| Prospectus

Supplement |

Filed

pursuant to Rule 424(b)(5) |

| (To

Prospectus dated February 13, 2019) |

Registration

No. 333-229505 |

DOGNESS

(INTERNATIONAL) CORPORATION

3,636,365

Class A Common Shares

Investor

Warrants to Purchase 3,636,365 Class A Common Shares

2,181,819

Class A Common Shares Issuable upon Exercise of the Investor Warrants

Pursuant

to this prospectus supplement and the accompanying prospectus, we are offering up to 3,636,365 Class A common shares (“Class A

Common Shares”) directly to selected investors. The purchasers in this offering will also receive warrants to initially purchase

an aggregate of 2,181,819 Class A Common Shares with a per share exercise price of $4.20. The warrants are exercisable immediately as

of the date of issuance and expire 36 months from the date of issuance. A holder of the warrants also will have the right to exercise

its warrants on a cashless basis if the registration statement or prospectus contained therein is not available for the issuance of the

Class A Common Shares issuable upon exercise thereof.

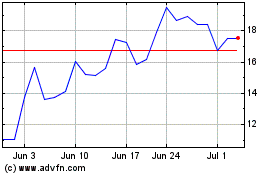

Our

Class A Common Shares trade on the Nasdaq Global Market under the symbol “DOGZ.” There is no established public trading market

for the warrants, and we do not expect a market to develop. We do not intend to apply to list the warrants on any securities exchange.

For a more detailed description of the Class A Common Shares and warrants, see the section entitled “Description of Our Securities

We Are Offering” beginning on page S-47.

As

of May 27, 2022, the aggregate market value of our outstanding Class A Common Shares held by non-affiliates was approximately $103,087,309

based on 26,568,894 outstanding Class A Common Shares, all of which are held by non-affiliates, and a per share price of $3.88, which

was the last reported price on the Nasdaq Global Market of our Class A Common Shares on that date.

We

have retained FT Global Capital, Inc. to act as the exclusive placement agent to use its best efforts to solicit offers from investors

to purchase the securities offered by us in this offering. The placement agent has no obligation to buy any securities from us or to

arrange for the purchase or sale of any specific number or dollar amount of securities. The placement agent is not purchasing or selling

any Class A Common Shares or warrants in this offering. We will pay the placement agent a fee equal to the sum of 6.5% of the aggregate

purchase price paid by investors for securities sold in this offering.

The

following table shows the per share and total fees we will pay to the placement agent in connection with the sale of the Class A Common

Shares and warrants offered pursuant to this prospectus supplement assuming the purchase of all of the Class A Common Shares and warrants

offered hereby:

| | |

Per

Unit | | |

Total | |

| Public offering price | |

$ | 3.3000 | | |

$ | 12,000,005 | |

| Placement agent fees(1) | |

$ | 0.2145 | | |

$ | 780,000 | |

| Offering proceeds to us, before expenses | |

$ | 3.0855 | | |

$ | 11,220,005 | |

| (1) |

See

“Plan of Distribution” for additional information regarding total compensation payable to the placement agent, including

expenses for which we have agreed to reimburse the placement agent. |

We

estimate the total expenses of this offering, excluding the placement agency fees, will be approximately $305,000. Because there is no

minimum offering amount, the actual offering amount, the placement agency fees and net proceeds to us, if any, in this offering may be

substantially less than the total offering amounts set forth above. We are not required to sell any specific number or dollar amount

of the securities offered in this offering. Assuming we complete the maximum offering, the net proceeds to us from this offering will

be approximately $10.9 million. We expect to deliver the shares and warrants to the purchasers on or before June 3, 2022.

Investing

in our Class A Common Shares and warrants involves a high degree of risk, including the risk of losing your entire investment. See “Risk

Factors” beginning on page S-17 to read about factors you should consider before buying our Class A Common Shares and warrants.

We

are not a Chinese operating company but a British Virgin Islands holding company with operations conducted by our subsidiaries established

in Delaware, People’s Republic of China (“PRC” or “China”), Hong Kong Special Administrative Region of

the People’s Republic of China (“HKSAR” or “Hong Kong”) and British Virgin Islands. The Securities offered

in this offering are of the off-shore holding company Dogness (International) Corporation (the “Company”), which owns equity

interests, directly or indirectly, of the operating subsidiaries. Unless otherwise stated, “PRC Subsidiaries” refer to

our subsidiaries incorporated in mainland China, including Dogness Intelligent Technology (Dongguan) Co., Ltd., a PRC company (“Dongguan

Dogness”), Dongguan Jiasheng Enterprise Co., Ltd., a PRC company (“Dongguan Jiasheng”), Zhangzhou Meijia Metal Product

Co., Ltd, a PRC company (“Meijia”), and Dogness Intelligence Technology Co., Ltd., a PRC company (“Intelligence Guangzhou”);

“Hong Kong Subsidiaries” refer to our subsidiaries incorporated in Hong Kong, including Jiasheng Enterprise (Hongkong) Co.,

Limited, a Hong Kong company (“HK Jiasheng”) and Dogness (Hongkong) Pet’s Products Co., Limited, a Hong Kong company

(“HK Dogness”). We will also refer to all of our subsidiaries, “Subsidiaries”. See Prospectus Summary –

Our Corporate Structure, for further information regarding name, place of incorporation, and equity ownership.

We

are also subject to legal and operational risks associated with being based in and having the majority of the company’s operations

in PRC and Hong Kong. The Chinese government may intervene or influence the operation of our Hong Kong and PRC operating entities and

exercise significant oversight and discretion over the conduct of their business and may intervene in or influence their operations at

any time, or may exert more control over offerings conducted overseas and/or foreign investment in China-based issuers, which could result

in a material change in our operations and/or the value of our Class A Common Shares and warrants. Further, any actions by the Chinese

government to exert more oversight and control over offerings that are conducted overseas and/or foreign investment in China-based issuers

could significantly limit or completely hinder our ability to offer or continue to offer Securities to investors and cause the value

of such securities to significantly decline or be worthless.

Recently,

the PRC government initiated a series of regulatory actions and statements to regulate business operations in China with little advance

notice, including cracking down on illegal activities in the securities market, adopting new measures to extend the scope of cybersecurity

reviews, and expanding the efforts in anti-monopoly enforcement, including the following.

On

July 6, 2021, the General Office of the Central Committee of the Communist Party of China and the General Office of the State Council

jointly released the Opinions on Severely Cracking Down on Illegal Securities Activities According to Law, or the Opinions. The Opinions

emphasized the need to strengthen the administration over illegal securities activities, and the need to strengthen the supervision over

overseas listings by Chinese companies. Effective measures, such as promoting the construction of relevant regulatory systems and cybersecurity

and data privacy protection requirements, will be taken to deal with the risks and incidents of China-concept overseas listed companies.

The Opinions and any related implementing rules to be enacted may subject us to compliance requirement in the future.

On

December 24, 2021, China Securities Regulatory Commission (the “CSRC”) issued the Administrative Provisions of the State

Council Regarding the Overseas Issuance and Listing of Securities by Domestic Enterprises (the “Draft Administrative Provisions”)

and the Measures for the Overseas Issuance of Securities and Listing Record-Filings by Domestic Enterprises (Draft for Comments) (the

“Draft Filing Measures”), collectively, the “Draft Rules Regarding Overseas Listings”, which were published for

public comments till January 23,2022. According to the Draft Rules Regarding Overseas Listings, among other things, after making initial

applications with overseas stock markets for initial public offerings or listings, all China-based companies shall file with the CSRC

within three working days. The required filing materials with the CSRC include (without limitation): (i) record-filing reports and related

undertakings, (ii) compliance certificates, filing or approval documents from the primary regulators of applicants’ businesses

(if applicable), (iii) security assessment opinions issued by related departments (if applicable), (iv) PRC legal opinions, and (v) prospectus.

