Strong operational performance delivered consistent Revenue and

Adjusted EBITDA positioning the company to upgrade more than

300,000 locations to Gigabit speeds in 2021

Company to upgrade 1.6 million locations as part of its

accelerated plan to extend fiber coverage to over 70% of its

footprint by 2025

Global refinancing extends maturities, lowers leverage and

increases liquidity

Fourth Quarter 2020 Highlights (compared to fourth

quarter 2019)

- Revenue totaled $326.1 million, generating increased Adjusted

EBITDA of $132.3 million, up 1.1%

- Commercial and carrier data-transport revenue grew 3.2%

- Consumer broadband revenue grew 2.8%, representing seven

consecutive quarters of year over year growth

- Net cash from operating activities was $67.6 million; cash on

hand totaled $155.6 million

- Net debt leverage improved to 3.39x, from 4.33x at Dec. 31,

2019

- Capital expenditures totaled $65.3 million, reflecting an

accelerated spend supporting preparations for the 2021 fiber

network expansion

Full-Year 2020 Highlights (compared to full-year

2019)

- Revenue totaled $1.30 billion, a decline of 2.4%

- Adjusted EBITDA totaled $529.2 million, an improvement of

1.1%

- Commercial and carrier data-transport revenue grew 1.9%

- Consumer broadband revenue grew 2.3%

- Free cash flow totaled $197.9 million, an increase of $131.7

million

- Fiber lit buildings increased 11% and more than 1,000

fiber-route miles were built

- Capital expenditures totaled $217.6 million supporting

success-based, fiber projects and broadband network

investments

Consolidated Communications Holdings, Inc. (Nasdaq: CNSL) (the

“Company” or “Consolidated”) reported results for the fourth

quarter and full-year 2020.

“We finished the year with strong performance which included

growing consumer broadband revenue for the seventh consecutive

quarter, and robust data-transport revenue growth of 3.2% in the

fourth quarter,” said Bob Udell, president and chief executive

officer at Consolidated Communications. “Our fiber build plans are

well underway.”

“We are heading into 2021 with solid momentum,” added Udell. “We

have a fully funded growth plan, which is supported by our robust

capital structure and the strategic partnership we secured in the

fourth quarter with Searchlight Capital. Our long-term outlook is

very positive. We are confident in our ability to upgrade more than

300,000 passings in 2021 as we execute on our fiber build plan and

bring highly competitive, gigabit broadband services to 70% of our

footprint by 2025.”

Financial Results for the Fourth Quarter

- Revenue totaled $326.1 million, a decline of 1.5% compared to

the fourth quarter 2019. This reflects a 250 basis point

improvement compared to the prior year. Data and transport service

revenue increased 3.2% or $2.9 million. Broadband revenue increased

2.8% or $1.8 million. Voice services revenue rate of decline across

all customer channels improved 1.4% or $1.7 million. Network access

revenues declined $1.7 million primarily due to a decrease in

special access.

- Income from operations totaled $21 million in the fourth

quarter, a decline of $5.7 million. The year-over-year change was

primarily due to a 1.5% revenue decline and transaction costs of

$7.6 million related to the Searchlight investment. These costs

were partially offset by a decrease of $10.8 million in

depreciation and amortization expense where certain acquired assets

became fully depreciated.

- Net interest expense was $48.4 million, an increase of $15

million, as a result of the recapitalization of the balance sheet

associated with the Oct. 2, 2020 refinancing and the receipt of the

$350 million Searchlight strategic investment. Interest expense

increased $3.5 million due to the higher mix of 6.5% Senior notes

in the Company’s external debt. Non-cash interest on the

Searchlight note combined with amortization of deferred financing

costs and the discount totaled $10.1 million. The Company expects

to make Payment in Kind (PIK) interest payments on the Searchlight

note through at least 2022.

- As part of the quarterly valuation of the Searchlight

contingent payment right, the Company recognized a gain of $23.8

million in the fourth quarter related to a change in the fair value

of contingent payment obligations as of Dec. 31, 2020. Upon receipt

of all approvals and the completion of the second close which is

expected in 2021, this contingent payment right will convert to

common stock.

