UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D/A

Under the Securities Exchange Act of 1934

(Amendment No. 7)*

|

CSI Compressco LP

|

|

(Name of Issuer)

|

|

|

|

Common Units Representing Limited Partner Interests

|

|

(Title of Class of Securities)

|

|

|

|

|

|

12637A 103

|

|

(CUSIP Number)

|

|

|

|

|

|

Brady M. Murphy

TETRA Technologies, Inc.

24955 Interstate 45 North

The Woodlands, Texas 77380

Telephone: (281) 367-1983

|

|

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

|

|

|

|

|

|

January 29, 2021

|

|

(Date of Event Which Requires Filing of this Statement)

|

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ☐

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are to be sent.

*The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

(1)

|

Name of reporting person

TETRA Technologies, Inc.

|

|

(2)

|

Check the appropriate box if a member of a group (see instructions)

(a):☐ (b):☒

|

|

(3)

|

SEC Use Only

|

|

(4)

|

Source of funds (see instructions)

OO (Please see Item 3)

|

|

(5)

|

Check if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e)

☐

|

|

(6)

|

Citizenship or place of organization

Delaware

|

|

Number of

shares beneficially owned by

each reporting person with:

|

(7)

|

Sole voting power (1)

5,237,970

|

|

(8)

|

Shared voting power

0

|

|

(9)

|

Sole dispositive power (1)

5,237,970

|

|

(10)

|

Shared dispositive power

0

|

|

(11)

|

Aggregate amount beneficially owned by each reporting person (1)

5,237,970

|

|

(12)

|

Check if the aggregate amount in Row (11) excludes certain shares (see instructions)

☐

|

|

(13)

|

Percent of class represented by amount in Row (11)

11.06% (2)

|

|

(14)

|

Type of reporting person (see instructions)

HC; CO

|

|

(1)

|

TETRA Technologies, Inc., a Delaware corporation (“TETRA”), has indirect, sole voting power and indirect, sole dispositive power with respect to the 5,237,970 common units representing limited partner interests (“Common Units”) in CSI Compressco LP, a Delaware limited partnership (the “Issuer”), reported herein, 1,476,087 of which are directly held by TETRA International Incorporated, a Delaware corporation (“TII”), and 3,761,883 of which are directly held by Compressco Field Services, L.L.C., an Oklahoma limited liability company (“CFS”). CFS is a direct, wholly owned subsidiary of Compressco, Inc., a Delaware corporation (“CI”), and CI and TII are direct, wholly owned subsidiaries of TETRA.

|

|

(2)

|

Based on 47,352,291 Common Units outstanding as of January 29, 2021.

|

1

|

(1)

|

Name of reporting person

TETRA International Incorporated

|

|

(2)

|

Check the appropriate box if a member of a group (see instructions)

(a):☐ (b):☒

|

|

(3)

|

SEC use only

|

|

(4)

|

Source of funds (see instructions)

OO (Please see Item 3)

|

|

(5)

|

Check if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e)

☐

|

|

(6)

|

Citizenship or place of organization

Delaware

|

|

Number of

shares beneficially owned by

each reporting person with:

|

(7)

|

Sole voting power (1)

1,476,087

|

|

(8)

|

Shared voting power

0

|

|

(9)

|

Sole dispositive power (1)

1,476,087

|

|

(10)

|

Shared dispositive power

0

|

|

(11)

|

Aggregate amount beneficially owned by each reporting person (1)

1,476,087

|

|

(12)

|

Check if the aggregate amount in Row (11) excludes certain shares (see instructions)

☐

|

|

(13)

|

Percent of class represented by amount in Row (11)

3.12% (2)

|

|

(14)

|

Type of reporting person (see instructions)

CO

|

|

(1)

|

TII is the holder of record of 1,476,087 Common Units.

|

|

(2)

|

Based on 47,352,291 Common Units outstanding as of January 29, 2021.

|

2

|

(1)

|

Name of reporting person

Compressco, Inc.

|

|

(2)

|

Check the appropriate box if a member of a group (see instructions)