In addition, overseas offerings and listings may be prohibited for such China-based companies when any of the following applies: (1)

if the intended securities offerings and listings are specifically prohibited by the laws, regulations or provision of the PRC; (2) if

the intended securities offerings and listings may constitute a threat to, or endanger national security as reviewed and determined by

competent authorities under the State Council in accordance with laws; (3) if there are material ownership disputes over applicants’

equity interests, major assets, core technologies, or the others; (4) if, in the past three years, applicants’ domestic enterprises,

controlling shareholders or de facto controllers have committed corruption, bribery, embezzlement, misappropriation of property, or other

criminal offenses disruptive to the order of the socialist market economy, or are currently under judicial investigation for suspicion

of criminal offenses, or are under investigation for suspicion of major violations; (5) if, in the past three years, any directors, supervisors,

or senior executives of applicants have been subject to administrative punishments for severe violations, or are currently under judicial

investigation for suspicion of criminal offenses, or are under investigation for suspicion of major violations; (6) other circumstances

as prescribed by the State Council. The Draft Administrative Provisions further stipulate that a fine between RMB 1 million and RMB 10

million may be imposed if an applicant fails to fulfill the filing requirements with the CSRC or conducts an overseas offering or listing

in violation of the Draft Rules Regarding Overseas Listings, and in cases of severe violations, a parallel order to suspend relevant

businesses or halt operations for rectification may be issued, and relevant business permits or operational license revoked. The Draft

Rules Regarding Overseas Listings, if enacted, may subject us or our Subsidiaries to additional compliance requirements in the future.

As of the date of this prospectus supplement, the Draft Rules Regarding Overseas Listings have not been promulgated, and neither us nor

any of our Subsidiaries has been required to obtain permission from the government of China for any of our U.S. offerings. While the

final version of the Draft Rules Regarding Overseas Listings are expected to be adopted in 2022, we believe that none of the situation

that would clearly prohibit overseas offering and listings applies to us. In reaching this conclusion, we are relying on an opinion of

our PRC counsel and that there is uncertainty inherent in relying on an opinion of counsel in connection with whether we or our Subsidiaries

are required to obtain permissions from the Chinese government that is required to approve of our operations and/or offering. In the

event that we or any of our Subsidiaries are subject to the compliance requirements, we cannot assure you that any of us will be able

to receive clearance of such filing requirements in a timely manner, or at all. Any failure of us or our Subsidiaries to fully comply

with new regulatory requirements may significantly limit or completely hinder our ability to offer or continue to offer our Class A Common

Shares and warrants, cause significant disruption to our business operations, severely damage our reputation, materially and adversely

affect our financial condition and results of operations and cause our Class A Common Shares and warrants to significantly decline in

value or become worthless. See “Risk Factor — Draft rules for China-based companies seeking for securities offerings in

foreign stock markets was released by the CSRC for public consultation. While such rules have not yet come into effect, the Chinese government

may exert more oversight and control over overseas public offerings conducted by China-based issuers, which could significantly limit

or completely hinder our ability to offer or continue to offer our Class A Common Shares to investors and could cause the value of our

Class A Common Shares to significantly decline or become worthless.”

We

or our Subsidiaries may also be subject to PRC laws relating to the use, sharing, retention, security and transfer of confidential and

private information, such as personal information and other data. On November 14, 2021, the Cyberspace Administration of China (“CAC”)

released the Regulations on the Network Data Security Management (Draft for Comments), or the Data Security Management Regulations Draft,

to solicit public opinion and comments. Pursuant to the Data Security Management Regulations Draft, data processors holding more than

one million users/users’ individual information shall be subject to cybersecurity review before listing abroad. Data processing

activities refers to activities such as the collection, retention, use, processing, transmission, provision, disclosure, or deletion

of data. According to the latest amended Cybersecurity Review Measures, which was promulgated on December 28, 2021, and became effective

on February 15, 2022, and replaced the Cybersecurity Review Measures promulgated on April 13, 2020, an online platform operator holding

more than one million users/users’ individual information shall be subject to cybersecurity review before listing abroad. As of

the date of this prospectus supplement, we have not been informed by any PRC governmental authority of any requirement that we or our

Subsidiaries file for approval for this offering. We don’t believe that we or any of our Subsidiaries will be subject to either

the amended Cybersecurity Review Measures or the Data Security Management Regulations Draft since none of us hold more than one million

users/users’ individual information. However, it is uncertain how the above-mentioned new laws or regulations will be enacted,

interpreted or implemented, and whether it will affect us. Since the regulatory actions are new, it is highly uncertain how soon legislative

or administrative regulation making bodies will respond and what existing or new laws or regulations or detailed implementations and

interpretations will be modified or promulgated, if any, and the potential impact such modified or new laws and regulations will have

on our Subsidiaries’ daily business operation, their ability to accept foreign investments, and our ability to continue to list

or offer securities on an U.S. exchange. See “Risk Factor — The Chinese government exerts substantial influence

over the manner in which we must conduct our business activities and may intervene or influence our operations at any time, which could

result in a material change in our operations and the value of our Class A Common Shares.”

On

February 7, 2021, the Anti-Monopoly Committee of the State Council promulgated the Anti-monopoly Guidelines for the Platform Economy

Sector, or the Anti-monopoly Guideline, aiming to improve anti-monopoly administration on online platforms. The Anti-monopoly Guideline,

operating as the compliance guidance under the then-existing PRC anti-monopoly regulatory regime for platform economy operators, specifically

prohibits certain acts of the platform economy operators that may have the effect of eliminating or limiting market competition, such

as concentration of undertakings. The PRC anti-monopoly regulatory regime started with the Anti-Monopoly Law promulgated by the Standing

Committee of the National People’s Congress of China (“SCNPC”) on August 30, 2007 and effective on August 1, 2008,

which requires that transactions which are deemed concentrations and involve parties with specified turnover thresholds must be cleared

by the Ministry of Commerce of China (“MOFCOM”) before they can be completed. In addition, on February 3, 2011, the General

Office of the State Council promulgated a Notice on Establishing the Security Review System for Mergers and Acquisitions of Domestic

Enterprises by Foreign Investors, or Circular 6, which officially established a security review system for mergers and acquisitions of

domestic enterprises by foreign investors. Further, on August 25, 2011, MOFCOM promulgated the Regulations on Implementation of Security

Review System for the Merger and Acquisition of Domestic Enterprises by Foreign Investors, or the MOFCOM Security Review Regulations,

which became effective on September 1, 2011, to implement Circular 6. Under Circular 6, a security review is required for mergers and

acquisitions by foreign investors having “national defense and security” concerns and mergers and acquisitions by which foreign

investors may acquire the “de facto control” of domestic enterprises with “national security” concerns. Under

the MOFCOM Security Review Regulations, MOFCOM will focus on the substance and actual impact of the transaction when deciding whether

a specific merger or acquisition is subject to security review. If MOFCOM decides that a specific merger or acquisition is subject to

security review, it will submit it to the Inter-Ministerial Panel, an authority established under the Circular 6 led by the NDRC, and

MOFCOM under the leadership of the State Council, to carry out the security review. The regulations prohibit foreign investors from bypassing

the security review by structuring transactions through trusts, indirect investments, leases, loans, control through contractual arrangements

or offshore transactions.

