PROSPECTUS SUPPLEMENT

(To Prospectus dated July 27, 2021)

|

Filed pursuant to Rule 424(b)(5)

Registration Statement No. 333-257910

|

|

Up to $25,000,000

Common Stock

|

We have entered into an Open Market Sale AgreementSM (the

“Sale Agreement”) with Jefferies LLC (“Jefferies” or the “Agent”), dated December 30, 2021,

relating to the sale of shares of our common stock, $0.001 par value per share (the “Common Stock”). In accordance with

the terms of the Sale Agreement, under this prospectus supplement and the accompanying prospectus, we may offer and sell shares of

our Common Stock, having an aggregate offering price of up to $25,000,000 from time to time through the Agent, acting as our sales

agent, or directly to the Agent, acting as principal.

Sales of our Common Stock, if any, under this prospectus

supplement and the accompanying prospectus may be made in sales deemed to be “at the market offerings” as defined in Rule

415(a)(4) promulgated under the Securities Act of 1933, as amended (the “Securities Act”). The Agent is not required to sell

any specific amount of securities but will act as our sales agent using commercially reasonable efforts consistent with its normal trading

and sales practices, on mutually agreed terms between the Agent and us. There is no arrangement for funds to be received in any escrow,

trust or similar arrangement.

The Agent will be entitled to compensation at

a commission rate equal to 3.0% of the gross sales price per share of Common Stock sold pursuant to the terms of the Sale Agreement.

In connection with the sale of the Common Stock on our behalf, the Agent will be deemed to be an “underwriter” within the

meaning of the Securities Act and the compensation of the Agent will be deemed to be underwriting commissions or discounts. We also have

agreed to provide indemnification and contribution to the Agent with respect to certain liabilities, including liabilities under the

Securities Act or the Securities Exchange Act of 1934, as amended (the “Exchange Act”). See “Plan of Distribution”

beginning on page S-13 for additional information regarding the compensation to be paid to the Agent.

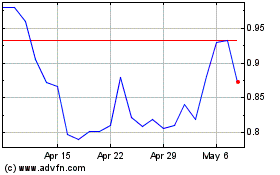

Our Common Stock is listed on the Nasdaq Capital

Market under the symbol “CTSO.” The last reported sale price of our Common Stock on December 29, 2021 was $4.15 per share.

Investing in our Common Stock involves significant

risks. See “Risk Factors” beginning on page S-9 of this prospectus supplement and in the documents incorporated by reference

in this prospectus supplement for a discussion of the factors you should consider before deciding to purchase our Common Stock.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus

supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is December

30, 2021.

TABLE OF CONTENTS

Prospectus Supplement

Prospectus

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement and the accompanying

prospectus relates to the offering of shares of our Common Stock. Before buying any shares of our Common Stock offered hereby, we urge

you to read carefully this prospectus supplement, the accompanying prospectus, and any free writing prospectus that we have authorized

for use in connection with this offering, together with the information incorporated herein by reference as described under the headings

“Where You Can Find More Information” and “Incorporation by Reference.” These documents contain important information

that you should consider when making your investment decision. This prospectus supplement and the accompanying prospectus contains information

about the Common Stock offered hereby.

You should rely only on the information that we

have provided or incorporated by reference in this prospectus supplement or the accompanying prospectus. We have not, and the Agent has

not, authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information,

you should not rely on it.

This document is in two parts. The first part is

this prospectus supplement, which describes the terms of this offering and also adds to and updates information contained in the accompanying

prospectus and the documents incorporated by reference in this prospectus supplement and the accompanying prospectus. The second part,

the accompanying prospectus dated July 27, 2021, including the documents incorporated by reference therein, provides more general information,

some of which may not apply to this offering. Generally, when we refer to this prospectus, we are referring to both parts of this document

combined. To the extent there is a conflict between (i) the information contained in this prospectus supplement and (ii) the information

contained in the accompanying prospectus or in any document incorporated by reference that was filed with the Securities and Exchange

Commission (the “SEC”) before the date of this prospectus supplement, you should rely on the information in this prospectus

supplement. If any statement in one of these documents is inconsistent with a statement in another document having a later date —

for example, a document incorporated by reference in the accompanying prospectus — the statement in the document having the later

date modifies or supersedes the earlier statement.

We are not making offers to sell or solicitations

to buy our Common Stock in any jurisdiction in which an offer or solicitation is not authorized or in which the person making that offer

or solicitation is not qualified to do so or to anyone to whom it is unlawful to make an offer or solicitation. You should assume that

the information in this prospectus supplement, the accompanying prospectus or any related free writing prospectus is accurate only as

of the date on the front of the document and that any information that we have incorporated by reference is accurate only as of the date

of the document incorporated by reference, regardless of the time of delivery of this prospectus supplement or any related free writing

prospectus, or any sale of a security.

Unless the context otherwise indicates, references

in this prospectus supplement to “we,” “our” and “us” collectively refer to CytoSorbents Corporation,

a Delaware corporation.

MARKET DATA

This prospectus supplement and the documents incorporated by reference

herein include market and industry data and forecasts concerning our business and the markets in which we operate, including data regarding

the estimated size of those markets and the prevalence of certain medical conditions, that we have derived from independent consultant

reports, publicly available information, various industry, medical and general publications, other published industry sources, government

data and our internal data and estimates. Independent consultant reports, industry publications and other published industry sources generally

indicate that the information contained therein was obtained from sources believed to be reliable. Our internal data and estimates are

based upon information obtained from trade and business organizations and other contacts in the markets in which we operate and our management’s

understanding of industry conditions.

FORWARD-LOOKING STATEMENTS

This prospectus supplement and the information

incorporated by reference in this prospectus supplement include “forward-looking statements” within the meaning of Section

27A of the Securities Act and Section 21E of the Exchange Act. All statements, other than statements of historical fact, included or incorporated

by reference herein regarding our strategy, future operations, clinical trials, collaborations, intellectual property, expected addressable

markets, cash resources, financial position, future revenues, projected costs, prospects, plans, and objectives of management are forward-looking

statements. The words “believes,” “anticipates,” “estimates,” “plans,” “expects,”

“intends,” “may,” “could,” “should,” “potential,” “likely,” “projects,”

“continue,” “will,” “would” and similar expressions, and the negatives thereof, are intended to identify

forward-looking statements, although not all forward-looking statements contain these identifying words. These statements are based on

current expectations, estimates, forecasts and projections about the industry in which we operate and the beliefs and assumptions of our

management. We cannot guarantee that we actually will achieve the plans, intentions or expectations disclosed in our forward-looking statements

and you should not place undue reliance on our forward-looking statements. There are a number of important factors that could cause our

actual results to differ materially from those indicated or implied by forward-looking statements. Accordingly, you are cautioned that

these forward-looking statements are only predictions and are subject to risks, uncertainties and assumptions, including those referenced

in the sections entitled “Risk Factors” included in this prospectus supplement and the accompanying prospectus, as well as

in our most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q, which are incorporated herein by reference and those

Current Reports on Form 8-K that are incorporated herein by reference. These risks and uncertainties include, among other matters: (i)

our history of losses and expectation that we will continue to incur substantial future losses; (ii) our additional capital needs; (iii)

the lack of assurance that we will be successful in developing and expanding commercial operations or balancing our research and development

activities with our commercialization activities; (iv) our ability to receive adequate reimbursement from third-party payors; (v) our

dependence on key personnel; (vi) acceptance of our medical devices in the marketplace; (vii) our ability to obtain and maintain patent

protection; (viii) potential litigation; (ix) our ability to obtain and maintain regulatory approval; (x) our ability to successfully

complete clinical studies; (xi) our exposure to product liability risk; and (xii) the results of a global pandemic which has adversely

affected, and may continue to adversely affect, our business by disrupting product sales, production, and/or impairing our progress in

clinical trials.

