Dime Community Bancshares, Inc. Provides Status Update on Loan Deferrals

January 12 2021 - 9:00AM

Dime Community Bancshares, Inc. (NASDAQ: DCOM) (the “Company” or

“Dime” or “its”), the parent company of Dime Community Bank (the

“Bank”), announced today a status update on loan deferrals within

its portfolio. The Company is seeing positive trends as loans

continue to exit deferment.

As of December 31, 2020, Principal and Interest (“P&I”)

deferrals decreased to $37.1 million or 0.7% of the total loan

portfolio. An additional 3.4% of our portfolio is comprised of

loans that are paying full interest and escrow, and only deferring

principal payments.

Mr. Kenneth J. Mahon, Chief Executive Officer (“CEO”) of the

Company, commented, “We are encouraged by the positive trends we

are seeing in our loan portfolio. The decrease in our deferrals is

a result of our ability to work closely with our borrowers towards

reasonable resolutions.”

ABOUT DIME COMMUNITY BANCSHARES,

INC.The Company had $6.62 billion in consolidated assets

as of September 30, 2020. The Bank was founded in 1864, is

headquartered in Brooklyn, New York, and currently has 28 retail

branches located throughout Brooklyn, Queens, the Bronx, Nassau and

Suffolk Counties, New York. More information on the Company and the

Bank can be found on Dime's website at www.dime.com.

Contact: Avinash

ReddySenior Executive Vice President – Chief

Financial Officer718-782-6200 extension

5909

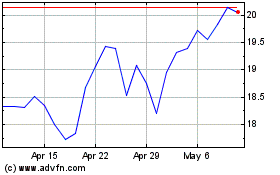

Dime Community Bancshares (NASDAQ:DCOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

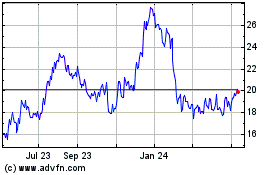

Dime Community Bancshares (NASDAQ:DCOM)

Historical Stock Chart

From Apr 2023 to Apr 2024