Daré Bioscience, Inc. (NASDAQ: DARE), a leader in women’s

health innovation, today reported financial results for the year

ended December 31, 2019 and provided a company update.

“During the fourth quarter of 2019 and into

early 2020, we made considerable progress against our longer-term

strategic and operational objectives, particularly with our

later-stage candidates Ovaprene®, DARE-BV1, and Sildenafil Cream,

3.6%. This progress has helped position us for what we expect to be

a transformative year for Daré. In 2020, we expect to achieve a

number of important milestones that we believe will deliver value

to our shareholders,” said Sabrina Martucci Johnson, President and

CEO of Daré.

“We started 2020 with the announcement of our

exclusive licensing agreement with Bayer, a world leader in women’s

health, for U.S. commercial rights to Ovaprene, our investigational

hormone-free, monthly contraceptive. Our agreement with Bayer is

perhaps the most significant deal in our company’s history as we

are eligible to receive a $20 million payment to reimburse Ovaprene

clinical development costs and commercial milestone payments

potentially totaling up to $310 million, in addition to tiered,

double-digit royalties on net sales. Moreover, we believe that

Bayer is the ideal partner for Ovaprene, given its track record in

women’s health and unparalleled expertise commercializing

first-in-category contraceptive products. We ended 2019 with

the announcement of the positive Ovaprene data that led to the

partnership with Bayer, as well as important alignment with the FDA

on the planned DARE-BV1 Phase 3 clinical study for the treatment of

bacterial vaginosis and on the planned Phase 2b clinical study of

Sildenafil Cream, 3.6% for Female Sexual Arousal Disorder.”

Ms. Johnson added, “We are currently on track to

conduct and report topline results from the planned Phase 3 study

of DARE-BV1 before the end of 2020, as well as to report topline

results of the planned Sildenafil Cream, 3.6% Phase 2b study in

2021 and the planned Ovaprene pivotal study in 2022. As a result of

the COVID-19 pandemic, these are unprecedented times, circumstances

are rapidly evolving, both from a macroeconomic perspective and in

our industry, and we will continue to assess our circumstances and

development timelines. We believe our unique accelerator

model, with our variety of programs and diversity of indications

and development stages, enables us to react quickly to the highly

dynamic and uncertain environment that we find ourselves facing

today. As a result, we believe we are well-positioned to

deliver the topline clinical data and regulatory actions projected

over the next three years.”

Portfolio Highlights:

- Ovaprene - 4Q 2019 – announced positive topline results of the

postcoital test (PCT) clinical study of Ovaprene, Daré’s

investigational hormone-free, monthly contraceptive.

- Sildenafil Cream, 3.6% - 4Q 2019 – announced alignment with FDA

on the design and novel primary endpoint patient-reported outcome

(PRO) instruments for the planned Phase 2b clinical study of

Sildenafil Cream, 3.6% for the treatment of Female Sexual Arousal

Disorder (FSAD), the female sexual dysfunction disorder most

analogous to erectile dysfunction in men.

- DARE-BV1 – 4Q 2019 – announced FDA clearance of the

investigational new drug (IND) application for DARE-BV1, enabling a

2020 pivotal Phase 3 study of DARE-BV1 for the treatment of

bacterial vaginosis.

Corporate Highlights

- 4Q 2019 – Completed acquisition of Microchips Biotech,

Inc.

- 1Q 2020 – Executed Ovaprene license agreement with Bayer

HealthCare, LLC

Operating Results

- General and administrative expenses were approximately $5.3

million for 2019, as compared to approximately $4.7 million

for 2018, with the increase due primarily to additional staff and

staff-related expenses and higher insurance costs, partially offset

by a decrease in expenses for accounting, legal and other

professional services.

- Research and development expenses were approximately $8.5

million for 2019, as compared to approximately $6.4

million for 2018, due primarily to increased costs of

development activities for DARE-BV1, Ovaprene, DARE-HRT1, DARE-FRT1

and Sildenafil Cream, 3.6%, and increased personnel costs,

partially offset by an increase in grant funding related to

Ovaprene and decreased costs of development activities for

pre-clinical stage product candidates.

- License expenses were approximately $0.5 million for 2019, as

compared to $0.6 million for 2018 and represent fees due under

Daré’s various product license agreements.

- Comprehensive loss for 2019 was approximately $15.1

million, as compared to approximately $16.8 million for the

prior year. While Daré’s overall operating expenses were higher in

2019, comprehensive loss decreased primarily because there was an

impairment of goodwill for 2018 totaling approximately $5.2 million

and no impairment charge in 2019.

Cash

and Cash Equivalents

- Cash and cash equivalents were approximately $4.8 million at

December 31, 2019, as compared to $6.8 million at December 31,

2018.

- Since January 1, 2020, Daré received cash gross proceeds of

approximately $8.1 million through a combination of the

upfront payment under its license agreement with Bayer, the sale

and issuance of approximately 3.3 million shares of its common

stock in at-the-market offerings, and the sale and issuance of

approximately 1.7 million shares of its common stock upon the

exercise of warrants it issued in 2018. Net proceeds to Daré

from these transactions are approximately $7.9 million.