As

a holding company, we may rely on dividends and other distributions on equity paid by our subsidiaries, including those based in the

PRC, for our cash and financing requirements. If any of our PRC Subsidiaries incurs debt on its own behalf in the future, the instruments

governing such debt may restrict their ability to pay dividends to us. To date, none of the Subsidiaries has made any dividends or distributions

to us and we have not made any dividends or distributions to our shareholders. We anticipate that we will retain any earnings to support

operations and to finance the growth and development of our business. Therefore, we do not expect to pay cash dividends in the foreseeable

future.

Under

British Virgin Islands law, we may only pay dividends from surplus (the excess, if any, at the time of the determination of the total

assets of our company over the sum of our liabilities, as shown in our books of account, plus our capital), and we must be solvent before

and after the dividend payment in the sense that we will be able to satisfy our liabilities as they become due in the ordinary course

of business; and the realizable value of assets of our company will not be less than the sum of our total liabilities, other than deferred

taxes as shown on our books of account, and our capital. If we determine to pay dividends on any of our Common Shares in the future,

as a holding company, we will be dependent on receipt of funds from our Hong Kong Subsidiaries, HK Jiasheng and HK Dogness. Current PRC

regulations permit the PRC Subsidiaries to pay dividends to HK Dogness only out of their accumulated profits, if any, determined in accordance

with Chinese accounting standards and regulations. The PRC government also imposes controls on the conversion of RMB into foreign currencies

and the remittance of currencies out of the PRC. Therefore, we may experience difficulties in completing the administrative procedures

necessary to obtain and remit foreign currency for the payment of dividends from our profits, if any. We have installed cash management

policies or procedures in place that dictate how funds are transferred, under an umbrella of corporate policies and financial reporting

policies. Even though our policies do not specifically address the limitations, as discussed above, on the amount of funds the Company

can transfer out of China, if we decide to transfer cash out of China in the future, all relevant transfers will be conducted in compliance

with such limitations. See “Prospectus Summary – Dividend Distributions and Cash Transfer among Dogness and the Subsidiaries”,

“Prospectus Summary – Selected Condensed Consolidated Financial Schedule of Dogness (International) Corporation and its Subsidiaries”

and the consolidated financial statements, “Risk Factor — China’s economic, political and social conditions,

as well as changes in any government policies, laws and regulations, could have a material adverse effect on our business”, “Risk

Factor – We may rely on dividends and other distributions on equity paid by our subsidiaries, including those based in the PRC,

for our cash and financing requirements we may have, and any limitation on the ability of our PRC subsidiaries to make payments to us

could have a material and adverse effect on our ability to conduct our business.”, “Risk Factor —

PRC regulation of loans and direct investment by offshore holding companies to PRC entities may delay or prevent us from using the proceeds

of this Offering to make loans or additional capital contributions to our PRC subsidiary, which could materially and adversely affect

our liquidity and our ability to fund and expand our business”, “Risk Factor — Governmental control of

currency conversion may limit our ability to use our revenues effectively and the ability of our PRC subsidiaries to obtain financing” , and

“Risk Factor — We must remit the offering proceeds to China before they may be used to benefit our business in China,

the process of which may be time-consuming, and we cannot assure that we can finish all necessary governmental registration processes

in a timely manner.”

Moreover,

the transfer of funds among our PRC Subsidiaries are subject to the Provisions of the Supreme People’s Court on Several Issues

Concerning the Application of Law in the Trial of Private Lending Cases (2020 Revision, the “Provisions on Private Lending Cases”),

which was implemented on August 20, 2020 to regulate the financing activities between natural persons, legal persons and unincorporated

organizations. As advised by our PRC counsel, the Provisions on Private Lending Cases do not prohibit using cash generated from one subsidiary

to fund the operations of another subsidiary in China. As of the date of this prospectus supplement, no cash generated from one subsidiary

has been used to fund another subsidiary’s operations; for that reason, our cash management policies do not specifically address

this type of transfers between subsidiaries. We do not anticipate any occasions where cash generated from one subsidiary needs to be

transferred to another subsidiary and will comply with PRC laws discussed above should we decide to conduct such a transfer. We do not

anticipate any difficulties or limitations on our ability to transfer cash between subsidiaries. See “Prospectus Summary –

Dividend Distributions and Cash Transfer among Dogness and the Subsidiaries”, “Prospectus Summary – Selected Condensed

Consolidated Financial Schedule of Dogness (International) Corporation and its Subsidiaries” and the consolidated financial statements.

Cash

flow between Dogness and the Subsidiaries primarily consists of transfers from Dogness to these Subsidiaries for short-term working capital

loan, which is mainly used in payment of operating expenses and investments. To date, there are no other assets transferred between Dogness

and the subsidiaries except for the below cash transfers:

| |

● |

For

the year ended June 30, 2019, cash transferred from Dogness to HK Dogness was $98 for payments of miscellaneous charge. The source

of fund was the cash retained in our Company after IPO. In addition, HK Dogness repaid $44 back to Dogness for the year ended June

30, 2019. |

| |

|

|

| |

● |

For

the year ended June 30, 2020, cash transferred from Dogness to HK Dogness was $103,333 for short-term working capital loan. The source

of funds was the cash retained. |

| |

|

|

| |

● |

For

the year ended June 30, 2021, Dogness transferred $505,850 to the Delaware subsidiary, Dogness Group LLC, for short term working

capital loan purpose and transferred $2,581,533 to HK Dogness for short term working capital loan purpose. The source of funds was

the registered direct public offering we completed on January 20,2021 with net proceeds of $6.6 million. For the year ended June

30, 2021, Dogness also received cash repayment transferred from HK Dogness in the amount of $304. |

| |

|

|

| |

● |

For

the six months ended December 31, 2021, Dogness transferred $1,355,982 ($30,000 + $1,325,982) to Dogness Group LLC. The source of

funds was the equity financing we completed in July 2021 and the exercise of warrants in November and December 2021. |

In

the future, cash proceeds raised from overseas financing activities may be transferred by Dogness to the Subsidiaries via capital contribution

or shareholder loans, as the case may be. See “Prospectus Summary

– Selected Condensed Consolidated Financial Schedule of Dogness (International) Corporation and its Subsidiaries” and “Prospectus

Summary – Dividend Distributions and Cash Transfer among Dogness and the Subsidiaries” and the consolidated financial statements

included in our annual reports on Form 20-F and any interim financial statements we may file.

Our

Class A Common Shares may be prohibited to trade on a United States national exchange or “over-the-counter” markets under

the Holding Foreign Companies Accountable Act (the “HFCA Act”) if Public Company Accounting Oversight Board (“PCAOB”)

is unable to inspect our auditors for three consecutive years beginning in 2021. Our auditor is currently subject to PCAOB inspections

and PCAOB is able to inspect our auditor. Furthermore, on June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies

Accountable Act (“AHFCAA”), which, if signed into law, would amend the HFCA Act and require the SEC to prohibit an issuer’s

securities from trading on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead

of three consecutive years. Pursuant to the HFCA Act, the PCAOB issued a Determination Report on December 16, 2021, which found that

the PCAOB is unable to inspect or investigate completely registered public accounting firms headquartered in: (1) mainland China of the

PRC, and (2) Hong Kong. In addition, the PCAOB’s report identified the specific registered public accounting firms which are subject

to these determinations. Our auditor, Prager Metis CPAs, LLC, is located at Hackensack New Jersey, and has been inspected by the PCAOB

on a regular basis with the last inspection in August 2020. Our auditor is not headquartered in mainland China or Hong Kong and was not

identified in this report as a firm subject to the PCAOB’s determination. Notwithstanding the foregoing, in the future, if there

is any regulatory change or step taken by PRC regulators that does not permit Prager Metis CPAs, LLC to provide audit documentations

located in China or Hong Kong to the PCAOB for inspection or investigation, or the PCAOB expands the scope of the determination so that

we are subject to the HFCA Act, as the same may be amended, you may be deprived of the benefits of such inspection which could result

in limitation or restriction to our access to the U.S. capital markets and trading of our securities, including trading on the national

exchange and trading on “over-the-counter” markets, may be prohibited under the HFCA Act. See “Risk Factors —

Recent joint statement by the SEC and PCAOB, proposed rule changes submitted by Nasdaq, and an act passed by the U.S. Senate all call

for additional and more stringent criteria to be applied to emerging market companies upon assessing the qualification of their auditors,

especially the non-U.S. auditors who are not inspected by the PCAOB. These developments could add uncertainties to our offering.”

for more information.

