Agricultural Business

Our

Agricultural business is further comprised of four

segments:

●

The

“Agricultural production” segment consists of planting,

harvesting and sale of crops as wheat, corn, soybeans, cotton and

sunflowers; breeding, purchasing and/or fattening of free-range

cattle for sale to slaughterhouses and local livestock auction

markets; leasing of the Company’s farms to third parties; and

planting, harvesting and sale of sugarcane. Our Agricultural

production segment had assets of ARS 34,284 million, ARS 34,663

million, ARS 35,222 million, and ARS 34,144 million as of September

30, 2020 and 2019, and June 30, 2020 and 2019, respectively,

representing 87.24%, 88.45%, 88.26%, and 91.67%, respectively, of

our agricultural business assets at such dates. Our Agricultural

production segment generated income from operations of ARS 164

million, ARS 1,124 million, ARS 3,792 million, and ARS 2,285

million, for the three-month periods ended September 30, 2020 and

2019, and fiscal years ended June 30, 2020 and 2019, respectively,

representing 9.66%, 58.18%, 53.08% and 67.49%, of our consolidated

profit from operations from Agricultural Business for such periods,

respectively.

The

segment “agricultural production” aggregate the crops,

cattle, sugarcane and agricultural rental and services

activities:

●

Our

“Crops” activity consists of planting, harvesting and

sale of crops as wheat, corn, soybeans, cotton, and sunflowers. The

Company is focused on the long-term performance of the land and

seeks to maximize the use of the land through crop rotation, the

use of technology and techniques. In this way, the type and

quantity of harvested crops change in each agricultural campaign.

Our Crops activity had assets of ARS 15,745 million, ARS 15,052

million, ARS 17,036 million and ARS 15,909 million as of September

30, 2020 and 2019, and June 30, 2020 and 2019, respectively,

representing 40.06%, 38.41%, 42.69% and 42.71% of our Agricultural

Business assets at such dates, respectively. Our Crops activity

generated loss from operations of ARS 403 million and profit from

operations of ARS 584 million, ARS 2,054 million and ARS 1,544

million for the three-month periods ended September 30, 2020 and

2019, and fiscal years ended June 30, 2020 and 2019, respectively,

representing (23.73%), 30.23%, 28.76% and 45.67%, of our

consolidated profit from operations from Agricultural Business for

such periods, respectively.

●

Our

“Cattle” activity consists of breeding, purchasing

and/or fattening of free-range cattle for sale to meat processors

and local livestock auction markets. Our Cattle activity had assets

of ARS 5,334 million, ARS 5,844 million, ARS 5,401 million and ARS

5,750 million as of September 30, 2020 and 2019, and June 30, 2020

and 2019, respectively, representing 13.57%, 14.91%, 13.53% and

15.44% of our agricultural business assets at such dates,

respectively. Our Cattle activity generated income from operations

of ARS 48 million, operating loss of ARS 90 million, operating

income of ARS 251 million

●

and operating loss

of ARS 109 million for the three-month periods ended September 30,

2020 and 2019, and fiscal years ended June 30, 2020 and 2019,

respectively, representing 2.83%, (4.66%), 3.51% and (3.22%), of

our consolidated profit from operations from Agricultural Business

for such periods, respectively.

●

Our

“Sugarcane” activity consists of planting, harvesting

and sale of sugarcane. Our Sugarcane activity had assets of ARS

8,032 million, ARS 10,508 million, ARS 8,060 million and ARS 9,370

million as of September 30, 2020 and 2019, and June 30, 2020 and

2019, respectively, representing 20.44%, 26.81%, 20.20% and 25.16%

of our agricultural business assets at such dates, respectively.

Our Sugarcane activity generated profit from operations of ARS 554

million, ARS 622 million, ARS 1,151 million and ARS 559 million for

the three-month periods ended September 30, 2020 and 2019, and

fiscal years ended June 30, 2020 and 2019, respectively,

representing 32.63%, 32.19%, 16.11% and 16.53%, of our consolidated

profit from operations from Agricultural Business for such periods,

respectively.

●

Our

“Agricultural rentals and Services” activity consists

of agricultural services (for example: irrigation) and leasing of

the Company’s farms to third parties. Our Agricultural

Rentals and Services activity had assets of ARS 5,173 million, ARS

3,259 million, ARS 4,724 million and ARS 3,114 million as of

September 30, 2020 and 2019, and June 30, 2020 and 2019,

respectively, representing 13.16%, 8.32%, 11.84% and 8.36% of our

agricultural business assets at such dates, respectively. Our

Agricultural Rentals and Services activity generated operating loss

of ARS 35 million, operating profit of ARS 8 million, ARS 335

million and ARS 288 million for the three-month periods ended

September 30, 2020 and 2019, and fiscal years ended June 30, 2020

and 2019, respectively, representing (2.06%), 0.41%, 4.69% and

8.52% of our profit from operations from Agricultural Business for

such periods, respectively.

●

Our “Land

transformation and Sales” segment comprises gains from the

disposal and development of farmlands activities. Our Land

Transformation and Sales segment had assets of ARS 192 million, ARS

185 million, ARS 549 million and ARS 160 million as of September

30, 2020 and 2019, and June 30, 2020 and 2019, respectively,

representing 0.49%, 0.47%, 1.38% and 0.43% of our agricultural

business assets at such dates, respectively. Our Land

Transformation and Sales segment generated profit from operations

of ARS 1,438 million, ARS 518 million, ARS 2,748 million and ARS

947 million for the three-month periods ended September 30, 2020

and 2019, and fiscal years ended June 30, 2020 and 2019,

respectively, representing 84.69%, 26.81%, 38.45% and 28.04% of our

profit from operations from Agricultural Business for such periods,

respectively.

●

Our “Other

segments” includes, principally, feedlot farming,

slaughtering and processing in the meat refrigeration plant, among

others. Our Others segment had assets of ARS 4,823 million, ARS

4,340 million, ARS 4,137 million and ARS 2,941 million as of

September 30, 2020 and 2019, and June 30, 2020 and 2019,

respectively, representing 12.27%, 11.07%, 10.37% and 7.90% of our

agricultural business assets at such dates, respectively. Our

Others activity generated profit from operations of ARS 153

million, ARS 341 million, ARS 796 million and ARS 446 million for

the three-month periods ended September 30, 2020 and 2019, and

fiscal years ended June 30, 2020 and 2019, respectively,

representing 9.01%, 17.65%, 11.15% and 13.19% of our consolidated

operating income from Agricultural Business for such periods,

respectively. The segment “Other segments” aggregate

the activities Agro-industrial and Others:

●

Our

“Agro-industrial” activity consists of feedlot farming

and the slaughtering and processing in the meat refrigerating

plant. Feedlot farming is distinctive and requires specific care

and diets which differ from those provided to free-range cattle.

This activity represents a separate operating activity due to the

distinctive characteristics of the cattle feedlot system and the

industrialized meat processing in the packing plant. Our

Agro-industrial activity had assets of ARS 1,985 million, ARS 1,226

million, ARS 1,945 million and ARS 1,139 million as of September

30, 2020 and 2019, and June 30, 2020 and 2019, respectively,

representing 5.05%, 3.13%, 4.87% and 3.06% of our agricultural

business assets at such dates, respectively. Our Agro-Industrial

activity generated losses from operations of ARS 37

million,

●

operating profit of

ARS 31 million, operating loss of ARS 57 million and ARS 208

million for the three-month periods ended September 30, 2020 and

2019, and fiscal years ended June 30, 2020 and 2019, respectively,

representing (2.18%), 1.60%, (0.80%) and (6.15%) of our

consolidated operating income from Agricultural Business for such

periods, respectively.