- Cash distributions from the Company’s wireless partnerships

totaled $9.5 million, an increase of $2.5 million from a year

ago.

- Other income, net was $12.2 million compared to expense of

$286,000 one year ago. The change included a $2.5 million increase

in investment income from the Company’s minority interest in

wireless partnerships and a reduction in non-operating pension/OPEB

expense of $8.8 million. The latter was the result of a non-cash

pension settlement charge of $6.7 million in 2019.

- On a GAAP basis, net loss was $6.8 million, compared to a loss

of $5.8 million for the same period a year ago. GAAP net loss per

share was ($0.09). Adjusted diluted net income (loss) per share

excludes certain items as outlined in the table provided in this

release. Adjusted diluted net income per share was $0.12 in the

fourth quarter of 2020, compared to $0.01 in the fourth quarter of

2019.

- Adjusted EBITDA was $132.3 million, an increase of 1.1% from

the fourth quarter a year ago.

- The total net debt leverage ratio was 3.39x, an improvement

from 4.33x at Dec. 31, 2019.

- Capital expenditures totaled $65.3 million in the fourth

quarter driven by success-based opportunities across all customer

channels as well as preparations for the 2021 fiber build

expansion.

Full Year 2020 Results

- Operating revenue totaled $1.30 billion, down 2.4% from fiscal

year 2019. This reflects an overall 200 basis point improvement

compared to the prior year.

- Total operating expenses were reduced 3.5% or $30.4 million

primarily driven by reduced labor costs, lower expense associated

with integration efforts and continued operating efficiencies.

- Net cash from operating activities was $365 million.

- Adjusted EBITDA was $529.2 million. Adjusted diluted net income

per share was $0.78.

- Capital expenditures totaled $217.6 million in 2020 supporting

success-based, fiber projects and broadband network

investments.

On Oct. 2, 2020, Consolidated closed on stage one of

Searchlight’s investment and received $350 million of the aggregate

$425 million. Concurrent with Searchlight’s investment,

Consolidated completed a global refinancing in which it raised

$2.25 billion in new secured debt at attractive rates, including a

$250 million revolving credit facility. On Jan. 15, 2021 the

Company secured an additional $150 million term loan financing on

substantially the same terms as the October refinancing.

2021 Outlook

For 2021, Consolidated Communications is providing outlook based

on the Company’s new fiber build plan and current capital

structure.

- Capital expenditures are expected to be in a range of $400

million to $420 million, reflecting a higher level of spending to

support the build plan.

- Adjusted EBITDA is expected to be in a range of $500 million to

$510 million, lower than 2020 primarily due to the start-up and

acceleration of the fiber build expansion plan.

- Cash interest expense is expected to be in a range of $142

million to $152 million, reflecting the current debt

structure.

- Cash income taxes are expected to be in a range of $2 million

to $4 million.

Conference Call

Consolidated’s fourth-quarter earnings conference call will be

webcast today at 10 a.m. ET. The live webcast and materials will be

available on the Investor Relations section of the Company’s

website at http://ir.consolidated.com. The live conference call

dial-in number for investors and analysts is 833-794-0898,

conference ID 3278619. A telephonic replay of the conference call

will be available through Mar. 4 and can be accessed by calling

800-585-8367, enter ID 3278619.

About Consolidated Communications

Consolidated Communications Holdings, Inc. (NASDAQ: CNSL) is a

leading broadband and business communications provider serving

consumers, businesses, and wireless and wireline carriers across

rural and metro communities and a 23-state service area. Leveraging

an advanced fiber network spanning 46,600 fiber route miles,

Consolidated Communications offers a wide range of communications

solutions, including: high-speed Internet, data, phone, security,

managed services, cloud services and wholesale, carrier solutions.

From our first connection 125 years ago, Consolidated is dedicated

to turning technology into solutions, connecting people and

enriching how they work and live. Visit www.consolidated.com for

more information.

