BBBY Stock: Can Bed Bath & Beyond Rise From the Ashes In 2023?

February 20 2023 - 5:59AM

Finscreener.org

Shares of U.S.-based

retailer Bed Bath & Beyond (NASDAQ:

BBBY) are down 80% in the

last 12 months as Wall Street remains concerned over the

company’s

chances of

survival. Similar

to Costco (NASDAQ:

COST) and Walmart (NYSE: WMT),

Bed Bath & Beyond is a big-box retailer.

BBBY is currently wrestling with

an over-levered balance sheet, weak financials, and poor

fundamentals. In recent years, it has failed to expand its presence

in the digital space, renovate its stores or refresh its product

portfolio.

In a filing with the SEC last

month, Bed Bath & Beyond warned shareholders and its creditors

that it might file for bankruptcy protection as it is running out

of funds to repay its debt.

Is BBBY stock a buy or sell right now?

Bed Bath & Beyond has

struggled to grow its sales since fiscal 2017 (which ended in

February). It was also the last year since the company reported a

net profit. In fiscal 2017, BBBY generated sales of $2.3 billion

and a net income of $425 million.

In fiscal 2022, its sales stood

at $7.9 billion, while net losses were $560 million. Moreover, in

fiscal 2023, Wall Street expects sales to fall by another 30% to

$5.5 billion, with net losses widening to $1.3 billion.

BBBY ended the November quarter

with just $153 million in cash, down 70% compared to the prior-year

period. In this period, its long-term debt grew 64% to $1.94

billion. The debt is primarily in the form of unsecured senior

notes that mature in 2024, 2034, and 2044. The coupon payments are

semi-annually due on the first of February and August each

year.

The company’s interest payments

in February amounted to $28 million. It also owes $550 million

to JP Morgan Chase (NYSE:

JPM), which is an asset-backed loan, and another $375

million to Sixth Street, after it expanded credit facilities in

August 2022.

What next for Bed Bath and Beyond for

investors?

Bed Bath & Beyond filed a

prospectus with the SEC recently and disclosed its intention to

begin a stock offering and raise capital. A report from the Motley

Fool states, “Bed Bath & Beyond will offer preferred stock and

warrants to purchase additional preferred and common stock in

sufficient quantities to raise $225 million in cash

immediately.”

It emphasized, “The company

expects as much as $800 million in additional proceeds that would

result from rights it has to force holders of its warrants to

exercise them.”

In case the offering fails, Bed

Bath and Beyond has claimed it will file for bankruptcy protection

and liquidate its assets.

Another option for Bed Bath &

Beyond is an offer for acquisition or a buyout. Valued at a market

cap of $211 million, the company has close to $4 billion of debt on

its balance sheet. Given its less-than-impressive financials, Bed

Bath & Beyond is unlikely to attract any buyers.

Lastly, BBBY might look to sell

Buy Buy Baby, which is its infant-oriented business segment. This

vertical might be worth around $400 million, injecting the

much-required liquidity into Bed Bath & Beyond.

Even if it raises capital, BBBY

will have to lay off employees, close multiple stores, and lower

its cost base. It will be extremely difficult for Bed Bath &

Beyond to survive until the end of 2023, considering it is

struggling with significant headwinds.

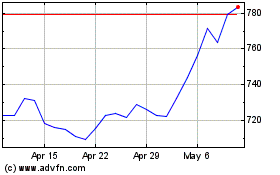

Costco Wholesale (NASDAQ:COST)

Historical Stock Chart

From Mar 2024 to Apr 2024

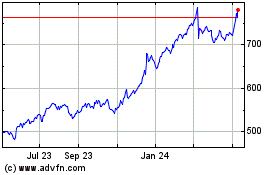

Costco Wholesale (NASDAQ:COST)

Historical Stock Chart

From Apr 2023 to Apr 2024