●

Our

“Others” activity consists of the aggregation of the

remaining operating segments, which do not meet the quantitative

thresholds for disclosure. This activity includes the brokerage and

sale of inputs activities. Our Others activity had assets of ARS

2,838 million, ARS 3,114 million, ARS 2,192 million and ARS 1,802

million as of September 30, 2020 and 2019, and June 30, 2020 and

2019, respectively, representing 7.22%, 7.95%, 5.49% and 4.84% of

our agricultural business assets at such dates, respectively. Our

Others activity generated profit from operations of ARS 190

million, ARS 310 million, ARS 853 million and ARS 654 million for

the three-month periods ended September 30, 2020 and 2019, and

fiscal years ended June 30, 2020 and 2019, respectively,

representing 11.19%, 16.05%, 11.94% and 19.34% of our consolidated

operating income from Agricultural Business for such periods,

respectively.

●

The

“Corporate” segment includes, principally, the

corporative expenses related to the agricultural business. Our

Corporate segment and corporate activity generated operating losses

of ARS 57 million, ARS 51 million, ARS 191 million and ARS 295

million for the three-month periods ended September 30, 2020 and

2019, and fiscal years ended June 30, 2020 and 2019, respectively,

representing (3.36%), (2.64%), (2.67%) and (8.73%) of our

consolidated profit from operations from Agricultural Business for

such periods, respectively.

Operation Center in Argentina

We

operate our business in Argentina through seven segments, namely

“Shopping Malls,” “Offices,” “Sales

and Developments,” “Hotels,”

“International.” “Corporate” and

“Others” as further described below:

●

Our “Shopping

Malls” segment includes the operating results from our

portfolio of shopping malls principally comprised of lease and

service revenue from tenants. Our Shopping Malls segment had assets

of ARS 54,406 million, ARS 55,279 million,

ARS 53,165 million and ARS 54,277 million as of September

30, 2020 and 2019, and June 30, 2020 and 2019, respectively,

representing 29.41%, 29.88%, 31.2% and 45.2% of our operating

assets for the Operations Center in Argentina at such dates,

respectively. Our Shopping Malls segment generated operating income

of ARS 986 million, operating income of ARS 2,082

million, operating income of ARS 1,818 million and operating

loss ARS 37,033 million for the three-month periods ended

September 30, 2020 and 2019, and fiscal years ended June 30, 2020

and 2019, respectively.

●

Our

“Offices” segment includes the operating results from

lease revenues of offices, other rental spaces and other service

revenues related to the office activities. Our Offices segment had

assets of ARS 72,262 million, ARS 40,970 million,

ARS 67,827 million and ARS 34,166 million as of September

30, 2020 and 2019, and June 30, 2020 and 2019, respectively,

representing and 39.06% and 22.14% of our operating assets for the

Operations Center in Argentina at such dates, respectively. Our

Offices segment generated an operating income of ARS 13,483

million, operating income of ARS 7,413 million, operating

income of ARS 27,099 million and operating income of

ARS 2,553 million for the three-month periods ended September

30, 2020 and 2019, and fiscal years ended June 30, 2020 and 2019,

respectively.

●

Our “Sales

and Developments” segment includes the operating results of

the development, maintenance and sales of undeveloped parcels of

land and/or trading properties. Real estate sales results are also

included. Our Sales and Developments segment had assets of

ARS 45,273 million, ARS 36,352 million, ARS 36,018

million and ARS 30,558 million as of September 30, 2020 and

2019, and June 30, 2020 and 2019, respectively, representing 24.47%

and 19.65% of our operating assets for the Operations Center in

Argentina. Our Sales and Developments segment generated an

operating income of ARS 9,661 million, ARS 5,045 million,

ARS 12,694 million and ARS 680 million for

the

●

three-month periods

ended September 30, 2020 and 2019, and fiscal years ended June 30,

2020 and 2019, respectively, respectively, without considering the

share of profit of associates and joint ventures.

●

Our

“Hotels” segment includes the operating results of our

hotels mainly comprised of room, catering and restaurant revenues.

Our Hotels segment had assets of ARS 1,954

million,ARS 2,155 million, ARS 1,979 million and

ARS 2,075 million as of September 30, 2020 and 2019, and June

30, 2020 and 2019, respectively, representing 1.06% and 1.16% of

our operating assets for the Operations Center in Argentina,

respectively. Our Hotels segment generated an operating loss of

ARS 191 million, operating income of ARS 84 million,

operating income of ARS 172 million and an operating income of

ARS 725 million for the three-month periods ended September

30, 2020 and 2019, and fiscal years ended June 30, 2020 and 2019,

respectively.

●

Our

“International” segment includes investments that

mainly operate in the United States in relation to the lease of

office buildings and hotels in that country. We intend to continue

evaluating investment opportunities outside Argentina as long as

they are attractive investment and development options. Our

International segment had assets of ARS 1,884 million, net

liabilities of ARS 9,269 million, net assets of ARS 2,488

million and net liabilities of ARS 7,484 million as of

September 30, 2020 and 2019, and June 30, 2020 and 2019,

respectively. Our International segment generated operating income

of ARS 11 million, operating losses of ARS 43 million,

operating losses of ARS 119 million and operating losses of

ARS 129 million for the three-month periods ended September

30, 2020 and 2019, and fiscal years ended June 30, 2020 and 2019,

respectively.

●

Our

“Corporate” segment. Since fiscal year 2019, we have

decided to disclose certain corporate expenses related to the

holding structure in a separate “Corporate” segment.

This segment generated a loss of ARS 74 million, ARS 88

million, ARS 304 million and ARS 560 million for the

three-month periods ended September 30, 2020 and 2019, and fiscal

years ended June 30, 2020 and 2019, respectively.

●

Our

“Others” Segment includes the entertainment activities

through La Arena and La Rural S.A. and the financial activities

carried out by Banco Hipotecario for both years and Tarshop

S.A. (“Tarshop”) just for 2020. Our

“Others” segment had assets of ARS 9,241 million,

ARS 7,357 million, ARS 8,902 million and ARS 6,510

million as of September 30, 2020 and 2019, and June 30, 2020 and

2019, respectively, representing 4.99 and 3.98% of our operating

assets for the Operations Center in Argentina, respectively. Our

Others segment generated operating income of ARS 492 million,

operating income of ARS 257 million, operating income of

ARS 596 million and operating loss of ARS 844 million for

the three-month periods ended September 30, 2020 and 2019, and

fiscal years ended June 30, 2020 and 2019, respectively, without

considering share of profit of associates and joint

ventures.

This summary highlights material information appearing elsewhere in

this prospectus or incorporated by reference. While this summary

highlights what we consider to be the most important information

about us and the offering, before investing in our common shares,

the ADSs or our warrants you should carefully read in its entirety

this prospectus, the documents incorporated herein by reference and

the registration statement of which this prospectus forms a part,

including the information set forth under “Risk

Factors” and “Operating Review and Prospects” and

our financial statements and related notes in our 2020 Form 20-F

and our Form 6-K. See “Incorporation by Reference” and

“Where You Can Find More Information.”

|

Offering of common

share rights and ADS rights

|

We are

granting to our common shareholders rights (“common share

rights”) to subscribe for 90,000,000 new common shares and

90,000,000 warrants to acquire additional common shares. Each

common share held of record at 6:00 p.m. (Buenos Aires City time)

on February 19, 2021 entitles its holder to one common share right.

