Amazon Looks to Raise $1 Billion via Its First Sustainability Bond -- Update

May 11 2021 - 12:51AM

Dow Jones News

By Dieter Holger

Amazon.com Inc. has issued its first sustainability bond, aiming

to raise $1 billion to support environmental and social projects as

investors clamor for more sustainability bonds to "green up" their

portfolios.

The Seattle-based e-commerce giant said Monday that the bond

proceeds will fund renewable energy, affordable housing, cutting

resources used by buildings and helping underrepresented groups

enter the technology workforce through training. Investors

oversubscribed to the sustainability bond, which matures in two

years and yields 0.257%, an Amazon spokesperson said.

Amazon aims for net-zero greenhouse-gas emissions across its

direct and indirect activities by 2040 and has rallied other big

companies to target the same year.

The bond doesn't have special terms but Amazon will use the net

proceeds as soon as possible for green or social projects, though a

breakdown of funding for each project is not yet available, a

spokesperson said. Down the road, companies often provide an update

on how funds from green or sustainable bonds were used.

Amazon ranks second among 18 publicly-traded e-commerce

companies for its management of environmental, social and

governance matters, including disclosures and programs, according

to The Wall Street Journal's ESG scores. EBay Inc. currently holds

the top spot in the e-commerce section of the rankings, which

update as more data becomes available.

Unlike green bonds that focus on climate change, sustainability

bonds are tied to both environmental and social efforts and have

gained in popularity in recent years. Investors who want to boost

the sustainability profile of their holdings tend to oversubscribe

to the bonds.

Late last month, home-appliance maker Whirlpool Corp. said it

completed its first $300 million sustainability bond, a 10-year

note with an interest coupon of 2.4%.

Loans that reward or punish companies with higher or lower

borrowing costs if they meet self-made environmental and social

targets continue to attract more corporate borrowers who want to

add teeth to their commitments. Beverage giant Anheuser-Busch InBev

SA signed a $10.1 billion sustainability-linked loan in

February.

The growing number of net-zero pledges from companies are

expected to boost the sustainable-debt market to record levels,

analysts say. The global market hit $2.2 trillion during the first

quarter and could surpass $3 trillion this year, according to the

Institute of International Finance.

In 2020, companies and governments issued a record $732.1

billion in sustainable debt including bonds and loans, a 29%

increase from 2019, according to BloombergNEF, a data provider.

Goldman Sachs Group Inc., Bank of America Corp., Wells Fargo

& Co., Morgan Stanley, HSBC Holdings PLC, JPMorgan Chase &

Co., Citigroup Inc., Societe Generale SA, Deutsche Bank AG and TD

Securities are acting as bookrunners for Amazon's sustainability

bond, the company's spokesperson said.

Write to Dieter Holger at dieter.holger@wsj.com

(END) Dow Jones Newswires

May 11, 2021 00:36 ET (04:36 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

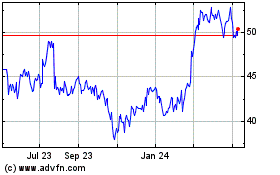

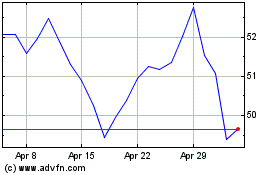

eBay (NASDAQ:EBAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

eBay (NASDAQ:EBAY)

Historical Stock Chart

From Apr 2023 to Apr 2024