UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE SECURITIES

EXCHANGE ACT OF 1934

(Amendment No. )

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

|

|

|

|

|

|

|

|

[ ] Preliminary Proxy Statement

|

|

|

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

[ ] Definitive Proxy Statement

|

|

|

[X] Definitive Additional Materials

|

|

|

[ ] Soliciting Material Pursuant to §240.14a-12

|

COSTAR GROUP, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

____________________________________________________________________________________

(2) Aggregate number of securities to which transaction applies:

____________________________________________________________________________________

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

____________________________________________________________________________________

(4) Proposed maximum aggregate value of transaction:

____________________________________________________________________________________

(5) Total fee paid:

____________________________________________________________________________________

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount previously paid:

____________________________________________________________________________________

(2) Form, schedule or registration statement no.:

____________________________________________________________________________________

(3) Filing party:

____________________________________________________________________________________

(4) Date filed:

____________________________________________________________________________________

COSTAR GROUP, INC.

SUPPLEMENT TO DEFINITIVE PROXY STATEMENT DATED APRIL 19, 2021

FOR THE 2021 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 2, 2021

This supplement (the “Supplement”) amends and supplements the definitive Proxy Statement of CoStar Group, Inc. (the “Company,” “CoStar,” “we” or “us”), dated April 19, 2021 (the “Proxy Statement”), provided to stockholders in connection with the Company’s 2021 Annual Meeting of Stockholders to be held on June 2, 2021. This Supplement is being filed with the Securities and Exchange Commission and is being made available to stockholders on or about April 26, 2021.

This Supplement updates the disclosure in the Proxy Statement regarding “Proposal 4 – Adoption of the Company’s Fourth Amended and Restated Certificate of Incorporation” to (1) clarify that our Board of Directors (the “Board”) unanimously approved a proposal to pursue a forward stock split, contingent upon stockholder approval of Proposal 4, pursuant to which the holder of record of each share of common stock, par value $0.01 per share (the “Common Stock”), would receive a dividend of nine additional shares of Common Stock so that such holder would then hold ten shares of Common Stock for each share of Common Stock held by each such holder (the “Stock Dividend”), and (2) provide answers to frequently asked questions about the Stock Split.

Except as specifically supplemented by the information in this Supplement, all information set forth in the Proxy Statement remains unchanged. From and after the date of this Supplement, all references to the “Proxy Statement” are to the Proxy Statement as supplemented hereby. The Proxy Statement contains important information and this Supplement should be read in conjunction with the Proxy Statement.

Stock Split Frequently Asked Questions

Why does the Company’s Board propose to split the Common Stock?

The trading price of our Common Stock has risen significantly since our initial public offering (“IPO”) in 1998 reflecting the consistently strong performance of our Company. As the trading price of our Common Stock has risen, we have carefully evaluated the effect of the trading price of our Common Stock on the liquidity and marketability of our Common Stock. We believe the considerable price appreciation, together with the fragmentation of the U.S. equity markets, may have impacted the liquidity of our Common Stock, making it more difficult to efficiently trade and less affordable to certain classes of investors and, therefore, potentially less attractive, to these investors. The price at our IPO was $9.00 and the closing market price of our Common Stock on April 7, 2021 was $859.88 as reported on the Nasdaq Stock Market. The Board believes that declaring and paying the Stock Dividend may increase liquidity in the trading of our Common Stock and make the Common Stock more attractive to a broader range of investors.

What is a 10-for-1 stock split in the form of a stock dividend?

A stock split is a common method for a company to increase the number of shares outstanding while maintaining the stock’s total valuation and the value of the shares held by each investor after the shares have been split. A dividend is a common way to implement a stock split. If Proposal 4 is approved by CoStar’s stockholders, the Board proposes to pay the Stock Dividend of nine additional shares of stock for each share held by a stockholder as of the close of business on the record date fixed by the Board for the Stock Dividend (the “Stock Dividend Record Date”), such that each stockholder of record would then hold ten shares of Common Stock for each share of Common Stock held by such stockholder. For example, if an investor owns 10 shares of Common Stock as of the Stock Dividend Record Date and the market price is $800 per share, that investor's total investment in Common Stock would be worth $8,000. After the split, that investor would have 100 shares of Common stock, but the market price would be approximately $80 per share. The value of the investor's total investment in CoStar would be the same – $8,000 – before and after the stock split.

How many shares of Common Stock will I receive for each share of Common Stock I hold?

You will receive nine (9) additional shares of Common Stock in the Stock Dividend for each share of Common Stock you hold as of the Stock Dividend Record Date. The Proxy Statement incorrectly stated that you would receive ten shares of Common Stock in the Stock Dividend. Instead, after payment of the Stock Dividend, you will hold ten shares of Common Stock for each share of Common Stock you hold as of the Stock Dividend Record Date. This Supplement supersedes the Proxy Statement with respect to the number of shares you will receive in the Stock Dividend.

Does the Stock Dividend dilute the value of my Common Stock by increasing the number of shares?

No, the Stock Dividend will not dilute the value of Common Stock. Each investor will have the same proportionate interest in CoStar shares before and after the Stock Dividend.

However, if stockholders approve Proposal 4 and the Company’s Fourth Amended and Restated Certificate of Incorporation (the “Fourth Restated Certificate”) is filed with the Secretary of State of the State of Delaware and becomes effective, the shares of Common Stock authorized by the Fourth Restated Certificate that are in excess of those distributed pursuant to the Stock Dividend will be available for issuance at such times and for such corporate purposes as our Board (or an authorized committee thereof) may deem advisable, including, without limitation, potential acquisitions, equity financings, equity incentive grants to employees, payments of future stock dividends and other forms of recapitalizations, without further stockholder approval (except as may be required by applicable law or the rules of any stock exchange or stock market on which the Common Stock may be listed or traded). Except for the Stock Dividend and shares to be issued under the Company’s equity incentive plans for employees, the Company has no present arrangement, agreement, understanding or plan for the issuance of any additional shares of Common Stock proposed to be authorized by the Fourth Restated Certificate.