Each common share right will entitle its holder to subscribe for

0.1794105273 new common shares and to receive free of charge, for

each new common share that it purchases pursuant to this offering,

one warrant to purchase one additional common share.

The

Bank of New York Mellon, as our ADS rights agent, will make

available to holders of ADSs the ADS rights to subscribe for new

ADSs and warrants to acquire additional common shares that may be

deposited for delivery of ADSs. Each ADS held of record at 5:00

p.m. (New York City time) on February 19, 2021 entitles its holder

to one ADS right. Each ADS right will entitle its holder to

subscribe for 0.1794105273 new ADSs and to receive free of charge,

for each new ADS that it purchases pursuant to this offering, 10

warrants, each of which will entitle such holder to purchase one

additional common share.

|

|

Subscription period

for the common share rights and ADS rights

|

From

February 22, 2021, through 6:00 p.m. (Buenos Aires City time) on

March 5, 2021, in the case of the common share rights (the

“common shares subscription period”) and from February

22, 2021, through 5:00 p.m. (New York City time) on March 2, 2021,

in the case of the ADS rights (the “ADS subscription

period”).

To

exercise common share rights, you must deliver to our common shares

agent a properly completed subscription form accompanied by a

certificate of ownership issued by the Caja de Valores or evidence of

assignment of the common share rights in your favor by 6:00 p.m.

(Buenos Aires City time) on March 5, 2021, or your common share

rights will lapse and will have no further value. Deposit in the

mail will not constitute delivery to us.

To

exercise the ADS rights, you must (i) instruct your broker or other

securities intermediary to exercise ADS rights on your behalf and

pay the amount specified below for each ADSs subscribed or sought

pursuant to accretion rights through the automated system of The

Depository Trust Company (“DTC”) (in the case of ADS

rights held through DTC) or (ii) deliver to the ADS rights agent a

properly completed ADS rights subscription form and pay the amount

specified below for each ADS subscribed or sought pursuant to

accretion rights by personal or business check (in the case of ADSs

held directly on the books of the Depositary). In either case, the

subscription and payment must be received by the ADS rights agent

by 5:00 p.m. (New York City time) on March 2, 2021. Your broker or

other securities intermediary will set an earlier cutoff date and

time to receive your instructions to subscribe.

If you

do not exercise your ADS rights, the Depositary will try to sell

the underlying share rights in the Argentine market. If the

Depositary is successful in selling those share rights, it expects

to receive Argentine pesos and will hold the net proceeds in

Argentine pesos for your account. However, under current Argentine

laws and regulations, the Depositary would not be able to convert

those pesos into U.S. dollars and thus would be unable to pay those

proceeds to you. If the Depositary receives payment in U.S. dollars

or is able to convert Argentine pesos into U.S. dollars, it will

convert the sales proceeds into dollars, if applicable, and pay you

your share, after deduction of applicable fees and

expenses.

The exercise of common share rights and ADS rights is irrevocable

and may not be canceled or modified.

|

|

Accretion

rights

|

Concurrently

with the exercise of their common share rights, holders of common

shares may exercise their statutory accretion rights with respect

to common shares not subscribed for by other holders of common

shares in the exercise of their respective preemptive rights, by

indicating the maximum number of additional common shares they

would like to purchase pursuant to their accretion rights, which

shall not exceed the amount of common shares subscribed for by such

holder in the exercise of its preemptive rights. Common shares

relating to such accretion rights will be allocated to each

exercising holder of common shares that has requested additional

shares through the exercise of accretion rights pro rata based on

the ratio between the number of common shares available and the

aggregate permissible amount sought by subscribing

holders.

Concurrently

with the exercise of their preemptive rights, ADS holders that

subscribe for new ADSs pursuant to their ADS rights may indicate to

their securities intermediary or on their subscription forms a

number of additional ADSs for which they would be willing to

subscribe pursuant to their accretion rights, which shall not

exceed the number of new ADSs subscribed for by such holder in the

exercise of its preemptive rights. If accretion rights are

allocated to the Depositary, the ADS rights agent will allocate

additional ADSs to ADS holders that requested them. If the amount

of additional ADSs available pursuant to accretion rights are

insufficient to satisfy all requests, we will allocate the

available additional ADSs among requesting ADS holders pro rata

based on the ratio between the number of ADSs available and the

aggregate permissible amount sought by subscribing

holders.

On

March 8, 2021, which is one business day after the end of the

common shares subscription period, we will notify holders of common

share rights and ADS holders who have indicated that they wish to

exercise their accretion rights of the aggregate number of

unsubscribed common shares and ADSs, as applicable, by publication

of a notice in the bulletin of the Buenos Aires Stock Exchange and

the CNV website. Based on this notice, we will allocate

unsubscribed common shares to holders of common share rights and

ADSs to ADS holders, as applicable, in accordance with the

procedure described above.

|

|

Results

of the offering

|

On

March 9, 2021, which is the second Argentine business day after the

end of the common shares subscription period, we will notify

holders of common share rights and ADS holders by publication of a

notice in the bulletin of the Buenos Aires Stock Exchange and PR

Newswire of the final results of the offering pursuant to common

share rights and ADS rights.

|

|

Subscription

price

|

On

February 12, 2021, we reported to the Argentine Comisión Nacional de Valores and

the BYMA and released to PR Newswire a non-binding indicative

subscription price for each of the new common shares and ADSs of

USD 0.472 and USD 4.72, respectively.

The

definitive subscription price for the new common shares will be

determined by our board of directors based on the average closing

price of the ADS on the NASDAQ for the five to thirty preceding

trading days, dividing such result by 10, and converting the

resulting amount into Argentine Pesos on the basis of the Blue Chip

Swap Rate. Our board of directors will calculate the definitive

subscription price for our new ADSs based on the average closing

price of the ADS on the NASDAQ for the five to thirty preceding

trading days. The board may also apply a discount to such average

closing price, as approved by our shareholders’ meeting on

October 30, 2019.

On

October 30, 2019, our shareholders’ meeting authorized our

board of directors to apply a discount of up to 10% of the current

trading price of our common shares and the ADSs when determining

the indicative and definitive subscription price of the new common

shares and the new ADSs. Our shareholders’ meeting also

authorized our board of directors to apply a discount of up to 15%

of the price determined pursuant to the guidelines approved by the

shareholders if required by market conditions at the time of

determining the price, in the discretion of our board of

directors.

|

|

|

The

subscription price for each new common share will be payable in

U.S. dollars outside Argentina or in Pesos in Argentina, determined

on the basis of the Blue Chip Swap Rate as of the second business

day prior to the expiration of the common shares subscription

period.

The

subscription price for each new ADS will be payable in U.S.

dollars. Holders of ADSs must deposit USD 5.192 per New ADS

subscribed for or sought (the “Deposit Amount”). which

is equal to 110% of the indicative subscription price. This extra

ten percent allowance will be used to cover the fee of the

Depositary that is USD 0.05 per new ADS and any other applicable

fees or expenses, and then will be applied to the final

subscription price, if it is higher than the indicative

subscription price.

