Datasea Reports Second Quarter Fiscal Year 2022 Earnings and Provides Business Updates

February 11 2022 - 8:30AM

Datasea Inc. (NASDAQ: DTSS) (“Datasea” or the “Company”),

incorporated in Nevada in September 2014, is a digital technology

corporation engaged in three converging and innovative business

segments: 5G messaging, acoustic intelligence and smart city in

China, today announced financial results for the quarter ended

December 31, 2021 and provided an update on its key strategic and

operational initiatives.

“Datasea had a solid quarter as our 5G messaging business

started to demonstrate its great value and capability to

improve the Company’s competitiveness and create new sources of

revenue and profits. As one of the first movers in this industry,

Datasea has been a leading 5G messaging service provider in China.

We will continue to leverage our advantages of entering the market

early to build brand recognition and customer loyalty,” said Zhixin

Liu, CEO of Datasea. “Benefiting from our proprietary technologies

and great synergy effects among the business lines, such as

acoustic intelligence and smart city, we believe that our business

development is on track and is supported by a strong product

portfolio. Datasea’s business goals are to focus on the sustainable

development, and we are integrating it into every business

decision.”

Second Quarter 2022 Financial Highlights

- Revenue was $8,979,479 and $126,184 for the three months ended

December 31, 2021 and 2020, respectively, representing an increase

of $8,853,295, or 7016%.

- Gross profit was $246,299 and $86,070 for the three months

ended December 31, 2021 and 2020, respectively, representing an

increase of $160,229, or 186%. The increase in gross profit was

mainly due to the delivery of services related to the 5G SMS

service platform in 2021.

- R&D expenses were $432,355 and $134,509 for the three

months ended December 31, 2021 and 2020, respectively, representing

an increase of $297,846, or 221%.

- 5G messaging sales revenue increased more than 900% this

quarter, compared with the immediate prior quarter ended September

30, 2021, representing nine-month consecutive growth.

Second Quarter 2022 Business Highlights

5G Messaging

- Client expansion. Since 2021, as a leading

service provider in the field of 5G messaging in China, the Company

has been engaged for services by 100+ institutional clients from

express delivery, catering, tourism, e-commerce, financing, and

technology industry to establish message marketing cloud platform

(“5G MMCP”).

- Marketing and sales expansion. From October

2021 to the end of December 2021, the Company was engaged in

various contracts that were related to SMS, integrated 5G message

marketing cloud platform (“5G IMMCP”) and value-added services,

with a total contract value of approximately $14.73 million, among

which $9.6 million worth of services have been delivered.

- Industry recognition. In December 2021, the

Company assisted ZTO Express to complete the first placement order

through 5G messaging services in express delivery industry. The

Company cooperated with the National Engineering Laboratory for

Logistics Information Technology (“National Engineering

Laboratory”), and continually worked to promote the formulation of

5G Messaging standards in the express industry.

Acoustic Intelligence

The Company commits to tap acoustic intelligence’s full business

potential and wield acoustic intelligence across industries in

meaningful ways.

- Research Partnerships. The Company has entered

into partnerships with top-notch institutions in this area,

equipped itself with solid R&D capability, and released China’s

inaugural white paper “Industry Development and Technology

Application of Acoustic Intelligence in China” with co-authors,

Institute of Cloud Computing and Big Data, China Academy of

Information and Communications Technology.

- Product lineup. Currently, the Company has

four flagship products to unfold the commercial possibilities of

acoustic intelligence in the most wanted areas such as health,

security, and environment protection. These products are 1)

ultrasonic sound sterilization and antivirus equipment (the

first-ever sterilization and antivirus equipment that combines

ultrasonic sound effects with optics to address the Covid-19

disinfecting needs); 2) Tianer voice recognition alarm; 3)

directional sound recognizer (a solution for noise pollution); 4)

sound effect refreshing directional sound device. Datasea has

prepared samples, completed laboratory tests and user pilot tests,

entered mass production to varying degrees for these products, and

they are expected to be introduced to the market in the fiscal year

of 2022.

Smart City

- Client expansion. From October 2021 to the end

of December 2021, the Company was engaged in various contracts that

were related to smart community solutions and food safety

supervision system of the Smart Canteen.

- Product update. The Company recently laid out

a series of upgrades to meet with the client needs in different

scenarios and enhance the system’s analysis efficiency and

integration capability.

