By Paul Ziobro

Companies whose businesses boomed during the Covid-19 pandemic

face new hurdles to sustaining fast growth as the U.S. economy

starts returning to normal activity.

Businesses from DoorDash Inc. and Etsy Inc. to Lowe's Cos. and

Kellogg Co. said they are bracing for the prospect that spending

will shift again as people indulge pent-up demand for eating out,

traveling, attending concerts and other activities that have been

heavily limited.

The reckoning might come in months. President Biden said last

week that the U.S. would have enough Covid-19 vaccines for all

adults by the end of May, and states including Texas have rolled

back limits on many businesses and commercial activities. On

Monday, the Centers for Disease Control and Prevention said fully

vaccinated people can gather privately without masks or social

distancing.

Delivery company DoorDash thrived during the downturn as

restaurants closed or sharply curtailed indoor dining. In the

fourth quarter, it handled 273 million orders, more than triple the

amount a year earlier. Its overall performance drove a

better-than-expected stock-market debut in December.

But as diners return to eating in restaurants, they are likely

to order less at home, and DoorDash, which remains unprofitable,

expects growth to slow. Finance chief Prabir Adarkar said on a

recent earnings call that while business held up somewhat in

markets that have reopened, "vaccination and full re-openings could

drive sharper changes in consumer behavior than current data would

predict."

Analysts project DoorDash's revenue will increase 29% this year,

according to data from FactSet -- healthy by most measures but

about one-eighth its rapid pace in 2020. Its stock is off more than

30% from its highest closing on record.

Sales at home-improvement retailer Lowe's rose 24% last year,

the fastest pace in two decades, as homeowners remodeled bathrooms,

built decks and completed other improvements to the houses they

spent so much time in. For this year, Lowe's has laid out three

projections for the coming year. All anticipate a decline in

revenue, ranging from 2% to 7%. Chief Executive Officer Marvin

Ellison has said the company will emphasize gaining market share

and improving profit margins. "2021, to state the obvious, is a

very difficult environment to forecast," he said late last

month.

Dick's Sporting Goods Inc. on Tuesday said it expects sales this

year to be between 2% higher and 2% lower, after rising nearly 10%

in the fiscal year that ended in January, as people spent more on

fitness and outdoors gear. The company said it is experimenting

with a new prototype location that will include features such as an

outdoor field and wellness spaces.

Tech companies in particular prospered over the past year as

people and companies diverted spending to online tools and

pursuits. Gene Munster, managing partner at investment and research

firm Loup Ventures, said that the biggest players will remain in

strong shape, but that for some smaller businesses that had

breakout years, "there's going to be some readjusting for these

companies when things go back to normal."

Online marketplace Etsy doubled its revenue in 2020, as shoppers

purchased everything from face masks to home décor. But executives

have said those purchases could wane.

"We also know, we hope, that as the world opens up later this

year, consumers will soon be able to spend more of their money on

travel, dining and entertainment, and this will create some

headwinds to Etsy's growth relative to 2020," financial chief

Rachel Glasser said on a recent earnings call. The company still

thinks that it can outgrow the broader e-commerce sector.

The tech-heavy Nasdaq Composite Index on Monday fell Monday into

correction territory, meaning a fall of more than 10%, after it

peaked in mid-February following a rise of 45% in the preceding 12

months. The index rebounded sharply Tuesday, however.

Many companies that thrived in the remote-work era might benefit

if overall consumer demand strengthens as the pandemic wanes.

Jonathan Golub, chief U.S. equity strategist at Credit Suisse,

projects that earnings for growth companies will increase 17% this

year, after rising 13% in 2020. "They're going to look even better

as a group because they are sitting on a much stronger economy," he

said.

At the same time, some companies whose business remains strong

might face slower growth. Amazon.com Inc. projects revenue

increasing 33% to 40% in the first quarter, in line with the 38%

jump in its sales in 2020, but analysts expect that to moderate to

16.8% in the fourth quarter, which would be its slowest pace since

early 2015, according to FactSet.

Corsair Gaming Inc., which makes headsets and other accessories

for videogamers, anticipates that with more people picking up

gaming over the past year, it has an opportunity to sell more

gaming accessories. More people going to school and work, however,

could mean less time at home playing. "That's why we think the

growth will be moderate in the second half," Corsair CEO Andrew

Paul said recently.

Best Buy Co. warned last month that its sharp growth, helped by

homebound shoppers splurging on televisions, laptops and other

electronics, would slow. Many of those sales were made online, and

the company has laid off some store workers as it expects that

shift to continue.

Other companies are looking for ways to adapt. Zoom Video

Communications Inc., whose revenue quadrupled last year as it

became a household name, is projecting revenue will rise more than

40% this year and is adapting its tools for businesses that will

have some workers in the office and others at home. CEO Eric Yuan

said this month that Zoom also plans to expand its services beyond

videoconference to sustain growth, such as with webinars.

Food makers including Kellogg are bracing for a shift after

sales during the pandemic rose as people were at home more

often.

Kellogg CEO Steve Cahillane said that he believes more people

will continue to eat at home than before the pandemic, but that a

key challenge is making sure they don't get bored of it, which the

company plans to address with new flavors of cereals and

snacks.

"How do we make this in-home dining experience more exciting

than a Michelin-starred restaurant so that people are not using our

food because they have to but because they want to?" he said in a

recent interview.

--Annie Gasparro contributed to this article.

Write to Paul Ziobro at Paul.Ziobro@wsj.com

(END) Dow Jones Newswires

March 10, 2021 09:14 ET (14:14 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

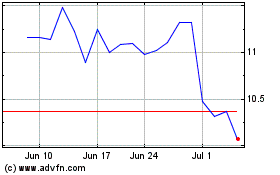

Corsair Gaming (NASDAQ:CRSR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Corsair Gaming (NASDAQ:CRSR)

Historical Stock Chart

From Apr 2023 to Apr 2024