Our

business and holding our Class A Common Shares and warrants involve a high degree of risk. See “Risk Factors” beginning on

page S-17 of this prospectus supplement, on page 7 of the accompanying base prospectus and the risk factors described in the documents

incorporated by reference into this prospectus supplement and the accompanying base prospectus for more information.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus supplement or the accompanying base prospectus is truthful or complete. Any representation to the contrary is a criminal

offense.

FT

Global Capital, Inc.

The

date of this prospectus supplement is June 1, 2022

TABLE

OF CONTENTS

Prospectus

Supplement

Prospectus

You

should rely only on the information contained in this prospectus supplement and the accompanying prospectus. We have not authorized anyone

else to provide you with additional or different information. We are offering to sell, and seeking offers to buy, Class A Common Shares

and warrants only in jurisdictions where offers and sales are permitted. You should not assume that the information in this prospectus

supplement or the accompanying prospectus is accurate as of any date other than the date on the front of those documents or that any

document incorporated by reference is accurate as of any date other than its filing date.

No

action is being taken in any jurisdiction outside the United States to permit a public offering of the Class A Common Shares and warrants

or possession or distribution of this prospectus supplement or the accompanying prospectus in that jurisdiction. Persons who come into

possession of this prospectus supplement or the accompanying prospectus in jurisdictions outside the United States are required to inform

themselves about and to observe any restrictions as to this offering and the distribution of this prospectus supplement and the accompanying

prospectus applicable to that jurisdiction.

ABOUT

THIS PROSPECTUS SUPPLEMENT

On

February 4, 2019, we filed with the SEC a registration statement on Form F-3 (File No. 333-229505) utilizing a shelf registration process

relating to the securities described in this prospectus supplement, which registration statement was declared effective on February 13,

2019. Under this shelf registration process, we may, from time to time, sell up to $88 million in the aggregate of Class A Common Shares,

share purchase contracts, share purchase units, warrants, rights and units.

The

two parts of this document include: (1) this prospectus supplement, which describes the specific details regarding this offering; and

(2) the accompanying base prospectus, which provides a general description of the securities that we may offer, some of which may not

apply to this offering. Generally, when we refer to this “prospectus,” we are referring to both documents combined. If information

in this prospectus supplement is inconsistent with the accompanying base prospectus, you should rely on this prospectus supplement. You

should read this prospectus supplement together with the additional information described below under the heading “Where You Can

Find More Information” and “Incorporation of Documents by Reference.”

Any

statement made in this prospectus supplement or in a document incorporated or deemed to be incorporated by reference into this prospectus

supplement will be deemed to be modified or superseded for purposes of this prospectus supplement to the extent that a statement contained

in this prospectus supplement or in any other subsequently filed document that is also incorporated by reference into this prospectus

supplement modifies or supersedes that statement. Any statements so modified or superseded will be deemed not to constitute a part of

this prospectus supplement except as so modified or superseded. In addition, to the extent of any inconsistencies between the statements

in this prospectus supplement and similar statements in any previously filed report incorporated by reference into this prospectus supplement,

the statements in this prospectus supplement will be deemed to modify and supersede such prior statements.

The

registration statement that contains this prospectus supplement, including the exhibits to the registration statement and the information

incorporated by reference, contains additional information about the securities offered under this prospectus supplement. That registration

statement can be read on the SEC’s website or at the SEC’s offices mentioned below under the heading “Where You Can

Find More Information.”

We

are responsible for the information contained and incorporated by reference in this prospectus supplement, the accompanying base prospectus

and any related free writing prospectus that we prepare or authorize. We have not authorized anyone to provide you with different or

additional information, and we take no responsibility for any other information that others may give you. If you receive any other information,

you should not rely on it.

This

prospectus supplement and the accompanying base prospectus do not constitute an offer to sell or the solicitation of an offer to buy

any securities other than the registered securities to which this prospectus supplement relates, nor do this prospectus supplement and

the accompanying base prospectus constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to

any person to whom it is unlawful to make such offer or solicitation in such jurisdiction.

You

should not assume that the information in this prospectus supplement and the accompanying base prospectus is accurate at any date other

than the date indicated on the cover page of this prospectus supplement or that any information that we have incorporated by reference

is correct on any date subsequent to the date of the document incorporated by reference. Our business, financial condition, results of

operations or prospects may have changed since that date.

You

should not rely on or assume the accuracy of any representation or warranty in any agreement that we have filed in connection with this

offering or that we may otherwise publicly file in the future because any such representation or warranty may be subject to exceptions

and qualifications contained in separate disclosure schedules, may represent the applicable parties’ risk allocation in the particular

transaction, may be qualified by materiality standards that differ from what may be viewed as material for securities law purposes or

may no longer continue to be true as of any given date.

Unless

stated otherwise or the context otherwise requires, references in this prospectus supplement and the accompanying base prospectus to

the “Company,” “Dogness,” “we,” “us” or “our” refer to Dogness (International)

Corporation.

CAUTIONARY

NOTE ON FORWARD LOOKING STATEMENTS

Certain

statements contained or incorporated by reference in this prospectus supplement, including the documents referred to or incorporated

by reference in this prospectus supplement or statements of our management referring to our summarizing the contents of this prospectus

supplement, include “forward-looking statements”. We have based these forward-looking statements on our current expectations

and projections about future events. Our actual results may differ materially or perhaps significantly from those discussed herein, or

implied by, these forward-looking statements. Forward-looking statements are identified by words such as “believe,” “expect,”

“anticipate,” “intend,” “estimate,” “plan,” “project” and other similar expressions.

In addition, any statements that refer to expectations or other characterizations of future events or circumstances are forward-looking

statements. Forward-looking statements included or incorporated by reference in this prospectus supplement or our other filings with

the Securities and Exchange Commission, or the SEC include, but are not necessarily limited to, those relating to:

| |

● |

risks

and uncertainties associated with the integration of the assets and operations we have acquired and may acquire in the future; |

| |

● |

our

possible inability to raise or generate additional funds that will be necessary to continue and expand our operations; |

| |

● |

our

potential lack of revenue growth; |

| |

● |

our

potential inability to add new products and services that will be necessary to generate increased sales; |

| |

● |

our

potential lack of cash flows; |

| |

● |

our

potential loss of key personnel; |

| |

● |

the

availability of qualified personnel; |

| |

● |

international,

national regional and local economic political changes; |

| |

● |

general

economic and market conditions; |

| |

● |

increases

in operating expenses associated with the growth of our operations; |

| |

● |

the

potential for increased competition; and |

| |

● |

other

unanticipated factors. |

The

foregoing does not represent an exhaustive list of matters that may be covered by the forward-looking statements contained herein or

risk factors that we are faced with that may cause our actual results to differ from those anticipate in our forward-looking statements.

