0001396536

true

Amendment No. 1

S-1/A

0001396536

2022-01-01

2022-09-30

0001396536

2021-12-31

0001396536

2020-12-31

0001396536

duot:ConvertibleSeriesAPreferredStockMember

2021-12-31

0001396536

duot:ConvertibleSeriesAPreferredStockMember

2020-12-31

0001396536

duot:ConvertibleSeriesBPreferredStockMember

2021-12-31

0001396536

duot:ConvertibleSeriesBPreferredStockMember

2020-12-31

0001396536

duot:ConvertibleSeriesCPreferredStockMember

2021-12-31

0001396536

duot:ConvertibleSeriesCPreferredStockMember

2020-12-31

0001396536

2021-01-01

2021-12-31

0001396536

2020-01-01

2020-12-31

0001396536

us-gaap:ProductMember

2021-01-01

2021-12-31

0001396536

us-gaap:ProductMember

2020-01-01

2020-12-31

0001396536

us-gaap:ServiceOtherMember

2021-01-01

2021-12-31

0001396536

us-gaap:ServiceOtherMember

2020-01-01

2020-12-31

0001396536

duot:OverheadMember

2021-01-01

2021-12-31

0001396536

duot:OverheadMember

2020-01-01

2020-12-31

0001396536

duot:PreferredStockBMember

2020-12-31

0001396536

duot:PreferredStockCMember

2020-12-31

0001396536

us-gaap:CommonStockMember

2020-12-31

0001396536

us-gaap:AdditionalPaidInCapitalMember

2020-12-31

0001396536

us-gaap:RetainedEarningsMember

2020-12-31

0001396536

us-gaap:TreasuryStockMember

2020-12-31

0001396536

duot:PreferredStockBMember

2019-12-31

0001396536

duot:PreferredStockCMember

2019-12-31

0001396536

us-gaap:CommonStockMember

2019-12-31

0001396536

us-gaap:AdditionalPaidInCapitalMember

2019-12-31

0001396536

us-gaap:RetainedEarningsMember

2019-12-31

0001396536

us-gaap:TreasuryStockMember

2019-12-31

0001396536

2019-12-31

0001396536

duot:PreferredStockBMember

2021-01-01

2021-12-31

0001396536

duot:PreferredStockCMember

2021-01-01

2021-12-31

0001396536

us-gaap:CommonStockMember

2021-01-01

2021-12-31

0001396536

us-gaap:AdditionalPaidInCapitalMember

2021-01-01

2021-12-31

0001396536

us-gaap:RetainedEarningsMember

2021-01-01

2021-12-31

0001396536

us-gaap:TreasuryStockMember

2021-01-01

2021-12-31

0001396536

duot:PreferredStockBMember

2020-01-01

2020-12-31

0001396536

duot:PreferredStockCMember

2020-01-01

2020-12-31

0001396536

us-gaap:CommonStockMember

2020-01-01

2020-12-31

0001396536

us-gaap:AdditionalPaidInCapitalMember

2020-01-01

2020-12-31

0001396536

us-gaap:RetainedEarningsMember

2020-01-01

2020-12-31

0001396536

us-gaap:TreasuryStockMember

2020-01-01

2020-12-31

0001396536

duot:PreferredStockBMember

2021-12-31

0001396536

duot:PreferredStockCMember

2021-12-31

0001396536

us-gaap:CommonStockMember

2021-12-31

0001396536

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001396536

us-gaap:RetainedEarningsMember

2021-12-31

0001396536

us-gaap:TreasuryStockMember

2021-12-31

0001396536

2020-01-02

2020-01-31

0001396536

duot:Customer1Member

us-gaap:SalesRevenueNetMember

2021-01-01

2021-12-31

0001396536

duot:Customer1Member

us-gaap:SalesRevenueNetMember

2020-01-01

2020-12-31

0001396536

duot:Customer2Member

us-gaap:SalesRevenueNetMember

2020-01-01

2020-12-31

0001396536

duot:Customer1Member

us-gaap:AccountsReceivableMember

2021-01-01

2021-12-31

0001396536

duot:Customer2Member

us-gaap:AccountsReceivableMember

2021-01-01

2021-12-31

0001396536

duot:Customer1Member

us-gaap:AccountsReceivableMember

2020-01-01

2020-12-31

0001396536

duot:Customer2Member

us-gaap:AccountsReceivableMember

2020-01-01

2020-12-31

0001396536

country:US

2021-01-01

2021-12-31

0001396536

country:US

2020-01-01

2020-12-31

0001396536

us-gaap:AccountsPayableMember

duot:VendorOneMember

2021-01-01

2021-12-31

0001396536

us-gaap:AccountsPayableMember

duot:VendorOneMember

2020-01-01

2020-12-31

0001396536

duot:SupplierConcentrationRiskOneMember

2020-01-01

2020-12-31

0001396536

srt:MinimumMember

2021-01-01

2021-12-31

0001396536

srt:MaximumMember

2021-01-01

2021-12-31

0001396536

duot:PatentsAndTrademarksMember

2021-01-01

2021-12-31

0001396536

us-gaap:EmployeeStockOptionMember

2021-12-31

0001396536

duot:SeriesBConvertiblePreferredStockMember

2021-12-31

0001396536

duot:SeriesCConvertiblePreferredStockMember

2021-12-31

0001396536

srt:ScenarioPreviouslyReportedMember

us-gaap:ProductMember

2020-01-01

2020-12-31

0001396536

srt:RestatementAdjustmentMember

us-gaap:ProductMember

2020-01-01

2020-12-31

0001396536

us-gaap:TechnologyServiceMember

srt:ScenarioPreviouslyReportedMember

2020-01-01

2020-12-31

0001396536

srt:RestatementAdjustmentMember

us-gaap:TechnologyServiceMember

2020-01-01

2020-12-31

0001396536

srt:ScenarioPreviouslyReportedMember

us-gaap:ServiceOtherMember

2020-01-01

2020-12-31

0001396536

srt:ScenarioPreviouslyReportedMember

duot:AITechnologiesMember

2020-01-01

2020-12-31

0001396536

srt:ScenarioPreviouslyReportedMember

2020-01-01

2020-12-31

0001396536

srt:RestatementAdjustmentMember

2020-01-01

2020-12-31

0001396536

srt:RestatementAdjustmentMember

us-gaap:ServiceOtherMember

2020-01-01

2020-12-31

0001396536

srt:RestatementAdjustmentMember

duot:OverheadMember

2020-01-01

2020-12-31

0001396536

srt:ScenarioPreviouslyReportedMember

us-gaap:ProductMember

2021-07-01

2021-09-30

0001396536

srt:RestatementAdjustmentMember

us-gaap:ProductMember

2021-07-01

2021-09-30

0001396536

us-gaap:ServiceOtherMember

srt:ScenarioPreviouslyReportedMember

2021-07-01

2021-09-30

0001396536

srt:RestatementAdjustmentMember

us-gaap:ServiceOtherMember

2021-07-01

2021-09-30

0001396536

srt:ScenarioPreviouslyReportedMember

2021-07-01

2021-09-30

0001396536

srt:RestatementAdjustmentMember

2021-07-01

2021-09-30

0001396536

duot:OverheadMember

srt:ScenarioPreviouslyReportedMember

2021-07-01

2021-09-30

0001396536

srt:ScenarioPreviouslyReportedMember

us-gaap:ProductMember

2021-01-01

2021-09-30

0001396536

srt:RestatementAdjustmentMember

us-gaap:ProductMember

2021-01-01

2021-09-30

0001396536

us-gaap:ServiceOtherMember

srt:ScenarioPreviouslyReportedMember

2021-01-01

2021-09-30

0001396536

srt:RestatementAdjustmentMember

us-gaap:ServiceOtherMember

2021-01-01

2021-09-30

0001396536

srt:ScenarioPreviouslyReportedMember

2021-01-01

2021-09-30

0001396536

srt:RestatementAdjustmentMember

2021-01-01

2021-09-30

0001396536

duot:OverheadMember

srt:ScenarioPreviouslyReportedMember

2021-01-01

2021-09-30

0001396536

srt:NorthAmericaMember

duot:RailMember

2021-01-01

2021-12-31

0001396536

srt:NorthAmericaMember

duot:CommercialMember

2021-01-01

2021-12-31

0001396536

srt:NorthAmericaMember

duot:PetrochemicalMember

2021-01-01

2021-12-31

0001396536

srt:NorthAmericaMember

duot:GovernmentsMember

2021-01-01

2021-12-31

0001396536

srt:NorthAmericaMember

duot:BankingOtherMember

2021-01-01

2021-12-31

0001396536

srt:NorthAmericaMember

duot:ItSuppliersMember

2021-01-01

2021-12-31

0001396536

srt:NorthAmericaMember

duot:ArtificialIntelligenceMember

2021-01-01

2021-12-31

0001396536

srt:NorthAmericaMember

2021-01-01

2021-12-31

0001396536

duot:TurnkeyProjectsMember

duot:RailMember

2021-01-01

2021-12-31

0001396536

duot:TurnkeyProjectsMember

duot:CommercialMember

2021-01-01

2021-12-31

0001396536

duot:TurnkeyProjectsMember

duot:PetrochemicalMember

2021-01-01

2021-12-31

0001396536

duot:TurnkeyProjectsMember

duot:GovernmentsMember

2021-01-01

2021-12-31

0001396536

duot:TurnkeyProjectsMember

duot:BankingOtherMember

2021-01-01

2021-12-31

0001396536

duot:TurnkeyProjectsMember

duot:ItSuppliersMember

2021-01-01

2021-12-31