Use of Non-GAAP Financial Measures

This press release, as well as the conference call, includes

disclosures regarding “EBITDA,” “adjusted EBITDA,” “total net debt

to last 12 month adjusted EBITDA ratio” or “Net debt leverage

ratio,” “free cash flow” and “adjusted diluted net income (loss)

per share,” all of which are non-GAAP financial measures and

described in this section as not being in compliance with

Regulation S-X. Accordingly, they should not be construed as

alternatives to net cash from operating or investing activities,

cash and cash equivalents, cash flows from operations, net income

or net income per share as defined by GAAP and are not, on their

own, necessarily indicative of cash available to fund cash needs as

determined in accordance with GAAP. In addition, not all companies

use identical calculations, and the non-GAAP financial measures may

not be comparable to other similarly titled measures of other

companies. A reconciliation of the differences between these

non-GAAP financial measures and the most directly comparable

financial measures presented in accordance with GAAP is included in

the tables that follow.

Adjusted EBITDA is comprised of EBITDA, adjusted for certain

items as permitted or required by the lenders under our credit

agreement in place at the end of each quarter in the periods

presented. The tables that follow include an explanation of how

adjusted EBITDA is calculated for each of the periods presented

with the reconciliation to net income. EBITDA is defined as net

earnings before interest expense, income taxes, depreciation and

amortization on a historical basis.

We present adjusted EBITDA for several reasons. Management

believes adjusted EBITDA is useful as a means to evaluate our

ability to fund our estimated uses of cash (including interest on

our debt). In addition, we have presented adjusted EBITDA to

investors in the past because it is frequently used by investors,

securities analysts and other interested parties in the evaluation

of companies in our industry, and management believes presenting it

here provides a measure of consistency in our financial reporting.

Adjusted EBITDA, referred to as Available Cash in our credit

agreement, is also a component of the restrictive covenants and

financial ratios contained in our credit agreement that requires us

to maintain compliance with these covenants and limit certain

activities, such as our ability to incur debt. The definitions in

these covenants and ratios are based on adjusted EBITDA after

giving effect to specified charges. In addition, adjusted EBITDA

provides our board of directors with meaningful information, with

other data, assumptions and considerations, to measure our ability

to service and repay debt. We present the related “total net debt

to last 12 month adjusted EBITDA ratio” or “Net debt leverage

ratio” principally to put other non-GAAP measures in context and

facilitate comparisons by investors, security analysts and others;

this ratio differs in certain respects from the similar ratio used

in our credit agreement. These measures differ in certain respects

from the ratios used in our senior notes indenture.

These non-GAAP financial measures have certain shortcomings. In

particular, adjusted EBITDA does not represent the residual cash

flows available for discretionary expenditures, since items such as

debt repayment and interest payments are not deducted from such

measure. Because adjusted EBITDA is a component of the ratio of

total net debt to last twelve month adjusted EBITDA, these measures

are also subject to the material limitations discussed above. In

addition, the ratio of total net debt to last twelve month adjusted

EBITDA is subject to the risk that we may not be able to use the

cash on the balance sheet to reduce our debt on a dollar-for-dollar

basis. Management believes this ratio is useful as a means to

evaluate our ability to incur additional indebtedness in the

future.

Free cash flow represents net cash provided by operating

activities adjusted for capital expenditures, cash dividends, and

proceeds received from the sale of assets, refinancing and

investment. Free cash flow is a measure of operating cash flows

available for corporate purposes after providing sufficient fixed

asset additions. The tables that follow include a calculation of

free cash flow for each of the periods presented with a

reconciliation to net cash provided by operating activities. Free

cash flow provides useful information to investors in the

evaluation of our operating performance and liquidity.

We present the non-GAAP measure “adjusted diluted net income

(loss) per share” because our net income (loss) and net income

(loss) per share are regularly affected by items that occur at

irregular intervals or are non-cash items. We believe that

disclosing these measures assists investors, securities analysts

and other interested parties in evaluating both our company over

time and the relative performance of the companies in our

industry.

