Nasdaq Temporary Relief Extends Energy Focus Listing Compliance Period

April 20 2020 - 8:30AM

Energy Focus, Inc. (NASDAQ: EFOI), a leader in sustainable LED

lighting technologies, today announced that it qualifies for

recently announced temporary relief from compliance with the Nasdaq

Stock Market (Nasdaq) $1.00 minimum bid price rule. As previously

disclosed, Nasdaq had advised the company that it had until May 11,

2020 to come into compliance with the Nasdaq $1.00 minimum bid

price rule. However, on April 16, 2020, Nasdaq announced

that, in response to the COVID-19 pandemic and related

extraordinary market conditions, it is providing temporary relief

through June 30, 2020 from, among other rules, the $1.00 minimum

bid price rule.

As a result, Energy Focus has until July 24, 2020 to come into

compliance with the $1.00 minimum bid price rule. Energy Focus is

evaluating its options to come into compliance, including, in the

discretion of its board of directors, effectuating a reverse stock

split of its common stock at a ratio of at least 1-for-2 and up to

1-for-20, which discretionary reverse stock split has been approved

by Energy Focus’ stockholders, provided it occurs no later than

June 17, 2020.

About Energy Focus

Energy Focus is an industry-leading innovator of

sustainable LED lighting technologies and solutions. As the creator

of the first flicker-free original LED products on the U.S.

market, Energy Focus products provide extensive energy

and maintenance savings, and aesthetics, safety, health and

sustainability benefits over conventional lighting. Our customers

include U.S. and foreign navies, U.S. federal,

state and local governments, healthcare and educational

institutions, as well as Fortune 500 companies. Since

2007, Energy Focus has installed approximately 650,000

lighting products across the US Navy fleet, including

TLEDs, waterline security lights, explosion-proof globes and berth

lights, saving more than four million gallons of fuel and 200,000

man-hours in lighting maintenance annually. Energy

Focus is headquartered in Solon, Ohio. For more

information, visit our website

at www.energyfocus.com.

Forward Looking Statements:

Forward-looking statements in this release are made pursuant to

the safe harbor provisions of the Private Securities Litigation

Reform Act of 1995. Generally, these statements can be identified

by the use of words such as “believes,” “estimates,” “anticipates,”

“expects,” “seeks,” “projects,” “intends,” “plans,” “may,” “will,”

“should,” “could,” “would” and similar expressions intended to

identify forward-looking statements, although not all

forward-looking statements contain these identifying words. These

forward-looking statements include all matters that are not

historical facts and include statements regarding our current

expectations and, among other things, statements regarding future

actions that may be taken by Nasdaq. By their nature,

forward-looking statements involve risks and uncertainties because

they relate to events and depend on circumstances that may or may

not occur in the future. Although we base these forward-looking

statements on assumptions that we believe are reasonable when made,

we caution you that forward-looking statements are not guarantees

of future performance and that actual results may differ materially

from statements made in or suggested by the forward-looking

statements contained in this release. We believe that important

factors that could cause our actual results to differ materially

from forward-looking statements include, but are not limited to,

changes in the policies of Nasdaq as a result of the COVID-19

pandemic or otherwise.

Media Contact:DGI

Comm212-825-3210EnergyFocus@Dgicomm.com

Investor Contact:Hayden IRCameron

Donahue646-536-7331ir@energyfocus.com

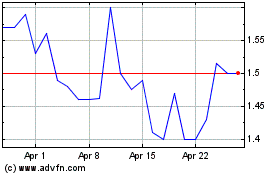

Energy Focus (NASDAQ:EFOI)

Historical Stock Chart

From Mar 2024 to Apr 2024

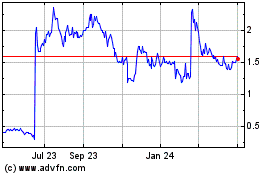

Energy Focus (NASDAQ:EFOI)

Historical Stock Chart

From Apr 2023 to Apr 2024