of common stock and the warrants to purchase common stock. We will not receive any proceeds from these sales. |

| |

|

|

| Nasdaq Capital Market Symbol for Our Common Stock and Warrants |

|

Our common stock and warrants to purchase common stock are currently traded on Nasdaq under the symbols “EOSE” and

“EOSEW,” respectively. |

|

Resale of the Notes

by Spring Creek

|

| |

| Issuer |

|

Eos Energy Enterprises, Inc., a Delaware corporation. |

| |

|

|

| The Notes |

|

Up to $130,350,642 principal amount of 5%/6% Convertible Senior PIK Toggle Notes due 2026. |

| |

|

|

| Maturity |

|

June 30, 2026, unless earlier repurchased, redeemed or converted. |

| |

|

|

| Interest |

|

We may, at our option, elect to pay any or all interest on the notes with respect to any interest payment date (i) in cash (such

method referred as the “cash method”) or (ii) in the form of an increase to the principal amount of the outstanding notes

(such method referred to as the “capitalization method”) or in the form of additional notes in integral multiples of $1.00.

We refer to interest paid by the cash method as “cash interest” and to interest paid as set forth in the foregoing clause

(ii) as “PIK interest”. The principal amount of any note at any time, as increased to such time by any PIK interest, is referred

to herein as the “capitalized principal amount” of such note.

Interest will accrue from the date of issuance or from the

most recent date to which interest has been paid or duly provided for, and will be payable semiannually in arrears on June 30 and December

30 of each year.

|

| Interest Rate |

|

5.00% per year with respect to cash interest. 6.00% per year

with respect to PIK interest.

Unless the context otherwise requires, any reference to accrued

interest on, or in respect of, any note that has not been paid or capitalized shall be deemed to refer to the amount of such interest

that would have accrued as of the relevant time at the applicable cash interest rate as if we had elected the cash method in respect of

all of the relevant interest.

|

| Conversion Rights |

|

Holders may convert all or any portion of their notes, if the portion to be converted is $1,000 capitalized principal amount or any integral multiple of $1.00 in excess thereof, at their option at any time prior to the close of business on the business day immediately preceding the maturity date: |

| |

|

|

| |

|

The conversion rate for the notes is initially 49.9910 shares

of common stock per $1,000 capitalized principal amount of notes (equivalent to an initial conversion price of approximately $20.00 per

share of common stock), subject to adjustment as described in this prospectus.

Upon conversion, we will pay or deliver, as the case may

be, cash, shares of our common stock or a combination of cash and shares of our common stock, at our election. If we satisfy our conversion

obligation solely in cash or through payment and delivery, as the case may be, of a combination of cash and shares of our common stock,

the amount of cash and shares of common stock, if any, due upon conversion will be based on a daily conversion value (as described herein)

calculated on a proportionate basis for each trading day in a 40 trading day observation period (as described herein). See “Description

of Notes—Conversion Rights—Settlement upon Conversion.”

You will not receive any additional cash payment or additional shares representing accrued and unpaid interest that has not been

capitalized, if any, upon conversion of a note, except in limited circumstances. Instead, interest will be deemed to be paid by the cash,

shares of our common stock or a combination of cash and shares of our common stock paid or delivered, as the case may be, to you upon

conversion of a note. |

| Redemption at Our Option |

|

We may not redeem the notes prior to June 30, 2024. We may redeem for cash all or part of the notes, at our option, on or after June 30, 2024 if the last reported sale price of our common stock has been at least 130% of the conversion price then in effect for at least 20 trading days (whether or not consecutive) during any 30 consecutive trading day period ending on, and including, the trading day immediately preceding the date on which we provide notice of redemption at a redemption price equal to 100% of the capitalized principal amount of the notes to be redeemed, plus any accrued interest that has not been paid or capitalized to, but excluding, the redemption date. No “sinking fund” is provided for the notes, which means that we are not required to redeem or retire the notes periodically. See “Description of Notes—Optional Redemption.” |

| |

|

|

| Fundamental Change |

|

If we undergo a “fundamental change” (as defined in this prospectus under “Description of Notes—Fundamental Change Permits Holders to Require Us to Repurchase Notes”), subject to certain conditions, holders may require us to repurchase for cash all or part of their notes in principal amounts of $1,000 or an integral multiple of $1.00 in excess thereof. The fundamental change repurchase price will be equal to 100% of the capitalized principal amount of the notes to be repurchased, plus any accrued interest thereon that has not been paid or capitalized to, but excluding, the fundamental change repurchase date. See “Description of Notes—Fundamental Change Permits Holders to Require Us to Repurchase Notes.” |