What additional approvals are required before the Stock Dividend becomes effective?

The Stock Dividend is contingent on CoStar stockholders approving Proposal 4 providing for an increase in the number of shares of Common Stock available for issuance under the Fourth Restated Certificate, as well as final approval of the Stock Dividend by the Board. Proposal 4 will be considered at CoStar’s Annual Meeting of Stockholders scheduled to be held on Wednesday, June 2, 2021.

Will I need to pay anything for these new shares if the Stock Dividend is effected and I am a stockholder of record as of the Stock Dividend Record Date?

No.

Will the Stock Dividend be a taxable transaction for me?

While individual stockholders should consult with their own tax advisors regarding their own specific tax circumstances, a stock split in the form of a stock dividend is generally not a taxable event for U.S. taxpayers. If the Stock Dividend is effected, the tax basis of each share owned immediately after the 10-for-1 stock split is equal to one-tenth of what it was immediately before the split. For example, if you owned 10 shares of the Common Stock that were purchased before the stock split with a cost basis of $800 per share, after the split you would own 100 shares with a cost basis of $80 per share. This summary of stock split tax consequences is not intended to be complete. Please consult with your tax advisor for any tax questions you may have regarding the stock split or your shares.

Will the par value of the Common Stock change?

No. The par value of the Common Stock will remain at $0.01 per share for both the old (pre-split) and new (post-split) shares.

What is the timing of the Stock Dividend?

There are several key dates:

The 2021 Annual Meeting of Stockholders – June 2, 2021. Stockholders will vote on Proposal 4 to approve the adoption of the Fourth Restated Certificate.

The Declaration Date. If the Company’s stockholders approve Proposal 4, the Board has discretion to authorize the filing of the Fourth Restated Certificate, approve the Stock Dividend and declare a record date for the Stock Dividend (the “Stock Dividend Record Date”).

The Record Date. Stockholders “of record” (that is, the stockholders in whose names shares are registered) of Common Stock at the close of business on the Stock Dividend Record Date will be entitled to receive nine additional shares of Common Stock for each share held of record on the Stock Dividend Record Date such that each stockholder of record would hold ten shares of Common Stock for each share of Common Stock held by such stockholder.

The Distribution Date. This is the date when the new Stock Dividend shares are distributed. American Stock Transfer & Trust Company, LLC (“AST”), our stock transfer agent and registrar, will mail written notice to stockholders of record as of the Stock Dividend Record Date indicating their split-adjusted share amounts.

The Ex-Stock Split Date. The date Common Stock will begin trading on the Nasdaq Stock Exchange at the new split-adjusted price.

We currently estimate that, if CoStar stockholders approve Proposal 4, and if the Board authorizes filing of the Fourth Restated Certificate, approves the Stock Dividend and declares the Stock Dividend Record Date, there will be a period of up to approximately 30 days between the Board’s action and the ex-stock split date.

Where will notice of my Stock Dividend shares be mailed?

If you currently hold Common Stock in your name, you will be notified at the address AST has on file for you. To verify your address, you can call AST at 800-937-5449. If your Common Stock is currently held in a brokerage account, the information will be sent directly to your broker.

What do I do with my current stock certificates?

If you hold any shares of Common Stock in certificated form, the stock certificates are still valid. DO NOT DESTROY ANY STOCK CERTIFICATES YOU CURRENTLY HOLD. Contact AST at 800-937-5449 if you want to change existing certificates to electronic book entry registration. All of the certificates you hold should be kept in a safe place.

What if I sell shares before the Stock Dividend Record Date?

If you sell shares of Common Stock on or before the Stock Dividend Record Date, you will not receive the additional Stock Dividend shares for any shares that were sold.

What happens if I purchase or sell shares of Common Stock after the Stock Dividend Record Date but on or before the Distribution Date?

Any trade of our Common Stock executed after the Stock Dividend Record Date but on or before the Distribution Date will include the right to the additional shares that will be distributed in the Stock Dividend. A record holder who sells his or her Common Stock after the Stock Dividend Record Date but on or before the Distribution Date will not be entitled to the receipt of the additional shares. In order for a record holder to receive the additional shares, the record holder must hold the shares through the Distribution Date. Buyers of our Common Stock are rightful claimants to the additional shares if purchased after the Stock Dividend Record Date but prior to the ex-stock split date; they need not be a holder of record on the record date.

Trades of our Common Stock that settle after the Stock Dividend Record Date and are traded through the Distribution Date will be considered “trades with distribution” that ultimately entitle the buyer to the Stock Dividend shares even though the buyer did not own the shares on the Stock Dividend Record Date. These trades will have a “due bill” attached to them. A “due bill” is an IOU from the seller indicating that the buyer, not the seller who held the stock on the Stock Dividend Record Date, is entitled to the Stock Dividend shares upon their issuance. A buyer will receive the Stock Dividend shares when the due bills settle after the ex-stock split date.

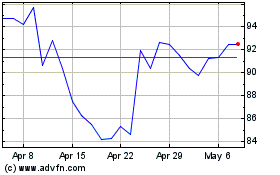

CoStar (NASDAQ:CSGP)

Historical Stock Chart

From Mar 2024 to Apr 2024

CoStar (NASDAQ:CSGP)

Historical Stock Chart

From Apr 2023 to Apr 2024