UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

|

|

|

|

|

|

|

|

Filed by the Registrant x

|

|

Filed by a Party other than the Registrant o

|

|

Check the appropriate box:

|

|

o

|

Preliminary Proxy Statement

|

|

o

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a‑6(e)(2))

|

|

o

|

Definitive Proxy Statement

|

|

x

|

Definitive Additional Materials

|

|

o

|

Soliciting Material under §240.14a‑12

|

|

|

|

|

|

|

|

|

|

|

|

Criteo S.A.

|

|

(Name of Registrant as Specified In Its Charter)

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

x

|

No fee required.

|

|

o

|

Fee computed on table below per Exchange Act Rules 14a‑6(i)(1) and 0‑11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0‑11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

o

|

Fee paid previously with preliminary materials.

|

|

o

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0‑11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

|

|

(4)

|

Date Filed:

|

|

|

|

|

Paris, April 29, 2021

Dear Shareholder,

We are pleased to hereby inform you that you are convened to the CRITEO S.A. (the “Company”) combined ordinary and extraordinary shareholders’ meeting to be held on June 15, 2021 at 4:00 p.m., Paris time (the “Combined Shareholders Meeting”), in order to deliberate on the agenda detailed in the enclosed document.

We hereby inform you, as an owner of Criteo Ordinary Shares, that our 2021 Proxy Statement (including a template of proxy card) and our Annual Report on Form 10-K for the year ended December 31, 2020 (the “proxy materials”), which are required to be disseminated to you under United States Securities laws, can all be located on the Investor Relations portion of our website at https://criteo.investorroom.com/annuals as of this date. The resolutions to be voted upon at the 2021 Combined Annual Shareholders Meeting are listed in the proxy materials.

We encourage you to access and review all of the important information contained in the proxy materials before voting. If you want to receive a paper or e-mail copy of these documents, you may request one by e-mailing InvestorRelations@criteo.com. There is NO charge for requesting a copy. Please make the request as instructed on or before June 1, 2021 to facilitate timely delivery. You will not otherwise receive a paper or e-mail copy.

In addition, any documents that must be made available to the shareholders pursuant to French law will be available, within the legal time period, upon request sent to the following email address: AGM@criteo.com, together with proof of a shareholding certificate.

In the context of the COVID-19 pandemic, and in compliance with the special rules enacted by the French government to prevent the spreading of this virus (notably, order n°2020-321 dated March 25, 2020 adapting the conditions in which shareholders’ meetings are held, as extended by order n°2021-255 dated March 9), the Board of Directors of the Company decided that the Combined Shareholders Meeting will be held in closed session, i.e., without the presence of the shareholders and any other person entitled to attend it. Nonetheless, the Company has set up an alternative process enabling you to view a live webcast of the Combined Shareholders Meeting in a “listen-only” mode through a link that will be posted on the portion of the Company’s website dedicated to the Combined Shareholders Meeting, which can also be found at https://criteo.investorroom.com/annuals.

Since you shall not be able to attend in person such meeting, you will have the right to (i) vote by submitting your voting card by mail, (ii) grant your voting proxy directly to the chairman of the Combined Shareholders Meeting, or (iii) grant your voting proxy to another shareholder, your spouse or your partner with whom you have entered into a civil union, provided in each case that you are the holder of record of such Ordinary Shares at 12:00 a.m., Paris time, on June 11, 2021.

Exceptionally, we urge you not to give proxy to a third party (other than the chairman of the Combined Shareholders Meeting) as the latter will not be able to attend the Combined Shareholders Meeting. We strongly recommend that you exercise your rights as shareholder before the holding of the Combined Shareholders Meeting, either by voting by submitting your voting card by mail or by being represented by the chairman of the Combined Shareholders Meeting, it being noted that in such case, the chairman of the Combined Shareholders Meeting will vote your Ordinary Shares in accordance with the board of directors’ recommendations.

To that end, you can request a voting or proxy form and return it to BNP Paribas Securities Services at the address provided below. All requests for voting or proxy forms must be received by BNP Paribas Securities Services (Services Assemblées Générales) at the following address:

BNP Paribas Securities Services

Les Grands Moulins de Pantin

Services Assemblées Générales

9 rue du Débarcadère

93761 Pantin Cedex - France

Tél. : + 33.1.57.43.02.30

The deadline for requesting a proxy card from BNP Paribas Securities Services is at least six days before the date of the Combined Shareholders Meeting, i.e., on June 9, 2021 at the latest.

Further, if you choose to vote by mail, please note that to be taken into account, the voting forms must be received by BNP Paribas Securities Services (Services Assemblées Générales) by June 11, 2021 at the latest.

You can also raise written questions in advance of the meeting. These questions must be sent to the Company at the latest on the fourth (4th) business day prior to the date on which the Combined Shareholders Meeting is held, i.e., June 9, 2021 included, to the attention of the Chief Executive Officer of the Company, either by letter sent with acknowledgment of receipt to the Company’s registered office, or by email at the following address : AGM@criteo.com, in each case accompanied with proof of a shareholding certificate. Given the current health context, we strongly recommend communications via email. At management’s discretion, proper questions raised in advance of the meeting in accordance with these procedures will be addressed by the Company during the Combined Shareholders Meeting.

