Amended Statement of Beneficial Ownership (sc 13d/a)

December 16 2022 - 5:07PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 1)*

Delcath

Systems, Inc.

(Name of Issuer)

Common Stock, par value $0.01 per share

(Title of Class of Securities)

24661P807

(CUSIP Number)

McCarter & English, LLP

Four Gateway Center

100

Mulberry Street

Newark, New Jersey 07102

Attention: Veronica H. Montagna

973-639-7948

(Name,

Address and Telephone Number of Person Authorized to Receive Notices and Communications)

December 13, 2022

(Date of Event which Requires Filing of this Statement)

If the filing

person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following

box. ☐

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form

with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the

Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

|

|

|

|

| CUSIP No. 24661P807 |

|

13D |

|

Page

2

of 5 Pages |

|

|

|

|

|

|

|

| 1. |

|

NAME(S) OF REPORTING PERSON(S) I.R.S.

IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY) Gerard

Michel |

| 2. |

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP (see instructions) (a) ☐ (b) ☐

|

| 3. |

|

SEC USE ONLY

|

| 4. |

|

SOURCE OF FUNDS (see

instructions) PF |

| 5. |

|

CHECK BOX IF DISCLOSURE OF

LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

☐ |

| 6. |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION United

States |

|

|

|

|

|

|

|

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7. |

|

SOLE VOTING POWER

676,477 (1) |

| |

8. |

|

SHARED VOTING POWER

0 |

| |

9. |

|

SOLE DISPOSITIVE POWER

676,477 (1) |

| |

10. |

|

SHARED DISPOSITIVE POWER

0 |

|

|

|

|

|

|

|

| 11. |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

676,477 (1) |

| 12. |

|

CHECK BOX IF THE AGGREGATE

AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions)

☐ |

| 13. |

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW (11) 6.7% (2) |

| 14. |

|

TYPE OF REPORTING PERSON

(see instructions) IN |

| (1) |

Includes 177,589 shares of common stock, and 498,888 shares of common stock which may be acquired by the

Reporting Person upon the exercise of stock options that are currently exercisable or will become exercisable within 60 days of the date of the event reported on the cover page of this Statement. |

| (2) |

Based on 10,046,571 shares of the Issuer’s common stock issued and outstanding as of December 13,

2022 (which consists of (i) 8,597,682 shares of common stock outstanding as of November 2, 2022 as reported in the Issuer’s Quarterly Report on Form 10-Q for the fiscal quarter ended

September 30, 2022 filed on November 8, 2022 plus (ii) 1,448,889 shares sold in a private placement transaction on December 13, 2022 discussed herein below and reported in the Issuer’s Form 8-K filed on

December 13, 2022). |

2

|

|

|

|

|

| CUSIP No. 24661P807 |

|

13D |

|

Page

3

of 5 Pages |

Explanatory Note

This statement constitutes Amendment No. 1 (“Amendment No. 1”) to the Statement on Schedule 13D filed on July 27,

2022 (the “Original Schedule 13D”) by Gerard Michel (the “Reporting Person”) relating to his beneficial ownership of the common stock, par value $0.01 per share (the “Common Stock”), of Delcath Systems, Inc., a Delaware

corporation (the “Company”).

In accordance with Rule 13d-2 of the Securities Exchange

Act of 1934, as amended, this Amendment No. 1 amends and supplements only information that has materially changed since the filing of the Original Schedule 13D, including the disclosure of the number of shares of the Company’s Common Stock

beneficially owned or deemed to be beneficially owned by the Reporting Person. Unless otherwise stated, the information set forth in the Original Schedule 13D remains accurate in all material respects.

Item 4. Purpose of Transaction.

