Current Report Filing (8-k)

April 30 2021 - 7:04AM

Edgar (US Regulatory)

0001642453

false

0001642453

2021-04-29

2021-04-29

0001642453

us-gaap:CommonStockMember

2021-04-29

2021-04-29

0001642453

dske:WarrantsEachExercisableForOneHalfOfAShareOfCommonStockAtAnExercisePriceOfUSD575PerHalfShareMember

2021-04-29

2021-04-29

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the

Securities Exchange Act of 1934

April 29, 2021

Date

of Report (Date of earliest event reported)

DASEKE, INC.

(Exact name of

registrant as specified in its charter)

|

Delaware

|

|

001-37509

|

|

47-3913221

|

(State or other jurisdiction of

incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

15455 Dallas Parkway, Suite 550

Addison, Texas

|

|

75001

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s

Telephone Number, Including Area Code: (972) 248-0412

Not Applicable

(Former name or

former address, if changed since last report)

Check the appropriate box below if

the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)

Securities registered pursuant to Section 12(b) of

the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.0001 per share

|

|

DSKE

|

|

The NASDAQ Capital Market

|

|

|

|

|

|

|

|

Warrants, each exercisable for one half of a share of Common Stock at an

exercise price of $5.75 per half share

|

|

DSKEW

|

|

The NASDAQ Capital Market

|

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

¨ Emerging

growth company

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act ¨

|

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

On April 29, 2021, Daseke, Inc. (the

“Company”), Daseke Companies, Inc., a wholly-owned subsidiary of the Company, and the Company’s other domestic

subsidiaries party thereto (together with Daseke Companies, Inc., the “Borrowers”) entered into the Fifth Amendment to

Fifth Amended and Restated Revolving Credit and Security Agreement (the “Amendment”) with the financial institutions party

thereto as lenders (the “Lenders”) and PNC Bank, National Association, as agent for the Lenders (the “Agent”),

which amends certain terms of the Fifth Amended and Restated Revolving Credit and Security Agreement, dated as of February 27, 2017,

among the Company, the Borrowers, the Agent and the Lenders (as amended, supplemented or otherwise modified, the “Credit Agreement”).

Capitalized terms used, but not otherwise defined, in this Current Report on Form 8-K have the meanings given to them in Exhibit A

to the Amendment.

Principally, the Amendment extended the scheduled

maturity date of the revolving credit facility provided by the Credit Agreement from February 27, 2025 to April 29, 2026. The

Amendment also, among other things, (a) increased the Maximum Revolving Advance Amount from $100 million to $150 million, (b) provides

that the Maximum Revolving Advance Amount may be increased further from $150 million to $200 million (for the avoidance of doubt, the

Amendment did not result in such an increase), (c) removed the Borrowers’ total leverage

financial covenant, which had been tested on a quarterly basis, and (d) provided additional covenant flexibility in the form of increased

debt, lien, investment, disposition and restricted payment baskets.

The foregoing description of the Amendment is not

complete and is qualified in its entirety by reference to the Amendment, a copy of which is filed herewith as Exhibit 10.1 and is

incorporated herein by reference.

|

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits.

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

|

|

*

|

Certain schedules and similar attachments have been omitted. The Company agrees to furnish a supplemental copy of any omitted schedule

or attachment to the Securities and Exchange Commission upon request.

|

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

|

|

DASEKE, INC.

|

|

|

|

|

|

Date: April 30, 2021

|

By:

|

/s/ Soumit Roy

|

|

|

Name:

|

Soumit Roy

|

|

|

Title:

|

Executive Vice President, Chief Legal Officer, General Counsel and Corporate Secretary

|

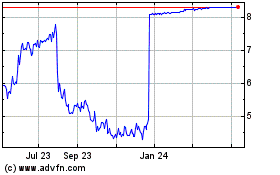

Daseke (NASDAQ:DSKE)

Historical Stock Chart

From Mar 2024 to Apr 2024

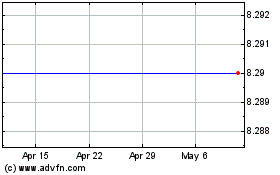

Daseke (NASDAQ:DSKE)

Historical Stock Chart

From Apr 2023 to Apr 2024