You also should carefully review the risk factors

and cautionary statements described in the other documents we file or furnish from time to time with the SEC, including our most recent

Annual Report on Form 10-K, our Quarterly Reports on Form 10-Q and our Current Reports on Form 8-K. In addition, any forward-looking statement

represents our estimates only as of the date that such statement was made, and should not be relied upon as representing our estimates

as of any subsequent date.

We do not assume any obligation to update any forward-looking

statements. We disclaim any intention or obligation to update or revise any forward-looking statement, whether as a result of new information,

future events or otherwise.

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights certain information

about us, this offering, and selected information contained elsewhere in or incorporated by reference into this prospectus supplement.

This summary is not complete and does not contain all of the information that you should consider before deciding whether to invest in

our Common Stock. For a more complete understanding of our company and this offering, we encourage you to read and consider carefully

the more detailed information in this prospectus supplement and the accompanying prospectus, including the information incorporated by

reference in this prospectus supplement, and the information included in any free writing prospectus that we have authorized for use

in connection with this offering, including the information under the heading “Risk Factors” beginning on page S-9 and

in the documents incorporated by reference into this prospectus supplement.

Our Business

We are a leader in the treatment of life-threatening

conditions in intensive care and cardiac surgery. We are investigating and commercializing our blood purification technology to reduce

deadly uncontrolled inflammation in hospitalized patients around the world, with the goal of preventing or treating multiple organ failure

in life-threatening illnesses and cardiac surgery. Organ failure is the cause of nearly half of all deaths in the intensive care unit

(“ICU”), with little to improve clinical outcome. CytoSorb, our flagship product, is approved in the European Union (“EU”)

as an extracorporeal cytokine adsorber and is designed to reduce the “cytokine storm” that could otherwise cause massive inflammation,

organ failure and death in common critical illnesses such as sepsis, burn injury, trauma, lung injury, and pancreatitis. These are conditions

where the mortality is extremely high, yet few to no effective treatments exist. In May 2018, we received a label expansion for CytoSorb

covering use of the device for the removal of bilirubin and myoglobin in the treatment of liver disease and trauma, respectively. In January

2020, we received a further EU label expansion for CytoSorb to remove the anti-platelet agent, ticagrelor, during urgent and emergent

cardiothoracic surgery on cardiopulmonary bypass. In May 2020, we received another EU label expansion for CytoSorb to remove rivaroxaban,

a Factor Xa inhibitor, for the same indication.

In April 2020, we announced that the United States

Food and Drug Administration (“FDA”) had granted our technology Breakthrough Designation for the removal of ticagrelor in

a cardiopulmonary bypass circuit during emergent and urgent cardiothoracic surgery. If FDA marketing approval for this indication is obtained,

the device would be marketed as DrugSorb-ATR in the United States. The DrugSorb-ATR Antithrombotic Removal System is based on the same

polymer technology as CytoSorb. We believe the current addressable market in the United States for ticagrelor removal in cardiac surgery

is approximately $250 million based on our expected pricing model, assuming FDA marketing approval, and we believe the addressable market

in the United States could expand to $500 million in the event that ticagrelor gain market share as the only reversible mainstream anti-platelet

agent.

In August 2021, we announced that we were granted

a second Breakthrough Device designation for our DrugSorb-ATR Antithrombotic Removal System by the FDA. This Breakthrough Device designation

covers the removal of the Direct Oral Anticoagulants (“DOACs”) apixaban and rivaroxaban in a cardiopulmonary bypass circuit

to reduce the likelihood of serious perioperative bleeding during urgent cardiothoracic surgery. In the event that DrugSorb-ATR also obtains

FDA marketing approval to remove the DOACs apixaban and rivaroxaban, we believe the total addressable market in the United States for

ticagrelor and DOAC removal during cardiothoracic surgery could potentially increase to approximately $1.0 billion. In the event that

DrugSorb-ATR obtains FDA marketing approval to be used prophylactically to remove ticagrelor, apixaban, and rivaroxaban in all patients

undergoing surgery, we believe it would potentially expand the total addressable market in the United States to approximately $2.0 billion.

CytoSorb is used during and after cardiac surgery

to remove inflammatory mediators, such as cytokines, activated complement, and free hemoglobin that can lead to post-operative complications

such as acute kidney injury, lung injury, shock, and stroke. We believe CytoSorb has the potential to be used in many other inflammatory

conditions, including the treatment of autoimmune disease flares, cytokine release syndrome in cancer immunotherapy, and other applications

in cancer, such as cancer cachexia. As of the filing of our most recent Quarterly Report on Form 10-Q, more than 152,000 CytoSorb devices

had been utilized in critical illnesses and in cardiac surgery. CytoSorb has received CE-Mark label expansions for the removal of bilirubin

(liver disease), myoglobin (trauma), and both ticagrelor and rivaroxaban during cardiothoracic surgery. In April 2020, CytoSorb also received

FDA Emergency Use Authorization (“EUA”) in the United States for use in adult critically-ill COVID-19 patients with imminent

or confirmed respiratory failure, in defined circumstances. The EUA will be effective until a declaration is made that the circumstances

justifying the EUA have terminated or until revoked by the FDA. As with other EUA therapies, CytoSorb has neither been cleared nor approved

for the indication to treat patients with COVID-19 infection. As of the filing of our most recent Quarterly Report on Form 10-Q, CytoSorb

had been used globally in more than 6,900 COVID-19 patients. Our technology has also been granted two FDA Breakthrough Designations for

the removal of ticagrelor and the removal of the DOAC apixaban and rivaroxaban in a cardiopulmonary bypass circuit during urgent cardiothoracic

surgery, and if FDA marketing approval is obtained for these indications, the device would be marketed as the DrugSorb-ATR Antithrombotic

Removal System in the United States. In July 2021, we received full approval of our Investigational Device Exemption (“IDE”)

by the FDA to conduct the pivotal STAR-T (Safe and Timely Antithrombotic Removal – Ticagrelor) double-blind, randomized control

trial for up to 120 patients in the United States to support FDA marketing approval. In October 2021, we also received full FDA approval

of an IDE application to conduct a double-blind, randomized, controlled clinical study for up to 120 patients entitled, “Safe and

Timely Antithrombotic Removal – Direct Oral Anticoagulants (STAR-D),” in the United States to support FDA marketing approval.

Our purification technologies are based on biocompatible,

highly porous polymer beads that can actively remove toxic substances from blood and other bodily fluids by pore capture and surface adsorption.

The technology is protected by 20 issued U.S. patents and multiple international patents, with applications pending both in the U.S. and

internationally. In October 2020, we announced the EU approval of the ECOS-300CY™ adsorption cartridge for use with ex vivo organ

perfusion systems to remove cytokines and other inflammatory mediators in the organ perfusate, with the goal of improving solid organ

support or rehabilitation. We have numerous other product candidates under development based upon this unique blood purification technology,

including CytoSorb XL, K+ontrol, HemoDefend-RBC, HemoDefend-BGA, ContrastSorb, DrugSorb, DrugSorb-ATR, and others.