(a):☐ (b):☒

|

|

(3)

|

SEC use only

|

|

(4)

|

Source of funds (see instructions)

OO (Please see Item 3)

|

|

(5)

|

Check if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e)

☐

|

|

(6)

|

Citizenship or place of organization

Delaware

|

|

Number of

shares beneficially owned by

each reporting person with:

|

(7)

|

Sole voting power (1)

3,761,883

|

|

(8)

|

Shared voting power

0

|

|

(9)

|

Sole dispositive power (1)

3,761,883

|

|

(10)

|

Shared dispositive power

0

|

|

(11)

|

Aggregate amount beneficially owned by each reporting person (1)

3,761,883

|

|

(12)

|

Check if the aggregate amount in Row (11) excludes certain shares (see instructions)

☐

|

|

(13)

|

Percent of class represented by amount in Row (11)

7.94% (2)

|

|

(14)

|

Type of reporting person (see instructions)

HC; CO

|

|

(1)

|

CI has indirect, sole voting power and indirect, sole dispositive power with respect to the 3,761,883 Common Units reported herein, all of which are directly held by CFS, which is a direct wholly owned subsidiary of CI.

|

|

(2)

|

Based on 47,352,291 Common Units outstanding as of January 29, 2021.

|

3

|

(1)

|

Name of reporting person

Compressco Field Services, L.L.C.

|

|

(2)

|

Check the appropriate box if a member of a group (see instructions)

(a):☐ (b):☒

|

|

(3)

|

SEC use only

|

|

(4)

|

Source of funds (see instructions)

OO (Please see Item 3)

|

|

(5)

|

Check if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e)

☐

|

|

(6)

|

Citizenship or place of organization

Oklahoma

|

|

Number of

shares beneficially owned by

each reporting person with:

|

(7)

|

Sole voting power (1)

3,761,883

|

|

(8)

|

Shared voting power

0

|

|

(9)

|

Sole dispositive power (1)

3,761,883

|

|

(10)

|

Shared dispositive power

0

|

|

(11)

|

Aggregate amount beneficially owned by each reporting person (1)

3,761,883

|

|

(12)

|

Check if the aggregate amount in Row (11) excludes certain shares (see instructions)

☐

|

|

(13)

|

Percent of class represented by amount in Row (11)

7.94% (2)

|

|

(14)

|

Type of reporting person (see instructions)

HC; CO

|

|

(1)

|

CFS is the holder of record of 3,761,883 Common Units.

|

|

(2)

|

Based on 47,352,291 Common Units outstanding as of January 29, 2021.

|

4

|

Item 1.

|

Security and Issuer

|

This Amendment No. 7 to Schedule 13D (this “Amendment”) relates to common units representing limited partner interests (“Common Units”) in CSI Compressco LP, a Delaware limited partnership (the “Issuer”), whose principal executive offices are located at 24955 Interstate 45 North, The Woodlands, Texas 77380, and amends the Schedule 13D filed with the Securities and Exchange Commission (the “SEC”) on June 30, 2011 (the “Original Schedule 13D”) by TETRA Technologies, Inc., a Delaware corporation (“TETRA”), TETRA International Incorporated, a Delaware corporation (“TII”), Compressco, Inc., a Delaware corporation (“CI”), Compressco Field Services, Inc., an Oklahoma corporation (now known as Compressco Field Services, L.L.C., an Oklahoma limited liability company) (“CFS” and, together with TETRA, TTI and CI, the “Reporting Persons”) and Compressco Partners GP Inc. (now known as CSI Compressco GP LLC, a Delaware limited liability company) (the “General Partner”), as amended by that certain Amendment No. 1 filed on August 8, 2014, that certain Amendment No. 2 filed on August 25, 2014, that certain Amendment No. 3 filed on June 20, 2017, that certain Amendment No. 4 filed on March 5, 2018, that certain Amendment No. 5 filed on August 16, 2018, and that certain Amendment No. 6 filed on November 21, 2018.

