Duluth Holdings Inc. (dba, Duluth Trading Company) (“Duluth

Trading” or the “Company”) (NASDAQ: DLTH), a lifestyle brand of

men’s and women’s workwear, casual wear, outdoor apparel and

accessories, today announced its financial results for the fiscal

first quarter ended May 1, 2022.

Highlights for the First Quarter Ended May 1,

2022

- Net sales of $122.9 million compared to $133.4 million in the

prior year first quarter

- Gross margin improved 470 basis points to 54.6% compared to

49.9% in the prior year first quarter

- Net loss of ($1.3) million, or ($0.04) per diluted share,

compared to net income of $0.5 million, or $0.02 per diluted share

in the prior year first quarter; excluding the $3.9 million

carryover of freight costs, net income would have been $1.6

million, or $0.05 per diluted share

- Adjusted EBITDA1 of $7.9 million, reflects 6.4% of net

sales

1See Reconciliation of net (loss) income to EBITDA and EBITDA to

Adjusted EBITDA in the accompanying financial tables.

Management Commentary

President and CEO, Sam Sato commented, “Our first quarter

results demonstrate our continued operational effectiveness in the

face of an uneven macro environment. With our inventories in a

healthy position at quarter end and digital marketing tactics that

draw on elevated data analytics, we are meeting the needs of our

customers and executing our strategies for long-term brand growth.

The efficiency of our omnichannel model is producing a consistently

strong gross profit margin, which for Q1 was 54.6%, an increase of

470 basis points over last year.”

“We are excited to bring our evolving portfolio of brands to

life with the launch of Duluth by Duluth Trading Co. and our

rebranding of Alaskan Hardgear as AKHG, which is now expanded to

include Women’s. Both brands stand behind our commitment to product

innovation and long-standing quality. Duluth is our core workwear

brand, while AKHG serves our customer’s desires to be active in the

outdoors and equips them for the adventures they are taking on.

We’re pleased with the customer response to our new brand

positioning and expect the momentum to continue building,” Sato

concluded.

Operating Results for the First Quarter Ended May 1,

2022

Net sales decreased 7.9% to $122.9 million, compared to $133.4

million in the same period a year ago. Retail store net sales

increased slightly by 0.4% to $45.2 million. Direct-to-consumer net

sales decreased by 12.1% to $77.7 million compared to the first

quarter last year primarily due to heavier clearance sales, coupled

with continued supply chain disruptions during the prior year.

Direct-to-consumer net sales decreased 18.8% and 22.9% in fiscal

February and March, respectively, as compared to the prior year,

but April ended strong with direct-to-consumer net sales increasing

10.8% as our inventory position continues to improve.

Net sales in store markets decreased 5.4% to $85.1 million,

compared to $89.9 million in the same period a year ago. Net sales

in non-store markets decreased by 12.5%, to $36.8 million driven by

less clearance sales due to managing with an improved inventory

system during the current quarter.

Gross profit increased 0.8% to $67.1 million, or 54.6% of net

sales, compared to $66.5 million, or 49.9% of net sales, in the

corresponding prior year period. Absent the $3.9 million carryover

of expedited freight costs that were expensed during the current

quarter, our first quarter gross profit margin would have been

approximately 58%. The increase in gross profit rate was driven by

less clearance sales due to improved inventory position.

Selling, general and administrative expenses increased 5.2% to

$68.0 million, compared to $64.6 million in the same period a year

ago. As a percentage of net sales, selling, general and

administrative expenses increased to 55.3%, compared to 48.5% in

the corresponding prior year period.

The increase in selling, general and administrative expense was

primarily due to investments in new headcount, as well as increased

brand development expense to support the launch of Duluth by Duluth

Trading Co. and rebrand of Alaskan Hardgear as AKHG.

The effective tax rate related to controlling interest was 25%

compared to 16% in the corresponding prior year period. The

effective tax rate in the prior year was impacted by changes to

certain discrete items.