In March 2011, CytoSorb was “CE Marked”

in the EU as an extracorporeal cytokine adsorber indicated for use in clinical situations where cytokines are elevated, allowing for commercial

marketing. The CE Mark demonstrates that a conformity assessment has been carried out and the product complies with the Medical Devices

Directive. The goal of CytoSorb is to prevent or treat organ failure by reducing cytokine storm and the potentially deadly systemic inflammatory

response syndrome (“SIRS”) in diseases such as sepsis, trauma, burn injury, acute respiratory distress syndrome, pancreatitis,

liver failure, and many others. Organ failure is the leading cause of death in the ICU, and remains a major unmet medical need, with little

more than supportive care therapy (e.g., mechanical ventilation, dialysis, vasopressors, fluid support, etc.) as treatment options. By

potentially preventing or treating organ failure, CytoSorb may improve clinical outcome, including survival, while reducing the need for

costly ICU treatment, thereby potentially saving significant healthcare costs.

The market focus for CytoSorb is the prevention

or treatment of organ failure in life-threatening conditions, including commonly seen illnesses in the ICU such as infection and sepsis,

trauma, burn injury, acute respiratory distress syndrome, and others. Severe sepsis and septic shock, a potentially life-threatening systemic

inflammatory response to a serious infection, accounts for approximately 10% to 20% of all ICU admissions and is responsible for an estimated

one in every five deaths worldwide. Sepsis is one of the largest target markets for CytoSorb. Sepsis is a major unmet medical need with

no approved products in the U.S. or Europe to treat it. As with other critical care illnesses, multiple organ failure is the primary cause

of death in sepsis. When used with standard of care therapy, including antibiotics, the goal of CytoSorb in sepsis is to reduce excessive

levels of cytokines and other inflammatory toxins, to help reduce the SIRS response and either prevent or treat organ failure.

We intend to conduct or support additional clinical

studies in the future in the core applications of critical care medicine and cardiac surgery. We intend to generate additional clinical

data to expand the scope of clinical experience for marketing purposes, to increase the number of treated patients, and to support potential

future regulatory submissions.

Our proprietary polymer technologies form the basis

of a broad technology portfolio. Some of our products and product candidates include:

|

|

·

|

CytoSorb - an extracorporeal hemoperfusion cartridge approved in the EU for cytokine removal, with the goal of reducing SIRS and sepsis

and preventing or treating organ failure.

|

|

|

·

|

DrugSorb-ATR — an investigational extracorporeal antithrombotic removal system based on the same polymer technology as CytoSorb

that is being evaluated in the U.S. STAR-T and STAR-D pivotal randomized, controlled trial to reduce the antithrombotic drugs, ticagrelor,

apixaban, and rivaroxaban to reduce bleeding complications in patients undergoing cardiothoracic surgery while on these drugs.

|

|

|

·

|

ECOS-300CY — an adsorption cartridge approved in the EU for use with ex vivo organ perfusion systems to remove cytokines and

other inflammatory mediators in the organ perfusate, with the goal of improving solid organ support or rehabilitation.

|

|

|

·

|

CytoSorb XL — an intended next generation successor to CytoSorb currently in advanced pre-clinical testing designed to reduce

a broad range of cytokines and inflammatory mediators, including lipopolysaccharide endotoxin, from blood.

|

|

|

·

|

VetResQ — a broad spectrum blood purification adsorber designed to help treat deadly inflammation and toxic injury in animals

with critical illnesses such as septic shock, toxic shock syndrome, severe systemic inflammation, toxin-mediated diseases, pancreatitis,

trauma, liver failure, and drug intoxication. VetResQ is being commercialized in the United States.

|

|

|

·

|

HemoDefend-RBC—a development-stage blood purification technology designed to remove non-infectious contaminants in blood transfusion

products, with the goal of reducing transfusion reactions and improving the quality and safety of blood.

|

|

|

·

|

HemoDefend-BGA—a development-stage purification technology that can remove anti-A and anti-B antibodies from plasma and whole

blood, to enable “universal plasma,” and safer whole blood transfusions, respectively.

|

|

|

·

|

K+ontrol—a development-stage blood purification technology designed to reduce excessive levels of potassium in the

blood that can be fatal in severe hyperkalemia.

|

|

|

·

|

ContrastSorb—a development-stage extracorporeal hemoperfusion cartridge designed to remove IV contrast from the blood of high-risk

patients undergoing radiological imaging with contrast, or interventional radiology procedures such as cardiac catheterization and angioplasty.

The goal of ContrastSorb is to prevent contrast-induced nephropathy.

|

|

|

·

|

DrugSorb—a development-stage extracorporeal hemoperfusion cartridge designed to remove toxic chemicals from the blood (e.g.,

drug overdose, high dose regional chemotherapy).

|

|

|

·

|

BetaSorb—a development-stage extracorporeal hemoperfusion cartridge designed to remove mid-molecular weight toxins, such as

b2-microglobulin, that standard high-flux dialysis cannot remove effectively. The goal of BetaSorb is to improve the efficacy of dialysis

or hemofiltration.

|

As at September 30, 2021, the Company had a cash balance of approximately

$61.0 million and no debt.

Corporate Information

Our executive offices are located at 7 Deer Park

Drive, Suite K, Monmouth Junction, New Jersey 08852, and our telephone number is (732) 329-8885. Our website address is http://www.cytosorbents.com.

We have included our website address as an inactive textual reference only. We are not including the information contained at http://www.cytosorbents.com,

or at any other website address, as part of, or incorporating it by reference into, this prospectus supplement or the accompanying prospectus.

THE OFFERING

|

Common Stock offered by us:

|

Shares of Common Stock having an aggregate offering price of up to $25,000,000.

|

|

Common Stock to be outstanding after this offering:

|

Up to 49,499,744 shares, assuming sales of 6,024,096 shares of Common Stock in this offering at an offering price of $4.15 per share, which was the last reported sale price of our Common Stock on the Nasdaq Capital Market on December 29, 2021. The actual number of shares issued will vary depending on the sales price under this offering.

|

|

Plan of Distribution::

|

“At

the market offering” made from time to time through our sales agent, Jefferies LLC. See “Plan of Distribution”

beginning on page S-13 of this prospectus supplement.

|

|

Use of Proceeds:

|

We intend

to use the net proceeds received from the sale of our Common Stock for general corporate purposes, including to fund clinical studies

in the United States and abroad, expand production capacity, support our sales and marketing efforts, further develop our products,

and for general operating expenses. See “Use of Proceeds” on page S-11.

|

|

Risk Factors:

|

See “Risk Factors” beginning on page S-9 of this prospectus supplement and the other information included in, or incorporated by reference into, this prospectus supplement for a discussion of certain factors you should carefully consider before deciding to invest in shares of our Common Stock.

|

|

Nasdaq Capital Market symbol

|

“CTSO”

|

The number of shares of Common Stock to be outstanding

after this offering, as set forth above, is based on 43,475,648 shares of Common Stock outstanding as of September 30, 2021, which amount

excludes:

|

|

·

|

6,864,854 aggregate shares of our Common Stock issuable upon the exercise of stock options outstanding under our 2014 Long-Term Incentive

Plan (the “LTIP”) and our 2006 Long-Term Incentive Plan (the “2006 LTIP”) as of September 30, 2021, at a weighted-average

exercise price of $7.10 per share, 3,847,753 options of which were exercisable as of such date;

|

|

|

·

|

301,212 shares of our Common Stock underlying non-vested restricted stock units outstanding under our LTIP, not including restricted

stock units that will only vest upon a “Change of Control,” as defined in our LTIP, as of September 30, 2021;

|

|

|

·

|

2,595,784 shares of our Common Stock reserved for future awards under our LTIP as of September 30, 2021; and

|

|

|

·

|

2,724,950 Change of Control restricted stock units, which would only vest upon a Change of Control to the Company, as defined in our

LTIP.

|

RISK FACTORS

An investment in our Common Stock involves a

high degree of risk. Before deciding whether to invest in our Common Stock, you should carefully consider the risks described below and

discussed under the sections captioned “Risk Factors” contained in our most recent Annual Report on Form 10-K, as well as

in any of our subsequent Quarterly Reports on Form 10-Q, which are incorporated by reference herein in their entirety, together with other

information in this prospectus supplement, the information and documents incorporated by reference in this prospectus supplement, in the

accompanying prospectus and in any free writing prospectus that we have authorized for use in connection with this offering. If any of

these risks actually occurs, our business, financial condition, results of operations or cash flow could be seriously harmed. This could

cause the trading price of our Common Stock to decline, resulting in a loss of all or part of your investment.