Please see “Risk Factors” in our reports filed with the SEC and in the accompanying prospectus for additional risks which

could adversely impact our business and financial performance.

Moreover,

new risks regularly emerge and it is not possible for our management to predict or articulate all risks we face, nor can we assess the

impact of all risks on our business or the extent to which any risk, or combination of risks, may cause actual results to differ from

those contained in any forward-looking statements. All forward-looking statements included in this prospectus supplement are based on

information available to us on the date of this prospectus supplement. Except to the extent required by applicable laws or rules, we

undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events

or otherwise. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly

qualified in their entirety by the cautionary statements contained above and throughout (or incorporated by reference in) this prospectus

supplement.

PROSPECTUS

SUPPLEMENT SUMMARY

The

following summary highlights selected information contained or incorporated by reference in this prospectus supplement. This summary

does not contain all of the information you should consider before investing in the securities. Before making an investment decision,

you should read the entire prospectus supplement and the accompanying prospectus carefully, including the risk factors section as well

as the financial statements and the notes to the financial statements incorporated herein by reference.

Our

Company - Overview

We

are not a Chinese operating company but a British Virgin Islands holding company with operations conducted by our Subsidiaries established

in Delaware, PRC, British Virgin Islands, and Hong Kong.

PRC

laws and regulations governing business operations are sometimes vague and uncertain, and therefore, these risks may result in a material

change in the operations of our PRC Subsidiaries and Hong Kong Subsidiaries, significant depreciation of the value of our Class A Common

Shares, or a complete hindrance of our ability to offer or continue to offer our securities to investors and cause the value of such

securities to significantly decline or be worthless. The Chinese government may intervene or influence the operations of our PRC operating

entities at any time and may exert more control over offerings conducted overseas and/or foreign investment in China-based issuers, which

could result in a material change in the operations of our PRC operating entities and/or the value of our Class A Common Shares. Further,

any actions by the Chinese government to exert more oversight and control over offerings that are conducted overseas and/or foreign investment

in China-based issuers could significantly limit or completely hinder our ability to offer or continue to offer securities to investors

and cause the value of such securities to significantly decline or be worthless. Recently, the PRC government initiated a series of regulatory

actions and statements to regulate business operations in China with little advance notice, including cracking down on illegal activities

in the securities market, adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly

enforcement. See “Prospectus Supplement Summary — Permission Required from the PRC Authorities for the Company’s

Operation and to Issue Our Class A Common Shares to Foreign Investors”; “Risk Factor — Draft rules for China-based

companies seeking for securities offerings in foreign stock markets was released by the CSRC for public consultation. While such rules

have not yet come into effect, the Chinese government may exert more oversight and control over overseas public offerings conducted by

China-based issuers, which could significantly limit or completely hinder our ability to offer or continue to offer our Class A Common

Shares to investors and could cause the value of our Class A Common Shares to significantly decline or become worthless”; “Risk

Factor — Our failure to obtain prior approval of the CSRC for the listing and trading of our Class A Common Shares on a foreign

stock exchange could delay this offering or could have a material adverse effect upon our business, operating results, reputation and

trading price of our Class A Common Shares.”

Our

Class A Common Shares may be prohibited to trade on a national exchange or “over-the-counter” markets under the Holding Foreign

Companies Accountable Act (the “HFCA Act”) if Public Company Accounting Oversight Board (“PCAOB”) is unable to

inspect our auditors for three consecutive years beginning in 2021. Our auditor is currently subject to PCAOB inspections and PCAOB is

able to inspect our auditor. Furthermore, on June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable

Act (“AHFCAA”), which, if signed into law, would amend the HFCA Act and require the SEC to prohibit an issuer’s securities

from trading on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead of three

consecutive years. Pursuant to the HFCA Act, the PCAOB issued a Determination Report on December 16, 2021 which found that the PCAOB

is unable to inspect or investigate completely registered public accounting firms headquartered in: (1) mainland China of the PRC, and

(2) Hong Kong. In addition, the PCAOB’s report identified the specific registered public accounting firms which are subject to

these determinations. Our auditor, Prager Metis CPAs, LLC, is located at Hackensack New Jersey, and has been inspected by the PCAOB on

a regular basis with the last inspection in August 2020. Our auditor is not headquartered in mainland China or Hong Kong and was not

identified in this report as a firm subject to the PCAOB’s determination. Notwithstanding the foregoing, in the future, if there

is any regulatory change or step taken by PRC regulators that does not permit Prager Metis CPAs, LLC to provide audit documentations

located in China or Hong Kong to the PCAOB for inspection or investigation, or the PCAOB expands the scope of the determination so that

we are subject to the HFCA Act, as the same may be amended, you may be deprived of the benefits of such inspection which could result

in limitation or restriction to our access to the U.S. capital markets and trading of our securities, including trading on the national

exchange and trading on “over-the-counter” markets, may be prohibited under the HFCA Act. See “Risk Factors —

Recent joint statement by the SEC and PCAOB, proposed rule changes submitted by Nasdaq, and an act passed by the US Senate all call

for additional and more stringent criteria to be applied to emerging market companies upon assessing the qualification of their auditors,

especially the non-U.S. auditors who are not inspected by the PCAOB. These developments could add uncertainties to our offering.”

for more information.

History

and Development of the Company

Dogness

(International) Corporation (the “Company” or “Dogness”) is a company limited by shares established under the

laws of the British Virgin Islands (“BVI”) on July 11, 2016 as a holding company. The Company, through its subsidiaries,

is primarily engaged in the design, manufacturing and sales of various types of pet leashes, pet collars, pet harnesses, intelligent

pet products and retractable leashes with products being sold all over the world mainly through distributions by large retailers.

A

reorganization of the legal structure was completed on January 9, 2017. Reorganization involved the incorporation of Dogness, a BVI holding

company; and Dogness Intelligent Technology (Dongguan) Co., Ltd. (“Dongguan Dogness”), a holding company established under

the laws of the People’s Republic of China (“PRC”); and the transfer of Dogness (Hongkong) Pet’s Products Co.,

Limited, (“HK Dogness”), Jiasheng Enterprise (Hongkong) Co., Limited, (“HK Jiasheng”) and Dongguan Jiasheng Enterprise

Co., Ltd. (“Dongguan Jiasheng”; collectively, the “Transferred Entities”) from the Controlling Shareholder to

Dogness and Dongguan Dogness. Prior to the reorganization, the Transferred Entities’ equity interests were 100% controlled by our

founder and Chief Executive Officer, Mr. Silong Chen (the “Controlling Shareholder”).

On

November 24, 2016, the Controlling Shareholder transferred his 100% ownership interest in Dongguan Jiasheng to Dongguan Dogness, which

is 100% owned by HK Dogness and considered a wholly foreign-owned entity (“WFOE”) in PRC. On January 9, 2017, the Controlling

Shareholder transferred his 100% equity interests in HK Dogness and HK Jiasheng to Dogness. After the reorganization, Dogness ultimately

owns 100% of the equity interests of the entities mentioned above.

Dongguan

Jiasheng was established on May 15, 2009 under the laws of the PRC, with registered capital of RMB 10 million (approximately $1.5 million)

contributed by individual shareholder Mr. Silong Chen. Dongguan Jiasheng is the main operating entity and is engaged in the research

and development, manufacturing and distribution of various types of gift suspenders, pet belts ribbon, lace, elastic belt, computer jacquard

ribbon and high-grade textile lace.