| |

|

|

| Ranking |

|

The notes are our senior unsecured obligations and rank: |

| |

|

|

| |

|

|

● |

senior in right of payment to any of our indebtedness that is expressly subordinated in right of payment to the notes; |

| |

|

|

| |

|

|

● |

equal in right of payment to any of our unsecured indebtedness that is not so subordinated; |

| |

|

|

| |

|

|

● |

effectively junior in right of payment to any of our secured indebtedness to the extent of the value of the assets securing such indebtedness; and |

| |

|

|

| |

|

|

● |

structurally junior to all indebtedness and other liabilities (including trade payables) of our subsidiaries. |

| |

|

|

| |

|

As of December 31, 2021, our total consolidated indebtedness was $129.3 million, of which an aggregate of $102.9 million was senior indebtedness and an aggregate of $26.4 million was secured indebtedness. As of December 31, 2021, our subsidiaries had $52.9 million of indebtedness and other liabilities (including trade payables, but excluding intercompany obligations and liabilities of a type not required to be reflected on a balance sheet of such subsidiaries in accordance with GAAP) to which the notes would have been structurally subordinated. |

| |

|

|

| |

|

The indenture governing the notes will not limit the amount of debt that we or our subsidiaries may incur. |

| |

|

|

| Registration Rights |

|

We prepared this prospectus in connection with our obligations under an investment agreement that provides the applicable selling

securityholder with certain registration rights with respect to the resale of the notes originally issued in a transaction exemption

from the registration requirements of the Securities Act and the shares of common stock issuable upon conversion of the notes, if

any. Pursuant to such investment agreement, we will use our reasonable efforts to keep the shelf registration statement of which

this prospectus is a part effective until the earlier of (i) such time as all registrable securities have been sold in accordance

with the plan of distribution disclosed in this prospectus and (ii) such time as there otherwise ceases to be any registrable

securities.

As of the date of this prospectus, and until July 7, 2022, the applicable selling securityholder remains subject to certain transfer

restrictions with respect to the notes and any shares of common stock issued upon conversion of the notes. |

| Use of Proceeds |

|

The applicable selling securityholder will receive all of the proceeds from the sale under this prospectus of the notes and the shares of common stock issuable upon conversion of the notes, if any. We will not receive any proceeds from these sales. |

| |

|

|

| Form |

|

The notes will initially be issued in physical,

certificated form. However, subject to certain conditions, the notes may be issued in book-entry form and be represented by

permanent global certificates deposited with, or on behalf of, The Depository Trust Company (“DTC”) and registered in

the name of a nominee of DTC. Beneficial interests in any of such notes would be shown on, and transfers will be effected only

through, records maintained by DTC or its nominee and any such interest may not be exchanged for certificated securities, except in

limited circumstances. |

| |

|

|

Absence of a Public

Market for the Notes |

|

The notes will be issued to a single investor in

a transaction exempt from the registration requirements of the Securities Act. There is currently no established market for the

notes. Accordingly, we cannot assure you as to the development or liquidity of any market for the notes. We do not intend to apply

for a listing of the notes on any securities exchange or any automated dealer quotation system. |

| |

|

|

| U.S. Federal Income Tax Consequences |

|

For the U.S. federal income tax consequences of the holding, disposition and conversion of the notes, and the holding and disposition

of shares of our common stock, see “Certain U.S. Federal Income Tax Considerations.” |

| |

|

|

| Nasdaq Capital Market Symbol for Our Common Stock |

|

Our common stock is listed on The Nasdaq Capital Market under the symbol “EOSE.” |

| |

|

|

Trustee, Paying Agent

and Conversion Agent |

|

Wilmington Trust, National Association |

Risk Factors

An investment in any securities offered pursuant

to this prospectus involves risk and uncertainties. You should consider carefully the risk factors described in our most recent Annual

Report on Form 10-K filed with the SEC and any subsequent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports

on Form 8-K that we file with the SEC after the date of this prospectus, as well as the other information contained or incorporated by

reference in this prospectus, and any applicable prospectus supplement, in light of your particular investment objectives and financial

circumstances.

Risk Related to Our Common Stock and Warrants

To the extent that any shares of common stock are issued

upon exercise of any of the warrants, the number of shares eligible for resale in the public market would increase.

We have 7,326,751 outstanding warrants exercisable

to purchase 7,326,751 shares of common stock at an exercise price of $11.50 per share. To the extent that any shares of common stock are

issued upon exercise of any of the warrants to purchase shares of common stock, there will be an increase in the number of shares of common

stock eligible for resale in the public market. Sales of a substantial number of such shares in the public market could adversely affect

the market price of our common stock.