We have broad discretion in the use of the net proceeds of this

offering and, despite our efforts, we may use the proceeds in a manner that does not improve our operating results or increase the value

of your investment.

We currently anticipate that the net proceeds

from the sale of our Common Stock will be used primarily for general corporate purposes, including to fund clinical studies in the United

States and abroad, expand production capacity, support our sales and marketing efforts, further develop our products and for general

operating expenses. However, we have not determined the specific allocation of the net proceeds among these potential uses. Our management

will have broad discretion over the use and investment of the net proceeds of this offering, and, accordingly, investors in this offering

will need to rely upon the judgment of our management with respect to the use of proceeds, with only limited information concerning our

specific intentions. These proceeds could be applied in ways that do not improve our operating results or increase the value of your

investment. Please see the section entitled “Use of Proceeds” on page S-11 for further information.

If you purchase Common Stock in this offering, you may experience

immediate dilution. You may also experience dilution as a result of future issuances of Common Stock or other equity securities.

Because the prices per share of our Common Stock

being offered may be higher than the book value per share of our Common Stock, you may suffer immediate substantial dilution in the net

tangible book value of the Common Stock if you purchase in this offering. See the section entitled “Dilution” on page S-12

for a more detailed discussion of the dilution you may incur if you purchase Common Stock in this offering.

In addition, in order to raise additional capital,

we may in the future offer, issue or sell additional shares of Common Stock or other securities convertible into or exchangeable for shares

of our Common Stock. We cannot assure you that we will be able to sell shares or other securities in any other transaction at a price

per share or that have an exercise price or conversion price per share that is equal to or greater than the prices for the Common Stock

purchased by investors in this offering, and investors purchasing shares or other securities in the future could have rights superior

to existing stockholders. If we sell shares or other securities in any future transaction at a price per share or that have an exercise

price or conversion price per share that is less than the price you pay for shares of Common Stock in this offering, you will experience

dilution.

Moreover, if outstanding options are exercised

at prices per share that are less than the price you pay in this offering, or shares of Common Stock issue upon the vesting of outstanding

restricted stock units, or if we issue options or warrants to purchase, or securities convertible into or exchangeable for, shares of

our Common Stock in the future at a price per share that is less than the price you pay in this offering and such options, warrants or

other securities are exercised, converted or exchanged, you will experience further dilution.

Sales of a significant number of shares of our Common Stock in the

public markets, or the perception that such sales could occur, could depress the market price of our Common Stock.

Sales of a substantial number of shares of our

Common Stock in the public markets could depress the market price of our Common Stock, which could impair your ability to sell any shares

of Common Stock that you purchase in this offering at prices above the price you pay in this offering and impair our ability to raise

capital through the sale of additional equity securities. We cannot predict the effect that future sales of our Common Stock would have

on the market price of our Common Stock.

We do not intend to pay any cash dividends on our Common Stock in

the foreseeable future and, therefore, any return on your investment in our Common Stock must come from increases in the fair market value

and trading price of our Common Stock.

We do not intend to pay any cash dividends on our

Common Stock in the foreseeable future and, therefore, any return on your investment in our Common Stock must come from increases in the

fair market value and trading price of our Common Stock.

The shares of our Common Stock offered hereby will be sold in “at

the market” offerings, and investors who buy shares of our Common Stock at different times will likely pay different prices.

Investors who purchase shares of Common Stock in

this offering at different times will likely pay different prices, and so may experience different levels of dilution and different outcomes

in their investment results. We will have discretion, subject to market demand, to vary the timing, prices, and numbers of shares of Common

Stock sold in this offering. In addition, subject to the final determination by our board of directors or a committee thereof, there is

no minimum or maximum sales price for ordinary shares to be sold in this offering. Investors may experience a decline in the value of

the ordinary shares they purchase in this offering as a result of sales made at prices lower than the prices they paid.

USE OF PROCEEDS

We may issue and sell shares of our Common Stock

having aggregate sales proceeds of up to $25,000,000 from time to time. Because there is no minimum offering amount required as a condition

to close this offering, the actual total public offering amount, commissions and proceeds to us, if any, are not determinable at this

time.

We currently estimate that we will use the net

proceeds from this offering for general corporate purposes, including to fund clinical studies in the United States and abroad, expand

production capacity, support our sales and marketing efforts, further develop our products, and for general operating expenses.

The amounts and timing of our actual expenditures

will depend on numerous factors, including the progress of our clinical trials and other development efforts and other factors described

under “Risk Factors” beginning on page S-9 in this prospectus supplement and the documents incorporated by reference herein,

as well as the amount of cash used in our operations. We may find it necessary or advisable to use the net proceeds for other purposes,

and we will have broad discretion in the application of the net proceeds. Pending the uses described above, we may invest the net proceeds

from this offering in investment-grade, interest-bearing securities.

DILUTION

If you invest in our Common Stock, your interest

will be diluted to the extent of the difference between the price per share you pay in this offering and the net tangible book value per

share of our Common Stock immediately after this offering. Our net tangible book value of our Common Stock as of September 30, 2021 was

approximately $66.0 million, or approximately $1.52 per share of Common Stock based upon 43,475,648 shares outstanding. Net tangible book

value per share is equal to our total tangible assets, less our total liabilities, divided by the total number of shares outstanding as

of September 30, 2021.

After giving effect to the sale of our Common Stock

in the aggregate amount of $25,000,000 at an assumed offering price of $4.15 per share, the last reported sale price of our Common Stock

on the Nasdaq Capital Market on December 29, 2021, and after deducting commissions and estimated offering expenses payable by us, our

as adjusted net tangible book value as of September 30, 2021 would have been approximately $90.1 million, or $1.82 per share of Common

Stock. This represents an immediate increase in net tangible book value of $0.30 per share to our existing stockholders and an immediate

dilution in net tangible book value of $2.33 per share to new investors in this offering. The following table illustrates this calculation

on a per share basis. The as adjusted information is illustrative only and will adjust based on the actual prices to the public, the actual

number of shares sold and other terms of the offering determined at the times shares of our Common Stock are sold pursuant to this prospectus

supplement. The shares of our Common Stock sold in this offering, if any, will be sold from time to time at various prices.