Since

the Company and its wholly-owned subsidiaries were effectively controlled by the same Controlling Shareholder before and after the reorganization,

they are considered under common control. The above-mentioned transactions were accounted for as a recapitalization. The consolidation

of the Company and its subsidiaries has been accounted for at historical cost and prepared on the basis as if the aforementioned transactions

had become effective as of the beginning of the first period presented in the accompanying consolidated financial statements.

In

January 2018, the Company formed a Delaware limited liability company, Dogness Group LLC (“Dogness Group”), with its operation

focusing primarily on promoting the Company’s pet products sales in the United States. In February 2018, Dogness Overseas Ltd (“Dogness

Overseas”), which is wholly owned by the Company, was established in the British Virgin Islands as a holding company. Dogness Overseas

owns all of the interests in Dogness Group.

On

March 16, 2018, the Company entered into a share purchase agreement to acquire 100% of the equity interests in Zhangzhou Meijia Metal

Product Co., Ltd (“Meijia”) from its original shareholder, Long Kai (Shenzhen) Industrial Co., Ltd (“Longkai”),

for a total cash consideration of approximately $11.0 million (or RMB 71.0 million). After the acquisition, Mejia became the Company’s

wholly-owned subsidiary. Meijia owns the land use right to a land parcel of 19,144.54 square meters and a factory and office buildings

of an aggregate of 18,912.38 square meters. This acquisition enables the Company to build its own facility instead of leasing manufacturing

facilities and expand its production capacity sustainably to meet increased customer demand. Total budgeted capital expenditure to bring

Meijia manufacturing facility into use was originally estimated to be completed at a cost of approximately RMB 110 million ($17.0 million).

The actual costs have been adjusted based on additional works required for waterproofing, sewage pipeline and hazardous waste leakage

prevention. Meijia plant has reached its designed production capacity by June 2021.

On

July 6, 2018, Dogness Intelligence Technology Co., Ltd. (“Intelligence Guangzhou”) was incorporated under the laws of the

People’s Republic of China in Guangzhou City, Guangdong Province, China with a total registered capital of RMB 80 million (approximately

$12.4 million). One of the Company’s subsidiaries, Dongguan Jiasheng, owns 58% of Intelligence Guangzhou, with the remaining 42%

of ownership interest owned by two unrelated entities. As of the date of this prospectus supplement, Dongguan Jiasheng has not made any

capital contribution. Intelligence Guangzhou has had immaterial operation since its inception.

On

February 5, 2019, in order to expand into the Japanese market and expedite the development of new smart pet products, the Company invested

$142,000 for 51% ownership interest in Dogness Japan Co. Ltd. (“Dogness Japan”), with the remaining 49% ownership interest

owned by an unrelated individual. Due to the negative impact of COVID-19 and because no material revenue was generated since its inception,

on November 28, 2020, the Board of Directors (the “Board”) of the Company approved to the sale of the Company’s 51%

ownership interest to the remaining shareholder of Dogness Japan.

Dogness

Pet Culture (Dongguan) Co., Ltd. (“Dogness Culture”) was incorporated on December 14, 2018 with registered capital of RMB

10 million (approximately $1.5 million). The capital was not paid at the time of incorporation and there were no active business operations.

On January 15, 2020, the Company’s subsidiary, Dongguan Dogness, entered into an agreement with the original shareholder of Dogness

Culture, who is related to Mr. Silong Chen, our Chief Executive Officer, to acquire 51.2% ownership interest of Dogness Culture for a

nominal fee. The remaining equity interest of 48.8% was also transferred to two other third-parties for a nominal fee. Dongguan Dogness

thereafter contributed cash consideration of RMB 5.12 million (approximately $0.79 million) on April 16, 2020, along with the other two

shareholders’ capital contributions of RMB 4.88 million (approximately $0.76 million). Dogness Culture is focusing on developing

and expanding pet food market in China in the near future.

Our

Corporate Structure

| |

● |

Dogness

(International) Corporation, a British Virgin Islands business company (“Dogness”), which is the parent holding company

issuing securities hereby; |

| |

|

|

| |

● |

Dogness

Overseas Ltd (“Dogness Overseas”), a British Virgin Islands business company, which is a wholly owned subsidiary of Dogness. |

| |

|

|

| |

● |

Dogness

Group LLC (“Dogness Group”), a Delaware limited company, which is a wholly owned subsidiary of Dogness Overseas; |

| |

|

|

| |

● |

Jiasheng

Enterprise (Hongkong) Co., Limited, a Hong Kong company (“HK Jiasheng”), which is a wholly owned subsidiary of Dogness; |

| |

|

|

| |

● |

Dogness

(Hongkong) Pet’s Products Co., Limited, a Hong Kong company (“HK Dogness”), which is a wholly owned subsidiary

of Dogness; |

| |

|

|

| |

● |

Dogness

Intelligent Technology (Dongguan) Co., Ltd., a PRC company (“Dongguan Dogness”), which is a wholly owned subsidiary of

HK Dogness; |

| |

|

|

| |

● |

Dongguan

Jiasheng Enterprise Co., Ltd., a PRC company (“Dongguan Jiasheng”), which is a wholly owned subsidiary of Dongguan Dogness; |

| |

|

|

| |

● |

Zhangzhou

Meijia Metal Product Co., Ltd, a PRC company (“Meijia”), which is a Wholly owned subsidiary of Dongguan Dogness; |

| |

|

|

| |

● |

Dogness

Intelligence Technology Co., Ltd. (“Intelligence Guangzhou”), a PRC company, and Dongguan Jiasheng owns 58% of the equity

of Intelligence Guangzhou; and |

| |

|

|

| |

● |

Dogness

Pet Culture (Dongguan) Co., Ltd. (“Dogness Culture”), a PRC company, and Dongguan Dogness owns 51.2%

of the equity of Dogness Culture. |

Permission

Required from the PRC Authorities for the Company’s Operation and to Issue Our Class A Common Shares to Foreign Investors

As

of the date of this prospectus supplement, we and our Subsidiaries have obtained all permits and licenses that are required by Chinese

authorities for our Subsidiaries to operate in China and for us to offer the securities being registered to foreign investors. Below

is a list of the required permits and licenses:

| |

● |

Business

Licenses |

| |

● |

Food

Distribution License |

| |

● |

Pollutant

Discharge Permit |

| |

● |

License

for the Discharge of Sewage into Drainage Pipelines |

| |

● |

Veterinary

Drugs Distribution Permit |

As

of the date of this prospectus supplement, all our Subsidiaries in the PRC have obtained the required business licenses from the State

Administration for Market Regulation for their operations, and all such licenses are currently in effect. Further, Meijia obtained a

Food Distribution License from the Zhangpu County Administration for Market Regulation on December 23, 2019, with a term of five years

till December 22, 2024, for its catering services provided to its workers at the cafeteria, and a Pollutant Discharge Permit for the

operation of the Meijia plant from the Zhangpu Ecological Environment Bureau of Zhangzhou City on June 20, 2019, with a term of three

years till June 19, 2022. Dongguan Jiasheng obtained a License for the Discharge of Sewage into Drainage Pipelines from the Ecological

Environment Bureau of Dongguan City on May 21, 2021, effective till May 20, 2026, for its manufacturing operations. Dogness Culture obtained

a Veterinary Drugs Distribution Permit from the Bureau of Agriculture and Rural Affairs of Dongguan City on April 27, 2021, effective

till April 27, 2026, for its importing and distributing pet drugs.