Safe Harbor

Certain statements in this press release are forward-looking

statements and are made pursuant to the safe harbor provisions of

the Securities Litigation Reform Act of 1995. These forward-looking

statements reflect, among other things, our current expectations,

plans, strategies, and anticipated financial results. There are a

number of risks, uncertainties, and conditions that may cause our

actual results to differ materially from those expressed or implied

by these forward-looking statements. These risks and uncertainties

include a number of factors related to our business, including the

uncertainties relating to the impact of the novel coronavirus

(COVID-19) pandemic on the Company’s business, results of

operations, cash flows, stock price and employees; the possibility

that any of the anticipated benefits of the strategic investment

from Searchlight or our refinancing of outstanding debt, including

our senior secured credit facilities, will not be realized; the

outcome of any legal proceedings that may be instituted against the

Company or its directors; the ability to obtain regulatory

approvals and meet other closing conditions to the investment on a

timely basis or at all, including the risk that regulatory

approvals required for the investment are not obtained subject to

conditions that are not anticipated or that could adversely affect

the Company or the expected benefits of the investment; the

anticipated use of proceeds of the strategic investment; economic

and financial market conditions generally and economic conditions

in our service areas; various risks to the price and volatility of

our common stock; changes in the valuation of pension plan assets;

the substantial amount of debt and our ability to repay or

refinance it or incur additional debt in the future; our need for a

significant amount of cash to service and repay the debt

restrictions contained in our debt agreements that limit the

discretion of management in operating the business; regulatory

changes, including changes to subsidies, rapid development and

introduction of new technologies and intense competition in the

telecommunications industry; risks associated with our possible

pursuit of acquisitions; system failures; cyber-attacks,

information or security breaches or technology failure of ours or

of a third party; losses of large customers or government

contracts; risks associated with the rights-of-way for the network;

disruptions in the relationship with third party vendors; losses of

key management personnel and the inability to attract and retain

highly qualified management and personnel in the future; changes in

the extensive governmental legislation and regulations governing

telecommunications providers and the provision of

telecommunications services; new or changing tax laws or

regulations; telecommunications carriers disputing and/or avoiding

their obligations to pay network access charges for use of our

network; high costs of regulatory compliance; the competitive

impact of legislation and regulatory changes in the

telecommunications industry; and liability and compliance costs

regarding environmental regulations; and risks associated with

discontinuing paying dividends on our common stock. A detailed

discussion of these and other risks and uncertainties that could

cause actual results and events to differ materially from such

forward-looking statements are discussed in more detail in our

filings with the SEC, including our reports on Form 10-K and Form

10-Q. Many of these circumstances are beyond our ability to control

or predict. Moreover, forward-looking statements necessarily

involve assumptions on our part. These forward-looking statements

generally are identified by the words “believe,” “expect,”

“anticipate,” “estimate,” “project,” “intend,” “plan,” “should,”

“may,” “will,” “would,” “will be,” “will continue” or similar

expressions. Such forward-looking statements involve known and

unknown risks, uncertainties and other factors that may cause

actual results, performance or achievements of the Company and its

subsidiaries to be different from those expressed or implied in the

forward-looking statements. All forward-looking statements

attributable to us or persons acting on our behalf are expressly

qualified in their entirety by the cautionary statements that

appear throughout this press release. Furthermore, forward-looking

statements speak only as of the date they are made. Except as

required under the federal securities laws or the rules and

regulations of the SEC, we disclaim any intention or obligation to

update or revise publicly any forward-looking statements. You

should not place undue reliance on forward-looking statements.