Balance Sheet and Liquidity

The Company ended the quarter with a cash balance of $40.4

million, an inventory balance of $152.2 million, net working

capital of $106.0 million, and no outstanding Duluth Trading bank

debt.

Fiscal 2022 Outlook

The Company’s fiscal 2022 outlook is as follows:

- Net sales in the range of $730 million to $755 million

- Adjusted EBITDA in the range of $84 million to $88

million1

- EPS in the range of $0.93 to $1.02 per diluted share

- Capital expenditures, inclusive of software hosting

implementation costs, of approximately $40 million

1See Reconciliation of forecasted net income to forecasted

EBITDA and forecasted EBITDA to forecasted Adjusted EBITDA in the

accompanying financial tables.

Conference Call Information

A conference call and audio webcast with analysts and investors

will be held on Thursday, June 2, 2022 at 9:30 am Eastern Time, to

discuss the results and answer questions.

- Live conference

call: 844-875-6915 (domestic) or 412-317-6711 (international)

- Conference call

replay available through June 9, 2022: 877-344-7529 (domestic) or

412-317-0088 (international)

- Replay access code:

6696956

- Live and archived

webcast:

ir.duluthtrading.com

Investors can pre-register for the earnings conference call to

expedite their entry into the call and avoid waiting for a live

operator. To pre-register for the call, please visit

https://dpregister.com/6696956 and enter your

contact information. You will then be issued a personalized phone

number and pin to dial into the live conference call. Investors can

pre-register any time prior to the start of the conference

call.

About Duluth Trading

Duluth Trading is a lifestyle brand for the Modern, Self-Reliant

American. Based in Mount Horeb, Wisconsin, we offer high quality,

solution-based casual wear, workwear and accessories for men and

women who lead a hands-on lifestyle and who value a job well-done.

We provide our customers an engaging and entertaining experience.

Our marketing incorporates humor and storytelling that conveys the

uniqueness of our products in a distinctive, fun way, and are

available through our content-rich website, catalogs, and “store

like no other” retail locations. We are committed to outstanding

customer service backed by our “No Bull Guarantee” - if it’s not

right, we’ll fix it. Visit our website at

http://www.duluthtrading.com.

Non-GAAP Measurements

Management believes that non-GAAP financial measures may be

useful in certain instances to provide additional meaningful

comparisons between current results and results in prior operating

periods. Within this release, including the tables attached hereto,

reference is made to adjusted earnings before interest, taxes,

depreciation and amortization (EBITDA). See attached Table

“Reconciliation of Net Income (Loss) to EBITDA and EBITDA to

Adjusted EBITDA,” for a reconciliation of net income (loss) to

EBITDA and EBITDA to Adjusted EBITDA for the three months ended May

1, 2022, versus the three months ended May 2, 2021.

Adjusted EBITDA is a metric used by management and frequently

used by the financial community, which provides insight into an

organization’s operating trends and facilitates comparisons between

peer companies, since interest, taxes, depreciation and

amortization can differ greatly between organizations as a result

of differing capital structures and tax strategies. Adjusted EBITDA

excludes certain items that are unusual in nature or not comparable

from period to period.

The Company provides this information to investors to assist in

comparisons of past, present and future operating results and to

assist in highlighting the results of on-going operations. While

the Company’s management believes that non-GAAP measurements are

useful supplemental information, such adjusted results are not

intended to replace the Company’s GAAP financial results and should

be read in conjunction with those GAAP results.