Provisions in our Charter and Delaware law may have the

effect of discouraging lawsuits against our directors and officers.

Our Charter requires, unless we consent in writing

to the selection of an alternative forum, that (i) any derivative action or proceeding brought on our behalf, (ii) any action asserting

a claim of breach of a fiduciary duty owed by any director, officer or other employee to us or our stockholders, (iii) any action asserting

a claim against us, our directors, officers or employees arising pursuant to any provision of the DGCL or our Charter or our bylaws, or

(iv) any action asserting a claim against us or our directors, officers or employees governed by the internal affairs doctrine may be

brought only in the Court of Chancery in the State of Delaware, except any claim (A) as to which the Court of Chancery of the State of

Delaware determines that there is an indispensable party not subject to the jurisdiction of the Court of Chancery (and the indispensable

party does not consent to the personal jurisdiction of the Court of Chancery within 10 days following such determination), (B) which is

vested in the exclusive jurisdiction of a court or forum other than the Court of Chancery, (C) for which the Court of Chancery does not

have subject matter jurisdiction, or (D) any action arising under the Securities Act, as to which the Court of Chancery and the federal

district court for the District of Delaware shall have concurrent jurisdiction. If an action is brought outside of Delaware, the stockholder

bringing the suit will be deemed to have consented to service of process on such stockholder’s counsel. Although we believe that

this provision benefits us by providing increased consistency in the application of Delaware law in the types of lawsuits to which it

applies, a court may determine that this provision is unenforceable, and to the extent it is enforceable, the provision may have the effect

of discouraging lawsuits against our directors and officers, although our stockholders will not be deemed to have waived our compliance

with federal securities laws and the rules and regulations thereunder.

Notwithstanding the foregoing, our Charter provides

that the exclusive forum provision will not apply to suits brought to enforce a duty or liability created by the Exchange Act or any other

claim for which the federal courts have exclusive jurisdiction. Section 27 of the Exchange Act creates exclusive federal jurisdiction

over all suits brought to enforce any duty or liability created by the Exchange Act or the rules and regulations thereunder. Although

we believe that this provision benefits us by providing increased consistency in the application of Delaware law in the types of lawsuits

to which it applies, the provision may have the effect of discouraging lawsuits against our directors and officers.

Provisions in our Charter may inhibit a takeover of us,

which could limit the price investors might be willing to pay in the future for our common stock and could entrench management.

Our Charter contains provisions that may hinder unsolicited

takeover proposals that stockholders may consider to be in their best interests. We are also subject to anti-takeover provisions under

Delaware law, which could delay or prevent a change of control. Together these provisions may make more difficult the removal of management

and may discourage transactions that otherwise could involve payment of a premium over prevailing market prices for our securities. These

provisions include:

| ● | no cumulative voting in the election of directors, which

limits the ability of minority stockholders to elect director candidates; |

| ● | a classified board of directors with three-year staggered

terms, which could delay the ability of stockholders to change the membership of a majority of the Board; |

| ● | the right of our Board to elect a director to fill a vacancy

created by the expansion of our Board or the resignation, death or removal of a director in certain circumstances, which prevents stockholders

from being able to fill vacancies on our Board; |

| ● | a prohibition on stockholder action by written consent, which

forces stockholder action to be taken at an annual or special meeting of our stockholders; |

| ● | advance notice procedures that stockholders must comply with

in order to nominate candidates to our Board or to propose matters to be acted upon at a meeting of stockholders, which may discourage

or deter a potential acquirer from conducting a solicitation of proxies to elect the acquirer’s own slate of directors or otherwise

attempting to obtain control of the Company; and |

| ● | the requirement that a meeting of stockholders may only be

called by members of our Board or the stockholders holding a majority of our shares, which may delay the ability of our stockholders

to force consideration of a proposal or to take action, including the removal of directors. |

Future resales of common stock may cause the market price

of our securities to drop significantly, even if our business is doing well.