Tag: [Consolidated-Communications-Earnings]

Consolidated Communications Holdings, Inc. Condensed

Consolidated Balance Sheets (Dollars in thousands, except share

and per share amounts) (Unaudited)

December 31,

December 31,

2020

2019

ASSETS Current assets: Cash and cash equivalents $

155,561

$

12,395

Accounts receivable, net

137,646

120,016

Income tax receivable

1,072

2,669

Prepaid expenses and other current assets

46,382

41,787

Total current assets

340,661

176,867

Property, plant and equipment, net

1,760,152

1,835,878

Investments

111,665

112,717

Goodwill

1,035,274

1,035,274

Customer relationships, net

113,418

164,069

Other intangible assets

10,557

10,557

Other assets

135,573

54,915

Total assets $

3,507,300

$

3,390,277

LIABILITIES AND SHAREHOLDERS' EQUITY Current

liabilities: Accounts payable $

25,283

$

30,936

Advance billings and customer deposits

49,544

45,710

Accrued compensation

74,957

57,069

Accrued interest

21,194

7,874

Accrued expense

81,931

75,406

Current portion of long-term debt and finance lease obligations

17,561

27,301

Total current liabilities

270,470

244,296

Long-term debt and finance lease obligations

1,932,666

2,250,677

Deferred income taxes

171,021

173,027

Pension and other post-retirement obligations

300,373

302,296

Convertible security interest

238,701

—

Contingent payment right

123,241

—

Other long-term liabilities

81,600

72,730

Total liabilities

3,118,072

3,043,026

Shareholders' equity: Common stock, par value $0.01 per

share; 100,000,000 shares authorized, 79,227,607 and 71,961,045,

shares outstanding as of December 31, 2020 and December 31, 2019,

respectively

792

720

Additional paid-in capital

525,673

492,246

Accumulated deficit

(34,514

)

(71,217

)

Accumulated other comprehensive loss, net

(109,418

)

(80,868

)

Noncontrolling interest

6,695

6,370

Total shareholders' equity

389,228

347,251

Total liabilities and shareholders' equity $

3,507,300

$

3,390,277

Consolidated Communications Holdings, Inc. Condensed

Consolidated Statements of Operations (Dollars in thousands,

except per share amounts) (Unaudited)

Three Months

Ended Year Ended December 31, December 31,

2020

2019

2020

2019

Net revenues $

326,124

$

331,035

$

1,304,028

$

1,336,542

Operating expenses: Cost of services and products

138,927

136,201

560,644

574,936

Selling, general and administrative expenses

77,682

76,473

275,361

299,088

Acquisition and other transaction costs

7,646

—

7,646

—

Depreciation and amortization

80,840

91,642

324,864

381,237

Income from operations

21,029

26,719

135,513

81,281

Other income (expense): Interest expense, net of interest income

(48,376

)

(33,390

)

(143,591

)

(136,660

)

Gain (loss) on extinguishment of debt

(18,498

)

3,140

(18,264

)

4,510

Change in fair value of contingent payment rights

23,802

—

23,802

—

Other income, net

12,249

(286

)

50,778

27,224

Income (loss) before income taxes

(9,794

)

(3,817

)

48,238

(23,645

)

Income tax expense (benefit)

(2,956

)

2,005

10,936

(3,714

)

Net income (loss)

(6,838

)

(5,822

)

37,302

(19,931

)

Less: net income attributable to noncontrolling interest

82

166

325

452

Net income (loss) attributable to common shareholders $

(6,920

)

$

(5,988

)

$

36,977

$

(20,383

)

Net income (loss) per basic and diluted common shares

attributable to common shareholders $

(0.09

)

$

(0.08

)

$

0.47

$

(0.29

)

Consolidated Communications Holdings, Inc. Condensed

Consolidated Statements of Cash Flows (Dollars in thousands)

(Unaudited)

Three Months Ended

Year Ended

December 31,

December 31,

2020

2019

2020

2019

OPERATING ACTIVITIES Net income (loss) $

(6,838

)

$

(5,822

)

$

37,302

$

(19,931

)

Adjustments to reconcile net income (loss) to net cash provided by

operating activities: Depreciation and amortization

80,840

91,642

324,864

381,237

Deferred income taxes

8,386

(5,888

)

8,386

(5,249

)