Webcast and Conference Call Information

The Company will host a conference call and webcast to discuss

its financial results at 8 a.m. ET (9 p.m. Beijing and Hong Kong

Time) on Monday, February 14, 2022.

Dial-in details for the earnings conference call are as

follows:

| Toll

Free: 1-877-451-6152 |

|

Toll/International: 1-201-389-0879 |

| |

Participants should dial-in at least 5 minutes before the

scheduled start time. Additionally, a live webcast of the

conference call will be available at:

https://viavid.webcasts.com/starthere.jsp?ei=1530184&tp_key=e52c484915

A replay of the conference call will be accessible approximately

soon after the conclusion of the live, by dialing the following

telephone numbers:

| Toll

Free: 1-844-512-2921Toll/International: 1-412-317-6671Replay

Pin Number: 13727206Replay Start: Monday February 14,

2022, 11:00 AM ETReplay Expiry: Monday February 21, 2022,

11:59 PM ET |

| |

About Datasea Inc. Datasea Inc., through its

variable interest entity, Shuhai Information Technology Co., Ltd.,

a digital technology company in China, engages in three converging

and innovative industries: smart city, acoustic intelligence and 5G

messaging. Datasea leverages facial recognition technology and

other visual intelligence algorithms, combined with cutting-edge

acoustic and non-visual intelligence algorithms, to provide smart

city solutions that meet the security needs of residential

communities, schools and commercial enterprises. Most recently, in

response to the growing utilization of 5G technologies and the

overall initiative to utilize Datasea’s technology capabilities to

expand business coverage and revenue resources, Datasea has also

strategically expanded business coverage to 5G messaging and smart

payment solutions. Datasea has been certified as one of the High

Tech Enterprises (jointly issued by the Beijing Science and

Technology Commission, Beijing Finance Bureau, Beijing State

Taxation Bureau and Beijing Local Taxation Bureau) and one of the

Zhongguancun High Tech Enterprises (issued by the Zhongguancun

Science Park Administrative Committee) in recognition of the

company’s achievement in high technology products. For additional

company information, please visit: www.dataseainc.com. Datasea

routinely posts important information on its website.

Cautionary Note Regarding Forward-Looking

Statements This press release contains forward-looking

statements within the meaning of Section 21E of the Securities

Exchange Act of 1934 and as defined in the U.S. Private Securities

Litigation Reform Act of 1995. These forward-looking statements can

be identified by terminology such as "will", "expects",

"anticipates", "future", "intends", "plans", "believes",

"estimates", "target", "going forward", "outlook," “objective” and

similar terms. Such statements are based upon management's current

expectations and current market and operating conditions, and

relate to events that involve known or unknown risks, uncertainties

and other factors, all of which are difficult to predict and which

are beyond Datasea's control, which may cause Datasea's actual

results, performance or achievements (including the RMB/USD value

of its anticipated benefit to Datasea as described herein) to

differ materially and in an adverse manner from anticipated results

contained or implied in the forward-looking statements. Further

information regarding these and other risks, uncertainties or

factors is included in Datasea's filings with the U.S. Securities

and Exchange Commission, which are available at www.sec.gov.

Datasea does not undertake any obligation to update any

forward-looking statement as a result of new information, future

events or otherwise, except as required under law.

Datasea investor and media

Contact:International Elite Capital Inc. Annabelle

ZhangTelephone: +1(646) 866-7989 Email:

datasea@iecapitalusa.com

DATASEA INC.CONSOLIDATED

STATEMENTS OF OPERATIONS AND COMPREHENSIVE

LOSS(UNAUDITED)