Conference Call

Daré will host a conference call and live

webcast today at 4:30 p.m. Eastern Time to review the

company's financial results for the year ended December 31,

2019 and to provide a company update.

To access the conference call via phone, dial

(844) 831-3031 (U.S.) or (443) 637-1284 (international). The

conference ID number for the call 3266966. The live webcast can be

accessed under “Events & Presentations" in the Investor

Relations section of the company's website

at www.darebioscience.com. Please log in approximately 5-10

minutes prior to the call to register and to download and install

any necessary software. To access the replay, please call (855)

859-2056 (U.S.) or (404) 537-3406 (international). The conference

ID number for the replay is 3266966. The call and webcast replay

will be available until April 6, 2020.

About Daré Bioscience

Daré Bioscience is a clinical-stage

biopharmaceutical company committed to the advancement of

innovative products for women’s health. The company’s mission is to

identify, develop and bring to market a diverse portfolio of

differentiated therapies that expand treatment options, improve

outcomes and facilitate convenience for women, primarily in the

areas of contraception, vaginal health, sexual health, and

fertility.

Daré’s product portfolio includes potential

first-in-category candidates in clinical development: Ovaprene®, a

hormone-free, monthly contraceptive intravaginal ring

whose U.S. commercial rights are under a license

agreement with Bayer; Sildenafil Cream, 3.6%, a novel cream

formulation of sildenafil to treat female sexual arousal disorder

utilizing the active ingredient in Viagra®; DARE-BV1, a unique

hydrogel formulation of clindamycin phosphate 2% to treat bacterial

vaginosis via a single application; and DARE-HRT1, a combination

bio-identical estradiol and progesterone intravaginal ring for

hormone replacement therapy following menopause. To learn more

about Daré’s full portfolio of women’s health product candidates,

and mission to deliver differentiated therapies for women, please

visit www.darebioscience.com.

Daré may announce material information about its

finances, product candidates, clinical trials and other matters

using its investor relations website

(http://ir.darebioscience.com), SEC filings, press

releases, public conference calls and webcasts. Daré will use these

channels to distribute material information about the company, and

may also use social media to communicate important information

about the company, its finances, product candidates, clinical

trials and other matters. The information Daré posts on its

investor relations website or through social media channels may be

deemed to be material information. Daré encourages investors, the

media, and others interested in the company to review the

information Daré posts on its investor relations website

(https://darebioscience.gcs-web.com/) and to follow these Twitter

accounts: @SabrinaDareCEO and @DareBioscience. Any updates to the

list of social media channels the company may use to communicate

information will be posted on the investor relations page of Daré’s

website mentioned above.

Forward-Looking Statements

Daré cautions you that all statements, other

than statements of historical facts, contained in this press

release, are forward-looking statements. Forward-looking

statements, in some cases, can be identified by terms such as

“believe,” “may,” “will,” “estimate,” “continue,” “anticipate,”

“design,” “intend,” “expect,” “could,” “plan,” “potential,”

“predict,” “seek,” “should,” “would,” “contemplate,” project,”

“target,” “tend to,” or the negative version of these words and

similar expressions. Such statements include, but are not limited

to, statements relating to Daré’s expectations for clinical

development of its product candidates, including the timing of

commencement and announcement of topline results of planned

clinical studies of DARE-BV1, Sildenafil Cream, 3.6% and Ovaprene,

the potential for regulatory approval to market DARE-BV1 and

Ovaprene based on a single successful Phase 3 study or

contraceptive effectiveness and safety clinical study,

respectively, and the potential payments and non-monetary benefits

to Daré under its agreement with Bayer. Forward-looking

statements involve known and unknown risks, uncertainties and other

factors that may cause Daré’s actual results, performance or

achievements to be materially different from future results,

performance or achievements expressed or implied by the

forward-looking statements in this press release, including,

without limitation, risk and uncertainties related to: the effects

of the COVID-19 pandemic on Daré’s operations, financial results

and condition, and ability to achieve current plans and objectives;