Cash distributions from wireless partnerships in excess of (less

than) earnings

(157

)

(340

)

844

(1,901

)

Pension and post-retirement contributions in excess of expense

(7,635

)

(246

)

(37,301

)

(24,507

)

Non-cash, stock-based compensation

2,046

1,596

7,533

6,836

Amortization of deferred financing costs and discounts

4,243

1,253

7,871

4,932

Loss (gain) on extinguishment of debt

10,863

(3,140

)

10,629

(4,510

)

Gain on change in fair value of contingent payment rights

(23,802

)

—

(23,802

)

—

Other adjustments, net

9,859

696

5,374

1,487

Changes in operating assets and liabilities, net

(10,175

)

10,708

23,280

702

Net cash provided by operating activities

67,630

90,459

364,980

339,096

INVESTING ACTIVITIES Purchase of property, plant and equipment, net

(65,348

)

(47,860

)

(217,563

)

(232,203

)

Proceeds from sale of assets

94

375

7,071

14,718

Proceeds from sale of investments

—

—

426

329

Other

—

(213

)

—

(663

)

Net cash used in investing activities

(65,254

)

(47,698

)

(210,066

)

(217,819

)

FINANCING ACTIVITIES Proceeds on bond offering

750,000

—

750,000

—

Proceeds from issuance of long-term debt

1,231,250

43,000

1,271,250

195,000

Proceeds from issuance of common stock

350,000

—

350,000

—

Payment of finance lease obligations

(1,777

)

(2,776

)

(9,020

)

(12,519

)

Payment on long-term debt

(1,774,075

)

(52,587

)

(1,867,838

)

(195,350

)

Retirement of senior notes

(440,509

)

(23,818

)

(444,717

)

(49,804

)

Payment of financing costs

(59,139

)

—

(59,139

)

—

Share repurchases for minimum tax withholding

(812

)

(363

)

(812

)

(363

)

Dividends on common stock

—

—

—

(55,445

)

Other

(1,472

)

—

(1,472

)

—

Net cash used in financing activities

53,466

(36,544

)

(11,748

)

(118,481

)

Net change in cash and cash equivalents

55,842

6,217

143,166

2,796

Cash and cash equivalents at beginning of period

99,719

6,178

12,395

9,599

Cash and cash equivalents at end of period $

155,561

$

12,395

$

155,561

$

12,395

Consolidated Communications Holdings, Inc. Consolidated

Revenue by Category (Dollars in thousands) (Unaudited)

Three Months Ended Year Ended December

31, December 31,

2020

2019

2020

2019

Commercial and carrier: Data and transport services (includes VoIP)

$

92,781

$

89,905

$

362,078

$

355,325

Voice services

44,862

46,510

181,700

188,322

Other

12,128

12,500

45,155

52,894

149,771

148,915

588,933

596,541

Consumer: Broadband (VoIP and Data)

66,253

64,474

263,059

257,083

Video services

17,547

19,838

74,343

81,378

Voice services

41,431

44,238

170,503

180,839

125,231

128,550

507,905

519,300

Subsidies

17,402

18,122

71,989

72,440

Network access

31,314

33,056

125,261

138,056

Other products and services

2,406

2,392

9,940

10,205

Total operating revenue $

326,124

$

331,035

$

1,304,028

$

1,336,542

Consolidated Communications Holdings, Inc. Consolidated

Revenue Trend by Category (Dollars in thousands) (Unaudited)

Three Months Ended

Q4 2020

Q3 2020

Q2 2020

Q1 2020

Q4 2019

Commercial and carrier: Data and transport services (includes VoIP)

$

92,781

$

90,153

$

89,572

$

89,572

$

89,905

Voice services

44,862

45,343

45,775

45,720

46,510

Other

12,128

10,909

10,406

11,712

12,500

149,771

146,405

145,753

147,004

148,915

Consumer: Broadband (VoIP and Data)