0001396536

duot:TurnkeyProjectsMember

duot:ArtificialIntelligenceMember

2021-01-01

2021-12-31

0001396536

duot:TurnkeyProjectsMember

2021-01-01

2021-12-31

0001396536

duot:MaintenanceAndSupportMember

duot:RailMember

2021-01-01

2021-12-31

0001396536

duot:MaintenanceAndSupportMember

duot:CommercialMember

2021-01-01

2021-12-31

0001396536

duot:MaintenanceAndSupportMember

duot:PetrochemicalMember

2021-01-01

2021-12-31

0001396536

duot:MaintenanceAndSupportMember

duot:GovernmentsMember

2021-01-01

2021-12-31

0001396536

duot:MaintenanceAndSupportMember

duot:BankingOtherMember

2021-01-01

2021-12-31

0001396536

duot:MaintenanceAndSupportMember

duot:ItSuppliersMember

2021-01-01

2021-12-31

0001396536

duot:MaintenanceAndSupportMember

duot:ArtificialIntelligenceMember

2021-01-01

2021-12-31

0001396536

duot:MaintenanceAndSupportMember

2021-01-01

2021-12-31

0001396536

duot:DataCenterAuditingServicesMember

duot:RailMember

2021-01-01

2021-12-31

0001396536

duot:DataCenterAuditingServicesMember

duot:CommercialMember

2021-01-01

2021-12-31

0001396536

duot:DataCenterAuditingServicesMember

duot:PetrochemicalMember

2021-01-01

2021-12-31

0001396536

duot:DataCenterAuditingServicesMember

duot:GovernmentsMember

2021-01-01

2021-12-31

0001396536

duot:DataCenterAuditingServicesMember

duot:BankingOtherMember

2021-01-01

2021-12-31

0001396536

duot:DataCenterAuditingServicesMember

duot:ItSuppliersMember

2021-01-01

2021-12-31

0001396536

duot:DataCenterAuditingServicesMember

duot:ArtificialIntelligenceMember

2021-01-01

2021-12-31

0001396536

duot:DataCenterAuditingServicesMember

2021-01-01

2021-12-31

0001396536

duot:SoftwareLicenseMember

duot:RailMember

2021-01-01

2021-12-31

0001396536

duot:SoftwareLicenseMember

duot:CommercialMember

2021-01-01

2021-12-31

0001396536

duot:SoftwareLicenseMember

duot:PetrochemicalMember

2021-01-01

2021-12-31

0001396536

duot:SoftwareLicenseMember

duot:GovernmentsMember

2021-01-01

2021-12-31

0001396536

duot:SoftwareLicenseMember

duot:BankingOtherMember

2021-01-01

2021-12-31

0001396536

duot:SoftwareLicenseMember

duot:ItSuppliersMember

2021-01-01

2021-12-31

0001396536

duot:SoftwareLicenseMember

duot:ArtificialIntelligenceMember

2021-01-01

2021-12-31

0001396536

duot:SoftwareLicenseMember

2021-01-01

2021-12-31

0001396536

duot:AlgorithmsMember

duot:RailMember

2021-01-01

2021-12-31

0001396536

duot:AlgorithmsMember

duot:CommercialMember

2021-01-01

2021-12-31

0001396536

duot:AlgorithmsMember

duot:PetrochemicalMember

2021-01-01

2021-12-31

0001396536

duot:AlgorithmsMember

duot:GovernmentsMember

2021-01-01

2021-12-31

0001396536

duot:AlgorithmsMember

duot:BankingOtherMember

2021-01-01

2021-12-31

0001396536

duot:AlgorithmsMember

duot:ItSuppliersMember

2021-01-01

2021-12-31

0001396536

duot:AlgorithmsMember

duot:ArtificialIntelligenceMember

2021-01-01

2021-12-31

0001396536

duot:AlgorithmsMember

2021-01-01

2021-12-31

0001396536

duot:RailMember

2021-01-01

2021-12-31

0001396536

duot:CommercialMember

2021-01-01

2021-12-31

0001396536

duot:PetrochemicalMember

2021-01-01

2021-12-31

0001396536

duot:GovernmentsMember

2021-01-01

2021-12-31

0001396536

duot:BankingOtherMember

2021-01-01

2021-12-31

0001396536

duot:ItSuppliersMember

2021-01-01

2021-12-31

0001396536

duot:ArtificialIntelligenceMember

2021-01-01

2021-12-31

0001396536

duot:GoodsTransferredOverTimeMember

duot:RailMember

2021-01-01

2021-12-31

0001396536

duot:GoodsTransferredOverTimeMember

duot:CommercialMember

2021-01-01

2021-12-31

0001396536

duot:GoodsTransferredOverTimeMember

duot:PetrochemicalMember

2021-01-01

2021-12-31

0001396536

duot:GoodsTransferredOverTimeMember

duot:GovernmentsMember

2021-01-01

2021-12-31

0001396536

duot:GoodsTransferredOverTimeMember

duot:BankingOtherMember

2021-01-01

2021-12-31

0001396536

duot:GoodsTransferredOverTimeMember

duot:ItSuppliersMember

2021-01-01

2021-12-31

0001396536

duot:GoodsTransferredOverTimeMember

duot:ArtificialIntelligenceMember

2021-01-01

2021-12-31

0001396536

duot:GoodsTransferredOverTimeMember

2021-01-01

2021-12-31

0001396536

duot:ServicesTransferredOverTimeMember

duot:RailMember

2021-01-01

2021-12-31

0001396536

duot:ServicesTransferredOverTimeMember

duot:CommercialMember

2021-01-01

2021-12-31

0001396536

duot:ServicesTransferredOverTimeMember

duot:PetrochemicalMember

2021-01-01

2021-12-31

0001396536

duot:ServicesTransferredOverTimeMember

duot:GovernmentsMember

2021-01-01

2021-12-31

0001396536

duot:ServicesTransferredOverTimeMember

duot:BankingOtherMember

2021-01-01

2021-12-31

0001396536

duot:ServicesTransferredOverTimeMember

duot:ItSuppliersMember

2021-01-01

2021-12-31

0001396536

duot:ServicesTransferredOverTimeMember

duot:ArtificialIntelligenceMember

2021-01-01

2021-12-31

0001396536

duot:ServicesTransferredOverTimeMember

2021-01-01

2021-12-31

0001396536

srt:NorthAmericaMember

duot:RailMember

2020-01-01

2020-12-31

0001396536

srt:NorthAmericaMember

duot:CommercialMember

2020-01-01

2020-12-31

0001396536

srt:NorthAmericaMember

duot:PetrochemicalMember

2020-01-01

2020-12-31

0001396536

srt:NorthAmericaMember

duot:GovernmentsMember

2020-01-01

2020-12-31

0001396536

srt:NorthAmericaMember

duot:BankingOtherMember

2020-01-01

2020-12-31

0001396536

srt:NorthAmericaMember

duot:ItSuppliersMember

2020-01-01

2020-12-31

0001396536

srt:NorthAmericaMember

duot:ArtificialIntelligenceMember

2020-01-01

2020-12-31

0001396536

srt:NorthAmericaMember

2020-01-01

2020-12-31

0001396536

duot:TurnkeyProjectsMember

duot:RailMember

2020-01-01

2020-12-31

0001396536

duot:TurnkeyProjectsMember

duot:CommercialMember

2020-01-01

2020-12-31

0001396536

duot:TurnkeyProjectsMember

duot:PetrochemicalMember

2020-01-01

2020-12-31

0001396536

duot:TurnkeyProjectsMember

duot:GovernmentsMember

2020-01-01

2020-12-31

0001396536

duot:TurnkeyProjectsMember

duot:BankingOtherMember

2020-01-01

2020-12-31

0001396536

duot:TurnkeyProjectsMember

duot:ItSuppliersMember

2020-01-01

2020-12-31

0001396536

duot:TurnkeyProjectsMember

duot:ArtificialIntelligenceMember

2020-01-01

2020-12-31

0001396536

duot:TurnkeyProjectsMember

2020-01-01

2020-12-31

0001396536

duot:MaintenanceAndSupportMember

duot:RailMember

2020-01-01

2020-12-31

0001396536

duot:MaintenanceAndSupportMember

duot:CommercialMember

2020-01-01

2020-12-31

0001396536

duot:MaintenanceAndSupportMember

duot:PetrochemicalMember

2020-01-01

2020-12-31

0001396536

duot:MaintenanceAndSupportMember

duot:GovernmentsMember

2020-01-01

2020-12-31

0001396536

duot:MaintenanceAndSupportMember

duot:BankingOtherMember

2020-01-01

2020-12-31

0001396536

duot:MaintenanceAndSupportMember

duot:ItSuppliersMember

2020-01-01

2020-12-31

0001396536

duot:MaintenanceAndSupportMember

duot:ArtificialIntelligenceMember

2020-01-01

2020-12-31

0001396536

duot:MaintenanceAndSupportMember

2020-01-01

2020-12-31

0001396536

duot:DataCenterAuditingServicesMember

duot:RailMember

2020-01-01

2020-12-31

0001396536

duot:DataCenterAuditingServicesMember

duot:CommercialMember

2020-01-01

2020-12-31

0001396536

duot:DataCenterAuditingServicesMember

duot:PetrochemicalMember

2020-01-01

2020-12-31

0001396536

duot:DataCenterAuditingServicesMember

duot:GovernmentsMember

2020-01-01

2020-12-31

0001396536

duot:DataCenterAuditingServicesMember

duot:BankingOtherMember

2020-01-01

2020-12-31