Forward-Looking Statements

This press release includes “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995. All statements, other than statements of historical facts

included in this press release, including statements concerning

Duluth Trading's plans, objectives, goals, beliefs, business

strategies, future events, business conditions, its results of

operations, financial position and its business outlook, business

trends and certain other information herein, including statements

under the heading “Fiscal 2022 Outlook” are forward-looking

statements. You can identify forward-looking statements by the use

of words such as “may,” ”might,” “will,” “should,” “expect,”

“plan,” “anticipate,” “could,” “believe,” “estimate,” “project,”

“target,” “predict,” “intend,” “future,” “budget,” “goals,”

“potential,” “continue,” “design,” “objective,” “forecasted,”

“would” and other similar expressions. The forward-looking

statements are not historical facts, and are based upon Duluth

Trading's current expectations, beliefs, estimates, and

projections, and various assumptions, many of which, by their

nature, are inherently uncertain and beyond Duluth Trading's

control. Duluth Trading's expectations, beliefs and projections are

expressed in good faith, and Duluth Trading believes there is a

reasonable basis for them. However, there can be no assurance that

management's expectations, beliefs, estimates, and projections will

be achieved and actual results may vary materially from what is

expressed in or indicated by the forward-looking statements.

Forward-looking statements are subject to risks and uncertainties

that could cause actual performance or results to differ materially

from those expressed in the forward-looking statements, including,

among others, the risks, uncertainties, and factors set forth under

Part 1, Item 1A “Risk Factors” in the Company’s Annual Report on

Form 10-K filed with the SEC on March 25, 2022 and other factors as

may be periodically described in Duluth Trading’s subsequent

filings with the SEC. These risks and uncertainties include, but

are not limited to, the following: the prolonged effects of

COVID-19 on store traffic and disruptions to our distribution

network, supply chains and operations; our ability to maintain and

enhance a strong brand image; effectively adapting to new

challenges associated with our expansion into new geographic

markets; generating adequate cash from our existing stores to

support our growth; effectively relying on sources for merchandise

located in foreign markets; transportation delays and

interruptions, including port congestion; inability to timely and

effectively obtain shipments of products from our suppliers and

deliver merchandise to our customers; the inability to maintain the

performance of a maturing store portfolio; the impact of changes in

corporate tax regulations; identifying and responding to new and

changing customer preferences; the success of the locations in

which our stores are located; our ability to attract and retain

customers in the various retail venues and locations in which our

stores are located; competing effectively in an environment of

intense competition; our ability to adapt to significant changes in

sales due to the seasonality of our business; price reductions or

inventory shortages resulting from failure to purchase the

appropriate amount of inventory in advance of the season in which

it will be sold in global market constraints; increases in costs of

fuel or other energy, transportation or utility costs and in the

costs of labor and employment; failure of our information

technology systems to support our current and growing business,

before and after our planned upgrades; and other factors that may

be disclosed in our SEC filings or otherwise. Forward-looking

statements speak only as of the date the statements are made.

Duluth Trading assumes no obligation to update forward-looking

statements to reflect actual results, subsequent events or

circumstances or other changes affecting forward-looking

information except to the extent required by applicable securities

laws.

(Tables Follow)

DULUTH HOLDINGS

INC.Condensed Consolidated Balance

Sheets(Unaudited) (Amounts in

thousands)