If the

Deposit Amount exceeds the sum of the final subscription price plus

the Depositary’s issuance fee and any other applicable fees

and expenses, the Depositary will refund the surplus to the

exercising ADS holders as soon as practicable after closing of the

rights offering. If the Deposit Amount is less than the sum of the

final subscription price plus the Depositary’s issuance fee

and any other applicable fees and expenses, the ADS rights agent

will notify the ADS holder of the amount of the shortfall, and the

ADS holder must fund that shortfall as no event later than the day

on which the ADS rights agent is required to make payment to the

Company. If the

shortfall is not funded, the ADS rights agent may withhold and sell

a portion of the new ADSs to cover that shortfall or reduce the

number of new ADSs subscribed.

|

|

Payment

for exercise ofpreemptive rights

|

The new

common shares subscribed pursuant to the common share rights must

be paid in cash or by wire transfer to the common shares agent no

later than 6:00 p.m. (Buenos Aires time) on March 5, 2021, which is

the last business day of the common shares subscription

period.

The

Deposit Amount for the new ADSs subscribed pursuant to the ADS

rights must be paid by the ADS holder’s broker or other

securities intermediary through the DTC system or, in the case of

ADSs held directly on the Depositary’s books, by personal or

business check to the ADS rights agent no later than 5:00 p.m. (New

York City time) on March 2, 2021, which is the last business day of

the ADS subscription period. Upon advance request, the ADS rights

agent will make arrangements so that the Deposit Amount may be paid

by wire transfer.

|

|

Payment

for exercise ofaccretion rights

|

The new

common shares subscribed pursuant to the accretion rights must be

paid by wire transfer or by certified or official bank check or

money order to the common share rights agent no later than 6:00

p.m. (Buenos Aires time) on March 5, 2021.

The

Deposit Amount for new ADSs sought pursuant to the accretion rights

must be paid at the same and in the same manner, as payment with

respect to the exercise of ADS rights.

|

|

Fractional common

shares and ADSs

|

We will

accept subscriptions for whole new common shares and new ADSs only

and will round down any subscription submitted for fractional new

common shares and fractional new ADSs to the nearest whole number

of new common shares or new ADSs, as applicable.

|

|

Use of

unsubscribed ADSsand common shares

|

After

expiration of the common shares subscription period and the ADS

subscription period, we may cancel the unsubscribed common shares

or sell them to third parties at such times as our board of

directors may determine. The price for such sales may not be more

favorable to the purchaser than the price offered herein. We

currently intend to offer any unsubscribed common shares to the

public promptly after completion of this offering.

|

|

Issuance and

delivery of new common shares and new ADSs

|

The new

common shares and warrants acquired pursuant to the preemptive

rights will be issued and made available within five business days

following the expiration of the common shares subscription period,

which is expected to occur on March 5, 2021.

The new

ADSs and warrants acquired pursuant to the preemptive rights will

be issued and made available as soon as practicable after the new

common shares are deposited with the Depositary’s custodian

in Argentina.

The new

common shares acquired pursuant to the accretion rights will be

issued and made available within five business days following the

expiration of the common shares subscription period, which is

expected to occur on March 5, 2021.

The new

ADS acquired pursuant to the accretion rights will be issued and

made available as soon as practicable after the new common shares

are deposited with the Depositary’s custodian in

Argentina.

We will

register new common shares issued upon exercise of common share

rights and related warrants in our share register as soon as

practicable after our receipt of payment with respect to such

exercise. Certificates representing the new common shares will be

issued upon request.

New

ADSs will be delivered through the facilities of DTC to the

securities accounts that exercised the ADS rights or, in the case

of ADSs held directly on the Depositary’s books, by

registration of new ADSs on an uncertificated basis in the name of

the exercising ADS holder.

|

|

Transferability

|

Any

holder of common share rights may transfer its common share rights.

Common share rights will be eligible to trade on the BYMA from

February 18, 2021 to March 4, 2021 but will not be eligible to

trade on any securities exchange in the United States.

The ADS

rights will not be transferable.

|

|

Combined

offering

|

In

connection with this rights offering, we intend to offer the

unsubscribed common shares, if any, in the form of ADSs in the

United States and other jurisdictions outside Argentina, provided

certain conditions are met and our board of directors approves such

subsequent offering. The price for such sale may not be more

favorable for the purchaser than the price offered

herein.

|

|

No

exchanges of common share rights or ADS rights

|

You may

not surrender ADS rights for the purpose of withdrawing rights to

subscribe for common shares or deposit common share rights to

obtain ADS rights.

|

|

Listing

of common shares

|

The

common shares are listed on the BYMA under the symbol

“CRES.” We have requested authorization to list the new

common shares rights underlying the rights on the

BYMA.

|

|

Listing

of ADSs

|

The

ADSs are listed on the Nasdaq Global Market under the symbol

“CRESY.” We have requested authorization to list the

new ADSs issuable pursuant to the ADS rights on the

Nasdaq.

|

|

ADS

rights agent

|

The

Bank of New York Mellon

|

|

Common

share rights agent

|

BACS

Banco de Crédito y Securitización S.A.

|

|

Depositary

|

The

Bank of New York Mellon

|

|

Information

Agent

|

Morrow

Sodali Global LLC

|

|

Blue

Chip Swap Rate

|

The

implied exchange rate between Pesos and U.S. dollars that results

from dividing the closing price of Cresud’s common shares on

ByMA as of a certain date by the closing price of Cresud’s

ADSs on Nasdaq as of that same date, further divided by

ten.

|

|

The

Warrants

|

|

|

Maximum

number of warrants

|

We will

issue up to a maximum of 90,000,000 warrants, assuming all of the

common shares and ADS available for purchase in this rights

offering are purchased.

We will

issue, free of charge:

● One warrant to each

holder of our common share rights for each new common share it

purchases in the common share rights offering; and

● Ten warrants to

each ADS rights holder for each new ADS it purchases in the ADS

rights offering.

|

|

Exercise of the

warrants

|

To

exercise the warrants, you must deliver to the warrant agent a

properly completed purchase form, accompanied by a certificate of

ownership, if any, and full payment of the exercise price by 5:00

p.m. (New York City time) during the exercise periods referred to

below.

The

warrants will be exercisable after 90 days following their

issuance, prior to their expiration on the fifth anniversary of

their issue date, quarterly on dates we will announce to the

Argentine Comisión Nacional

de Valores and BYMA and release to PR Newswire on or about

February 25, 2021. The warrants will be freely transferable. We

will accept the exercise of warrants to purchase whole new common

shares. One warrant must be exercised in order to purchase one new

common share.

ADS

holders wishing to obtain additional ADSs upon exercise of their

warrants must deposit the common shares acquired under the warrants

with The Bank of New York Mellon, as our Depositary, to obtain ADSs

in accordance with the terms of the deposit agreement.

Unexercised

warrants will not entitle their holders to any rights to vote at or

attend our shareholders meetings or to receive any dividends in

respect of our common shares. The number of our common shares for

which, and the price at which, a warrant is exercisable are subject

to adjustment upon the occurrence of certain events, as provided in

the warrant agreement relating to the warrants.