Except as otherwise specified in this Amendment, all items left blank remain unchanged in all material respects and any items that are reported are deemed to amend, or amend and restate, as indicated herein, the corresponding items in the Original Schedule 13D, as previously amended. Capitalized terms used herein but not defined herein have the respective meanings ascribed to them in the Original Schedule 13D, as previously amended.

|

Item 2.

|

Identity and Background

|

The information previously provided in response to Item 2 is hereby amended and restated by replacing the text thereof in its entirety with the following:

|

|

(a)

|

This Schedule 13D is filed by:

|

|

|

(i)

|

TETRA Technologies, Inc., a Delaware corporation (“TETRA”);

|

|

|

(ii)

|

TETRA International Incorporated, a Delaware corporation (“TII”);

|

|

|

(iii)

|

Compressco, Inc., a Delaware corporation (“CI”); and

|

|

|

(iv)

|

Compressco Field Services, L.L.C., an Oklahoma limited liability company (“CFS”).

|

The foregoing persons are hereinafter sometimes collectively referred to as the “Reporting Persons.” All disclosures herein with respect to any Reporting Person are made only by such Reporting Person. Any disclosures herein with respect to persons other than the Reporting Persons are made on information and belief after making inquiry to the appropriate party.

TETRA is a publicly traded company. CFS is a direct, wholly owned subsidiary of CI and CI and TII are direct, wholly owned subsidiaries of TETRA. Accordingly, the Reporting Persons are hereby filing a joint Schedule 13D/A.

|

|

(b)

|

The principal business address of each Reporting Person is 24955 Interstate 45 North, The Woodlands, Texas, 77380.

|

|

|

(c)

|

TETRA, together with TII, CI, CFS and other of its subsidiaries, is a geographically diversified oil and gas services company. TETRA’s principal business, together with TII, CI, CFS and other of its subsidiaries, is to provide completion fluids and associated products and services, water management, frac flowback, and production well testing services.

|

(d) – (e) During the past five years, none of the Reporting Persons has (i) been convicted in a criminal proceeding or (ii) been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of which was or is subject to a judgment, decree or final

5

order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

In accordance with the provisions of General Instruction C to Schedule 13D, information concerning the executive officers, directors and each person controlling the Reporting Persons, as applicable (collectively, the “Listed Persons”), required by Item 2 of Schedule 13D is provided on Schedule 1 and is incorporated by reference herein. To the Reporting Persons’ knowledge, none of the Listed Persons have been, during the last five years, (i) convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors), or (ii) a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of which was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

|

Item 4.

|

Purpose of Transaction

|

The information previously provided in the initial paragraph in response to Item 4 is hereby amended and supplemented by adding the following:

On January 29, 2021, TETRA entered into a Purchase and Sale Agreement (the “Purchase Agreement”) with Spartan Energy Holdco, LLC, a Delaware limited liability company (“Spartan Holdco”), and, solely for certain purposes therein, Spartan Energy Partners LP, a Delaware limited partnership (“Spartan”), pursuant to which TETRA sold (i) 10,952,478 Common Units of the Issuer and (ii) all of the outstanding membership interests (the “GP Equity”) in the General Partner, to Spartan Holdco. The General Partner holds all of the incentive distribution rights of the Issuer and a 1.4 percent general partner interest in the Issuer. Collectively, the sale of Common Units and the GP Equity pursuant to the Purchase Agreement is referred to herein as the “GP Sale.” The consideration for the GP Sale was $14.0 million, which consisted of $13.4 million in cash paid at the closing and $0.5 million to be paid on the six-month anniversary of the closing. TETRA is also entitled to earn additional consideration of $3.1 million in the form of cash and/or Common Units if the Issuer achieves certain financial targets on or prior to December 31, 2022, as set forth in the Purchase Agreement.

The information previously provided in response to Item 4(a) is hereby amended and supplemented by adding the following:

Pursuant to the Purchase Agreement, TETRA is entitled to earn additional consideration of $3.1 million in the form of cash and/or Common Units if the Issuer achieves certain financial targets on or prior to December 31, 2022, as set forth in the Purchase Agreement. If earned, the additional consideration is payable on or before the 26-month anniversary of the closing.