Pursuant

to the Food Safety Law of the PRC and the Administrative Measures for Food Distribution Licensing, a permit is required for vendors

engaging in the sale of food and catering services. Meijia provides catering services to its workers at its cafeteria and has

obtained the Food Distribution License. In the event that Meijia could not maintain or renew such license but continues to engage in

catering services, it would be subject to the confiscation of the illegal income, the illegally distributed food, and the tools,

equipment, raw materials and other items that are used in the illegal distribution activities (“Goods Used”), as well as

a fine of no less than RMB 50,000 but no more than RMB 100,000 if the illegally distributed food was worth no more than RMB 10,000,

or a fine of no less than ten times but no more than twenty times of the value of the Goods Used if such value is no less than RMB

10,000.

Pursuant

to the Environmental Protection Law of the PRC and the Regulation on the Permit Administration of Pollutant Discharge, a business operator

which is subject to the permit administration of pollutant discharge, such as Meijia, shall obtain a pollutant discharge permit. If Meijia

fails to maintain or renew such permit and continues to discharge pollutant, it would be subject to an order of rectification, restriction

on production, or suspension of production for rectification, and a fine of no less than RMB 2 million and no more than RMB 10 million;

in case of serious violation, upon the approval of the competent people’s government, it may be ordered to suspend or cease its

business.

Pursuant

to the Regulations on Urban Drainage and Sewage Treatment and the Administrative Measures for the Licensing of Discharge of Urban Sewage

into the Drainage Pipelines, any person or entity engaging in industry, construction, catering, medical services and other activities

(the “drainage entity”) that discharges sewage into municipal drainage facilities shall apply to the competent authority

for a license authorizing the sewage being discharged into drainage pipelines (the “Sewage Discharge License”), the violation

of which could subject the drainage entity to (i) an order to cease the illegal act and take measures to remedy within the prescribed

time, (ii) an obligation to apply for the Sewage Discharge License, and (iii) potentially, a fine of no more than RMB 500,000. Further,

if the drainage entity does not discharge sewage in accordance with the requirements specified by the Sewage Discharge License, it shall

be ordered to cease the illegal act and rectify within the prescribed time, and may be subject to a fine of no more than RMB 50,000;

in case of serious violations, its Sewage Discharge License shall be revoked, and it shall be subject to a fine of more than RMB 50,000

but less than RMB 500,000, and the public can be informed of its violations. In the event of violations that cause damages, the drainage

entity shall bear the compensation liability, and if a violation constitutes a criminal act, the drainage entity shall bear the relevant

criminal liability. Dongguan Jiasheng has obtained the Sewage Discharge License and it is currently effective.

Pursuant

to the Regulations on the Administration of Veterinary Drugs, an enterprise that engages in the distribution of veterinary drugs shall

obtain a veterinary drugs distribution permit, violation of which may subject the enterprise to penalties including suspension of operation,

confiscation of the raw materials, auxiliary materials and packing materials used in the distribution of the veterinary drugs and the

illegal income related, and a fine worth no less than twice but no more than five times of the value of the illegally distributed veterinary

drugs. If the value of such goods cannot be verified, the enterprise shall be subject to a fine of more than RMB 100,000 but less than

RMB 200,000. In case of serious violation, the enterprise shall be subject to the revocation of the veterinary drug distribution permit

and may be subject to criminal liability. Dogness Culture has obtained a Veterinary Drugs Distribution Permit which is currently in effect.

As

of the date of this prospectus supplement, except for the potential uncertainties disclosed below, we and our Subsidiaries have not received

any requirements to obtain permissions from any PRC authorities , including the China Securities Regulatory Commission (“CSRC”)

and the Cyberspace Administration of China (“CAC”), to operate in China or to issue our Class A Common Shares to foreign

investors. In reaching this conclusion, we relied on an opinion of our PRC counsel, and a consent from the PRC counsel has been filed

on a Form 6-K in connection with this offering.

On

August 8, 2006, six Chinese regulatory agencies, including the Ministry of Commerce of China (“MOFCOM”), jointly issued the

Regulations on Mergers and Acquisitions of Domestic Enterprises by Foreign Investors (the “M&A Rules”), which became

effective on September 8, 2006 and amended on June 22, 2009. The M&A Rules contain provisions that require that an offshore special

purpose vehicle (“SPV”) formed for listing purposes and controlled directly or indirectly by Chinese companies or individuals

shall obtain the approval of CSRC prior to the listing and trading of such SPV’s securities on an overseas stock exchange. On September

21, 2006, CSRC published procedures specifying documents and materials required to be submitted to it by an SPV seeking CSRC approval

of overseas listings. However, the application of the M&A Rules remains unclear with no consensus currently existing among leading

Chinese law firms regarding the scope and applicability of the CSRC approval requirement. We have not chosen to voluntarily request approval

under the M&A Rules. Based on the understanding of the current PRC law, rules and regulations, given that Dogness was not established

by a merger with or an acquisition of any PRC domestic companies as defined under the M&A Rules, we believe that, as of the date

of this prospectus supplement, CSRC’s approval under the M&A Rules is not required for the listing and trading of our Common

Shares on Nasdaq in the context of this offering. However, our PRC legal counsel has further advised us that there remains some uncertainty

as to how the M&A Rules will be interpreted or implemented, and our understanding summarized above is subject to any new laws, rules

and regulations or detailed implementations and interpretations in any form relating to the M&A Rules. We cannot assure you that

relevant Chinese government agencies, including the CSRC, would reach the same conclusion.

On

February 7, 2021, the Anti-Monopoly Committee of the State Council promulgated the Anti-Monopoly Guidelines for the Platform Economy

Sector, or the Anti-Monopoly Guideline, aiming to improve anti-monopoly administration on online platforms. The Anti-Monopoly Guideline,

operating as the compliance guidance under the then-existing PRC anti-monopoly regulatory regime for platform economy operators, specifically

prohibits certain acts of the platform economy operators that may have the effect of eliminating or limiting market competition, such

as concentration of undertakings. The Anti-Monopoly Guideline requires that the Ministry of Commerce, or MOC, shall be notified in advance

of any concentration of undertaking if certain thresholds are triggered. In addition, the security review rules issued by the MOC that

became effective in September, 2011 specify that mergers and acquisitions by foreign investors that raise “national defense and

security” concerns and mergers and acquisitions through which foreign investors may acquire de facto control over domestic enterprises

that raise “national security” concerns are subject to strict review by the MOC, and the rules prohibit any activities attempting

to bypass a security review, including by structuring the transaction through a proxy or contractual control arrangement. In the future,

we may grow our business by acquiring complementary businesses. Complying with the requirements of the above-mentioned regulations and

other relevant rules to complete such transactions could be time consuming, and any required approval processes, including obtaining

approval from the MOC or its local counterparts, may delay or inhibit our ability to complete such transactions, which could affect our

ability to expand our business or maintain our market share.

On

July 6, 2021, the General Office of the Central Committee of the Communist Party of China and the General Office of the State Council

jointly released the Opinions on Severely Cracking Down on Illegal Securities Activities According to Law, or the Opinions. The Opinions

emphasized the need to strengthen the administration over illegal securities activities, and the need to strengthen the supervision over

overseas listings by Chinese companies. Effective measures, such as promoting the construction of relevant regulatory systems will be

taken to deal with the risks and incidents of China-concept overseas listed companies, and cybersecurity and data privacy protection

requirements, etc. Given the current PRC regulatory environment, it is uncertain when and whether we or our PRC subsidiaries, will be

required to obtain permission from the PRC government to list on U.S. exchanges in the future, and even when such permission is obtained,

whether it will be denied or rescinded. We have been closely monitoring regulatory developments in China regarding any necessary

approvals from the CSRC or other PRC governmental authorities required for overseas listings, including this offering. As of the date

of this prospectus supplement, we have not received any inquiry, notice, warning, sanctions or regulatory objection to this offering

from the CSRC or other PRC governmental authorities. However, there remains significant uncertainty as to the enactment, interpretation

and implementation of regulatory requirements related to overseas securities offerings and other capital markets activities.