0001396536

duot:DataCenterAuditingServicesMember

duot:ItSuppliersMember

2020-01-01

2020-12-31

0001396536

duot:DataCenterAuditingServicesMember

duot:ArtificialIntelligenceMember

2020-01-01

2020-12-31

0001396536

duot:DataCenterAuditingServicesMember

2020-01-01

2020-12-31

0001396536

duot:SoftwareLicenseMember

duot:RailMember

2020-01-01

2020-12-31

0001396536

duot:SoftwareLicenseMember

duot:CommercialMember

2020-01-01

2020-12-31

0001396536

duot:SoftwareLicenseMember

duot:PetrochemicalMember

2020-01-01

2020-12-31

0001396536

duot:SoftwareLicenseMember

duot:GovernmentsMember

2020-01-01

2020-12-31

0001396536

duot:SoftwareLicenseMember

duot:BankingOtherMember

2020-01-01

2020-12-31

0001396536

duot:SoftwareLicenseMember

duot:ItSuppliersMember

2020-01-01

2020-12-31

0001396536

duot:SoftwareLicenseMember

duot:ArtificialIntelligenceMember

2020-01-01

2020-12-31

0001396536

duot:SoftwareLicenseMember

2020-01-01

2020-12-31

0001396536

duot:AlgorithmsMember

duot:RailMember

2020-01-01

2020-12-31

0001396536

duot:AlgorithmsMember

duot:CommercialMember

2020-01-01

2020-12-31

0001396536

duot:AlgorithmsMember

duot:PetrochemicalMember

2020-01-01

2020-12-31

0001396536

duot:AlgorithmsMember

duot:GovernmentsMember

2020-01-01

2020-12-31

0001396536

duot:AlgorithmsMember

duot:BankingOtherMember

2020-01-01

2020-12-31

0001396536

duot:AlgorithmsMember

duot:ItSuppliersMember

2020-01-01

2020-12-31

0001396536

duot:AlgorithmsMember

duot:ArtificialIntelligenceMember

2020-01-01

2020-12-31

0001396536

duot:AlgorithmsMember

2020-01-01

2020-12-31

0001396536

duot:RailMember

2020-01-01

2020-12-31

0001396536

duot:CommercialMember

2020-01-01

2020-12-31

0001396536

duot:PetrochemicalMember

2020-01-01

2020-12-31

0001396536

duot:GovernmentsMember

2020-01-01

2020-12-31

0001396536

duot:BankingOtherMember

2020-01-01

2020-12-31

0001396536

duot:ItSuppliersMember

2020-01-01

2020-12-31

0001396536

duot:ArtificialIntelligenceMember

2020-01-01

2020-12-31

0001396536

duot:GoodsTransferredOverTimeMember

duot:RailMember

2020-01-01

2020-12-31

0001396536

duot:GoodsTransferredOverTimeMember

duot:CommercialMember

2020-01-01

2020-12-31

0001396536

duot:GoodsTransferredOverTimeMember

duot:PetrochemicalMember

2020-01-01

2020-12-31

0001396536

duot:GoodsTransferredOverTimeMember

duot:GovernmentsMember

2020-01-01

2020-12-31

0001396536

duot:GoodsTransferredOverTimeMember

duot:BankingOtherMember

2020-01-01

2020-12-31

0001396536

duot:GoodsTransferredOverTimeMember

duot:ItSuppliersMember

2020-01-01

2020-12-31

0001396536

duot:GoodsTransferredOverTimeMember

duot:ArtificialIntelligenceMember

2020-01-01

2020-12-31

0001396536

duot:GoodsTransferredOverTimeMember

2020-01-01

2020-12-31

0001396536

duot:ServicesTransferredOverTimeMember

duot:RailMember

2020-01-01

2020-12-31

0001396536

duot:ServicesTransferredOverTimeMember

duot:CommercialMember

2020-01-01

2020-12-31

0001396536

duot:ServicesTransferredOverTimeMember

duot:PetrochemicalMember

2020-01-01

2020-12-31

0001396536

duot:ServicesTransferredOverTimeMember

duot:GovernmentsMember

2020-01-01

2020-12-31

0001396536

duot:ServicesTransferredOverTimeMember

duot:BankingOtherMember

2020-01-01

2020-12-31

0001396536

duot:ServicesTransferredOverTimeMember

duot:ItSuppliersMember

2020-01-01

2020-12-31

0001396536

duot:ServicesTransferredOverTimeMember

duot:ArtificialIntelligenceMember

2020-01-01

2020-12-31

0001396536

duot:ServicesTransferredOverTimeMember

2020-01-01

2020-12-31

0001396536

2022-09-30

0001396536

duot:SeriesDConvertiblePreferredStockMember

2022-01-01

2022-09-30

0001396536

2018-12-31

0001396536

duot:ThirdPartyInsuranceNoteOneMember

2021-12-31

0001396536

duot:ThirdPartyInsuranceNoteOneMember

2020-12-31

0001396536

duot:ThirdPartyInsuranceNoteTwoMember

2021-12-31

0001396536

duot:ThirdPartyInsuranceNoteTwoMember

2020-12-31

0001396536

duot:ThirdPartyInsuranceNoteThreeMember

2021-12-31

0001396536

duot:ThirdPartyInsuranceNoteThreeMember

2020-12-31

0001396536

duot:ThirdPartyInsuranceNoteFourMember

2021-12-31

0001396536

duot:ThirdPartyInsuranceNoteFourMember

2020-12-31

0001396536

duot:ThirdPartyInsuranceNoteOneMember

2022-09-30

0001396536

duot:ThirdPartyInsuranceNoteTwoMember

2022-09-30

0001396536

duot:ThirdPartyInsuranceNoteThreeMember

2022-09-30

0001396536

duot:ThirdPartyInsuranceNoteFourMember

2022-09-30

0001396536

duot:ThirdPartyInsuranceNoteOneMember

2020-12-23

0001396536

duot:ThirdPartyInsuranceNoteOneMember

2020-11-28

2020-12-23

0001396536

duot:ThirdPartyInsuranceNoteTwoMember

2020-12-23

0001396536

duot:ThirdPartyInsuranceNoteTwoMember

2020-11-28

2020-12-23

0001396536

duot:ThirdPartyInsuranceNoteTwoMember

2020-04-15

0001396536

duot:ThirdPartyInsuranceNoteTwoMember

2020-04-02

2020-04-15

0001396536

duot:ThirdPartyInsuranceNoteTwoMember

2021-04-15

0001396536

duot:ThirdPartyInsuranceNoteTwoMember

2021-04-02

2021-04-15

0001396536

duot:ThirdPartyInsuranceNoteThreeMember

2020-09-15

0001396536

duot:ThirdPartyInsuranceNoteThreeMember

2021-09-15

0001396536

duot:ThirdPartyInsuranceNoteFourMember

2021-09-01

2021-09-15

0001396536

duot:ThirdPartyInsuranceNoteFourMember

2020-02-03

0001396536

duot:ThirdPartyInsuranceNoteFourMember

2020-02-02

2020-02-03

0001396536

2021-02-03

0001396536

duot:ThirdPartyInsuranceNoteFourMember

2021-01-01

2021-12-31

0001396536

duot:EquipmentFinancingMember

2019-08-26

0001396536

duot:EquipmentFinancingMember

2019-08-01

2019-08-26

0001396536

duot:EquipmentFinancingMember

2020-05-22

0001396536

duot:EquipmentFinancingMember

2020-05-01

2020-05-22

0001396536

duot:EquipmentFinancingMember

2021-12-31

0001396536

duot:EquipmentFinancingMember

2020-12-31

0001396536

duot:PromissoryNoteMember

duot:PaycheckProtectionProgramMember

2020-04-23

0001396536

duot:PromissoryNoteMember

duot:PaycheckProtectionProgramMember

2020-04-01

2020-04-23

0001396536

duot:NotesPayableMember

2021-12-31

0001396536

duot:NotesPayableMember

2020-12-31

0001396536

duot:ThirdPartyInsuranceNoteOneMember

2021-12-23

0001396536

duot:ThirdPartyInsuranceNoteOneMember

2021-11-28

2021-12-23

0001396536

duot:ThirdPartyInsuranceNoteOneMember

2021-04-15

0001396536

duot:ThirdPartyInsuranceNoteTwoMember

2021-11-15

0001396536

duot:ThirdPartyInsuranceNoteTwoMember

2022-04-15

0001396536

duot:ThirdPartyInsuranceNoteTwoMember

2022-04-02

2022-04-15

0001396536

duot:ThirdPartyInsuranceNoteThreeMember

2021-09-01

2021-09-15

0001396536

duot:ThirdPartyInsuranceNoteThreeMember

2022-09-23

0001396536

duot:ThirdPartyInsuranceNoteThreeMember

2022-09-01

2022-09-23

0001396536

duot:ThirdPartyInsuranceNoteFourMember

2021-02-03

0001396536

duot:ThirdPartyInsuranceNoteFourMember

2021-04-01

2021-04-06

0001396536

2022-02-03

0001396536

2020-02-02

2020-02-03

0001396536

duot:EquipmentFinancingMember

2022-09-30

0001396536

duot:PPPLoanMember

duot:RelatedPartyOneMember

2021-12-31

0001396536

duot:PPPLoanMember

duot:RelatedPartyOneMember

2020-12-31

0001396536

duot:LineOfCreditWellsFargoBankMember

2015-04-02

0001396536

duot:LineOfCreditWellsFargoBankMember

2021-12-31

0001396536

duot:LineOfCreditWellsFargoBankMember

2020-12-31

0001396536

srt:MinimumMember

2019-03-30

2019-04-03

0001396536

srt:MaximumMember

2019-03-30

2019-04-03

0001396536

srt:MinimumMember

stpr:FL

2018-05-25

2018-06-01

0001396536

2021-07-02

2021-07-26

0001396536