The information previously provided in response to Item 4(d) is hereby amended and restated in its entirety as follows:

(d) None.

The information previously provided in response to Item 4(e) is hereby amended and restated in its entirety as follows:

(e) None.

|

Item 5.

|

Interest in Securities of the Issuer

|

The information previously provided in response to Item 5 is hereby amended and restated by replacing the text thereof in its entirety with the following:

|

|

(a)

|

(1)TETRA may be deemed to beneficially own 5,237,970 Common Units, 1,476,087 of which are directly held by TII and 3,761,883 of which are directly held by CFS. CFS is a direct, wholly

|

6

|

|

|

owned subsidiary of CI, and CI and TII are direct, wholly owned subsidiaries of TETRA. Such Common Units represent approximately 11.06% of the outstanding Common Units (based on calculations made in accordance with Rule 13d-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), there being 47,352,291 Common Units outstanding as of January 29, 2021).

|

|

|

(2)

|

TII is the record and beneficial owner of 1,476,087 Common Units. Such Common Units represent approximately 3.12% of the outstanding Common Units (based on calculations made in accordance with Rule 13d-3 of the Exchange Act, there being 47,352,291 Common Units outstanding as of January 29, 2021).

|

|

|

(3)

|

CI may be deemed to beneficially own 3,761,883 Common Units, all of which are directly held by CFS, which is a direct wholly owned subsidiary of CI. Such Common Units represent approximately 7.94% of the outstanding Common Units (based on calculations made in accordance with Rule 13d-3 of the Exchange Act, there being 47,352,291 Common Units outstanding as of January 29, 2021).

|

(4) CFS is the record and beneficial owner of 3,761,883 Common Units. Such Common Units represent approximately 7.94% of the outstanding Common Units (based on calculations made in accordance with Rule 13d-3 of the Exchange Act, there being 47,352,291 Common Units outstanding as of January 29, 2021).

|

|

(5)

|

See Schedule 1 for the aggregate number and percentage of Common Units beneficially owned by the Listed Persons as of January 29, 2021.

|

|

|

(b)

|

The information set forth in Items 7 through 11 of the cover pages hereto is incorporated herein by reference. See Schedule 1 for information applicable to the Listed Persons.

|

|

|

(c)

|

Except as described in Item 4 above or elsewhere in this Amendment, none of the Reporting Persons has effected any transactions in the Common Units during the past 60 days. Schedule 1 lists, to the Reporting Persons’ knowledge, transactions in Common Units during the past 60 days by the Listed Persons.

|

|

|

(d)

|

The Reporting Persons have the right to receive distributions from, and the proceeds from the sale of, the respective Common Units reported on the cover pages of this Schedule 13D and in this Item 5. See Schedule 1 for information applicable to the Listed Persons. The Reporting Persons may have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, Common Units beneficially owned by the Reporting Persons. Except for the foregoing and the cash distribution described in Item 6 below, no other person is known by the Reporting Persons to have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, Common Units beneficially owned by the Reporting Persons or, to the Reporting Persons’ knowledge, the Listed Persons.

|

|

Item 6.

|

Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer

|

The information previously provided in response to Item 6 is hereby amended and supplemented by adding the following:

On January 29, 2021, TETRA entered into the Purchase Agreement with Spartan Holdco and, solely for certain purposes therein, Spartan, pursuant to which TETRA sold (i) 10,952,478 Common Units of the Issuer and (ii) the GP Equity to Spartan Holdco.

7

|

Item 7.

|

Material to Be Filed as Exhibits

|

The information previously provided in response to Item 7 is hereby amended to add the following exhibits:

|

|

Exhibit G

|

Purchase and Sale Agreement, dated January 29, 2021, by and between TETRA Technologies, Inc., Spartan Energy Holdco, LLC, and, solely for the limited purposes set forth therein, Spartan Energy Partners LP (incorporated by reference to Exhibit 2.1 to TETRA’s Current Report on Form 8-K filed on January 29, 2021) (SEC File No. 001-13455).

|

|

|

Exhibit H

|

Joint Filing Statement filed herewith.

|

8

SIGNATURES

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this Statement is true, complete and correct.