The Sponsor’s founder shares, Private Placement

Units, Private Placement Shares, Private Placement Warrants, and any shares of common stock issued upon conversion or exercise thereof

were each subject to transfer restrictions pursuant to lock-up provisions in a letter agreement, dated May 19, 2020, between us and the

Sponsor. Likewise, the shareholders who have received common stock in connection with the business combination were contractually restricted

from selling or transferring any shares of our common stock they received pursuant to the lock-up provisions contained therein. However,

following the expiration of these lock-up periods on August 1, 2021, neither such shareholders nor the Sponsor are restricted from selling

their shares of our common stock, other than by applicable securities laws. Additionally, the investors are not restricted from selling

any of their shares of our common stock following the Closing, other than by applicable securities laws. A resale prospectus covering

43,744,680 shares and 325,000 warrants held by the shareholders and warrant holders and the Sponsor was declared effective by the SEC

on January 21, 2021, which may be utilized to sell such securities for so long as it remains effective. A resale prospectus covering 4,000,000

shares held by the PIPE investors was declared effective by the SEC on November 16, 2020, which may be utilized to sell such securities

for so long as it remains effective.

Sales of a substantial number of shares of our common

stock in the public market could occur at any time irrespective of the Company’s performance. These sales, or the perception in

the market that the holders of a large number of shares intend to sell shares, could reduce the market price of our common stock. Such

sales may occur based upon individual investor liquidity requirements or other factors outside of our control. The investors, who own

Sponsor’s founder shares, Private Placement Units, Private Placement Shares, or received common stock in connection with the business

combination, collectively owned approximately 62% of the outstanding shares of our common stock as of December 31, 2021.

As restrictions on resale end and registration statements

are available for use, the sale or possibility of sale of shares by the shareholders who received common stock in connection with the

business combination, and the investors, could have the effect of increasing the volatility in our share price or the market price of

our common stock could decline if the holders of currently restricted shares sell them or are perceived by the market as intending to

sell them.

We may redeem the Public Warrants prior to their exercise

at a time that is disadvantageous to such warrant holders, thereby making your Public Warrants worthless.

We will have the ability to redeem outstanding public

warrants at any time after they become exercisable and prior to their expiration, at a price of $0.01 per warrant, provided that the closing

price of our common stock equals or exceeds $18.00 per share (as adjusted for stock splits, share dividends, reorganizations, recapitalizations

and the like) for any twenty (20) trading days within a thirty (30) trading-day period ending on the third (3rd) trading day

prior to proper notice of such redemption. When the warrants become redeemable by us, we may exercise our redemption right even if we

are unable to register or qualify the underlying securities for sale under all applicable state securities laws. Redemption of the outstanding

warrants could force holders (i) to exercise the warrants and pay the exercise price therefor at a time when it may be disadvantageous

to do so, (ii) to sell the warrants at the then-current market price when the holder might otherwise wish to hold their warrants or (iii)

to accept the nominal redemption price which, at the time the outstanding warrants are called for redemption, is likely to be substantially

less than the market value of the warrants. The Private Placement warrants are not redeemable by us so long as they are held by the Sponsor

or its permitted transferees.

Our stock price may be volatile and may decline regardless

of our operating performance.

Fluctuations in the price of our securities could

contribute to the loss of part or all of your investment. The trading price of our securities could be volatile and subject to wide fluctuations

in response to various factors, some of which are beyond our control. Any of the factors listed below could have a material adverse effect

on your investment in our securities and our securities may trade at prices significantly below the price you paid for them. In such circumstances,

the trading price of our securities may not recover and may experience a further decline.

Factors affecting the trading price of our securities

may include:

| ● | actual or anticipated fluctuations in our quarterly financial

results or the quarterly financial results of companies perceived to be similar to us; |

| ● | changes in the market’s expectations about our operating

results; |

| ● | our operating results failing to meet the expectation of securities analysts or investors in a particular period; |

| ● | changes in financial estimates and recommendations by securities analysts concerning us or the industries in which we operate in general; |

| ● | operating and stock price performance of other companies that investors deem comparable to us; |

| ● | our ability to market new and enhanced products on a timely basis; |

| ● | changes in laws and regulations affecting our business; |

| ● | commencement of, or involvement in, litigation involving us; |

| ● | changes in our capital structure, such as future issuances of securities or the incurrence of additional debt; |

| ● | the volume of shares of our common stock available for public sale; |

| ● | any major change in our board of directors or management; |

| ● | sales of substantial amounts of our common stock by our directors, executive officers or significant stockholders or the perception

that such sales could occur; and |

| ● | general economic and political conditions such as recessions, interest rates, fuel prices, international currency fluctuations and

acts of war or terrorism. |

Broad market and industry factors may materially

harm the market price of our securities irrespective of our operating performance. The stock market in general, and Nasdaq, have experienced

price and volume fluctuations that have often been unrelated or disproportionate to the operating performance of the particular companies

affected. The trading prices and valuations of these stocks, and of our securities, may not be predictable. A loss of investor confidence

in the market for the stocks of other companies that investors perceive to be similar to us could depress our stock price regardless of

our business, prospects, financial conditions or results of operations. A decline in the market price of our securities also could adversely

affect our ability to issue additional securities and our ability to obtain additional financing in the future.