66,253

67,163

65,567

64,076

64,474

Video services

17,547

18,452

19,213

19,131

19,838

Voice services

41,431

42,775

43,121

43,176

44,238

125,231

128,390

127,901

126,383

128,550

Subsidies

17,402

18,064

18,069

18,454

18,122

Network access

31,314

32,009

30,473

31,465

33,056

Other products and services

2,406

2,198

2,980

2,356

2,392

Total operating revenue $

326,124

$

327,066

$

325,176

$

325,662

$

331,035

Consolidated Communications Holdings, Inc. Schedule of

Adjusted EBITDA Calculation (Dollars in thousands) (Unaudited)

Three Months Ended Year Ended

December 31, December 31,

2020

2019

2020

2019

Net income (loss) $

(6,838

)

$

(5,822

)

$

37,302

$

(19,931

)

Add (subtract): Income tax expense (benefit)

(2,956

)

2,005

10,936

(3,714

)

Interest expense, net

48,376

33,390

143,591

136,660

Depreciation and amortization

80,840

91,642

324,864

381,237

EBITDA

119,422

121,215

516,693

494,252

Adjustments to EBITDA (1): Other, net (2)

17,518

3,914

14,238

17,754

Investment income (accrual basis)

(9,793

)

(7,483

)

(41,062

)

(38,088

)

Investment distributions (cash basis)

9,483

6,986

41,529

35,809

Pension/OPEB expense (benefit)

(1,062

)

7,797

(4,169

)

11,487

Loss (gain) on extinguishment of debt

18,498

(3,140

)

18,264

(4,510

)

Change in fair value of contingent payment right

(23,802

)

—

(23,802

)

—

Non-cash compensation (3)

2,046

1,596

7,533

6,836

Adjusted EBITDA $

132,310

$

130,885

$

529,224

$

523,540

Notes:

(1) These adjustments reflect

those required or permitted by the lenders under our credit

agreement.

(2) Other, net includes income

attributable to noncontrolling interests, acquisition and

non-recurring related costs, and certain miscellaneous items.

(3) Represents compensation

expenses in connection with our Restricted Share Plan, which

because of the non-cash nature of the expenses are excluded from

adjusted EBITDA.

Consolidated Communications Holdings, Inc. Total Net Debt

to LTM Adjusted EBITDA Ratio (Dollars in thousands) (Unaudited)

December 31,

2020

Summary of Outstanding Debt: Term loans, net of discount $18,181 $

1,228,694

Senior secured notes due 2028

750,000

Finance leases

17,467

Total debt as of December 31, 2020

1,996,161

Less deferred debt issuance costs

(45,934

)

Less cash on hand

(155,561

)

Total net debt as of December 31, 2020 $

1,794,666

Adjusted EBITDA for the twelve months ended December 31,

2020 $

529,224

Total Net Debt to last twelve months Adjusted EBITDA

3.39x

Consolidated Communications Holdings, Inc. Schedule of

Free Cash Flow Calculation (Dollars in thousands) (Unaudited)

Three Months Ended Year Ended

December 31, December 31,

2020

2019

2020

2019

Net cash provided by operating activities $

67,630

$

90,459

$

364,980

$

339,096

Add (subtract): Capital expenditures

(65,348

)

(47,860

)

(217,563

)

(232,203

)

Dividends paid

—

—

—

(55,445

)

Proceeds from the sale of assets

94

375

7,071

14,718

Net proceeds from refinancing and Searchlight investment

43,420

—

43,420

—

Free cash flow $

45,796

$

42,974

$

197,908

$

66,166

Consolidated Communications Holdings, Inc. Reconciliation

of Net Income to Adjusted EBITDA Guidance (Dollars in millions)

(Unaudited)

Twelve Months Ended December

31, 2021 Range Low High Net income

$

30

$

45

Add: Income tax expense

11

16

Interest expense, net

150

145

Depreciation and amortization

305

300

EBITDA

496

506

Adjustments to EBITDA (1): Other, net (2)

1

1

Pension/OPEB expense

(4

)

(4

)

Non-cash compensation (3)

7

7

Adjusted EBITDA

$

500

$

510

Notes:

(1) These adjustments reflect

those required or permitted by the lenders under our credit

agreement.