Since the Combined Shareholders Meeting will be held without the presence of shareholders and the live webcast will be available in “listen-only” mode, you will not be allowed to raise questions during such meeting.

Shareholders will also not be allowed to modify the text of the resolutions nor to submit new resolutions during the Combined Shareholders Meeting. We recommend that you regularly check out our webpage dedicated to the Combined Shareholders Meeting available at https://criteo.investorroom.com/annuals.

Finally, note that all information regarding the Combined Shareholders Meeting can be found online on the Company’s Investor Relations website: http://criteo.investorroom.com/annuals.

Yours sincerely,

/s/Rachel Picard

For the Board of Directors

Rachel Picard

Chairwoman of the Board

Encl.: agenda of the Combined Shareholders Meeting

COMBINED SHAREHOLDERS MEETING OF JUNE 15, 2021

Agenda for the Ordinary Shareholders’ Meeting

1. renewal of the term of office of Ms. Rachel Picard as Director,

2. renewal of the term of office of Ms. Nathalie Balla as Director,

3. renewal of the term of office of Mr. Hubert de Pesquidoux as Director,

4. ratification of the temporary appointment by the Board of Directors of Ms. Megan Clarken as Director,

5. non-binding advisory vote to approve the compensation for the named executive officers of the Company,

6. approval of the statutory financial statements for the fiscal year ended December 31, 2020,

7. approval of the consolidated financial statements for the fiscal year ended December 31, 2020,

8. approval of the allocation of profits for the fiscal year ended December 31, 2020,

9. delegation of authority to the Board of Directors to execute a buyback of Company stock in accordance with L. 225-209-2 of the French Commercial Code,

Agenda for the Extraordinary Shareholders’ Meeting

10. authorization to be given to the Board of Directors to reduce the Company’s share capital by cancelling shares as part

of the authorization to the Board of Directors allowing the Company to buy back its own shares in accordance with the

provisions of Article L. 225-209-2 of the French Commercial Code,

11. authorization to be given to the Board of Directors to reduce the Company’s shares capital by cancelling shares

acquired by the Company in accordance with the provisions of Article L. 225-208 of the French Commercial Code,

12. delegation of authority to the Board of Directors to reduce the share capital by way of a buyback of Company stock

followed by the cancellation of the repurchased stock,

13. approval of the maximum number of shares that may be issued or acquired pursuant to the authorizations given to the

Board of Directors by the Shareholders’ Meeting dated June 25, 2020 to grant OSAs (options to subscribe for new Ordinary

Shares) or OAAs (options to purchase Ordinary Shares), time-based restricted stock units (Time-Based RSUs) and

performance-based restricted stock units (Performance-Based RSUs) pursuant to resolutions 16 to 18 of the Shareholders’

Meeting dated June 25, 2020,

14. delegation of authority to the Board of Directors to increase the Company’s share capital by issuing ordinary shares,

or any securities giving access to the Company’s share capital, for the benefit of a category of persons meeting predetermined

criteria (underwriters), without shareholders’ preferential subscription rights,

15. Delegation of authority to the Board of Directors to increase the Company’s share capital by issuing ordinary shares or

any securities giving access to the Company’s share capital through a public offering referred to in paragraph 1° of article L.

411-2 of the French Monetary and Financial Code, without shareholders’ preferential subscription rights,

16. Delegation of authority to the Board of Directors to increase the Company’s share capital through incorporation of

premiums, reserves, profits or any other amounts that may be capitalized,

17. delegation of authority to the Board of Directors to increase the number of securities to be issued as a result of a

share capital increase without shareholders’ preferential subscription rights pursuant to items 14 and 15 above (“green shoe”),

18. delegation of authority to the Board of Directors to increase the Company’s share capital by way of issuing shares and

securities giving access to the Company’s share capital for the benefit of members of a Company savings plan (plan

d'épargne d’entreprise),

19. approval of the overall limits on the amount of ordinary shares to be issued pursuant to items 14 to 16 and 18 above,

20. amendment to Article 11 of the by-laws of the Company to provide for a Vice-chairperson of the board of directors,

21. amendment of Article 12.4 of the by-laws of the Company to remove the requirement that an in-person Board meeting

be held for the dismissal of the CEO for any cause other than willful misconduct.

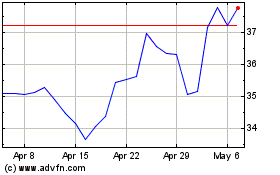

Criteo (NASDAQ:CRTO)

Historical Stock Chart

From Mar 2024 to Apr 2024

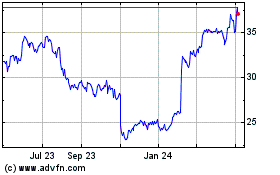

Criteo (NASDAQ:CRTO)

Historical Stock Chart

From Apr 2023 to Apr 2024