There can be no assurance that the Warrants will be in

the money at the time they become exercisable, and they may expire worthless.

The exercise price for the outstanding warrants is

$11.50 per share of common stock. There can be no assurance that the warrants will be in the money following the time they become exercisable

and prior to their expiration, and as such, the Warrants may expire worthless.

There can be no assurance that our common stock will be

able to comply with the continued listing standards of Nasdaq.

The shares of our common stock and warrants are listed

on Nasdaq. If Nasdaq delists the common stock from trading on its exchange for failure to meet the listing standards, we and our stockholders

could face significant material adverse consequences, including:

| ● | a limited availability of market quotations for our securities; |

| ● | a determination that our common stock is a “penny stock,” which will require brokers trading in our common stock to adhere

to more stringent rules, possibly resulting in a reduced level of trading activity in the secondary trading market for our common stock; |

| ● | a limited amount of analyst coverage; and |

| ● | a decreased ability to issue additional securities or obtain additional financing in the future. |

We do not intend to pay dividends on our common stock in

the foreseeable future and, consequently, your ability to achieve a return on your investment will depend on appreciation in the price

of our common stock.

We have never declared or paid cash dividends on our common stock.

We currently do not anticipate paying any cash dividends in the foreseeable future. Any future determination to declare cash dividends

will be made at the discretion of our board of directors, subject to applicable laws, and will depend on our financial condition, results

of operations, capital requirements, general business conditions and other factors that our board of directors may deem relevant.

Risks Related to the Notes

The notes will be effectively subordinated to our secured debt

and any liabilities of our subsidiaries.

The notes rank senior in right of payment to any of our indebtedness

that is expressly subordinated in right of payment to the notes; equal in right of payment to any of our liabilities that are not so subordinated;

effectively junior in right of payment to any of our secured indebtedness to the extent of the value of the assets securing such indebtedness;

and structurally junior to all indebtedness and other liabilities (including trade payables) of our subsidiaries. In the event of our

bankruptcy, liquidation, reorganization or other winding up, our assets that secure debt ranking senior or equal in right of payment to

the notes will be available to pay obligations on the notes only after the secured debt has been repaid in full from these assets. There

may not be sufficient assets remaining to pay amounts due on any or all of the notes then outstanding. The indenture governing the notes

will not prohibit us from incurring additional senior debt or secured debt, nor will it prohibit any of our subsidiaries from incurring

additional liabilities.

As of December 31, 2021, our total consolidated indebtedness was $129.3

million, of which an aggregate of $102.9 million was senior indebtedness and an aggregate of $26.4 million was secured indebtedness. As

of December 31, 2021, our subsidiaries had $52.9 million of indebtedness and other liabilities (including trade payables, but excluding

intercompany obligations and liabilities of a type not required to be reflected on a balance sheet of such subsidiaries in accordance

with GAAP) to which the notes would have been structurally subordinated.

The notes will be our obligations only and our operations are

conducted through, and substantially all of our consolidated assets are held by, our subsidiaries.

The notes will be our obligations exclusively and will not guaranteed

by any of our operating subsidiaries. A substantial portion of our consolidated assets is held by our subsidiaries. Accordingly, our ability

to service our debt, including the notes, depends on the results of operations of our subsidiaries and upon the ability of such subsidiaries

to provide us with cash, whether in the form of dividends, loans or otherwise, to pay amounts due on our obligations, including the notes.

Our subsidiaries are separate and distinct legal entities and have no obligation, contingent or otherwise, to make payments on the notes

or to make any funds available for that purpose. In addition, dividends, loans or other distributions to us from such subsidiaries may

be subject to contractual and other restrictions and are subject to other business considerations.

Servicing our debt requires a significant amount of cash, and

we may not have sufficient cash flow from our business to pay our substantial debt.

Our ability to make scheduled payments of the principal of, to pay

interest on or to refinance our indebtedness, including the notes, depends on our future performance, which is subject to economic, financial,

competitive and other factors beyond our control. Our business may not continue to generate cash flow from operations in the future sufficient

to service our debt and make necessary capital expenditures. If we are unable to generate such cash flow, we may be required to adopt

one or more alternatives, such as selling assets, restructuring debt or obtaining additional equity capital on terms that may be onerous

or highly dilutive. Our ability to refinance our indebtedness will depend on the capital markets and our financial condition at such time.

