Amended Current Report Filing (8-k/a)

February 13 2023 - 4:10PM

Edgar (US Regulatory)

falseCRONOS GROUP INC.0001656472TorontoCanada001-38403Ontario00016564722022-01-102022-01-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

Amendment No. 1

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 13, 2022

CRONOS GROUP INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

British Columbia, Canada | 001-38403 | N/A |

| (State or other jurisdiction | (Commission | (I.R.S. Employer |

| of incorporation) | File Number) | Identification No.) |

| | | | | | | | |

| 111 Peter Street, Suite 300 | | |

Toronto , Ontario | | M5V 2H1 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (416) 504-0004

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class | Trading Symbol(s)

| Name of each exchange on which registered |

| Common Shares, no par value | CRON | The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

As previously disclosed, effective as of November 14, 2022, Robert Madore ceased to serve as Chief Financial Officer of Cronos Group Inc. (the “Company”) and ceased to be employed by the Company and Cronos USA Client Services LLC (“Cronos USA”). In accordance with the terms and conditions of his employment agreement and outstanding equity award agreements, subject to Mr. Madore’s entering into a release of claims, Mr. Madore became entitled to (1) a lump sum payment of $450,000, which represents one year of Mr. Madore’s annual base salary, (2) a pro-rated annual bonus for the Company’s 2022 fiscal year, and (3) accelerated vesting of 450,000 non-qualified stock options and 37,500 restricted share units.

On February 8, 2023, the Company and Cronos USA, entered into a separation agreement with Mr. Madore (the “Separation Agreement”). The Separation Agreement specifies that Mr. Madore’s pro-rated annual bonus for the Company’s 2022 fiscal year will have an individual performance component of $123,750 and a business performance component equal to: $562,500, multiplied by 60%, multiplied by the business performance rating percentage determined solely by the Company, and thereafter multiplied by a fraction where the numerator is 11 and the denominator is 12, subject to the terms and conditions of the Company’s short-term incentive compensation program and Mr. Madore entering into the aforementioned release of claims. In addition, the Separation Agreement provides for a lump sum payment of $18,356.61, which is equal to one year of Cronos USA’s portion of Mr. Madore’s benefits premium, grossed up, in lieu of the continuation of group insured benefits he was entitled to under his employment agreement.

Pursuant to the Separation Agreement, Mr. Madore continues to be subject to an ongoing non-disparagement provision, and the ongoing confidentiality and intellectual property provisions contained in his employment agreement.

The foregoing description of the Separation Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Separation Agreement, which is attached hereto as Exhibit 10.1 and incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | | | | | | | |

| Exhibit No. | | Description | | |

| 10.1 | | | | |

| 104 | | Cover Page Interactive Data File | | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | CRONOS GROUP INC. |

| | | |

| | | |

| Dated: February 13, 2013 | | By: | /s/ Michael Gorenstein |

| | | Name: Michael Gorenstein |

| | | Title: President & Chief Executive Officer |

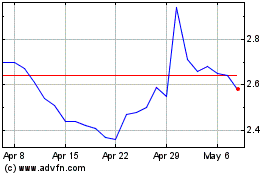

Cronos (NASDAQ:CRON)

Historical Stock Chart

From Mar 2024 to Apr 2024

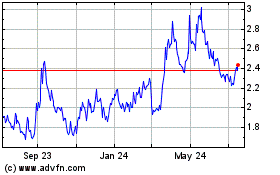

Cronos (NASDAQ:CRON)

Historical Stock Chart

From Apr 2023 to Apr 2024