Dated: February 2, 2021

TETRA Technologies, Inc.

By:/s/ Brady M. Murphy

Name:Brady M. Murphy

Title:President and Chief Executive Officer

TETRA International Incorporated

By:/s/ Brady M. Murphy

Name:Brady M. Murphy

Title:President

Compressco, Inc.

By:/s/ Brady M. Murphy

Name:Brady M. Murphy

Title:President

Compressco Field Services, L.L.C.

By:Compressco, Inc.,

its sole member

By:/s/ Brady M. Murphy

Name:Brady M. Murphy

Title:President

9

SCHEDULE 1

Listed Persons*

(as of January 29, 2021)

Executive Officers of TETRA Technologies, Inc.

Name: Brady M. Murphy

Address: c/o TETRA Technologies, Inc., 24955 Interstate 45 North, The Woodlands, Texas 77380

Principal Occupation: President and Chief Executive Officer, TETRA Technologies, Inc.

Citizenship: USA

Amount Beneficially Owned: 195,121 Common Units (less than 1%)

Name: Elijio V. Serrano

Address: c/o TETRA Technologies, Inc., 24955 Interstate 45 North, The Woodlands, Texas 77380

Principal Occupation: Senior Vice President and Chief Financial Officer, TETRA Technologies, Inc.

Citizenship: USA

Amount Beneficially Owned: 82,045 Common Units (less than 1%)

Name: Matthew J. Sanderson

Address: c/o TETRA Technologies, Inc., 24955 Interstate 45 North, The Woodlands, Texas 77380

Principal Occupation: Senior Vice President, TETRA Technologies, Inc.

Citizenship: Canadian

Amount Beneficially Owned: 0

Name: Timothy C. Moeller

Address: c/o TETRA Technologies, Inc., 24955 Interstate 45 North, The Woodlands, Texas 77380

Principal Occupation: Senior Vice President – Global Supply Chain and Chemicals, TETRA Technologies, Inc.

Citizenship: USA

Amount Beneficially Owned: 17,458 Common Units (less than 1%)

Name: Richard D. O’Brien

Address: c/o TETRA Technologies, Inc., 24955 Interstate 45 North, The Woodlands, Texas 77380

Principal Occupation: Vice President – Finance, Global Controller, and Assistant Treasurer

Citizenship: USA

Amount Beneficially Owned: 0

Name: Jacek M. Mucha

Address: c/o TETRA Technologies, Inc., 24955 Interstate 45 North, The Woodlands, Texas 77380

Principal Occupation: Vice President – Finance and Treasurer

Citizenship: USA

Amount Beneficially Owned: 16,412 Common Units (less than 1%)

Directors of TETRA Technologies, Inc.

Name: Mark E. Baldwin

Address: c/o TETRA Technologies, Inc., 24955 Interstate 45 North, The Woodlands, Texas 77380

Principal Occupation: Director, TETRA Technologies, Inc.

Citizenship: USA

Amount Beneficially Owned: 0

10

Name: Thomas R. Bates, Jr.

Address: c/o TETRA Technologies, Inc., 24955 Interstate 45 North, The Woodlands, Texas 77380

Principal Occupation: Director, TETRA Technologies, Inc.

Citizenship: USA

Amount Beneficially Owned: 10,500 Common Units (less than 1%)

Name: Paul D. Coombs

Address: c/o TETRA Technologies, Inc., 24955 Interstate 45 North, The Woodlands, Texas 77380

Principal Occupation: Director, TETRA Technologies, Inc.

Citizenship: USA

Amount Beneficially Owned: 62,680 Common Units (less than 1%)

Name: John F. Glick

Address: c/o TETRA Technologies, Inc., 24955 Interstate 45 North, The Woodlands, Texas 77380

Principal Occupation: Director, TETRA Technologies, Inc.