|

Assumed

public offering price per share

|

|

|

|

|

$

|

4.15

|

|

|

Net

tangible book value per share as September 30, 2021

|

|

$

|

1.52

|

|

|

|

|

|

Increase

in net tangible book value per share attributable to the offering

|

|

$

|

0.30

|

|

|

|

|

|

As

adjusted net tangible book value per share after giving effect to this offering

|

|

|

|

|

$

|

1.82

|

|

|

Dilution

per share to new investors participating in the offering

|

|

|

|

|

$

|

2.33

|

|

The number of shares of Common Stock to be outstanding

after this offering, as set forth above, is based on 43,475,648 shares of Common Stock outstanding as of September 30, 2021, which amount

excludes:

|

|

·

|

6,864,854 aggregate shares of our Common Stock issuable upon the exercise of stock options outstanding under our LTIP and 2006 LTIP

as of September 30, 2021, at a weighted-average exercise price of $7.10 per share, 3,847,753 options of which were exercisable as of such

date;

|

|

|

·

|

301,212 shares of our Common Stock underlying non-vested restricted stock units outstanding under our LTIP, not including restricted

stock units that will only vest upon a “Change of Control,” as defined in our LTIP, as of September 30, 2021;

|

|

|

·

|

2,595,784 shares of our Common Stock reserved for future awards under our LTIP as of September 30, 2021; and

|

|

|

·

|

2,724,950 Change of Control restricted stock units, which would only vest upon a Change of Control to the Company, as defined in our

LTIP.

|

To the extent outstanding warrants or options are

exercised at prices per share that are less than the prices paid by investors in this offering, or shares of Common Stock issue upon the

vesting of outstanding restricted stock units, there will be further dilution to investors. In addition, to the extent that we issue additional

equity securities in connection with future capital raising activities, our then-existing stockholders may experience dilution.

PLAN OF DISTRIBUTION

We have entered into the Sale Agreement with Jefferies,

under which we may offer and sell our shares of Common Stock from time to time through Jefferies acting as the agent. Pursuant to this

prospectus supplement and the accompanying prospectus, we may offer and sell up to $25,000,000 of our shares of Common Stock. Sales of

our shares of Common Stock, if any, under this prospectus supplement and the accompanying prospectus will be made by any method that is

deemed to be an “at the market offering” as defined in Rule 415(a)(4) under the Securities Act.

Each time we wish to issue and sell our shares

of Common Stock under the Sale Agreement, we will notify Jefferies of the number of shares to be issued, the dates on which such sales

are anticipated to be made, any limitation on the number of shares to be sold in any one day and any minimum price below which sales may

not be made. Once we have so notified the Agent, unless the Agent declines to accept the terms of such notice, the Agent has agreed to

use its commercially reasonable efforts consistent with its normal trading and sales practices to sell such shares up to the amount specified

on such terms. The obligations of the Agent under the Sale Agreement to sell our shares of Common Stock are subject to a number of conditions

that we must meet.

The settlement of sales of shares between us and

the Agent is generally anticipated to occur on the second trading day following the date on which the sale was made. Sales of our shares

of Common Stock as contemplated in this prospectus supplement will be settled through the facilities of The Depository Trust Company or

by such other means as we and the Agent may agree upon. There is no arrangement for funds to be received in an escrow, trust or similar

arrangement.

We will pay the Agent a commission equal to

3.0% of the aggregate gross proceeds we receive from each sale of shares of Common Stock by the Agent. Because there is no minimum

offering amount required as a condition to close this offering, the actual total public offering amount, commissions and proceeds to

us, if any, are not determinable at this time. In addition, we have agreed to reimburse the Agent for the fees and disbursements of

its counsel, payable upon execution of the Sale Agreement, in an amount not to exceed $75,000, in addition to certain ongoing

disbursements of its legal counsel unless we and the Agent otherwise agree. We estimate that the total expenses for the offering,

excluding any commissions or expense reimbursement payable to the Agent under the terms of the Sale Agreement, will be approximately

$175,000. The remaining sale proceeds, after deducting any other transaction fees, will equal our net proceeds from the sale of such

shares.

The Agent will provide written confirmation to

us before the open on The Nasdaq Capital Market on the day following each day on which our shares of Common Stock are sold by the Agent

under the Sale Agreement. Each confirmation will include the number of shares sold on that day, the aggregate gross proceeds of such sales

and the proceeds to us.

In connection with the sale of our shares of Common

Stock on our behalf, the Agent will be deemed to be an “underwriter” within the meaning of the Securities Act, and the compensation

of the Agent will be deemed to be underwriting commissions or discounts. We have agreed to indemnify the Agent against certain civil liabilities,

including liabilities under the Securities Act. We have also agreed to contribute to payments the Agent may be required to make in respect

of such liabilities.

The offering of our shares of common stock pursuant

to the Sale Agreement will terminate as permitted therein. This summary of the material provisions of the Sale Agreement does not purport

to be a complete statement of its terms and conditions. A copy of the Sale Agreement will be filed as an exhibit to a current report on

Form 8-K filed under the Exchange Act and incorporated by reference in this prospectus supplement.

Jefferies and its respective affiliates may in

the future provide various investment banking, commercial banking, financial advisory and other financial services for us and our affiliates,

for which services they may in the future receive customary fees. In the course of its businesses, Jefferies may actively trade our securities

for its own account or for the accounts of its customers, and, accordingly, Jefferies may at any time hold long or short positions in

such securities.

A prospectus supplement and the accompanying prospectus

in electronic format may be made available on a website maintained by Jefferies, and Jefferies may distribute the prospectus supplement

and the accompanying prospectus electronically.

LEGAL MATTERS

The validity of the securities offered hereby will

be passed upon by Morgan, Lewis & Bockius LLP, Princeton, New Jersey. Jefferies LLC is being represented in connection with this offering

by Cooley LLP, New York, New York.

EXPERTS

WithumSmith+Brown, PC, independent registered public

accounting firm, has audited our financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2020

and the effectiveness of our internal control over financial reporting as of December 31, 2020, as set forth in their reports, which are

incorporated by reference in this prospectus supplement and elsewhere in the registration statement of which this prospectus supplement

forms a part. Our financial statements are incorporated by reference in reliance on WithumSmith+Brown, PC’s reports, given on their

authority as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports,

proxy statements and other information with the SEC. Our SEC filings are available to the public over the internet at the SEC’s

website at www.sec.gov. Copies of certain information filed by us with the SEC are also available on our website at www.cytosorbents.com.

Our website is not a part of this prospectus supplement and is not incorporated by reference into this prospectus supplement or the accompanying

prospectus.

This prospectus supplement is only part of a registration

statement we filed with the SEC and therefore omits some information contained in our registration statement in accordance with the SEC’s

rules and regulations. You should review the information contained in any exhibits filed to the registration statement for further information

on us and the securities we are offering. Statements in this prospectus supplement concerning any document we filed as an exhibit to the

registration statement or that we otherwise filed with the SEC are not intended to be comprehensive and are qualified by reference to

those filings. You should review the complete document to evaluate these statements.

INCORPORATION BY REFERENCE

The SEC allows us to incorporate by reference into

this prospectus supplement much of the information we file with the SEC, which means that we can disclose important information to you

by referring you to those publicly available documents. The information that we incorporate by reference into this prospectus supplement

is considered to be part of this prospectus supplement. Because we are incorporating by reference future filings with the SEC, this prospectus

supplement is continually updated and those future filings may modify or supersede some of the information included or incorporated in

this prospectus supplement. This means that you must look at all of the SEC filings that we incorporate by reference to determine if any

of the statements in this prospectus supplement or in any document previously incorporated by reference have been modified or superseded.

