Current Report Filing (8-k)

April 03 2020 - 4:32PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT

REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

April 3, 2020

(Date of Report (date of earliest event reported)

Cutera, Inc.

(Exact name

of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

000-50644

|

|

77-0492262

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification Number)

|

3240 Bayshore Blvd.

Brisbane, California 94005

(Address of principal executive offices)

(415) 657-5500

(Registrant’s telephone number, including area code)

N/A

(Former name or

former address, if changed since last report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock ($0.001 par value)

|

|

CUTR

|

|

The NASDAQ Stock Market, LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the

Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ☐

|

Item 7.01

|

Regulation FD Disclosure.

|

The recent outbreak of COVID-19, and government and third party restrictions enacted in response, have had, and will

continue to have, a negative effect on our business, results of operations and financial condition. These effects have included, and we expect will continue to include, among other effects, disruptions or restrictions on our employees’ ability

to work effectively, temporary closures of our facilities and those of our customers, the temporary suspension of elective procedures performed by our customers, and disruption in our supply chain and contract manufacturing facilities. The extent to

which COVID-19 could impact our business, results of operations and financial condition is highly uncertain and will depend on future developments. Such developments may include the geographic spread and

duration of the virus, the severity of the disease and the actions that may be taken by various governmental authorities and other third parties in response to the COVID-19 outbreak, as well as the effectiveness of any governmental actions intended

to address the economic impact of the COVID-19 outbreak.

As a result, we are withdrawing our previously announced annual guidance for 2020, which was

issued on February 26, 2020, due to the rapidly evolving and continued uncertainties resulting from the impact of COVID-19. We plan to provide more information during our first quarter earnings call based

on the information available at that time. In the meantime, we are taking actions to reduce expenses, including discontinuing non-essential services and programs, instituting controls on travel and entertainment, implementing further cost-cutting

measures and evaluating whether improved efficiencies can be obtained in our workforce. For example, the directors on our board of directors have agreed to a 25% reduction in their fees, our Chief Executive Officer and our President and Chief

Operating Officer have each agreed to a 25% reduction in their salaries and other members of management have also agreed to significant reductions in their salaries, until such time as our business operations and economic conditions improve. In

addition, in order to further conserve cash, management has agreed to have the bonuses owed to them from the 2019 Management Bonus Program paid mostly in equity rather than in cash.

The information in this Item 7.01 of this Form 8-K shall not be deemed “filed” for purposes of

Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, or incorporated by reference in any filing under the Securities Act of 1933, as amended (the

“Securities Act”), or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

CUTERA, INC.

|

|

|

|

|

|

Date: April 3, 2020

|

|

|

|

/s/ Darren W. Alch

|

|

|

|

|

|

Darren W. Alch

|

|

|

|

|

|

Vice President, General Counsel & Corporate Secretary

|

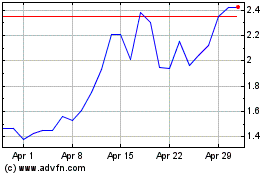

Cutera (NASDAQ:CUTR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cutera (NASDAQ:CUTR)

Historical Stock Chart

From Apr 2023 to Apr 2024