Item 4 is hereby amended and supplemented by adding the following:

On December 13, 2022, the Company and certain accredited investors, including the Reporting Person, entered into a securities purchase

agreement (the “Securities Purchase Agreement”) pursuant to which the Company agreed to sell and issue to the investors in a private placement (the “Private Placement”): (i) an aggregate of 1,448,889 shares of Common Stock at a

purchase price of $2.90 per share and (ii) in lieu of shares of Common Stock, 692,042 pre-funded warrants to purchase Common Stock at a purchase price of $2.89 per

pre-funded warrant, which pre-funded warrants have an exercise price of $0.01 per share of Common Stock and are immediately exercisable and remain exercisable until

exercised in full. The Reporting Person purchased and was issued 51,725 shares of Common Stock in the Private Placement, which closed on December 13, 2022.

In connection with the Private Placement, the Company and the investors entered into a registration rights agreement dated December 7,

2022 (the “Registration Rights Agreement”), providing for the registration for resale of the securities (including the shares of Common Stock underlying the pre-funded warrants) issued under the

Securities Purchase Agreement that are not then registered on an effective registration statement, pursuant to a registration statement to be filed with the Securities and Exchange Commission on or prior to February 6, 2023.

The foregoing descriptions of the Securities Purchase Agreement and the Registration Rights Agreement do not purport to be complete and are

qualified in their entirety by reference to the Securities Purchase Agreement and Registration Rights Agreement, copies of which are filed as Exhibits A and B hereto and incorporated herein by reference.

The Reporting Person holds the Common Stock for investment purposes. The Securities Purchase Agreement and the Registration Rights Agreement

were not entered into, and the shares of Common Stock were not acquired by the Reporting Person, and are not held by the Reporting Person for the purpose or with the effect of changing or influencing the control of the Company. The Reporting Person

may, from time to time, acquire additional shares of Common Stock and/or retain and/or sell all or a portion of the shares of Common Stock held by the Reporting Person in open market or in privately negotiated transactions, and/or may distribute the

3

|

|

|

|

|

| CUSIP No. 24661P807 |

|

13D |

|

Page

4

of 5 Pages |

Common Stock held by the Reporting Person to other persons. All transactions involving Common Stock by the Reporting Person are subject to the Company’s policies, including its policies with

respect to insider trading. Except as set forth above, the Reporting Person has no present plans or intentions which would result in or relate to any of the transactions described in subparagraphs (a) through (j) of Item 4 of Schedule 13D.

Item 5. Interest in Securities of the Issuer.

| |

(a, b) |

For information regarding beneficial ownership, see the information presented on the cover page of this

Schedule 13D. |

| |

(c) |

Except for the shares of Common Stock purchased by the Reporting Person pursuant to the Securities Purchase

Agreement, the Reporting Person has not effected any transaction relating to the Company’s Common Stock during the past 60 days. |

Item 6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.

The information set forth, or incorporated by reference, in Items 4 and 5 above is hereby incorporated by this reference in this Item

6. To the Reporting Person’s knowledge, except as otherwise described in Item 4 hereof and in Item 4 of the Original Schedule 13D, there are no contracts, arrangements, understandings or relationships (legal or otherwise) between the

Reporting Person and any person with respect to any securities of the Company, including but not limited to transfer or voting of any of the securities, finder’s fees, joint ventures, loan or option arrangements, puts or calls, guarantees of

profits, division of profits or loss, or the giving or withholding of proxies.

Item 7. Material to Be Filed as Exhibits.

4

|

|

|

|

|

| CUSIP No. 24661P807 |

|

13D |

|

Page

5

of 5 Pages |

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

Dated: December 16, 2022

|

|

|

| By: |

|

/s/ Gerard Michel |

|

|

Gerard Michel |

5

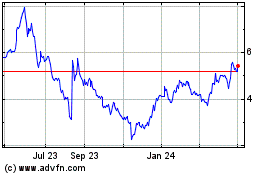

Delcath Systems (NASDAQ:DCTH)

Historical Stock Chart

From Mar 2024 to Apr 2024

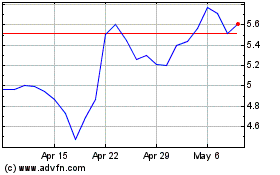

Delcath Systems (NASDAQ:DCTH)

Historical Stock Chart

From Apr 2023 to Apr 2024