We may not be able to engage in any of these activities or engage in these activities on desirable terms, which could result in a default

on our debt obligations.

The notes will not include any make-whole conversion feature

and therefore will not adequately compensate you for any lost value of your notes as a result of a fundamental change transaction or redemption.

The notes will not include any feature that increases the conversion

rate for notes converted in connection with a fundamental change or notice of redemption or any other transaction or event. As a result,

if you convert your notes early as a result of a corporate event or our delivery of a notice of redemption, you will not receive any compensation

for any lost value of your notes as a result of such event or redemption, as the case may be.

The notes may not pay any cash interest.

We may, at our option, elect to pay any or all interest on the notes

with respect to any interest payment date (i) in cash (such method referred as the “cash method”) or (ii) in the form of an

increase to the principal amount of the outstanding notes (such method referred to as the “capitalization method”) or in the

form of additional notes in integral multiples of $1.00. As a result, you may not receive any ongoing cash payments in respect of your

investment in the notes. See “Description of Notes—Interest.”

Regulatory actions and other events may adversely affect the

trading price and liquidity of the notes.

We expect that many investors in, and potential purchasers of, the

notes will employ, or seek to employ, a convertible arbitrage strategy with respect to the notes. Investors would typically implement

such a strategy by selling short the common stock underlying the notes and dynamically adjusting their short position while continuing

to hold the notes. Investors may also implement this type of strategy by entering into swaps on our common stock in lieu of or in addition

to short selling the common stock. We cannot assure you that market conditions will permit investors to implement this type of strategy,

whether on favorable pricing and other terms or at all. If market conditions do not permit investors to implement this type of strategy,

whether on favorable pricing and other terms or at all, at any time while the notes are outstanding, the trading price and liquidity of

the notes may be adversely affected.

The SEC and other regulatory and self-regulatory authorities have implemented

various rules and taken certain actions, and may in the future adopt additional rules and take other actions, that may impact those engaging

in short selling activity involving equity securities (including our common stock). Such rules and actions include Rule 201 of SEC Regulation

SHO, the adoption by the Financial Industry Regulatory Authority, Inc. and the national securities exchanges of a “Limit Up-Limit

Down” program, the imposition of market-wide circuit breakers that halt trading of securities for certain periods following specific

market declines, and the implementation of certain regulatory reforms required by the Dodd-Frank Wall Street Reform and Consumer Protection

Act of 2010. Any governmental or regulatory action that restricts the ability of investors in, or potential purchasers of, the notes to

effect short sales of our common stock, borrow our common stock or enter into swaps on our common stock could adversely affect the trading

price and the liquidity of the notes.

In addition, the number of shares of our common stock available for

lending in connection with short sale transactions and the number of counterparties willing to enter into an equity swap on our common

stock with a note investor may not be sufficient for the implementation of a convertible arbitrage strategy. These and other market events

could make implementing a convertible arbitrage strategy prohibitively expensive or infeasible. We cannot assure you that a sufficient

number of shares of our common stock will be available to borrow on commercial terms, or at all, to potential purchasers or holders of

the notes. If potential purchasers of the notes that seek to employ a convertible arbitrage strategy are unable to do so on commercial

terms, or at all, then the trading price of, and the liquidity of the market for, the notes may significantly decline.

Volatility in the market price and trading volume of our common

stock could adversely impact the trading price of the notes.

The stock market in recent years has experienced significant price

and volume fluctuations that have often been unrelated to the operating performance of companies. The market price of our common stock

could fluctuate significantly for many reasons, including in response to the risks described in this section, elsewhere in this prospectus

or the documents we have incorporated by reference in this prospectus or for reasons unrelated to our operations, such as reports by industry

analysts, investor perceptions or negative announcements by our customers, competitors or suppliers regarding their own performance, as

well as industry conditions and general financial, economic and political instability. A decrease in the market price of our common stock

would likely adversely impact the trading price of the notes. The market price of our common stock could also be affected by possible

sales of our common stock by investors who view the notes as a more attractive means of equity participation in us and by hedging or arbitrage

trading activity that we expect to develop involving our common stock. This trading activity could, in turn, affect the trading price

of the notes.

Despite our current debt levels, we may still incur substantially

more debt or take other actions that would intensify the risks discussed above.