| |

|

|

|

|

|

|

| |

|

May 1, 2022 |

|

January 30, 2022 |

| |

|

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

| Current Assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

40,370 |

|

|

$ |

77,051 |

|

|

Receivables |

|

|

5,097 |

|

|

|

5,455 |

|

|

Income tax receivable |

|

|

— |

|

|

|

— |

|

|

Inventory, net |

|

|

152,244 |

|

|

|

122,672 |

|

|

Prepaid expenses & other current assets |

|

|

16,422 |

|

|

|

17,333 |

|

|

Prepaid catalog costs |

|

|

— |

|

|

|

10 |

|

|

Total current assets |

|

|

214,133 |

|

|

|

222,521 |

|

| Property and equipment,

net |

|

|

108,283 |

|

|

|

110,078 |

|

| Operating lease right-of-use

assets |

|

|

118,414 |

|

|

|

120,911 |

|

| Finance lease right-of-use

assets, net |

|

|

49,402 |

|

|

|

50,133 |

|

| Available-for-sale

security |

|

|

6,066 |

|

|

|

6,554 |

|

| Other assets, net |

|

|

6,495 |

|

|

|

5,353 |

|

|

Total assets |

|

$ |

502,793 |

|

|

$ |

515,550 |

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

Trade accounts payable |

|

$ |

54,523 |

|

|

$ |

45,402 |

|

|

Accrued expenses and other current liabilities |

|

|

32,214 |

|

|

|

47,504 |

|

|

Income taxes payable |

|

|

4,782 |

|

|

|

6,814 |

|

|

Current portion of operating lease liabilities |

|

|

13,191 |

|

|

|

12,882 |

|

|

Current portion of finance lease liabilities |

|

|

2,730 |

|

|

|

2,701 |

|

|

Current portion of Duluth long-term debt |

|

|

— |

|

|

|

— |

|

|

Current maturities of TRI long-term debt1 |

|

|

711 |

|

|

|

693 |

|

|

Total current liabilities |

|

|

108,151 |

|

|

|

115,996 |

|

| Operating lease liabilities,

less current maturities |

|

|

104,448 |

|

|

|

107,094 |

|

| Finance lease liabilities,

less current maturities |

|

|

39,574 |

|

|

|

40,267 |

|

| Duluth long-term debt, less

current maturities |

|

|

— |

|

|

|

— |

|

| TRI long-term debt, less

current maturities1 |

|

|

26,440 |

|

|

|

26,608 |

|

| Deferred tax liabilities |

|

|

2,791 |

|

|

|

2,867 |

|

|

Total liabilities |

|

|

281,404 |

|

|

|

292,832 |

|

| Commitments and

contingencies |

|

|

|

|

|

|

| Shareholders' equity: |

|

|

|

|

|

|

| Treasury stock |

|

|

(1,457 |

) |

|

|

(1,002 |

) |

| Capital stock |

|

|

96,299 |

|

|

|

95,515 |

|

| Retained earnings |

|

|

129,575 |

|

|

|

130,868 |

|

| Accumulated other

comprehensive income, net |

|

|

153 |

|

|

|

489 |

|

|

Total shareholders' equity of Duluth Holdings Inc. |

|

|

224,570 |

|

|

|

225,870 |

|

| Noncontrolling interest |

|

|

(3,181 |

) |

|

|

(3,152 |

) |

|

Total shareholders' equity |

|

|

221,389 |

|

|

|

222,718 |

|

|

Total liabilities and shareholders' equity |

|

$ |

502,793 |

|

|

$ |

515,550 |

|

1Represents debt of the variable interest entity, TRI Holdings,

LLC, that is consolidated in accordance with ASC 810,

Consolidation. Duluth Holdings Inc. is not the guarantor nor the

obligor of this debt.

DULUTH HOLDING

INC.Consolidated Statements of

Operations(Unaudited)(Amounts in

thousands, except per share figures)

| |

|

|

|

|

|

|

|

|

|

Three Months Ended |

| |

|

May 1, 2022 |

|

May 2, 2021 |

|

Net sales |

|

$ |

122,904 |

|

|

$ |

133,419 |

|

| Cost of goods sold (excluding

depreciation and amortization) |

|

|

55,841 |

|

|

|

66,876 |

|

| Gross profit |

|

|

67,063 |

|

|

|

66,543 |

|

| Selling, general and

administrative expenses |

|

|

67,994 |

|

|

|

64,648 |

|

| Operating (loss) income |

|

|

(931 |

) |

|

|

1,895 |

|

| Interest expense |

|

|

876 |

|

|

|

1,308 |

|

| Other income, net |

|

|

46 |

|

|

|

16 |

|

| (Loss) income before income

taxes |

|

|

(1,761 |

) |

|

|

603 |

|

| Income tax (benefit)