| |

|

SIX MONTHS ENDEDDECEMBER 31, |

|

|

THREE MONTHS ENDEDDECEMBER

31, |

|

| |

|

2021 |

|

|

2020 |

|

|

2021 |

|

|

2020 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

|

$ |

9,650,609 |

|

|

$ |

135,239 |

|

|

$ |

8,979,479 |

|

|

$ |

126,184 |

|

| Cost of goods sold |

|

|

9,340,715 |

|

|

|

57,013 |

|

|

|

8,733,180 |

|

|

|

40,114 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

|

309,894 |

|

|

|

78,226 |

|

|

|

246,299 |

|

|

|

86,070 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling |

|

|

386,991 |

|

|

|

174,036 |

|

|

|

156,192 |

|

|

|

119,971 |

|

|

General and administrative |

|

|

2,618,280 |

|

|

|

1,431,972 |

|

|

|

1,498,809 |

|

|

|

812,536 |

|

|

Research and development |

|

|

719,571 |

|

|

|

329,235 |

|

|

|

432,355 |

|

|

|

134,509 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating expenses |

|

|

3,724,842 |

|

|

|

1,935,243 |

|

|

|

2,087,356 |

|

|

|

1,067,016 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from operations |

|

|

(3,414,948 |

) |

|

|

(1,857,017 |

) |

|

|

(1,841,057 |

) |

|

|

(980,946 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-operating income

(expenses) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expenses) |

|

|

5,247 |

|

|

|

(12,202 |

) |

|

|

5,224 |

|

|

|

(19,854 |

) |

|

Interest income |

|

|

32,893 |

|

|

|

1,804 |

|

|

|

12,359 |

|

|

|

208 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total non-operating income

(expenses), net |

|

|

38,140 |

|

|

|

(10,398 |

) |

|

|

17,583 |

|

|

|

(19,646 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss before income tax |

|

|

(3,376,808 |

) |

|

|

(1,867,415 |

) |

|

|

(1,823,474 |

) |

|

|

(1,000,592 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income tax |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss before noncontrolling

interest |

|

|

(3,376,808 |

) |

|

|

(1,867,415 |

) |

|

|

(1,823,474 |

) |

|

|

(1,000,592 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Less: loss attributable to

noncontrolling interest |

|

|

(258,281 |

) |

|

|

(36,555 |

) |

|

|

(146,181 |

) |

|

|

(36,555 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss to the Company |

|

|

(3,118,527 |

) |

|

|

(1,830,860 |

) |

|

|

(1,677,293 |

) |

|

|

(964,037 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other comprehensive item |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Foreign currency translation

gain attributable to the Company |

|

|

69,992 |

|

|

|

112,543 |

|

|

|

74,689 |

|

|

|

54,064 |

|

| Foreign currency translation

gain (loss) attributable to noncontrolling interest |

|

|

2,294 |

|

|

|

(1,390 |

) |

|

|

2,548 |

|

|

|

(1,390 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Comprehensive loss

attributable to the Company |

|

$ |

(3,048,535 |

) |

|

$ |

(1,718,317 |

) |

|

$ |

(1,602,604 |

) |

|

$ |

(909,973 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Comprehensive loss

attributable to noncontrolling interest |

|

$ |

(255,987 |

) |

|

$ |

(37,945 |

) |

|

$ |

(143,633 |

) |

|

$ |

(37,945 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted net loss per

share |

|

$ |

(0.13 |

) |

|

$ |

(0.09 |

) |

|

$ |

(0.07 |

) |

|

$ |

(0.05 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average shares used

for computing basic and diluted loss per share |

|

$ |

23,637,930 |

|

|

$ |

21,088,837 |

|

|

|

23,919,867 |

|

|

|

21,233,829 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DATASEA INC.CONSOLIDATED

BALANCE SHEETS

| |

|

DECEMBER 31, 2021 |

|

|

JUNE 30,2021 |

|

| |

|

(Unaudited) |

|

|

|

|

| |

|

|

|

|

|

|

| ASSETS |

|

|

|

|

|

|

| CURRENT ASSETS |

|

|

|

|

|

|

|

Cash |

|

$ |

2,240,708 |

|

|

$ |

49,676 |

|

|

Accounts receivable |

|

|

5,223,231 |

|

|

|

1,856 |

|

|

Inventory |

|

|

210,808 |

|

|

|

194,264 |

|

|

Value-added tax prepayment |

|

|

156,995 |

|

|

|

171,574 |

|

|

Prepaid expenses and other current assets |

|

|

1,297,321 |

|

|

|

468,615 |

|

|

Total current assets |

|

|

9,129,063 |

|

|

|

885,985 |

|

| |

|

|

|

|

|

|

|

|

| NONCURRENT ASSETS |

|

|

|

|

|

|

|

|

|

Security deposit for rents |

|

|

275,170 |

|

|

|

256,987 |

|

|

Long term investment |

|

|

62,738 |

|

|

|

- |

|

|

Property and equipment, net |

|

|

249,393 |

|

|

|

309,408 |

|

|

Intangible assets, net |

|

|

1,195,303 |

|

|

|

1,092,147 |

|

|

Right-of-use assets, net |

|

|

962,056 |

|

|

|

1,350,590 |

|

|

Total noncurrent assets |

|

|

2,744,660 |

|

|

|

3,009,132 |

|

| |

|

|

|

|

|

|

|

|

| TOTAL

ASSETS |

|

$ |

11,873,723 |

|

|

$ |

3,895,117 |

|

| |

|

|

|

|

|

|

|

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| CURRENT LIABILITIES |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

