Current Report Filing (8-k)

April 16 2020 - 7:32AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 9, 2020

DESTINATION XL GROUP, INC.

(Exact name of Registrant as Specified in Its Charter)

|

Delaware

|

01-34219

|

04-2623104

|

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission File Number)

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

555 Turnpike Street,

Canton, Massachusetts

|

|

02021

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s Telephone Number, Including Area Code: (781) 828-9300

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act.

|

|

|

|

|

Title of each class

|

Trading symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 par value

|

DXLG

|

NASDAQ Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On April 15, 2020, Destination XL Group, Inc. (the “Company”) amended its credit facility with Bank of America, N.A, as amended (the “Credit Agreement”) by executing the Third Amendment to Seventh Amended and Restated Credit Agreement (the “Third Amendment”).

The Third Amendment amends, among other things:

|

|

•

|

the definition of “Permitted Indebtedness” to permit the Company the ability to enter into promissory notes with merchandise vendors in satisfaction of outstanding accounts payable for existing goods, in an aggregate amount not to exceed $15.0 million;

|

|

|

•

|

the financial covenant such that it is no longer a “springing” financial covenant but now requires that Availability at any time cannot be less than the greater of (i) 10% of the Revolving Loan Cap (calculated without giving effect to the FILO (first-in, last-out) Push Down Reserve) or (ii) $10.0 million. Previously, the “springing” financial covenant was dependent on the Availability not being less than the greater of (i) 12.5% of the Revolving Loan Cap (calculated without giving effect to the FILO Push Down Reserve) or (ii) $7.5 million;

|

|

|

•

|

the FILO Advance Rates, which step-down over time, to extend the applicable advance rate for the first step by approximately seven months. As such, the 10% FILO Advance Rate was extended from May 24, 2020 to December 31, 2020, then it will decrease to 7.5% through May 24, 2021 and then to 5% for the remainder of the term of the first-in, last-out term loan facility (“FILO Facility”);

|

|

|

•

|

the FILO IP Advance Rate, which steps-down over time, to extend the applicable advance rates for the first step by approximately seven months. As such, the 50% FILO IP Advance Rate was extended from May 24, 2020 to December 31, 2020, then it will decrease to 45% through May 24, 2021, then it will decrease to 40% through May 24, 2022 and then to 35% for the remainder of the FILO Facility term;

|

|

|

•

|

the Applicable Margins for the Company’s revolving loan facility (“Revolving Facility”) and its FILO Facility to increase the respective Applicable Margins for both LIBOR and Base Rate Loans by 150 basis points effective as of the date of the Third Amendment;

|

|

|

•

|

the definition of “LIBOR Rate” to add a “LIBOR Floor” of 1.00% per annum;

|

|

|

•

|

the Company’s ability to declare or make Restricted Payments to state that no such payments may be made until after December 31, 2020, and thereafter subject to the conditions set forth in the Credit Agreement; and

|

|

|

•

|

the Company’s covenants to add an Excess Cash Amount requirement, which states that at no time when the Availability is less than 15% of the Borrowing Base shall the aggregate of the Company’s DDA accounts exceed $1.0 million.

|

The foregoing description of the Third Amendment does not purport to be complete and is qualified in its entirety by reference to the full text of the Third Amendment, which is filed herewith as Exhibit 10.1 and is incorporated herein by reference.

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On April 9, 2020, the Company received a letter (the “Notice”) from the Listing Qualifications staff of The Nasdaq Stock Market LLC (“Nasdaq”) indicating that, based upon the closing bid price of the Company’s common stock for the last 30 consecutive business days, the

2

Company no longer meets the requirement to maintain a minimum consolidated closing bid price of $1.00 per share, as set forth in Nasdaq Listing Rule 5450(a)(1).

In accordance with Nasdaq Listing Rule 5810(c)(3)(A), the Company has been provided a period of 180 calendar days, or until October 6, 2020, in which to regain compliance. In order to regain compliance with the minimum bid price requirement, the consolidated closing bid price of the Company’s common stock must be at least $1.00 per share for a minimum of ten consecutive business days during this 180-day period. In the event that the Company does not regain compliance within this 180-day period, the Company may be eligible to seek an additional compliance period of 180 calendar days if it (i) transfers its listing to the Nasdaq Capital Market and (ii) meets the continued listing requirement for market value of publicly held shares and all other initial listing standards for the Nasdaq Capital Market, with the exception of the bid price requirement, and provides written notice to Nasdaq of its intent to cure the deficiency during this second compliance period, by effecting a reverse stock split, if necessary. However, if it appears to Nasdaq that the Company will not be able to cure the deficiency, or if the Company is otherwise not eligible, Nasdaq will provide notice to the Company that its common stock will be subject to delisting.

The Notice does not result in the immediate delisting of the Company’s common stock from the Nasdaq Global Select Market. The Company intends to monitor the closing bid price of the Company’s common stock to allow a reasonable period for the price to rebound from its recent decline but will continue to consider its available options to regain compliance. There can be no assurance that the Company will be able to regain compliance with the minimum bid price requirement or maintain compliance with the other listing requirements.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

Exhibit No.Description

|

10.1

|

Third Amendment to Seventh Amended and Restated Credit Agreement dated as of April 15, 2020, by and among Bank of America, N.A., as Administrative Agent and Collateral Agent, the Lenders identified therein, the Company, as Lead Borrower, the Company and CMRG Apparel, LLC, as Borrowers, and the Guarantors identified therein.

|

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

DESTINATION XL GROUP, INC.

|

|

Date:

|

April 16, 2020

|

By:

|

/s/ Robert S. Molloy

|

|

|

|

|

Robert S. Molloy

|

|

|

|

|

Chief Administrative Officer, General Counsel and Secretary

|

4

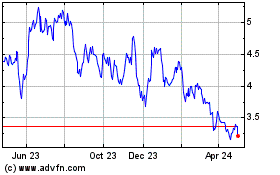

Destination XL (NASDAQ:DXLG)

Historical Stock Chart

From Mar 2024 to Apr 2024

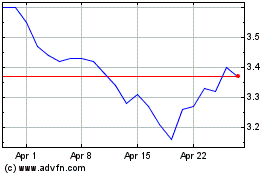

Destination XL (NASDAQ:DXLG)

Historical Stock Chart

From Apr 2023 to Apr 2024