2021-11-24

0001396536

2021-07-26

0001396536

srt:ChiefExecutiveOfficerMember

2018-04-01

2018-04-30

0001396536

srt:ChiefExecutiveOfficerMember

2020-07-10

0001396536

srt:ChiefExecutiveOfficerMember

2021-03-02

0001396536

srt:ChiefExecutiveOfficerMember

2021-12-31

0001396536

srt:ChiefExecutiveOfficerMember

2020-07-01

2020-07-10

0001396536

srt:ChiefExecutiveOfficerMember

2022-09-30

0001396536

2021-01-01

2021-09-30

0001396536

2021-09-30

0001396536

duot:TwoThousandsTwentyOneEquityIncentivePlanMember

2021-01-01

2021-12-31

0001396536

us-gaap:EmployeeStockOptionMember

2021-01-01

2021-12-31

0001396536

duot:SeriesBConvertiblePreferredStockMember

2021-01-01

2021-12-31

0001396536

duot:SeriesBConvertiblePreferredStockMember

us-gaap:EquityUnitPurchaseAgreementsMember

2017-11-24

0001396536

duot:SeriesBConvertiblePreferredStockMember

us-gaap:EquityUnitPurchaseAgreementsMember

2017-11-23

2017-11-24

0001396536

duot:PurchaseAgreementMember

2021-02-01

2021-02-26

0001396536

us-gaap:WarrantMember

2020-07-01

2020-09-30

0001396536

srt:BoardOfDirectorsChairmanMember

2020-01-01

2020-03-31

0001396536

srt:BoardOfDirectorsChairmanMember

2020-04-01

2020-06-30

0001396536

srt:BoardOfDirectorsChairmanMember

2020-07-01

2020-09-30

0001396536

srt:BoardOfDirectorsChairmanMember

2021-08-01

2021-08-05

0001396536

srt:BoardOfDirectorsChairmanMember

2021-07-01

2021-09-30

0001396536

srt:BoardOfDirectorsChairmanMember

2021-11-01

2021-11-05

0001396536

srt:BoardOfDirectorsChairmanMember

2021-01-01

2021-12-31

0001396536

duot:EmployeesAndDirectorsMember

2021-01-01

2021-12-31

0001396536

duot:EmployeesAndDirectorsMember

2020-01-01

2020-12-31

0001396536

us-gaap:SeriesBPreferredStockMember

2021-01-01

2021-12-31

0001396536

duot:SeriesBConvertiblePreferredStockMember

2021-01-01

2021-12-31

0001396536

us-gaap:SeriesCPreferredStockMember

2021-01-01

2021-12-31

0001396536

duot:SeriesCConvertiblePreferredStockMember

2021-01-01

2021-12-31

0001396536

duot:SeriesCConvertiblePreferredStockMember

2021-01-01

2021-12-31

0001396536

2017-12-31

0001396536

duot:ShareholdersOneMember

2018-01-01

2018-12-31

0001396536

duot:ShareholdersTwoMember

2018-01-01

2018-12-31

0001396536

duot:ShareholdersOneMember

2020-01-01

2020-12-31

0001396536

duot:ShareholdersTwoMember

2020-01-01

2020-12-31

0001396536

2022-01-02

2022-01-11

0001396536

duot:ConvertibleSeriesCPreferredStockMember

2022-01-02

2022-01-11

0001396536

2022-01-29

2022-02-03

0001396536

2022-02-01

2022-02-21

0001396536

2022-02-21

0001396536

srt:DirectorMember

2022-01-01

2022-03-31

0001396536

srt:DirectorMember

2022-04-01

2022-06-30

0001396536

2022-08-01

2022-08-25

0001396536

us-gaap:CommonStockMember

2022-07-01

2022-09-30

0001396536

2022-07-01

2022-09-30

0001396536

2022-09-01

2022-09-30

0001396536

duot:SeriesBConvertiblePreferredStockMember

2022-09-30

0001396536

duot:ConvertibleSeriesBPreferredStockMember

srt:DirectorMember

2022-09-30

0001396536

duot:SeriesBConvertiblePreferredStockMember

2022-01-01

2022-09-30

0001396536

us-gaap:CommonStockMember

2022-01-01

2022-09-30

0001396536

duot:ConvertibleSeriesBPreferredStockMember

2022-09-30

0001396536

duot:ConvertibleSeriesCPreferredStockMember

2022-01-01

2022-01-31

0001396536

duot:ConvertibleSeriesCPreferredStockMember

2022-09-30

0001396536

duot:PurchaseAgreementMember

2022-01-01

2022-09-30

0001396536

duot:EmployeesAndDirectorsMember

2022-01-01

2022-09-30

0001396536

duot:EmployeesAndDirectorsMember

2021-01-01

2021-09-30

0001396536

duot:Plan2021Member

2021-05-01

2021-05-12

0001396536

us-gaap:EmployeeStockOptionMember

2022-09-30

0001396536

duot:Plan2016Member

2022-09-30

0001396536

duot:Plan2016Member

2021-12-31

0001396536

duot:NonPlanMember

2022-09-30

0001396536

duot:NonPlanMember

2021-12-31

0001396536

duot:EmployeeStockOption1Member

2022-09-30

0001396536

us-gaap:WarrantMember

2022-09-30

0001396536

us-gaap:WarrantMember

2021-12-31

0001396536

srt:BoardOfDirectorsChairmanMember

2021-01-01

2021-03-31

0001396536

srt:BoardOfDirectorsChairmanMember

2021-03-31

0001396536

duot:OptionsMember

duot:FormerStaffMember

2021-04-01

2021-06-30

0001396536

us-gaap:EmployeeStockOptionMember

duot:KeyStaffMembersOfficersAndDirectorsMember

2020-04-01

2020-06-30

0001396536

us-gaap:EmployeeStockOptionMember

duot:KeyStaffMembersOfficersAndDirectorsMember

us-gaap:ShareBasedCompensationAwardTrancheOneMember

2020-04-01

2020-06-30

0001396536

duot:TransactionOneMember

us-gaap:EmployeeStockOptionMember

duot:KeyStaffMembersOfficersAndDirectorsMember

2020-04-01

2020-06-30

0001396536

duot:TransactionOneMember

us-gaap:EmployeeStockOptionMember

duot:KeyStaffMembersOfficersAndDirectorsMember

duot:VestedOn1January2021Member

2020-04-01

2020-06-30

0001396536

duot:TransactionOneMember

us-gaap:EmployeeStockOptionMember

duot:KeyStaffMembersOfficersAndDirectorsMember

duot:VestedOn1January2022Member

2020-04-01

2020-06-30

0001396536

us-gaap:EmployeeStockOptionMember

srt:ChiefExecutiveOfficerMember

2020-07-01

2020-09-30

0001396536

us-gaap:EmployeeStockOptionMember

srt:ChiefExecutiveOfficerMember

duot:VestOn1September2021Member

2020-07-01

2020-09-30

0001396536

us-gaap:EmployeeStockOptionMember

srt:ChiefExecutiveOfficerMember

duot:VestOn1September2022Member

2020-07-01

2020-09-30

0001396536

us-gaap:EmployeeStockOptionMember

duot:FormerChiefExecutiveOfficerMember

2020-07-01

2020-09-30

0001396536

us-gaap:EmployeeStockOptionMember

duot:TwoNewKeyEmployeesMember

2020-10-01

2020-12-31

0001396536

duot:SevenHolderMember

us-gaap:WarrantMember

2021-04-01

2021-06-30

0001396536

duot:SevenHolderMember

srt:MinimumMember

us-gaap:WarrantMember

2021-06-30

0001396536

duot:SevenHolderMember

srt:MaximumMember

us-gaap:WarrantMember

2021-06-30

0001396536

us-gaap:WarrantMember

2020-03-31

0001396536

us-gaap:WarrantMember

2020-06-30

0001396536

us-gaap:WarrantMember

2020-04-01

2020-06-30

0001396536

us-gaap:WarrantMember

2020-09-30

0001396536

us-gaap:WarrantMember

2020-10-01

2020-12-31

0001396536

us-gaap:EmployeeStockOptionMember

2019-12-31

0001396536

us-gaap:EmployeeStockOptionMember

2019-01-01

2019-12-31

0001396536

us-gaap:EmployeeStockOptionMember

2020-01-01

2020-12-31

0001396536

us-gaap:EmployeeStockOptionMember

2020-12-31

0001396536

us-gaap:EmployeeStockOptionMember

2021-01-01

2021-12-31

0001396536

us-gaap:EmployeeStockOptionMember

srt:MinimumMember

2020-01-01

2020-12-31

0001396536

us-gaap:EmployeeStockOptionMember

srt:MaximumMember

2020-01-01

2020-12-31

0001396536

us-gaap:WarrantMember

2019-12-31

0001396536

us-gaap:WarrantMember

2019-01-01

2019-12-31

0001396536

us-gaap:WarrantMember

2020-12-31

0001396536

us-gaap:WarrantMember

2020-01-01

2020-12-31

0001396536

us-gaap:WarrantMember

2021-01-01

2021-12-31

0001396536

us-gaap:WarrantMember

2021-12-31

0001396536

2019-01-01

2019-01-31

0001396536

2019-02-01

2019-02-28

0001396536

duot:ContractorsMember

2019-06-01

2019-06-30

0001396536

2019-06-01

2019-06-30

0001396536

2021-01-02

0001396536

duot:ContractorsMember

2019-09-01

2019-09-30

0001396536

duot:NonQualifiedStockOptionsMember

us-gaap:SubsequentEventMember

2021-12-28

2022-01-03

0001396536

us-gaap:SubsequentEventMember

2022-01-01

2022-01-11

0001396536

us-gaap:SubsequentEventMember

duot:SeriesCConvertiblePreferredStockMember

2022-01-01

2022-01-11