5,022,008 |

|

|

$ |

174,718 |

|

|

Unearned revenue |

|

|

256,108 |

|

|

|

189,527 |

|

|

Deferred revenue |

|

|

47,053 |

|

|

|

46,439 |

|

|

Accrued expenses and other payables |

|

|

502,909 |

|

|

|

561,674 |

|

|

Due to related party |

|

|

56,541 |

|

|

|

69,305 |

|

|

Loans payable |

|

|

- |

|

|

|

1,486,819 |

|

|

Operating lease liabilities |

|

|

688,520 |

|

|

|

730,185 |

|

|

Total current liabilities |

|

|

6,573,139 |

|

|

|

3,258,667 |

|

| |

|

|

|

|

|

|

|

|

| NONCURRENT LIABILITIES |

|

|

|

|

|

|

|

|

|

Operating lease liabilities |

|

|

229,024 |

|

|

|

558,739 |

|

|

Total noncurrent liabilities |

|

|

229,024 |

|

|

|

558,739 |

|

| |

|

|

|

|

|

|

|

|

| TOTAL LIABILITIES |

|

|

6,802,163 |

|

|

|

3,817,406 |

|

| |

|

|

|

|

|

|

|

|

| COMMITMENTS AND

CONTINGENCIES |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

Common stock, $0.001 par value, 375,000,000 shares authorized,

24,244,130 and 21,474,138 shares issued and outstanding,

respectively |

|

|

24,244 |

|

|

|

21,474 |

|

|

Additional paid-in capital |

|

|

20,382,389 |

|

|

|

12,086,788 |

|

|

Accumulated comprehensive income |

|

|

343,242 |

|

|

|

273,250 |

|

|

Accumulated deficit |

|

|

(15,180,385 |

) |

|

|

(12,061,858 |

) |

|

TOTAL COMPANY STOCKHOLDERS’ EQUITY |

|

|

5,569,490 |

|

|

|

319,654 |

|

| |

|

|

|

|

|

|

|

|

|

Noncontrolling interest |

|

|

(497,930 |

) |

|

|

(241,943 |

) |

| |

|

|

|

|

|

|

|

|

|

TOTAL EQUITY |

|

|

5,071,560 |

|

|

|

77,711 |

|

| |

|

|

|

|

|

|

|

|

| TOTAL LIABILITIES AND

EQUITY |

|

$ |

11,873,723 |

|

|

$ |

3,895,117 |

|

| |

|

|

|

|

|

|

|

|

DATASEA INC.CONSOLIDATED

STATEMENTS OF CASH FLOWS(UNAUDITED)