Despite our current consolidated debt levels, we and our subsidiaries

may be able to incur substantial additional debt in the future, subject to the restrictions contained in our future debt instruments,

some of which may be secured debt. We will not be restricted under the terms of the indenture governing the notes from incurring additional

debt, securing existing or future debt, recapitalizing our debt or taking a number of other actions that are not limited by the terms

of the indenture governing the notes that could have the effect of diminishing our ability to make payments on the notes when due.

Redemption may adversely affect your return on the notes.

We may not redeem the notes prior to June 30, 2024. We may redeem for

cash all or part of the notes, at our option, on or after June 30, 2024 if the last reported price of our common stock has been at least

130% of the conversion price then in effect for at least 20 trading days (whether or not consecutive) during any 30 consecutive trading

day period ending on, and including, the trading day immediately preceding the date on which we provide notice of redemption at a redemption

price equal to 100% of the capitalized principal amount of the notes to be redeemed, plus any accrued interest that has not been paid

or capitalized to, but excluding, the redemption date. As a result, we may choose to redeem some or all of the notes, including at times

when prevailing interest rates are relatively low. As a result, you may not be able to reinvest the proceeds you receive from the redemption

in a comparable security at an effective interest rate as high as the interest rate on your notes being redeemed. In addition, the foregoing

stock price condition only needs to be met for any 20 trading days in the 30 trading day period ending on, and including, the trading

day immediately preceding the date of the redemption notice. As a result, the price of our common stock may decrease dramatically, including

below the conversion price, between the 20th such trading day that the stock price condition is satisfied and the day we actually deliver

the redemption notice. See “Description of Notes—Optional Redemption.”

We may not have the ability to raise the funds necessary to settle

conversions of the notes or to repurchase the notes upon a fundamental change, and our future debt may contain limitations on our ability

to pay cash upon conversion or repurchase of the notes.

Holders of the notes will have the right to require us to repurchase

their notes upon the occurrence of a fundamental change at a fundamental change repurchase price equal to 100% of the capitalized principal

amount of the notes to be repurchased, plus any accrued interest that has not been paid or capitalized, as described under “Description

of Notes—Fundamental Change Permits Holders to Require Us to Repurchase Notes.” In addition, upon conversion of the notes,

unless we elect (or are deemed to have elected) to deliver solely shares of our common stock to settle such conversion (other than paying

cash in lieu of delivering any fractional share), we will be required to make cash payments in respect of the notes being converted as

described under “Description of Notes—Conversion Rights—Settlement upon Conversion.” However, we may not have

enough available cash or be able to obtain financing at the time we are required to make repurchases of notes surrendered therefor or

notes being converted. In addition, our ability to repurchase the notes or to pay cash upon conversions of the notes may be limited by

law, by regulatory authority or by agreements governing our future indebtedness. Our failure to repurchase notes at a time when the repurchase

is required by the indenture or to pay any cash payable on future conversions of the notes as required by the indenture would constitute

a default under the indenture. A default under the indenture or the fundamental change itself could also lead to a default under agreements

governing our future indebtedness. If the repayment of the related indebtedness were to be accelerated after any applicable notice or

grace periods, we may not have sufficient funds to repay the indebtedness and repurchase the notes or make cash payments upon conversions

thereof.

The conversion feature of the notes may adversely affect our

financial condition and operating results.

Holders of notes are entitled to convert the notes at any time at their

option. See “Description of Notes—Conversion Rights.” If one or more holders elect to convert their notes, unless we

elect (or are deemed to have elected) to satisfy our conversion obligation by delivering solely shares of our common stock (other than

paying cash in lieu of delivering any fractional share), we would be required to settle a portion or all of our conversion obligation

through the payment of cash, which could adversely affect our liquidity.

Future sales of our common stock or equity-linked securities

in the public market could lower the market price for our common stock and adversely impact the trading price of the notes.

In the future, we may sell additional shares of our common stock or

equity-linked securities to raise capital. In addition, a substantial number of shares of our common stock is reserved for issuance upon

the exercise of stock options, upon exercise of our outstanding warrants, and upon conversion of the notes. We cannot predict the size

of future issuances or the effect, if any, that they may have on the market price for our common stock. The issuance and sale of substantial

amounts of common stock or equity-linked securities, or the perception that such issuances and sales may occur, could adversely affect

the trading price of the notes and the market price of our common stock and impair our ability to raise capital through the sale of additional

equity or equity-linked securities.

Holders of notes will not be entitled to any rights with respect

to our common stock, but they will be subject to all changes made with respect to them to the extent our conversion obligation includes

shares of our common stock.