Citizenship: USA

Amount Beneficially Owned: 2,000 Common Units (less than 1%)

Name: Gina A. Luna

Address: c/o TETRA Technologies, Inc., 24955 Interstate 45 North, The Woodlands, Texas 77380

Principal Occupation: Director, TETRA Technologies, Inc.

Citizenship: USA

Amount Beneficially Owned: 0

Name: Brady M. Murphy

Director, TETRA Technologies, Inc.

(see above)

Name: William D. Sullivan

Address: c/o TETRA Technologies, Inc., 24955 Interstate 45 North, The Woodlands, Texas 77380

Principal Occupation: Chairman of the Board of Directors, TETRA Technologies, Inc.

Citizenship: USA

Amount Beneficially Owned: 77,449 Common Units (less than 1%)

Name: Joseph C. Winkler III

Address: c/o TETRA Technologies, Inc., 24955 Interstate 45 North, The Woodlands, Texas 77380

Principal Occupation: Director, TETRA Technologies, Inc.

Citizenship: USA

Amount Beneficially Owned: 0

Executive Officers of TETRA International Incorporated

Name: Brady M. Murphy

President, TETRA International Incorporated

(see above)

Name: Matthew J. Sanderson

Vice President, TETRA International Incorporated

(see above)

Name: Jacek M. Mucha

Treasurer, TETRA International Incorporated

(see above)

11

Directors of TETRA International Incorporated

Name: Brady M. Murphy

Director, TETRA International Incorporated

(see above)

Executive Officers of Compressco, Inc.

Name: Brady M. Murphy

President, Compressco, Inc.

(see above)

Name: Jacek M. Mucha

Treasurer, Compressco, Inc.

(see above)

Directors of Compressco, Inc.

Name: Brady M. Murphy

Director, Compressco, Inc.

(see above)

Executive Officers of Compressco Field Services, L.L.C.

Name: Brady M. Murphy

President, Compressco Field Services, L.L.C.

(see above)

Name: Jacek M. Mucha

Treasurer, Compressco Field Services, L.L.C.

(see above)

Directors of Compressco Field Services, L.L.C.

Name: Brady M. Murphy

Director, Compressco Field Services, L.L.C.

(see above)

*Unless otherwise indicated, the Listed Person has sole power to vote or direct the vote and sole power to dispose or direct the disposition of the Common Units.

12

JOINT FILING STATEMENT

We, the undersigned, hereby express our agreement that the attached Amendment No. 7 to Schedule 13D is, and any further amendments hereto shall be, filed on behalf of each of us pursuant to and in accordance with the provisions of Rule 13d-1(k) under the Securities Exchange Act of 1934. This agreement may be terminated with respect to the obligations to jointly file future amendments to such statement on Schedule 13D as to any of the undersigned upon such person giving written notice thereof to each of the other persons signatory hereto, at the principal office thereof.

Dated: February 2, 2021

TETRA Technologies, Inc.

By:/s/ Brady M. Murphy

Name:Brady M. Murphy

Title:President and Chief Executive Officer

TETRA International Incorporated

By:/s/ Brady M. Murphy

Name:Brady M. Murphy

Title:President

Compressco, Inc.

By:/s/ Brady M. Murphy

Name:Brady M. Murphy

Title:President

Compressco Field Services, L.L.C.

By:Compressco, Inc.,

its sole member

By:/s/ Brady M. Murphy

Name:Brady M. Murphy

Title:President

13

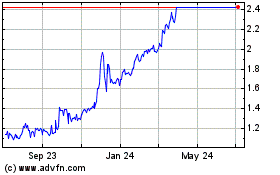

CSI Compressco (NASDAQ:CCLP)

Historical Stock Chart

From Mar 2024 to Apr 2024

CSI Compressco (NASDAQ:CCLP)

Historical Stock Chart

From Apr 2023 to Apr 2024