Hot Housing Market Fuels Takeover Battle for CoreLogic

February 23 2021 - 8:29AM

Dow Jones News

By Peter Grant

CoreLogic Inc., once a sleepy data firm, is the focus of a

takeover battle as the hot housing market drives up the value of

home- and mortgage-data services.

The country's largest provider of information on home values,

mortgages and other housing statistics for financial firms and

real-estate brokers agreed this month to accept an all-cash bid of

$80 a share, or about $6 billion. The bid came from private-equity

firms Stone Point Capital LLC and Insight Partners.

That bid won out over a competing all-stock offer at a nominally

higher value from CoStar Group Inc., one of the world's largest

providers of commercial real-estate data and online

marketplaces.

But CoStar wasn't ready to give up. Last week, it boosted its

all-stock bid to about $96 a share at the time, or around $6.9

billion. That represented a premium of 17% to CoreLogic's share

price before CoStar made its offer.

If CoStar prevails, the Washington, D.C.-based data giant plans

to use CoreLogic to challenge Zillow Group Inc. for dominance of

the multibillion-dollar online home-sales marketplace. CoStar last

year made its first push into the home-sales market by buying

Homesnap Inc. for $250 million.

The fight for control of CoreLogic is a vivid sign of the

investor interest in businesses tied to the housing market, which

has been roaring throughout much of the pandemic.

U.S. home sales last year surged to their highest level in 14

years, fueled by record low interest rates and a pandemic that sent

buyers searching for more spacious homes to accommodate remote

work. That activity has stoked the revenue of residential

brokerages like Realogy Holdings Corp. and home builders like Toll

Brothers Inc.

Residential real-estate-data firms also have been riding the

upswing.

"With housing white-hot, there's inevitably going to be more

demand for data: everything from for-sale housing, to residential

development, and even single-family rental homes," said Ryan

Tomasello, an analyst at Keefe, Bruyette & Woods.

CoreLogic enjoyed a banner year in 2020. The company had $1.17

billion in revenue the first nine months of the year, compared with

$1.09 billion for the first three quarters of 2019. Its database

holds billions of housing-related records that banks rely on to

make mortgages, and that insurance companies use to write policies.

Its share price has more than doubled since the beginning of 2020,

thanks to the housing-market rally and takeover interest.

Data and technology-driven services are expected to become even

more important to the home-buying experience in the years to come,

Mr. Tomasello said.

"A lot of housing demand is being driven by millennials and

first-time buyers," he said. "They are the ones who are going to be

more demanding of a tech-enabled home-search and home-buying

experience."

Interest in acquiring CoreLogic goes back to at least June, when

a pair of private-equity firms made the first bid for Irvine,

Ca.-based CoreLogic. That bid was valued at $65 a share, or about

$5.2 billion. That unsolicited bid, combined with the strong

housing market, attracted the attention of other investors. Suitors

included a venture of Warburg Pincus LLC and the private-equity

firm GTCR LLC, according to people familiar with the matter.

CoreLogic's chairman, Paul Folino, said in a written statement

when the company chose Stone Point and Insight that the bid was in

cash "with a high degree of regulatory certainty and a closing

expected in the near term."

But that was before CoStar increased its bid. The board is now

weighing CoStar's competing offer and a decision is expected as

early as this week.

Write to Peter Grant at peter.grant@wsj.com

(END) Dow Jones Newswires

February 23, 2021 08:14 ET (13:14 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

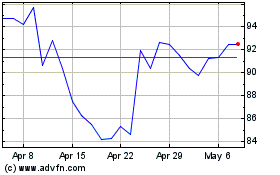

CoStar (NASDAQ:CSGP)

Historical Stock Chart

From Mar 2024 to Apr 2024

CoStar (NASDAQ:CSGP)

Historical Stock Chart

From Apr 2023 to Apr 2024