We will

accept exercises of warrants for whole, new common shares only and

will round down any warrant exercise submitted for fractional, new

common shares to the nearest whole number of new common

shares.

|

|

Exercise

price

|

The

exercise price of the warrants will be determined by our board of

directors and reported by us to the Argentine Comisión Nacional de Valores and

BYMA and released to PR Newswire on or about February 25, 2021. The

exercise price of the warrant will be equivalent to the definitive

subscription price for common shares plus a 20% premium. If, as of

the payment date of the warrant exercise price, payment in U.S.

dollars is legally prevented in Argentina, holders of warrants will

be entitled to pay the exercise price directly to us, in Pesos in

an amount equal to the Peso equivalent of the U.S. dollar exercise

price of the warrants determined on the basis of Blue Chip Swap

Rate on the business day preceding the payment date of the exercise

price of the warrants.

|

|

Expiration of

warrants

|

The

warrants will expire automatically and become void on fifth

anniversary of their issue date.

|

|

Transferability

|

Any

holder of warrants may transfer its warrants at any time after the

date of issuance. Warrants will be eligible to trade on the BYMA

and we intend to have the warrants listed on the

Nasdaq.

|

|

Shelf

registration

|

We have

agreed that until the earlier to occur of the exercise or

expiration of all the warrants, we will keep a registration

statement current with respect to the issuance of our common shares

from time to time upon exercise of the warrants.

|

|

Listing

|

We have

applied to have the warrants listed on the BYMA. We intend to have

the warrants listed on the Nasdaq.

|

|

Warrant

agent

|

Computershare,

Inc.

|

|

Representative of

the warrant agent in Argentina

|

BACS

Banco de Crédito y Securitización S.A.

|

|

General

|

|

|

Use of

proceeds

|

We

currently expect the net proceeds from our rights offering to be

approximately USD 41.28 million after payment of estimated expenses

(assuming all of the common shares and ADSs available for purchase

in this rights offering will be purchased, and that none of the

warrants will be exercised upon consummation of this

offering).

We

intend to use the proceeds of the offering as follows:

● Investments in our

agricultural activities in Argentina, Latin America and/or other

countries to the extent we believe such investments are consistent

with our business strategy;

● Investments in

agricultural services, mainly through our subsidiary

FYO;

● Investments in

subsidiaries, primarily in IRSA, through capital contributions,

repurchase of shares or subscription of preemptive and accretion

rights issued in connection with future capital increases of such

subsidiaries;

● Exercise warrants

for the purchase of common shares in our subsidiary Brasilagro, due

to expire in May 2021; and

● Repayment of debt,

working capital and for other general corporate

purposes.

The

amount of proceeds we will receive from this offering will depend

on the extent to which our shareholders elect to exercise their

rights to subscribe for new common shares. The extent to which our

shareholders elect to do so is beyond our control and cannot be

predicted with certainty. If a significant percentage of our

shareholders do not exercise their rights to subscribe for new

common shares, our net proceeds could be materially less than the

amount indicated above (which assumes that 100% of the common

shares and ADSs available for purchase will be

purchased).

Although

we are constantly evaluating investment opportunities, at this time

we do not have any binding commitment to make any material

investments not identified in this prospectus. Because several of

the proposed investments above are uncertain at this time, the net

proceeds from this offering may not be fully used in the short

term. Until those investments are made, we intend to invest the net

proceeds of this offering in high quality, liquid financial

instruments. The allocation of the net proceeds from this offering

will be influenced by prevailing market conditions from time to

time, and as a result, we reserve the right to reallocate all or a

portion of such anticipated uses to other uses we deem consistent

with our strategy.

|

|

Outstanding common

shares immediately before and after the preemptive rights

offering

|

Immediately

prior to this preemptive rights offering, our outstanding capital

stock consists of approximately 501,642,804 common

shares.

Immediately

after this preemptive rights offering, a total of 591,642,804

common shares are expected to be outstanding (assuming all of the

new common shares and ADSs available for purchase in this rights

offering are purchased, and that none of the warrants are

immediately exercised upon consummation of this

offering).

|

|

Dividends

|

Under

Argentine law, the declaration, payment and amount of dividends on

the common shares are subject to the approval of the our

shareholders and to certain requirements of Argentine law. Pursuant

to the deposit agreement, holders of ADSs will be entitled to

receive dividends, if any, declared on the common shares

represented by such ADSs to the same extent as the holders of the

common shares. Cash dividends will be paid in Pesos and, subject to

applicable Argentine laws, regulations and approvals, to the extent

that the Depositary can in its judgment convert Pesos (or any other

foreign currency) into U.S. dollars on a reasonable basis and

transfer the resulting U.S. dollars to the United States, will be

paid to the holders of ADSs net of any dividend distribution fees,

currency conversion expenses, taxes or governmental charges. See

“Description of Capital Stock” and “Description

of American Depositary Receipts.”

|

|

Voting

Rights

|

Holders

of our common shares are entitled to one vote for each common share

at any of our shareholders’ meeting. See “Description

of Capital Stock.” Pursuant to the deposit agreement and

subject to Argentine law and our bylaws, holders of ADSs are

entitled to instruct the Depositary to vote or cause to be voted

the number of common shares represented by such ADSs. See

“Description of American Depositary

Receipts.”

|

|

Termination,

cancellation and amendment

|

We may terminate or cancel the offering in our sole

discretion at any time on or before the expiration of the common

shares subscription period for any reason (including, without

limitation, a change in the market price of our common shares or

the ADSs). If the offering is terminated, all rights will expire

without value and we will promptly arrange for the refund, without

interest or deduction, of all funds received from holders of common

share and ADS rights. Any termination or cancellation of the rights

offering will be followed as promptly as practicable by an

announcement. We may amend or modify the terms of the rights

offering, and may extend the expiration date of the rights

offering.

|

|

Information

|

Any

questions or requests for assistance may be directed

to:

BACS

Banco de Crédito y Securitización S.A., our common share

rights agent, at Tucumán 1, 19th Floor,

“A”, City of Buenos Aires, Argentina, or by calling +

54 (11) 4329-4200, in the case of holders of our common

shares,

Morrow

Sodali, our information agent, at 509 Madison Avenue, Suite 1608,

New York, NY 10022, or by calling (203) 561-6945 (banks and

brokers); (800) 662-5200 (stockholders call toll free); e-mail:

CRESY@investor.morrowsodali.com

or IRS@investor.morrowsodali.com;

or

Cresud

Sociedad Anónima Comercial Inmobiliaria Financiera y

Agropecuaria, Carlos Della Paolera 261, C1001ADA Buenos Aires,

Argentina, or by calling +54 (11) 4323-7400.

For

additional information concerning the common shares, the ADSs and

the warrants, see “Description of Capital Stock,”

“Description of American Depositary Receipts” and

“Description of Warrants.”

|

|

Risk

factors

|

See

“Risk Factors” in our 2020 Form 20-F for a discussion

of certain significant risks you should consider before making an

investment decision.

|

|

Business

day

|

Any

day, other than a Saturday or Sunday, that is neither a legal

holiday nor a day on which commercial banks are authorized or

required by law, regulation or executive order to close in New York

City, United States of America, or Buenos Aires, Argentina, are

authorized or required by law to remain closed.

|

|

Timetable

for the Offering

|

|

|

Publication of

non-binding indicative subscription price

|

February

12, 2021

|

|

Common

shares record date 6:00 p.m. (Buenos Aires, Argentina

time)

|

February

19, 2021

|

|

ADS

record date 5:00 p.m. (New York City time)

|

February

19, 2021

|

|

Common

share rights commence trading on the BYMA

|

February

18, 2021

|

|

Common

shares subscription period

|

February

22, 2021 to March 5, 2021

|

|

ADS

subscription period

|

February

22, 2021 to March 2, 2021

|

|

Publication of the

definitive subscription price for the new common shares and the new

ADSs

|

On or

about February 25, 2021

|

|

Expiration date for

holdersof ADS rights

|

March

2, 2021

|

|

End of

common share rights trading on the BYMA

|

March

4, 2021

|

|

Expiration date of

common shares subscription period

|

March

5, 2021

|

|

Allocation of

accretion rights

|

March

8, 2021

|

|

Delivery date for

new common shares pursuant to common share preemptive

rights

|

Within

five business days of the expiration date of the common shares

subscription period

|

|

Delivery date for

new common shares pursuant to common share accretion

rights

|

Within

five business days of the expiration date of the common shares

subscription period

|

|

Delivery date for

the new ADS pursuant to ADS preemptive rights

|

As

promptly as practicable after the delivery of the new common shares

pursuant to common share preemptive rights

|

|

Delivery date for

the new ADS pursuant to ADS accretion rights

|

As

promptly as practicable after the delivery of the new common shares

pursuant to common share accretion rights

|

You should carefully consider the risks described below, in

addition to the other information contained in this prospectus,

including our 2020 Form 20-F and our Form 6-K, before making an

investment decision. We also may face additional risks and

uncertainties that are not presently known to us, or that we

currently deem immaterial, which may impair our business. In

general, you take more risk when you invest in the securities of

issuers in emerging markets such as Argentina than when you invest

in the securities of issuers in the United States. You should

understand that an investment in our common shares, ADSs and

warrants involves a high degree of risk, including the possibility

of loss of your entire investment.