0001396536

us-gaap:SubsequentEventMember

duot:SeriesCConvertiblePreferredStockMember

2022-01-11

0001396536

us-gaap:SubsequentEventMember

us-gaap:CommonStockMember

2022-01-01

2022-01-11

0001396536

us-gaap:SubsequentEventMember

2022-02-01

2022-02-03

0001396536

us-gaap:SubsequentEventMember

2022-01-01

2022-02-21

0001396536

us-gaap:SubsequentEventMember

us-gaap:PrivatePlacementMember

2022-10-02

2022-10-29

0001396536

us-gaap:SubsequentEventMember

us-gaap:PrivatePlacementMember

2022-10-29

0001396536

us-gaap:SubsequentEventMember

us-gaap:SeriesDPreferredStockMember

2022-10-02

2022-10-29

0001396536

us-gaap:SubsequentEventMember

us-gaap:SeriesDPreferredStockMember

2022-10-29

0001396536

us-gaap:SubsequentEventMember

us-gaap:SeriesDPreferredStockMember

2022-10-01

2022-10-29

0001396536

duot:ConvertibleSeriesAPreferredStockMember

2022-09-30

0001396536

duot:ConvertibleSeriesDPreferredStockMember

2022-09-30

0001396536

duot:ConvertibleSeriesDPreferredStockMember

2021-12-31

0001396536

2021-07-01

2021-09-30

0001396536

us-gaap:ProductMember

2022-07-01

2022-09-30

0001396536

us-gaap:ProductMember

2021-07-01

2021-09-30

0001396536

us-gaap:ProductMember

2022-01-01

2022-09-30

0001396536

us-gaap:ProductMember

2021-01-01

2021-09-30

0001396536

us-gaap:ServiceOtherMember

2022-07-01

2022-09-30

0001396536

us-gaap:ServiceOtherMember

2021-07-01

2021-09-30

0001396536

us-gaap:ServiceOtherMember

2022-01-01

2022-09-30

0001396536

us-gaap:ServiceOtherMember

2021-01-01

2021-09-30

0001396536

duot:PreferredsStockBMember

2021-12-31

0001396536

duot:PreferredsStockCMember

2021-12-31

0001396536

duot:PreferredStockDMember

2021-12-31

0001396536

duot:AdditionalsPaidInCapitalMember

2021-12-31

0001396536

duot:PreferredsStockBMember

2022-03-31

0001396536

duot:PreferredsStockCMember

2022-03-31

0001396536

duot:PreferredStockDMember

2022-03-31

0001396536

us-gaap:CommonStockMember

2022-03-31

0001396536

duot:AdditionalsPaidInCapitalMember

2022-03-31

0001396536

us-gaap:RetainedEarningsMember

2022-03-31

0001396536

us-gaap:TreasuryStockMember

2022-03-31

0001396536

2022-03-31

0001396536

duot:PreferredsStockBMember

2022-06-30

0001396536

duot:PreferredsStockCMember

2022-06-30

0001396536

duot:PreferredStockDMember

2022-06-30

0001396536

us-gaap:CommonStockMember

2022-06-30

0001396536

duot:AdditionalsPaidInCapitalMember

2022-06-30

0001396536

us-gaap:RetainedEarningsMember

2022-06-30

0001396536

us-gaap:TreasuryStockMember

2022-06-30

0001396536

2022-06-30

0001396536

duot:PreferredsStockBMember

2020-12-31

0001396536

duot:PreferredsStockCMember

2020-12-31

0001396536

duot:PreferredStockDMember

2020-12-31

0001396536

duot:AdditionalsPaidInCapitalMember

2020-12-31

0001396536

duot:PreferredsStockBMember

2021-03-31

0001396536

duot:PreferredsStockCMember

2021-03-31

0001396536

duot:PreferredStockDMember

2021-03-31

0001396536

us-gaap:CommonStockMember

2021-03-31

0001396536

duot:AdditionalsPaidInCapitalMember

2021-03-31

0001396536

us-gaap:RetainedEarningsMember

2021-03-31

0001396536

us-gaap:TreasuryStockMember

2021-03-31

0001396536

2021-03-31

0001396536

duot:PreferredsStockBMember

2021-06-30

0001396536

duot:PreferredsStockCMember

2021-06-30

0001396536

duot:PreferredStockDMember

2021-06-30

0001396536

us-gaap:CommonStockMember

2021-06-30

0001396536

duot:AdditionalsPaidInCapitalMember

2021-06-30

0001396536

us-gaap:RetainedEarningsMember

2021-06-30

0001396536

us-gaap:TreasuryStockMember

2021-06-30

0001396536

2021-06-30

0001396536

duot:PreferredsStockBMember

2022-01-01

2022-03-31

0001396536

duot:PreferredsStockCMember

2022-01-01

2022-03-31

0001396536

duot:PreferredStockDMember

2022-01-01

2022-03-31

0001396536

us-gaap:CommonStockMember

2022-01-01

2022-03-31

0001396536

duot:AdditionalsPaidInCapitalMember

2022-01-01

2022-03-31

0001396536

us-gaap:RetainedEarningsMember

2022-01-01

2022-03-31

0001396536

us-gaap:TreasuryStockMember

2022-01-01

2022-03-31

0001396536

2022-01-01

2022-03-31

0001396536

duot:PreferredsStockBMember

2022-04-01

2022-06-30

0001396536

duot:PreferredsStockCMember

2022-04-01

2022-06-30

0001396536

duot:PreferredStockDMember

2022-04-01

2022-06-30

0001396536

us-gaap:CommonStockMember

2022-04-01

2022-06-30

0001396536

duot:AdditionalsPaidInCapitalMember

2022-04-01

2022-06-30

0001396536

us-gaap:RetainedEarningsMember

2022-04-01

2022-06-30

0001396536

us-gaap:TreasuryStockMember

2022-04-01

2022-06-30

0001396536

2022-04-01

2022-06-30

0001396536

duot:PreferredsStockBMember

2022-07-01

2022-09-30

0001396536

duot:PreferredsStockCMember

2022-07-01

2022-09-30

0001396536

duot:PreferredStockDMember

2022-07-01

2022-09-30

0001396536

duot:AdditionalsPaidInCapitalMember

2022-07-01

2022-09-30

0001396536

us-gaap:RetainedEarningsMember

2022-07-01

2022-09-30

0001396536

us-gaap:TreasuryStockMember

2022-07-01

2022-09-30

0001396536

duot:PreferredsStockBMember

2021-01-01

2021-03-31

0001396536

duot:PreferredsStockCMember

2021-01-01

2021-03-31

0001396536

duot:PreferredStockDMember

2021-01-01

2021-03-31

0001396536

us-gaap:CommonStockMember

2021-01-01

2021-03-31

0001396536

duot:AdditionalsPaidInCapitalMember

2021-01-01

2021-03-31

0001396536

us-gaap:RetainedEarningsMember

2021-01-01

2021-03-31

0001396536

us-gaap:TreasuryStockMember

2021-01-01

2021-03-31

0001396536

2021-01-01

2021-03-31

0001396536

duot:PreferredsStockBMember

2021-04-01

2021-06-30

0001396536

duot:PreferredsStockCMember

2021-04-01

2021-06-30

0001396536

duot:PreferredStockDMember

2021-04-01

2021-06-30

0001396536

us-gaap:CommonStockMember

2021-04-01

2021-06-30

0001396536

duot:AdditionalsPaidInCapitalMember

2021-04-01

2021-06-30

0001396536

us-gaap:RetainedEarningsMember

2021-04-01

2021-06-30

0001396536

us-gaap:TreasuryStockMember

2021-04-01

2021-06-30

0001396536

2021-04-01

2021-06-30

0001396536

duot:PreferredsStockBMember

2021-07-01

2021-09-30

0001396536

duot:PreferredsStockCMember

2021-07-01

2021-09-30

0001396536

duot:PreferredStockDMember

2021-07-01

2021-09-30

0001396536

us-gaap:CommonStockMember

2021-07-01

2021-09-30

0001396536

duot:AdditionalsPaidInCapitalMember

2021-07-01

2021-09-30

0001396536

us-gaap:RetainedEarningsMember

2021-07-01

2021-09-30

0001396536

us-gaap:TreasuryStockMember

2021-07-01

2021-09-30

0001396536

duot:PreferredsStockBMember

2022-09-30

0001396536

duot:PreferredsStockCMember

2022-09-30

0001396536

duot:PreferredStockDMember

2022-09-30

0001396536

us-gaap:CommonStockMember

2022-09-30

0001396536

duot:AdditionalsPaidInCapitalMember

2022-09-30

0001396536

us-gaap:RetainedEarningsMember

2022-09-30

0001396536

us-gaap:TreasuryStockMember

2022-09-30

0001396536

duot:PreferredsStockBMember

2021-09-30

0001396536

duot:PreferredsStockCMember

2021-09-30

0001396536

duot:PreferredStockDMember

2021-09-30

0001396536

us-gaap:CommonStockMember

2021-09-30

0001396536

duot:AdditionalsPaidInCapitalMember

2021-09-30

0001396536

us-gaap:RetainedEarningsMember

2021-09-30

0001396536

us-gaap:TreasuryStockMember

2021-09-30

0001396536

duot:SeriesBPreferredConvertibleStockMember

2021-01-01

2021-12-31

0001396536

duot:SeriesCPreferredConvertibleStockMember

2021-01-01

2021-12-31

0001396536

duot:Customer3Member

us-gaap:SalesRevenueNetMember

2022-01-01

2022-09-30

0001396536

duot:Customer4Member

us-gaap:SalesRevenueNetMember