expense |

|

|

(438 |

) |

|

|

105 |

|

| Net (loss) income |

|

|

(1,323 |

) |

|

|

498 |

|

| Less: Net loss attributable to

noncontrolling interest |

|

|

(29 |

) |

|

|

(46 |

) |

| Net (loss) income attributable

to controlling interest |

|

$ |

(1,294 |

) |

|

$ |

544 |

|

| Basic (loss) earnings

per share (Class A and Class B): |

|

|

|

|

|

|

| Weighted average shares of

common stock outstanding |

|

|

32,714 |

|

|

|

32,540 |

|

| Net (loss) income per share

attributable to controlling interest |

|

$ |

(0.04 |

) |

|

$ |

0.02 |

|

| Diluted (loss)

earnings per share (Class A and Class B): |

|

|

|

|

|

|

| Weighted average shares and

equivalents outstanding |

|

|

32,714 |

|

|

|

32,720 |

|

| Net (loss) income per share

attributable to controlling interest |

|

$ |

(0.04 |

) |

|

$ |

0.02 |

|

DULUTH HOLDINGS

INC.Consolidated Statements of Cash

Flows(Unaudited)(Amounts in

thousands)

| |

|

|

|

|

|

|

|

|

|

Three Months Ended |

| |

|

May 1, 2022 |

|

May 2, 2021 |

| Cash flows from

operating activities: |

|

|

|

|

|

|

|

Net (loss) income |

|

$ |

(1,323 |

) |

|

$ |

498 |

|

| Adjustments to reconcile net

(loss) income to net cash used in operating activities: |

|

|

|

|

|

|

| Depreciation and

amortization |

|

|

7,520 |

|

|

|

7,274 |

|

| Stock based compensation |

|

|

618 |

|

|

|

371 |

|

| Deferred income taxes |

|

|

37 |

|

|

|

(16 |

) |

| Loss on disposal of property

and equipment |

|

|

26 |

|

|

|

51 |

|

| Changes in operating assets

and liabilities: |

|

|

|

|

|

|

|

Receivables |

|

|

358 |

|

|

|

262 |

|

|

Inventory |

|

|

(29,572 |

) |

|

|

4,867 |

|

|

Prepaid expense & other current assets |

|

|

746 |

|

|

|

(595 |

) |

|

Software hosting implementation costs, net |

|

|

(1,007 |

) |

|

|

(132 |

) |

|

Deferred catalog costs |

|

|

10 |

|

|

|

212 |

|

|

Trade accounts payable |

|

|

10,362 |

|

|

|

5,991 |

|

|

Income taxes payable |

|

|

(2,032 |

) |

|

|

104 |

|

|

Accrued expenses and deferred rent obligations |

|

|

(17,500 |

) |

|

|

(6,330 |

) |

|

Other assets |

|

|

(11 |

) |

|

|

(33 |

) |

|

Noncash lease impacts |

|

|

51 |

|

|

|

(101 |

) |

| Net cash (used in) provided by

operating activities |

|

|

(31,717 |

) |

|

|

12,423 |

|

| Cash flows from

investing activities: |

|

|

|

|

|

|

| Purchases of property and

equipment |

|

|

(3,885 |

) |

|

|

(2,033 |

) |

| Principal receipts from

available-for-sale security |

|

|

39 |

|

|

|

35 |

|

| Proceeds from disposals |

|

|

3 |

|

|

|

24 |

|

| Net cash used in investing

activities |

|

|

(3,843 |

) |

|

|

(1,974 |

) |

| Cash flows from

financing activities: |

|

|

|

|

|

|

| Payments on delayed draw term

loan |

|

|

— |

|

|

|

(30,625 |

) |

| Payments on TRI long term

debt |

|

|

(168 |

) |

|

|

(151 |

) |

| Payments on finance lease