This prospectus supplement incorporates by reference the documents listed below and any future filings we make with the SEC under Sections

13(a), 13(c), 14 or 15(d) of the Exchange Act (in each case, other than those documents or the portions of those documents deemed to be

furnished and not filed) until the termination of this offering:

|

|

·

|

Quarterly Reports on Form 10-Q for the fiscal quarters ended March 31, 2021, June 30, 2021 and September 30, 2021, as filed with the

SEC on May 4, 2021, August 3, 2021 and November 4, 2021, respectively;

|

|

|

·

|

Current Reports on Form 8-K filed with the SEC on March 17, 2021, March 31, 2021, April 8, 2021, April 15, 2021, April 20, 2021, June 2, 2021 (with respect to Item 5.07 only), July 6, 2021, July 27, 2021, August 12, 2021, September 1, 2021, September 10, 2021, September 14, 2021, October 8, 2021, October 13, 2021, October 15, 2021, October 21, 2021 and December 21, 2021; and

|

We will provide without charge to each person to

whom this prospectus supplement is delivered a copy of any or all of the information that has been incorporated by reference into but

not delivered with this prospectus supplement. You may request a copy of these filings by writing or telephoning us at the following address

or telephone number:

7 Deer Park Drive, Suite K

Monmouth Junction, New Jersey 08852

Attn: Kathleen P. Bloch, CFO

Phone: (973) 329-8885

PROSPECTUS

$150,000,000

Common Stock, Preferred Stock,

Debt Securities, Warrants and Units

We may offer from time to

time in one or more offerings up to an aggregate of $150,000,000 of the common stock, preferred stock, debt securities, warrants or units

described in this prospectus, separately or together in one or more combinations. The preferred stock, debt securities, and warrants may

be convertible into or exercisable or exchangeable for common stock or preferred stock or other securities, as identified in the applicable

prospectus supplement.

This prospectus provides a

general description of the securities we may offer. Each time we sell securities, we will provide specific terms of the securities offered

in a supplement to this prospectus. We may also authorize one or more free writing prospectuses to be provided to you in connection with

these offerings. The prospectus supplement and any related free writing prospectus may add, update or change information contained in

this prospectus. You should carefully read this prospectus, the applicable prospectus supplement and any related free writing prospectus,

as well as the documents incorporated by reference herein and therein, before you invest in any of our securities. This prospectus may

not be used to sell the securities unless accompanied by a prospectus supplement.

We may offer and sell the

securities through underwriters, dealers or agents, or directly to purchasers, or through a combination of these methods. See “Plan

of Distribution” beginning on page 18 of this prospectus.

Our common stock is listed

on the Nasdaq Capital Market under the symbol “CTSO.” The last reported sale price of our common stock on the Nasdaq Capital

Market on July 13, 2021 was $7.70 per share.

Investing in our securities

involves risk. See “Risk Factors” beginning on page 5 of this prospectus. You should carefully read this prospectus,

the applicable prospectus supplement and any related free writing prospectus, as well as the documents incorporated by reference herein

and therein, before you invest in any of our securities.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus

is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2021

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of

a registration statement that we have filed with the Securities and Exchange Commission (the “SEC”) using a “shelf”

registration process under the Securities Act of 1933, as amended (the “Securities Act”). Under this shelf registration process,

we may offer and sell, from time to time, any combination of the securities described in this prospectus in one or more offerings up to

a total dollar amount of $150,000,000.

This prospectus provides you

with a general description of the securities we may offer. Each time we sell the securities, we will, to the extent required by law, provide

a prospectus supplement that will contain specific information about the terms of the offering. We may also authorize one or more free

writing prospectuses to be provided to you in connection with the offering. The prospectus supplement and any related free writing prospectus

may add, update or change information contained in this prospectus. This prospectus does not contain all of the information included in

the registration statement. For a more complete understanding of the offering of the securities, you should refer to the registration

statement, including its exhibits. You should carefully read this prospectus, the applicable prospectus supplement, and any applicable

free writing prospectus, as well as the information and documents incorporated herein and therein by reference and the additional information

under the heading “Where You Can Find More Information,” before making an investment decision.

We have not authorized any

dealer, salesman or other person to give any information or to make any representation other than those contained in, or incorporated

by reference into, this prospectus and the applicable prospectus supplement, and any free writing prospectus we have authorized for use

in connection with a specific offering. You must not rely upon any other information or representation.

This prospectus and any accompanying

supplement to this prospectus do not constitute an offer to sell or the solicitation of an offer to buy any securities other than the

registered securities to which they relate, nor do this prospectus and any accompanying supplement to this prospectus constitute an offer

to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer

or solicitation in such jurisdiction. You should not assume that the information contained in this prospectus, any accompanying prospectus

supplement and any applicable free writing prospectus is accurate on any date subsequent to the date set forth on the front of the document

or that any information we have incorporated by reference is correct on any date subsequent to the date of the document incorporated by

reference, even though this prospectus, any accompanying prospectus supplement or any applicable free writing prospectus is delivered,

or securities sold, on a later date.

This prospectus may not be

used by us to consummate sales of our securities unless it is accompanied by a prospectus supplement. To the extent there are inconsistencies

between any prospectus supplement, this prospectus and any documents incorporated by reference, the document with the most recent date

will control.

This prospectus includes

our trademarks and trade names, such as “CytoSorb,” “CytoSorb XL,” “ECOS-300CY,”

“BetaSorb,” “ContrastSorb,” “DrugSorb,” “DrugSorb-ATR,” “HemoDefend-RBC,”

“HemoDefend-BGA,“K+ontrol” and “VetResQ,” which are protected under applicable intellectual property

laws and are the property of CytoSorbents Corporation and its subsidiaries. This prospectus also contains the trademarks, trade

names and service marks of other companies, which are the property of their respective owners. Solely for convenience, trademarks,

trade names and service marks referred to in this prospectus may appear without the ™, ®, or SM symbols, but such

references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights

or the rights of the applicable licensor to these trademarks, trade names and service marks. We do not intend our use or display of

other parties’ trademarks, trade names or service marks to imply, and such use or display should not be construed to imply, a

relationship with, or endorsement or sponsorship of us by, these other parties.

Unless the context otherwise

requires, references in this prospectus to “we,” “us,” “our,” or the “Company” refer to

CytoSorbents Corporation, a Delaware corporation, and its subsidiaries.

PROSPECTUS SUMMARY

This summary highlights

selected information contained elsewhere in this prospectus or incorporated by reference into this prospectus. This summary does not contain

all the information that you should consider before investing in our securities. You should carefully read this entire prospectus, the

applicable prospectus supplement and any related free writing prospectus, including each of the documents incorporated herein or therein

by reference, before making an investment decision.

We are a leader in

critical care immunotherapy, investigating and commercializing our CytoSorb blood purification technology to reduce deadly

uncontrolled inflammation in hospitalized patients around the world, with the goal of preventing or treating multiple organ failure

in life-threatening illnesses and cardiac surgery. Organ failure is the cause of nearly half of all deaths in the intensive care

unit (“ICU”), with little to improve clinical outcome. CytoSorb, our flagship product, is approved in the European Union

(“EU”) as a safe and effective extracorporeal cytokine filter and is designed to reduce the “cytokine storm”

that could otherwise cause massive inflammation, organ failure and death in common critical illnesses such as sepsis, burn injury,

trauma, lung injury, and pancreatitis. These are conditions where the mortality is extremely high, yet no effective treatments

exist. In May 2018, we received a label expansion for CytoSorb covering use of the device for the removal of bilirubin and myoglobin

in the treatment of liver disease and trauma, respectively. In January 2020, we received a further E.U. label expansion for CytoSorb

to remove the anti-platelet agent, ticagrelor, during urgent and emergent cardiothoracic surgery on cardiopulmonary bypass. In May

2020, we received another E.U. label expansion for CytoSorb to remove rivaroxaban, a Factor Xa inhibitor, for the same indication.