2022-01-01

2022-09-30

0001396536

duot:Customer1Member

us-gaap:SalesRevenueNetMember

2022-01-01

2022-09-30

0001396536

duot:Customer2Member

us-gaap:SalesRevenueNetMember

2022-01-01

2022-09-30

0001396536

duot:Customer2Member

us-gaap:SalesRevenueNetMember

2021-01-01

2021-09-30

0001396536

us-gaap:AccountsReceivableMember

duot:Customer1Member

2022-01-01

2022-09-30

0001396536

us-gaap:AccountsReceivableMember

duot:Customer2Member

2022-01-01

2022-09-30

0001396536

country:US

duot:Customer4Member

2022-01-01

2022-09-30

0001396536

country:US

duot:Customer3Member

2021-01-01

2021-09-30

0001396536

us-gaap:AccountsPayableMember

duot:VendorOneMember

2022-01-01

2022-09-30

0001396536

us-gaap:AccountsPayableMember

duot:VendorTwoMember

2022-01-01

2022-09-30

0001396536

us-gaap:AccountsPayableMember

2022-01-01

2022-09-30

0001396536

us-gaap:AccountsPayableMember

duot:SuppliersOneMember

2021-01-01

2021-09-30

0001396536

duot:SeriesDConvertiblePreferredStockMember

2022-09-30

0001396536

us-gaap:EmployeeStockOptionMember

2021-09-30

0001396536

duot:SeriesBConvertiblePreferredStockMember

2021-09-30

0001396536

duot:SeriesCConvertiblePreferredStockMember

2021-09-30

0001396536

srt:NorthAmericaMember

duot:RailMember

2022-07-01

2022-09-30

0001396536

srt:NorthAmericaMember

duot:CommercialMember

2022-07-01

2022-09-30

0001396536

srt:NorthAmericaMember

duot:GovernmentsMember

2022-07-01

2022-09-30

0001396536

srt:NorthAmericaMember

duot:AIMember

2022-07-01

2022-09-30

0001396536

srt:NorthAmericaMember

2022-07-01

2022-09-30

0001396536

duot:TurnkeyProjectsMember

duot:RailMember

2022-07-01

2022-09-30

0001396536

duot:TurnkeyProjectsMember

duot:CommercialMember

2022-07-01

2022-09-30

0001396536

duot:TurnkeyProjectsMember

duot:GovernmentsMember

2022-07-01

2022-09-30

0001396536

duot:TurnkeyProjectsMember

duot:AIMember

2022-07-01

2022-09-30

0001396536

duot:TurnkeyProjectsMember

2022-07-01

2022-09-30

0001396536

duot:MaintenanceAndSupportMember

duot:RailMember

2022-07-01

2022-09-30

0001396536

duot:MaintenanceAndSupportMember

duot:CommercialMember

2022-07-01

2022-09-30

0001396536

duot:MaintenanceAndSupportMember

duot:GovernmentsMember

2022-07-01

2022-09-30

0001396536

duot:MaintenanceAndSupportMember

duot:AIMember

2022-07-01

2022-09-30

0001396536

duot:MaintenanceAndSupportMember

2022-07-01

2022-09-30

0001396536

duot:AlgorithmsMember

duot:RailMember

2022-07-01

2022-09-30

0001396536

duot:AlgorithmsMember

duot:CommercialMember

2022-07-01

2022-09-30

0001396536

duot:AlgorithmsMember

duot:GovernmentsMember

2022-07-01

2022-09-30

0001396536

duot:AlgorithmsMember

duot:AIMember

2022-07-01

2022-09-30

0001396536

duot:AlgorithmsMember

2022-07-01

2022-09-30

0001396536

duot:GoodsTransferredOverTimeMember

duot:RailMember

2022-07-01

2022-09-30

0001396536

duot:GoodsTransferredOverTimeMember

duot:CommercialMember

2022-07-01

2022-09-30

0001396536

duot:GoodsTransferredOverTimeMember

duot:GovernmentsMember

2022-07-01

2022-09-30

0001396536

duot:GoodsTransferredOverTimeMember

duot:AIMember

2022-07-01

2022-09-30

0001396536

duot:GoodsTransferredOverTimeMember

2022-07-01

2022-09-30

0001396536

duot:GoodsDeliveredAtPointInTimeMember

duot:RailMember

2022-07-01

2022-09-30

0001396536

duot:GoodsDeliveredAtPointInTimeMember

duot:CommercialMember

2022-07-01

2022-09-30

0001396536

duot:GoodsDeliveredAtPointInTimeMember

duot:GovernmentsMember

2022-07-01

2022-09-30

0001396536

duot:GoodsDeliveredAtPointInTimeMember

duot:AIMember

2022-07-01

2022-09-30

0001396536

duot:GoodsDeliveredAtPointInTimeMember

2022-07-01

2022-09-30

0001396536

duot:ServicesTransferredOverTimeMember

duot:RailMember

2022-07-01

2022-09-30

0001396536

duot:ServicesTransferredOverTimeMember

duot:CommercialMember

2022-07-01

2022-09-30

0001396536

duot:ServicesTransferredOverTimeMember

duot:GovernmentsMember

2022-07-01

2022-09-30

0001396536

duot:ServicesTransferredOverTimeMember

duot:AIMember

2022-07-01

2022-09-30

0001396536

duot:ServicesTransferredOverTimeMember

2022-07-01

2022-09-30

0001396536

duot:ServicesDeliveredAtPointInTimeMember

duot:RailMember

2022-07-01

2022-09-30

0001396536

duot:ServicesDeliveredAtPointInTimeMember

duot:CommercialMember

2022-07-01

2022-09-30

0001396536

duot:ServicesDeliveredAtPointInTimeMember

duot:GovernmentsMember

2022-07-01

2022-09-30

0001396536

duot:ServicesDeliveredAtPointInTimeMember

duot:AIMember

2022-07-01

2022-09-30

0001396536

duot:ServicesDeliveredAtPointInTimeMember

2022-07-01

2022-09-30

0001396536

duot:RailMember

2022-07-01

2022-09-30

0001396536

duot:CommercialMember

2022-07-01

2022-09-30

0001396536

duot:GovernmentsMember

2022-07-01

2022-09-30

0001396536

duot:AIMember

2022-07-01

2022-09-30

0001396536

srt:NorthAmericaMember

duot:RailMember

2021-07-01

2021-09-30

0001396536

srt:NorthAmericaMember

duot:CommercialMember

2021-07-01

2021-09-30

0001396536

srt:NorthAmericaMember

duot:GovernmentsMember

2021-07-01

2021-09-30

0001396536

srt:NorthAmericaMember

duot:BankingsMember

2021-07-01

2021-09-30

0001396536

srt:NorthAmericaMember

duot:ItSuppliersMember

2021-07-01

2021-09-30

0001396536

srt:NorthAmericaMember

duot:AIMember

2021-07-01

2021-09-30

0001396536

srt:NorthAmericaMember

2021-07-01

2021-09-30

0001396536

duot:TurnkeyProjectsMember

duot:RailMember

2021-07-01

2021-09-30

0001396536

duot:TurnkeyProjectsMember

duot:CommercialMember

2021-07-01

2021-09-30

0001396536

duot:TurnkeyProjectsMember

duot:GovernmentsMember

2021-07-01

2021-09-30

0001396536

duot:TurnkeyProjectsMember

duot:BankingsMember

2021-07-01

2021-09-30

0001396536

duot:TurnkeyProjectsMember

duot:ItSuppliersMember

2021-07-01

2021-09-30

0001396536

duot:TurnkeyProjectsMember

duot:AIMember

2021-07-01

2021-09-30

0001396536

duot:TurnkeyProjectsMember

2021-07-01

2021-09-30

0001396536

duot:MaintenanceAndSupportMember

duot:RailMember

2021-07-01

2021-09-30

0001396536

duot:MaintenanceAndSupportMember

duot:CommercialMember

2021-07-01

2021-09-30

0001396536

duot:MaintenanceAndSupportMember

duot:GovernmentsMember

2021-07-01

2021-09-30

0001396536

duot:MaintenanceAndSupportMember

duot:BankingsMember

2021-07-01

2021-09-30

0001396536

duot:MaintenanceAndSupportMember

duot:ItSuppliersMember

2021-07-01

2021-09-30

0001396536

duot:MaintenanceAndSupportMember

duot:AIMember

2021-07-01

2021-09-30

0001396536

duot:MaintenanceAndSupportMember

2021-07-01

2021-09-30

0001396536

duot:GoodsTransferredOverTimeMember

duot:RailMember

2021-07-01

2021-09-30

0001396536

duot:GoodsTransferredOverTimeMember

duot:CommercialMember

2021-07-01

2021-09-30

0001396536

duot:GoodsTransferredOverTimeMember

duot:GovernmentsMember

2021-07-01

2021-09-30

0001396536

duot:GoodsTransferredOverTimeMember

duot:BankingsMember

2021-07-01

2021-09-30

0001396536

duot:GoodsTransferredOverTimeMember

duot:ItSuppliersMember

2021-07-01

2021-09-30

0001396536

duot:GoodsTransferredOverTimeMember

duot:AIMember

2021-07-01

2021-09-30

0001396536

duot:GoodsTransferredOverTimeMember

2021-07-01

2021-09-30

0001396536

duot:ServicesTransferredOverTimeMember

duot:RailMember

2021-07-01

2021-09-30

0001396536

duot:ServicesTransferredOverTimeMember

duot:CommercialMember

2021-07-01

2021-09-30

0001396536

duot:ServicesTransferredOverTimeMember

duot:GovernmentsMember

2021-07-01

2021-09-30

0001396536