| |

|

SIX MONTHS ENDEDDECEMBER 31 |

|

| |

|

2021 |

|

|

2020 |

|

| |

|

|

|

|

|

|

| Cash flows from

operating activities: |

|

|

|

|

|

|

|

Loss including noncontrolling interest |

|

$ |

(3,376,808 |

) |

|

$ |

(1,867,415 |

) |

|

Adjustments to reconcile loss including noncontrolling interest to

net cash used in operating activities: |

|

|

|

|

|

|

|

|

|

Loss on disposal on fixed assets |

|

|

460 |

|

|

|

- |

|

|

Depreciation and amortization |

|

|

233,544 |

|

|

|

68,239 |

|

|

Bad debt expense |

|

|

286,055 |

|

|

|

- |

|

|

Operating lease expense |

|

|

435,762 |

|

|

|

369,810 |

|

|

Stock compensation expense |

|

|

294,750 |

|

|

|

- |

|

|

Changes in assets and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

(5,175,377 |

) |

|

|

- |

|

|

Inventory |

|

|

(13,850 |

) |

|

|

(27,296 |

) |

|

Value-added tax prepayment |

|

|

16,702 |

|

|

|

(49,206 |

) |

|

Prepaid expenses and other current assets |

|

|

(1,165,822 |

) |

|

|

(123,475 |

) |

|

Accounts payable |

|

|

4,803,114 |

|

|

|

22,838 |

|

|

Advance from customers |

|

|

63,507 |

|

|

|

- |

|

|

Accrued expenses and other payables |

|

|

191,289 |

|

|

|

89,762 |

|

|

Payment on operating lease liabilities |

|

|

(417,948 |

) |

|

|

(329,549 |

) |

| |

|

|

|

|

|

|

|

|

| Net cash used in operating

activities |

|

|

(3,824,622 |

) |

|

|

(1,846,292 |

) |

| |

|

|

|

|

|

|

|

|

| Cash flows from

investing activities: |

|

|

|

|

|

|

|

|

|

Acquisition of property and equipment |

|

|

(23,787 |

) |

|

|

(91,214 |

) |

|

Acquisition of intangible assets |

|

|

(198,151 |

) |

|

|

(8,482 |

) |

|

Long-term investment |

|

|

(62,186 |

) |

|

|

- |

|

| |

|

|

|

|

|

|

|

|

| Net cash used in investing

activities |

|

|

(284,124 |

) |

|

|

(99,696 |

) |

| |

|

|

|

|

|

|

|

|

| Cash flows from

financing activities: |

|

|

|

|

|

|

|

|

|

Due to related parties |

|

|

(13,391 |

) |

|

|

- |

|

|

Payment of loan payable |

|

|

(1,493,237 |

) |

|

|

- |

|

|

Proceeds from capital contribution from a major shareholder |

|

|

62,186 |

|

|

|

- |

|

|

Net proceeds from issuance of common stock |

|

|

7,681,796 |

|

|

|

931,000 |

|

| |

|

|

|

|

|

|

|

|

| Net cash provided by financing

activities |

|

|

6,237,354 |

|

|

|

931,000 |

|

| |

|

|

|

|

|

|

|

|

| Effect of exchange

rate changes on cash |

|

|

62,424 |

|

|

|

23,449 |

|

| |

|

|

|

|

|

|

|

|

| Net increase

(decrease) in cash |

|

|

2,191,032 |

|

|

|

(991,539 |

) |

| |

|

|

|

|

|

|

|

|

| Cash, beginning of

period |

|

|

49,676 |

|

|

|

1,665,936 |

|

| |

|

|

|

|

|

|

|

|

| Cash, end of

period |

|

$ |

2,240,708 |

|

|

$ |

674,397 |

|

| |

|

|

|

|

|

|

|

|

| Supplemental

disclosures of cash flow information: |

|

|

|

|

|

|

|

|

| Cash paid for interest |

|

$ |

- |

|

|

$ |

- |

|

| Cash paid for income tax |

|

$ |

- |

|

|

$ |

- |

|

| |

|

|

|

|

|

|

|

|

| Supplemental

disclosures of non-cash investing and financing

activities: |

|

|

|

|

|

|

|

|

| Transfer of prepaid software

development expenditure to intangible assets |

|

$ |

50,000 |

|

|

$ |

850,000 |

|

| Right-of-use assets obtained

in exchange for new operating lease liabilities |

|

$ |

- |

|

|

$ |

1,276,944 |

|

| Shares issued for accrued

bonus to officers |

|

$ |

259,023 |

|

|

$ |

- |

|

| |

|

|

|

|

|

|

|

|

IMPORTANT NOTICE TO USERS (summary only, please refer to

the Form 10-Q for full text of notice); All information is

unaudited unless otherwise noted or accompanied by an audit opinion

and is subject to the more comprehensive information contained in

our SEC reports and filings. We do not endorse third-party

information. All information speaks as of the last fiscal quarter

or year for which we have filed a Form 10-K or 10-Q, or for

historical information the date or period expressly indicated in or

with such information. We undertake no duty to update the

information. Forward-looking statements are subject to risks and

uncertainties described in our Forms 10-Q and 10-K.

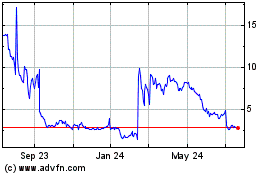

Datasea (NASDAQ:DTSS)

Historical Stock Chart

From Mar 2024 to Apr 2024

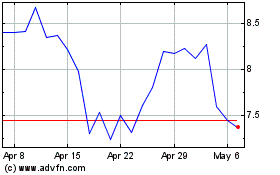

Datasea (NASDAQ:DTSS)

Historical Stock Chart

From Apr 2023 to Apr 2024