Risks Relating to the Common Share Rights, the ADS Rights and to

the ADSs, Common Shares and Warrants

You will experience immediate and substantial dilution in the book

value of the common shares or ADSs you purchase in this

offering.

Because

the offering price of the common shares and ADSs being sold in this

offering will be substantially higher than the net tangible book

value per share, you will experience immediate and substantial

dilution in the book value of these common shares. Net tangible

book value represents the amount of our tangible assets on a pro

forma basis, minus our pro forma total liabilities. Moreover, if

you do not exercise your common share rights or ADS rights, as the

case may be, you will also experience immediate and substantial

dilution in the book value of your common shares or ADSs. See

“Dilution.”

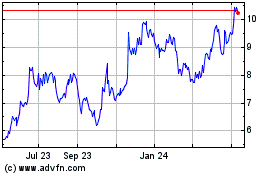

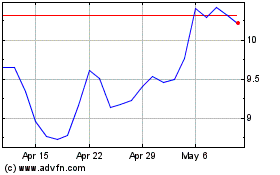

The market price for the ADSs could be highly volatile, and the

ADSs could trade at prices below the initial offering

price.

The

market price for the ADSs after this offering is likely to

fluctuate significantly from time to time in response to factors

including:

●

fluctuations in our

periodic operating results;

●

changes in

financial estimates, recommendations or projections by securities

analysts;

●

changes in

conditions or trends in our industry;

●

changes in the

economic performance or market valuation of our

competitors;

●

announcements by

our competitors of significant acquisitions, divestitures,

strategic partnerships, joint ventures or capital

commitments;

●

events affecting

equities markets in the countries in which we operate;

●

legal or regulatory

measures affecting our financial conditions;

●

departures of

management and key personnel; or

●

potential

litigation or the adverse resolution of pending litigation against

us or our subsidiaries.

Volatility in the

price of the ADSs may be caused by factors outside of our control

and may be unrelated or disproportionate to our operating results.

In particular, announcements of potentially adverse developments,

such as proposed regulatory changes, new government investigations

or the commencement or threat of litigation against us, as well as

announced changes in our business plans or those of competitors,

could adversely affect the trading price of our common shares,

regardless of the likely outcome of those developments or

proceedings. Broad market and industry factors could adversely

affect the market price of the ADSs, regardless of our actual

operating performance. As a result, the ADSs may trade at prices

significantly below the initial public offering price.

The warrants are exercisable under limited circumstances and will

expire.

Each

warrant will be exercisable only if the common share rights or ADS

rights to which such warrant relates have been exercised, and such

warrant will be exercisable after 90 days following its issuance,

prior to its expiration on the fifth anniversary of its issue date,

quarterly on dates we will announce to the Argentine Comisión Nacional de Valores and

BYMA and release to PR Newswire on or about February 25,

2021.

If we are considered to be a passive foreign investment company for

United States federal income tax purposes, U.S. holders of our

common shares, ADSs, common share rights, ADS rights or warrants

may suffer negative consequences.

Based

on the past and projected composition of our income and assets, and

the valuation of our assets, we do not believe we were a passive

foreign investment company (a “PFIC”) for United States

federal income tax purposes for our most recent taxable year, and

do not expect to become a PFIC in the current taxable year or the

foreseeable future, although there can be no assurance in this

regard. The determination of whether we are a PFIC is made

annually. Accordingly, it is possible that we may become a PFIC in

the current or any future taxable year due to changes in our asset

or income composition. In addition, this determination is based on

the interpretation of certain United States Treasury regulations

relating to rental income, which regulations are potentially

subject to differing interpretation. If we become a PFIC, U.S.

Holders (as defined in “Taxation—Certain United States

Federal Income Tax Consequences”) of our common shares, ADSs,

common share rights, ADS rights or warrants will be subject to

certain United States federal income tax rules that may have

negative consequences. See “Taxation— Certain United

States Federal Income Tax Consequences—Passive Foreign

Investment Company” for a more detailed discussion of the

consequences if we are deemed a PFIC. You should consult your own

tax advisors regarding the application of the PFIC rules to your

particular circumstances.

We

currently expect the net proceeds from our rights offering to be

approximately USD 41.28 million after payment of estimated expenses

(assuming all of the common shares and ADSs available for purchase

in this rights offering will be purchased, and that none of the

warrants will be exercised upon consummation of this

offering).

We

intend to use the proceeds of the offering as follows:

●

Investments in our

agricultural activities in Argentina, Latin America and/or other

countries to the extent we believe such investments are consistent

with our business strategy;

●

Investments in

agricultural services, mainly through our subsidiary

FYO;

●

Investments in

subsidiaries, primarily in IRSA, through capital contributions,

repurchase of shares or subscription of preemptive and accretion

rights issued in connection with future capital increases of such

subsidiaries;

●

Exercise warrants

for the purchase of common shares in our subsidiary Brasilagro, due

to expire in May 2021; and

●

Repayment of debt,

working capital and for other general corporate

purposes.

The

amount of proceeds we receive from this offering will depend on the

extent to which our shareholders elect to exercise their rights to

subscribe for new common shares. The extent to which our

shareholders elect to do so is beyond our control and cannot be

predicted with certainty. If a significant percentage of our

shareholders do not exercise their rights to subscribe for new

common shares, our net proceeds could be materially less than the

amount indicated above (which assumes that 100% of the common

shares and ADSs available for purchase will be

purchased).

Although we are

constantly evaluating investment opportunities, at this time we do

not have any binding commitment to make any material investments

not identified in this prospectus. Because several of the proposed

investments above are uncertain at this time, the net proceeds from

this offering may not be fully used in the short term. Until those

investments are made, we intend to invest the net proceeds of this

offering in high quality, liquid financial instruments. The

allocation of the net proceeds from this offering will be

influenced by prevailing market conditions from time to time, and

as a result we reserve the right to reallocate all or a portion of

such anticipated uses to other uses we deem consistent with our

strategy.