Notwithstanding

the foregoing, on December 24, 2021, the CSRC issued the Administrative Provisions of the State Council Regarding the Overseas Issuance

and Listing of Securities by Domestic Enterprises (the “Draft Administrative Provisions”) and the Measures for the Overseas

Issuance of Securities and Listing Record-Filings by Domestic Enterprises (Draft for Comments) (the “Draft Filing Measures”),

collectively, the “Draft Rules Regarding Overseas Listings”, which were published for public comments till January 23, 2022.

According to the Draft Rules Regarding Overseas Listings, among other things, after making initial applications with overseas stock markets

for initial public offerings or listings, all China-based companies shall file with the CSRC within three working days. The required

filing materials with the CSRC include (without limitation): (i) record-filing reports and related undertakings, (ii) compliance certificates,

filing or approval documents from the primary regulator of the applicants’ businesses (if applicable), (iii) security assessment

opinions issued by related departments (if applicable), (iv) PRC legal opinions, and (v) prospectus. In addition, overseas offerings

and listings may be prohibited for such China-based companies when any of the following applies: (1) if the intended securities offerings

and listings are specifically prohibited by the laws, regulations or provision of the PRC; (2) if the intended securities offerings and

listings may constitute a threat to, or endanger national security as reviewed and determined by competent authorities under the State

Council in accordance with laws; (3) if there are material ownership disputes over applicants’ equity interests, major assets,

core technologies, or the others; (4) if, in the past three years, applicants’ domestic enterprises or controlling shareholders,

de facto controllers have committed corruption, bribery, embezzlement, misappropriation of property, or other criminal offenses disruptive

to the order of the socialist market economy, or are currently under judicial investigation for suspicion of criminal offenses, or are

under investigation for suspicion of major violations; (5) if, in the past three years, any directors, supervisors, or senior executives

of applicants have been subject to administrative punishments for severe violations, or are currently under judicial investigation for

suspicion of criminal offenses, or are under investigation for suspicion of major violations; (6) other circumstances as prescribed by

the State Council. The Draft Administrative Provisions further stipulate that a fine between RMB 1 million and RMB 10 million may be

imposed if an applicant fails to fulfill the filing requirements with the CSRC or conducts an overseas offering or listing in violation

of the Draft Rules Regarding Overseas Listings, and in cases of severe violations, a parallel order to suspend relevant businesses or

halt operations for rectification may be issued, and relevant business permits or operational license revoked.

As

of the date of this prospectus supplement, the Draft Rules Regarding Overseas Listings have not been promulgated, and neither us nor

any of our Subsidiaries has been required to obtain permission from, or make filings with, the CSRC or any Chinese governmental agencies

for any of our U.S. offerings. While the final version of the Draft Rules Regarding Overseas Listings is expected to be adopted in 2022,

we believe that none of the six situations that would clearly prohibit overseas offering and listings apply to us. In reaching this conclusion,

we are relying on an opinion of our PRC counsel and that there is uncertainty inherent in relying on an opinion of counsel in connection

with whether we or our Subsidiaries are required to obtain permissions from the Chinese government that is required to approve of our

operations and/or offering. Further, the Draft Rules Regarding Overseas Listings, if enacted, may subject us or our Subsidiaries to additional

compliance requirements for our follow-on offerings in the future. In the event that we or any of our Subsidiaries are subject to the

compliance requirements, we cannot assure you that any of us will be able to receive clearance of such filing requirements in a timely

manner, or at all. Any failure of us or our Subsidiaries to fully comply with new regulatory requirements may significantly limit or

completely hinder our ability to offer or continue to offer our Class A Common Shares, cause significant disruption to our business operations,

severely damage our reputation, materially and adversely affect our financial condition and results of operations and cause our Class

A Common Shares to significantly decline in value or become worthless. See “Risk Factor — Draft rules for China-based

companies seeking for securities offerings in foreign stock markets was released by the CSRC for public consultation. While such rules

have not yet come into effect, the Chinese government may exert more oversight and control over overseas public offerings conducted by

China-based issuers, which could significantly limit or completely hinder our ability to offer or continue to offer our Class A Common

Shares to investors and could cause the value of our Class A Common Shares to significantly decline or become worthless.”;

“Risk Factor — Our failure to obtain prior approval of the China Securities Regulatory Commission (“CSRC”)

for the listing and trading of our Class A Common Shares on a foreign stock exchange could delay this offering or could have a material

adverse effect upon our business, operating results, reputation and trading price of our Class A Common Shares”.

We

or our Subsidiaries may also be subject to PRC laws relating to the use, sharing, retention, security and transfer of confidential and

private information, such as personal information and other data. On November 14, 2021, the Cyberspace Administration of China (“CAC”)

released the Regulations on the Network Data Security Management (Draft for Comments), or the Data Security Management Regulations Draft,

to solicit public opinion and comments. Pursuant to the Data Security Management Regulations Draft, data processor holding more than

one million users/users’ individual information shall be subject to cybersecurity review before listing abroad. Data processing

activities refers to activities such as the collection, retention, use, processing, transmission, provision, disclosure, or deletion

of data. According to the latest amended Cybersecurity Review Measures, which was promulgated on December 28, 2021, and became effective

on February 15, 2022, and replace the Cybersecurity Review Measures promulgated on April 13, 2020, an online platform operator holding

more than one million users/users’ individual information shall be subject to cybersecurity review before listing abroad. As of

the date of this prospectus supplement, we have not been informed by any PRC governmental authority of any requirement that we or our

Subsidiaries file for approval for this offering. We don’t believe that we or any of our Subsidiaries will be subject to either

the amended Cybersecurity Review Measures or the Data Security Management Regulations Draft since none of us hold more than one million

users/users’ individual information. However, it is uncertain how the above-mentioned new laws or regulations will be enacted,

interpreted or implemented, and whether it will affect us. Since the regulatory actions are new, it is highly uncertain how soon legislative

or administrative regulation making bodies will respond and what existing or new laws or regulations or detailed implementations and

interpretations will be modified or promulgated, if any, and the potential impact such modified or new laws and regulations will have

on our Subsidiaries’ daily business operation, their ability to accept foreign investments, and our ability to list or offer securities

on an U.S. exchange.

In

addition, according to the Personal Information Protection Law issued by Standing Committee of the National People’s Congress of

the PRC on August 20, 2021, where the purpose of the activity is to provide a product or service to that natural person located within

China, such activity shall comply with the Personal Information Protection Law. Further, the Data Security Law, which took effect in

September 2021, provides that where any data handling activity carried out outside of the territory of China harms the national security,

public interests, or the legitimate rights and interests of citizens or organizations of China, legal liability shall be investigated

in accordance with such law. As of the date hereof, we are of the view that we and our Subsidiaries are in compliance with the applicable

PRC laws and regulations governing the data privacy and personal information in all material respects, including the data privacy and

personal information requirements of the CAC, and we and our Subsidiaries have not received any complaints from any third party, or been

investigated or punished by any PRC competent authority in relation to data privacy and personal information protection. In reaching

this conclusion, we and our Subsidiaries have adopted corresponding internal control measures to ensure the security of our information

system and confidentiality of our customers’ personal information, including, but not limited to the followings:

| |

● |

We

and our Subsidiaries provide training to our employees to ensure that they are aware of our internal policies in relation to data

protection. |

| |

|

|