We believe the current addressable market in the United States for ticagrelor removal in cardiac surgery is approximately $250

million based on our current pricing model, assuming FDA approval, that could expand to $500 million should ticagrelor gain market

share as the only reversible mainstream anti-platelet agent. In the event that CytoSorb also obtains FDA approval to remove novel

oral anticoagulants (“NOACs”) such as rivaroxaban and apixaban, we believe the total addressable market in the United

States for ticagrelor and NOAC removal during cardiac surgery could potentially increase to approximately $1.0 billion. In the event

that CytoSorb obtains FDA approval to be used prophylactically to remove ticagrelor and NOACs in all patients undergoing surgery, we

believe it would potentially expand the total addressable market in the United States to approximately $2.0 billion.

CytoSorb is used during

and after cardiac surgery to remove inflammatory mediators, such as cytokines, activated complement, and free hemoglobin that can lead

to post-operative complications such as acute kidney injury, lung injury, shock, and stroke. We believe CytoSorb has the potential to

be used in many other inflammatory conditions, including the treatment of autoimmune disease flares, cytokine release syndrome in cancer

immunotherapy, and other applications in cancer, such as cancer cachexia. CytoSorb has been used globally in more than 131,000 human treatments

to date in critical illnesses and in cardiac surgery. CytoSorb has received CE-Mark label expansions for the removal of bilirubin (liver

disease), myoglobin (trauma) and both ticagrelor and rivaroxaban during cardiothoracic surgery. CytoSorb has also received FDA Emergency

Use Authorization in the United States for use in critically-ill COVID-19 patients with imminent or confirmed respiratory failure, in

defined circumstances. The EUA will be effective until a declaration is made that the circumstances justifying the EUA have terminated

or until revoked by the FDA. CytoSorb has been used globally in more than 6,000 human treatments to date in COVID-19 patients. CytoSorb

has also been granted FDA Breakthrough Designation for the removal of ticagrelor in a cardiopulmonary bypass circuit during emergent and

urgent cardiothoracic surgery.

Our purification

technologies are based on biocompatible, highly porous polymer beads that can actively remove toxic substances from blood and other

bodily fluids by pore capture and surface adsorption. The technology is protected by 16 issued U.S. patents and multiple

international patents, with applications pending both in the U.S. and internationally. In October 2020, we announced the E.U.

approval of the ECOS-300CY™ adsorption cartridge for use with ex vivo organ perfusion systems to remove cytokines and

other inflammatory mediators in the organ perfusate, with the goal of improving solid organ support or rehabilitation. We have

numerous other product candidates under development based upon this unique blood purification technology, including CytoSorb XL,

K+ontrol, HemoDefend-RBC, HemoDefend-BGA, ContrastSorb, DrugSorb, DrugSorb-ATR and others.

In March 2011,

CytoSorb was “CE Marked” in the E.U. as an extracorporeal cytokine filter indicated for use in clinical situations where

cytokines are elevated, allowing for commercial marketing. The CE Mark demonstrates that a conformity assessment has been carried

out and the product complies with the Medical Devices Directive. The goal of CytoSorb is to prevent or treat organ failure by

reducing cytokine storm and the potentially deadly systemic inflammatory response syndrome (“SIRS”) in diseases such as

sepsis, trauma, burn injury, acute respiratory distress syndrome, pancreatitis, liver failure, and many others. Organ failure is the

leading cause of death in the ICU, and remains a major unmet medical need, with little more than supportive care therapy (e.g.,

mechanical ventilation, dialysis, vasopressors, fluid support, etc.) as treatment options. By potentially preventing or treating

organ failure, CytoSorb may improve clinical outcome, including survival, while reducing the need for costly ICU treatment, thereby

potentially saving significant healthcare costs.

The market focus for CytoSorb

is the prevention or treatment of organ failure in life-threatening conditions, including commonly seen illnesses in the ICU such as infection

and sepsis, trauma, burn injury, acute respiratory distress syndrome (“ARDS”), and others. Severe sepsis and septic shock,

a potentially life-threatening systemic inflammatory response to a serious infection, accounts for approximately 10% to 20% of all ICU

admissions, and is responsible for an estimated one in every five deaths worldwide. Sepsis is one of the largest target markets for CytoSorb.

Sepsis is a major unmet medical need with no approved products in the U.S. or Europe to treat it. As with other critical care illnesses,

multiple organ failure is the primary cause of death in sepsis. When used with standard of care therapy, that includes antibiotics, the

goal of CytoSorb in sepsis is to reduce excessive levels of cytokines and other inflammatory toxins, to help reduce the SIRS response

and either prevent or treat organ failure.

In addition to the sepsis

indication, we intend to conduct or support additional clinical studies in sepsis, cardiac surgery, and other critical care diseases where

CytoSorb could be used, such as ARDS, liver disease, trauma, severe burn injury, acute pancreatitis, and in other acute conditions that

may benefit by the reduction of cytokines in the bloodstream. Some examples include the prevention of post-operative complications of

cardiac surgery (cardiopulmonary bypass surgery) and damage to organs donated for transplant prior to organ harvest. We intend to generate

additional clinical data to expand the scope of clinical experience for marketing purposes, to increase the number of treated patients,

and to support potential future publications and regulatory submissions.

Our proprietary polymer

technologies form the basis of a broad technology portfolio. Some of our products and product candidates include:

|

|

•

|

CytoSorb — an extracorporeal hemoperfusion cartridge approved in the EU for cytokine removal, with

the goal of reducing SIRS and sepsis and preventing or treating organ failure.

|

|

|

•

|

DrugSorb-ATR — an investigational extracorporeal antithrombotic removal system based on the same polymer technology as CytoSorb

that is being evaluated in the U.S. STAR-T pivotal randomized, controlled trial to reduce the antithrombotic drug, ticagrelor, and reduce

bleeding complications in patients undergoing cardiothoracic surgery while on the drug.

|

|

|

•

|

ECOS-300CY — an adsorption cartridge

approved in the E.U. for use with ex vivo organ perfusion systems to remove cytokines

and other inflammatory mediators in the organ perfusate, with the goal of improving solid

organ support or rehabilitation.

|

|

|

•

|

CytoSorb XL — an intended next generation successor to CytoSorb currently in advanced pre-clinical

testing designed to reduce a broad range of cytokines and inflammatory mediators, including lipopolysaccharide endotoxin, from blood.

|

|

|

•

|

VetResQ — a broad spectrum blood purification adsorber designed to help treat deadly inflammation and

toxic injury in animals with critical illnesses such as septic shock, toxic shock syndrome, severe systemic inflammation, toxin-mediated

diseases, pancreatitis, trauma, liver failure, and drug intoxication. VetResQ is being commercialized in the United States.

|

|

|

•

|

HemoDefend-RBC—a development-stage blood purification technology designed to remove non-infectious

contaminants in blood transfusion products, with the goal of reducing transfusion reactions and improving the quality and safety of blood.

|

|

|

•

|

HemoDefend-BGA—a development-stage purification technology that can remove anti-A and anti-B antibodies

from plasma and whole blood, to enable “universal plasma,” and safer whole blood transfusions, respectively.