Holders of notes will not be entitled to any rights with respect to

our common stock (including, without limitation, voting rights and rights to receive any dividends or other distributions on our common

stock) prior to the conversion date relating to such notes (if we have elected to settle the relevant conversion by delivering solely

shares of our common stock (other than paying cash in lieu of delivering any fractional share)) or the last trading day of the relevant

observation period (if we elect to pay and deliver, as the case may be, a combination of cash and shares of our common stock in respect

of the relevant conversion) (and, in each case, assuming all relevant governmental approvals as described under “Description of

Notes—Conversion Rights—Governmental Approvals” have been obtained), but holders of notes will be subject to all changes

affecting our common stock. For example, if an amendment is proposed to our certificate of incorporation or bylaws requiring stockholder

approval and the record date for determining the stockholders of record entitled to vote on the amendment occurs prior to the conversion

date related to a holder’s conversion of its notes (if we have elected to settle the relevant conversion by delivering solely shares

of our common stock (other than paying cash in lieu of delivering any fractional share)) or the last trading day of the relevant observation

period (if we elect to pay and deliver, as the case may be, a combination of cash and shares of our common stock in respect of the relevant

conversion), such holder will not be entitled to vote on the amendment, although such holder will nevertheless be subject to any changes

affecting our common stock.

The governmental approval requirement with respect to conversions

of the notes could result in your receiving less than the value of our common stock into which the notes would otherwise be convertible,

and could delay your receipt of any shares of our common stock upon conversion.

To the extent that physical settlement or combination settlement in

respect of any conversion of notes would require us or any holder to obtain any regulatory approvals or consents from, or make any filing

with, any governmental entity, the right to convert the relevant notes and our obligation to deliver (or cause to be delivered) any related

shares of common stock upon such conversion will be contingent upon, and subject to, the receipt of any required governmental approval

(as determined by the holder or us, as applicable), and any such delivery will be delayed until such governmental approval is received.

If you attempt to convert your notes and such a governmental approval is required but not obtained in time, you will not be able to convert

your notes, and you may not be able to receive the shares of common stock into which the notes would otherwise be convertible. Receipt

of any such governmental approval could take a significant amount of time, delaying your ability to receive any shares of common stock

into which the notes would otherwise be convertible. The trading price of our common stock at the time of the ultimate delivery of such

shares (if any) may be less than, and possibly significantly less than, the trading price at the time of the attempted conversion. See

“Description of Notes—Conversion Rights—Governmental Approvals.”

Upon conversion of the notes, you may receive less valuable consideration

than expected because the value of our common stock may decline after you exercise your conversion right but before we settle our conversion

obligation.

Under the notes, a converting holder will be exposed to fluctuations

in the value of our common stock during the period from the date such holder surrenders notes for conversion until the date we settle

our conversion obligation.

Upon conversion of the notes, we have the option to pay or deliver,

as the case may be, cash, shares of our common stock, or a combination of cash and shares of our common stock. If we elect to satisfy

our conversion obligation in cash or a combination of cash and shares of our common stock, the amount of consideration that you will receive

upon conversion of your notes will be determined by reference to the volume-weighted average price of our common stock for each trading

day in a 40 trading day observation period. As described under “Description of Notes—Conversion Rights—Settlement upon

Conversion,” this period would be (i) subject to clause (ii), if the relevant conversion date occurs prior to the 45th scheduled

trading day immediately preceding the maturity date, the 40 consecutive trading day period beginning on, and including, the third trading

day immediately succeeding such conversion date; (ii) if the relevant conversion date occurs on or after the date of our issuance of a

notice of redemption with respect to the notes as described under “Description of Notes—Optional Redemption” and prior

to the relevant redemption date, the 40 consecutive trading days beginning on, and including, the 42nd scheduled trading day immediately

preceding such redemption date; and (iii) subject to clause (ii), if the relevant conversion date occurs on or after the 45th scheduled

trading day immediately preceding the maturity date, the 40 consecutive trading days beginning on, and including, the 42nd scheduled trading

day immediately preceding the maturity date. Accordingly, if the price of our common stock decreases during this period, the amount and/or

value of consideration you receive will be adversely affected. In addition, if the market price of our common stock at the end of such

period is below the average volume-weighted average price of our common stock during such period, the value of any shares of our common

stock that you will receive in satisfaction of our conversion obligation will be less than the value used to determine the number of shares

that you will receive.

If we elect to satisfy our conversion obligation solely in shares of

our common stock upon conversion of the notes, we will be required to deliver the shares of our common stock, together with cash for any

fractional share, on the third business day following the relevant conversion date. Accordingly, if the price of our common stock decreases