(2) Other, net includes income

attributable to noncontrolling interests, cash distributions less

equity earnings from our investments, dividend income, acquisition

and non-recurring related costs and certain miscellaneous

items.

(3) Represents compensation

expenses in connection with our Restricted Share Plan, which

because of the non-cash nature of the expenses are excluded from

adjusted EBITDA.

Consolidated Communications Holdings, Inc. Adjusted Net

Income (Loss) and Net Income (Loss) Per Share (Dollars in

thousands, except per share amounts) (Unaudited)

Three

Months Ended Year Ended December 31, December

31,

2020

2019

2020

2019

Net income (loss) $

(6,838

)

$

(5,822

)

$

37,302

$

(19,931

)

Integration and severance related costs, net of tax

13,171

5,712

13,201

17,449

Storm costs (recoveries), net of tax

172

105

71

(171

)

Loss (gain) on extinguishment of debt, net of tax

13,674

(2,289

)

13,501

(3,288

)

Change in fair value of contingent payment rights

(23,802

)

—

(23,802

)

—

Non-cash interest expense for Searchlight note including

amortization of discount and fees

10,131

—

10,131

—

Non-cash interest expense for swaps, net of tax

(175

)

(112

)

(727

)

(28

)

Change in deferred tax rate

(6

)

686

(6

)

686

Other, tax

1,346

1,227

1,346

1,865

Non-cash stock compensation, net of tax

1,512

1,163

5,568

4,983

Adjusted net income (loss) $

9,185

$

670

$

56,585

$

1,565

Weighted average number of shares outstanding

77,515

70,909

72,752

70,837

Adjusted diluted net income (loss) per share $

0.12

$

0.01

$

0.78

$

0.02

Notes:

Calculations above assume a 26.1%

effective tax rate for the three months and year ended December 31,

2020 and 27.1% effective tax rate for the three months and year

ended December 31, 2019.

Consolidated Communications Holdings, Inc. Key Operating

Statistics (Unaudited)

December 31,

September 30,

% Change

December 31,

% Change

2020

2020

in Qtr

2019

YOY

Voice Connections

779,590

794,333

(1.9%)

835,997

(6.7%)

Data and Internet Connections

792,200

792,211

(0.0%)

784,165

1.0%

Video Connections

76,041

77,854

(2.3%)

84,171

(9.7%)

Business and Broadband as % of total revenue (1)

76.5

%

75.9

%

0.9%

75.8

%

1.0%

Fiber route network miles (long-haul, metro and FTTH) (2)

46,664

46,326

0.7%

37,511

24.4%

On-net buildings

13,564

13,202

2.7%

12,264

10.6%

Consumer Customers

554,763

562,587

(1.4%)

582,818

(4.8%)

Consumer ARPU $

75.25

$

76.07

(1.1%)

$

73.52

2.4%

Notes:

(1) Business and Broadband

revenue % includes: commercial/carrier, equipment sales and

service, directory, consumer broadband and special access.

(2) FTTH miles added to fiber

route network miles beginning in Q2 2020, which were previously not

included. Prior period amounts have not been restated to the

current period presentation.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210225005255/en/

Investor and Media Contact Jennifer Spaude, Consolidated

Communications Phone: 507-386-3765

jennifer.spaude@consolidated.com

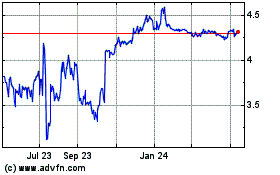

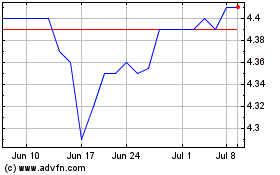

Consolidated Communicati... (NASDAQ:CNSL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Consolidated Communicati... (NASDAQ:CNSL)

Historical Stock Chart

From Apr 2023 to Apr 2024