|

|

|

•

|

K+ontrol—a development-stage blood purification technology designed to reduce excessive levels of potassium

in the blood that can be fatal in severe hyperkalemia.

|

|

|

•

|

ContrastSorb—a development-stage extracorporeal hemoperfusion cartridge designed to remove IV contrast

from the blood of high-risk patients undergoing radiological imaging with contrast, or interventional radiology procedures such as cardiac

catheterization and angioplasty. The goal of ContrastSorb is to prevent contrast-induced nephropathy.

|

|

|

•

|

DrugSorb—a development-stage extracorporeal hemoperfusion cartridge designed to remove toxic chemicals

from the blood (e.g., drug overdose, high dose regional chemotherapy).

|

|

|

•

|

BetaSorb—a development-stage extracorporeal hemoperfusion cartridge designed to remove mid-molecular

weight toxins, such as b2-microglobulin, that standard high-flux dialysis cannot remove effectively. The goal of BetaSorb is to improve

the efficacy of dialysis or hemofiltration.

|

Corporate History

We

were originally organized as a Delaware limited liability company in August 1997 as Advanced Renal Technologies, LLC. We changed

our name to RenalTech International, LLC in November 1998, and to MedaSorb Technologies, LLC in October 2003. In December 2005,

MedaSorb Technologies, LLC converted from a limited liability company to a corporation, called MedaSorb Technologies, Inc. CytoSorbents

Corporation was incorporated in Nevada on April 25, 2002 as Gilder Enterprises, Inc., and was originally engaged in the business

of installing and operating computer networks that provided high-speed access to the Internet. On June 30, 2006, we disposed of our

original business, and pursuant to an Agreement and Plan of Merger, acquired all of the stock of MedaSorb Technologies, Inc., in

a merger, and the business of MedaSorb Technologies, Inc. became our business. Following the merger, in July 2006, we changed

our name to MedaSorb Technologies Corporation. In November 2008, we changed the name of our operating subsidiary from MedaSorb Technologies, Inc.

to CytoSorbents, Inc. In May 2010, we finalized the name change of MedaSorb Technologies Corporation to CytoSorbents Corporation.

On October 28, 2014, we changed the name of our operating subsidiary from CytoSorbents, Inc. to CytoSorbents Medical, Inc.

On

December 3, 2014, we effected a twenty-five-for-one (25:1) reverse split of our common stock. As a result of this reverse stock split,

shares of our common stock outstanding were reduced by approximately 96%. Immediately after the reverse stock split, pursuant to an Agreement

and Plan of Merger dated December 3, 2014, we changed our state of incorporation from the State of Nevada to the State of Delaware,

whereby we merged with and into our wholly-owned Delaware subsidiary. At the effective time of the merger, (i) we merged with and

into our Delaware subsidiary, (ii) our separate corporate existence in Nevada ceased to exist, (iii) the Delaware subsidiary

became the surviving corporation, (iv) the certificate of incorporation, as amended and restated, and the bylaws of the Delaware

subsidiary became our certificate of incorporation and bylaws, and (v) each share of our common stock outstanding immediately prior

to the effective time was converted into one fully-paid and non-assessable share of our common stock as a Delaware corporation. The reverse

stock split, the merger and the Agreement and Plan of Merger were approved by our Board of Directors and stockholders representing a majority

of our then-outstanding common stock. All references to “us”, “we”, or the Company, on or after December 3,

2014, refer to CytoSorbents Corporation, a Delaware corporation.

Our executive offices are

located at 7 Deer Park Drive, Suite K, Monmouth Junction, New Jersey 08852, and our telephone number is (732) 329-8885. Our website address

is http://www.cytosorbents.com. We have included our website address as an inactive textual reference only. We are not including the information

contained at http://www.cytosorbents.com, or at any other website address, as part of, or incorporating it by reference into, this prospectus

or any accompanying prospectus supplement or related free writing prospectus. We make available free of charge through our website our

Annual Reports on Form 10-K, our Quarterly Reports on Form 10-Q, our Current Reports on Form 8-K and amendments to those reports filed

or furnished pursuant to Section 13(a) or 15(d) of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”),

as soon as reasonably practicable after we electronically file such material, or furnish it to the SEC. We also similarly make available,

free of charge on our website, the reports filed with the SEC by our executive officers, directors and 10% stockholders pursuant to Section

16 under the Exchange Act as soon as reasonably practicable after copies of those filings are provided to us by those persons.

RISK FACTORS

Investing

in our securities involves risks. Before making an investment decision, you should carefully consider these risks as well as other information

we include or incorporate by reference in this prospectus. In particular, you should carefully consider the information under the heading

“Risk Factors,” as well as the factors listed under the heading “Special Note Regarding Forward-Looking Statements,”

in each case contained in our Annual Report on Form 10-K for our most recent fiscal year, in any Quarterly Reports on Form 10-Q that have

been filed since our most recent Annual Report on Form 10-K and in any other documents that we file with the SEC under the Exchange Act,

each of which is incorporated by reference in this prospectus. New risks may emerge in the future at any time, and we cannot predict such

risks or estimate the extent to which they may affect our financial condition or performance. The prospectus supplement applicable to

a specific offering may contain a discussion of additional risks applicable to an investment in us and our securities we are offering

under that prospectus supplement. Each of the risks described could result in a decrease in the value of the securities and your investment

therein.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, any accompanying

prospectus supplement or related free writing prospectus, and the documents incorporated by reference herein and therein may contain “forward-looking

statements” within the meaning of the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended, Section 21E

of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the Private Securities Litigation Reform Act

of 1995. These forward-looking statements only provide our current expectations or forecasts of future events and financial performance

and may be identified by the use of forward-looking terminology, including the terms “believes,” “estimates,”

“anticipates,” “expects,” “plans,” “intends,” “may,” “will,” “should,”

“could,” “predicts,” or the negative thereof, or other variations or comparable terminology, though the absence

of these words does not necessarily mean that a statement is not forward-looking. Forward-looking statements include all matters that

are not historical facts and include, without limitation, statements concerning possible or assumed future results of our operations;

business strategies; future cash flows; financing plans; plans and objectives of management; any other statements regarding future operations,

future cash needs, business plans and future financial results, and any other statements that are not historical facts. You should be

aware that the forward-looking statements included herein represent management’s current judgment and expectations, but our actual

results, events and performance could differ materially from those in the forward-looking statements.

You should read carefully

the risks described in the section entitled “Risk Factors” beginning on page 5 of this prospectus and those contained in our

Annual Report on Form 10-K for our most recent fiscal year, in any Quarterly Reports on Form 10-Q that have been filed since our most

recent Annual Report on Form 10-K and in any other documents that we file with the SEC under the Exchange Act, each of which is incorporated

by reference in this prospectus. and in any accompanying prospectus supplement or related free writing prospectus, together with all information

incorporated by reference herein and therein, to better understand the significant risks and uncertainties inherent in our business and

underlying any forward-looking statements. As a result of these risks, actual results could differ materially and adversely from those

anticipated or implied in the forward-looking statements in this prospectus or in any accompanying prospectus supplement or related free

writing prospectus, or incorporated by reference herein and therein, and you should not place undue reliance on any forward-looking statements.

Any forward-looking statements

that we make in this prospectus speak only as of the date of such statements and we undertake no obligation to publicly update any forward-looking

statements or to publicly announce revisions to any of the forward-looking statements, whether as a result of new information, future

events or otherwise.