duot:ServicesTransferredOverTimeMember

duot:BankingsMember

2021-07-01

2021-09-30

0001396536

duot:ServicesTransferredOverTimeMember

duot:ItSuppliersMember

2021-07-01

2021-09-30

0001396536

duot:ServicesTransferredOverTimeMember

duot:AIMember

2021-07-01

2021-09-30

0001396536

duot:ServicesTransferredOverTimeMember

2021-07-01

2021-09-30

0001396536

duot:RailMember

2021-07-01

2021-09-30

0001396536

duot:CommercialMember

2021-07-01

2021-09-30

0001396536

duot:GovernmentsMember

2021-07-01

2021-09-30

0001396536

duot:BankingsMember

2021-07-01

2021-09-30

0001396536

duot:ItSuppliersMember

2021-07-01

2021-09-30

0001396536

duot:AIMember

2021-07-01

2021-09-30

0001396536

srt:NorthAmericaMember

duot:RailMember

2022-01-01

2022-09-30

0001396536

srt:NorthAmericaMember

duot:CommercialMember

2022-01-01

2022-09-30

0001396536

srt:NorthAmericaMember

duot:GovernmentsMember

2022-01-01

2022-09-30

0001396536

srt:NorthAmericaMember

duot:AIMember

2022-01-01

2022-09-30

0001396536

srt:NorthAmericaMember

2022-01-01

2022-09-30

0001396536

duot:TurnkeyProjectsMember

duot:RailMember

2022-01-01

2022-09-30

0001396536

duot:TurnkeyProjectsMember

duot:CommercialMember

2022-01-01

2022-09-30

0001396536

duot:TurnkeyProjectsMember

duot:GovernmentsMember

2022-01-01

2022-09-30

0001396536

duot:TurnkeyProjectsMember

duot:AIMember

2022-01-01

2022-09-30

0001396536

duot:TurnkeyProjectsMember

2022-01-01

2022-09-30

0001396536

duot:MaintenanceAndSupportMember

duot:RailMember

2022-01-01

2022-09-30

0001396536

duot:MaintenanceAndSupportMember

duot:CommercialMember

2022-01-01

2022-09-30

0001396536

duot:MaintenanceAndSupportMember

duot:GovernmentsMember

2022-01-01

2022-09-30

0001396536

duot:MaintenanceAndSupportMember

duot:AIMember

2022-01-01

2022-09-30

0001396536

duot:MaintenanceAndSupportMember

2022-01-01

2022-09-30

0001396536

duot:AlgorithmsMember

duot:RailMember

2022-01-01

2022-09-30

0001396536

duot:AlgorithmsMember

duot:CommercialMember

2022-01-01

2022-09-30

0001396536

duot:AlgorithmsMember

duot:GovernmentsMember

2022-01-01

2022-09-30

0001396536

duot:AlgorithmsMember

duot:AIMember

2022-01-01

2022-09-30

0001396536

duot:AlgorithmsMember

2022-01-01

2022-09-30

0001396536

duot:GoodsTransferredOverTimeMember

duot:RailMember

2022-01-01

2022-09-30

0001396536

duot:GoodsTransferredOverTimeMember

duot:CommercialMember

2022-01-01

2022-09-30

0001396536

duot:GoodsTransferredOverTimeMember

duot:GovernmentsMember

2022-01-01

2022-09-30

0001396536

duot:GoodsTransferredOverTimeMember

duot:AIMember

2022-01-01

2022-09-30

0001396536

duot:GoodsTransferredOverTimeMember

2022-01-01

2022-09-30

0001396536

duot:GoodsDeliveredAtPointInTimeMember

duot:RailMember

2022-01-01

2022-09-30

0001396536

duot:GoodsDeliveredAtPointInTimeMember

duot:CommercialMember

2022-01-01

2022-09-30

0001396536

duot:GoodsDeliveredAtPointInTimeMember

duot:GovernmentsMember

2022-01-01

2022-09-30

0001396536

duot:GoodsDeliveredAtPointInTimeMember

duot:AIMember

2022-01-01

2022-09-30

0001396536

duot:GoodsDeliveredAtPointInTimeMember

2022-01-01

2022-09-30

0001396536

duot:ServicesTransferredOverTimeMember

duot:RailMember

2022-01-01

2022-09-30

0001396536

duot:ServicesTransferredOverTimeMember

duot:CommercialMember

2022-01-01

2022-09-30

0001396536

duot:ServicesTransferredOverTimeMember

duot:GovernmentsMember

2022-01-01

2022-09-30

0001396536

duot:ServicesTransferredOverTimeMember

duot:AIMember

2022-01-01

2022-09-30

0001396536

duot:ServicesTransferredOverTimeMember

2022-01-01

2022-09-30

0001396536

duot:ServicesDeliveredAtPointInTimeMember

duot:RailMember

2022-01-01

2022-09-30

0001396536

duot:ServicesDeliveredAtPointInTimeMember

duot:CommercialMember

2022-01-01

2022-09-30

0001396536

duot:ServicesDeliveredAtPointInTimeMember

duot:GovernmentsMember

2022-01-01

2022-09-30

0001396536

duot:ServicesDeliveredAtPointInTimeMember

duot:AIMember

2022-01-01

2022-09-30

0001396536

duot:ServicesDeliveredAtPointInTimeMember

2022-01-01

2022-09-30

0001396536

duot:RailMember

2022-01-01

2022-09-30

0001396536

duot:CommercialMember

2022-01-01

2022-09-30

0001396536

duot:GovernmentsMember

2022-01-01

2022-09-30

0001396536

duot:AIMember

2022-01-01

2022-09-30

0001396536

srt:NorthAmericaMember

duot:RailMember

2021-01-01

2021-09-30

0001396536

srt:NorthAmericaMember

duot:CommercialMember

2021-01-01

2021-09-30

0001396536

srt:NorthAmericaMember

duot:GovernmentsMember

2021-01-01

2021-09-30

0001396536

srt:NorthAmericaMember

duot:BankingsMember

2021-01-01

2021-09-30

0001396536

srt:NorthAmericaMember

duot:ItSuppliersMember

2021-01-01

2021-09-30

0001396536

srt:NorthAmericaMember

duot:AIMember

2021-01-01

2021-09-30

0001396536

srt:NorthAmericaMember

2021-01-01

2021-09-30

0001396536

duot:TurnkeyProjectsMember

duot:RailMember

2021-01-01

2021-09-30

0001396536

duot:TurnkeyProjectsMember

duot:CommercialMember

2021-01-01

2021-09-30

0001396536

duot:TurnkeyProjectsMember

duot:GovernmentsMember

2021-01-01

2021-09-30

0001396536

duot:TurnkeyProjectsMember

duot:BankingsMember

2021-01-01

2021-09-30

0001396536

duot:TurnkeyProjectsMember

duot:ItSuppliersMember

2021-01-01

2021-09-30

0001396536

duot:TurnkeyProjectsMember

duot:AIMember

2021-01-01

2021-09-30

0001396536

duot:TurnkeyProjectsMember

2021-01-01

2021-09-30

0001396536

duot:MaintenanceAndSupportMember

duot:RailMember

2021-01-01

2021-09-30

0001396536

duot:MaintenanceAndSupportMember

duot:CommercialMember

2021-01-01

2021-09-30

0001396536

duot:MaintenanceAndSupportMember

duot:GovernmentsMember

2021-01-01

2021-09-30

0001396536

duot:MaintenanceAndSupportMember

duot:BankingsMember

2021-01-01

2021-09-30

0001396536

duot:MaintenanceAndSupportMember

duot:ItSuppliersMember

2021-01-01

2021-09-30

0001396536

duot:MaintenanceAndSupportMember

duot:AIMember

2021-01-01

2021-09-30

0001396536

duot:MaintenanceAndSupportMember

2021-01-01

2021-09-30

0001396536

duot:DataCenterAuditingServicesMember

duot:RailMember

2021-01-01

2021-09-30

0001396536

duot:DataCenterAuditingServicesMember

duot:CommercialMember

2021-01-01

2021-09-30

0001396536

duot:DataCenterAuditingServicesMember

duot:GovernmentsMember

2021-01-01

2021-09-30

0001396536

duot:DataCenterAuditingServicesMember

duot:BankingsMember

2021-01-01

2021-09-30

0001396536

duot:DataCenterAuditingServicesMember

duot:ItSuppliersMember

2021-01-01

2021-09-30

0001396536

duot:DataCenterAuditingServicesMember

duot:AIMember

2021-01-01

2021-09-30

0001396536

duot:DataCenterAuditingServicesMember

2021-01-01

2021-09-30

0001396536

duot:SoftwareLicenseMember

duot:RailMember

2021-01-01

2021-09-30

0001396536

duot:SoftwareLicenseMember

duot:CommercialMember

2021-01-01

2021-09-30

0001396536

duot:SoftwareLicenseMember

duot:GovernmentsMember

2021-01-01

2021-09-30

0001396536

duot:SoftwareLicenseMember

duot:BankingsMember

2021-01-01

2021-09-30

0001396536

duot:SoftwareLicenseMember

duot:ItSuppliersMember

2021-01-01

2021-09-30

0001396536

duot:SoftwareLicenseMember

duot:AIMember

2021-01-01

2021-09-30

0001396536

duot:SoftwareLicenseMember

2021-01-01

2021-09-30

0001396536

duot:AlgorithmsMember

duot:RailMember

2021-01-01

2021-09-30

0001396536

duot:AlgorithmsMember

duot:CommercialMember

2021-01-01

2021-09-30

0001396536

duot:AlgorithmsMember

duot:GovernmentsMember

2021-01-01

2021-09-30

0001396536

duot:AlgorithmsMember