obligations |

|

|

(664 |

) |

|

|

(615 |

) |

| Payments of tax withholding on

vested restricted shares |

|

|

(455 |

) |

|

|

(358 |

) |

| Other |

|

|

166 |

|

|

|

133 |

|

| Net cash used in financing

activities |

|

|

(1,121 |

) |

|

|

(31,616 |

) |

| Decrease in cash, cash

equivalents |

|

|

(36,681 |

) |

|

|

(21,167 |

) |

| Cash and cash equivalents at

beginning of period |

|

|

77,051 |

|

|

|

47,221 |

|

| Cash and cash equivalents at

end of period |

|

$ |

40,370 |

|

|

$ |

26,054 |

|

| Supplemental

disclosure of cash flow information: |

|

|

|

|

|

|

| Interest paid |

|

$ |

876 |

|

|

$ |

1,348 |

|

| Income taxes paid |

|

$ |

1,610 |

|

|

$ |

— |

|

| Supplemental

disclosure of non-cash information: |

|

|

|

|

|

|

| Unpaid liability to acquire

property and equipment |

|

$ |

4,121 |

|

|

$ |

962 |

|

DULUTH HOLDINGS

INC.Reconciliation of Net Income (Loss) to EBITDA

and EBITDA to Adjusted EBITDAFor the Fiscal

Quarter Ended May 1,

2022(Unaudited)(Amounts in

thousands)

| |

|

|

|

|

|

|

|

|

|

Three Months Ended |

| |

|

May 1, 2022 |

|

May 2, 2021 |

| (in thousands) |

|

|

|

|

|

|

|

Net (loss) income |

|

$ |

(1,323 |

) |

|

$ |

498 |

|

Depreciation and amortization |

|

|

7,520 |

|

|

|

7,274 |

|

Amortization of internal-use software hosting subscription

implementation costs |

|

|

633 |

|

|

|

— |

|

Interest expense |

|

|

876 |

|

|

|

1,308 |

|

Income tax (benefit) expense |

|

|

(438 |

) |

|

|

105 |

| EBITDA |

|

$ |

7,268 |

|

|

$ |

9,185 |

|

Stock based compensation |

|

|

618 |

|

|

|

371 |

| Adjusted EBITDA |

|

$ |

7,886 |

|

|

$ |

9,556 |

DULUTH HOLDINGS

INC.Reconciliation of Forecasted Net Income to

Forecasted EBITDA and Forecasted EBITDA to Forecasted Adjusted

EBITDAFor the Fiscal Year Ending January 29,

2023(Unaudited)(Amounts in

thousands)

|

|

|

|

|

|

|

|

| |

|

Low |

|

High |

|

Forecasted |

|

|

|

|

|

|

| Net income |

|

$ |

30,800 |

|

$ |

33,500 |

|

Depreciation and amortization |

|

|

32,200 |

|

|

32,600 |

|

Amortization of internal-use software hosting subscription

implementation costs |

|

|

3,000 |

|

|

3,200 |

|

Interest expense |

|

|

4,750 |

|

|

4,450 |

|

Income tax expense |

|

|

10,250 |

|

|

11,150 |

| EBITDA |

|

$ |

81,000 |

|

$ |

84,900 |

|

Stock based compensation |

|

|

3,000 |

|

|

3,100 |

| Adjusted EBITDA |

|

$ |

84,000 |

|

$ |

88,000 |

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/adae3add-d45b-4ec0-b3e8-7f181fd173e6

https://www.globenewswire.com/NewsRoom/AttachmentNg/9a4e13b0-c681-4b97-92c3-707ac2cebb1b

Investor Contacts:

ICR, Inc.

(646) 277-1200

DuluthIR@icrinc.com

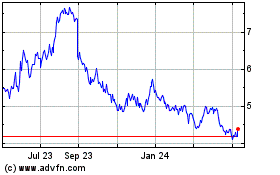

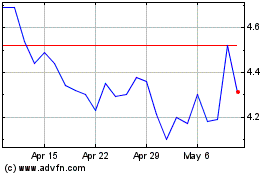

Duluth (NASDAQ:DLTH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Duluth (NASDAQ:DLTH)

Historical Stock Chart

From Apr 2023 to Apr 2024