The

following table sets forth our consolidated capitalization in

accordance with IFRS as of September 30, 2020 and as adjusted to

give the effect of the sale of 90,000,000 common shares assuming a

non-binding indicative subscription price of USD 4.72 (converted to

ARS 68.74 on the basis of the Blue Chip Swap Rate as of February

12, 2021, which was ARS 145.64 per USD 1.00, solely for purposes of

this capitalization analysis). The table below should be read in

conjunction with, and is qualified in its entirety by

“Operating Review and Prospects” and our financial

statements included in our 2020 Form 20-F and our Form

6-K.

|

|

|

|

|

|

|

|

|

|

|

Total current

borrowings

|

47,535

|

47,535

|

|

Total non-current

borrowings

|

52,255

|

52,255

|

|

Total

debt(2)

|

99,790

|

99,790

|

|

|

|

|

|

Shareholders’

equity

|

|

|

|

Attributable to

equity holders of the parent:

|

|

|

|

Share

capital

|

499

|

589

|

|

Treasury

stock

|

3

|

3

|

|

Inflation

adjustment of share capital and treasury stock

|

10,572

|

10,572

|

|

Share

premium

|

11,403

|

17,397

|

|

Additional paid-in

capital from treasury stock

|

97

|

97

|

|

Legal reserve

(3)

|

402

|

402

|

|

Special reserve

(4)

|

829

|

829

|

|

Other

reserve

|

2,580

|

2,580

|

|

Retained

earnings

|

5,090

|

5,090

|

|

Attributable to

non-controlling interest:

|

|

|

|

Non-controlling

interest

|

61,207

|

61,207

|

|

Total

shareholders’ equity

|

92,682

|

98,766

|

|

Total

capitalization

|

192,472

|

198,556

|

|

(1)

|

Assumes

net proceeds of the rights offering of USD 41.3 million resulting

from the issuance of 90,000,000 common shares, net of expenses

(converted into ARS at the exchange rate quoted by the Central Bank

for February 8, 2020 which was ARS 88.17 per USD 1.00 solely for

this capitalization analysis), related to the rights

offering.

|

|

(2)

|

Of our

total debt, ARS 5,043 million is secured debt and ARS 94,747

million is unsecured.

|

|

(3)

|

Under

Argentine law, we are required to allocate 5% of our net income to

a legal reserve until the amount of such legal reserve equals 20%

of our outstanding capital.

|

|

(4)

|

Pursuant to a

resolution of the Inspección

General de Justicia, companies should indicate the intended

use of the accumulated retained earnings balance of the period.

Accordingly, we transferred the balance of accumulated retained

earnings to a special reserve labeled as “Reserve for New

Developments.” This reclassification has no impact on our

total shareholders’ equity.

|

See

“Dividend Policy” in our 2020 Form 20-F.

EXCHANGE

RATES AND EXCHANGE CONTROLS

See

“Local Exchange Market and Exchange Rates” in our Form

6-K.

Statutory Preemptive and Accretion Rights

Pursuant to our

bylaws and as required by Argentine law, each existing holder of

our common shares has the following rights:

●

a preemptive right

to subscribe for new shares in all issues of common shares in

proportion to such shareholder’s respective shareholdings,

and

●

an accretion right

which provides that if any new common shares are not subscribed for

by our shareholders pursuant to their preemptive rights, the

shareholders which have exercised their preemptive rights are

entitled to subscribe for such unsubscribed common shares in

proportion to the number of new common shares purchased by such

exercising shareholders pursuant to their exercise of preemptive

rights.

On

October 30, 2019, our shareholders authorized the future issuance

of up to 200,000,000 common shares. We are granting to our

shareholders common share rights to subscribe for 90,000,000 new

common shares and receive up to 90,000,000 warrants to acquire

additional common shares. Each common share held of record at 6:00

p.m. (Buenos Aires, Argentina time) on February 19, 2021; entitles

its holder to one common share right. Each common share right

entitles its holder to (i) subscribe for 0.1794105273 new common

shares pursuant to the exercise of preemptive rights, (ii)

subscribe for additional new common shares remaining unsubscribed

after the preemptive rights offering pursuant to the exercise of

accretion rights and (iii) receive free of charge, for each new

common share that it purchases pursuant to this offering, one

warrant to purchase one additional new common shares.

The

Bank of New York Mellon, as our ADS rights agent, will make

available to our ADS holders ADS rights to subscribe for new ADS

and receive warrants to acquire additional common shares in the

form of ADS. Each ADS held of record at 5:00 p.m. (New York City

time) on February 19, 2021, entitles its holder to one ADS right.

Each ADS right entitles its holder to (i) subscribe for

0.1794105273 new ADSs pursuant to the exercise of preemptive

rights, (ii) subscribe for additional ADSs remaining unsubscribed

after the preemptive rights offering pursuant to the exercise of

accretion rights and (iii) receive free of charge, for each new ADS

that it purchases pursuant to this offering, 10 warrants, each of

which will entitle such holder to purchase one additional new

common shares.

On

February 12, 2021, we reported to the Argentine Comisión Nacional de Valores and

the BYMA and released to PR Newswire a non-binding indicative

subscription price for each of the new common shares and ADSs of

USD 0.472 and USD 4.72, respectively.

The

definitive subscription price for the new common shares will be

determined by our board of directors based on the average closing

price of the ADS on the NASDAQ for the five to thirty preceding

trading days, dividing such result by 10, and converting the

resulting amount into Argentine Pesos on the basis of the Blue Chip

Swap Rate. Our board of directors will calculate the non-binding

indicative subscription price for our new ADSs based on the average

closing price of the ADS on the NASDAQ for the five to thirty

preceding trading days. The board may also apply a discount to such

average closing price, as approved by our shareholders’

meeting on October 30, 2019.

On

October 30, 2019, our shareholders’ meeting authorized our

board of directors to apply a discount of up to 10% of the current

trading price of our common shares and the ADSs when determining

the indicative and definitive subscription price of the new common

shares and the new ADSs. Our shareholders’ meeting also

authorized our board of directors to apply a discount of up to 15%

of the price determined pursuant to the guidelines approved by the

shareholders if required by market conditions at the time of

determining the price, in the discretion of our board of directors.

We expect to publish a notice including the definitive subscription

price in the bulletin of the ByMA, the website of the Argentine

Comisión Nacional de

Valores and released to PR Newswire.

Subscription Period

Holders

must exercise their rights from February 21, 2021, through 6:00

p.m. (Buenos Aires, Argentina time) on March 5, 2021, in the case

of the common share rights (the “common shares subscription

period”) and from February 22, 2021, through 5:00 p.m. (New

York time) on March 2, 2021, in the case of the ADS rights (the

“ADS subscription period”).

To

exercise common share rights, you must deliver to our common shares

agent a properly completed subscription form accompanied by a

certificate of ownership issued by Caja de Valores or evidence of

assignment of the common share rights in your favor by 6:00 p.m.

(Buenos Aires, Argentina time) on March 5, 2021, or your common

share rights will lapse and have no further value. Deposit in the

mail will not constitute delivery to us.

To

exercise ADS rights, you must (i) instruct your broker or other

securities intermediary to exercise ADS rights on your behalf and

pay the amount specified below for each ADSs subscribed or sought

pursuant to accretion rights through the automated system of The

Depository Trust Company (“DTC”) (in the case of ADS

rights held through DTC) or (ii) deliver to the ADS rights agent a

properly completed ADS rights subscription form and pay the amount

specified below for each ADS subscribed or sought pursuant to

accretion rights by personal or business check (in the case of ADSs

held directly on the books of the Depositary). In either case, the

subscription and payment must be received by the ADS rights agent

by 5:00 p.m. (New York City time) on March 2, 2021. Your broker or

other securities intermediary will set an earlier cutoff date and

time to receive your instructions to subscribe

If you

do not exercise your ADS rights, the Depositary will try to sell

the underlying share rights in the Argentine market. If the

depositary is successful in selling those share rights, it expects

to receive Argentine pesos and will hold the net proceeds in

Argentine pesos for your account.. However, under current Argentina

laws and regulations, the Depositary would not be able to convert

those pesos into U.S. dollars and thus would be unable to pay those

proceeds to you. If the Depositary receives payment in U.S. dollars

or is able to convert Argentine pesos into U.S. dollars, it will

convert the sales proceeds into dollars, if applicable, and pay you

your share, after deduction of applicable fees and

expenses.