duot:BankingsMember

2021-01-01

2021-09-30

0001396536

duot:AlgorithmsMember

duot:ItSuppliersMember

2021-01-01

2021-09-30

0001396536

duot:AlgorithmsMember

duot:AIMember

2021-01-01

2021-09-30

0001396536

duot:AlgorithmsMember

2021-01-01

2021-09-30

0001396536

duot:GoodsTransferredOverTimeMember

duot:RailMember

2021-01-01

2021-09-30

0001396536

duot:GoodsTransferredOverTimeMember

duot:CommercialMember

2021-01-01

2021-09-30

0001396536

duot:GoodsTransferredOverTimeMember

duot:GovernmentsMember

2021-01-01

2021-09-30

0001396536

duot:GoodsTransferredOverTimeMember

duot:BankingsMember

2021-01-01

2021-09-30

0001396536

duot:GoodsTransferredOverTimeMember

duot:ItSuppliersMember

2021-01-01

2021-09-30

0001396536

duot:GoodsTransferredOverTimeMember

duot:AIMember

2021-01-01

2021-09-30

0001396536

duot:GoodsTransferredOverTimeMember

2021-01-01

2021-09-30

0001396536

duot:ServicesTransferredOverTimeMember

duot:RailMember

2021-01-01

2021-09-30

0001396536

duot:ServicesTransferredOverTimeMember

duot:CommercialMember

2021-01-01

2021-09-30

0001396536

duot:ServicesTransferredOverTimeMember

duot:GovernmentsMember

2021-01-01

2021-09-30

0001396536

duot:ServicesTransferredOverTimeMember

duot:BankingsMember

2021-01-01

2021-09-30

0001396536

duot:ServicesTransferredOverTimeMember

duot:ItSuppliersMember

2021-01-01

2021-09-30

0001396536

duot:ServicesTransferredOverTimeMember

duot:AIMember

2021-01-01

2021-09-30

0001396536

duot:ServicesTransferredOverTimeMember

2021-01-01

2021-09-30

0001396536

duot:RailMember

2021-01-01

2021-09-30

0001396536

duot:CommercialMember

2021-01-01

2021-09-30

0001396536

duot:GovernmentsMember

2021-01-01

2021-09-30

0001396536

duot:BankingsMember

2021-01-01

2021-09-30

0001396536

duot:ItSuppliersMember

2021-01-01

2021-09-30

0001396536

duot:AIMember

2021-01-01

2021-09-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

utr:sqft

As filed with the Securities and Exchange Commission

on December 29, 2022.

Registration No. 333-268638

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

————————

AMENDMENT NO. 1 TO

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT

OF 1933

————————

DUOS TECHNOLOGIES GROUP, INC.

(Exact name of registrant as specified in its charter)

| Florida |

7373 |

65-0493217 |

(State or Other Jurisdiction

of Incorporation) |

(Primary Standard Industrial

Classification Code Number) |

(I.R.S. Employer

Identification Number) |

7660 Centurion Parkway, Suite 100

Jacksonville, Florida 32256

(904) 652-1637

(Address and telephone number of registrant’s

principal executive offices)

————————

Andrew W. Murphy

Chief Financial Officer

Duos Technologies Group, Inc.

7660 Centurion Parkway, Suite 100

Jacksonville, Florida 33256

(904) 652-1637

(Name, address. including zip code, and telephone

number,

including area code, of agent for service)

————————

Copies to:

J. Thomas Cookson, Esq.

Shutts & Bowen LLP

200 South Biscayne Boulevard, Suite 4100

Miami, FL 33131

Tel. No.: (305) 358-6300

Fax No.: (305) 347-7767

Approximate date of commencement of proposed

sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on

this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following

box. ☒

If this Form is filed to register additional

securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, please check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed

pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number

of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed

pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number

of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ |

Accelerated filer ☐ |

| Non-accelerated filer ☒ |

Smaller reporting company ☒ |

| |

Emerging growth company ☐ |

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION

STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH

SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES

ACT OF 1933, AS AMENDED, OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE SECURITIES AND EXCHANGE COMMISSION,

ACTING PURSUANT TO SUCH SECTION 8(a), MAY DETERMINE.

The information

in this prospectus is not complete and may be changed. The selling stockholders may not sell these securities until the registration statement

filed with the Securities and Exchange Commission (“SEC”) is effective. This prospectus is not an offer to sell securities,

and we are soliciting offers to buy these securities, in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS |

Subject to Completion |

Dated

DECEMBER 29, 2022 |

DUOS TECHNOLOGIES GROUP, INC.

902,002 Shares of Common Stock

433,000 Shares of Common Stock issuable upon

Conversion

of Series D Convertible Preferred Stock

This prospectus relates to the offering and resale

by the Selling Stockholders identified herein of up to 1,335,002 shares of common stock, par value $0.001 per share (the “Common

Stock”), of Duos Technologies Group, Inc. (the “Company”), of which 433,000 are issuable upon the conversion of shares

of Series D Convertible Preferred Stock, par value $0.001 per share (the “Series D Preferred Stock”). On September 30, 2022,

we sold to the Selling Stockholders in a private placement 818,335 shares of common stock and 999 shares of Series D Preferred Stock.

On October 29, 2022, we sold to the Selling Stockholders in a private placement an additional 83,667 shares of common stock and 300 shares

of Series D Preferred Stock This prospectus includes those 902,002 shares of common stock and the 433,000 shares of common stock receivable

upon conversion of the Series D Preferred Stock.

The Selling Stockholders may from time to time sell,

transfer, or otherwise dispose of any or all of the securities in a number of different ways and at varying prices. See “Plan of

Distribution” beginning on page 25 of this prospectus for more information.

We are not selling any shares of Common Stock in this

offering, and we will not receive any proceeds from the sale of shares by the Selling Stockholders.

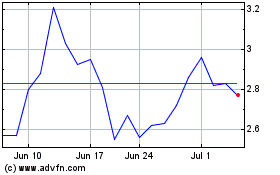

Our Common Stock is currently quoted on the Nasdaq

Capital Market under the symbol “DUOT.” On October 31, 2022, the closing price as reported on the Nasdaq Capital Market was

$3.25 per share. This price will fluctuate based on the demand for our Common Stock.

The Selling Stockholders may offer all or part of

the shares for resale from time to time through public or private transactions, at either prevailing market prices or at privately negotiated

prices.

This prospectus provides a general description of

the securities being offered. You should read this prospectus and the registration statement of which it forms a part before you invest

in any securities.

Investing in our securities involves a high degree

of risk. See “Risk Factors” beginning on page 15 of this prospectus for a discussion of information that should be considered

in connection with an investment in our securities.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete.

Any representation to the contrary is a criminal offense.

The date of this prospectus is December __,

2022

TABLE OF CONTENTS

This prospectus is part of a registration statement

that we have filed with the Securities and Exchange Commission (the “SEC” or the “Commission”). By using such

registration statement, the Selling Stockholders may, from time to time, offer and sell shares of our common stock pursuant to this prospectus.