Daré’s ability to continue as a going concern; Daré’s ability to

raise additional capital when and as needed, to advance its product

candidates; Daré’s ability to develop, obtain regulatory approval

for, and commercialize its product candidates; the failure or delay

in starting, conducting and completing clinical trials or

obtaining FDA or foreign regulatory approval for Daré’s

product candidates in a timely manner; Daré’s ability to conduct

and design successful clinical trials, to enroll a sufficient

number of patients, to meet established clinical endpoints, to

avoid undesirable side effects and other safety concerns, and to

demonstrate sufficient safety and efficacy of its product

candidates; the risk that positive findings in early clinical

and/or nonclinical studies of a product candidate may not be

predictive of success in subsequent clinical studies of that

candidate; Daré’s ability to retain its licensed rights to develop

and commercialize a product candidate; Daré’s ability to satisfy

the monetary obligations and other requirements in connection with

its exclusive, in-license agreements covering the critical patents

and related intellectual property related to its product

candidates; the risks that the license agreement with Bayer may not

become effective and, if it becomes effective, that future payments

to Daré under the agreement may be significantly less than the

anticipated or potential amounts; developments by Daré’s

competitors that make its product candidates less competitive or

obsolete; Daré’s dependence on third parties to conduct clinical

trials and manufacture clinical trial material; Daré’s ability to

adequately protect or enforce its, or its licensor’s, intellectual

property rights; the lack of patent protection for the active

ingredients in certain of Daré’s product candidates which could

expose its products to competition from other formulations using

the same active ingredients; the risk of failure associated with

product candidates in preclinical stages of development that may

lead investors to assign them little to no value and make these

assets difficult to fund; and disputes or other developments

concerning Daré’s intellectual property rights. Daré’s

forward-looking statements are based upon its current expectations

and involve assumptions that may never materialize or may prove to

be incorrect. All forward-looking statements are expressly

qualified in their entirety by these cautionary statements. For a

detailed description of Daré’s risks and uncertainties, you are

encouraged to review its documents filed with

the SEC including Daré’s recent filings on Form 8-K, Form

10-K and Form 10-Q. You are cautioned not to place undue reliance

on forward-looking statements, which speak only as of the date on

which they were made. Daré undertakes no obligation to update such

statements to reflect events that occur or circumstances that exist

after the date on which they were made, except as required by

law.

Contacts:

Investors on behalf of Daré Bioscience, Inc.:Lee

Roth Burns McClellan lroth@burnsmc.com 212.213.0006

OR

Media on behalf of Daré Bioscience, Inc.:Jake

Robison Canale Communications jake@canalecomm.com

619.849.5383

Source: Daré Bioscience, Inc.

| |

|

| Daré

Bioscience, Inc. |

|

| Condensed

Consolidated Balance Sheets |

|

| (in

thousands) |

|

| |

December 31, |

|

| |

|

2019 |

|

|

2018 |

|

| |

|

|

|

|

| Cash and

cash equivalents |

$ |

4,780 |

|

$ |

6,806 |

|

| Other

receivables |

|

555 |

|

|

31 |

|

| Prepaid

expenses |

|

1,109 |

|

|

403 |

|

| Property and

equipment, net |

|

64 |

|

|

9 |

|

| Other

non-current assets |

|

935 |

|

|

578 |

|

|

Total assets |

$ |

7,443 |

|

$ |

7,827 |

|

| Current

liabilities |

|

5,612 |

|

|

1,091 |

|

| Contingent

consideration |

|

1,000 |

|

|

- |

|

| Lease

liabilities long-term |

|

390 |

|

|

9 |

|

| Total

stockholders' equity |

|

441 |

|

|

6,727 |

|

|

Total liabilities and stockholders' equity |

$ |

7,443 |

|

$ |

7,827 |

|

| |

|

|

|

|

| Daré

Bioscience, Inc. |

|

| Consolidated

Statement of Operations |

|

| (in

thousands, except share and per share data) |

|

| |

Years Ended December 31, |

|

| |

|

2019 |

|

|

|

2018 |

|

|

|

Operating expenses |

|

|

|

|

|

General and administrative |

$ |

5,266 |

|

|

$ |

4,656 |

|

|

|

Research and development expenses |

|

8,546 |

|

|

|

6,414 |

|

|

|

License expenses |

|

533 |

|

|

|

625 |

|

|

|

Impairment of goodwill |

|

- |

|

|

|

5,187 |

|

|

|

Total operating expenses |

|

14,345 |

|

|

|

16,882 |

|

|

| Loss

from operations |

|

(14,345 |

) |

|

|

(16,882 |

) |

|

| Other

income |

|

81 |

|

|

|

143 |

|

|

| Net

loss |

$ |

(14,264 |

) |

|

$ |

(16,739 |

) |

|

| Deemed

dividend from trigger of round down provision feature |

|

(789 |

) |

|

|

- |

|

|

| Net

loss to common shareholders |

|

(15,053 |

) |

|

|

(16,739 |

) |

|

|

Foreign currency translation adjustments, net of tax |

|

(6 |

) |

|

|

(78 |

) |

|

|

Comprehensive loss |

$ |

(15,059 |

) |

|

$ |

(16,817 |

) |

|

| Loss per

common share - basic and diluted |

$ |

(0.97 |

) |

|

$ |

(1.57 |

) |

|

| Weighted

average number of common shares outstanding: |

|

|

|

|

|

Basic and diluted |

|

15,579 |

|

|

|

10,732 |

|

|

| |

|

|

|

|

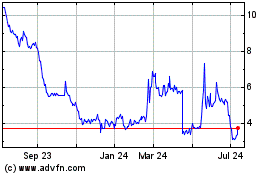

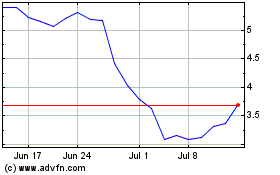

Dare Bioscience (NASDAQ:DARE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Dare Bioscience (NASDAQ:DARE)

Historical Stock Chart

From Apr 2023 to Apr 2024