The

amount you must deposit upon exercise will be the Deposit Amount

for each new ADSs subscribed for or sought.

Registered holders

of ADSs on the books of the Depositary must send their completed

and signed ADS rights subscription form and payment of the Deposit

Amount to the ADS rights agent as follows:

|

By

Mail:

The

Bank of New York MellonVoluntary Corporate Actions, Suite VPO Box

505049Louisville, KY 40233-5049

|

By

Overnight Delivery:

The

Bank of New York MellonVoluntary Corporate Actions, Suite V462

South 4th

Street, Suite 1600Louisville, KY 40202

|

Submissions of

subscriptions through the DTC system or submission of subscription

forms will represent an irrevocable exercise of preemptive and

accretion rights to purchase common shares or ADSs, as the case may

be, and may not be canceled or modified. Timely submission of these

documents is necessary for effective subscription of common shares,

and prospective subscribers should carefully review these

documents.

Forms

for completion and submission have been delivered with this

prospectus. Prospective subscribers requiring additional or

replacement copies of such forms, may obtain them upon request from

BACS Banco de

Crédito y

Securitización S.A. in its capacity as our common share rights

agent or The Bank of New York Mellon in its capacity as our ADS

rights agent.

Our

common share rights agent and ADS rights agent have discretion to

refuse any improperly completed or delivered or unexecuted

subscription form. The common shares subscription period and the

ADS subscription period, as the case may be, are the sole

opportunity to exercise preemptive and accretion rights with

respect to the common shares and ADSs, respectively.

Important Dates

The

summary timetable set forth below lists certain important dates

relating to the exercise of rights:

|

Timetable

for the Offering

|

|

|

Publication of

non-binding indicative subscription price

|

February

12, 2021

|

|

Common

shares record date 6:00 p.m. (Buenos Aires, Argentina

time)

|

February

19, 2021

|

|

ADS

record date 5:00 p.m. (New York City time)

|

February

19, 2021

|

|

Common

share rights commence trading on the BYMA

|

February

18, 2021

|

|

Common

shares subscription period

|

February

22, 2021 to March 5, 2021

|

|

ADS

subscription period

|

February

22, 2021 to March 2, 2021

|

|

Publication of the

definitive subscription price for the new common shares and the new

ADSs

|

On or

about February 25, 2021

|

|

Expiration date for

holdersof ADS rights

|

March

2, 2021

|

|

End of

common share rights trading on the BYMA

|

March

4, 2021

|

|

Expiration date of

common shares subscription period

|

March

5, 2021

|

|

Allocation of

accretion rights

|

March

8, 2021

|

|

Delivery date for

new common shares pursuant to common share preemptive

rights

|

Within

five business days of the expiration date of the common shares

subscription period

|

|

Delivery date for

new common shares pursuant to common share accretion

rights

|

Within

five business days of the expiration date of the common shares

subscription period

|

|

Delivery date for

the new ADS pursuant to ADS preemptive rights

|

As

promptly as practicable after the delivery of the new common shares

pursuant to common share preemptive rights

|

|

Delivery date for

the new ADS pursuant to ADS accretion rights

|

As

promptly as practicable after the delivery of the new common shares

pursuant to common share accretion rights

|

Fractional Entitlements

We will

not issue fractional common shares or ADSs, pursuant to this rights

offering or the exercise of the warrants, and entitlements to

common shares or ADSs will be rounded down to the nearest whole

common share or ADS, as the case may be.

Trading of Common Share and ADS Rights

Common

share rights will trade separately from such common shares on the

BYMA from the third business day preceding the subscription period.

A holder of record of common shares that sells rights on the BYMA

will transfer to the purchaser thereof the right to participate in

this rights offering and shall have no further right to participate

in the rights offering, regardless of whether such holder continues

to hold its common shares.

The ADS

rights will not be transferable and will not be listed on any

exchange.

The

Bank of New York Mellon, as Depositary, will try, to the extent

permitted by applicable law, to sell the common share rights

underlying the unexercised ADS rights on the BYMA. If the

depositary is successful in selling those share rights, it expects

to receive Argentine pesos and will hold the net proceeds in

Argentine pesos for your account.. However, under current Argentina

laws and regulations, the Depositary would not be able to convert

those pesos into U.S. dollars and thus would be unable to pay those

proceeds to you. If the Depositary receives payment in U.S. dollars

or is able to convert Argentine pesos into U.S. dollars, it will

convert the sales proceeds into dollars and pay you your share,

after deduction of applicable fees and expenses.

Common Share Rights Agent

BACS

Banco de Crédito y Securitización S.A., located at

Tucumán 1, 19th Floor,

“A”, City of Buenos Aires, Argentina is acting as our

common share rights agent for the common share rights offering.

Holders of common shares who wish to subscribe for additional

common shares must subscribe through the common share rights agent.

The common share rights agent will not accept subscriptions from

holders of ADSs.

ADS Rights Agent

The

Bank of New York Mellon, located at 240 Greenwich Street, New York,

New York 10286, is acting as the ADS rights agent for the ADS

rights offering. Holders of ADSs who wish to subscribe for

additional ADSs must subscribe through the ADS rights agent. The

ADS rights agent will not accept subscriptions from holders of

common shares.

Subscription Price

On

February 12, 2021, we reported to the Argentine Comisión Nacional de Valores and

the BYMA and released to PR Newswire a non-binding indicative

subscription price for each of the new common shares and ADSs of

USD 0.472 and USD 4.72, respectively.

The

definitive subscription price for the new common shares will be

determined by our board of directors based on the average closing

price of the ADS on the NASDAQ for the five to thirty preceding

trading days, dividing such result by 10, and converting the

resulting amount into Argentine Pesos on the basis of the Blue Chip

Swap Rate. Our board of directors will calculate the non-binding

indicative subscription price for our new ADSs based on the average

closing price of the ADS on the NASDAQ for the five to thirty

preceding trading days. The board may also apply a discount to such

average closing price, as approved by our shareholders’

meeting on October

30,

2019. We expect to publish a notice including the definitive

subscription price in the bulletin of the Buenos Aires Stock

Exchange, the website of the Argentine Comisión Nacional de Valores and

released to PR Newswire.

The

subscription price for each new common share will be payable in

U.S. dollars outside Argentina or in Pesos in Argentina, determined

on the basis of the Blue Chip Swap Rate as of the second business

day prior to the expiration of the common shares subscription

period.

The

subscription price for each new ADS will be payable in U.S.

dollars. Holders of new ADSs must deposit USD 5.192 per New ADS

subscribed for or sought (the “Deposit Amount”). which

is equal to 110% of the indicative subscription price. This extra

ten percent allowance will be used to cover the fee of the

Depositary that is USD 0.05 per new ADS and any other applicable

fees or expenses, and then will be applied to the final

subscription price, if it is higher than the indicative

subscription price.If the Deposit Amount exceeds the sum of the

final subscription price plus the Depositary’s issuance fee

and any other applicable fees and expenses, the Depositary will

refund the surplus to the exercising ADS holders as soon as

practicable after closing of the rights offering. If the Deposit

Amount is less than the sum of the final subscription price plus

the Depositary’s issuance fee and any other applicable fees